TV advertising revenue: €220.1 m, up

2.9% Consolidated revenue: €322.3 m, up 4.3% excluding scope

effects1 EBITA: €57.9m

Governance:

Appointment of David Larramendy as Chairman

of the Executive Board

Regulatory News:

M6 METROPOLE TELEVISION (Paris:MMT):

Q1

(€ millions)

2024

2023

% change

Consolidated revenue2

322.3

312.9

+3.0% Group advertising revenue

252.1

247.1

+2.0% - of which TV advertising revenue

220.1

214.0

+2.9% - of which other advertising revenue

31.9

33.1

-3.6%

Group non advertising revenue

70.2

65.8

+6.7%

Consolidated profit (EBITA)3

57.9

59.5

-2.6%

Operating margin

18.0%

19.0%

-1.0pt

For the first quarter of 2024, M6 Group posted consolidated

revenue2 of €322.3 million, up 4.3% at constant

scope.

Group advertising revenue grew 2.0% in comparison with the

first quarter of 2023, as a result of the increase in TV

advertising revenue, which totalled €220.1 million (up 2.9%).

Non-advertising revenue grew 6.7%, primarily driven by the

momentum of the film business over the first quarter.

Group operating profit (EBITA)3 totalled €57.9

million, down 2.6%, due to an increase in forecast investments

as part of the streaming plan, thereby recording an operating

margin of 18.0%.

Television

Q1

(€ millions)

2024

2023

%

Consolidated revenue

254.5

249.8

1.9%

o.w. advertising revenue

220.1

214.0

2.9%

In the first quarter of 2024, individual viewing time stood at 3

hours 6 minutes4 across the public as a whole. Over the same

period, M6 Group’s free-to-air channels (M6, W9, 6ter and

Gulli) achieved an audience share of 20.6% on the key commercial

target of 25-49 year olds (down 0.4 percentage points).

The M6 channel continued to achieve healthy audience shares

amongst 25-49 year olds for its enduring brands such as Top Chef

(29%), Pékin Express (29%) and Mariés au premier regard (22%), and

during the period it completed the successful launch of the cult

show Le Juste Prix (19% audience share amongst 25-49 year

olds).

On DTT, W9 and Gulli enjoyed a very successful start to the

year, with W9 confirming its position as the second most popular

DTT channel amongst the under 50s, while Gulli remained the top

children’s channel.

6play, the platform with the youngest audience on the

market, posted an all-time record in early 2024 with 23.1

million unique monthly users in March (up 25% in relation to March

2023). As such, the non-linear Video activity (streaming) accounted

for 156.9 million5 hours viewed, representing 6.5% of total hours

consumed on the Group’s networks.

Driven by the recovery of the TV advertising market, TV

advertising revenue totalled €220.1 million for the three months to

31 March 2024, representing growth of 2.9% in comparison

with Q1 2023. Streaming revenue6 accounted for 7.7% of the TV

division’s total revenue for the year to 31 March 2024.

Radio

The RTL radio division recorded an audience share of 16.6%7 with

listeners aged 13 and over and attracted almost 9 million listeners

each day, thereby maintaining its position as the leading commercial radio group.

For the year to 31 March 2024, the radio advertising revenue

grew 0.9% in comparison with the first quarter of 2023. Radio

division’s revenue stood at €33.9 million, down 1.4% in relation to

the previous year as a result of a very high comparison base due to

an exceptional revenue over the first quarter of 2023.

Production and Audiovisual Rights

Revenue from Production & Audiovisual Rights rose by €8.3

million in comparison with the first quarter of 2023 and totalled

€27.0 million. The quarter’s activity was driven by momentum in

film with the number of cinema admissions

reaching 5 million over the period, against 1.2 million in

the first quarter of 2023. Two films recorded more than one million

admissions – Cocorico (1.9 million) and One Life (1.4 million) –

whilst other films, such as Breaking Point (0.5 million) and Bolero

(0.3 million), also performed well.

