Vulcan Downgraded to Underperform - Analyst Blog

August 16 2011 - 7:30AM

Zacks

We have

downgraded our recommendation on Vulcan Materials

Company (VMC) to Underperform from Neutral. Based in

Birmingham, Alabama, Vulcan Materials is engaged in the production,

distribution and sale of construction aggregates, and other

construction materials and related services in the U.S. and Mexico.

It is the nation’s largest producer of construction aggregates and

a leading producer of other construction materials.

Vulcan Materials released its second quarter earnings on August

02, 2011. The company posted adjusted earnings of $9 million or 7

cents per share from continuing operations compared with $5 million

or 3 cents per share in the year-ago quarter.

Net sales dropped 5.1% to $657.5 million from $692.8 million in

the corresponding quarter of 2010. The year-over-year decline was

primarily attributed to lower-than- expected demand, bad weather in

April, partly offset by stronger demand for public infrastructure

projects in some markets and price rise across all the

segments.

Despite

increased earnings in the most recent quarter, the company may see

reduced earnings in the near future given the rising costs of

certain essential materials along with the soaring prices of diesel

fuel. The price rise for necessary resources is expected to

continue, and raising the prices of products may not be enough to

fully offset the inflationary effects in the near

future.

Secondly,

the growing competitive pressure is a major threat to Vulcan’s

business. Although it is the nation’s largest supplier of

construction materials, other companies are growing faster and

capturing Vulcan’s market share, including CEMEX,

S.A.B. de C.V. (CX), Lafarge S.A.

(LFRGY), Cement Roadstone Holdings and Martin Marietta

Materials Inc. (MLM).

Moreover, Vulcan generated only $7 million of cash from

operating activities in the first six months of 2011 compared with

$18.7 million in the year-ago period. This decrease was largely

driven by an unfavorable variance in trade payables and accruals.

Accordingly, the company’s working capital has been reduced to

($44.5) million at the end of the second quarter in 2011. This

deterioration in the balance sheet may restrict the company’s

future investment plans.

CEMEX SA ADR (CX): Free Stock Analysis Report

LAFARGE SA-ADR (LFRGY): Free Stock Analysis Report

MARTIN MRT-MATL (MLM): Free Stock Analysis Report

VULCAN MATLS CO (VMC): Free Stock Analysis Report

Zacks Investment Research

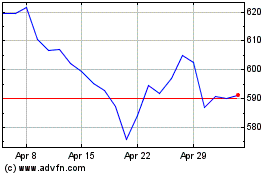

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

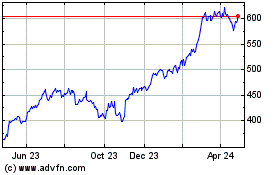

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jul 2023 to Jul 2024