Wiley (NYSE: WLY), a trusted leader in research and learning,

today reported results for the first quarter ended July 31,

2024.

HIGHLIGHTS

- Strong year-over-year financial performance driven by solid

growth in Research Publishing, AI-related demand for Learning

content, and continued execution of the Value Creation Plan

- Third and final divestiture closed and remainder of $130

million cost savings program actioned

- Second GenAI content rights project executed with large tech

company

FIRST QUARTER PERFORMANCE

- GAAP Results (including Held for Sale or Sold

businesses): Revenue of $404 million (-10%), Operating Income of

$29 million (+$45 million), and EPS loss of ($0.03) (+$1.64).

- Adjusted Results at Constant Currency (excluding Held

for Sale or Sold businesses, restructuring costs and other adjusted

items): Revenue of $390 million (+6%), Adjusted EBITDA of $73

million (+22%), and Adjusted EPS of $0.47 (+74%).

MANAGEMENT COMMENTARY

“The Wiley leadership team and I are pleased with how we started

the year, as measured by both our performance indicators and

financial results,” said Matthew Kissner, Wiley President and CEO.

“Research delivered solid growth driven by robust demand to publish

in our journals and execution of our publishing and go-to-market

strategies. Learning delivered strong growth as it sees continued

demand for its authoritative content in training GenAI models and

core growth in Academic. Finally, we closed our third and final

divestiture and actioned the remainder of our $130 million cost

savings program, positioning us for further performance and profit

improvement.”

Research

- Revenue of $265 million was up 3% as reported and at

constant currency, mainly due to growth in open access and

institutional licensing models in Research Publishing.

- Adjusted EBITDA of $78 million was up 1% as reported and

at constant currency due to revenue performance largely offset by

the timing of employee benefit costs related to higher incentive

compensation and investments in technology. Adjusted EBITDA margin

for the quarter was 29.3% compared to 29.8% in the prior year

period.

Learning

- Revenue of $124 million was up 14% as reported and at

constant currency driven by a $16 million Q1 contribution from an

executed $21 million content rights project for training GenAI

models and continued growth in Academic courseware, offsetting

moderate declines in Professional. Excluding the GenAI project, Q1

Learning revenue declined 1%.

- Adjusted EBITDA of $34 million was up 60% as reported

and at constant currency mainly due to the GenAI content rights

project. Adjusted EBITDA margin for the quarter was 27.2% compared

to 19.4% in the prior year period.

Corporate Expense Category

- Adjusted Corporate Expenses of $39 million on an

Adjusted EBITDA basis was 2% higher at reported and at constant

currency, primarily due to higher tech expenses.

Businesses Held for Sale or Sold (HFS)

Our Held for Sale or Sold segment reflects the performance of

those businesses for the periods owned. Wiley University Services

was completed on January 1, 2024. The sale of Wiley Edge, with the

exception of its India operation, was completed on May 31, 2024.

The sale of Wiley Edge's India operation was completed on August

31, 2024. The sale of CrossKnowledge was also completed on August

31, 2024.

EPS

- GAAP EPS loss was ($0.03) compared to ($1.67) in the

prior year period. The quarterly loss was primarily due to a

non-cash income tax adjustment as a consequence of the US valuation

allowance related to our divested businesses (see accompanying EPS

reconciliation table for more information), as well as

restructuring charges and foregone net income from Businesses Sold

or Held for Sale. The year over year variance is primarily due to

favorability compared to prior year impairments, restructuring

charges, and losses on the sale of businesses, partially offset by

the current quarter tax adjustment.

- Adjusted EPS of $0.47 was up 74% at constant currency

due to higher Adjusted Operating Income and accrued interest income

from divestitures.

Balance Sheet, Cash Flow, and Capital Allocation

- Net Debt-to-EBITDA Ratio (Trailing Twelve Months) at

quarter end was 2.0 compared to 1.9 in the year-ago period.

- Net Cash Used in Operating Activities was $89 million

compared to $82 million in the prior year period with higher annual

incentive compensation payments for prior year performance

offsetting higher cash earnings. Note, Wiley’s regular use of cash

in the first half of the fiscal year is driven by the timing of

cash collections for annual journal subscriptions, which are

concentrated in Q3 and Q4.

