Successfully Executed More than $2.5 Billion

in Year-to-Date Liquidity Transactions

Modified Credit Facility Terms and

Conditions

Medical Properties Trust, Inc. (the “Company” or “MPT”) (NYSE:

MPW) today announced financial and operating results for the second

quarter ended June 30, 2024, as well as certain events occurring

subsequent to quarter end.

Second Quarter Financial

Highlights

- Net loss of ($0.54) and Normalized Funds from Operations

(“NFFO”) of $0.23 for the 2024 second quarter on a per share

basis;

- Second quarter net loss included approximately $400 million in

real estate gains, offset by approximately $700 million in

impairments and negative fair value adjustments.

Corporate Updates During and Subsequent

to the Second Quarter

- Closed on the sale of five previously leased hospitals to Prime

Healthcare for total consideration of $350 million in April;

- Closed on the sale of a 75% interest in five Utah hospitals

leased to CommonSpirit to a new joint venture with an institutional

investor in April for total proceeds of $1.1 billion;

- Completed a £631 million (~$800 million) secured financing of

27 U.K. hospitals leased to Circle Health in May;

- Sold for approximately $160 million seven freestanding

emergency department (“FSED”) facilities as well as one general

acute hospital in Arizona to Dignity Health in July;

- Repaid approximately $1.5 billion in debt, including all 2024

maturities; and

- Paid a regular quarterly dividend of $0.15 per share.

Edward K. Aldag, Jr., Chairman, President and Chief Executive

Officer, said, “MPT took decisive action to generate more than $2.5

billion of liquidity year-to-date – well above our initial target

for the year – as well as to expedite debt paydown. The vast

majority of our portfolio continues to perform well, and we remain

focused on executing our strategy to demonstrate the tremendous

value embedded in our platform.”

Included in the financial tables accompanying this press release

is information about the Company’s assets and liabilities,

operating results, and reconciliations of net loss to NFFO,

including per share amounts, all on a basis comparable to 2023

results.

CAPITAL ALLOCATION UPDATE

Subsequent to the end of the quarter, MPT amended its credit

facility to reflect recent disposition and financing transactions

and better align with the Company’s current capital allocation

strategy, as well as to accommodate the expected timing of sales

and re-tenanting transactions that Steward Health Care (“Steward”)

is pursuing through its court-supervised restructuring process.

The amendment includes the reduction of MPT’s revolver

commitment from $1.4 billion to $1.28 billion, a permanent

resetting of the facility’s consolidated net worth covenant from

approximately $6.7 billion to $5.0 billion, and modifications to

certain other covenants through September 30, 2025. In addition,

MPT has agreed to limit the cash component of total quarterly

dividends to no more than $0.08 per share. In the event that

Steward’s hospital operations are transitioned to other operators

more rapidly, the Company has the right to terminate the amendment

provisions earlier than September 30, 2025.

PORTFOLIO UPDATE

Medical Properties Trust has total assets of approximately $16.2

billion, including $10.0 billion of general acute facilities, $2.4

billion of behavioral health facilities and $1.7 billion of

post-acute facilities. As of June 30, 2024, MPT’s portfolio

included 435 properties and approximately 42,000 licensed beds

leased to or mortgaged by 53 hospital operating companies across

the United States as well as in the United Kingdom, Switzerland,

Germany, Spain, Finland, Colombia, Italy and Portugal.

MPT’s European general acute portfolio continues to benefit from

the broadening role of private hospitals in addressing rapidly

growing care needs, particularly in the U.K. Further, increasing

reimbursement rates and acuity levels have largely kept pace with

ongoing expense pressures. Swiss Medical Network is reporting

success in broadening its presence in Switzerland by successfully

marketing new integrated care programs. Behavioral and post-acute

operations have remained consistent, with MEDIAN reporting

increasing occupancy and profit margins and Priory continuing to

execute its plans in the U.K. to meet market demands for more

high-acuity services.

