- Revenues increase 5 percent led by

growth in North America irrigation

- GAAP diluted earnings per share of

$0.16 ($0.56 adjusted)1

- Results include a $2.6 million tax

expense due to the enactment of U.S. tax reform

- Results include pre-tax costs of $2.3

million related to the Foundation for Growth initiative

Lindsay Corporation (NYSE: LNN), a leading global manufacturer

of irrigation and infrastructure equipment and technology, today

announced results for its second quarter ended February 28,

2018.

Second Quarter Summary

Revenues for the second quarter of fiscal 2018 were $130.3

million, an increase of 5 percent compared to revenues of $124.1

million in the prior year’s second quarter. Net earnings for the

quarter were $1.7 million and diluted earnings per share were

$0.16, compared with net earnings of $5.0 million and diluted

earnings per share of $0.47 in the prior year. Net earnings for the

quarter were reduced by tax expense of $2.6 million due to the

enactment of the U.S. Tax Cuts and Jobs Act and by after-tax costs

of $1.7 million comprised of severance costs and professional

consulting fees related to the Company’s Foundation for Growth

initiative. Adjusted net earnings for the second quarter were $6.0

million, or $0.56 per diluted share.1

“We were pleased to have achieved revenue and operating income

improvement in both the Irrigation and Infrastructure segments for

the quarter,” said Tim Hassinger, President and Chief Executive

Officer. “Improved demand in North America irrigation drove overall

revenue growth, and growth in our Road Zipper System® business

continues to support solid performance in our Infrastructure

segment.”

Segment Results

Irrigation segment revenues increased 5 percent to $111.9

million from $106.2 million in the prior year’s second quarter.

North America irrigation revenues increased 23 percent, driven by

an increase in irrigation system unit volume. International

irrigation revenues for the second quarter were $33.0 million, a

decrease of 22 percent compared to the second quarter of the prior

year. The second quarter of the prior year included revenues from

projects in developing markets that did not repeat in the current

period, while demand in core markets remained stable.

Irrigation segment operating margin was 10.7 percent of sales in

the second quarter (11.2 percent adjusted)1, compared to 10.6

percent of sales in the prior year. Improved volume leverage from

higher North America irrigation system sales was partially offset

by the impact of lower project sales and margins in international

markets.

Infrastructure segment revenues increased 3 percent to $18.5

million for the quarter, as increased Road Zipper System revenue

was partially offset by lower revenue from North America road

safety products.

Infrastructure segment operating margin was 13.6 percent of

sales in the quarter compared to 8.9 percent of sales in the second

quarter of the prior year. A higher proportion of revenue from Road

Zipper Systems resulted in an improved margin mix.

The backlog of unshipped orders at February 28, 2018 was $90.2

million, compared with $62.3 million at February 28, 2017, with

higher backlogs in both the irrigation and infrastructure segments.

Additions to the backlog during the quarter include an order valued

at approximately $9.3 million to deploy the Road Zipper System on

the Richmond-San Rafael Bridge in California and follow-on orders,

valued at approximately $11.1 million, from an existing customer in

Japan.

Impact of U.S. Tax Reform

Second quarter earnings include a $2.6 million, or $0.241 per

diluted share, expense for the estimated impact of the U.S. Tax

Cuts and Jobs Act enacted during the quarter. This amount includes

one-time impacts from the deemed repatriation transition tax on

certain foreign earnings and from the remeasurement of deferred tax

items at a lower rate.

Foundation for Growth Initiative

During the quarter the Company initiated a focused performance

improvement initiative referred to as Foundation for Growth.

Objectives include setting strategic direction, defining

priorities, and improving overall operating performance. A key

financial objective is to achieve operating margin performance of

11 percent to 12 percent in fiscal 2020 without assuming

improvement in the market environment. Second quarter earnings

include after-tax costs of $1.7 million, or $0.151 per diluted

share, related to severance costs and professional consulting fees

incurred in connection with the initiative. Additional costs

anticipated in connection with this initiative, over each of the

next several quarters, are expected to be recovered through

improved operating income in fiscal 2020.

Outlook

“Although we have seen improved demand this year in North

America, agricultural market conditions are expected to remain

challenging until there is a meaningful improvement in commodity

prices and farm income. In our Infrastructure business, a growing

backlog of Road Zipper projects provides for growth,” said Mr.

