MOGU Inc. (NYSE: MOGU) (“MOGU” or the "Company"), a KOL-driven

online fashion and lifestyle destination in China, today announced

its unaudited financial results for the six months ended March 31,

2023 and fiscal year 2023.

Mr. Fan Yiming, Chief Executive Officer of MOGU, commented,

“Fiscal Year 2023 has been an extremely challenging year. The

competitive environment of online shopping continued to intensify

and several surges in COVID-19 cases in China resulted in supply

chain and logistics disruptions.

The Gross Merchandise Value (“GMV1”) and revenue of MOGU for the

second half of fiscal year 2023 decreased by 38.0% and 30.2%, to

RMB3,241 million and RMB117.2 million period-over-period,

respectively.The declining GMV was driven by weakening demand in

the fashion & accessories category, which was partially offset

by accelerating growth for healthcare and food.

Consumer behavior has shifted during the Covid-19 pandemic. As

many customers temporarily adopted a more conservative consumption

attitude, they tend to exercise more prudence on discretionary

spending like fashion and accessories. Meanwhile, people pay more

attention to their health and general well-being, which in turn

leads to more interest and willingness to consume healthcare

related products. In response to this trend, we have proactively

adjusted our product offerings and expanded our product portfolio

with a variety of healthcare products, groceries, household

supplies and foods. Our goal is to offer our customers a wider

variety of products while providing a more enjoyable shopping

experience."

"During the second half of fiscal year of 2023, our total

revenues decreased by 30.2%, as compared with the same period of

fiscal year 2022, to RMB117.2 million. We continued to take a

holistic approach to improve our financial performance. The

adjusted EBITDA (non-GAAP) and loss from operations were negative

RMB6.8 million and RMB139.4 million, compared with negative RMB16.3

million and RMB240.3 million, respectively, for the same period of

fiscal year 2022. We will also continue to explore new business

opportunities to diversify our revenue structure," added Ms. Qi

Feng, Financial Controller of MOGU.

Highlights For the Six Months Ended March 31, 2023

- Total revenues for the six months ended March 31, 2023

decreased by 30.2% to RMB117.2 million (US$17.1 million) from

RMB168.0 million during the same period of fiscal year 2022.

- Live video broadcast (“LVB”) associated GMV for

the six months ended March 31, 2023 decreased by 34.7%

period-over-period to RMB3,165 million (US$460.9 million2).

- GMV for the six months ended March 31, 2023 was RMB3,241

million (US$471.9 million), a decrease of 38.0%

period-over-period.

Financial Results For the Six Months Ended March 31,

2023

Total revenues for the six months ended March 31, 2023

decreased by 30.2% to RMB117.2 million (US$17.1 million) from

RMB168.0 million during the same period of fiscal year 2022.

- Commission revenues for the six months ended March 31,

2023 decreased by 31.0% to RMB75.8 million (US$11.0 million) from

RMB109.9 million in the same period of fiscal year 2022, primarily

attributable to the lower GMV due to the heightened competitive

environment and the COVID-19 pandemic resurgence.

- Marketing services revenues for the six months ended

March 31, 2023 decreased by 70.6% to RMB1.4 million (US$0.2

million) from RMB4.9 million in the same period of fiscal year

2022, primarily due to the challenging competitive

environment.

- Financing solutions revenues for the six months ended

March 31, 2023 decreased by 42.0% to RMB6.0 million (US$0.9

million) from RMB10.4 million in the same period of fiscal year

2022. The decrease was primarily due to the decrease in the service

fee of loans to users in line with the lower GMV.

- Technology service revenues for the six months ended

March 31,2023 decreased by 13.8% to RMB30.8 million (US$4.5

million) from RMB35.7 million in the same period of fiscal year

2022, primarily attributable to the decrease of software services

revenue.

- Other revenues for the six months ended March 31, 2023

decreased by 55.3% to RMB3.2 million (US$0.5 million) from RMB7.1

million in the same period of fiscal year 2022, primarily due to

the decrease of promotion services revenue provided to financial

institutions under the impact of the COVID-19 pandemic.

Cost of revenues for the six months ended March 31, 2023

decreased by 27.2% to RMB54.2 million (US$7.9 million) from RMB74.5

million in the same period of fiscal year 2022, which was primarily

due to a decrease in payroll, IT-related expenses and payment

handling and outsourcing costs, in line with the overall reduction

in revenue.