In the Company’s U.S. portfolio, excluding facilities operated

by Steward and Prospect Medical Holdings (“Prospect”), general

acute revenue trends are strong and benefitting from higher

admissions, acuity mix and reimbursement rates, while the

behavioral segment is reporting steady growth in volumes and

moderating expenses. Most notably, MPT’s portfolio of general acute

hospitals operated by Lifepoint Health recorded its highest total

admissions in nearly three years in the first quarter and continues

to see increasing profitability. Overall performance of the

post-acute segment, which combines inpatient rehabilitation (“IRF”)

and long-term acute care (“LTACH”) facilities, remained stable with

strong performance across well-established IRF properties

offsetting the anticipated ramping of operations at newly developed

IRF properties.

As expected, Steward paid May and June cash rent of

approximately $19 million with respect to the consolidated master

lease and remained current on its obligations to the Company’s

Massachusetts partnership with Macquarie Asset Management (together

with its affiliates, “Macquarie”). Steward also made July payments

as scheduled for all leased facilities.

Due to unanticipated restrictions imposed by regulators that

impacted the process of transitioning ownership of eight hospitals

operated by Steward in Massachusetts, MPT – which owns a 50%

interest in these properties through a partnership that has a

separate master lease agreement with Steward – expects to

relinquish its ownership of those properties to the non-recourse

secured lender. As a result, MPT has fully impaired its equity

investment in the partnership. The NFFO contribution of the joint

venture in the second quarter was approximately $7 million, or

$0.01 per diluted share.

During the second quarter of 2024, Prospect paid cash rent of

$18 million and cash interest of $4 million, fully satisfying

past-due amounts from the first quarter as well as all amounts due

in the second quarter.

OPERATING RESULTS

Net loss for the second quarter ended June 30, 2024 was ($321

million), or ($0.54) per share, compared to net loss of ($42

million), or ($0.07) per share, in the year earlier period. Net

loss for the quarter ended June 30, 2024 included approximately

$400 million in real estate gains resulting from joint venture and

asset sales transactions as well as approximately $700 million in

impairments and negative fair value adjustments that primarily

included:

- The impairment of MPT’s approximate $400 million equity stake

in the Massachusetts partnership with Macquarie (included on the

income statement in earnings from equity interests); and

- A $163 million negative fair market value adjustment to the

Company’s investment in PHP due to changes in third-party

valuations and other discounting assumptions.

NFFO for the second quarter ended June 30, 2024 was $139

million, or $0.23 per share, compared to $285 million, or $0.48 per

share in the year earlier period.

A reconciliation of net loss to FFO and NFFO, including per

share amounts, can be found in the financial tables accompanying

this press release.

CONFERENCE CALL AND WEBCAST

The Company has scheduled a conference call and webcast for

August 8, 2024 at 11:00 a.m. Eastern Time to present the Company’s

financial and operating results for the quarter ended June 30,

2024. The dial-in numbers for the conference call are 877-883-0383

(U.S.) and 412-902-6506 (International) along with passcode

1112764. The conference call will also be available via webcast in

the Investor Relations section of the Company’s website,

www.medicalpropertiestrust.com.

A telephone and webcast replay of the call will be available

beginning shortly after the call’s completion. The telephone replay

will be available through August 22, 2024, using dial-in numbers

877-344-7529 (U.S.), 855-669-9658 (Canada) and 412-317-0088

(International) along with passcode 6602146. The webcast replay

will be available for one year following the call’s completion on

the Investor Relations section of the Company’s website.

The Company’s supplemental information package for the current

period will also be available on the Company’s website in the

Investor Relations section.

The Company uses, and intends to continue to use, the Investor

Relations page of its website, which can be found at

www.medicalpropertiestrust.com, as a means of disclosing

material nonpublic information and of complying with its disclosure

obligations under Regulation FD, including, without limitation,

through the posting of investor presentations that may include

material nonpublic information. Accordingly, investors should

monitor the Investor Relations page, in addition to following our

press releases, SEC filings, public conference calls, presentations

and webcasts. The information contained on, or that may be accessed

through, our website is not incorporated by reference into, and is

not a part of, this document.

About Medical Properties Trust, Inc.

