UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the Month of August 2024

Commission File Number: 001-41569

LANVIN GROUP HOLDINGS LIMITED

4F, 168 Jiujiang Road,

Carlowitz & Co, Huangpu District

Shanghai, 200001, China

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

INCORPORATION

BY REFERENCE

The Report attached

hereto as Exhibit 99.1 is hereby incorporated by reference into the registration statement on Form F-3

(No. 333-276476), the post-effective amendment No. 4 to Form F-1 on Form F-3 (No. 333-269150) and the registration statement on

Form F-3 (No. 333-280891) of Lanvin Group Holdings Limited and shall be a part thereof from the date on which this Report is

furnished, to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | LANVIN GROUP HOLDINGS LIMITED |

| | |

| By: | /s/ Zhen Huang |

| | | Name: |

Zhen Huang |

| | | Title: |

Chairman |

Date: August 26, 2024

Exhibit 99.1

Lanvin Group Holdings Limited

Semi-Annual Report

As of and for the six months ended June 30, 2024

TABLE OF CONTENTS

| |

Page |

| |

|

| CERTAIN

DEFINED TERMS |

1 |

| |

|

| INTRODUCTION |

1 |

| |

|

| NOTE

ON PRESENTATION |

1 |

| |

|

| CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS |

1 |

| |

|

| MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

3 |

Lanvin Group Holdings Limited

Interim condensed consolidated financial statements (unaudited)

At and for the six months ended June 30, 2024 and 2023

| Table of Contents |

Page(s) |

| |

|

| Interim condensed consolidated statements of profit or loss |

F-1 |

| |

|

| Interim condensed consolidated statements of comprehensive loss |

F-2 |

| |

|

| Interim condensed consolidated statements of financial position |

F-3 |

| |

|

| Interim condensed consolidated statements of cash flows |

F-4 |

| |

|

| Interim condensed consolidated statements of changes in equity |

F-5 |

| |

|

| Notes to interim condensed consolidated financial statements |

F-6 - F-25 |

CERTAIN

DEFINED TERMS

In this report (the “Semi-Annual Report”),

unless otherwise specified, the terms “we,” “us,” “our,” “Lanvin Group,” “the Company”

and “our Company” refer to Fosun Fashion Group (Cayman) Limited, or FFG, and its consolidated subsidiaries, prior to the

consummation of the Business Combination (as defined below) and to Lanvin Group Holdings Limited, or LGHL, and its consolidated subsidiaries

following the Business Combination, as the context requires. The term “PCAC” refers to Primavera Capital Acquisition Corporation

prior to the consummation of the Business Combination.

INTRODUCTION

The interim condensed consolidated financial

statements as of and for the six months ended June 30, 2024 (the “Semi-Annual Condensed Consolidated Financial Statements”)

included in this Semi-Annual Report have been prepared in compliance with IAS 34 — Interim Financial Reporting as issued by the

International Accounting Standards Board and as endorsed by the European Union. The accounting principles applied are consistent with

those used for the preparation of the annual consolidated financial statements as of December 31, 2023 and December 31, 2022

and for each of the three years in the period ended December 31, 2023 (the “Annual Consolidated Financial Statements”),

except as otherwise stated in Note 3 in the notes to the Semi-Annual Condensed Consolidated Financial Statements.

The Group’s financial information in

this Semi-Annual Report is presented in Euro except that, in some instances, information is presented in U.S. dollar. All references

in this report to “Euro,” “EUR” and “€” refer to the currency introduced at the start of the

third stage of European Economic and Monetary Union pursuant to the Treaty on the Functioning of the European Union, as amended, and

all references to “U.S. dollar,” “USD” and “$” refer to the currency of the United States of America

(the “U.S.”).

Certain totals in the tables included in this

Semi-Annual Report may not add up due to rounding.

This Semi-Annual Report is unaudited.

NOTE

ON PRESENTATION

On March 23, 2022, we entered into the Business

Combination Agreement (the “Business Combination Agreement”) by and among LGHL, PCAC, FFG, Lanvin Group Heritage I Limited

(“Merger Sub 1”) and Lanvin Group Heritage II Limited (“Merger Sub 2”), which was subsequently amended on October 17,

2022, October 20, 2022, October 28, 2022 and December 2, 2022. Pursuant to the Business Combination Agreement, (i) PCAC

merged with and into Merger Sub 1, with Merger Sub 1 surviving and remaining as a wholly-owned subsidiary of LGHL, (ii) following

the Initial Merger, Merger Sub 2 merged with and into FFG, with FFG being the surviving entity and becoming a wholly-owned subsidiary

of LGHL, and (iii) subsequently, Merger Sub 1 as the surviving company of the Initial Merger merged with and into FFG as the surviving

company of the Second Merger, with FFG surviving such merger (the “Business Combination”). For more information relating

to the Business Combination, including a description of the transactions undertaken to complete the Business Combination, reference should

be made to Note 1— General information to the Annual Consolidated Financial Statements in the Annual Consolidated Financial

Statements.

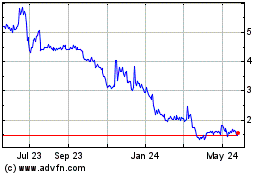

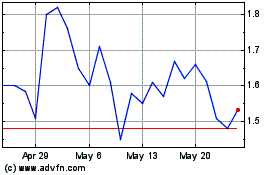

Following the completion of the Business Combination,

on December 14, 2022, our ordinary shares and public warrants began trading on the New York Stock Exchange (“NYSE”)

under the symbols “LANV” and “LANV-WT”, respectively.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Semi-Annual Report contains forward-looking

statements. Forward-looking statements include all statements that are not historical statements of fact and statements regarding, but

not limited to, our expectations, hopes, beliefs, intention or strategies of regarding the future. You can identify these statements

by forward-looking words such as “may,” “expect,” “predict,” “potential,” “anticipate,”

“contemplate,” “believe,” “estimate,” “intend,” “plan,” “future,”

“outlook,” “project,” “will,” “would” and “continue” or similar words. You

should read statements that contain these words carefully because they:

| · | discuss

future expectations; |

| · | contain

projections of future results of operations or financial condition; or |

| · | state

other “forward-looking” information. |

We believe it is important to communicate our

expectations to our security holders. However, there may be events in the future that we are not able to predict accurately or over which

we have no control. The risk factors and cautionary language discussed in this Semi-Annual Report provide examples of risks, uncertainties

and events that may cause actual results to differ materially from the expectations described by us in such forward-looking statements,

including among other things:

| · | changes

adversely affecting the business in which we are engaged; |

| · | our

projected financial information, anticipated growth rate, profitability and market opportunity

may not be an indication of our actual results or our future results; |

| · | the

impact of health epidemics, pandemics and similar outbreaks, including the COVID-19 pandemic

on our business; |

| · | our

ability to safeguard the value, recognition and reputation of our brands and to identify

and respond to new and changing customer preferences; |

| · | the

ability and desire of consumers to shop; |

| · | our

ability to successfully implement our business strategies and plans; |

| · | our

ability to effectively manage our advertising and marketing expenses and achieve the desired

impact; |

| · | our

ability to accurately forecast consumer demand; high levels of competition in the personal

luxury products market; |

| · | disruptions

to our distribution facilities or our distribution partners; |

| · | our

ability to negotiate, maintain or renew our license agreements; |

| · | our

ability to protect our intellectual property rights; |

| · | our

ability to attract and retain qualified employees and preserve craftmanship skills; |

| · | our

ability to develop and maintain effective internal controls; |

| · | general

economic conditions; |

| · | the

result of future financing efforts; and |

| · | other

factors discussed elsewhere in this Semi-Annual Report. |

In

addition, statements that “we believe” and other similar statements reflect our belief and opinions on the relevant subject.

These statements are based upon information available to us as of the date of this Semi-Annual Report, and while we believe such information

forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be

read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These

statements are inherent uncertain and investors are cautioned not to unduly rely upon these statements.

The foregoing factors should not be construed

as exhaustive and should be read together with the other cautionary statements included in this Semi-Annual Report. All forward-looking

statements included herein are expressly qualified in their entirety by the cautionary statements contained or referred to in this section

as well as any other cautionary statements contained herein. Except to the extent required by applicable laws and regulations, we undertake

no obligations to update these forward-looking statements to reflect events or circumstances after the date of this Semi-Annual Report

or to reflect the occurrence of unanticipated events. In light of these risks and uncertainties, you should keep in mind that any event

described in a forward-looking statement made in this Semi-Annual Report or elsewhere might not occur.

MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Overview

We are a global luxury fashion group with five

portfolio brands, namely Lanvin, Wolford, Sergio Rossi, St. John and Caruso. Founded in 1889, Lanvin is one of the oldest French couture

houses still in operation, offering products ranging from apparel to leather goods, footwear, and accessories. Wolford, founded in 1950,

is one of the largest luxury skinwear brands in the world, offering luxury legwear and bodywear, with a recent successful diversification

into leisurewear and athleisure. Sergio Rossi is a highly recognized Italian shoemaker brand and has been a household name for luxury

shoes since 1951. St. John is a classic, timeless and sophisticated American luxury womenswear house founded in 1962 and Caruso has been

a premier menswear manufacturer in Europe since 1958. In addition to our current five portfolio brands, we are also actively looking

at potential add-on acquisitions as part of our growth strategy.

Our

goal is to build a leading global luxury group with unparalleled access to Asia and to provide customers with excellent products that

reflect our brands’ tradition of fine craftsmanship with exclusive design content and a style that preserves the exceptional manufacturing

quality for which those brands are known. This is consistently achieved through the sourcing of superior raw materials, the careful finish

of each piece, and the way the products are manufactured and delivered to our customers. For the six months ended June 30, 2024

and 2023, we recorded revenues of €171.0 million and €214.5 million, respectively, net loss of €69.4 million

and €72.2 million, respectively and Adjusted EBITDA of €(42.1) million and €(40.9) million, respectively.

We

operate a combination of direct-to-consumer, or DTC, and wholesale channels worldwide through our extensive network of around 1,100

points of sale, including approximately 266 directly-operated retail stores (across our five portfolio brands) as of June 30,

2024. We distribute our products worldwide via retail and outlet stores, wholesale customers and e-commerce platforms. Taking into account

the DTC (including both directly-operated stores and e-commerce sites) and wholesale channels, we are present in more than 80 countries.

Key Factors Affecting Our Financial Condition and Results of Operations

Fluctuations in exchange rates

A significant portion of our operations are in

international markets outside the Eurozone, where we record revenues and expenses in various currencies other than the Euro, mainly the

Chinese Renminbi and U.S. dollar, as well as other currencies.

The table below shows the exchange rates of the

main foreign currencies used to prepare the Semi-Annual Condensed Consolidated Financial Statements compared to the Euro.

| | |

Exchange

rate at June

30, 2023 | | |

1H2023

Average

exchange

rate | | |

Exchange

rate at June

30, 2024 | | |

1H2024

Average

exchange

rate | |

| U.S. Dollar | |

| 1.0901 | | |

| 1.0809 | | |

| 1.0751 | | |

| 1.0854 | |

| Chinese Renminbi | |

| 7.8771 | | |

| 7.4848 | | |

| 7.6617 | | |

| 7.7120 | |

| Hong Kong Dollar | |

| 8.5435 | | |

| 8.4723 | | |

| 8.3945 | | |

| 8.4869 | |

| British Pound | |

| 0.8615 | | |

| 0.8763 | | |

| 0.8473 | | |

| 0.8545 | |

| Japanese Yen | |

| 157.2589 | | |

| 145.3643 | | |

| 171.2494 | | |

| 163.9456 | |

The following table shows the sensitivity at the

end of the reporting period to a reasonably possible change in the main foreign currencies against the Euro, with all other variables

held constant, of our profit before tax due to differences arising on settlement or translation of monetary assets and liabilities and

our equity excluding the impact of retained earnings due to the changes of exchange fluctuation reserve of certain overseas subsidiaries

of which the functional currencies are currencies other than the Euro.

| | |

As of June 30, 2024 | |

| | |

Increase /

(decrease) in

loss before

tax if Euro

strengthens

by 5% | | |

Increase /

(decrease) in

loss before

tax if Euro

weakens

by 5% | |

| U.S. Dollar | |

| (13,004 | ) | |

| 13,004 | |

| Chinese Renminbi | |

| (96 | ) | |

| 96 | |

| Hong Kong Dollar | |

| 112 | | |

| (112 | ) |

| British Pound | |

| 44 | | |

| (44 | ) |

| Japanese Yen | |

| (824 | ) | |

| 824 | |

| Total | |

| (13,768 | ) | |

| 13,768 | |

Results of Operations

Six months ended June 30, 2024 compared with six months

ended June 30, 2023

The following is a discussion of our results of

operations for the six months ended June 30, 2024 as compared to the six months ended June 30, 2023.

| | |

For the six months ended June 30, | |

| (Euro thousands, except percentages) | |

2024 | | |

Percentage

of

revenues | | |

2023 | | |

Percentage

of

revenues | |

| Revenues | |

| 170,976 | | |

| 100.0 | % | |

| 214,537 | | |

| 100.0 | % |

| Cost of sales | |

| (72,598 | ) | |

| (42.5 | )% | |

| (89,083 | ) | |

| (41.5 | )% |

| Gross profit | |

| 98,378 | | |

| 57.5 | % | |

| 125,454 | | |

| 58.5 | % |

| Marketing and selling expenses | |

| (105,591 | ) | |

| (61.8 | )% | |

| (110,600 | ) | |

| (51.6 | )% |

| General and administrative expenses | |

| (58,065 | ) | |

| (34.0 | )% | |

| (76,544 | ) | |

| (35.7 | )% |

| Other operating income and expenses | |

| 5,457 | | |

| 3.2 | % | |

| (7,960 | ) | |

| (3.7 | )% |

| Loss from operations before non-underlying items | |

| (59,821 | ) | |

| (35.0 | )% | |

| (69,650 | ) | |

| (32.5 | )% |

| Non-underlying items | |

| 3,143 | | |

| 1.8 | % | |

| 9,666 | | |

| 4.5 | % |

| Operating Loss/Profit | |

| (56,678 | ) | |

| (33.1 | )% | |

| (59,984 | ) | |

| (28.0 | )% |

| Financial costs — net | |

| (13,187 | ) | |

| (7.7 | )% | |

| (11,970 | ) | |

| (5.6 | )% |

| Loss before taxes | |

| (69,865 | ) | |

| (40.9 | )% | |

| (71,954 | ) | |

| (33.5 | )% |

| Income tax benefits / (expenses) | |

| 489 | | |

| 0.3 | % | |

| (271 | ) | |

| (0.1 | )% |

| (Loss)/Profit for the period | |

| (69,376 | ) | |

| (40.6 | )% | |

| (72,225 | ) | |

| (33.7 | )% |

| Non-IFRS Financial Measures(1): | |

| | | |

| | | |

| | | |

| | |

| Contribution profit | |

| (7,213 | ) | |

| (4.2 | )% | |

| 14,854 | | |

| 6.9 | % |

| Adjusted EBIT | |

| (58,994 | ) | |

| (34.5 | )% | |

| (67,679 | ) | |

| (31.5 | )% |

| Adjusted EBITDA | |

| (42,111 | ) | |

| (24.6 | )% | |

| (40,916 | ) | |

| (19.1 | )% |

| (1) | See “— Non-IFRS Financial Measures.” |

Revenues

We generate revenue primarily through our five

brands: Lanvin, Wolford, St. John, Sergio Rossi and Caruso, whose revenues are generated from the sale of their products, manufacturing

and services for private labels and other luxury brands, as well as from royalties received from third parties and licensees. Revenue

is measured at the transaction price which is based on the amount of consideration that we expect to receive in exchange for transferring

the promised goods or services to the customer. For each period presented, revenue is exclusive of sales incentives, rebates and sales

discounts. As such, the percentage contribution of these sales incentives, rebates and sales discount is zero.

Revenues

for the six months ended June 30, 2024 amounted to €171.0 million, a decrease of €43.6 million or (20.3)

%, compared to €214.5 million in the same period in 2023.

