Highlights

- Korn Ferry reports Q1 FY'25 fee revenue of $674.9 million, a

year-over-year decrease of 3% (down 2% on a constant currency

basis).

- Executive Search fee revenue grew 2% year-over-year (up 3% at

constant currency).

- Fee revenue for Consulting and Digital was flat year-over-year

(up 1% and 2%, respectively, at constant currency), continuing to

demonstrate stability in a challenging market.

- Net income attributable to Korn Ferry was $62.6 million, while

diluted and adjusted diluted earnings per share were $1.17 and

$1.18 in Q1 FY'25, respectively.

- Operating income was $76.1 million and Adjusted EBITDA was

$111.2 million.

- Operating margin increased 320bps year-over-year to 11.3%.

Adjusted EBITDA margin was 16.5%, a 280bps increase compared to the

year-ago quarter, and our fifth consecutive quarter of sequential

improvement.

- The Company repurchased 351,250 shares of stock during the

quarter for $23.5 million.

- Declared a quarterly dividend of $0.37 per share on September

4, 2024, which is payable on October 15, 2024 to stockholders of

record on September 19, 2024.

Korn Ferry (NYSE: KFY), a global organizational consulting firm,

today announced first quarter fee revenue of $674.9 million. In

addition, first quarter diluted earnings per share was $1.17 and

adjusted diluted earnings per share was $1.18.

“I am pleased with our first quarter results, as we generated

$675 million in fee revenue,” said Gary D. Burnison. “Earnings and

profitability increased year over year as we delivered $111 million

of Adjusted EBITDA, at a 16.5% margin, which is our fifth

consecutive quarter of profitability improvement.

“Our sustained success stems from a balanced approach – from our

colleagues and IP to our diversified strategy and broad offerings.

As a result, our topline is more than 30 percent higher than before

the pandemic, with even greater profitability. During the quarter,

Consulting and Digital maintained their positive momentum, with

improved growth in Executive Search and stable trends across

Professional Search permanent placement and RPO. We are also

confident about the future, as evidenced by our capital allocation,

which not only included share buybacks but also more than a twofold

increase in our quarterly dividend year over year. Moving forward,

we will continue to transform the business to enable our clients to

Be More Than.”

Selected Financial Results

(dollars in millions, except per share

amounts) (a)

First Quarter

FY’25

FY’24

Fee revenue

$

674.9

$

699.2

Total revenue

$

682.8

$

706.3

Operating income

$

76.1

$

56.8

Operating margin

11.3

%

8.1

%

Net income attributable to Korn Ferry

$

62.6

$

46.6

Basic earnings per share

$

1.19

$

0.89

Diluted earnings per share

$

1.17

$

0.89

Adjusted Results (b):

First Quarter

FY’25

FY’24

Adjusted EBITDA

$

111.2

$

95.7

Adjusted EBITDA margin

16.5

%

13.7

%

Adjusted net income attributable to Korn

Ferry

$

63.1

$

51.5

Adjusted basic earnings per share

$

1.20

$

0.99

Adjusted diluted earnings per share

$

1.18

$

0.99

(a)

Numbers may not total due to rounding.

(b)

Adjusted EBITDA refers to earnings before

interest, taxes, depreciation and amortization, further adjusted to

exclude integration/acquisition costs, impairment of fixed assets,

impairment of right-of-use assets and restructuring charges, net

when applicable. Adjusted results on a consolidated basis are

non-GAAP financial measures that adjust for the following, as

applicable (see attached reconciliations):

First Quarter

FY’25

FY’24

Integration/acquisition costs

$

1.1

$

4.1

Impairment of fixed assets

$

—

$

0.1

Impairment of right-of-use assets

$

—

$

1.6

Restructuring charges, net

$

—

$

0.4

The Company reported fee revenue in Q1 FY'25 of $674.9 million,

a decrease of 3% (down 2% on a constant currency basis) compared to

Q1 FY'24. The decrease in fee revenue was primarily due to lower

fee revenues in Professional Search & Interim and RPO driven by

a decline in demand due to the current economic environment,

partially offset by an increase in Executive Search fee

revenue.

Operating income was $76.1 million (at an operating margin of

11.3%) in Q1 FY'25, compared to $56.8 million (at an operating

margin of 8.1%) in the year-ago quarter, an increase of 320bps. Net

income attributable to Korn Ferry was $62.6 million in Q1 FY'25,

compared to $46.6 million in Q1 FY'24. Adjusted EBITDA was $111.2

million in Q1 FY'25 compared to $95.7 million in Q1 FY'24. Adjusted

EBITDA margin was 16.5% in Q1 FY'25, an increase of 280bps.