Sales and marketing expenses for the six months ended March 31,

2023 decreased by 37.0% to RMB35.1 million (US$5.1 million) from

RMB55.6 million in the same period of fiscal year 2022, primarily

due to optimized spending on branding and user acquisition

activities, in line with the overall reduction in revenue.

Research and development expenses for the six months ended March

31, 2023 decreased by 56.8% to RMB16.1 million (US$2.4 million)

from RMB37.4 million in the same period of fiscal year 2022,

primarily due to a decrease in payroll costs.

General and administrative expenses for the six months ended

March 31, 2023 decreased by 17.2% to RMB30.7 million (US$4.5

million) from RMB37.1 million in the same period of fiscal year

2022, primarily due to a decrease in professional service fees and

payroll costs.

Amortization of intangible assets for the six months ended March

31, 2023 decreased by 76.2% to RMB40.0 million (US$5.8 million)

from RMB168.0 million in the same period of fiscal year 2022,

primarily because the majority of the intangible assets recorded as

a result of the business cooperation agreement MOGU entered into

with Tencent in July 2018 have been fully amortized as of March 31,

2022.

Impairment of goodwill and intangible assets for the six months

ended March 31, 2023 increased by 73.2% to RMB84.7 million (US$12.3

million) from RMB48.9 million in the same period of fiscal year

2022, primarily due to the Company’s recognition of a full

impairment charge of RMB 63.5 million against its remaining

goodwill balance and impairments totaling RMB21.2 million for

intangible assets which had been recorded in connection with the

acquisition of Ruisha Technology. The recorded impairments resulted

from weaker-than-expected operating results which reflect an

increasingly competitive business environment and the related

limited future economic benefit expected to be generated from these

intangible assets. As of March 31, 2023, the carrying value of the

Company’s goodwill is $0.

Loss from operations for the six months ended March 31,

2023 was RMB139.4 million (US$20.3 million), compared to loss from

operations of RMB240.3 million in the same period of fiscal year

2022.

Net loss attributable to MOGU Inc. for the six months

ended March 31, 2023 was RMB113.9 million (US$16.6 million),

compared to a net loss attributable to MOGU Inc. of RMB227.9

million in the same period of fiscal year 2022.

Adjusted EBITDA3 for the six months ended March 31, 2023

was negative RMB6.8 million (US$1.0 million), compared to negative

RMB16.3 million in the same period of fiscal year 2022.

Adjusted net loss4 for the six months ended March 31,

2023 was RMB40.0 million (US$5.8 million), compared to an adjusted

net loss of RMB180.6 million in the same period of fiscal year

2022.

Basic and diluted loss per ADS5 for the six months ended

March 31, 2023 were RMB13.29 (US$1.93) and RMB13.29 (US$1.93),

respectively, compared with RMB27.13 and RMB27.13, respectively, in

the same period of fiscal year 2022. One ADS represents 300 Class A

ordinary shares.

Cash and cash equivalents, Restricted cash and Short-term

investments were RMB562.8 million (US$82.0 million) as of March

31, 2023, compared with RMB636.3 million as of March 31, 2022.

Fiscal Year 2023 Financial Results

Total revenues decreased by 31.2% to RMB232.1 million

(US$33.8 million) from RMB337.5 million in fiscal year 2022.

- Commission revenues decreased by 34.9% to RMB147.5

million (US$21.5 million) from RMB226.7 million in fiscal year

2022, primarily attributable to the lower GMV due to the heightened

competitive environment.

- Marketing services revenues decreased by 75.3% to RMB4.4

million (US$0.6 million) from RMB17.9 million in fiscal year 2022.

The decrease was primarily due to the challenging competitive

environment.

- Financing solutions revenues decreased by 59.4% to

RMB12.9 million (US$1.9 million) from RMB31.9 million in the same

period of fiscal year 2022. The decrease was primarily due to the

decrease in service fees of loans to users in line with the lower

GMV.

- Technology service revenues increased by 27.8% to

RMB58.9 million (US$8.6 million) from RMB46.1 million in the fiscal

year 2022, primarily attributable to the incremental year-over-year

revenue contribution of Hangzhou Ruisha Technology Co., Ltd.