- Free Cash Flow less Product Development Spending was a

use of $107 million compared to a use of $106 million in the prior

year, with higher annual incentive compensation payments for prior

year performance offsetting higher cash earnings and lower capex.

Capex of $18 million was below prior year by $6 million due to

timing. Note, Wiley does not provide an adjusted Free Cash Flow

metric; results include held for sale or sold businesses.

- Returns to Shareholders: Wiley allocated $32 million

toward dividends and share repurchases, up from $29 million in the

prior year, with $13 million used to acquire 295 thousand shares at

an average cost per share of $42.34. In June 2024, Wiley raised its

dividend for the 31st consecutive year.

FISCAL YEAR 2025 GROWTH OUTLOOK

Wiley is reaffirming its Fiscal 2025 growth outlook. Wiley’s

revenue outlook is driven by favorable demand trends and

strong performance indicators. Wiley’s earnings outlook is

driven by expected revenue growth and cost savings, while

reflecting reinvestments to scale and optimize Research, modernize

infrastructure and expand GenAI content licensing and capabilities.

Wiley’s cash flow outlook is driven by lower restructuring

payments and favorable working capital partially offset by higher

capex and a year-over-year swing in incentive compensation

payments. The Company expects capex of $130 million compared to $93

million in Fiscal 2024 driven by the acceleration of its Research

Publishing platform work and infrastructure modernization.

Metric

Fiscal 2024 Results

Fiscal 2025 Outlook

($millions, except EPS)

Ex-Divestitures

Ex-Divestitures

Adj. Revenue*

$1,617

$1,650 to $1,690

Research

$1,043

Low to mid-single digit

growth

Learning

$574

Low-single digit growth

Adj. EBITDA*

$369

$385 to $410

Adj. EPS*

$2.78

$3.25 to $3.60

Free Cash Flow

$114

Approx. $125

*Excludes held for sale or sold

businesses

The Company remains on track with its Fiscal 2026 targets.

EARNINGS CONFERENCE CALL

Scheduled for today, September 5 at 10:00 am (ET). Access

webcast at Investor Relations at investors.wiley.com, or directly

at https://events.q4inc.com/attendee/543994488. U.S. callers,

please dial (888) 210-3346 and enter the participant code

2521217#. International callers, please dial (646) 960-0253

and enter the participant code 2521217#.

ABOUT WILEY

Wiley (NYSE: WLY) is one of the world’s largest publishers and a

trusted leader in research and learning. Our industry-leading

content, services, platforms, and knowledge networks are tailored

to meet the evolving needs of our customers and partners, including

researchers, students, instructors, professionals, institutions,

and corporations. We enable knowledge-seekers to transform today’s

biggest obstacles into tomorrow’s brightest opportunities. For more

than two centuries, Wiley has been delivering on its timeless

mission to unlock human potential. Visit us at Wiley.com. Follow us

on Facebook, Twitter, LinkedIn and Instagram.

NON-GAAP FINANCIAL MEASURES

Wiley provides non-GAAP financial measures and performance

results such as “Adjusted EPS,” “Adjusted Operating Income,”

“Adjusted EBITDA,” “Adjusted Income before Taxes,” “Adjusted Income

Tax Provision,” “Adjusted Effective Income Tax Rate,” “Free Cash

Flow less Product Development Spending,” “organic revenue,”

“Adjusted Revenue,” and results on a Constant Currency basis to

assess underlying business performance and trends. Management

believes non-GAAP financial measures, which exclude the impact of

restructuring charges and credits and certain other items, and the

impact of divestitures and acquisitions provide a useful comparable

basis to analyze operating results and earnings. See the

reconciliations of non-GAAP financial measures and explanations of

the uses of non-GAAP measures in the supplementary information. We

have not provided our 2025 outlook for the most directly comparable

U.S. GAAP financial measures, as they are not available without

unreasonable effort due to the high variability, complexity, and

low visibility with respect to certain items, including

restructuring charges and credits, gains and losses on foreign

currency, and other gains and losses. These items are uncertain,

depend on various factors, and could be material to our

consolidated results computed in accordance with U.S. GAAP.