The following table sets forth a breakdown of

revenues by portfolio brand for the six months ended June 30, 2024 and 2023.

| | |

For the six months ended June 30, | | |

Increase /

(Decrease) | |

| (Euro thousands, except percentages) | |

2024 | | |

2023 | | |

2024 vs

2023 | | |

% | |

| Lanvin | |

| 48,272 | | |

| 57,052 | | |

| (8,780 | ) | |

| (15.4 | )% |

| Wolford | |

| 42,594 | | |

| 58,802 | | |

| (16,208 | ) | |

| (27.6 | )% |

| St. John | |

| 39,981 | | |

| 46,663 | | |

| (6,682 | ) | |

| (14.3 | )% |

| Sergio Rossi | |

| 20,404 | | |

| 33,019 | | |

| (12,615 | ) | |

| (38.2 | )% |

| Caruso | |

| 19,734 | | |

| 19,926 | | |

| (192 | ) | |

| (1.0 | )% |

| Other and holding companies | |

| 4,366 | | |

| 3,990 | | |

| 376 | | |

| 9.4 | % |

| Eliminations and unallocated | |

| (4,375 | ) | |

| (4,915 | ) | |

| 540 | | |

| (11.0 | )% |

| Total | |

| 170,976 | | |

| 214,537 | | |

| (43,561 | ) | |

| (20.3 | )% |

The following table sets forth a breakdown of

revenues by sales channel for the six months ended June 30, 2024 and 2023.

| | |

For the six months ended

June 30, | | |

Increase /

(Decrease) | |

| (Euro thousands, except percentages) | |

2024 | | |

2023 | | |

2024 vs

2023 | | |

% | |

| DTC | |

| 104,574 | | |

| 121,041 | | |

| (16,467 | ) | |

| (13.6 | )% |

| Wholesale | |

| 59,589 | | |

| 85,446 | | |

| (25,857 | ) | |

| (30.3 | )% |

| Other(1) | |

| 6,813 | | |

| 8,050 | | |

| (1,237 | ) | |

| (15.4 | )% |

| Total Revenues | |

| 170,976 | | |

| 214,537 | | |

| (43,561 | ) | |

| (20.3 | )% |

| (1) |

Royalties received from third parties and licensees, and clearance income. |

The following table sets forth a breakdown of

revenues by geographical area for the six months ended June 30, 2024 and 2023.

| | |

For the six months ended

June 30, | | |

Increase /

(Decrease) | |

| (Euro thousands, except percentages) | |

2024 | | |

2023 | | |

2024 vs

2023 | | |

% | |

| EMEA(1) | |

| 75,704 | | |

| 103,905 | | |

| (28,201 | ) | |

| (27.1 | )% |

| North America(2) | |

| 64,324 | | |

| 72,487 | | |

| (8,163 | ) | |

| (11.3 | )% |

| Greater China(3) | |

| 19,761 | | |

| 26,063 | | |

| (6,302 | ) | |

| (24.2 | )% |

| Other Asia(4) | |

| 11,187 | | |

| 12,082 | | |

| (895 | ) | |

| (7.4 | )% |

| Total | |

| 170,976 | | |

| 214,537 | | |

| (43,561 | ) | |

| (20.3 | )% |

| (1) | EMEA includes EU countries, the United Kingdom, Switzerland, the countries

of the Balkan Peninsula, Eastern Europe, Scandinavian, Azerbaijan, Kazakhstan and the Middle East. |

| (2) | North America includes the United States of America and Canada. |

| (3) |

Greater China includes mainland China, Hong Kong Special Administrative Region, Macao Special Administrative

Region and Taiwan. |

| (4) | Other Asia includes Japan, South Korea, Thailand, Malaysia, Vietnam, Indonesia,

Philippines, Australia, New Zealand, India and other Southeast Asian countries. |

By segment

By

segment, the decrease in revenues was driven by (i) a decrease of €16.2 million (or (27.6)%) in sales from Wolford

segment, which was mainly due to market headwinds and shipping disruptions caused by a transition to a new logistics supplier, (ii) a

decrease of €12.6 million in sales (or (38.2)%) from Sergio Rossi segment, which was attributed to its decline in the wholesale

channel, (iii) a decrease of €8.8 million (or (15.4)%) from Lanvin segment, which was mainly due to market headwinds and

Lanvin’s transition of artistic director, (iv) a decrease of €6.7 million (or (14.3)%) from St.John segment, which

was mainly due to global market softness, and (v) a decrease of €0.2 million (or (1.0)%) from Caruso segment due to global

market softness, particularly in the wholesale channel.

By sales channel

By

sales channel, the decrease in revenues was mainly related to a decrease of €25.9 million (or (30.3)%) in the wholesale

channel, a decrease of €16.5 million (or (13.6)%) in the DTC channel, and a decrease of €1.2 million (or (15.4)%)

in the other channel.

The

decrease in wholesale revenues was mainly due to the decrease of Wolford, Sergio Rossi and Lanvin’s wholesale business,

which was mainly impacted by the softening demand for luxury goods. Sales to our five largest customers were 7.8% and 8.7% of our revenues

for the six months ended June 30, 2024 and 2023, respectively. No single customer accounted for more than 5% of our consolidated

revenues for the six months ended June 30, 2024 and 2023.The decrease in the DTC channel was primarily due to reduced retail traffic.

Other

channel decrease was mainly due to the decrease of Lanvin’s clearance income.

The following table sets forth a breakdown

of store count at the end of the six months ended June 30, 2024 and 2023:

| | |

As of June 30, | |

| | |

2024 | | |

2023 | |

| Lanvin | |

| 37 | | |

| 32 | |

| Wolford | |

| 140 | | |

| 156 | |

| St. John | |

| 42 | | |

| 44 | |

| Sergio Rossi | |

| 47 | | |

| 50 | |

| Caruso | |

| – | | |

| – | |

| Total | |

| 266 | | |

| 282 | |

By geography

By

geographical region, the decrease in revenues was mainly due to (i) a decrease of €28.2 million (or (27.1) %) in EMEA,

(ii) a decrease of €8.2 million (or (11.3)%) in North America, (iii) a decrease of €6.3 million (or (24.2)%) in

Greater China, and (iv) a decrease of €0.9 million (or (7.4)%) in other Asia.

The

decrease in EMEA was due to the decrease of Wolford, Sergio Rossi, Lanvin and St.John, which was partially offset by the increase

of Caruso. Wolford’s EMEA business decreased €13.6 million (or (34.0)%) year-over-year to €26.5 million in

the six months ended June 30, 2024, mainly attributed to the impact of shift to new logistic supplier. Sergio Rossi’s EMEA

business decreased €9.0 million (or (48.5)%) year-over-year to €9.5 million in the six months ended June 30, 2024,

mainly attributable to its reduction in wholesale channels (including third-party production), and in part due to Sergio Rossi’s

strategic adjustment on third-party production. Lanvin’s EMEA business decreased €6.3 million (or (21.4)%) year-over-year

to €23.2 million in the six months ended June 30, 2024. St. John’s EMEA business decreased €0.4 million

(or (59.1)%) year-over-year to €0.3 million in the six months ended June 30, 2024. Caruso’s EMEA business increased

€0.5 million or 3.3% year-over-year to €16.8 million in the six months ended June 30, 2024.

The

decrease in North America was mainly due to the decrease of St.John, Wolford and Lanvin. St. John’s North America

business decreased €4.3 million (or (10.3)%) year-over-year to €37.3 million in the six months ended June 30, 2024.

Wolford’s North America business decreased €1.5 million (or (10.4)%) year-over-year to €12.7 million in the

six months ended June 30, 2024. Lanvin’s North America business decreased €1.2 million (or (9.2)%) year-over-year

to €12.0 million in the six months ended June 30, 2024.

The

decrease in Greater China was mainly due to the decrease of Sergio Rossi, St.John, Lanvin and Wolford. In the six months ended

June 30, 2024, Sergio Rossi’s revenue decreased by (34.3)% to €4.2 million, St. John decreased by (47.1)%

to €2.2 million, Lanvin decreased by (14.1)% to €9.5 million and Wolford decreased by (20.3)% to €3.3 million.

The

decrease in other Asia was mainly due to the decrease of Sergio Rossi and Wolford, which was partially offset by the increase

of Lanvin. Sergio Rossi’s other Asia business decreased €0.9 million (or (12.2)%) year-over-year to €6.4 million

in the six months ended June 30, 2024, which was mainly due to the decrease in wholesale channel while its DTC channel was flat.

Wolford’s other Asia business decreased €0.3 million (or (69.1)%) year-over-year to €0.1 million in the six months

ended June 30, 2024, which was mainly impacted by the transition to its new logistics supplier.

The decrease across all regions was primarily

attributed to the globally softening demand for luxury fashion goods.

Cost of sales

Cost of sales includes the raw material cost,

production labor, assembly overhead including depreciation expense, procurement of the merchandise, and inventory valuation adjustments.

In addition, cost of sales also includes customs duties, product packaging cost, royalty cost associated with sales of licensed products,

and freight charges.

