Martin Marietta Materials, Inc. (NYSE:MLM), today announced results

for the second quarter and six months ended June 30, 2008. Notable

items for the quarter were: Earnings per diluted share of $1.52

compared with $1.92 in the prior-year quarter Cost of

petroleum-based products up $18 million, which reduced earnings by

$0.26 per diluted share Heritage aggregates product line pricing up

6% and volume down 9% Record Specialty Products� earnings from

operations up 20% from prior-year quarter Net sales of $527

million, down 1% compared with the prior-year quarter Selling,

general and administrative expenses down $2.3 million and down 40

basis points as a percentage of net sales compared with prior-year

quarter Acquisition and successful integration of six quarries from

Vulcan Materials Company Significant new transportation funding in

North Carolina Issuance of $300 million of Senior Notes MANAGEMENT

COMMENTARY Stephen P. Zelnak, Jr., Chairman and CEO of Martin

Marietta Materials, stated, �Second-quarter results highlighted our

ability to successfully operate in one of the most challenging

economic environments in our industry�s history. We faced diesel

fuel and natural gas costs that escalated nearly 60%, a ninth

consecutive quarter of declining aggregates volume and its

resulting impact on our operating leverage as production volumes

were aligned with sales expectations. Nonetheless, our management

team and employees did an excellent job of matching operating

levels with demand and aggressively addressed controllable costs.

�Despite the reduced demand, we continued to achieve sustainable

pricing growth within all groups of the aggregates business as

overall pricing for aggregates was up over 6% for the quarter. The

West Group again reported positive volume levels for its aggregates

product line, resulting from the comparative strength of the

infrastructure and commercial construction markets in Texas,

Oklahoma, and Iowa. Shipments in Iowa increased over 9% during the

quarter despite severe flooding in much of the state; however,

lower production levels and higher operating costs as a result of

the flooding had a negative impact on profitability compared with

expectations and the prior-year period. Infrastructure demand in

other key states, including North Carolina and Georgia, remains

challenging to forecast as rising costs for construction materials

have constrained state highway budgets, as well as municipal

spending. Demand dropped significantly in the Mideast Group, as the

usually resilient North Carolina and South Carolina markets

experience the effects of residential construction declines in

addition to weakening infrastructure expenditures. Several states

are taking active measures to address their infrastructure funding

needs; however, it is difficult to predict the impact of these

measures on volume levels for the remainder of 2008. �The rapid and

extreme increases in the cost of petroleum-based products affected

both our costs and sales. Liquid asphalt, used in the production of

asphalt paving products, increased approximately 135% over the

prior year with average prices approaching $700 per ton. Our

customers cannot react quickly enough to these escalating costs

and, when possible, have made the choice to defer work in

anticipation of future potential cost reductions. Cost control

initiatives in place throughout the Corporation served to limit the

increase in consolidated cost of sales despite the nearly 60%

increase in diesel fuel and natural gas costs compared with the

prior-year quarter. The rise in the cost of petroleum-based

products alone resulted in additional production costs of $18

million, or $0.26 per diluted share, for the quarter. Compounding

the sharply-escalating energy costs, the Corporation incurred

expenses of $24 million, or $0.35 per diluted share, to control

aggregates production and reduce inventory levels. �The focus and

execution on cost control also extended to our overhead costs.

Selling, general and administrative expenses decreased by $2.3

million in terms of absolute dollars and as a percentage of net

sales to 8.0% from 8.4% for the prior-year quarter. �We completed

the acquisition and highly-successful integration of the operations

acquired from Vulcan Materials Company in the previously announced

asset exchange transaction during the quarter. The Corporation

recorded a total gain on the exchange transaction of $16.4 million.

Of this total gain, $7.2 million has been reported in other

operating income of both the West and Mideast Groups. The remainder

of the gain has been reported as part of discontinued operations.

