UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

For

the month of August 2024

Commission File Number: 001-35942

LightInTheBox Holding Co., Ltd.

4 Pandan Crescent #03-03

Singapore (128475)

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

x Form 20-F

¨ Form 40-F

EXHIBIT INDEX

Exhibit 99.1

– LightInTheBox Reports Second Quarter 2024 Financial Results - Returns to Profitability with Net Income of $0.6 Million

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

LIGHTINTHEBOX HOLDING CO., LTD. |

| |

|

| |

By: |

/s/ Jian He |

| |

Name: |

Jian He |

| |

Title: |

Chief Executive Officer |

Date:

August 2, 2024

Exhibit 99.1

LightInTheBox Reports Second Quarter 2024 Financial

Results

-

Returns to Profitability with Net Income of $0.6 Million

Singapore, August 2, 2024 - LightInTheBox

Holding Co., Ltd. (NYSE: LITB) (“LightInTheBox” or the “Company”), an apparel e-commerce retailer that ships

products to consumers worldwide, today announced its unaudited financial results for the second quarter ended June 30, 2024.

“The second quarter of 2024 was a challenging

one, with intensified competition and high traffic acquisition costs in the global e-commerce market continuing to weigh on our topline,”

said Mr. Jian He, Chairman and CEO of LightInTheBox. “However, our strategic pivot to prioritize profitability proved effective,

resulting in a turnaround with net income reaching $0.6 million for the second quarter of 2024 compared with a loss for the same period

of last year and the first quarter of this year. Meanwhile, we continued to refine our differentiation strategy with a focus on strengthening

localized operations, propelling progress in certain product lines.”

“Encouraged by the outcomes of these initiatives,

we will continue to concentrate on overall efficiency and profitability amid the evolving environment. Additionally, we will further upgrade

our products, services and customer experience, as well as our localized operations, to differentiate ourselves and build brand recognition

and loyalty in this competitive industry. As always, we are committed to driving high-quality development and delivering sustainable value

to all stakeholders in the long run,” Mr. He concluded.

Second Quarter 2024 Financial Highlights

| · | Total revenues were $69.4 million in the second quarter of 2024, compared with $191.8 million in

the same period of 2023. |

| · | Net income was $0.6 million in the second quarter of 2024, compared with net loss of $1.5 million

in the same period of 2023. |

| · | Adjusted EBITDA was an income of $1.2 million in the second quarter of 2024, compared with a loss

of $0.7 million in the same period of 2023. |

First Half 2024 Financial Highlights

| · | Total revenues were $140.5 million in the first half of 2024, compared with $339.5 million in the

same period of 2023. |

| · | Net loss was $3.2 million in the first half of 2024, compared with $5.4 million in the same period

of 2023. |

| · | Adjusted EBITDA was a loss of $1.9 million in the first half of 2024, compared with $3.8 million

in the same period of 2023. |

Second Quarter 2024 Financial Results

Total

revenues decreased by 63.8% year-over-year to $69.4 million from $191.8 million in the same quarter of 2023.

Total

cost of revenues was $26.1 million in the second quarter of 2024, compared with $81.6 million in the same quarter of 2023.

Gross

profit in the second quarter of 2024 was $43.3 million, compared with $110.2 million in the same quarter of 2023. Gross margin

was 62.4% in the second quarter of 2024, compared with 57.5% in the same quarter of 2023.

Total

operating expenses in the second quarter of 2024 were $42.7 million, compared with $111.8 million in the same quarter of 2023.

| · | Fulfillment expenses in the second quarter of 2024 were $5.0 million, compared with $9.9 million in the

same quarter of 2023. As a percentage of total revenues, fulfillment expenses were 7.2% in the second quarter of 2024, compared with 5.2%

in the same quarter of 2023 and 8.1% in the first quarter of 2024. |

| · | Selling and marketing expenses in the second quarter of 2024 were $31.5 million, compared with $94.0 million

in the same quarter of 2023. As a percentage of total revenues, selling and marketing expenses were 45.5% in the second quarter of 2024,

compared with 49.0% in the same quarter of 2023 and 46.0% in the first quarter of 2024. |

| · | G&A expenses in the second quarter of 2024 were $6.4 million, compared with $8.2 million in the same

quarter of 2023. As a percentage of total revenues, G&A expenses were 9.2% in the second quarter of 2024, compared with 4.3% in the

same quarter of 2023 and 10.2% in the first quarter of 2024. As part of G&A expenses, R&D expenses in the second quarter of 2024

were $4.0 million, compared with $5.1 million in the same quarter of 2023 and $4.6 million in the first quarter of 2024. |

Income

from operations was $0.6 million in the second quarter of 2024, compared with a loss of $1.6 million in the same quarter of

2023.