(“Ruisha”), a business acquired in July 2021. This acquisition

demonstrates the Company’s commitment to providing brand merchants

with one-stop and customized services for full-domain operations,

including a wide variety of operational services, data platforms

and other software services, as well as value-added services such

as traffic placement.

- Other revenues decreased by 44.1% to RMB8.3 million

(US$1.2 million) from RMB14.9 million in fiscal year 2022,

primarily due to the COVID -related decrease in promotion services

revenue provided to financial institutions.

Cost of revenues decreased by 28.6% to RMB113.9 million (US$16.6

million) from RMB159.6 million in fiscal year 2022, which was

primarily due to a decrease in payroll, IT-related expenses and

payment handling and outsourcing costs, in line with the overall

reduction in revenue.

Sales and marketing expenses decreased by 54.4% to RMB67.7

million (US$9.9 million) from RMB148.4 million in fiscal year 2022,

primarily due to optimized spending on branding and user

acquisition activities, in line with the overall reduction in

revenue.

Research and development expenses decreased by 55.1% to RMB37.1

million (US$5.4 million) from RMB82.6 million in fiscal year 2022,

primarily due to a decrease in payroll costs.

General and administrative expenses decreased by 19.9% to

RMB63.4 million (US$9.2 million) from RMB79.2 million in fiscal

year 2022, primarily due to a decrease in professional service fees

and payroll costs.

Amortization of intangible assets decreased by 81.7% to RMB60.0

million (US$8.7 million) from RMB328.2 million in fiscal year 2022,

primarily because the majority of the intangible assets recorded as

a result of the business cooperation agreement MOGU entered into

with Tencent in July 2018 have been fully amortized as of March 31,

2022.

Impairment of goodwill and intangible assets for the year ended

March 31, 2023 was RMB84.7 million (US$12.3 million), compared to

RMB235.4 million in the fiscal year 2022. As of March 31, 2023, the

goodwill of the Company has been fully impaired.

Loss from operations was RMB187.4 million (US$27.3

million), compared to loss from operations of RMB670.5 million in

fiscal year 2022.

Net loss attributable to MOGU Inc. was RMB171.3 million

(US$24.9 million), compared to a net loss attributable to MOGU Inc.

of RMB639.8 million in fiscal year 2022.

Adjusted EBITDA was negative RMB23.9 million (US$3.5

million), compared to negative RMB89.1 million in fiscal year

2022.

Adjusted net loss was RMB71.8 million (US$10.5 million),

compared to an adjusted net loss of RMB410.7 million in fiscal year

2022.

Basic and diluted loss per ADS were RMB20.12 (US$2.93)

and RMB20.12 (US$2.93) respectively, compared with RMB76.17 and

RMB76.17, respectively, in fiscal year 2022. One ADS represents 300

Class A ordinary shares.

Use of Non-GAAP Financial Measures

In evaluating the business, the Company considers and uses

nonGAAP measures, such as Adjusted EBITDA and Adjusted net

income/loss as supplemental measures to review and assess operating

performance. The presentation of these nonGAAP financial measures

is not intended to be considered in isolation or as a substitute

for the financial information prepared and presented in accordance

with accounting principles generally accepted in the United States

of America (“U.S. GAAP”). The Company defines Adjusted EBITDA as

net loss before interest income, interest expense, (gain)/loss from

investments, net, income tax benefits, share of results of equity

investees, goodwill impairment, share-based compensation expenses,

amortization of intangible assets, and depreciation of property and

equipment. The Company defines Adjusted net loss as net loss

excluding (gain)/loss from investments, net, goodwill impairment,

share-based compensation expenses, and adjustments for tax effects.

The Company excluded “amortization of intangible assets” as a

non-recurring item in the presentation of adjusted net loss in its

Unaudited Reconciliations of GAAP and Non-GAAP Results for the six

months ended March 31, 2023 and fiscal year 2023. As a result, the

Company made the corresponding change to the prior period

comparative metrics to conform with the new definition. See

“Unaudited Reconciliations of GAAP and NonGAAP Results” at the end

of this press release.

The Company presents these nonGAAP financial measures because

they are used by management to evaluate operating performance and

formulate business plans. The Company believes that the nonGAAP

financial measures help identify underlying trends in its business

by excluding certain expenses, gain/loss and other items that are

not expected to result in future cash payments or that are

nonrecurring in nature or may not be indicative of the Company’s

core operating results and business outlook. The Company also

believes that the nonGAAP financial measures could provide further

information about the Company’s results of operations, enhance the

overall understanding of the Company’s past performance and future

prospects.