The following table sets forth a breakdown of

cost of sales by nature for the six months ended June 30, 2024 and 2023.

| | |

For the six months

ended June 30, | | |

Increase /

(Decrease) | |

| (Euro thousands, except percentages) | |

2024 | | |

2023 | | |

2024 vs

2023 | | |

% | |

| Purchases of raw materials, finished goods and manufacturing services | |

| 50,419 | | |

| 63,632 | | |

| (13,213 | ) | |

| (20.8 | )% |

| Change in inventories | |

| 4,276 | | |

| 2,882 | | |

| 1,394 | | |

| 48.4 | % |

| Labor cost | |

| 12,601 | | |

| 17,358 | | |

| (4,757 | ) | |

| (27.4 | )% |

| Logistics costs, duties and insurance | |

| 7,523 | | |

| 6,662 | | |

| 861 | | |

| 12.9 | % |

| Depreciation and amortization | |

| 452 | | |

| 871 | | |

| (419 | ) | |

| (48.1 | )% |

| Others | |

| (2,673 | ) | |

| (2,322 | ) | |

| (351 | ) | |

| 15.1 | % |

| Total cost of sales by nature | |

| 72,598 | | |

| 89,083 | | |

| (16,485 | ) | |

| (18.5 | )% |

The following table sets forth a breakdown of

cost of sales by portfolio brand for the six months ended June 30, 2024 and 2023.

| | |

For the six months

ended

June 30, | | |

Increase /

(Decrease) | |

| (Euro thousands, except percentages) | |

2024 | | |

2023 | | |

2024 vs

2023 | | |

% | |

| Lanvin | |

| 20,268 | | |

| 25,093 | | |

| (4,825 | ) | |

| (19.2 | )% |

| Wolford | |

| 15,799 | | |

| 16,740 | | |

| (941 | ) | |

| (5.6 | )% |

| St. John | |

| 12,285 | | |

| 17,639 | | |

| (5,354 | ) | |

| (30.4 | )% |

| Sergio Rossi | |

| 10,186 | | |

| 15,884 | | |

| (5,698 | ) | |

| (35.9 | )% |

| Caruso | |

| 14,011 | | |

| 14,693 | | |

| (682 | ) | |

| (4.6 | )% |

| Other and holding companies | |

| 717 | | |

| 200 | | |

| 517 | | |

| 258.5 | % |

| Eliminations and unallocated | |

| (668 | ) | |

| (1,166 | ) | |

| 498 | | |

| (42.7 | )% |

| Total | |

| 72,598 | | |

| 89,083 | | |

| (16,485 | ) | |

| (18.5 | )% |

Cost

of sales for the six months ended June 30, 2024 amounted to €72.6 million, a decrease of €16.5 million or (18.5)%,

compared to €89.1 million in the same period in 2023.

By

segment, the decrease in cost of sales was mainly related to the decrease in scale and sales for all of our brands.

Cost

of sales as a percentage of revenues slightly increased to 42.5% for the six months ended June 30, 2024, compared to

41.5% in the same period in 2023. The increase was primarily due to the gross margin decrease of Wolford. Inventory impairment costs

improved in the six months ended June 30, 2024 was €3.3 million gain (or 1.9% as a percentage of revenue), compared to

€2.9 million gain (or 1.4% as a percentage of revenue) in the same period in 2023.

Gross profit

The following table sets forth a breakdown of

gross profit by portfolio brand for the six months ended June 30, 2024 and 2023.

| | |

For the six months

ended

June 30, | | |

Increase / (Decrease) | |

| (Euro thousands, except percentages) | |

2024 | | |

2023 | | |

2024 vs

2023 | | |

% | |

| Lanvin | |

| 28,004 | | |

| 31,959 | | |

| (3,955 | ) | |

| (12.4 | )% |

| Wolford | |

| 26,795 | | |

| 42,062 | | |

| (15,267 | ) | |

| (36.3 | )% |

| St. John | |

| 27,696 | | |

| 29,024 | | |

| 1,328 | | |

| 4.6 | % |

| Sergio Rossi | |

| 10,218 | | |

| 17,135 | | |

| (6,917 | ) | |

| (40.4 | )% |

| Caruso | |

| 5,723 | | |

| 5,233 | | |

| 490 | | |

| 9.4 | % |

| Other and holding companies | |

| 3,649 | | |

| 3,790 | | |

| (141 | ) | |

| (3.7 | )% |

| Eliminations and unallocated | |

| (3,707 | ) | |

| (3,749 | ) | |

| 42 | | |

| (1.1 | )% |

| Total | |

| 98,378 | | |

| 125,454 | | |

| (27,076 | ) | |

| (21.6 | )% |

Gross

profit for the six months ended June 30, 2024 amounted to 98.4 million, a decrease of €27.1 million or (21.6)%,

compared to €125.5 million in the same period in 2023.

The

decrease in gross profit was mainly related to the double digit decrease in revenue. Gross profit margin declined to 57.5%

for the six months ended June 30, 2024 from 58.5% in the same period in 2023, which was mainly due to the gross profit margin decrease

in Wolford despite all other brands improved.

Marketing and selling expenses

Marketing and selling expenses include store employee

compensation, occupancy costs, depreciation, supply costs for store equipment, wholesale and retail account administration compensation

globally, as well as depreciation and amortization which includes depreciation of right-of-use assets under IFRS 16. These expenses are

affected by the number of stores that are open during any fiscal period and store performance, as compensation and rent expenses can

vary with sales. Marketing and selling expenses also include advertising and marketing expenses, which consist of media space and production

costs, advertising agency fees, public relations and market research expenses. In addition, marketing and selling expenses include distribution

and customer service expenses which consist of warehousing, order fulfillment, shipping and handling, customer service, employee compensation

and bag repair costs.

The following table sets forth a breakdown of

marketing and selling expenses by portfolio brand for the six months ended June 30, 2024 and 2023.

| | |

For the six months ended

June 30, | | |

Increase /

(Decrease) | |

| (Euro thousands, except percentages) | |

2024 | | |

2023 | | |

2024 vs

2023 | | |

% | |

| Lanvin | |

| (37,389 | ) | |

| (36,793 | ) | |

| (596 | ) | |

| 1.6 | % |

| Wolford | |

| (34,916 | ) | |

| (38,128 | ) | |

| 3,212 | | |

| (8.4 | )% |

| St. John | |

| (23,036 | ) | |

| (23,719 | ) | |

| 683 | | |

| (2.9 | )% |

| Sergio Rossi | |

| (9,490 | ) | |

| (11,355 | ) | |

| 1,865 | | |

| (16.4 | )% |

| Caruso | |

| (936 | ) | |

| (842 | ) | |

| (94 | ) | |

| 11.2 | % |

| Other and holding companies | |

| (2,004 | ) | |

| (1,995 | ) | |

| (9 | ) | |

| 0.5 | |

| Eliminations and unallocated | |

| 2,180 | | |

| 2,232 | | |

| (52 | ) | |

| (2.3 | )% |

| Total | |

| (105,591 | ) | |

| (110,600 | ) | |

| 5,009 | | |

| (4.5 | )% |

Marketing

and selling expenses for the six months ended June 30, 2024 amounted to €105.6 million, a decrease of €5.0 million

(or (4.5)%), compared to €110.6 million in the same period in 2023.

By

segment, the decrease in marketing and selling expenses was mainly related to (i) a decrease of €3.2 million (or (8.4)%)

from Wolford, (ii) a decrease of €1.9 million (or (16.4)%) from Sergio Rossi, (iii) a decrease of €0.7 million

(or (2.9)%) from St.John, which was offset by (iv) an increase of €0.6 million (or 1.6%) from Lanvin, and (v) an increase

of €0.1 million (or 11.2%) from Caruso.

Marketing

and selling expenses increased as a percentage of revenue due to higher store related costs and expense deleverage on lower revenue.

Contribution profit

Contribution profit is defined as net revenues

less the cost of sales and selling and marketing expenses, which constitutes the majority of our variable costs. Contribution profit

is a non-IFRS financial measure. See “—Non-IFRS Financial Measures.”

Our

consolidated contribution profit decreased by €22.1 million (or (148.6)%) to €7.2 million loss for the six months

ended June 30, 2024 from €14.8 million gain in the same period in 2023. The decrease was mainly related to (i) a decrease

of €12.1 million from Wolford, (ii) a decrease of €5.1 million from Sergio Rossi, (iii) a decrease of €4.6

million from Lanvin, (iv) a decrease of €(0.6) million from St.John, which was offset by an increase of €0.4 million

from Caruso.

General and administrative expenses

General and administrative expenses include administrative

and management staff costs, product creation and sample costs, rent, depreciation, and amortization expenses for our administrative staff,

as well as IT system development and maintenance expenses.

General

and administrative expenses decreased to €58.1 million or by (24.1)% for the six months ended June 30, 2024, from

€76.5 million in the same period in 2023. General and administrative expenses also declined as a percentage of revenues to 34.0%

for the six months ended June 30, 2024 from 35.7% in the same period in 2023, due to continuous cost optimization.

We expect general and administrative expenses

to continue to decline as a percentage of revenues as we continue to leverage synergies across the group.

Other operating income and expenses

Other operating income and expenses include foreign

exchange gains or losses and impairment losses.