�During the quarter, we received some very positive news in North

Carolina. The legislature passed a budget that provided funding for

the construction of four toll road projects for a total of $3.2

billion. The first of these projects is scheduled for letting in

the third quarter of this year with completion in 2011. It is

valued at approximately $1 billion and will consume about 2 million

tons of aggregates. Two additional projects will begin in 2009 and

the remaining one is scheduled for 2010. These three projects are

estimated to consume 4.5 million tons of aggregates. Of the total

6.5 million tons for the four projects, we should be fully

competitive on about 85%. �Finally, in another positive

development, we now expect that our new plant in Augusta, Georgia,

will begin operations in the fourth quarter of 2008 versus the

prior forecast of second quarter 2009. The earlier completion of

this project, which increases capacity from 2 million tons to 6

million tons annually, is enabling us to engage in marketing

discussions with major customers. We expect that this will increase

our market share in high-growth markets in Georgia and Florida.

�Our Specialty Products business continues to perform exceptionally

well. The United States� steel market has remained strong, leading

to increased demand for dolomitic lime. We've experienced increased

demand for magnesia-based chemicals products used in a number of

environmental applications as well as for our flame retardant

products. The business delivered record second-quarter net sales of

$45.2 million, an increase of 14% compared with the prior-year

quarter, and record earnings from operations of $9.7 million, an

increase of 20% compared with the prior-year quarter. The business�

operating margin excluding freight and delivery revenues increased

120 basis points to 21.6% for the quarter. 2008 OUTLOOK �Our 2008

outlook has turned decidedly more cautious in the past few months

as the shock of high oil prices has affected both demand for our

products and our costs. A challenging economic environment, energy

inflation, credit market uncertainty and lagging infrastructure

demand make forecasting increasingly difficult. Accordingly, we are

adjusting downward our range for 2008 net earnings per diluted

share to $5.00 to $5.65 from $6.25 to $7.00. Even in this difficult

environment, however, our outlook for 2008 pricing in our

Aggregates business remains positive. Accordingly, we reaffirm our

6.0% to 8.0% range for the rate of heritage aggregates price

increases in 2008. �Over the balance of the year, we expect

infrastructure volumes in certain of our key states to be affected

more by funding limitations than underlying demand. In addition,

the sharp increase in diesel fuel prices may continue to affect

infrastructure volume as customers do not have funding mechanisms

to react quickly to the increases currently being experienced in

liquid asphalt and other petroleum-based raw materials. However,

assuming that recent downward trends in oil and commodity pricing

continue, this could be a catalyst in turning demand in a positive

direction. Residential construction continues to be dismal, but we

still expect that large industrial commercial projects will be a

plus for second-half 2008 results. �As a result, we are lowering

our range for 2008 heritage aggregates volumes to be down 3% to

down 6%, both exclusive of acquisitions. We also expect to deliver

record levels of net sales and earnings from both our lime and

magnesia chemicals businesses and reaffirm our guidance of $36

million to $38 million in pretax earnings from Specialty Products.�

RISKS TO EARNINGS EXPECTATIONS The 2008 estimated earnings range

includes management�s assessment of the likelihood of certain risk

factors that will affect performance within the range. The most

significant risk to 2008 earnings, whether within or outside

current earnings expectations, continues to be the performance of

the United States economy and its effect on construction activity.

Risks to the earnings range are primarily volume-related and

include a greater-than-expected drop in demand as a result of the

continued decline in residential construction, a decline in

commercial construction, delays in infrastructure projects, or some

combination thereof. Further, increased highway construction

funding pressures as a result of either federal or state issues can

affect profitability. Currently, North Carolina, Georgia, Texas,

and South Carolina are experiencing state-level funding pressures,

and these states may disproportionately affect profitability. The

level of aggregates demand in the Corporation�s end-use markets,

production levels and the management of production costs will

affect the operating leverage of the Aggregates business and,

therefore, profitability. Production costs in the aggregates

business are also sensitive to energy prices, the costs of repair

and supply parts, and the start-up expenses for large-scale plant

projects. The continued rising cost of diesel and other fuels

increases production costs either directly through consumption or

indirectly through the increased cost of energy-related

consumables, namely steel, explosives, tires and conveyor belts.