The nonGAAP financial measures are not defined under U.S. GAAP

and are not presented in accordance with U.S. GAAP. The nonGAAP

financial measures have limitations as analytical tools. The

Company’s nonGAAP financial measures do not reflect all items of

income and expense that affect the Company’s operations and do not

represent the residual cash flow available for discretionary

expenditures. Further, these nonGAAP measures may differ from the

nonGAAP information used by other companies, including peer

companies, and therefore their comparability may be limited. The

Company compensates for these limitations by reconciling the

nonGAAP financial measures to the nearest U.S. GAAP performance

measure, all of which should be considered when evaluating

performance. The Company encourages you to review the Company’s

financial information in its entirety and not rely on a single

financial measure.

For more information on the nonGAAP financial measures, please

see the table captioned “Unaudited Reconciliations of GAAP and

NonGAAP Results” set forth at the end of this press release.

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “aims,” “future,” “intends,”

“plans,” “believes,” “estimates,” “confident,” “potential,”

“continue” or other similar expressions. Among other things, the

business outlook and quotations from management in this

announcement, as well as MOGU’s strategic and operational plans,

contain forward-looking statements. MOGU may also make written or

oral forward-looking statements in its periodic reports to the U.S.

Securities and Exchange Commission (the “SEC”), in its annual

report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical

facts, including but not limited to statements about MOGU’s beliefs

and expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: MOGU’s growth strategies; the risk that

COVID-19 or other health risks in China or globally could adversely

affect its operations or financial results; its future business

development, results of operations and financial condition; its

ability to understand buyer needs and provide products and services

to attract and retain buyers; its ability to maintain and enhance

the recognition and reputation of its brand; its ability to rely on

merchants and third-party logistics service providers to provide

delivery services to buyers; its ability to maintain and improve

quality control policies and measures; its ability to establish and

maintain relationships with merchants; trends and competition in

China’s ecommerce market; changes in its revenues and certain cost

or expense items; the expected growth of China’s ecommerce market;

PRC governmental policies and regulations relating to MOGU’s

industry, and general economic and business conditions globally and

in China and assumptions underlying or related to any of the

foregoing. Further information regarding these and other risks is

included in MOGU’s filings with the SEC. All information provided

in this press release and in the attachments is as of the date of

this press release, and MOGU undertakes no obligation to update any

forward-looking statement, except as required under applicable

law.

About MOGU Inc.

MOGU Inc. (NYSE: MOGU) is a KOL-driven online fashion and

lifestyle destination in China. MOGU provides people with a more

accessible and enjoyable shopping experience for everyday fashion,

particularly as they increasingly live their lives online. By

connecting merchants, KOLs and users together, MOGU’s platform

serves as a valuable marketing channel for merchants, a powerful

incubator for KOLs, and a vibrant and dynamic community for people

to discover and share the latest fashion trends with others, where

users can enjoy a truly comprehensive online shopping

experience.

MOGU INC.

Unaudited Condensed

Consolidated Balance Sheets

(All amounts in thousands,

except for share and per share data)

As of March 31,

As of March 31,

2022

2023

RMB

RMB

US$

ASSETS

Current assets:

Cash and cash equivalents

438,608

416,201

60,604

Restricted cash

809

810

118

Short-term investments

196,853

145,836

21,235

Inventories, net

79

144

21

Loan receivables, net

26,788

7,229

1,053

Prepayments, receivables and other current

assets

55,135

69,126

10,066

Amounts due from related parties

640

1,260

183

Total current assets

718,912

640,606

93,280

Non-current assets:

Property, equipment and software, net

7,702

194,589

28,334

Intangible assets, net

89,822

12,554

1,828

Right-of-use assets*

-

5,441

792

Goodwill

63,460

-

-

Investments

72,120

69,318

10,093

Other non-current assets

214,964

63,640

9,267

Total non-current assets

448,068

345,542

50,314

Total assets

1,166,980

986,148

143,594

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Short-term borrowings

10,064

-

-

Accounts payable

17,950

8,179

1,191

Salaries and welfare payable

12,311

13,550

1,973

Advances from customers

901

245

36

Taxes payable

3,265

4,446

647

Amounts due to related parties

4,694

4,196

611

Current portion of lease liabilities*

-

2,654

386

Accruals and other current liabilities

272,638

270,717

39,419

Total current liabilities

321,823

303,987

44,263

Non-current liabilities:

Non-current lease liabilities*

-

753

110

Deferred tax liabilities

12,112

3,369

491

Other non-current liabilities

890

-

-

Total non-current liabilities

13,002

4,122

601

Total liabilities

334,825

308,109

44,864

Shareholders’ equity

Ordinary shares

181

181

26

Treasury stock

(136,113)

(137,446)

(20,014)

Statutory reserves

3,331

3,331

485

Additional paid-in capital

9,471,101

9,484,664

1,381,074

Accumulated other comprehensive income

69,016

82,396

11,999

Accumulated deficit

(8,617,780)

(8,789,084)

(1,279,790)

Total MOGU Inc. shareholders’ equity

789,736

644,042

93,780

Non-controlling interests

42,419

33,997

4,950

Total shareholders’ equity

832,155

678,039

98,730

Total liabilities and shareholders’

equity

1,166,980

986,148

143,594

*On April 1, 2022, the Company adopted ASC

842, Leases and, as acceptable under the Standard, elected not to

retrospectively adjust prior periods. Right-of-use assets and lease

liabilities were recognized on the Company's consolidated financial

statements in connection with the adoption of the Standard.

MOGU INC.

Unaudited Condensed

Consolidated Statements of Operations and Comprehensive

Loss

(All amounts in thousands,

except for share and per share data)

For the six months

ended

For the year ended

March 31,

March 31,

2022

2023

2022

2023

RMB

RMB

US$

RMB

RMB

US$

Net revenues

Commission revenues

109,935

75,814

11,039

226,742

147,514

21,480

Marketing services revenues

4,882

1,434

209

17,888

4,416

643

Financing service revenues

10,367

6,017

876

31,852

12,947

1,885

Technology service revenues

35,709

30,790

4,483

46,077

58,867

8,572

Other revenues

7,102

3,175

462

14,910

8,332

1,213

Total revenues

167,995

117,230

17,069

337,469

232,076

33,793

Cost of revenues (exclusive of

amortization of intangible assets shown separately below)

(74,468)

(54,243)

(7,898)

(159,601)

(113,884)

(16,583)

Sales and marketing expenses

(55,638)

(35,063)

(5,106)

(148,410)

(67,709)

(9,859)

Research and development expenses

(37,414)

(16,146)

(2,351)

(82,641)

(37,068)

(5,398)

General and administrative expenses

(37,083)

(30,704)

(4,471)

(79,178)

(63,445)

(9,238)

Amortization of intangible assets

(167,964)

(39,970)

(5,820)

(328,154)

(59,992)

(8,736)

Impairment of goodwill and intangible

assets

(48,890)

(84,693)

(12,332)

(235,394)

(84,693)

(12,332)

Other income, net

13,117

4,201

612

25,427

7,267

1,058

Loss from operations

(240,345)

(139,388)

(20,297)

(670,482)

(187,448)

(27,295)

Interest income

6,902

8,463

1,232

13,903

17,476

2,545

Interest expense

-

(357)

(52)

-

(685)

(100)

(Loss)/gain from investments, net

(7,590)

816

119

232

(18,615)

(2,711)

Loss before income tax and share of

results of equity investees

(241,033)

(130,466)

(18,998)

(656,347)

(189,272)

(27,561)

Income tax benefits

12,797

7,577

1,103

14,512

8,663

1,261

Share of results of equity investee, net

of tax

(121)

2,008

292

(539)

883

129

Net loss

(228,357)

(120,881)

(17,603)

(642,374)

(179,726)

(26,171)

Net loss attributable to non-controlling

interests

(483)

(7,015)

(1,021)

(2,574)

(8,422)

(1,226)

Net loss attributable to MOGU

Inc.