Net

income was $0.6 million in the second quarter of 2024, compared with a loss of $1.5 million in the same quarter of 2023.

Net

income per American Depository Share (“ADS”) was $0.01 in the second quarter of 2024, compared with net loss per

ADS of $0.01 in the same quarter of 2023. Each ADS represents two ordinary shares. The diluted net income per ADS in the second quarter

of 2024 was $0.01, compared with net loss per ADS of $0.01 in the same quarter of 2023.

In the second quarter of 2024, the Company’s

basic weighted average number of ADSs used in computing the net income per ADS was 110,342,430.

Adjusted

EBITDA was an income of $1.2 million in the second quarter of 2024, compared with a loss of $0.7 million in the same quarter

of 2023.

As of June 30, 2024, the Company had cash

and cash equivalents and restricted cash of $27.9 million, compared with $71.7 million as of December 31, 2023.

First Half 2024 Financial Results

Total

revenues decreased by 58.6% year-over-year to $140.5 million from $339.5 million in the same period of 2023.

Total

cost of revenues was $55.8 million in the first half of 2024, compared with $146.9 million in the same period of 2023.

Gross

profit in the first half of 2024 was $84.7 million, compared with $192.7 million in the same period of 2023. Gross margin was

60.3% in the first half of 2024, compared with 56.7% in the same period of 2023.

Total

operating expenses in the first half of 2024 were $88.1 million, compared with $198.2 million in the same period of 2023.

| · | Fulfillment expenses in the first half of 2024 were $10.8 million, compared with $18.5 million in the

same period of 2023. As a percentage of total revenues, fulfillment expenses were 7.7% in the first half of 2024, compared with 5.5% in

the same period of 2023. |

| · | Selling and marketing expenses in the first half of 2024 were $64.3 million, compared with $163.2 million

in the same period of 2023. As a percentage of total revenues, selling and marketing expenses were 45.7% for the first half of 2024, compared

with 48.0% in the same period of 2023. |

| · | G&A expenses in the first half of 2024 were $13.7 million, compared with $17.2 million in the same

period of 2023. As a percentage of total revenues, G&A expenses were 9.7% for the first half of 2024, compared with 5.1% in the same

period of 2023. Included in G&A expenses, R&D expenses in the first half of 2024 were $8.6 million, compared with $10.3 million

in the same period of 2023. |

Loss

from operations was $3.4 million in the first half of 2024, compared with $5.6 million in the same period of 2023.

Net

loss was $3.2 million in the first half of 2024, compared with $5.4 million in the same period of 2023.

Net

loss per American Depository Share ("ADS") was $0.03 in the first half of 2024, compared with $0.05 in the same period

of 2023. Each ADS represents two ordinary shares. The diluted net loss per ADS for the first half of 2024 was $0.03, compared with $0.05

in the same period of 2023.

In the first half of 2024, the Company's basic

weighted average number of ADSs used in computing the net loss per ADS was 110,802,352.

Adjusted

EBITDA was a loss of $1.9 million in the first half of 2024, compared with $3.8 million in the same period of 2023.

Non-GAAP Financial Measure

In evaluating the business, the Company considers

and uses a non-GAAP measure, Adjusted EBITDA, as a supplemental measure to review and assess operating performance. The presentation of

this non-GAAP financial measure is not intended to be considered in isolation or as a substitute for the financial information prepared

and presented in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The

Company’s non-GAAP financial measure excludes share-based compensation expenses, depreciation and amortization expenses, interest

income, interest expenses and income tax expense.

The Company presents this non-GAAP financial measure

because it is used by management to evaluate operating performance and formulate business plans. The Company believes that the non-GAAP

financial measure helps identify underlying trends in its business. The Company also believes that the non-GAAP financial measure could

provide further information about the Company’s results of operations and enhance the overall understanding of the Company’s

past performance and future prospects.