FORWARD-LOOKING STATEMENTS

This release contains certain forward-looking statements

concerning the Company's operations, performance, and financial

condition. Reliance should not be placed on forward-looking

statements, as actual results may differ materially from those in

any forward-looking statements. Any such forward-looking statements

are based upon a number of assumptions and estimates that are

inherently subject to uncertainties and contingencies, many of

which are beyond the control of the Company and are subject to

change based on many important factors. Such factors include, but

are not limited to: (i) the level of investment in new technologies

and products; (ii) subscriber renewal rates for the Company's

journals; (iii) the financial stability and liquidity of journal

subscription agents; (iv) the consolidation of book wholesalers and

retail accounts; (v) the market position and financial stability of

key online retailers; (vi) the seasonal nature of the Company's

educational business and the impact of the used book market; (vii)

worldwide economic and political conditions; (viii) the Company's

ability to protect its copyrights and other intellectual property

worldwide (ix) the ability of the Company to successfully integrate

acquired operations and realize expected opportunities; (x) the

ability to realize operating savings over time and in fiscal year

2025 in connection with our multiyear Global Restructuring Program

and planned and completed dispositions; (xi) the possibility that

the divestitures will not be pursued, failure to obtain necessary

regulatory approvals or required financing or to satisfy any of the

other conditions to planned dispositions; (xii) cyber risk and the

failure to maintain the integrity of our operational or security

systems or infrastructure, or those of third parties with which we

do business; (xiii) as a result of acquisitions, we have and may

record a significant amount of goodwill and other identifiable

intangible assets and we may never realize the full carrying value

of these assets; (xiv) our ability to leverage artificial

intelligence technologies in our products and services, including

generative artificial intelligence, large language models, machine

learning, and other artificial intelligence tools; and (xv) other

factors detailed from time to time in our filings with the SEC. The

Company undertakes no obligation to update or revise any such

forward-looking statements to reflect subsequent events or

circumstances.

CATEGORY: EARNINGS RELEASES

JOHN WILEY & SONS, INC. SUPPLEMENTARY INFORMATION

(1)(2) CONDENSED CONSOLIDATED STATEMENTS OF NET LOSS

(Dollars in thousands, except per share information)

(unaudited) Three Months Ended July 31,

2024

2023

Revenue, net

$

403,809

$

451,013

Costs and expenses: Cost of sales

109,220

157,101

Operating and administrative expenses

248,819

255,801

Impairment of goodwill (3)

-

26,695

Restructuring and related charges

3,870

12,123

Amortization of intangible assets

12,927

15,648

Total costs and expenses

374,836

467,368

Operating income (loss)

28,973

(16,355

)

As a % of revenue

7.2

%

-3.6

%

Interest expense

(12,787

)

(11,334

)

Foreign exchange transaction gains (losses)

234

(1,620

)

Gains (losses) on sale of businesses and impairment charges related

to assets held-for-sale (3)

5,801

(75,929

)

Other income (expense), net

782

(1,485

)

Income (loss) before taxes

23,003

(106,723

)

Provision (benefit) for income taxes

24,439

(14,459

)

Effective tax rate

106.2

%

13.5

%

Net loss

$

(1,436

)

$

(92,264

)

As a % of revenue

-0.4

%

-20.5

%

Loss per share Basic

$

(0.03

)

$

(1.67

)

Diluted (4)

$

(0.03

)

$

(1.67

)

Weighted average number of common shares outstanding

Basic

54,377

55,270

Diluted (4)

