Martin Marietta Materials, Inc. Updates 2009 Earnings Expectations

July 13 2009 - 6:15PM

Business Wire

Martin Marietta Materials, Inc. (NYSE:MLM) reported today that

it now expects 2009 net earnings to be in a range of $2.70 to $3.30

per diluted share. The revised earnings range is driven by three

primary factors: (i) a weaker and slower-than-expected recovery of

the general United States economy; (ii) a marked decrease in

transportation infrastructure spending resulting from a decline in

state revenues and a longer-than-expected delay in federal stimulus

projects moving to the construction stage; and (iii) an adverse

weather-affected first half of the year.

Stephen P. Zelnak, Jr., Chairman and Chief Executive Officer of

Martin Marietta Materials commented, "As we have consistently

indicated, we have expected our 2009 performance to be driven

primarily by anticipated economic growth in the second half of the

year. This growth was to be principally fueled by federal economic

stimulus, or the American Recovery and Reinvestment Act, which was

specifically crafted to provide for increased construction and for

investment in the nation's infrastructure.

"Among other things, this stimulus program was designed to

address job creation as well as the underlying demand in

infrastructure repair and expansion together with

industrial-related construction activity. While we have seen an

increase in bidding activity for infrastructure projects and

awarding of projects to successful bidders by a significant number

of states, we now believe that 25% of projects will commence later

in the year with most of the remainder coming in 2010. The pace at

which these projects have moved to the actual construction stage,

to date, is slower than expected even though the majority of the

work is resurfacing. Aside from the federal programs, a number of

states are challenged with their own budgets as revenues decline.

This has caused most states to pull back and defer on state funded

projects.

"We have seen resurgence in alternative-energy construction

projects, namely wind farms in Iowa and south Texas, and we are

benefiting from the continued strength of the farm economy through

our position in the Midwest. Commercial construction activity

remains weak, primarily in office and retail construction, and

there has been little change in the residential construction

markets, although the indicators point to the beginning of recovery

in the second half of 2009.

"We continue to adjust our operating plan in response to the

current economic environment with a strict focus on cost

containment and maintaining our strong financial base. Favorable

energy prices have helped mitigate the impact of declining volumes

on the operating leverage of the aggregates business and we

continue to maintain excellent productivity, as measured by tons

per worked man hour. We are carefully controlling headcount as well

as the number of hours worked. We have fully integrated the

aggregates quarries that we acquired from Cemex in June 2009 and

are positive about their contribution this year and going

forward.

"Our Specialty Products segment has experienced a decline in

dolomitic lime volume, which is used in both our chemicals products

and as a fluxing agent in steel production. With steel production

forecasted to decline in line with general industrial demand, we do

not expect volume growth in dolomitic lime in 2009.

"Based upon our current economic view, our 2009 guidance of net

earnings per diluted share in the range of $2.70 to $3.30,

including the effect of the economic stimulus plan, incorporates

the following assumptions: aggregates volumes to range from down

13% to 18% compared with 2008; the rate of price increase for the

aggregates product line to range from 3.5% to 5% compared with

2008; and Specialty Products segment to contribute $28 million to

$30 million in pretax earnings.

"Although it is too early to provide guidance for 2010, we have

begun to frame our view on the upcoming year. As noted above, we

see some of the projects that we had earlier anticipated to

commence in 2009 now beginning next year. Specifically, we believe

there will be a significant increase in infrastructure related

projects as the effects of federal economic stimulus work their way

into the economy. We continue to believe we will see a moderate

increase in aggregates volume to portions of home building and

steady growth for chemical grade aggregates used for flue gas

desulfurization and in agricultural lime, as well as ballast used

in the railroad industry. These markets cumulatively comprised 69%

of our 2008 aggregates volumes, and we expect them to increase in

2010. Commercial construction represents the balance of our

aggregates volume and, while we expect a decline in commercial

construction volumes in 2010, we do not have meaningful visibility

into these markets at this time. Aggregates pricing growth in 2010

is expected to trend closer to our 20-year average," Zelnak

concluded.