Operating income, margin, and net income attributable to Korn

Ferry increased as a result of strong cost management, coupled with

the lower cost of services expense compared to the year-ago

quarter. These decreases in expenses were partially offset by the

decrease in fee revenue discussed above.

Adjusted EBITDA and margin increased due to the same factors

above but excluded integration/acquisition costs.

Results by Line of Business

Selected Consulting Data

(dollars in millions) (a)

First Quarter

FY’25

FY’24

Fee revenue

$

167.9

$

168.1

Total revenue

$

170.8

$

170.8

Ending number of consultants and execution

staff (b)

1,663

1,855

Hours worked in thousands (c)

395

427

Average bill rate (d)

$

425

$

394

Adjusted Results (e):

First Quarter

FY’25

FY’24

Adjusted EBITDA

$

29.3

$

25.2

Adjusted EBITDA margin

17.5

%

15.0

%

(a)

Numbers may not total due to rounding.

(b)

Represents number of employees

originating, delivering and executing consulting services.

(c)

The number of hours worked by consultant

and execution staff during the period.

(d)

The amount of fee revenue divided by the

number of hours worked by consultants and execution staff.

(e)

Adjusted results exclude the

following:

First Quarter

FY’25

FY’24

Impairment of right-of-use assets

$

—

$

0.6

Restructuring charges, net

$

—

$

0.2

Fee revenue was $167.9 million in Q1 FY'25 compared to $168.1

million in Q1 FY'24, essentially flat (up 1% on a constant currency

basis) compared to Q1 FY'24.

Adjusted EBITDA increased 16.3% compared to Q1 FY'24 to $29.3

million. Adjusted EBITDA margin in the quarter increased

year-over-year by 250bps to 17.5%. These increases resulted

primarily from higher average bill rates and greater consultant and

execution staff productivity.

Selected Digital Data

(dollars in millions) (a)

First Quarter

FY’25

FY’24

Fee revenue

$

88.2

$

88.0

Total revenue

$

88.2

$

88.0

Ending number of consultants

259

336

Subscription & License fee revenue

$

34.1

$

32.5

Adjusted Results:

First Quarter

FY’25

FY’24

Adjusted EBITDA

$

26.6

$

24.3

Adjusted EBITDA margin

30.2

%

27.6

%

(a)

Numbers may not total due to rounding.

Fee revenue was $88.2 million in Q1 FY'25 compared to $88.0

million in Q1 FY'24, essentially flat year-over-year and up 2% on a

constant currency basis. Subscription and license fee revenue in

the quarter increased 5% year-over-year.

Adjusted EBITDA was $26.6 million in Q1 FY'25 compared to $24.3

million in the year-ago quarter. Adjusted EBITDA margin in the

quarter increased year-over-year by 260bps to 30.2%. The increase

in Adjusted EBITDA and Adjusted EBITDA margin was mainly due to

improved consultant productivity and strong cost management.

Selected Executive Search Data

(a)

(dollars in millions) (b)

First Quarter

FY’25

FY’24

Fee revenue

$

208.6

$

205.2

Total revenue

$

210.4

$

207.6

Ending number of consultants

559

612

Average number of consultants

551

607

Engagements billed

3,448

3,633

New engagements (c)

1,556

1,549

Adjusted Results (d):

First Quarter

FY’25

FY’24

Adjusted EBITDA

$

49.4

$

42.5

Adjusted EBITDA margin

23.7

%

20.7

%

(a)

Executive Search is the sum of the

individual Executive Search Reporting Segments described in our

annual and quarterly reporting on Forms 10-K and 10-Q and is

presented on a consolidated basis as it is consistent with the

Company’s discussion of its Lines of Business, and financial

metrics used by the Company’s investor base.

(b)

Numbers may not total due to rounding.

(c)

Represents new engagements opened in the

respective period.

(d)

Executive Search Adjusted EBITDA and

Adjusted EBITDA margin are non-GAAP financial measures that adjust

for the following:

First Quarter

FY’25

FY’24

Impairment of fixed assets

$

—

$

0.1

Impairment of right-of-use assets

$

—

$

0.9

Restructuring charges, net

$

—

$

0.2

Fee revenue was $208.6 million in Q1 FY'25, an increase of $3.4

million or 2% compared to Q1 FY'24 (up 3% on a constant currency

basis). The increase in fee revenue was primarily driven by a 4%

increase in the number of engagements billed in our North America

region.