The non-GAAP financial measure is not defined

under U.S. GAAP and is not presented in accordance with U.S. GAAP. The non-GAAP financial measure has limitations as an analytical tool.

The Company’s non-GAAP financial measure does not reflect all items of income and expenses that affect the Company’s operations

and does not represent the residual cash flow available for discretionary expenditures. Further, the non-GAAP measure may differ from

the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited. The Company

compensates for the limitations by reconciling the non-GAAP financial measure to the nearest U.S. GAAP performance measure, all of which

should be considered when evaluating performance. The Company encourages you to review the Company’s financial information in its

entirety and not rely on a single financial measure.

For more information on the non-GAAP financial

measure, please see the table captioned “Unaudited Reconciliations of GAAP and Non-GAAP Results” set forth at the end of this

press release.

Conference Call

The Company’s management will hold an earnings

conference call at 9:00 a.m. Eastern Time on August 2, 2024 (9:00 p.m. Hong Kong/Singapore Time on the same day).

Preregistration Information

Participants

can register for the conference call by going to https://s1.c-conf.com/diamondpass/10040986-jh7t5r.html.

Upon registration, participants will receive dial-in numbers, an event passcode, and a unique access PIN.

To join the conference, simply dial the number

in the calendar invite you receive after preregistering, enter the event passcode followed by your unique access PIN, and you will be

connected to the conference instantly.

A telephone replay will be available two hours

after the conclusion of the conference call through August 9, 2024. The dial-in details are:

| |

US/Canada: |

+1-855-883-1031 |

| |

Singapore: |

800-101-3223 |

| |

Hong Kong, China: |

800-930-639 |

| |

Replay PIN: |

10040986 |

Additionally,

a live and archived webcast of the conference call will be available on the Company's Investor Relations website at http://ir.lightinthebox.com.

About LightInTheBox Holding Co., Ltd.

LightInTheBox is an apparel e-commerce retailer

that ships products to consumers worldwide. With a focus on serving its middle-aged and senior customers, LightInTheBox leverages its

global supply chain and logistics networks, along with its in-house R&D and design capabilities to offer a wide selection of comfortable,

aesthetically pleasing and visually interesting apparel that brings fresh joy to customers. LightInTheBox operates its business through

www.lightinthebox.com, www.ezbuy.sg and other websites as well as mobile applications, which are available in over 20 major languages

and over 140 countries and regions. The Company is headquartered in Singapore, with additional offices in California, Shanghai and Beijing.

For

more information, please visit www.lightinthebox.com.

Investor Relations Contact

Investor Relations

LightInTheBox Holding Co., Ltd.

Email: ir@lightinthebox.com

Jenny Cai

Piacente Financial Communications

Email: lightinthebox@tpg-ir.com

Brandi Piacente

Piacente Financial Communications

Tel: +1-212-481-2050

Email: lightinthebox@tpg-ir.com

Forward-Looking Statements

This announcement contains forward-looking statements.

These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995.

These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates,” “potential,”

“continue,” “ongoing,” “targets” and similar statements. Among other things, statements that are not

historical facts, including statements about LightInTheBox’s beliefs and expectations, the business outlook and quotations from

management in this announcement, as well as LightInTheBox’s strategic and operational plans, are or contain forward-looking statements.

LightInTheBox may also make written or oral forward-looking

statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in press releases and other

written materials and in oral statements made by its officers, directors or employees to third parties. Forward-looking statements involve

inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking

statement, including but not limited to the following: LightInTheBox’s goals and strategies; LightInTheBox’s future business

development, results of operations and financial condition; the expected growth of the global online retail market; LightInTheBox’s

ability to attract customers and further enhance customer experience and product offerings; LightInTheBox’s ability to strengthen

its supply chain efficiency and optimize its logistics network; LightInTheBox’s expectations regarding demand for and market acceptance

of its products; competition; fluctuations in general economic and business conditions and assumptions underlying or related to any of

the foregoing. Further information regarding these and other risks is included in LightInTheBox’s filings with the SEC. All information

provided in this press release and in the attachments is as of the date of this press release, and LightInTheBox does not undertake any

obligation to update any forward-looking statement, except as required under applicable law.