Sustained periods of diesel fuel cost at the current level will

continue to have a negative impact on profitability. The

availability of transportation in the Corporation's long-haul

network, particularly the availability of barges on the Mississippi

River system and the availability of rail cars and locomotive power

to move trains, affects the Corporation�s ability to efficiently

transport material into certain markets, most notably Texas and the

Gulf Coast region. The Aggregates business is also subject to

weather-related risks that can significantly affect production

schedules and profitability. Hurricane activity in the Atlantic

Ocean and Gulf Coast generally is most active during the third and

fourth quarters. Opportunities to reach the upper end of the

earnings range depend on the aggregates product line demand

exceeding expectations. Risks to earnings outside of the range

include a change in volume beyond current expectations as a result

of economic events outside of the Corporation�s control. In

addition to the impact of residential and commercial construction,

the Corporation is exposed to risk in its earnings expectations

from tightening credit markets and the availability of and interest

cost related to its commercial paper program, which is rated A-2 by

Standards & Poor�s and P-2 by Moody�s. Commercial paper of $75

million was outstanding at June 30, 2008. CONSOLIDATED FINANCIAL

HIGHLIGHTS Net sales for the quarter were $527.2 million, a 0.6%

decrease versus the $530.2 million recorded in the second quarter

of 2007. Earnings from operations for the second quarter of 2008

were $104.9 million compared with $136.3 million in 2007. Net

earnings were $63.8 million, or $1.52 per diluted share, versus

2007 second-quarter net earnings of $83.0 million, or $1.92 per

diluted share. Net sales for the first six months of 2008 were

$923.9 million compared with $940.9 million for the year-earlier

period. Year-to-date earnings from operations were $147.4 million

in 2008 versus $194.2�million in 2007. The Corporation posted an

after-tax gain on discontinued operations of $5.5�million in 2008

compared with $0.8 million in 2007. For the six-month period ended

June�30, net earnings were $84.7 million, or $2.02 per diluted

share, in 2008 compared with net earnings of $115.9 million, or

$2.62 per diluted share, in 2007. BUSINESS FINANCIAL HIGHLIGHTS Net

sales for the Aggregates business for the second quarter were

$482.0 million compared with 2007 second-quarter sales of $490.5

million. Aggregates pricing at heritage locations was up 6.3%,

while volume decreased 9.3%. Including acquisitions and

divestitures, aggregates pricing increased 6.4% and aggregates

volume declined 8.5%. Earnings from operations for the quarter were

$107.0 million in 2008 versus $138.6 million in the year-earlier

period. Year-to-date net sales for the Aggregates business were

$835.8 million versus $862.7 million in 2007. Earnings from

operations on a year-to-date basis were $150.0 million in 2008

compared with $199.1�million in 2007. For the six-month period

ended June 30, 2008, heritage aggregates pricing increased 5.1%,

while volume was down 8.9%. Including acquisitions and

divestitures, aggregates average selling price increased 5.2% while

volume declined 8.6%. Specialty Products� second-quarter net sales

of $45.2 million increased 14% over prior-year net sales of

$39.7�million. Earnings from operations for the second quarter were

$9.7 million compared with $8.1�million in the year-earlier period.