54,377

55,270

Notes: (1) The supplementary information

included in this press release for the three months ended July 31,

2024 is preliminary and subject to change prior to the filing of

our upcoming Quarterly Report on Form 10-Q with the Securities and

Exchange Commission. (2) All amounts are approximate due to

rounding. (3) As previously announced in fiscal year 2024,

we executed a plan to divest non-core businesses, including

University Services, Wiley Edge, and CrossKnowledge. These three

businesses met the held-for-sale criteria starting in the first

quarter of fiscal year 2024. We measured each disposal group at the

lower of carrying value or fair value less costs to sell prior to

its disposition.On May 31, 2024, we completed the sale of Wiley

Edge, with the exception of its India operations. The sale of Wiley

Edge's India operation closed on August 31, 2024. The pretax loss

was $19.6 million. In connection with the held-for-sale

classification, we recognized cumulative impairment charges of

$19.4 million in the year ended April 30, 2024.On January 1, 2024

we completed the sale of University Services. In the three months

ended July 31, 2024, there was a reduction in the pretax loss on

the sale of University Services previously in our Held for Sale or

Sold segment due to third-party customer consents and working

capital adjustments of $1.5 million that occurred in the first

quarter of fiscal year 2025. In the three months ended July 31,

2024, there was a reduction in the pretax loss on the sale of our

Tuition Manager business previously in our Held for Sale or Sold

segment due to a selling price adjustment for cash received after

the closing.As of July 31, 2024, Wiley Edge's India operation and

CrossKnowledge continue to be reported as held-for-sale and we

measured each business at the lower of carrying value or fair value

less costs to sell. We recorded pretax impairment charges in the

three months ended July 31, 2024 and 2023 related to

CrossKnowledge. On August 2, 2024 we entered into an agreement to

sell our CrossKnowledge business, which closed on August 31,

2024.In fiscal year 2024, we reorganized our segments and recorded

pretax noncash goodwill impairments of $26.7 million which included

$11.4 million related to University Services and $15.3 million

related to CrossKnowledge.

Three Months EndedJuly 31,

2024

2023

Wiley Edge

$

(168

)

$

-

University Services

1,489

(40,659

)

Tuition Manager

120

(2,068

)

CrossKnowledge

4,360

(33,202

)

Gains (losses) on sale of businesses and impairment charges related

to assets held-for-sale

$

5,801

$

(75,929

)

(4) In calculating diluted net loss per common share for the

three months ended July 31, 2024 and 2023, our diluted weighted

average number of common shares outstanding excludes the effect of

unvested restricted stock units and other stock awards as the

effect was antidilutive. This occurs when a US GAAP net loss is

reported and the effect of using dilutive shares is antidilutive.

JOHN WILEY & SONS, INC. SUPPLEMENTARY

INFORMATION (1) (2) RECONCILIATION OF US GAAP MEASURES to

NON-GAAP MEASURES (unaudited) Reconciliation

of US GAAP Loss per Share to Non-GAAP Adjusted EPS Three

Months Ended July 31,

2024

2023

US GAAP Loss Per Share - Diluted

$

(0.03

)

$

(1.67

)

Adjustments: Impairment of goodwill

-

0.43

Restructuring and related charges

0.06

0.16

Foreign exchange gains on intercompany transactions, including the

write off of certain cumulative translation adjustments (3)

(0.05

)

-

Amortization of acquired intangible assets (4)

0.20

0.23

(Gains) losses on sale of businesses and impairment charges related

to assets held-for-sale (5)

(0.09

)

1.17

Held for Sale or Sold segment Adjusted Net Loss (Income) (5)

0.04

(0.07

)

Income tax adjustments

0.33

-

EPS impact of using weighted-average dilutive shares for adjusted

EPS calculation (6)

0.01

0.02

Non-GAAP Adjusted Earnings Per Share - Diluted

$

0.47

$

0.27

Reconciliation of US GAAP Income (Loss) Before Taxes to

Non-GAAP Adjusted Income Before Taxes Three Months Ended

(amounts in thousands)

July 31,

2024

2023

US GAAP Income (Loss) Before Taxes

$

23,003

$

(106,723

)

Pretax Impact of Adjustments: Impairment of goodwill

-

26,695

Restructuring and related charges

3,870

12,123

Foreign exchange gains on intercompany transactions, including the

write off of certain cumulative translation adjustments (3)

(2,591

)

(6

)

Amortization of acquired intangible assets (4)

12,969

16,668

(Gains) losses on sale of businesses and impairment charges related

to assets held-for-sale (5)

(5,801

)

75,929

Held for Sale or Sold segment Adjusted Loss (Income) Before Taxes

(5)

2,519

(5,034

)