LightInTheBox Holding Co., Ltd.

Unaudited Condensed Consolidated Balance Sheets

(U.S. dollars in thousands, or otherwise noted)

| | |

As of December 31, | |

As of June 30, | |

| | |

2023 | |

2024 | |

| ASSETS | |

| |

| |

| Current Assets | |

| |

| |

| Cash and cash equivalents | |

66,425 | |

25,287 | |

| Restricted cash | |

5,279 | |

2,624 | |

| Accounts receivable, net of allowance for credit losses | |

634 | |

994 | |

| Inventories | |

5,767 | |

4,480 | |

| Prepaid expenses and other current assets | |

6,875 | |

9,098 | |

| Total current assets | |

84,980 | |

42,483 | |

| Property and equipment, net | |

2,789 | |

2,145 | |

| Intangible assets, net | |

3,604 | |

3,089 | |

| Goodwill | |

27,393 | |

26,778 | |

| Operating lease right-of-use assets | |

6,559 | |

6,934 | |

| Long-term rental deposits | |

392 | |

312 | |

| Long-term investment | |

- | |

74 | |

| Other non-current assets | |

592 | |

- | |

| TOTAL ASSETS | |

126,309 | |

81,815 | |

| | |

| |

| |

| LIABILITIES AND EQUITY / (DEFICIT) | |

| |

| |

| Current Liabilities | |

| |

| |

| Accounts payable | |

15,846 | |

14,227 | |

| Advance from customers | |

17,001 | |

13,258 | |

| Operating lease liabilities | |

5,046 | |

4,049 | |

| Accrued expenses and other current liabilities | |

94,622 | |

61,891 | |

| Total current liabilities | |

132,515 | |

93,425 | |

| | |

| |

| |

| Operating lease liabilities | |

1,915 | |

1,650 | |

| Deferred tax liabilities | |

154 | |

150 | |

| Unrecognized tax benefits | |

107 | |

107 | |

| TOTAL LIABILITIES | |

134,691 | |

95,332 | |

| | |

| |

| |

| EQUITY / (DEFICIT) | |

| |

| |

| Ordinary shares | |

17 | |

17 | |

| Additional paid-in capital | |

283,137 | |

282,862 | |

| Treasury shares | |

(30,359 | ) |

(31,045 | ) |

| Accumulated other comprehensive loss | |

(1,856 | ) |

(2,823 | ) |

| Accumulated deficit | |

(259,321 | ) |

(262,528 | ) |

| TOTAL EQUITY / (DEFICIT) | |

(8,382 | ) |

(13,517 | ) |

| TOTAL LIABILITIES AND EQUITY / (DEFICIT) | |

126,309 | |

81,815 | |

LightInTheBox Holding Co., Ltd.

Unaudited

Condensed Consolidated Statements of Operations

(U.S. dollars in thousands, except per share

data, or otherwise noted)

