Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

September 11 2024 - 3:42PM

Edgar (US Regulatory)

SCHEDULE

OF INVESTMENTS

as

of July 31, 2024 (Unaudited)

| Shares | | |

| |

Value | | |

Percent of | |

| Held | | |

| |

(Note 1) | | |

Net Assets | |

| | | |

COMMON STOCK - 97.39% | |

| | |

| |

| | | |

Airports | |

| | |

| |

| | 600,000 | | |

Grupo Aeroportuario del Pacífico, S.A.B.

de C.V. Series B | |

$ | 9,579,954 | | |

| 3.29 | % |

| | 330,000 | | |

Grupo Aeroportuario del Sureste, S.A.B. de C.V. Series B | |

| 9,958,318 | | |

| 3.42 | |

| | 1,100,000 | | |

Grupo Aeroportuario del Centro Norte,

S.A.B. de C.V. Series B | |

| 9,450,180 | | |

| 3.26 | |

| | | | |

| |

| 28,988,452 | | |

| 9.97 | |

| | | | |

Auto Parts | |

| | | |

| | |

| | 17,000,000 | | |

Nemak, S.A.B. de C.V. Series A (a) | |

| 2,319,386 | | |

| 0.80 | |

| | | | |

| |

| | | |

| | |

| | | | |

Beverages | |

| | | |

| | |

| | 750,000 | | |

Arca Continental, S.A.B. de C.V. | |

| 7,385,991 | | |

| 2.54 | |

| | 3,230,000 | | |

Fomento Económico Mexicano, S.A.B.

de C.V. Series UBD | |

| 35,695,343 | | |

| 12.27 | |

| | | | |

| |

| 43,081,334 | | |

| 14.81 | |

| | | | |

Building Materials | |

| | | |

| | |

| | 22,400,000 | | |

Cemex, S.A.B. de C.V. Series CPO | |

| 14,486,545 | | |

| 4.98 | |

| | 950,000 | | |

GCC, S.A.B. de C.V. | |

| 8,072,219 | | |

| 2.78 | |

| | | | |

| |

| 22,558,764 | | |

| 7.76 | |

| | | | |

Chemical Products | |

| | | |

| | |

| | 3,500,000 | | |

Alpek, S.A.B. de C.V. Series A (a) | |

| 2,329,323 | | |

| 0.80 | |

| | 3,200,000 | | |

Orbia Advance Corporation, S.A.B. de

C.V. | |

| 4,109,792 | | |

| 1.41 | |

| | | | |

| |

| 6,439,115 | | |

| 2.21 | |

| | | | |

Consumer Products | |

| | | |

| | |

| | 6,200,000 | | |

Kimberly-Clark de México, S.A.B.