Non-GAAP Adjusted Income Before Taxes

$

33,969

$

19,652

Reconciliation of US GAAP Income Tax Provision (Benefit)

to Non-GAAP Adjusted Income Tax Provision, including our US GAAP

Effective Tax Rate and our Non-GAAP Adjusted Effective Tax Rate

US GAAP Income Tax Provision (Benefit)

$

24,439

$

(14,459

)

Income Tax Impact of Adjustments (7) Impairment of goodwill

-

2,697

Restructuring and related charges

749

2,936

Foreign exchange gains on intercompany transactions, including the

write off of certain cumulative translation adjustments (3)

(390

)

(34

)

Amortization of acquired intangible assets (4)

1,809

3,873

(Gains) losses on sale of businesses and impairment charges related

to assets held-for-sale (5)

(925

)

10,660

Held for Sale or Sold segment Adjusted Tax Benefit (Provision) (5)

372

(996

)

Income Tax Adjustments Impact of valuation allowance on the US GAAP

effective tax rate (8)

(18,030

)

-

Non-GAAP Adjusted Income Tax Provision

$

8,024

$

4,677

US GAAP Effective Tax Rate

106.2

%

13.5

%

Non-GAAP Adjusted Effective Tax Rate

23.6

%

23.8

%

Notes: (1) See Explanation of Usage of Non-GAAP

Performance Measures included in this supplementary information for

additional details on the reasons why management believes

presentation of each non-GAAP performance measure provides useful

information to investors. The supplementary information included in

this press release for the three months ended July 31, 2024 is

preliminary and subject to change prior to the filing of our

upcoming Quarterly Report on Form 10-Q with the Securities and

Exchange Commission. (2) All amounts are approximate due to

rounding. (3) In fiscal year 2023 due to the closure of our

operations in Russia, the Russia entity was deemed substantially

liquidated. In the three months ended July 31, 2024 and 2023, we

wrote off an additional $0.5 million and $0.9 million,

respectively, of cumulative translation adjustments in earnings.

This amount is reflected in Foreign exchange transaction gains

(losses) on our Condensed Consolidated Statements of Net Loss.

(4) Reflects the amortization of intangible assets

established on the opening balance sheet for an acquired business.