Adjusted EBITDA was $49.4 million in Q1 FY'25 compared to $42.5

million in the year-ago quarter. Adjusted EBITDA margin increased

by 300bps to 23.7% in Q1 FY'25. The increase in Adjusted EBITDA and

Adjusted EBITDA margin was primarily due to higher consultant

productivity and strong cost management.

Selected Professional Search &

Interim Data

(dollars in millions) (a)

First Quarter

FY’25

FY’24

Fee revenue

$

121.7

$

142.2

Total revenue

$

122.7

$

143.1

Permanent Placement:

Fee revenue

$

52.2

$

58.3

Engagements billed

1,820

2,209

New engagements (b)

972

1,235

Ending number of consultants

319

405

Interim:

Fee revenue

$

69.5

$

83.9

Average bill rate (c)

$

133

$

122

Average weekly billable consultants

(d)

1,068

1,485

Adjusted Results (e):

First Quarter

FY’25

FY’24

Adjusted EBITDA

$

25.7

$

24.3

Adjusted EBITDA margin

21.1

%

17.1

%

(a)

Numbers may not total due to rounding.

(b)

Represents new engagements opened in the

respective period.

(c)

Fee revenue from interim divided by the

number of hours worked by consultants.

(d)

The number of billable consultants based

on a weekly average in the respective period.

(e)

Adjusted results exclude the

following:

First Quarter

FY’25

FY’24

Integration/acquisition costs

$

1.1

$

4.0

Fee revenue was $121.7 million in Q1 FY'25, a decrease of 14% in

both actual and constant currency compared to the year-ago quarter,

due primarily to lower demand in the current economic

environment.

Adjusted EBITDA was $25.7 million in Q1 FY'25 compared to $24.3

million in the year-ago quarter. Adjusted EBITDA margin increased

year-over-year by 400bps to 21.1%. The increase in Adjusted EBITDA

and Adjusted EBITDA margin was primarily due to a higher average

bill rate in Interim, increased consultant productivity in

Permanent Placement and strong cost management.

Selected Recruitment Process

Outsourcing ("RPO") Data

(dollars in millions) (a)

First Quarter

FY’25

FY’24

Fee revenue

$

88.5

$

95.7

Total revenue

$

90.7

$

96.8

Remaining revenue under contract (b)

$

656.1

$

679.8

RPO new business (c)

$

103.6

$

48.2

Adjusted Results (d):

First Quarter

FY’25

FY’24

Adjusted EBITDA

$

12.5

$

10.5

Adjusted EBITDA margin

14.1

%

10.9

%

(a)

Numbers may not total due to rounding.

(b)

Estimated fee revenue associated with

signed contracts for which revenue has not yet been recognized.

(c)

Estimated total value of a contract at the

point of execution of the contract.

(d)

Adjusted results exclude the

following:

First Quarter

FY’25

FY’24

Impairment of right-of-use assets

$

—

$

0.1

Fee revenue was $88.5 million in Q1 FY'25, a decrease of $7.2

million or 8% (down 7% on a constant currency basis) compared to

the year-ago quarter. RPO fee revenue decreased due to moderation

in the hiring volume in the existing base of clients due to the

current economic environment.

Adjusted EBITDA was $12.5 million in Q1 FY'25 compared to $10.5

million in the year-ago quarter. Adjusted EBITDA margin increased

320bps to 14.1% in Q1 FY'25. The increase in Adjusted EBITDA and

Adjusted EBITDA margin both resulted from greater execution staff

productivity and strong cost management.

Outlook

Assuming worldwide geopolitical conditions, economic conditions,

financial markets and foreign exchange rates remain steady, on a

consolidated basis:

- Q2 FY’25 fee revenue is expected to be in the range of $655

million and $685 million; and

- Q2 FY’25 diluted earnings per share is expected to range

between $1.11 to $1.23.

On a consolidated adjusted basis:

- Q2 FY’25 adjusted diluted earnings per share is expected to be

in the range from $1.14 to $1.26.