de C.V. (b) Series A | |

| 11,036,579 | | |

| 3.79 | |

| | | | |

| |

| | | |

| | |

| | | | |

Financial Groups | |

| | | |

| | |

| | 3,800,000 | | |

Grupo Financiero Banorte, S.A.B. de

C.V. Series O | |

| 28,496,428 | | |

| 9.80 | |

| | | | |

| |

| | | |

| | |

| | | | |

Food | |

| | | |

| | |

| | 600,000 | | |

Gruma, S.A.B. de C.V. Series B | |

| 11,225,869 | | |

| 3.86 | |

| | 2,500,000 | | |

Grupo Bimbo, S.A.B. de C.V. Series A | |

| 8,751,410 | | |

| 3.01 | |

| | | | |

| |

| 19,977,279 | | |

| 6.87 | |

| | | | |

Holding Companies | |

| | | |

| | |

| | 10,390,000 | | |

Alfa, S.A.B. de C.V. (b) Series A | |

| 5,977,166 | | |

| 2.05 | |

| | | | |

| |

| | | |

| | |

| | | | |

Mining | |

| | | |

| | |

| | 5,800,000 | | |

Grupo México, S.A.B. de C.V. (b) Series B | |

| 32,712,037 | | |

| 11.25 | |

| | 70,000 | | |

Industrias Peñoles, S.A.B. de

C.V. (a) | |

| 1,023,398 | | |

| 0.35 | |

| | | | |

| |

| 33,735,435 | | |

| 11.60 | |

| | | | |

Railroad | |

| | | |

| | |

| | 2,000,000 | | |

Gméxico Transportes, S.A.B. de

C.V. | |

| 3,891,067 | | |

| 1.34 | |

| | | | |

| |

| | | |

| | |

| | | | |

Real Estate | |

| | | |

| | |

| | 2,100,000 | | |

Corporación Inmobiliaria Vesta,

S.A.B. de C.V. | |

| 6,154,375 | | |

| 2.12 | |

SCHEDULE

OF INVESTMENTS

as

of July 31, 2024 (Unaudited) concluded

| Shares | | |

| |

Value | | |

Percent of | |

| Held | | |

| |

(Note

1) | | |

Net Assets | |

| | | |

| |

| | |

| |

| | | | |

Restaurants | |

| | | |

| | |

| | 1,200,000 | | |

Alsea, S.A.B. de C.V. | |

| 3,625,718 | | |

| 1.25 | |

| | | | |

| |

| | | |

| | |

| | | | |

Retail | |

| | | |

| | |

| | 900,000 | | |

El Puerto de Liverpool, S.A.B. de C.V. Series C-1 | |

| 6,321,803 | | |

| 2.17 | |

| | 1,000,000 | | |

Grupo Comercial Chedraui, S.A.B. de C.V. Series B | |

| 7,458,237 | | |

| 2.56 | |

| | 3,300,000 | | |

La Comer, S.A.B. de C.V. Series UBC | |

| 6,145,512 | | |

| 2.11 | |

| | 8,000,000 | | |

Wal-Mart de México, S.A.B. de

C.V. | |

| 26,625,128 | | |

| 9.15 | |

| | | | |

| |

| 46,550,680 | | |

| 15.99 | |

| | | | |

Steel | |

| | | |

| | |

| | 120,000 | | |

Ternium, S.A. ADR (c) | |

| 4,161,616 | | |

| 1.43 | |

| | | | |

| |

| | | |

| | |

| | | | |

Telecommunications Services | |

| | | |

| | |

| | 19,000,000 | | |

América Móvil, S.A.B. de C.V. (b) Series B | |

| 15,880,110 | | |

| 5.46 | |

| | 2,000,000 | | |

Sitios Latinoamérica, S.A.B.

de C.V. Series B-1 (a) | |

| 415,749 | | |

| 0.14 | |

| | | | |

| |

| 16,295,859 | | |

| 5.60 | |

| | | | |

| |

| | | |

| | |

| | | | |

Total Common Stock (Identified cost

- $277,332,887) | |

$ | 283,289,253 | | |

| 97.39 | % |

Principal Amount | | |

| |

Value (Note

1) | | |

Percent of Net Assets | |

| | | |

SHORT-TERM SECURITIES – 2.56% | |

| | |

| |

| | | |

Repurchase Agreements | |

| | |

| |

| $ | 3,625,472 | | |

BBVA México, S.A.,

10.86%, dated 7/31/24, due 8/1/24 repurchase price $3,626,566 collateralized by BPA182 (Bonds issued by the Mexican Government),