This includes the amortization of intangible assets such as

developed technology, customer relationships, tradenames, etc.,

which is reflected in the "Amortization of intangible assets" line

in the Condensed Consolidated Statements of Net Loss. It also

includes the amortization of acquired product development assets,

which is reflected in Cost of sales in the Condensed Consolidated

Statements of Net Loss. (5) On May 31, 2024, we completed

the sale of Wiley Edge, which resulted in a pretax loss of $19.6

million (net of tax loss of $20.4 million). Prior to the

disposition, in fiscal year 2024 we had recorded a held-for-sale

impairment of $19.4 million for Wiley Edge. This resulted in an

additional loss of $0.2 million in the three months ended July 31,

2024. In the three months ended July 31, 2024, there was a

reduction in the pretax loss on the sale of University Services of

approximately $1.5 million, which resulted in a total pretax loss

of $105.6 million (net of tax loss of $79.4 million). In the three

months ended July 31, 2024, there was a reduction in the pretax

loss on the sale of our Tuition Manager business of approximately

$0.1 million, which resulted in a total net pretax loss of $1.4

million (net of tax loss of $1.0 million).CrossKnowledge continues

to be reported as held-for-sale, and we measured the business at

the lower of carrying value or fair value less costs to sell. In

the three months ended July 31, 2024, we reduced the held-for-sale

pretax impairment by $4.4 million related to CrossKnowledge.In the

three months ended July 31, 2023, the loss on sale of a business is

due to the sale of our Tuition Manager business previously in our

Held for Sale or Sold segment, which resulted in a pretax loss of

approximately $2.0 million (net of tax loss of $1.6 million). In

fiscal year 2024 while University Services, Wiley Edge, and

CrossKnowledge continued to be reported as held-for-sale, we

measured each business at the lower of carrying value or fair value

less cost to sell. We recorded a pretax impairment of $40.6 million

for University Services and $33.3 million for CrossKnowledge in the

three months ended July 31, 2023.In addition, our Adjusted EPS

excludes the Adjusted Net Income of our Held for Sale or Sold

segment. (6) Represents the impact of using diluted

weighted-average number of common shares outstanding (55.0 million

and 55.8 million for the three months ended July 31, 2024 and 2023,

respectively) included in the Non-GAAP Adjusted EPS calculation in

order to apply the dilutive impact on adjusted net income due to

the effect of unvested restricted stock units and other stock

awards. This impact occurs when a US GAAP net loss is reported and

the effect of using dilutive shares is antidilutive. (7) For

the three months ended July 31, 2024 and 2023, substantially all of

the tax impact was from deferred taxes. (8) In the three

months ended July 31, 2024, there was an $18.0 million impact on

the US GAAP effective tax rate due to the valuation allowance on

deferred tax assets in the US.

JOHN WILEY & SONS,

INC. SUPPLEMENTARY INFORMATION (1) RECONCILIATION OF

US GAAP NET LOSS TO NON-GAAP EBITDA AND ADJUSTED EBITDA

(unaudited) Three Months Ended July 31,

2024

2023

Net Loss

$

(1,436

)

$

(92,264

)

Interest expense

12,787

11,334

Provision (benefit) for income taxes

24,439

(14,459

)

Depreciation and amortization

37,253

43,728

Non-GAAP EBITDA

73,043

(51,661

)

Impairment of goodwill

-

26,695

Restructuring and related charges

3,870

12,123

Foreign exchange (gains) losses, including the write off of certain

cumulative translation adjustments

(234

)

1,620

(Gains) losses on sale of businesses and impairment charges related

to assets held-for-sale

(5,801

)

75,929

Other (income) expense, net

(782

)

1,485

Held for Sale or Sold segment Adjusted EBITDA (2)

2,519

(6,521

)

Non-GAAP Adjusted EBITDA

$

72,615

$

59,670

Adjusted EBITDA Margin

18.6

%

16.3

%

Notes: (1) See Explanation of Usage of Non-GAAP

Performance Measures included in this supplementary information for

additional details on the reasons why management believes

presentation of each non-GAAP performance measure provides useful

information to investors. The supplementary information included in

this press release for the three months ended July 31, 2024 is

preliminary and subject to change prior to the filing of our

upcoming Quarterly Report on Form 10-Q with the Securities and

Exchange Commission. (2) Our Non-GAAP Adjusted EBITDA

excludes the Held for Sale or Sold segment Non-GAAP Adjusted

EBITDA.

JOHN WILEY & SONS, INC. SUPPLEMENTARY

INFORMATION (1) (2) (3) SEGMENT RESULTS (in

thousands) (unaudited) % Change

Three Months Ended July 31, Favorable (Unfavorable)

2024

2023

Reported Constant Currency Research:

Revenue, net Research Publishing

$

230,951

$

223,000

4

%

4

%

Research Solutions

34,358

34,804

-1

%

-1

%

Total Revenue, net

$

265,309

$

257,804

3

%

3

%

Non-GAAP Adjusted Operating Income

$

55,216

$

53,527

3

%

3

%

Depreciation and amortization

22,559

23,212

3

%

3

%

Non-GAAP Adjusted EBITDA

$

77,775

$

76,739

1

%

1

%

Adjusted EBITDA margin

29.3

%

29.8

%

Learning:

Revenue, net Academic

$

59,964

$

48,292

24

%

24

%

Professional

64,350

61,028

5

%

5

%

Total Revenue, net

$

124,314

$

109,320

14

%

14

%

Non-GAAP Adjusted Operating Income

$

22,500

$

7,626

#

#

Depreciation and amortization

11,294

13,552

17

%

17

%

Non-GAAP Adjusted EBITDA

$

33,794

$

21,178

60

%

60

%

Adjusted EBITDA margin

27.2

%

19.4

%

Held for Sale or Sold:

Total Revenue, net

$

14,186

$

83,889

-83

%

-83

%

Non-GAAP Adjusted Operating (Loss) Income

$

(2,519

)

$

3,084

#

#

Depreciation and amortization

-

3,437

#

#

Non-GAAP Adjusted EBITDA

$

(2,519

)