Other

operating income and expenses increased to €5.5 million gain for the six months ended June 30, 2024 from €8.0

million loss in the same period in 2023, mainly due to a foreign exchange gain compared to loss in the same period in 2023.

Loss from operations before non-underlying items

Loss

from operations before non-underlying items for the six months ended June 30, 2024 decreased by €9.8 million (or (14.1)%)

to €59.8 million, compared to €69.7 million in the same period in 2023. The decrease in loss from operations before non-underlying

items was mainly due to decrease in expenses, partially offset by the decrease of gross profit.

Adjusted EBITDA

Adjusted

EBITDA, which is a non-IFRS financial measure, for the six months ended June 30, 2024 decreased to €(42.1) million

from €(40.9) million in the same period in 2023. This decrease was mainly due to the decrease in gross profit and partially offset

by the decrease of expenses. Adjusted EBITDA as a percentage of total revenues decreased to (24.6)% in the six months ended June 30,

2024 from (19.1)% in the same period in 2023. See “—Non-IFRS Financial Measures.”

Non-underlying items

Non-underlying items comprise net gains on disposals,

negative goodwill from acquisition of a subsidiary, gain on debt restructuring, government grants and others.

The

non-underlying items was €3.1 million gain, or 1.8% of revenues for the six months ended June 30, 2024, compared

to €9.7 million gain or 4.5% of revenues in the same period in 2023. The decrease in the non-underlying items by €6.5 million

was mainly due to the decrease in government grants from €8.2 million in the six months ended June 30, 2023 to €15 thousand

in the same period in 2024.

Operating loss

Operating

loss for the six months ended June 30, 2024 amounted to €56.7 million, a decrease of €3.3 million or (5.5)%,

compared to €60.0 million in the same period in 2023. The improvement in operating loss resulted from a decrease in loss from operations

before non-underlying items and partially offset by a decrease of non-underlying items.

Finance cost—(net)

Finance costs (net) primarily include income and

expenses relating to our interest income and expenses on financial assets and liabilities, including interest expense resulting from

IFRS 16 lease liability.

Finance

costs for the six months ended June 30, 2024 amounted to €13.2 million, an increase of €1.2 million or 10.2%,

compared to finance costs of €12.0 million in the same period in 2023. The increase was primarily attributable to an increase of

€4.2 million of interest expense on borrowings and partially offset

by a decrease of €3.5 million in foreign exchange loss.

Loss before income tax

Loss

before income tax for the six months ended June 30, 2024 amounted to €69.9 million, an decrease of €2.1 million

or (2.9)%, compared to €72.0 million in the same period in 2023.

Income tax benefits / (expenses)

Income taxes include the current taxes on the

results of our operations and any changes in deferred income taxes.

Income

tax expenses for the six months ended June 30, 2024 amounted to €0.5 million gain, decreased by €0.8 million,

compared to €0.3 million loss in the same period in 2023. The decrease was primarily due to €0.6 million deferred income

taxes gain for the six months ended June 30, 2024, compared to €0.2 million gain in the same period in 2023, and €0.1 million

current taxes loss for the six months ended June 30, 2024, compared to €0.5 million loss in the same period in 2023.

Loss for the period

Loss

for the six months ended June 30, 2024 amounted to €69.4 million, a decrease of €2.8 million or (3.9)%, compared

to €72.2 million in the same period in 2023.

Results by Segment

Six months ended June 30, 2024 compared with six months

ended June 30, 2023

The following is a discussion of revenues, gross

profit and contribution profit for each segment for the six months ended June 30, 2024 as compared to the six months ended June 30,

2023.

Lanvin Segment

The following table sets forth revenues and gross

profit for the Lanvin segment for the six months ended June 30, 2024 and 2023:

| | |

For the six months ended

June 30, | | |

Increase /

(Decrease) | |

| (Euro thousands, except percentages) | |

2024 | | |

2023 | | |

2024 vs

2023 | | |

% | |

| Revenues | |

| 48,272 | | |

| 57,052 | | |

| (8,780 | ) | |

| (15.4 | )% |

| Gross profit | |

| 28,004 | | |

| 31,959 | | |

| (3,955 | ) | |

| (12.4 | )% |

| Gross profit margin | |

| 58.0 | % | |

| 56.0 | % | |

| 2.0 | % | |

| - | |

| Marketing and selling expenses | |

| (37,389 | ) | |

| (36,793 | ) | |

| (596 | ) | |

| 1.6 | % |

| Contribution profit/(loss)(1)(3) | |

| (9,385 | ) | |

| (4,834 | ) | |

| (4,551 | ) | |

| 94.2 | % |

| Contribution profit margin(2)(3) | |

| (19.4 | )% | |

| (8.5 | )% | |

| (11.0 | )% | |

| - | |

| (1) |

Contribution profit equals gross profit less marketing and selling expenses. |

| (2) |

Contribution profit margin equals contribution profit divided by revenue. |

| (3) |

Contribution profit and contribution profit margin are non-IFRS financial measures. |

Revenues

Revenues

for the six months ended June 30, 2024 was €48.3 million, a decrease of €8.8 million or (15.4)% compared

to €57.1 million in the same period in 2023.

The

decrease is attributable to global market softness and it’s the brand’s creative transition during the period.

DTC

revenues decreased by 10.1% from €26.8 million for the six months ended June 30, 2023, to €24.1 million for the

six months ended June 30, 2024. The drop in DTC channels was mainly due to lower sales from softer market in Great China and EMEA.

Great China DTC revenues decreased by €1.7 million (or (16.3)% year-over-year) to €8.8 million in the six months ended June 30,

2024. EMEA DTC revenues decreased by €0.7 million (or (9.7)% year-over-year) to €6.7 million in the six months ended June 30,

2024.

Wholesale

revenues decreased by 23.4% from €23.0 million for the six months ended June 30, 2023, to €17.6 million for

the six months ended June 30, 2024, mainly due to the softness in global luxury market as well as general challenges in the wholesale

market. The wholesale revenues as percentage of Lanvin’s total revenues decreased from 40.4% for the six months ended June 30,

2023 to 36.5% for the six months ended June 30, 2024 as company’s more focusing on higher margin channel.

Gross profit

Gross

profit for the six months ended June 30, 2024 decreased to €28.0 million, a decrease of €4.0 million or (12.4)%

compared to €32.0 million in the same period in 2023.

The

decrease in gross profit was primarily attributable to the decrease in revenue. While gross margin increased to 58.0% compared

to 56.0% in the same period in 2023, which was mainly driven by its optimization of channel mix as well as the improvement in inventory

management.

Contribution profit/(loss)

Contribution

loss for the six months ended June 30, 2024 was €9.4 million, a decrease of €4.6 million from the €4.8

million loss in the same period in 2023.

The

increase in contribution loss was mainly due to the loss in gross margin and expense deleverage on lower revenue.

Wolford Segment

The following table sets forth revenues and gross

profit for the Wolford segment for the six months ended June 30, 2024 and 2023:

| | |

For the six months ended

June 30, | | |

Increase /

(Decrease) | |

| (Euro thousands, except percentages) | |

2024 | | |

2023 | | |

2024 vs

2023 | | |

% | |

| Revenues | |

| 42,594 | | |

| 58,802 | | |

| (16,208 | ) | |

| (27.6 | )% |

| Gross profit | |

| 26,795 | | |

| 42,062 | | |

| (15,267 | ) | |

| (36.3 | )% |

| Gross profit margin | |

| 62.9 | % | |

| 71.5 | % | |

| (8.6 | )% | |

| - | |

| Marketing and selling expenses | |

| (34,916 | ) | |

| (38,128 | ) | |

| 3,212 | | |

| (8.4 | )% |

| Contribution profit/(loss)(1)(3) | |

| (8,121 | ) | |

| 3,934 | | |

| (12,055 | ) | |

| (306.4 | )% |

| Contribution profit margin(2)(3) | |

| (19.1 | )% | |

| 6.7 | % | |

| (25.8 | )% | |

| - | |

| (1) |

Contribution profit equals gross profit less marketing and selling expenses. |

| (2) |

Contribution profit margin equals contribution profit divided by revenue. |

| (3) |

Contribution profit and contribution profit margin are non-IFRS financial measures. |

Revenues

Revenues

for the six months ended June 30, 2024 decreased to €42.6 million, a decrease of €16.2 million or (27.6)%

compared to €58.8 million for the six months ended June 30, 2023.

The

decrease in all regions was led by the wholesale channels, which decreased by €9.9 million or (53.3)% from the six months

ended June 30, 2023 to €8.7 million in the six months ended June 30, 2024. The decline in the EMEA region accounted for

most of the decrease, EMEA revenue was lower by 34.0% year-over-year to €26.5 million for the six months ended June 30, 2024.