Medical Properties Trust, Inc. is a self-advised real estate

investment trust formed in 2003 to acquire and develop net-leased

hospital facilities. From its inception in Birmingham, Alabama, the

Company has grown to become one of the world’s largest owners of

hospital real estate with 435 facilities and approximately 42,000

licensed beds in nine countries and across three continents as of

June 30, 2024. MPT’s financing model facilitates acquisitions and

recapitalizations and allows operators of hospitals to unlock the

value of their real estate assets to fund facility improvements,

technology upgrades and other investments in operations. For more

information, please visit the Company’s website at

www.medicalpropertiestrust.com.

Forward-Looking Statements

This press release includes forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements can generally be identified by

the use of forward-looking words such as “may”, “will”, “would”,

“could”, “expect”, “intend”, “plan”, “estimate”, “target”,

“anticipate”, “believe”, “objectives”, “outlook”, “guidance” or

other similar words, and include statements regarding our

strategies, objectives, asset sales and other liquidity

transactions (including the use of proceeds thereof), expected

returns on investments and financial performance, expected trends

and performance across our various markets, and expected outcomes

from Steward’s restructuring process. Forward-looking statements

involve known and unknown risks and uncertainties that may cause

our actual results or future events to differ materially from those

expressed in or underlying such forward-looking statements,

including, but not limited to: (i) the risk that the bankruptcy

restructuring of Steward, the Company’s largest tenant, does not

result in MPT recovering deferred rent or its other investments in

Steward at full value, within a reasonable time period or at all;

(ii) macroeconomic conditions, including due to geopolitical

conditions and instability, which may lead to a disruption of or

lack of access to the capital markets, disruptions and instability

in the banking and financial services industries, rising inflation

and movements in currency exchange rates; (iii) the risk that

previously announced or contemplated property sales, loan

repayments, and other capital recycling transactions do not occur

as anticipated or at all; (iv) the risk that MPT is not able to

attain its leverage, liquidity and cost of capital objectives

within a reasonable time period or at all; (v) MPT’s ability to

obtain debt financing on attractive terms or at all, as a result of

changes in interest rates and other factors, which may adversely

impact its ability to pay down, refinance, restructure or extend

its indebtedness as it becomes due, or pursue acquisition and

development opportunities; (vi) the ability of our tenants,

operators and borrowers to satisfy their obligations under their

respective contractual arrangements with us; (vii) the economic,

political and social impact of, and uncertainty relating to, the

potential impact from health crises (like COVID-19), which may

adversely affect MPT’s and its tenants’ business, financial

condition, results of operations and liquidity; (viii) our success

in implementing our business strategy and our ability to identify,

underwrite, finance, consummate and integrate acquisitions and

investments; (ix) the nature and extent of our current and future

competition; (x) international, national and local economic, real

estate and other market conditions, which may negatively impact,

among other things, the financial condition of our tenants, lenders

and institutions that hold our cash balances, and may expose us to

increased risks of default by these parties; (xi) factors affecting

the real estate industry generally or the healthcare real estate

industry in particular; (xii) our ability to maintain our status as

a REIT for income tax purposes in the U.S. and U.K.; (xiii) federal

and state healthcare and other regulatory requirements, as well as

those in the foreign jurisdictions where we own properties; (xiv)

the value of our real estate assets, which may limit our ability to

dispose of assets at attractive prices or obtain or maintain equity

or debt financing secured by our properties or on an unsecured

basis; (xv) the ability of our tenants and operators to operate

profitably and generate positive cash flow, remain solvent, comply

with applicable laws, rules and regulations in the operation of our

properties, to deliver high-quality services, to attract and retain

qualified personnel and to attract patients; (xvi) potential

environmental contingencies and other liabilities; (xvii) the risk

that expected asset sales do not occur at the agreed upon terms or

at all; (xviii) the risk that we are unable to monetize our

investments in certain tenants at full value within a reasonable

time period or at all; (xix) the cooperation of our joint venture

partners, including adverse developments affecting the financial

health of such joint venture partners or the joint venture itself;

and (xx) the risks and uncertainties of litigation or other

regulatory proceedings.