Q2 FY’25

Earnings Per Share

Outlook

Low

High

Consolidated diluted earnings per

share

$

1.11

$

1.23

Integration/acquisition costs

0.03

0.03

Consolidated adjusted diluted earnings per

share(1)

$

1.14

$

1.26

(1)

Consolidated adjusted diluted earnings per

share is a non-GAAP financial measure that excludes the items

listed in the table.

Earnings Conference Call Webcast

The earnings conference call will be held today at 12:00 PM

(EDT) and hosted by CEO Gary Burnison, CFO Robert Rozek, SVP

Business Development & Analytics Gregg Kvochak and VP Investor

Relations Tiffany Louder. The conference call will be webcast and

available online at ir.kornferry.com. We will also post to the

investor relations section of our website earnings slides, which

will accompany our webcast, and other important information, and

encourage you to review the information that we make available on

our website.

About Korn Ferry

Korn Ferry is a global organizational consulting firm. We help

clients synchronize strategy and talent to drive superior

performance. We work with organizations to design their structures,

roles, and responsibilities. We help them hire the right people to

bring their strategy to life. And we advise them on how to reward,

develop, and motivate their people. Visit kornferry.com for more

information.

Forward-Looking Statements

Statements in this press release and our conference call that

relate to our outlook, projections, goals, strategies, future plans

and expectations, including statements relating to expected demand

for and relevance of our products and services, expected results of

our business diversification strategy, and other statements of

future events or conditions are forward-looking statements that

involve a number of risks and uncertainties. Words such as

“believes”, “expects”, “anticipates”, “goals”, “estimates”,

“guidance”, “may”, “should”, “could”, “will” or “likely”, and

variations of such words and similar expressions are intended to

identify such forward-looking statements. Readers are cautioned not

to place undue reliance on such statements. Such statements are

based on current expectations; actual results in future periods may

differ materially from those currently expected or desired because

of a number of risks and uncertainties that are beyond the control

of Korn Ferry. The potential risks and uncertainties include those

relating to global and local political and or economic developments

in or affecting countries where we have operations, such as

inflation, interest rates, global slowdowns, or recessions,

competition, geopolitical tensions, shifts in global trade

patterns, changes in demand for our services as a result of

automation, dependence on and costs of attracting and retaining

qualified and experienced consultants, impact of inflationary

pressures on our profitability, our ability to maintain

relationships with customers and suppliers and retaining key

employees, maintaining our brand name and professional reputation,

potential legal liability and regulatory developments, portability

of client relationships, consolidation of or within the industries

we serve, changes and developments in government laws and

regulations, evolving investor and customer expectations with

regard to environmental, social and governance matters, currency

fluctuations in our international operations, risks related to

growth, alignment of our cost structure, including as a result of

recent workforce, real estate, and other restructuring initiatives,

restrictions imposed by off-limits agreements, reliance on

information processing systems, cyber security vulnerabilities or

events, changes to data security, data privacy, and data protection

laws, dependence on third parties for the execution of critical

functions, limited protection of our intellectual property ("IP"),

our ability to enhance, develop and respond to new technology,

including artificial intelligence, our ability to successfully

recover from a disaster or other business continuity problems,

employment liability risk, an impairment in the carrying value of

goodwill and other intangible assets, treaties, or regulations on

our business and our Company, deferred tax assets that we may not

be able to use, our ability to develop new products and services,

changes in our accounting estimates and assumptions, the

utilization and billing rates of our consultants, seasonality, the

expansion of social media platforms, the ability to effect

acquisitions and integrate acquired businesses, resulting

organizational changes, our indebtedness, and those relating to the

ultimate magnitude and duration of any pandemic or outbreaks. For a

detailed description of risks and uncertainties that could cause

differences from our expectations, please refer to Korn Ferry’s

periodic filings with the Securities and Exchange Commission. Korn

Ferry disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Use of Non-GAAP Financial Measures

This press release contains financial information calculated

other than in accordance with U.S. Generally Accepted Accounting

Principles (“GAAP”). In particular, it includes:

- Adjusted net income attributable to Korn Ferry, adjusted to

exclude integration/acquisition costs, impairment of fixed assets,

impairment of right-of-use assets and restructuring charges, net of

income tax effect;

- Adjusted basic and diluted earnings per share, adjusted to

exclude integration/acquisition costs, impairment of fixed assets,

impairment of right-of-use assets and restructuring charges, net of

income tax effect;

- Constant currency (calculated using a quarterly average)

percentages that represent the percentage change that would have

resulted had exchange rates in the prior period been the same as

those in effect in the current period; and

- Consolidated and Executive Search Adjusted EBITDA, which is

earnings before interest, taxes, depreciation and amortization,

further adjusted to exclude integration/acquisition costs,

impairment of fixed assets, impairment of right-of-use assets and

restructuring charges, net when applicable, and Consolidated and

Executive Search Adjusted EBITDA margin.

