0001929589

false

00-0000000

0001929589

2023-06-28

2023-06-28

0001929589

us-gaap:CommonStockMember

2023-06-28

2023-06-28

0001929589

us-gaap:WarrantMember

2023-06-28

2023-06-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 28, 2023

MariaDB plc

(Exact name of registrant as specified in its

charter)

| Ireland |

|

001-41571 |

|

N/A |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

699 Veterans Blvd

Redwood City, CA 94063

(Address of principal executive offices, including

zip code)

(855) 562-7423

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communication pursuant to Rule 425 under the Securities Act (17

CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17

CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange

Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange

Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Ordinary Shares, nominal value $0.01 per share |

|

MRDB |

|

New York Stock Exchange |

| Warrants, each whole warrant exercisable for one Ordinary Share at an exercise price of $11.50 per share |

|

MRDBW |

|

New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard; Transfer of Listing.

On June 28, 2023, MariaDB plc (the “Company”)

received a notice from the New York Stock Exchange (the “NYSE”) that, as of June 23, 2023, it was not in compliance

with the continued listing standard set forth in Section 802.01C of the NYSE Listed Company Manual because the average closing price of

the Company’s ordinary shares (the “Ordinary Shares”) were less than $1.00 per share over a consecutive

30 trading-day period. The notice has no immediate impact on the listing of the Ordinary Shares on the NYSE, subject to the Company’s

compliance with the NYSE’s other continued listing requirements.

The Company intends to consider a number of available alternatives

to cure its non-compliance with the applicable price criteria in the NYSE’s continued listing standards. Pursuant to Section 802.01C,

the Company has a period of six months following the receipt of the notice to regain compliance with the minimum share price requirement.

The Company can regain compliance with the minimum share price requirement at any time during the six-month cure period if, on the last

trading day of any calendar month during the cure period or on the last day of the cure period, the Company has (i) a closing share price

of at least $1.00, and (ii) an average closing share price of at least $1.00 over the 30 trading-day period ending on the last trading

day of that month.

Section 802.01C also requires the Company to notify the NYSE, within

10 business days of receipt of the notice, of its intent to cure this deficiency. The Company intends to notify the NYSE of its intent

to regain compliance with the requirements of Section 802.01C. The notice does not affect the Company’s business operations or its

reporting obligations with the Securities and Exchange Commission (the “SEC”).

On June 30, 2023, the Company issued a press release regarding receipt

of the notice from the NYSE. The press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 5.07 Submission of Matters to a Vote of Security Holders.

At the Annual General Meeting of Shareholders of the Company held on

June 29, 2023, the items listed below were submitted to a vote of the shareholders through the solicitation of proxies. The proposals

are described in the Company’s Proxy Statement for the 2023 Annual General Meeting of Shareholders. Each of the items was approved

by the shareholders. The voting results for each proposal are set forth below.

Item 1: Electing the Class I director nominees named in the

proxy statement.

Each of the following individuals was elected as a Class I director,

based on the voting results shown below, to serve until the conclusion of the 2026 Annual General Meeting of Shareholders or until his

or her successor is duly elected and qualified:

| Director | |

For | |

Against | |

Abstain | |

Broker Non-Votes |

| Christine Russell | |

37,679,740 | |

56,160 | |

187,125 | |

1,376,871 |

| Jurgen Ingels | |

37,918,762 | |

1,511 | |

2,752 | |

1,376,871 |

Item 2: Ratification of MaloneBailey, LLP as the Company’s

independent registered public accounting firm for the fiscal year ending September 30, 2023.

| For | |

Against | |

Abstain | |

Broker Non-Votes |

| 39,240,166 | |

59,730 | |

0 | |

0 |

Item 3: Appointment of UHY Farrelly Dawe White Limited as the

Company’s statutory auditor under Irish law, to hold office until the conclusion of the 2024 Annual General Meeting of shareholders.

| For | |

Against | |

Abstain | |

Broker Non-Votes |

| 39,052,321 | |

237,592 | |

9,983 | |

0 |

Item 4: Authorization of the Audit Committee to determine the

remuneration of UHY Farrelly Dawe White Limited in its capacity as the Company’s statutory auditor under Irish law.

| For | |

Against | |

Abstain | |

Broker Non-Votes |

| 39,232,231 | |

59,678 | |

7,987 | |

0 |

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

MariaDB plc |

| Dated: June 30, 2023 |

|

| |

By: |

/s/ Conor McCarthy |

| |

|

Name: |

Conor McCarthy |

| |

|

Title: |

Chief Financial Officer |

Exhibit 99.1

MariaDB

Receives NYSE Continued Listing Standards Notice

REDWOOD

CITY, Calif. and DUBLIN – June 30, 2023 – MariaDB plc (NYSE: MRDB) today announced that it was notified

on June 28, 2023 by the New York Stock Exchange (“NYSE”) that the company is not in compliance with Section 802.01C of the

NYSE Listed Company Manual because the average closing price of the company's ordinary shares was less than $1.00 per share over a consecutive

30 trading-day period. The notice does not result in the immediate delisting of MariaDB’s ordinary shares from the NYSE.

The company

intends to notify the NYSE of its intent to regain compliance with the applicable NYSE continued listing standards. The company can regain

compliance at any time within a six-month cure period following its receipt of the NYSE notice if, on the last trading day of any calendar

month during the cure period, MariaDB’s ordinary shares have a closing share price of at least $1.00 and an average closing share

price of at least $1.00 over the 30 trading-day period ending on the last trading day of the applicable calendar month.

MariaDB’s

ordinary shares will continue to be listed and will continue to trade on the NYSE during the cure period, subject to the company’s

compliance with other NYSE continued listing standards.

About

MariaDB

MariaDB is

a new generation cloud database company whose products are used by companies big and small, reaching more than a billion users through

Linux distributions and have been downloaded over one billion times. Deployed in minutes and maintained with ease, leveraging cloud automation,

our database products are engineered to support any workload, any cloud and any scale – all while saving up to 90% of proprietary

database costs. Trusted by organizations such as Bandwidth, DigiCert, InfoArmor, Oppenheimer, Samsung, SelectQuote and SpendHQ, MariaDB’s

software is the backbone of critical services that people rely on every day. Learn more at mariadb.com.

Contacts

Investors:

ir@mariadb.com

Media:

pr@mariadb.com

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

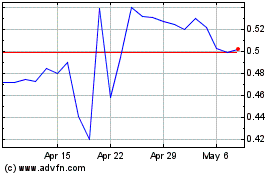

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Jun 2024 to Jul 2024

MariaDB (NYSE:MRDB)

Historical Stock Chart

From Jul 2023 to Jul 2024