Martin Marietta Materials, Inc. Acquires Aggregate Operations from CEMEX

June 15 2009 - 8:55AM

Business Wire

Martin Marietta Materials, Inc. (NYSE:MLM), announced today that

it has acquired three quarries plus the remaining 49% interest in

an existing joint venture from CEMEX, Inc. The purchase price for

the assets of the three quarries plus the 49% interest was $65

million. Based on 2008 results without synergies, this equates to a

multiple of 6.8 times EBITDA. Estimated mineral reserves are 255

million tons.

The quarry operations are located at Fort Calhoun, Nebraska;

Guernsey, Wyoming; and Milford, Utah. Guernsey and Milford are

rail-connected quarries while Fort Calhoun ships material via barge

on the Missouri River in addition to its local and long-haul truck

market in Nebraska. The 49% interest purchased relates to the

Granite Canyon, Wyoming, quarry where Martin Marietta is the

operating manager. Granite Canyon is a major supplier of railroad

ballast serving both the Union Pacific Railroad and Burlington

Northern Santa Fe Railway. Aggregate shipments in 2008, including

the partial interest only in Granite Canyon, were 3.3 million

tons.

Commenting on the acquisition, Stephen P. Zelnak, Jr., Chairman

& CEO of Martin Marietta, stated: �We are pleased to be able to

add this set of quarries to our western operations as well as being

able to purchase the minority interest at Granite Canyon. These

operations are a very good fit with our Western business and will

enable us to pursue growth via additional rail and water transport

possibilities. Financially, we expect the acquired operations to be

modestly accretive in 2009 with increased contributions as the

economy improves.�

Ward Nye, President & COO, further commented: �In addition

to enhancing our existing logistical network, these new quarries

provide attractive product synergies. Ballast and rip-rap are

notable in stimulus and other construction projects critical to the

rebuilding of U.S. infrastructure. The sites also strengthen our

position as a premier stone supplier to the railroad industry. We

will substantially complete the integration of these new operations

into our existing business within a matter of days.�

Martin Marietta Materials is a leading producer of construction

aggregates and a producer of magnesia-based chemical and dolomitic

lime. For more information about Martin Marietta Materials, refer

to our Web site at www.martinmarietta.com.

Investors are cautioned that all statements in this Press

Release that relate to the future involve risks and uncertainties,

and are based on assumptions that the Corporation believes in good

faith are reasonable but which may be materially different from

actual results. Factors that the Corporation currently believes

could cause actual results to differ materially from the

forward-looking statements in this press release include, but are

not limited to business and economic conditions and trends in the

markets the Company serves; the level and timing of federal and

state transportation funding; levels of construction spending in

the markets the Company serves; unfavorable weather conditions;

ability to recognize quantifiable savings from internal expansion

projects; ability to successfully integrate acquisitions quickly

and in a cost-effective manner; fuel costs; transportation costs;

competition from new or existing competitors; and other risk

factors listed from time to time found in the Corporation�s filings

with the Securities and Exchange Commission. The Corporation

assumes no obligation to update any such forward-looking

statements.

MLM-G

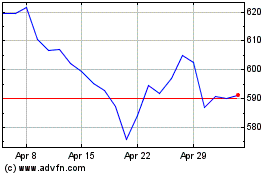

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

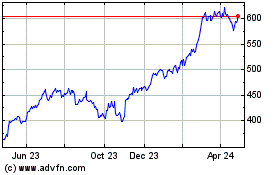

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jul 2023 to Jul 2024