This non-GAAP disclosure has limitations as an analytical tool,

should not be viewed as a substitute for financial information

determined in accordance with GAAP, and should not be considered in

isolation or as a substitute for analysis of the Company’s results

as reported under GAAP, nor is it necessarily comparable to

non-GAAP performance measures that may be presented by other

companies.

Management believes the presentation of non-GAAP financial

measures in this press release provides meaningful supplemental

information regarding Korn Ferry’s performance by excluding certain

charges that may not be indicative of Korn Ferry’s ongoing

operating results. These non-GAAP financial measures are

performance measures and are not indicative of the liquidity of

Korn Ferry. These charges, which are described in the footnotes in

the attached reconciliations, represent 1) costs we incurred to

acquire and integrate a portion of our Professional Search &

Interim business, 2) impairment of fixed assets associated with the

decision to terminate and sublease some of our offices, 3)

impairment of right-of-use assets due to the decision to terminate

and sublease some of our offices and 4) restructuring charges, net

to realign our workforce with the Company's business needs and

objectives. The use of non-GAAP financial measures facilitates

comparisons to Korn Ferry’s historical performance. Korn Ferry

includes non-GAAP financial measures because management believes

they are useful to investors in allowing for greater transparency

with respect to supplemental information used by management in its

evaluation of Korn Ferry’s ongoing operations and financial and

operational decision-making. Adjusted net income attributable to

Korn Ferry, adjusted basic and diluted earnings per share and

Consolidated and Executive Search Adjusted EBITDA, exclude certain

charges that management does not consider on-going in nature and

allows management and investors to make more meaningful

period-to-period comparisons of the Company’s operating results.

Management further believes that Consolidated and Executive Search

Adjusted EBITDA is useful to investors because it is frequently

used by investors and other interested parties to measure operating

performance among companies with different capital structures,

effective tax rates and tax attributes and capitalized asset

values, all of which can vary substantially from company to

company. In the case of constant currency percentages, management

believes the presentation of such information provides useful

supplemental information regarding Korn Ferry's performance as

excluding the impact of exchange rate changes on Korn Ferry's

financial performance allows investors to make more meaningful

period-to-period comparisons of the Company’s operating results, to

better identify operating trends that may otherwise be masked or

distorted by exchange rate changes and to perform related trend

analysis, and provides a higher degree of transparency of

information used by management in its evaluation of Korn Ferry's

ongoing operations and financial and operational

decision-making.

KORN FERRY AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(in thousands, except per

share amounts)

Three Months Ended

July 31,

2024

2023

(unaudited)

Fee revenue

$

674,946

$

699,189

Reimbursed out-of-pocket engagement

expenses

7,815

7,073

Total revenue

682,761

706,262

Compensation and benefits

451,775

479,881

General and administrative expenses

59,999

65,917

Reimbursed expenses

7,815

7,073

Cost of services

67,544

77,190

Depreciation and amortization

19,578

19,012

Restructuring charges, net

—

421

Total operating expenses

606,711

649,494

Operating income

76,050

56,768

Other income, net

14,505

13,577

Interest expense, net

(3,945

)

(4,740

)

Income before provision for income

taxes

86,610

65,605

Income tax provision

22,354

18,420

Net income

64,256

47,185

Net income attributable to noncontrolling

interest

(1,652

)

(580

)

Net income attributable to Korn Ferry

$

62,604

$

46,605

Earnings per common share attributable to

Korn Ferry:

Basic

$

1.19

$

0.89

Diluted

$

1.17

$

0.89

Weighted-average common shares

outstanding:

Basic

51,950

50,934

Diluted

52,745

51,082

Cash dividends declared per share:

$

0.37

$

0.18

KORN FERRY AND

SUBSIDIARIES

FINANCIAL SUMMARY BY REPORTING

SEGMENT

(dollars in thousands)

(unaudited)

Three Months Ended July

31,

2024

2023

% Change

Fee revenue:

Consulting

$

167,870

$

168,088

(0.1

%)