RISKS TO EARNINGS EXPECTATIONS

The 2009 estimated earnings range includes management's

assessment of the likelihood of certain risk factors that will

affect performance within the range. The most significant risk to

2009 earnings, whether within or outside current earnings

expectations, will be, as previously noted, the performance of the

United States economy and that performance's effect on construction

activity. Management has estimated its earnings range, assuming a

stabilization of the United States economy in the second half of

2009. Should the second half 2009 stabilization not occur or the

economy is worse than currently expected, earnings could vary

significantly.

Risks to the earnings range are primarily volume-related and

include a greater-than-expected drop in demand as a result of the

continued decline in commercial construction, a further decline in

residential construction, continued delays in infrastructure

projects, or some combination thereof. Further, increased highway

construction funding pressures as a result of either federal or

state issues can affect profitability. Currently, nearly all states

are experiencing state-level funding pressures driven by lower tax

revenues and an inability to finance approved projects. North

Carolina and Texas are among the states experiencing these

pressures and these states disproportionately affect revenue and

profitability. The level of aggregates demand in the Corporation's

end-use markets, production levels and the management of production

costs will affect the operating leverage of the Aggregates business

and, therefore, profitability.

Production costs in the Aggregates business are also sensitive

to energy prices, both directly and indirectly. Diesel and other

fuels change production costs directly through consumption or

indirectly in the increased cost of energy-related consumables,

namely steel, explosives, tires and conveyor belts. Changing diesel

costs also affect transportation costs, primarily through fuel

surcharges in our long-haul distribution network. The Corporation's

earnings expectations do not include rapidly increasing diesel

costs or sustained periods of increased diesel fuel cost during

2009 at the level experienced in 2008 and, in fact, expectations

are that reduced diesel costs will contribute $35 million to $50

million in profitability in 2009. The Corporation experienced

favorable diesel costs in the first quarter 2009, but there is no

guarantee that this level of cost decrease will continue. The

availability of transportation in the Corporation's long-haul

network, particularly the availability of barges on the Mississippi

River system and the availability of rail cars and locomotive power

to move trains, affects the Corporation's ability to efficiently

transport material into certain markets, most notably Texas,

Florida and the Gulf Coast region. The Aggregates business is also

subject to weather-related risks that can significantly affect

production schedules and profitability. Atlantic Ocean and Gulf

Coast hurricane activity is most acute from June to November and

can cause significant disruption to production activity and

increase production costs. Opportunities to reach the upper end of

the earnings range depend on demand exceeding expectations for the

aggregates product line.

Risks to earnings outside of the range include a change in

volume beyond current expectations as a result of economic events

outside of the Corporation's control. In addition to the impact on

commercial and residential construction, the Corporation is exposed

to risk in its earnings expectations from tightening credit markets

and the availability of and interest cost related to its debt. If

volumes decline worse than expected, the Corporation is exposed to

greater risk in its earnings, including its debt covenant, as the

pressure of operating leverage increases disproportionately.

Martin Marietta Materials is a leading producer of construction

aggregates and a producer of magnesia-based chemical and dolomitic

lime. For more information about Martin Marietta Materials, refer

to our Web site at www.martinmarietta.com.

Investors are cautioned that all statements in this Press

Release that relate to the future involve risks and uncertainties,

and are based on assumptions that the Corporation believes in good

faith are reasonable but which may be materially different from

actual results. Factors that the Corporation currently believes

could cause actual results to differ materially from the

forward-looking statements in this press release include, but are

not limited to business and economic conditions and trends in the

markets the Company serves; the level and timing of federal and

state transportation funding; levels of construction spending in

the markets the Company serves; unfavorable weather conditions;

ability to recognize quantifiable savings from internal expansion

projects; ability to successfully integrate acquisitions quickly

and in a cost-effective manner; fuel costs; transportation costs;

competition from new or existing competitors; and other risk

factors listed from time to time found in the Corporation's filings

with the Securities and Exchange Commission. The Corporation

assumes no obligation to update any such forward-looking

statements.

MLM-G

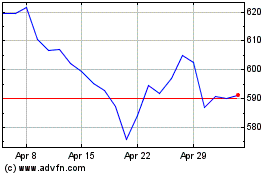

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

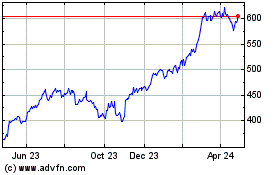

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jul 2023 to Jul 2024