Diversification

Diversification revenue stood at €6.6 million for the three

months to 31 March 2024, down €3.1 million, €2.4 million of

which related to the deconsolidation of M6 Digital Services’

special interest media and services division, sold on 30 September

2023. The remainder of the change was primarily due to the slowdown

in the property market which impacted Stéphane Plaza Immobilier’s

business.

Financial position

The Group had shareholders’ equity of €1,347.4 million at 31

March 2024, compared with €1,305.1 million at 31 December 2023.

The net cash position increased by €38.9 million, standing at

€355.6 million8, compared with €316.7 million at 31 March 2023

(€320.8 million at 31 December 2023).

Dividend

The Combined General Meeting held today has approved the payment

of a dividend of €1.25 per share in respect of the 2023 financial

year, providing a yield of 9.7% calculated based on the 2023

closing price. The ex-dividend date will be 30 April and dividends

will be paid on 3 May 2024.

Outlook

The second quarter of 2024 will be marked by the broadcast of

Euro 2024 for which, as official broadcaster, the Group will

exclusively show, free-to-air and live, half of the top 25 matches

including the final, one semi-final and two quarter finals

(including France’s match if they qualify).

CSR commitments

As a producer and broadcaster of content, M6 Group has been

committed to raising public awareness of sustainable development

issues for several years. It is the first broadcasting group to run

a one-off programme-based campaign dedicated to the environment,

“Green Week”, held this year for the fifth time. Followed by 30.1

million French viewers9, this initiative aims to improve the

awareness of, mobilise and offer practical solutions to audiences

for whom environmental concerns have become a reality. Programmes

such as Enquête Exclusive – “Indonesia: Trashing the lungs of the

planet” (34% audience share amongst 25-34 year olds) and Capital –

“Solutions for the Planet” (29%) were particularly popular amongst

25-34 year olds.

Ethics Committee

In accordance with Law n°2016-1524 of 14 November 2016, aimed at

strengthening the freedom, independence and pluralism of the media,

at its meeting of 23 April 2024 the Supervisory Board of Métropole

Télévision appointed Sylvie Clément-Cuzin and François Hurard to

the Ethics Committee, chaired by Louis de Broissia, for a term of

three years.

The Ethics Committee will thus be comprised of Louis de

Broissia, Nicole Tricart, Patrice Duhamel, Sylvie Clément-Cuzin and

François Hurard.

Governance

The Combined General Meeting held today approved the

reappointments of Elmar Heggen and CMA-CGM Participations

represented by Véronique Albertini-Saadé, as well as the

appointment for a term of four years of RTL Group

Verm�gensverwaltung GmbH, represented by Philippe Delusinne.

The Supervisory Board is made up of nine members, including

three independent members and 50% female members10, in compliance

with the Article L.225-69-1 of the French Commercial Code:

- Elmar Heggen, Chairman of the Supervisory

Board, - Marie Cheval, independent member, Vice-Chair of the Board

and Chair of the Appointments and Remuneration Committee, - Nicolas

Houzé, independent member, Chairman of the Audit Committee, -

CMA-CGM Participations, represented by Véronique Albertini-Saadé,

independent member, - Bj�rn Bauer, - Siska Ghesquiere, - Ingrid

Heisserer, - RTL Group Verm�gensverwaltung GmbH, represented by

Philippe Delusinne, - Sophie de Bourgues, member representing

employees, Chair of the CSR Committee.

The Supervisory Board which met today duly noted the resignation

of Nicolas de Tavernost, founder of M6 Group, from his role as

Chairman of the Executive Board of M6 Group, after 37 years during

which he has led the Group to exceptional growth.

Upon the recommendation of the Appointments Committee and of the

firm belief that the Group’s demanding and dynamic culture is an

essential asset in its continued development, the Group has

appointed David Larramendy as Nicolas de Tavernost’s successor as

Chairman of the Executive Board, with effect from today.

In addition, upon the recommendation of the Appointments

Committee, the Supervisory Board appointed Hortense

Thomine-Desmazures as member of the Executive Board with effect

from today.