Digital

88,180

87,986

0.2

%

Executive Search:

North America

134,752

127,498

5.7

%

EMEA

45,981

46,776

(1.7

%)

Asia Pacific

20,579

24,539

(16.1

%)

Latin America

7,323

6,421

14.0

%

Total Executive Search (a)

208,635

205,234

1.7

%

Professional Search & Interim

121,741

142,179

(14.4

%)

RPO

88,520

95,702

(7.5

%)

Total fee revenue

674,946

699,189

(3.5

%)

Reimbursed out-of-pocket engagement

expenses

7,815

7,073

10.5

%

Total revenue

$

682,761

$

706,262

(3.3

%)

(a)

Total Executive Search is the sum of the

individual Executive Search Reporting Segments and is presented on

a consolidated basis as it is consistent with the Company’s

discussion of its Lines of Business, and financial metrics used by

the Company’s investor base.

KORN FERRY AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except per

share amounts)

July 31,

2024

April 30,

2024 (1)

(unaudited)

ASSETS

Cash and cash equivalents

$

633,376

$

941,005

Marketable securities

40,626

42,742

Receivables due from clients, net of

allowance for doubtful accounts of $46,714 and $44,192 at July 31,

2024 and April 30, 2024, respectively

573,019

541,014

Income taxes and other receivables

49,606

40,696

Unearned compensation

62,375

59,247

Prepaid expenses and other assets

56,479

49,456

Total current assets

1,415,481

1,674,160

Marketable securities, non-current

231,195

211,681

Property and equipment, net

159,522

161,849

Operating lease right-of-use assets,

net

155,881

160,464

Cash surrender value of company-owned life

insurance policies, net of loans

234,725

218,977

Deferred income taxes

124,180

133,564

Goodwill

908,485

908,376

Intangible assets, net

82,606

88,833

Unearned compensation, non-current

113,171

99,913

Investments and other assets

22,323

21,052

Total assets

$

3,447,569

$

3,678,869

LIABILITIES AND

STOCKHOLDERS' EQUITY

Accounts payable

$

49,611

$

50,112

Income taxes payable

23,775

24,076

Compensation and benefits payable

270,897

525,466

Operating lease liability, current

35,931

36,073

Other accrued liabilities

277,804

298,792

Total current liabilities

658,018

934,519

Deferred compensation and other retirement

plans

469,583

440,396

Operating lease liability, non-current

137,218

143,507

Long-term debt

397,140

396,946

Deferred tax liabilities

4,173

4,540

Other liabilities

22,195

21,636

Total liabilities

1,688,327

1,941,544

Stockholders' equity

Common stock: $0.01 par value, 150,000

shares authorized, 78,210 and 77,460 shares issued and 52,154 and

51,983 shares outstanding at July 31, 2024 and April 30, 2024,

respectively

390,053

414,885

Retained earnings

1,468,648

1,425,844

Accumulated other comprehensive loss,

net

(104,860

)

(107,671

)

Total Korn Ferry stockholders' equity

1,753,841

1,733,058

Noncontrolling interest

5,401

4,267

Total stockholders' equity

1,759,242

1,737,325

Total liabilities and stockholders'

equity

$

3,447,569

$

3,678,869

(1)

Information is derived from audited

financial statements included in Form 10-K.

KORN FERRY AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(dollars in thousands, except

per share amounts)

(unaudited)

Three Months Ended

July 31,

2024

2023

Net income attributable to Korn Ferry

$

62,604

$

46,605

Net income attributable to non-controlling

interest

1,652

580

Net income

64,256

47,185

Income tax provision

22,354

18,420

Income before provision for income

taxes

86,610

65,605

Other income, net

(14,505

)

(13,577

)

Interest expense, net

3,945

4,740

Operating income

76,050

56,768

Depreciation and amortization

19,578

19,012

Other income, net

14,505

13,577

Integration/acquisition costs (1)

1,076

4,128

Impairment of fixed assets (2)

—

123

Impairment of right-of-use assets (3)

—

1,629

Restructuring charges, net (4)

—

421

Adjusted EBITDA

$

111,209

$

95,658

Operating margin

11.3

%

8.1

%

Depreciation and amortization

2.9

%

2.7

%

Other income, net

2.1

%

2.0

%

Integration/acquisition costs (1)

0.2

%

0.6

%

Impairment of fixed assets (2)