(227,874)

(113,866)

(16,582)

(639,800)

(171,304)

(24,945)

Net loss

(228,357)

(120,881)

(17,603)

(642,374)

(179,726)

(26,171)

Other comprehensive loss:

Foreign currency translation adjustments,

net of nil tax

(6,744)

(4,231)

(616)

(17,400)

14,264

2,077

Unrealized securities holding losses, net

of tax

(516)

302

44

(10,729)

(884)

(129)

Total comprehensive loss

(235,617)

(124,810)

(18,175)

(670,503)

(166,346)

(24,223)

Total comprehensive loss attributable to

non-controlling interests

(483)

(7,015)

(1,021)

(2,574)

(8,422)

(1,226)

Total comprehensive loss attributable

to MOGU Inc.

(235,134)

(117,795)

(17,154)

(667,929)

(157,924)

(22,997)

Net loss per share attributable to

ordinary shareholders

Basic

(0.09)

(0.04)

(0.01)

(0.25)

(0.07)

(0.01)

Diluted

(0.09)

(0.04)

(0.01)

(0.25)

(0.07)

(0.01)

Net loss per ADS*

Basic

(27.13)

(13.29)

(1.93)

(76.17)

(20.12)

(2.93)

Diluted

(27.13)

(13.29)

(1.93)

(76.17)

(20.12)

(2.93)

Weighted average number of shares used

in computing net loss per share

Basic

2,520,103,689

2,570,915,725

2,570,915,725

2,519,948,060

2,554,338,579

2,554,338,579

Diluted

2,520,103,689

2,570,915,725

2,570,915,725

2,519,948,060

2,554,338,579

2,554,338,579

Share-based compensation expenses

included in:

Cost of revenues

631

640

93

1,872

1,448

211

General and administrative expenses

3,121

2,786

406

6,789

7,855

1,144

Sales and marketing expenses

1,143

950

138

3,905

3,398

495

Research and development expenses

(352)

351

51

(108)

862

126

MOGU INC.

Unaudited Condensed

Consolidated Statements of Cash Flows

(All amounts in thousands,

except for share and per share data)

For the six months

ended

For the year ended

March 31,

March 31,

2022

2023

2022

2023

RMB

RMB

US$

RMB

RMB

US$

Net cash (used in)/provided by

operating activities

(40,881)

5,930

863

(114,409)

(10,090)

(1,469)

Net cash (used in)/provided by

investing activities

(35,511)

28,763

4,188

13,947

608

89

Net cash provided by/(used in)

financing activities

8,815

(9,092)

(1,324)

450

(12,064)

(1,757)

Effect of foreign exchange rate changes on

cash and cash equivalents and restricted cash

(861)

(2,369)

(344)

(3,455)

(860)

(125)

Net (decrease)/increase in cash and cash

equivalents and restricted cash

(68,438)

23,232

3,383

(103,467)

(22,406)

(3,262)

Cash and cash equivalents and restricted

cash at beginning of period

507,855

393,779

57,339

542,884

439,417

63,984

Cash and cash equivalents and restricted

cash at end of period

439,417

417,011

60,722

439,417

417,011

60,722

MOGU INC.

Unaudited Reconciliations of

GAAP and Non-GAAP Results

(All amounts in thousands,

except for share and per share data)

For the six months

ended

For the year ended

March 31

March 31,

2022

2023

2022

2023

RMB

RMB

US$

RMB

RMB

US$

Net loss

(228,357)

(120,881)

(17,603)

(642,374)

(179,726)

(26,171)

Add:

Interest expense

-

357

52

-

685

100

Less:

Income tax benefits

(12,797)

(7,577)

(1,103)

(14,512)

(8,663)

(1,261)

Less:

Interest income

(6,902)

(8,463)

(1,232)

(13,903)

(17,476)

(2,545)

Add:

Amortization of intangible assets

167,964

39,970

5,820

328,154

59,992

8,736

Add:

Depreciation of property and equipment

2,599

3,244

472

5,396

5,311

773

EBITDA

(77,493)

(93,350)

(13,594)

(337,239)

(139,877)

(20,368)

Add:

Impairment of goodwill and intangible

assets

48,890

84,693

12,332

235,394

84,693

12,332

Add:

Share-based compensation expenses

4,543

4,727

688

12,458

13,563

1,976

Add:

Share of result of equity investees

121

(2,008)

(292)

539

(883)

(129)

Less:

Loss/(gain) from investments, net

7,590

(816)

(119)

(232)

18,615

2,711

Adjusted EBITDA

(16,349)

(6,754)