Hassinger. “The recently announced tariffs on steel and aluminum

product imports are concerning because of the potential impact on

raw material cost and possible trade retaliation that would affect

U.S. agricultural products, however it won’t be possible to fully

assess the impact until more details are known.”

Mr. Hassinger continued, “The organization is excited about the

launch of our Foundation for Growth initiative. This effort,

focused on delivering better results to our customers and

shareholders, is already underway and I look forward to providing

regular updates as this initiative progresses.”

Second Quarter Conference Call

Lindsay’s fiscal 2018 second quarter investor conference call is

scheduled for 11:00 a.m. Eastern Time today. Interested investors

may participate in the call by dialing (877) 317-6789 in the U.S.,

or (412) 317-6789 internationally, and requesting the Lindsay

Corporation call. Additionally, the conference call will be

simulcast live on the Internet and can be accessed via the investor

relations section of the Company's Web site, www.lindsay.com.

Replays of the conference call will remain on our Web site through

the next quarterly earnings release. The Company will have a slide

presentation available to augment management's formal presentation,

which will also be accessible via the Company's Web site.

About the Company

Lindsay Corporation is a leading global manufacturer and

distributor of irrigation and infrastructure equipment and

technology. The Lindsay family of irrigation brands includes

Zimmatic® and FieldNET® as well as irrigation consulting, design,

pump and filtration offerings, advanced machine-to-machine

communication, remote control and monitoring technology, and

wireless networking solutions. Also a global leader in the

transportation industry, Lindsay Transportation Solutions

manufactures equipment to improve road safety and keep traffic

moving on the world’s roads, bridges and tunnels, through the

Barrier Systems®, Road Zipper® and Snoline™ brands. For more

information about Lindsay Corporation, visit www.lindsay.com.

1 Please see Reg G reconciliation of GAAP operating income,

net earnings and earnings per share to adjusted figures at end of

document.

Concerning Forward-looking Statements

This release contains forward-looking statements that are

subject to risks and uncertainties and which reflect management’s

current beliefs and estimates of future economic circumstances,

industry conditions, Company performance and financial results. You

can find a discussion of many of these risks and uncertainties in

the annual, quarterly and current reports that the Company files

with the Securities and Exchange Commission. Forward-looking

statements include information concerning possible or assumed

future results of operations and planned financing of the Company

and those statements preceded by, followed by or including the

words “anticipate,” “estimate,” “believe,” “intend,” "expect,"

"outlook," "could," "may," "should," “will,” or similar

expressions. For these statements, the Company claims the

protection of the safe harbor for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995.

The Company undertakes no obligation to update any forward-looking

information contained in this press release.

LINDSAY CORPORATION AND SUBSIDIARIES CONDENSED

CONSOLIDATED STATEMENTS OF EARNINGS (Unaudited)

Three months ended Six

months ended (in thousands, except per share amounts)

February 28,2018

February 28,2017

February 28,2018

February 28,2017

Operating revenues $ 130,339 $ 124,125 $ 254,865 $

234,515 Cost of operating revenues 95,023

91,184 187,152 173,200 Gross

profit 35,316 32,941

67,713 61,315 Operating expenses: Selling

expense 10,020 10,132 20,245 20,114 General and administrative

expense 14,311 10,230 26,229 21,585 Engineering and research

expense 3,919 4,057 7,972

8,359 Total operating expenses 28,250

24,419 54,446 50,058

Operating income 7,066 8,522 13,267 11,257 Interest

expense (1,095 ) (1,201 ) (2,331 ) (2,410 ) Interest income 311 171

686 336 Other expense, net (606 ) 144

(1,154 ) (212 ) Earnings before

income taxes 5,676 7,636 10,468 8,971 Income tax expense

3,941 2,624 5,548

3,086 Net earnings $ 1,735 $ 5,012 $

4,920 $ 5,885 Earnings per share: Basic $ 0.16

$ 0.47 $ 0.46 $ 0.55 Diluted $ 0.16 $ 0.47 $ 0.46 $ 0.55

Shares used in computing earnings per share: Basic 10,743 10,657

10,724 10,647 Diluted 10,765 10,674 10,752 10,670 Cash

dividends declared per share $ 0.30 $ 0.29 $ 0.60 $ 0.58

LINDSAY CORPORATION AND SUBSIDIARIES SUMMARY

OPERATING RESULTS (Unaudited)

Three months ended

Six months ended (in thousands)