—

%

—

%

Impairment of right-of-use assets (3)

—

%

0.2

%

Restructuring charges, net (4)

—

%

0.1

%

Adjusted EBITDA margin

16.5

%

13.7

%

Net income attributable to Korn Ferry

$

62,604

$

46,605

Integration/acquisition costs (1)

1,076

4,128

Impairment of fixed assets (2)

—

123

Impairment of right-of-use assets (3)

—

1,629

Restructuring charges, net (4)

—

421

Tax effect on the adjusted items (5)

(560

)

(1,419

)

Adjusted net income attributable to Korn

Ferry

$

63,120

$

51,487

Basic earnings per common share

$

1.19

$

0.89

Integration/acquisition costs (1)

0.02

0.08

Impairment of fixed assets (2)

—

—

Impairment of right-of-use assets (3)

—

0.03

Restructuring charges, net (4)

—

0.01

Tax effect on the adjusted items (5)

(0.01

)

(0.02

)

Adjusted basic earnings per share

$

1.20

$

0.99

Diluted earnings per common share

$

1.17

$

0.89

Integration/acquisition costs (1)

0.02

0.08

Impairment of fixed assets (2)

—

—

Impairment of right-of-use assets (3)

—

0.03

Restructuring charges, net (4)

—

0.01

Tax effect on the adjusted items (5)

(0.01

)

(0.02

)

Adjusted diluted earnings per share

$

1.18

$

0.99

Explanation of

Non-GAAP Adjustments

(1)

Costs associated with previous

acquisitions, such as legal and professional fees, retention awards

and the on-going integration expenses.

(2)

Costs associated with impairment of fixed

assets (i.e. leasehold improvements) due to terminating and

deciding to sublease some of our offices.

(3)

Costs associated with impairment of

right-of-use assets due to terminating and deciding to sublease

some of our offices.

(4)

Restructuring charges we incurred to

realign our workforce with business needs and objectives due to

shifts in global trade lanes and persistent inflationary

pressures.

(5)

Tax effect on integration/acquisition

costs, impairment of fixed assets and right-of-use assets, and

restructuring charges, net.

KORN FERRY AND

SUBSIDIARIES

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES - CONTINUED

(unaudited)

Three Months Ended July

31,

2024

2023

Fee

revenue

Total

revenue

Adjusted

EBITDA

Adjusted

EBITDA

margin

Fee

revenue

Total

revenue

Adjusted

EBITDA

Adjusted

EBITDA

margin

(dollars in thousands)

Consulting

$

167,870

$

170,767

$

29,294

17.5

%

$

168,088

$

170,793

$

25,180

15.0

%

Digital

88,180

88,211

26,623

30.2

%

87,986

88,012

24,325

27.6

%

Executive Search:

North America

134,752

136,087

35,098

26.0

%

127,498

129,413

28,756

22.6

%

EMEA

45,981

46,276

7,265

15.8

%

46,776

47,135

5,638

12.1

%

Asia Pacific

20,579

20,704

4,218

20.5

%

24,539

24,610

6,315

25.7

%

Latin America

7,323

7,326

2,798

38.2

%

6,421

6,422

1,741

27.1

%

Total Executive Search

208,635

210,393

49,379

23.7

%

205,234

207,580

42,450

20.7

%

Professional Search &

Interim

121,741

122,730

25,706

21.1

%

142,179

143,069

24,329

17.1

%

RPO

88,520

90,660

12,494

14.1

%

95,702

96,808

10,471

10.9

%

Corporate

—

—

(32,287

)

—

—

(31,097

)

Consolidated

$

674,946

$

682,761

$

111,209

16.5

%

$

699,189

$

706,262

$

95,658

13.7

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240829500751/en/

Investor Relations: Tiffany Louder, (214) 310-8407 Media: Dan

Gugler, (310) 226-2645

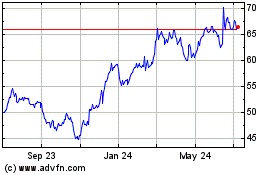

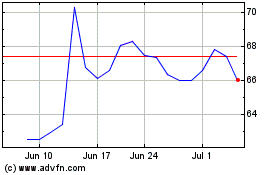

Korn Ferry (NYSE:KFY)

Historical Stock Chart

From Dec 2024 to Jan 2025

Korn Ferry (NYSE:KFY)

Historical Stock Chart

From Jan 2024 to Jan 2025