The risks described above are not exhaustive and additional

factors could adversely affect our business and financial

performance, including the risk factors discussed under the section

captioned “Risk Factors” in our most recent Annual Report on Form

10-K and our Form 10-Q, and as may be updated in our other filings

with the SEC. Forward-looking statements are inherently uncertain

and actual performance or outcomes may vary materially from any

forward-looking statements and the assumptions on which those

statements are based. Readers are cautioned to not place undue

reliance on forward-looking statements as predictions of future

events. We disclaim any responsibility to update such

forward-looking statements, which speak only as of the date on

which they were made.

MEDICAL PROPERTIES TRUST, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(Amounts in thousands, except for

per share data) June 30, 2024 December 31, 2023

Assets

(Unaudited) (A) Real estate assets Land, buildings

and improvements, intangible lease assets, and other

$

11,949,385

$

13,237,187

Investment in financing leases

1,181,959

1,231,630

Mortgage loans

399,150

309,315

Gross investment in real estate assets

13,530,494

14,778,132

Accumulated depreciation and amortization

(1,417,910

)

(1,407,971

)

Net investment in real estate assets

12,112,584

13,370,161

Cash and cash equivalents

606,550

250,016

Interest and rent receivables

39,471

45,059

Straight-line rent receivables

664,271

635,987

Investments in unconsolidated real estate joint ventures

1,143,231

1,474,455

Investments in unconsolidated operating entities

635,206

1,778,640

Other loans

505,942

292,615

Other assets

487,488

457,911

Total Assets

$

16,194,743

$

18,304,844

Liabilities and Equity Liabilities Debt, net

$

9,369,064

$

10,064,236

Accounts payable and accrued expenses

446,893

412,178

Deferred revenue

25,700

37,962

Obligations to tenants and other lease liabilities

160,009

156,603

Total Liabilities

10,001,666

10,670,979

Equity Preferred stock, $0.001 par value. Authorized 10,000

shares; no shares outstanding

-

-

Common stock, $0.001 par value. Authorized 750,000 shares; issued

and outstanding - 600,057 shares at June 30, 2024 and 598,991

shares at December 31, 2023

600

599

Additional paid-in capital

8,571,662

8,560,309

Retained deficit

(2,348,170

)

(971,809

)

Accumulated other comprehensive (loss) income

(33,910

)

42,501

Total Medical Properties Trust, Inc. Stockholders' Equity

6,190,182

7,631,600

Non-controlling interests

2,895

2,265

Total Equity

6,193,077

7,633,865

Total Liabilities and Equity

$

16,194,743

$

18,304,844

(A) Financials have been derived from the prior year

audited financial statements.

MEDICAL PROPERTIES TRUST, INC. AND

SUBSIDIARIES Consolidated Statements of Income

(Unaudited)

(Amounts in thousands, except for per share

data) For the Three Months Ended For the Six Months Ended June

30, 2024 June 30, 2023 June 30, 2024 June 30, 2023

Revenues Rent billed

$

183,764

$

247,491

$

383,063

$

495,648

Straight-line rent

38,381

(39,329

)

83,117

17,364

Income from financing leases

27,641

68,468

44,034

81,663

Interest and other income

16,774

60,765

27,662

92,931

Total revenues

266,560

337,395

537,876

687,606

Expenses Interest

101,430

104,470

210,115

202,124

Real estate depreciation and amortization

102,240

364,403

177,826

448,263

Property-related (A)

7,663

24,676

12,481

31,786

General and administrative

35,327

35,604

68,675

77,328

Total expenses

246,660

529,153

469,097

759,501

Other (expense) income Gain on sale of real estate

384,824

167

383,401

229

Real estate and other impairment charges, net

(137,419

)

-

(830,507

)

(89,538

)

(Loss) earnings from equity interests

(401,757

)

12,224

(391,208

)

23,576

Debt refinancing and unutilized financing costs

(2,964

)

(816

)

(2,964

)

(816

)

Other (including fair value adjustments on securities)

(167,686

)

(10,512

)