Gross profit

Gross

profit decreased by €15.3 million to €26.8 million for the six months ended June 30, 2024, compared to €42.1

million in the same period in 2023. Gross profit margin decreased to 62.9% for the six months ended June 30, 2024 from 71.5% in

the same period in 2023.

The decrease

in gross profit margin was primarily attributable to the delays from integration with new logistic provider that resulted in an inability to absorb fixed production costs as well as the digestion of excess stock for purposes of inventory management.

Contribution profit/(loss)

Contribution

loss for the six months ended June 30, 2024 was €8.1 million (or (19.1)% of revenue), compared to a profit of €3.9

million (or 6.7% of revenue) in the same period in 2023, driven by the decrease in revenue and expense deleverage on lower revenues. Marketing and selling expenses declined to €34.9 million (or 82.0% of revenues) for the six months ended June 30, 2024

from €38.1 million (or 64.8% of revenues) in the same period in 2023.

St. John Segment

The following table sets forth revenues and gross

profit for the St. John segment for the six months ended June 30, 2024 and 2023:

| | |

For the six months ended

June 30, | | |

Increase /

(Decrease) | |

| (Euro thousands, except percentages) | |

2024 | | |

2023 | | |

2024 vs

2023 | | |

% | |

| Revenues | |

| 39,981 | | |

| 46,663 | | |

| (6,682 | ) | |

| (14.3 | )% |

| Gross profit | |

| 27,696 | | |

| 29,024 | | |

| (1,328 | ) | |

| (4.6 | )% |

| Gross profit margin | |

| 69.3 | % | |

| 62.2 | % | |

| 7.1 | % | |

| - | |

| Marketing and selling expenses | |

| (23,036 | ) | |

| (23,719 | ) | |

| 683 | | |

| (2.9 | )% |

| Contribution profit/(loss)(1)(3) | |

| 4,660 | | |

| 5,305 | | |

| (645 | ) | |

| (12.2 | )% |

| Contribution profit margin(2)(3) | |

| 11.7 | % | |

| 11.4 | % | |

| 0.3 | % | |

| - | |

| (1) | Contribution profit equals gross profit less marketing and selling

expenses. |

| (2) | Contribution profit margin equals contribution profit divided by revenue. |

| (3) | Contribution profit and contribution profit margin are non-IFRS financial

measures. |

Revenues

Revenues

for the six months ended June 30, 2024 amounted to €40.0 million, a decrease of €6.7 million compared to €46.7

million in the same period in 2023.

St.

John decrease its revenues by (14.3)% year-over-year, due to both sales weakness in DTC and wholesales channels, as a result of

slowing luxury market in the North America. DTC sales decreased by €5.6 million (or (14.8)% to €32.2 million, and wholesales

decreased by €1.1 million (or (12.7)% to €7.7 million for the six months ended June 30, 2024.

Gross profit

Gross

profit for the six months ended June 30, 2024 was €27.7 million, a decrease of €1.3 million compared to €29.0

million in the same period in 2023. However gross profit margin improved to 69.3% in the six months ended June 30, 2024, compared

to 62.2% in the same period in 2023. The improvement in gross margin was primarily driven by the improvement of full-price sell-through

and better channel mix.

Contribution profit

Contribution

profit for the six months ended June 30, 2024 was €4.7 million (or 11.7% of revenue), compared to €5.3 million

(or 11.4% of revenue) in the same period in 2023.

Sergio Rossi Segment

The following table sets forth revenues and gross

profit for the Sergio Rossi segment for the six months ended June 30, 2024 and 2023:

| | |

For the six months ended

June 30, | | |

Increase /

(Decrease) | |

| (Euro thousands, except percentages) | |

2024 | | |

2023 | | |

2024 vs

2023 | | |

% | |

| Revenues | |

| 20,404 | | |

| 33,019 | | |

| (12,615 | ) | |

| (38.2 | )% |

| Gross profit | |

| 10,218 | | |

| 17,135 | | |

| (6,917 | ) | |

| (40.4 | )% |

| Gross profit margin | |

| 50.1 | % | |

| 51.9 | % | |

| (1.8 | )% | |

| - | |

| Marketing and selling expenses | |

| (9,490 | ) | |

| (11,355 | ) | |

| 1,865 | | |

| (16.4 | )% |

| Contribution profit/(loss)(1)(3) | |

| 728 | | |

| 5,780 | | |

| (5,052 | ) | |

| (87.4 | ) |

| Contribution profit margin(2)(3) | |

| 3.6 | % | |

| 17.5 | % | |

| (13.9 | )% | |

| - | |

| (1) | Contribution profit equals gross profit less marketing and selling

expenses. |

| (2) | Contribution profit margin equals contribution profit divided by revenue. |

| (3) | Contribution profit and contribution profit margin are non-IFRS financial

measures. |

Revenues

Revenues

for the six months ended June 30, 2024 amounted to €20.4 million, a decrease of €12.6 million compared to €33.0

million in the same period in 2023. The decrease was primarily due to sales decrease in wholesale channel, including third-party production

business.

Revenues

through our DTC channels decreased by 17.0% from €16.8 million for the six months ended June 30, 2023, to €14.0

million for the six months ended June 30, 2024. The decrease in DTC channels was mainly attributable to weakness in EMEA outlets

and APAC retail stores.

Wholesale

revenues decreased by 60.3% from €16.2 million for the six months ended June 30, 2023, to €6.4 million for

the six months ended June 30, 2024. Third-party production contributed to €1.7 million of wholesale revenues for the six

months ended June 30, 2024 compared to €7.6 million in the same period in 2023.

Gross profit

Gross

profit for the six months ended June 30, 2024 was €10.2 million, a decrease of €6.9 million compared to €17.1

million in the same period in 2023. Gross profit margin decreased to 50.1% in the six months ended June 30, 2024, compared to 51.9%

in the same period in 2023. The decrease in gross profit margin was primarily due to fixed production costs on lower revenues.

Contribution profit

Contribution

profit for the six months ended June 30, 2024 was €0.7 million (or 3.6% of revenue), compared to €5.8 million (or

17.5% of revenue) in the same period in 2023, caused by higher store related costs and fixed expense deleverage on lower revenue. Marketing

and selling expenses decreased to €9.5 million (but increase to 46.5% of revenue) in the six months ended June 30, 2024 from

€11.4 million (or 34.4% of revenue) in the same period in 2023, which was due to cost control and implementation of efficiency improvement

measures.

Caruso Segment

The following table sets forth revenues and gross

profit for the Caruso segment for the six months ended June 30, 2024 and 2023:

| | |

For the six months ended

June 30, | | |

Increase /

(Decrease) | |

| (Euro thousands, except percentages) | |

2024 | | |

2023 | | |

2024 vs

2023 | | |

% | |

| Revenues | |

| 19,734 | | |

| 19,926 | | |

| (192 | ) | |

| (1.0 | )% |

| Gross profit | |

| 5,723 | | |

| 5,233 | | |

| 490 | | |

| 9.4 | % |

| Gross profit margin | |

| 29.0 | % | |

| 26.3 | % | |

| 2.7 | % | |

| - | |

| Marketing and selling expenses | |

| (936 | ) | |

| (842 | ) | |

| (94 | ) | |

| 11.2 | % |

| Contribution profit/(loss)(1)(3) | |

| 4,787 | | |

| 4,391 | | |

| 396 | | |

| 9.0 | % |

| Contribution profit margin(2)(3) | |

| 24.3 | % | |

| 22.0 | % | |

| 2.3 | % | |

| - | |

| (1) | Contribution profit equals gross profit less marketing and selling

expenses. |

| (2) | Contribution profit margin equals contribution profit divided by revenue. |

| (3) | Contribution profit and contribution profit margin are non-IFRS financial

measures. |

Revenues

Revenues

for the six months ended June 30, 2024 was €19.7 million, a decrease of €0.2 million or (1.0)% compared to

€19.9 million in the same period in 2023.

Gross profit

Gross

profit for the six months ended June 30, 2024 was €5.7 million, an increase of €0.5 million compared to €5.2

million in the same period in 2023. Gross profit margin increased to 29.0% for the six months ended June 30, 2024 from 26.3% for

the six months ended June 30, 2023 due to better management of labor costs.

Contribution profit

Contribution

profit for the six months ended June 30, 2024 was €4.8 million (or 24.3% of revenue), compared to €4.4 million

(or 22.0% of revenue) in the same period in 2023. The improvement in contribution profit was driven by the improvement in gross profit.