interest rate 11.26% (d), due 4/12/2028. Value of collateral $3,661,866. | |

$ | 3,625,472 | | |

| 1.25 | % |

| | | | |

| |

| | | |

| | |

| | | | |

Time

Deposits | |

| | | |

| | |

| $ | 3,806,524 | | |

Comerica Bank, 5.00%, dated 7/31/24,

due 8/1/24 | |

| 3,806,524 | | |

| 1.31 | |

| | | | |

Total Short-Term Securities (Identified

cost - $7,431,996) | |

$ | 7,431,996 | | |

| 2.56 | % |

| | | | |

Total Investments (Identified cost - $284,764,883) | |

| 290,721,249 | | |

| 99.95 | |

| | | | |

Other Assets in Excess of Liabilities | |

| 151,646 | | |

| 0.05 | |

| | | | |

Net Assets Equivalent

to $19.69 per share on 14,771,862 shares of capital stock outstanding. | |

$ | 290,872,895 | | |

| 100.00 | % |

| (a) | Shares

of these securities are currently non-income producing. Equity investments that have not

paid distributions within the last twelve months are considered to be non-income producing. |

| (b) | A

member of the Board also serves as a member of the company’s board of directors. |

| (c) | ADR

– American Depositary Receipt |

| (d) | Floating

rate security. Rate shown is the rate in effect as of July 31, 2024. |

See Notes to Financial Statements

Supplemental

Information

GAAP establishes

a fair value hierarchy that distinguishes between market data obtained from independent sources (observable inputs) and the Fund’s

own market assumptions (unobservable inputs). These inputs are used in determining the value of the Fund’s investments and are

summarized in the following fair value hierarchy:

| • | Level 1 —

quoted prices in active markets for identical securities |

| • | Level 2 —

other significant observable inputs (including quoted prices for similar securities, interest

rates, prepayment speeds, credit risk, etc.) |

| • | Level 3 —

significant unobservable inputs (including the Fund’s own assumptions in determining

the fair value of investments) |

The inputs

or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

An investment’s level within the fair value hierarchy is based on the lowest level of any input, both individually and in the aggregate,

that is significant to the fair value measurement.

The following

is a summary of the inputs used as of July 31, 2024, in valuing the Fund’s investments in securities:

| Valuation Inputs | |

LEVEL 1 | | |

LEVEL 2 | | |

LEVEL 3 | | |

TOTAL | |

| ASSETS: | |

| | |

| | |

| | |

| |

| Investments in Securities: | |

| | | |

| | | |

| | | |

| | |

| Equity Investments(a) | |

$ | 283,289,253 | | |

| - | | |

| - | | |

$ | 283,289,253 | |

| Short Term Investments(b) | |

| - | | |

$ | 7,431,996 | | |

| - | | |

$ | 7,431,996 | |

| Total Investments in Securities | |

$ | 283,289,253 | | |

$ | 7,431,996 | | |

| - | | |

$ | 293,721,249 | |

| (a) | For detailed industry descriptions,

see the accompanying Schedule of Investments |

| (b) | These assets consist of time deposits

and repurchase agreements with maturities of one business day. They are classified as Level 2 solely as a result of the Fund’s

valuation technique for short-term investments, using amortized cost which approximates fair value, instead of quoted prices in active

markets, and thereby may not present any higher risk than Level 1 assets. |

The following

is a reconciliation of the change in value of Level 3 assets (for which significant unobservable inputs were used to determine fair value):

| | |

Investments in

Securities | |

| Balance as of 10/31/23 | |

$ | - | |

| Realized gain (loss) | |

| - | |

| Change in unrealized appreciation (depreciation) | |

| - | |

| Net Purchases (Sales) | |

| - | |

| Transfers in and/or (out) of Level 3 | |

$ | - | |

| Balance as of 7/31/24 | |

| - | |

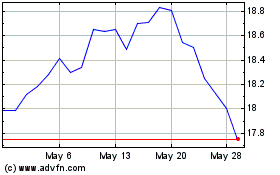

Mexico (NYSE:MXF)

Historical Stock Chart

From Aug 2024 to Sep 2024

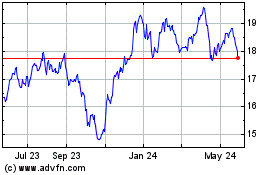

Mexico (NYSE:MXF)

Historical Stock Chart

From Sep 2023 to Sep 2024