February 28,2018

February 28,2017

February 28,2018

February 28,2017

Operating revenues: Irrigation segment $ 111,865 $ 106,209 $

215,218 $ 196,061 Infrastructure segment 18,474

17,916 39,647 38,454

Total operating revenues $ 130,339 $ 124,125 $

254,865 $ 234,515 Operating income: Irrigation

segment $ 11,933 $ 11,304 $ 19,784 $ 16,453 Infrastructure segment

2,519 1,595 5,810 4,571 Corporate (7,386 )

(4,377 ) (12,327 ) (9,767 )

Total operating income $ 7,066 $ 8,522 $

13,267 $ 11,257

The Company manages its business activities in two reportable

segments as follows:

Irrigation - This reporting segment includes the manufacture and

marketing of center pivot, lateral move, and hose reel irrigation

systems as well as various water pumping stations, controls,

filtration solutions and machine-to-machine technology.

Infrastructure – This reporting segment includes the manufacture

and marketing of moveable barriers, specialty barriers, crash

cushions and end terminals, and road marking and road safety

equipment.

LINDSAY CORPORATION AND SUBSIDIARIES CONDENSED

CONSOLIDATED BALANCE SHEETS (Unaudited)

(in

thousands)

February 28,2018

February 28,2017

August 31,2017

ASSETS Current assets: Cash and cash equivalents $ 102,211 $

102,825 $ 121,620 Receivables, net 96,738 78,828 73,850

Inventories, net 102,975 82,847 86,155 Prepaid expenses 5,339 5,208

4,384 Other current assets 6,092 15,968

6,925 Total current assets 313,355

285,676 292,934 Property, plant,

and equipment, net 72,678 75,632 74,498 Intangibles, net 40,677

44,890 42,808 Goodwill 77,296 76,577 77,131 Deferred income tax

assets 5,773 3,094 5,311 Other noncurrent assets, net

12,575 4,747 13,350 Total assets $

522,354 $ 490,616 $ 506,032 LIABILITIES

AND SHAREHOLDERS' EQUITY Current liabilities: Accounts payable $

46,599 $ 44,254 $ 36,717 Current portion of long-term debt 203 199

201 Other current liabilities 57,720

46,350 55,119 Total current liabilities

104,522 90,803 92,037 Pension

benefits liabilities 6,152 6,708 6,295 Long-term debt 116,673

116,876 116,775 Deferred income tax liabilities 1,179 1,678 1,191

Other noncurrent liabilities 20,768

20,995 19,679 Total liabilities 249,294

237,060 235,977 Shareholders'

equity: Preferred stock — — — Common stock 18,841 18,746 18,780

Capital in excess of stated value 66,625 59,002 63,006 Retained

earnings 476,091 466,630 477,615 Less treasury stock - at cost

(277,238 ) (277,238 ) (277,238 ) Accumulated other comprehensive

loss, net (11,259 ) (13,584 )

(12,108 ) Total shareholders' equity 273,060

253,556 270,055 Total liabilities and

shareholders' equity $ 522,354 $ 490,616 $

506,032

LINDSAY CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited) Six months

ended (in thousands)

February 28,2018

February 28,2017

CASH FLOWS FROM OPERATING ACTIVITIES: Net earnings $ 4,920 $ 5,885

Adjustments to reconcile net earnings to net cash provided by

operating activities: Depreciation and amortization 8,599 8,120

Provision for uncollectible accounts receivable 228 (609 ) Deferred

income taxes (931 ) 1,707 Share-based compensation expense 1,887

1,815 Other, net 45 (594 ) Changes in assets and liabilities:

Receivables (23,084 ) 2,710 Inventories (15,239 ) (7,368 ) Prepaid

expenses and other current assets (1,731 ) 3,375 Accounts payable

9,728 11,926 Other current liabilities 5,313 (14,122 ) Other

noncurrent assets and liabilities 1,368

(2,123 ) Net cash (used in) provided by operating activities

(8,897 ) 10,722 CASH FLOWS FROM

INVESTING ACTIVITIES: Purchases of property, plant, and equipment

(4,715 ) (4,194 ) Proceeds from settlement of net investment hedges

101 2,054 Payments for settlement of net investment hedges (1,967 )

(482 ) Other investing activities, net 137

136 Net cash used in investing activities

(6,444 ) (2,486 ) CASH FLOWS FROM FINANCING

ACTIVITIES: Proceeds from exercise of stock options 2,788 647

Common stock withheld for payroll tax obligations (833 ) (635 )