For the first six months of 2008, net sales were $88.1 million and

earnings from operations were $18.8 million compared with net sales

of $78.2 million and earnings from operations of $15.5 million for

the first six months of 2007. CONFERENCE CALL INFORMATION The

Corporation will host an online Web simulcast of its second-quarter

2008 earnings conference call later today (August 7, 2008). The

live broadcast of Martin Marietta Materials' conference call will

begin at 2:00�p.m. Eastern Time. An online replay will be available

approximately two hours following the conclusion of the live

broadcast. A link to these events will be available at the

Corporation�s Web site: www.martinmarietta.com. For those investors

without online web access, the conference call may also be accessed

by calling 719-325-4884, confirmation number 9485638. Martin

Marietta Materials is a leading producer of construction aggregates

and a producer of magnesia-based chemicals and dolomitic lime. For

more information about Martin Marietta Materials, refer to the

Corporation's Web site at www.martinmarietta.com. If you are

interested in Martin Marietta Materials, Inc. stock, management

recommends that, at a minimum, you read the Corporation's current

annual report and Forms 10-K, 10-Q and 8-K reports to the SEC over

the past year. The Corporation's recent proxy statement for the

annual meeting of shareholders also contains important information.

These and other materials that have been filed with the SEC are

accessible through the Corporation's Web site at

www.martinmarietta.com and are also available at the SEC's Web site

at www.sec.gov. You may also write or call the Corporation's

Corporate Secretary, who will provide copies of such reports.

Investors are cautioned that all statements in this press release

that relate to the future involve risks and uncertainties, and are

based on assumptions that the Corporation believes in good faith

are reasonable but which may be materially different from actual

results. Forward-looking statements give the investor our

expectations or forecasts of future events. You can identify these

statements by the fact that they do not relate only historical or

current facts. They may use words such as "anticipate," "expect,"

"should be," "believe," and other words of similar meaning in

connection with future events or future operating or financial

performance. Any or all of our forward-looking statements here and

in other publications may turn out to be wrong. Factors that the

Corporation currently believes could cause actual results to differ

materially from the forward-looking statements in this press

release include, but are not limited to the level and timing of

federal and state transportation funding, particularly in North

Carolina and Georgia, two of the Corporation�s largest and most

profitable states, and in South Carolina, the Corporation�s fifth

largest state as measured by 2007 Aggregates business� net sales;

levels of construction spending in the markets the Corporation

serves; the severity and duration of a continued decline in the

residential construction market and the impact on commercial

construction; unfavorable weather conditions, including hurricane

activity; the ability to recognize quantifiable savings from

internal expansion projects; the ability to successfully integrate

acquisitions quickly and in a cost-effective manner; the volatility

of fuel costs, most notably diesel fuel, liquid asphalt and natural

gas; continued increases in the cost of repair and supply parts;

logistical issues and costs, notably barge availability on the

Mississippi River system and the availability of railcars and

locomotive power to move trains to supply the Corporation�s Texas

and Gulf Coast markets; continued strength in the steel industry

markets served by the Corporation�s dolomitic lime products; and

other risk factors listed from time to time found in the

Corporation�s filings with the Securities and Exchange Commission.

Other factors besides those listed here may also adversely affect

the Corporation, and may be material to the Corporation. The

Corporation assumes no obligation to update any such

forward-looking statements. MARTIN MARIETTA MATERIALS, INC.