(397,031

)

(15,678

)

Total other (expense) income

(325,002

)

1,063

(1,238,309

)

(82,227

)

Loss before income tax

(305,102

)

(190,695

)

(1,169,530

)

(154,122

)

Income tax (expense) benefit

(14,557

)

148,262

(25,506

)

144,719

Net loss

(319,659

)

(42,433

)

(1,195,036

)

(9,403

)

Net (income) loss attributable to non-controlling interests

(976

)

396

(1,224

)

160

Net loss attributable to MPT common stockholders

$

(320,635

)

$

(42,037

)

$

(1,196,260

)

$

(9,243

)

Earnings per common share - basic and diluted: Net

loss attributable to MPT common stockholders

$

(0.54

)

$

(0.07

)

$

(1.99

)

$

(0.02

)

Weighted average shares outstanding - basic

600,057

598,344

600,181

598,323

Weighted average shares outstanding - diluted

600,057

598,344

600,181

598,323

Dividends declared per common share

$

0.30

$

0.29

$

0.30

$

0.58

(A) Includes $4.9 million and $21.1 million of ground lease

and other expenses (such as property taxes and insurance) paid

directly by us and reimbursed by our tenants for the three months

ended June 30, 2024 and 2023, respectively, and $7.2 million and

$25.3 million for the six months ended June 30, 2024 and 2023,

respectively.

MEDICAL PROPERTIES TRUST, INC. AND

SUBSIDIARIES Reconciliation of Net Loss to Funds From

Operations (Unaudited)

(Amounts in thousands, except for

per share data) For the Three Months Ended For the Six Months

Ended June 30, 2024 June 30, 2023 June 30, 2024 June 30, 2023

FFO information: Net loss attributable to MPT

common stockholders

$

(320,635

)

$

(42,037

)

$

(1,196,260

)

$

(9,243

)

Participating securities' share in earnings

(654

)

(469

)

(654

)

(984

)

Net loss, less participating securities' share in earnings

$

(321,289

)

$

(42,506

)

$

(1,196,914

)

$

(10,227

)

Depreciation and amortization

117,239

382,244

211,482

484,204

Gain on sale of real estate

(384,824

)

(167

)

(383,401

)

(229

)

Real estate impairment charges

499,324

-

499,324

52,104

Funds from operations

$

(89,550

)

$

339,571

$

(869,509

)

$

525,852

Write-off of billed and unbilled rent and other

1,188

95,642

3,005

135,268

Other impairment charges, net

48,885

-

741,973

-

Litigation and other

11,738

2,502

17,608

10,228

Share-based compensation adjustments

-

(4,363

)

-

(4,363

)

Non-cash fair value adjustments

159,247

8,374

380,523

4,253

Tax rate changes and other

4,895

(157,230

)

4,588

(164,535

)

Debt refinancing and unutilized financing costs

2,964

816

2,964

816

Normalized funds from operations

$

139,367

$

285,312

$

281,152

$

507,519

Certain non-cash and related recovery information:

Share-based compensation

$

8,521

$

10,800

$

16,154

$

22,629

Debt costs amortization

$

4,936

$

5,203

$

9,775

$

10,324

Non-cash rent and interest revenue (A)

$

-

$

(129,494

)

$

-

$

(150,357

)

Cash recoveries of non-cash rent and interest revenue (B)

$

540

$

2,380

$

6,288

$

33,736

Straight-line rent revenue from operating and finance leases

$

(40,786

)

$

(60,825

)

$

(88,032

)

$

(123,414

)

Per diluted share data: Net loss, less

participating securities' share in earnings

$

(0.54

)

$

(0.07

)

$

(1.99

)

$

(0.02

)

Depreciation and amortization

0.20

0.64

0.35

0.81

Gain on sale of real estate

(0.64

)

-

(0.64

)

-

Real estate impairment charges

0.83

-

0.83

0.09

Funds from operations

$

(0.15

)

$

0.57

$

(1.45

)