Principal payments on long-term debt (100 ) (98 ) Dividends paid

(6,444 ) (6,181 ) Net cash used in

financing activities (4,589 ) (6,267 )

Effect of exchange rate changes on cash and cash equivalents

521 (390 ) Net change in cash and cash

equivalents (19,409 ) 1,579 Cash and cash equivalents, beginning of

period 121,620 101,246 Cash and cash

equivalents, end of period $ 102,211 $ 102,825

LINDSAY CORPORATION AND

SUBSIDIARIESRECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES(Unaudited)

The non-GAAP tables below disclose (a) the impact on diluted

earnings per share of (1) tax expense attributed to enactment of

the U.S. Tax Cuts and Jobs Act ("U.S. Tax Reform"), and (2)

severance costs and professional consulting fees associated with

the Company's Foundation for Growth initiative ("FFG costs"), (b)

the impact on operating income of FFG costs, and (c) the impact on

segment operating income of FFG costs. Management believes adjusted

net earnings, adjusted diluted earnings per share and adjusted

operating income are important indicators of the Company’s business

performance because they exclude items that may not be indicative

of, or may be unrelated to, the Company’s underlying operating

results, and provide a useful baseline for analyzing trends in the

business. Non-GAAP measures used by the Company may differ from

similar measures used by other companies, even when similar terms

are used to identify such measures. These adjusted financial

measures should not be considered in isolation or as a substitute

for reported net earnings, diluted earnings per share and operating

income. These non-GAAP financial measures reflect an additional way

of viewing the Company’s operations that, when viewed with the GAAP

results and the following reconciliations to the corresponding GAAP

financial measures, management believes provides a more complete

understanding of the Company’s business.

Three months ended Six months

ended (in thousands, except per share amounts)

February 28,2018

Dilutedearningsper

share

February 28,2018

Dilutedearningsper

share

Net earnings - reported GAAP measure $ 1,735 $ 0.16 $ 4,920

$ 0.46 Impact of U.S. Tax Reform 2,578 0.24 2,578 0.24

FFG costs - after tax 1,668 0.15 1,668

0.16 Net earnings - adjusted $ 5,981 $ 0.56 $ 9,166 $

0.85 Average shares outstanding - diluted 10,765 10,752

Three months ended February 28, 2018

Operating income reconciliation

Consolidated Irrigation Infrastructure

Corporate Operating income - reported GAAP measure $

7,066 $ 11,933 $ 2,519 $ (7,386 ) FFG costs - before tax

2,331 573 — 1,758 Adjusted

operating income $ 9,397 $ 12,506 $ 2,519 $ (5,628 )

Operating revenues $ 130,339 $ 111,865 $ 18,474 $ —

Operating income as a percent of operating revenues 5.4 % 10.7 %

13.6 % N/A Adjusted operating income as a percent of

operating revenues 7.2 % 11.2 % 13.6 % N/A

Six months ended February 28, 2018

Operating income reconciliation

Consolidated Irrigation Infrastructure

Corporate Operating income - reported GAAP measure $

13,267 $ 19,784 $ 5,810 $ (12,327 ) FFG costs - before tax

2,331 573 — 1,758 Adjusted

operating income $ 15,598 $ 20,357 $ 5,810 $ (10,569 )

Operating revenues $ 254,865 $ 215,218 $ 39,647 $ —

Operating income as a percent of operating revenues 5.2 % 9.2 %

14.7 % N/A Adjusted operating income as a percent of

operating revenues 6.1 % 9.5 % 14.7 % N/A

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180329005297/en/

LINDSAY CORPORATION:Brian Ketcham, 402-827-6579Vice

President & Chief Financial OfficerorHALLIBURTON INVESTOR

RELATIONS:Hala Elsherbini, 972-458-8000orGeralyn DeBusk,

972-458-8000

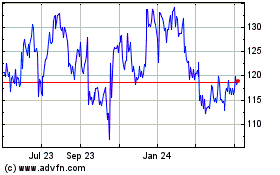

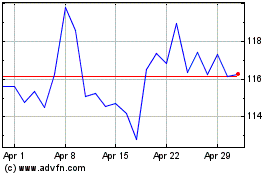

Lindsay (NYSE:LNN)

Historical Stock Chart

From Jun 2024 to Jul 2024

Lindsay (NYSE:LNN)

Historical Stock Chart

From Jul 2023 to Jul 2024