Unaudited Statements of Earnings (In millions, except per share

amounts) � � � � Three Months Ended Six Months Ended June 30, June

30, � 2008 � � 2007 � � 2008 � � 2007 � Net sales $ 527.2 $ 530.2 $

923.9 $ 940.9 Freight and delivery revenues � 71.5 � � 60.1 � �

126.9 � � 107.5 � Total revenues � 598.7 � � 590.3 � � 1,050.8 � �

1,048.4 � � Cost of sales 387.8 352.3 709.7 669.0 Freight and

delivery costs � 71.5 � � 60.1 � � 126.9 � � 107.5 � Cost of

revenues � 459.3 � � 412.4 � � 836.6 � � 776.5 � Gross profit 139.4

177.9 214.2 271.9 � Selling, general and administrative expenses

42.0 44.3 79.7 82.6 Research and development 0.1 0.2 0.3 0.4 Other

operating (income) and expenses, net � (7.6 ) � (2.9 ) � (13.2 ) �

(5.3 ) Earnings from operations 104.9 136.3 147.4 194.2 � Interest

expense 19.3 16.7 35.1 27.9 Other nonoperating (income) and

expenses, net � 1.0 � � (1.1 ) � 0.1 � � (3.8 ) Earnings before

taxes on income 84.6 120.7 112.2 170.1 Income tax expense � 26.3 �

� 38.3 � � 33.0 � � 55.0 � Earnings from continuing operations 58.3

82.4 79.2 115.1 � Discontinued operations: Gain on discontinued

operations, net of related tax expense of $3.7, $0.5, $3.7 and

$0.6, respectively � 5.5 � � 0.6 � � 5.5 � � 0.8 � � Net Earnings $

63.8 � $ 83.0 � $ 84.7 � $ 115.9 � � Net earnings per share: Basic

from continuing operations $ 1.41 $ 1.94 $ 1.92 $ 2.65 Discontinued

operations � 0.13 � � 0.01 � � 0.13 � � 0.02 � $ 1.54 � $ 1.95 � $

2.05 � $ 2.67 � � Diluted from continuing operations $ 1.39 $ 1.91

$ 1.89 $ 2.60 Discontinued operations � 0.13 � � 0.01 � � 0.13 � �

0.02 � $ 1.52 � $ 1.92 � $ 2.02 � $ 2.62 � � Dividends per share $

0.345 � $ 0.275 � $ 0.69 � $ 0.55 � � Average number of shares

outstanding: Basic � 41.3 � � 42.5 � � 41.3 � � 43.5 � Diluted �

41.9 � � 43.1 � � 41.9 � � 44.2 � MARTIN MARIETTA MATERIALS, INC.