Liquidity and Capital Resources

Overview

We

and our portfolio brands’ principal sources of liquidity have been through issuance of shares, loans from our shareholder Fosun

International (including its subsidiaries and joint ventures), and bank borrowings. As of June 30, 2024, we had cash and cash equivalents

of €17.9 million.

Additionally, we have relied on liquidity provided by revenues generated from our operating activities. We require liquidity in order

to meet our obligations and fund our business. Short-term liquidity is required to fund ongoing cash requirements, including to purchase

inventory and to fund costs for services and other expenses. In addition to our general working capital and operational needs, our main

use of cash is now focused on maintaining and optimizing existing store operations, investing in digital transformation initiatives, and

enhancing our supply chain capabilities.

Cash flows

Six months ended June 30, 2024 compared to the six months

ended June 30, 2023

The following table summarizes the cash flows

provided by/used in operating, investing and financing activities for each of the six months ended June 30, 2024 and 2023. Refer

to the consolidated cash flows statement and accompanying notes included elsewhere in this Semi-Annual Report for additional information.

| | |

For the six months ended

June 30, | | |

Increase /

(Decrease) | |

| (Euro thousands, except percentages) | |

2024 | | |

2023 | | |

2024 vs

2023 | | |

% | |

| Net cash used in operating activities | |

| (33,483 | ) | |

| (58,118 | ) | |

| (24,635 | ) | |

| (42.4 | )% |

| Net cash used in investing activities | |

| (3,780 | ) | |

| (28,531 | ) | |

| 24,751 | | |

| (86.8 | )% |

| Net cash generated from financing activities | |

| 26,646 | | |

| 26,396 | | |

| (250 | ) | |

| (0.9 | )% |

| Net change in cash and cash equivalents | |

| (10,617 | ) | |

| (60,253 | ) | |

| 49,636 | | |

| (82.4 | )% |

| Cash and cash equivalents less bank overdrafts at the beginning of the period | |

| 27,850 | | |

| 91,749 | | |

| (63,899 | ) | |

| (69.4 | )% |

| Effect of foreign exchange differences on cash and cash equivalents | |

| 646 | | |

| (649 | ) | |

| 1,295 | | |

| (199.5 | )% |

| Cash and cash equivalents less bank overdrafts at the end of the period | |

| 17,879 | | |

| 30,847 | | |

| (12,968 | ) | |

| (42.0 | )% |

Net cash used in operating activities

Net

cash used in operating activities decreased by €24.6 million from €(58.1) million for the six months ended June 30,

2023 to €(33.5) million for the six months ended June 30, 2024. The decrease was primarily attributable to (i) a decrease

in trade receivables of €10.2 million (or (22.4)%) to €35.4 million, and (ii) a decrease in trade payables of

€2.5 million (or (3.2)%) to €81.1 million at the end of June 30, 2024.

Net cash used in investing activities

Net

cash used in investing activities decreased by €24.8 million from €(28.5) million for the six months ended June 30,

2023 to €(3.8) million net cash used for the six months ended June 30, 2024. The decrease was primarily attributable to (i) the

decrease of payment for the purchase of long-term assets from €29.3 million in the six months ended June 30, 2023 to €5.6 million

in the same period in 2024, and (ii) the increase in proceeds from disposal of long-term assets from €0.8 million in six

months ended June 30, 2023 to €1.8 million in the same period in 2024.

Net cash flows generated from financing activities

Net cash flows generated from financing activities increased by €0.3 million from €26.4 million for the six months ended June

30, 2023 to €26.6 million for the six months ended June 30, 2024. The increase in cash flows from financing activities was primarily

attributable to (i) increased proceeds from borrowings of € 114.8 million, (ii) lower repayments of borrowings of €(55.5) million,

(iii) lower payment of borrowings interest of €(3.3) million, and partially offset by (iv) lack of proceeds from financing fund compared

to €22.8 million in 2023, (v) increase repurchase of ordinary shares of €(9.4) million, (vi) lower capital contribution from

noncontrolling interests of €5 thousands compared to €5.6 million in 2023, (vi) higher payment of lease liabilities of €(16.2)

million and higher payment of lease liabilities interest of €(3.6) million.

Borrowings

We enter into and manage debt facilities centrally

in order to satisfy the short and medium-term needs of each of our subsidiaries based on criteria of efficiency and cost-effectiveness.

Our portfolio brands have historically entered into and maintained with a diversified pool of lenders a total amount of committed credit

lines that is considered consistent with their needs and suitable to ensure at any time the liquidity needed to satisfy and comply with

all of their financial commitments, as well as guaranteeing an adequate level of operational flexibility for any expansion programs.

As

of June 30, 2024, borrowings amounted to €8.3 million were guaranteed by a third-party SACE S.p.A., and

borrowings amounted to €28.9 million were secured by pledges of our assets including property, plant and equipment, inventories

and trade receivables.

Our

unsecured borrowings are principally used for operations. As of June 30, 2024, the borrowings are at rates ranging from 4.55%

to 17.11% per annum.

For additional information, see Note 18-Borrowings

in the Semi-Annual Condensed Consolidated Financial Statements.

We are subject to certain covenants, including

financial and otherwise, under our financing agreements. As of June 30, 2024, we were in material compliance with all covenants.

Contractual obligations and commitments

The following table summarizes our contractual

obligations and commitments as of June 30, 2024:

| | |

Payments Due by Period | |

| (Euro thousands, except percentages) | |

On demand | | |

Less than 1 year | | |

1 to 3 years | | |

Over 3 years | | |

Total | |

| Trade payables | |

| 18,301 | | |

| 62,751 | | |

| - | | |

| - | | |

| 81,052 | |

| Other current liabilities | |

| 8,312 | | |

| 78,694 | | |

| - | | |

| - | | |

| 87,006 | |

| Lease liabilities | |

| - | | |

| 39.476 | | |

| 62,540 | | |

| 73,971 | | |

| 175,987 | |

| Bank overdrafts | |

| 429 | | |

| - | | |

| - | | |

| - | | |

| 429 | |

| Borrowings | |

| - | | |

| 98,219 | | |

| 17,301 | | |

| 10,769 | | |

| 126,289 | |

| Total contractual obligations | |

| 27,042 | | |

| 279,140 | | |

| 79,841 | | |

| 84,740 | | |

| 470,763 | |

Cash and cash equivalents

The table below sets forth the breakdown of our

cash and cash equivalents as of the dates indicated.

| | |

As of June 30, | | |

As of December 31, | | |

Increase /

(Decrease) | |

| (Euro thousands, except percentages) | |

2024 | | |

2023 | | |

June 30, 2024

vs December

31,2023 | | |

% | |

| Cash on hand | |

| 491 | | |

| 710 | | |

| (219 | ) | |

| (30.8 | )% |

| Bank balances | |

| 17,817 | | |

| 27,420 | | |

| (9,603 | ) | |

| (35.0 | )% |

| Cash and cash equivalents | |

| 18,308 | | |

| 28,130 | | |

| (9,822 | ) | |

| (34.9 | )% |

| Restricted cash | |

| - | | |

| - | | |

| - | | |

| - | |

| Cash and bank balances | |

| 18,308 | | |

| 28,130 | | |

| (9,822 | ) | |

| (34.9 | )% |

As of June 30, 2024, the cash and cash equivalents

are held with reputable commercial banks at various jurisdictions including Greater China, France, Italy and U.S. Certain jurisdictions

may not have official deposit insurance program or agency similar to the Federal Deposit Insurance Corporation (FDIC) in the U.S. The

Group does not foresee substantial credit risk with respect to cash and cash equivalents held at commercial banks in such jurisdictions.

We may be subject to restrictions which limit

our ability to use cash. In particular, our cash held at banks in China is subject to certain repatriation restrictions and may only

be repatriated as dividends. We do not believe that such transfer restrictions have any adverse impacts on our ability to meet liquidity

requirements. There was no restricted cash as of June 30, 2024.

Other current assets

The table below sets forth the breakdown of our

other current assets as of the dates indicated.

| | |

As of June 30, | | |

As of December 31, | | |

Increase /

(Decrease) | |

| (Euro thousands, except percentages) | |

2024 | | |

2023 | | |

June 30, 2024

vs December

31, 2023 | | |

% | |

| Tax recoverable | |

| 6,713 | | |

| 7,078 | | |

| (365 | ) | |

| (5.2 | )% |

| Prepaid expenses | |

| 6,685 | | |

| 5,374 | | |

| 1,311 | | |

| 24.4 | % |

| Other receivables of royalties | |

| 4,555 | | |

| 4,147 | | |

| 408 | | |

| 9.8 | % |

| Advances and payments on account to vendors | |

| 3,793 | | |

| 4,486 | | |

| (693 | ) | |

| (15.4 | )% |

| Deposits of rental, utility and other | |

| 1,945 | | |

| 1,859 | | |

| 86 | | |

| 4.6 | % |

| Others | |

| 1,796 | | |

| 2,706 | | |

| (910 | ) | |

| (33.6 | )% |

| Total other current assets | |

| 25,487 | | |

| 25,650 | | |

| (163 | ) | |

| (0.6 | )% |

Off-Balance Sheet Arrangements

We did not have during the periods presented,

and we do not currently have, any off-balance sheet financing arrangements or any relationships with unconsolidated entities or financial

partnerships, including entities sometimes referred to as structured finance or special purpose entities, that were established for the

purpose of facilitating off-balance sheet arrangements or other contractually narrow or limited purposes.