(985)

(89,080)

(23,889)

(3,478)

Net loss

(228,357)

(120,881)

(17,603)

(642,374)

(179,726)

(26,171)

Add:

Loss/(gain) from investments, net

7,590

(816)

(119)

(232)

18,615

2,711

Add:

Share-based compensation expenses

4,543

4,727

688

12,458

13,563

1,976

Add:

Impairment of goodwill and intangible

assets

48,890

84,693

12,332

235,394

84,693

12,332

Less:

Adjusted for tax effects

(13,291)

(7,713)

(1,123)

(15,963)

(8,948)

(1,303)

Adjusted net loss

(180,625)

(39,990)

(5,825)

(410,717)

(71,803)

(10,455)

________________________________ 1GMV are to gross merchandise

volume, refers to the total value of orders placed on the MOGU

platform regardless of whether the products are sold, delivered or

returned, calculated based on the listed prices of the ordered

products without taking into consideration any discounts on the

listed prices. Buyers on the MOGU platform are not charged for

separate shipping fees over the listed price of a product. If

merchants include certain shipping fees in the listed price of a

product, such shipping fees will be included in GMV. As a prudent

matter aiming at eliminating any influence on MOGU’s GMV of

irregular transactions, the Company excludes from its calculation

of GMV transactions over a certain amount (RMB100,000) and

transactions by users over a certain amount (RMB1,000,000) per

day.

2 The U.S. dollar (US$) amounts disclosed in this press release,

except for those transaction amounts that were actually settled in

U.S. dollars, are presented solely for the convenience of the

readers. The conversion of Renminbi (RMB) into US$ in this press

release is based on the exchange rate set forth in the H.10

statistical release of the Board of Governors of the Federal

Reserve System as of March 31, 2023, which was RMB6.8676 to

US$1.00. The percentages stated in this press release are

calculated based on the RMB amounts.

3 Adjusted EBITDA represents net loss before (i) interest

income, (gain)/loss from investments, net, income tax

expenses/(benefits) and share of results of equity investee,

impairment of goodwill and intangible assets and (ii) certain

non-cash expenses, consisting of share-based compensation expenses,

amortization of intangible assets, and depreciation of property and

equipment. See “Unaudited Reconciliations of GAAP and NonGAAP

Results” at the end of this press release.

4 Adjusted net loss represents net loss excluding (i)

(gain)/loss from investments, net, (ii) share-based compensation

expenses, (iii) impairment of goodwill and intangible assets, (iv)

adjustments for tax effects. The Company excluded “amortization of

intangible assets” as a non-recurring item in the presentation of

adjusted net loss in its Unaudited Reconciliations of GAAP and

Non-GAAP Results for the six months ended March 31, 2023 and fiscal

year 2023. As a result, the Company made the corresponding change

to the prior period comparative metrics to conform with this new

definition. See “Unaudited Reconciliations of GAAP and NonGAAP

Results” at the end of this press release.

5 The Company changed the ADS to common share conversion ratio

on March 28, 2022. The ratio changed from one (1) ADS to

twenty-five (25) Class A ordinary share to the current ratio of one

(1) ADS to three hundred (300) Class A ordinary shares. As a

result, the Company made the corresponding change to the basic and

diluted loss per ADS retroactively to reflect the new ADS

conversion ratio.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230601006130/en/

For investor and media inquiries:

MOGU Inc.

Ms. Qi Feng Phone: +86-571-8530-8201 E-mail: ir@mogu.com

Christensen

In China Mr. Eric Yuan Phone: +86-10-5900-1548 E-mail:

eric.yuan@christensencomms.com

In the United States Ms. Linda Bergkamp Phone: +1-480-614-3004

Email: linda.bergkamp@christensencomms.com

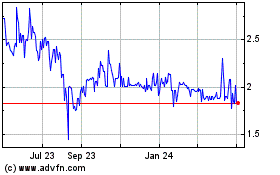

MOGU (NYSE:MOGU)

Historical Stock Chart

From Nov 2024 to Dec 2024

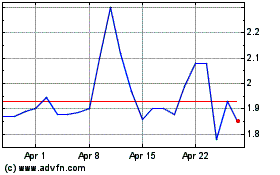

MOGU (NYSE:MOGU)

Historical Stock Chart

From Dec 2023 to Dec 2024