Unaudited Financial Highlights (In millions) � � � � � Three Months

Ended Six Months Ended June 30, June 30, � 2008 � � 2007 � � 2008 �

� 2007 � Net sales: Aggregates Business: Mideast Group $ 168.9 $

194.1 $ 287.6 $ 331.4 Southeast Group 122.0 118.3 225.1 230.0 West

Group � 191.1 � � 178.1 � � 323.1 � � 301.3 � Total Aggregates

Business 482.0 490.5 835.8 862.7 Specialty Products � 45.2 � � 39.7

� � 88.1 � � 78.2 � Total $ 527.2 � $ 530.2 � $ 923.9 � $ 940.9 � �

Gross profit: Aggregates Business: Mideast Group $ 66.5 $ 90.4 $

104.0 $ 141.8 Southeast Group 19.5 33.5 35.3 60.7 West Group � 40.8

� � 41.5 � � 52.6 � � 49.9 � Total Aggregates Business 126.8 165.4

191.9 252.4 Specialty Products 12.4 10.9 24.1 21.1 Corporate � 0.2

� � 1.6 � � (1.8 ) � (1.6 ) Total $ 139.4 � $ 177.9 � $ 214.2 � $

271.9 � � Selling, general, and administrative expenses: Aggregates

Business: Mideast Group $ 11.8 $ 11.8 $ 23.1 $ 23.3 Southeast Group

6.6 6.6 13.2 12.8 West Group � 11.2 � � 11.5 � � 22.5 � � 23.0 �

Total Aggregates Business 29.6 29.9 58.8 59.1 Specialty Products

2.5 2.7 5.1 5.3 Corporate � 9.9 � � 11.7 � � 15.8 � � 18.2 � Total

$ 42.0 � $ 44.3 � $ 79.7 � $ 82.6 � � Earnings (Loss) from

operations: Aggregates Business: Mideast Group $ 61.4 $ 79.5 $ 93.5

$ 120.3 Southeast Group 13.5 27.6 22.9 48.8 West Group � 32.1 � �

31.5 � � 33.6 � � 30.0 � Total Aggregates Business 107.0 138.6

150.0 199.1 Specialty Products 9.7 8.1 18.8 15.5 Corporate � (11.8

) � (10.4 ) � (21.4 ) � (20.4 ) Total $ 104.9 � $ 136.3 � $ 147.4 �

$ 194.2 � � Depreciation $ 40.8 $ 35.4 $ 78.3 $ 69.8 Depletion 1.1

1.2 1.8 2.1 Amortization � 0.9 � � 0.8 � � 1.6 � � 1.5 � $ 42.8 � $

37.4 � $ 81.7 � $ 73.4 � MARTIN MARIETTA MATERIALS, INC. Balance

Sheet Data (In millions) � � � � � � June 30, December 31, June 30,

� 2008 � 2007 � 2007 (Unaudited) (Audited) (Unaudited) ASSETS Cash

and cash equivalents $ 13.2 $ 20.0 $ 30.9 Accounts receivable, net

322.0 245.8 296.6 Inventories, net 297.4 286.9 297.8 Other current

assets 58.2 73.3 66.0 Property, plant and equipment, net 1,704.7

1,433.6 1,347.4 Other noncurrent assets 46.9 40.1 44.0 Intangible

assets, net 629.2 584.1 585.0 Total assets $ 3,071.6 $ 2,683.8 $

2,667.7 � � LIABILITIES AND SHAREHOLDERS' EQUITY Current maturities

of long-term debt and commercial paper $ 279.7 $ 276.1 $ 127.1

Other current liabilities 212.8 230.5 226.3 Long-term debt

(excluding current maturities) 1,153.0 848.2 1,051.5 Other

noncurrent liabilities 409.3 383.0 358.5 Shareholders' equity �

1,016.8 � 946.0 � 904.3 Total liabilities and shareholders' equity

$ 3,071.6 $ 2,683.8 $ 2,667.7 MARTIN MARIETTA MATERIALS, INC.

Unaudited Statements of Cash Flows (In millions) � � � � � Six

Months Ended June 30, � 2008 � � � 2007 � Net earnings $ 84.7 $

115.9 Adjustments to reconcile net earnings to cash provided by

operating activities: Depreciation, depletion and amortization 81.7

73.4 Share-based compensation expense 13.2 13.0 Excess tax benefits

from share-based compensation (1.1 ) (17.7 ) Gains on divestitures

and sales of assets (22.6 ) (3.2 ) Deferred income taxes 14.4 2.6 �

Other items, net (1.0 ) (1.5 ) � Changes in operating assets and

liabilities: Accounts receivable, net (76.1 ) (54.7 ) Inventories,

net (4.4 ) (42.3 ) Accounts payable 14.1 7.1 Other assets and

liabilities, net � 22.2 � � 47.4 � � Net cash provided by operating

activities � 125.1 � � 140.0 � � Investing activities: Additions to

property, plant and equipment (159.4 ) (115.0 ) Acquisitions, net

(218.4 ) (12.1 ) Proceeds from divestitures and sales of assets 5.5

7.1 Railcar construction advances (7.3 ) - Repayment of railcar

construction advances � 7.3 � � - � � Net cash used for investing

activities � (372.3 ) � (120.0 ) � Financing activities: Borrowings

of long-term debt 297.8 472.0 Repayments of long-term debt and

payments on capital lease obligations (3.0 ) (0.5 ) Net borrowings

(repayments) of commercial paper and overnight loan 3.0 (0.5 )

Termination of interest rate swaps (11.1 ) - Debt issue costs (1.1

) (0.8 ) Change in bank overdraft 5.8 (4.3 ) Dividends paid (28.9 )

(24.3 ) Repurchases of common stock (24.0 ) (493.6 ) Issuances of

common stock 0.8 12.9 Excess tax benefits from share-based

compensation � 1.1 � � 17.7 � � Net cash provided by (used for)

financing activities � 240.4 � � (21.4 ) � Net decrease in cash and

cash equivalents (6.8 ) (1.4 ) Cash and cash equivalents, beginning

of period � 20.0 � � 32.3 � � Cash and cash equivalents, end of

period $ 13.2 � $ 30.9 � MARTIN MARIETTA MATERIALS, INC. Unaudited

Operational Highlights � � � � � � Three Months Ended Six Months

Ended June 30, 2008 June 30, 2008 Volume Pricing Volume Pricing

Volume/Pricing Variance (1) Heritage Aggregates Product Line: (2)