Recent Developments

Ordinary Shares repurchase

We entered into a side letter with Meritz on

April 30, 2024, which modified the Amended and Restated Relationship Agreement (the “Meritz Side Letter”). Pursuant

to the Meritz Side Letter, we agreed to repurchase from Meritz 5,245,648 Ordinary Shares in aggregate for a total purchase price of

US$20.0 million under the prescribed schedule therein. As of the date of this filing, we made repurchases of (i) 1,328,704

Ordinary Shares on April 30, 2024 for US$5.0 million, (ii) 1,318,129 Ordinary Shares on June 28, 2024 for US$5.0 million,

and (iii) 1,305,220 Ordinary Shares on July 31, 2024 for US$5.0 million.

Shareholder loans

We received certain unsecured shareholder

loans for working capital purposes from our shareholder Fosun International and its subsidiaries, being FPI (US) 1 LLC, Shanghai

Fosun High Technology (Group) Co., Ltd. and Shanghai Fosun High Technology Group Finance Co., Ltd. Most of such

shareholder loans have interest rates ranging from 6% to 10% per annum. For the six months

ended June 30, 2024, we received proceeds of shareholder loans €61.5 million from Fosun International and its subsidiaries

and repaid €1.1 million to Fosun International and its subsidiaries. As of June 30, 2024, we had amounts due to Fosun

International and its subsidiaries (excluding accrued interest) of €87.6 million.

See Note 24 — Subsequent events to the

Semi-Annual Condensed Consolidated Financial Statements included elsewhere in this Semi-Annual Report.

Non-IFRS Financial Measures

Our management monitors and evaluates operating

and financial performance using several non-IFRS financial measures including: contribution profit, contribution profit margin, adjusted

earnings before interest and taxes (“Adjusted EBIT”), adjusted earnings before interest, taxes, depreciation and amortization

(“Adjusted EBITDA”). Our management believes that these non-IFRS financial measures provide useful and relevant information

regarding our performance and improve their ability to assess financial performance and financial position. They also provide comparable

measures that facilitate management’s ability to identify operational trends, as well as make decisions regarding future spending,

resource allocations and other operational decisions. While similar measures are widely used in the industry in which we operate, the

financial measures that we use may not be comparable to other similarly named measures used by other companies nor are they intended

to be substitutes for measures of financial performance or financial position as prepared in accordance with IFRS.

Contribution profit and contribution profit margin

Contribution profit is defined as revenues less

the cost of sales and selling and marketing expenses. Contribution profit margin is defined as contribution profit divided by revenue.

Contribution profit subtracts the main variable

expenses of selling and marketing expenses from gross profit, and our management believes this measure is an important indicator of profitability

at the marginal level.

Below contribution profit, the main expenses are

general administrative expenses and other operating expenses (which include foreign exchange gains or losses and impairment losses).

As we continue to improve the management of our portfolio brands, we believe we can achieve greater economy of scale across the different

brands by maintaining the fixed expenses at a lower level as a proportion of revenue. We therefore use contribution profit margin as

a key indicator of profitability at the group level as well as the portfolio brand level.

The table below reconciles revenues to contribution

profit for the periods indicated.

| | |

For the six months ended June 30, | |

| | |

2024 | | |

2023 | |

| Revenues | |

| 170,976 | | |

| 214,537 | |

| Cost of Sales | |

| (72,598 | ) | |

| (89,083 | ) |

| Gross profit | |

| 98,378 | | |

| 125,454 | |

| Marketing and selling expenses | |

| (105,591 | ) | |

| (110,600 | ) |

| Contribution profit | |

| (7,213 | ) | |

| 14,854 | |

Adjusted EBIT

Adjusted EBIT is defined as profit or loss before

income taxes, net finance cost, share based compensation, adjusted for income and costs which are significant in nature and that management

considers not reflective of underlying operational activities, mainly including net gains on disposal of long-term assets and government

grants.

The table below reconciles loss for the year to

adjusted EBIT for the periods indicated.

| | |

For the six months ended June 30, | |

| (Euro thousands) | |

2024 | | |

2023 | |

| Loss for the period | |

| (69,376 | ) | |

| (72,225 | ) |

| Add / (Deduct) the impact of: | |

| | | |

| | |

| Income tax expenses | |

| (489 | ) | |

| 271 | |

| Finance cost - net | |

| 13,187 | | |

| 11,970 | |

| Non-underlying items | |

| (3,143 | ) | |

| (9,666 | ) |

| Loss from operations before non-underlying items | |

| (59,821 | ) | |

| (69,650 | ) |

| Add / (Deduct) the impact of: | |

| | | |

| | |

| Share based compensation | |

| 827 | | |

| 1,971 | |

| Adjusted EBIT | |

| (58,994 | ) | |

| (67,679 | ) |

Adjusted EBITDA is defined as profit or loss before

income taxes, net finance cost, exchange gains/(losses), depreciation, amortization, share based compensation and provisions and impairment

losses adjusted for income and costs which are significant in nature and that management considers not reflective of underlying operational

activities, mainly including net gains on disposal of long-term assets and government grants.

The table below reconciles loss for the year to

adjusted EBITDA for the periods indicated.

| | |

For the six months ended June 30, | |

| | |

2024 | | |

2023 | |

| Loss for the period | |

| (69,376 | ) | |

| (72,225 | ) |

| Add / (Deduct) the impact of: | |

| | | |

| | |

| Income tax expenses | |

| (489 | ) | |

| 271 | |

| Finance cost - net | |

| 13,187 | | |

| 11,970 | |

| Non-underlying items | |

| (3,143 | ) | |

| (9,666 | ) |

| Loss from operations before non-underlying items | |

| (59,821 | ) | |

| (69,650 | ) |

| Add / (Deduct) the impact of: | |

| | | |

| | |

| Share based compensation | |

| 827 | | |

| 1,971 | |

| Provisions and impairment losses | |

| (2,220 | ) | |

| (3,241 | ) |

| Net foreign exchange (gains) / losses | |

| (3,353 | ) | |

| 8,486 | |

| Depreciation / Amortization | |

| 22,456 | | |

| 21,518 | |

| Adjusted EBITDA | |

| (42,111 | ) | |

| (40,916 | ) |

Qualitative and Quantitative Information on Financial Risks

We are exposed to market risks in the ordinary

course of our business. These risks primarily include foreign exchange risk, interest rate risk, credit risk and liquidity risk. See

Note 4.3—Financial risk factors to the Semi-Annual Condensed Consolidated Financial Statements included elsewhere in this Semi-Annual

Report and Note 4.3—Financial risk factors to the Annual Consolidated Financial Statements for further details.

Our overall risk management program focuses on

the unpredictability of financial markets and seeks to minimize potential adverse effects on our financial performance. We did not use

any derivative financial instruments to hedge certain risk exposures.

Foreign exchange risk

We have a vast international presence, and therefore

is exposed to the risk that changes in currency exchange rates could adversely impact revenue, expenses, margins and profit. Our management

manages our foreign exchange risk by performing regular review.

Interest rate risk

We do not have any significant interest bearing

financial assets or liabilities except for cash and cash equivalents and borrowings, details of which are disclosed in Notes 17 and

18 to the Semi-Annual Condensed Consolidated Financial Statements included elsewhere in this Semi-Annual Report and Notes 23 and 24

to Lanvin Group’s consolidated financial statements, respectively.

Our

exposure to the risk of changes in market interest rates relates primarily to our borrowings with floating interest rates. Our policy

is to manage our interest cost using a mix of fixed and variable rate debts. As of June 30, 2024, approximately 81% of our

interest-bearing borrowings bore interest at fixed rates.

Credit risk

Credit risk is defined as the risk of financial

loss caused by the failure of a counterparty to repay amounts owed or meet its contractual obligations. The maximum risk to which an

entity is exposed is represented by all the financial assets recognized in the financial statements. Management considers our credit

risk to relate primarily to trade receivables generated from the wholesale channel and mitigates the related effects through specific