The Executive Board is therefore made up of five members:

- David Larramendy, Chairman of the Executive

Board, - Karine Blouët, Member of the Executive Board in charge of

Public Affairs, - Guillaume Charles, Member of the Executive Board

in charge of Programming and Content, - Henri de Fontaines, Member

of the Executive Board in charge of Strategy, Streaming and

Development, - Hortense Thomine-Desmazures, Member of the Executive

Board in charge of Sales Activities.

David Larramendy is a graduate of Supélec Paris and holds an MBA

from Wharton School of the University of Pennsylvania. He began his

career at Ernst & Young before joining Mistergooddeal when it

was created in 2000. He then worked in the London offices of

Goldman Sachs prior to joining M6 Group in 2008 as Commercial

Director of the Ventadis Division, which included home shopping and

Mistergooddeal, of which he became CEO in 2010. Appointed CEO of

both M6 Publicité and M6 Interactions in December 2014, David

Larramendy joined the Executive Board in February 2015.

Hortense Thomine-Desmazures is a graduate of Paris-Dauphine

University and Sciences Po Paris. She joined M6 Group in 2006 after

gaining experience at an advertising agency. Appointed Deputy

Director in charge of trading in 2011, she became Deputy Manager of

M6 Digital in 2015, and in June 2022 she was appointed Deputy

Managing Director in charge of digital, innovation and marketing

and joined the Executive Committee of M6 Group.

Next release: 2024 half-year financial

information on 23 July 2024 after close of trading M6 Métropole

Télévision is listed on Euronext Paris, Compartment A. Ticker: MMT,

ISIN Code: FR0000053

1 Excluding the deconsolidation of Ctzar, sold on 1 July 2023

and M6 Digital Services’ special interest media and services

division, sold on 30 September 2023.

2 The information provided is intended to highlight the

breakdown of consolidated revenue between advertising and

non-advertising revenue. Group advertising revenue includes TV

advertising revenue (advertising revenue of free-to-air channels

M6, W9, 6ter and Gulli, and the platforms 6play and Gulli Replay,

as well as the share of advertising revenue from pay channels), the

advertising revenue of radio stations RTL, RTL2 and Fun, and the

share of advertising revenue generated by diversification

activities.

3 Profit from recurring operations (EBITA) is defined as

operating profit (EBIT) before amortisation and impairment of

intangible assets (excluding audiovisual rights) related to

acquisitions and capital gains and losses on the disposal of

financial assets and subsidiaries.

4 Médiamétrie Mediamat – whole of France, all locations (change

in measurement on 1 January 2024)

5 Médiamétrie – TV rating across 4 screens (channels) – not

including viewing of 6play exclusive programmes

6 Total revenue from digital advertising revenues (AVOD) and

revenues from subscriptions related to SVOD (6playMax and

GulliMax)

7 Médiamétrie Radio Audience Survey > National, Jan-Mar 24

Mon-Fri, 05:00 – 00:00

8 The net cash position does not take into account lease

liabilities resulting from the application of IFRS 16 - Leases and

now excludes loans to and borrowings from associates. Earlier

periods have been restated to provide a similar comparison

base.

9 Mediamat Médiamétrie – Coverage (10 consecutive seconds) of

programmes on free-to-air channels that took part in the campaign

(M6 + W9 + 6ter + Gulli)

10 Excluding the Board member representing employees

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240423882905/en/

INVESTOR RELATIONS Myriam Pinot +33 (0)1 41 92 57 73

/ myriam.pinot@m6.fr

PRESS Paul Mennesson +33 (0)1 41 92 61 36

/ paul.mennesson@m6.fr

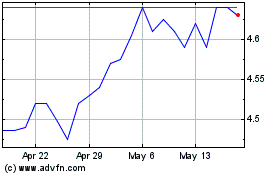

MFS Multimarket Income (NYSE:MMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

MFS Multimarket Income (NYSE:MMT)

Historical Stock Chart

From Dec 2023 to Dec 2024