Mideast Group (22.3%) 12.0% (22.8%) 12.3% Southeast Group (9.9%)

6.5% (10.6%) 5.6% West Group 4.4% 3.9% 6.2% 2.1% Heritage

Aggregates Operations (9.3%) 6.3% (8.9%) 5.1% Aggregates Product

Line (3) (8.5%) 6.4% (8.6%) 5.2% � Three Months Ended Six Months

Ended June 30, June 30, Shipments (tons in thousands) 2008 2007

2008 2007 Heritage Aggregates Product Line: (2) Mideast Group

14,994 19,302 24,734 32,025 Southeast Group 10,144 11,260 19,212

21,481 West Group 19,716 18,892 33,731 31,746 Heritage Aggregates

Operations 44,854 49,454 77,677 85,252 Acquisitions 930 - 930 -

Divestitures (4) 15 588 259 1,070 Aggregates Product Line (3)

45,799 50,042 78,866 86,322 � � (1) Volume/pricing variances

reflect the percentage increase (decrease) from the comparable

period in the prior year. � (2) Heritage Aggregates product line

excludes volume and pricing data for acquisitions that have not

been included in prior-year operations for the comparable period

and divestitures. � (3) Aggregates product line includes all

acquisitions from the date of acquisition and divestitures through

the date of disposal. � (4) Divestitures include the tons related

to divested aggregates product line operations up to the date of

divestiture. MARTIN MARIETTA MATERIALS, INC. Non-GAAP Financial

Measures (In millions) � � � � Gross margin as a percentage of net

sales and operating margin as a percentage of net sales represent

non-GAAP measures. The Corporation presents these ratios calculated

based on net sales, as it is consistent with the basis by which

management reviews the Corporation's operating results. Further,

management believes it is consistent with the basis by which

investors analyze the Corporation's operating results given that

freight and delivery revenues and costs represent pass-throughs and

have no profit mark-up. Gross margin and operating margin

calculated as percentages of total revenues represent the most

directly comparable financial measures calculated in accordance

with generally accepted accounting principles ("GAAP"). The

following tables present the calculations of gross margin and

operating margin for the three and six months ended June 30, 2008

and 2007, in accordance with GAAP and reconciliations of the ratios

as percentages of total revenues to percentages of net sales: � � �

� � Gross Margin in Accordance with Generally Accepted Accounting

Principles Three Months Ended Six Months Ended June 30, June 30, �

2008 � � 2007 � � 2008 � � 2007 � Gross profit $ 139.4 � $ 177.9 �

$ 214.2 � $ 271.9 � Total revenues $ 598.7 � $ 590.3 � $ 1,050.8 �

$ 1,048.4 � Gross margin � 23.3 % � 30.1 % � 20.4 % � 25.9 % � �

Gross Margin Excluding Freight and Delivery Revenues Three Months

Ended Six Months Ended June 30, June 30, � 2008 � � 2007 � � 2008 �

� 2007 � � Gross profit $ 139.4 � $ 177.9 � $ 214.2 � $ 271.9 �

Total revenues $ 598.7 $ 590.3 $ 1,050.8 $ 1,048.4 Less: Freight

and delivery revenues � (71.5 ) � (60.1 ) � (126.9 ) � (107.5 ) Net

sales $ 527.2 � $ 530.2 � $ 923.9 � $ 940.9 � Gross margin

excluding freight and delivery revenues � 26.4 % � 33.6 % � 23.2 %

� 28.9 % � � Operating Margin in Accordance with Generally Accepted

Three Months Ended Six Months Ended Accounting Principles June 30,