| | |

Three Months Ended June 30, | |

Six Months Ended June 30, | |

| | |

2023 | |

2024 | |

2023 | |

2024 | |

| Revenues | |

| |

| |

| |

| |

| Product sales | |

189,730 | |

67,152 | |

334,331 | |

134,983 | |

| Services and others | |

2,037 | |

2,210 | |

5,217 | |

5,548 | |

| Total revenues | |

191,767 | |

69,362 | |

339,548 | |

140,531 | |

| Cost of revenues | |

| |

| |

| |

| |

| Product sales | |

(81,142 | ) |

(25,513 | ) |

(145,318 | ) |

(54,583 | ) |

| Services and others | |

(435 | ) |

(559 | ) |

(1,538 | ) |

(1,209 | ) |

| Total Cost of revenues | |

(81,577 | ) |

(26,072 | ) |

(146,856 | ) |

(55,792 | ) |

| Gross profit | |

110,190 | |

43,290 | |

192,692 | |

84,739 | |

| Operating expenses | |

| |

| |

| |

| |

| Fulfillment | |

(9,906 | ) |

(5,010 | ) |

(18,542 | ) |

(10,756 | ) |

| Selling and marketing | |

(94,038 | ) |

(31,527 | ) |

(163,150 | ) |

(64,268 | ) |

| General and administrative | |

(8,176 | ) |

(6,411 | ) |

(17,233 | ) |

(13,670 | ) |

| Other operating income | |

332 | |

277 | |

677 | |

563 | |

| Total operating expenses | |

(111,788 | ) |

(42,671 | ) |

(198,248 | ) |

(88,131 | ) |

| (Loss) / income from operations | |

(1,598 | ) |

619 | |

(5,556 | ) |

(3,392 | ) |

| Interest income | |

143 | |

14 | |

173 | |

84 | |

| Interest expense | |

(1 | ) |

- | |

(2 | ) |

- | |

| Other (expense) / income, net | |

(1 | ) |

(9 | ) |

20 | |

102 | |

| Total other income | |

141 | |

5 | |

191 | |

186 | |

| (Loss) / income before income taxes | |

(1,457 | ) |

624 | |

(5,365 | ) |

(3,206 | ) |

| Income tax expense | |

- | |

(1 | ) |

(48 | ) |

(1 | ) |

| Net (loss) / income | |

(1,457 | ) |

623 | |

(5,413 | ) |

(3,207 | ) |

| Net (loss) / income attributable to LightInTheBox Holding Co., Ltd. | |

(1,457 | ) |

623 | |

(5,413 | ) |

(3,207 | ) |

| | |

| |

| |

| |

| |

| Weighted average numbers of shares used in calculating (loss) / income per ordinary share | |

| |

| |

| |

| |

| -Basic | |

226,738,924 | |

220,684,859 | |

226,699,828 | |

221,604,704 | |

| -Diluted | |

226,738,924 | |

221,451,741 | |

226,699,828 | |

221,604,704 | |

| | |

| |

| |

| |

| |

| Net (loss) / income per ordinary share | |

| |

| |

| |

| |

| -Basic | |

(0.01 | ) |

0.00 | |

(0.02 | ) |

(0.01 | ) |

| -Diluted | |

(0.01 | ) |

0.00 | |

(0.02 | ) |

(0.01 | ) |

| | |

| |

| |

| |

| |

| Net (loss) / income per ADS (2 ordinary shares equal to 1 ADS) | |

| |

| |

| |

| |

| -Basic | |

(0.01 | ) |

0.01 | |

(0.05 | ) |

(0.03 | ) |

| -Diluted | |

(0.01 | ) |

0.01 | |

(0.05 | ) |

(0.03 | ) |

LightInTheBox Holding Co., Ltd.

Unaudited Reconciliations of GAAP and Non-GAAP

Results

(U.S. dollars in thousands, or otherwise noted)

| | |

Three

Months Ended June 30, | |

Six Months Ended June 30, | |

| | |

2023 | |

2024 | |

2023 | |

2024 | |

| Net (loss) / income | |

(1,457 | ) |

623 | |

(5,413 | ) |

(3,207 | ) |

| Less: Interest income | |

143 | |

14 | |

173 | |

84 | |

| Interest expense | |

(1 | ) |

- | |

(2 | ) |

- | |

| Income tax expense | |

- | |

(1 | ) |

(48 | ) |

(1 | ) |

| Depreciation and amortization | |

(826 | ) |

(521 | ) |

(1,655 | ) |

(1,147 | ) |

| EBITDA | |

(773 | ) |

1,131 | |

(3,881 | ) |

(2,143 | ) |

| Less: Share-based compensation | |

(78 | ) |

(52 | ) |

(83 | ) |

(276 | ) |

| Adjusted EBITDA* | |

(695 | ) |

1,183 | |

(3,798 | ) |

(1,867 | ) |

*

Adjusted EBITDA represents net (loss) / income before share-based compensation expense, interest income, interest expense, income

tax expense and depreciation and amortization expenses.

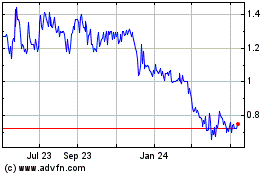

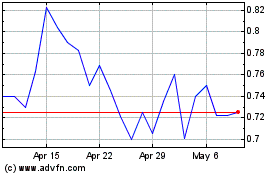

LightInTheBox (NYSE:LITB)

Historical Stock Chart

From Aug 2024 to Sep 2024

LightInTheBox (NYSE:LITB)

Historical Stock Chart

From Sep 2023 to Sep 2024