$

0.88

Write-off of billed and unbilled rent and other

-

0.16

0.01

0.23

Other impairment charges, net

0.08

-

1.24

-

Litigation and other

0.02

-

0.03

0.01

Share-based compensation adjustments

-

-

-

-

Non-cash fair value adjustments

0.27

0.01

0.63

-

Tax rate changes and other

0.01

(0.26

)

0.01

(0.27

)

Debt refinancing and unutilized financing costs

-

-

-

-

Normalized funds from operations

$

0.23

$

0.48

$

0.47

$

0.85

Certain non-cash and related recovery information:

Share-based compensation

$

0.01

$

0.02

$

0.03

$

0.04

Debt costs amortization

$

0.01

$

0.01

$

0.02

$

0.02

Non-cash rent and interest revenue (A)

$

-

$

(0.22

)

$

-

$

(0.25

)

Cash recoveries of non-cash rent and interest revenue (B)

$

-

$

-

$

0.01

$

0.06

Straight-line rent revenue from operating and finance leases

$

(0.07

)

$

(0.10

)

$

(0.15

)

$

(0.21

)

Notes:

Investors and analysts following the real estate industry

utilize funds from operations ("FFO") as a supplemental performance

measure. FFO, reflecting the assumption that real estate asset

values rise or fall with market conditions, principally adjusts for

the effects of GAAP depreciation and amortization of real estate

assets, which assumes that the value of real estate diminishes

predictably over time. We compute FFO in accordance with the

definition provided by the National Association of Real Estate

Investment Trusts, or Nareit, which represents net income (loss)

(computed in accordance with GAAP), excluding gains (losses) on

sales of real estate and impairment charges on real estate assets,

plus real estate depreciation and amortization, including

amortization related to in-place lease intangibles, and after

adjustments for unconsolidated partnerships and joint ventures.

In addition to presenting FFO in accordance with the Nareit

definition, we disclose normalized FFO, which adjusts FFO for items

that relate to unanticipated or non-core events or activities or

accounting changes that, if not noted, would make comparison to

prior period results and market expectations less meaningful to

investors and analysts. We believe that the use of FFO, combined

with the required GAAP presentations, improves the understanding of

our operating results among investors and the use of normalized FFO

makes comparisons of our operating results with prior periods and

other companies more meaningful. While FFO and normalized FFO are

relevant and widely used supplemental measures of operating and

financial performance of REITs, they should not be viewed as a

substitute measure of our operating performance since the measures

do not reflect either depreciation and amortization costs or the

level of capital expenditures and leasing costs (if any not paid by

our tenants) to maintain the operating performance of our

properties, which can be significant economic costs that could

materially impact our results of operations. FFO and normalized FFO

should not be considered an alternative to net income (loss)

(computed in accordance with GAAP) as indicators of our results of

operations or to cash flow from operating activities (computed in

accordance with GAAP) as an indicator of our liquidity.

Certain line items above (such as depreciation and amortization)

include our share of such income/expense from unconsolidated joint

ventures. These amounts are included with all activity of our

equity interests in the "(Loss) earnings from equity interests"

line on the consolidated statements of income.

(A) Includes revenue accrued during the period but not received

in cash, such as deferred rent, payment-in-kind ("PIK") interest or

other accruals.

(B) Includes cash received to satisfy previously accrued

non-cash revenue, such as the cash receipt of previously deferred

rent or PIK interest.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240807354979/en/

Drew Babin, CFA, CMA Head of Financial Strategy and Investor

Relations Medical Properties Trust, Inc. (646) 884-9809

dbabin@medicalpropertiestrust.com

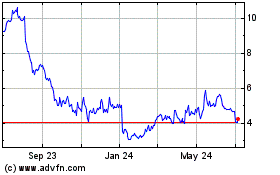

Medical Properties (NYSE:MPW)

Historical Stock Chart

From Oct 2024 to Nov 2024

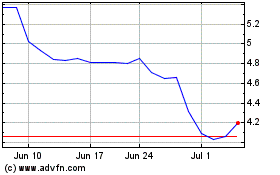

Medical Properties (NYSE:MPW)

Historical Stock Chart

From Nov 2023 to Nov 2024