June 30, � 2008 � � 2007 � � 2008 � � 2007 � Earnings from

operations $ 104.9 � $ 136.3 � $ 147.4 � $ 194.2 � Total revenues $

598.7 � $ 590.3 � $ 1,050.8 � $ 1,048.4 � Operating margin � 17.5 %

� 23.1 % � 14.0 % � 18.5 % � � Operating Margin Excluding Freight

and Delivery Revenues Three Months Ended Six Months Ended June 30,

June 30, � 2008 � � 2007 � � 2008 � � 2007 � Earnings from

operations $ 104.9 � $ 136.3 � $ 147.4 � $ 194.2 � Total revenues $

598.7 $ 590.3 $ 1,050.8 $ 1,048.4 Less: Freight and delivery

revenues � (71.5 ) � (60.1 ) � (126.9 ) � (107.5 ) Net sales $

527.2 � $ 530.2 � $ 923.9 � $ 940.9 � Operating margin excluding

freight and delivery revenues � 19.9 % � 25.7 % � 16.0 % � 20.6 %

MARTIN MARIETTA MATERIALS, INC. Non-GAAP Financial Measures

(continued) (Dollars in millions) � � � � � � � Three Months Ended

Six Months Ended June 30, June 30, 2008 2007 2008 2007 � Earnings

Before Interest, Income Taxes, Depreciation, Depletion and

Amortization (EBITDA) (1) $ 155.6 $ 175.9 $ 237.6 $ 272.8 � (1)

EBITDA is a widely accepted financial indicator of a company's

ability to service and/or incur indebtedness. EBITDA is not defined

by generally accepted accounting principles and, as such, should

not be construed as an alternative to net income or operating cash

flow. For further information on EBITDA, refer to the Corporation's

Web site at www.martinmarietta.com. � � A reconciliation of Net

Cash Provided by Operating Activities to EBITDA is as follows: �

Three Months Ended Six Months Ended June 30, June 30, 2008 2007

2008 2007 Net Cash Provided by Operating Activities $ 49.9 $ 90.9 $

125.1 $ 140.0 � � Changes in operating assets and liabilities, net

of effects of acquisitions and divestitures 56.8 31.7 44.2 42.5

Other items, net (0.4) (2.2) (3.5) 6.8 Income tax expense 30.0 38.8

36.7 55.6 Interest expense 19.3 16.7 35.1 27.9 EBITDA $ 155.6 $

175.9 $ 237.6 $ 272.8 � The ratio of Consolidated

Debt-to-Consolidated EBITDA, as defined, for the trailing twelve

months is a covenant under the Corporation's $325,000,000 five-year

revolving credit agreement. Under the agreement, the Corporation's

ratio of Consolidated Debt-to-Consolidated EBITDA, as defined, for

the trailing twelve months can not exceed 2.75 to 1.00 as of the

end of any fiscal quarter, with certain exceptions related to

qualifying acquisitions, as defined. � � The following presents the

calculation of Consolidated Debt-to-Consolidated EBITDA, as

defined, for the trailing twelve months at June 30, 2008. For

supporting calculations, refer to Corporation's Web site at

www.martinmarietta.com. � � Twelve-Month Period July 1, 2007 to

June 30, 2008 Net earnings $ 224.7 Add back: Interest expense 68.1

Income tax expense 94.0 Depreciation, depletion and amortization

expense 156.6 Stock-based compensation expense 19.8 Deduct:

Interest income (1.2) Consolidated EBITDA, as defined $ 562.0

Consolidated Debt at June 30, 2008 $ 1,432.7 Consolidated

Debt-to-Consolidated EBITDA, as defined, at June 30, 2008 for the

trailing twelve-month EBITDA 2.55 MLM-E

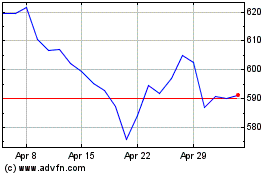

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

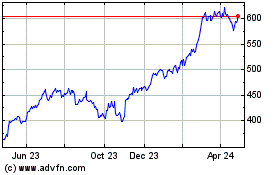

Martin Marietta Materials (NYSE:MLM)

Historical Stock Chart

From Jul 2023 to Jul 2024