$

6,521

#

#

Adjusted EBITDA margin

-17.8

%

7.8

%

Non-GAAP Adjusted Corporate

Expenses

$

(42,354

)

$

(41,774

)

-1

%

-1

%

Depreciation and amortization

3,400

3,527

4

%

3

%

Non-GAAP Adjusted EBITDA

$

(38,954

)

$

(38,247

)

-2

%

-2

%

Consolidated Results:

Revenue, net

$

403,809

$

451,013

-10

%

-10

%

Less: Held for Sale or Sold Segment (3)

(14,186

)

(83,889

)

-83

%

-83

%

Adjusted Revenue, net

$

389,623

$

367,124

6

%

6

%

Operating Income (Loss)

$

28,973

$

(16,355

)

#

#

Adjustments: Restructuring charges

3,870

12,123

68

%

68

%

Impairment of goodwill

-

26,695

#

#

Held for Sale or Sold Segment Adjusted Operating Loss (Income) (3)

2,519

(3,084

)

#

#

Non-GAAP Adjusted Operating Income

$

35,362

$

19,379

82

%

83

%

Adjusted Operating Income margin

9.1

%

5.3

%

Depreciation and amortization

37,253

43,728

15

%

15

%

Less: Held for Sale or Sold Segment depreciation and amortization

(3)

-

(3,437

)

#

#

Non-GAAP Adjusted EBITDA

$

72,615

$

59,670

22

%

22

%

Adjusted EBITDA margin

18.6

%

16.3

%

Notes: (1) The supplementary

information included in this press release for the three months

ended July 31, 2024 is preliminary and subject to change prior to

the filing of our upcoming Quarterly Report on Form 10-Q with the

Securities and Exchange Commission. (2) All amounts

are approximate due to rounding. (3) Our

Adjusted Revenue, Adjusted Operating Income and Adjusted EBITDA

excludes the impact of our Held for Sale or Sold segment Revenue,

Adjusted Operating Income or Loss and Adjusted EBITDA results.

# Variance greater than 100%

JOHN WILEY & SONS, INC. SUPPLEMENTARY INFORMATION

(1) CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL

POSITION (in thousands) (unaudited)

July 31, April 30,

2024

2024

Assets: Current assets Cash and cash equivalents

$

82,545

$

83,249

Accounts receivable, net

192,153

224,198

Inventories, net

25,846

26,219

Prepaid expenses and other current assets

87,004

85,954

Current assets held-for-sale (2)

5,282

34,422

Total current assets

392,830

454,042

Technology, property and equipment, net

185,104

192,438

Intangible assets, net

609,224

615,694

Goodwill

1,099,817

1,091,368

Operating lease right-of-use assets

72,424

69,074

Other non-current assets

292,635

283,719

Non-current assets held-for-sale (2)

24

19,160

Total assets

$

2,652,058

$

2,725,495

Liabilities and shareholders' equity: Current

liabilities Accounts payable

$

38,641

$

55,659

Accrued royalties

105,063

97,173

Short-term portion of long-term debt

8,750

7,500

Contract liabilities

367,307

483,778

Accrued employment costs

49,039

96,980

Short-term portion of operating lease liabilities

17,647

18,294

Other accrued liabilities

78,241

76,266

Current liabilities held-for-sale (2)

24,103

37,632

Total current liabilities

688,791

873,282

Long-term debt

909,850

767,096

Accrued pension liability

67,850

70,832

Deferred income tax liabilities

97,362

97,186

Operating lease liabilities

91,587

94,386

Other long-term liabilities

76,980

71,760

Long-term liabilities held-for-sale (2)

5,965

11,237

Total liabilities

1,938,385

1,985,779

Shareholders' equity

713,673

739,716

Total liabilities and shareholders' equity

$

2,652,058

$

2,725,495

Notes: (1) The supplementary information included in

this press release for July 31, 2024 is preliminary and subject to

change prior to the filing of our upcoming Quarterly Report on Form

10-Q with the Securities and Exchange Commission. (2) As

previously announced, we are divesting non-core businesses,

including Wiley Edge's India operations and CrossKnowledge. These

businesses met the held-for-sale criteria and were measured at the

lower of carrying value or fair value less costs to sell. We

recorded a pretax impairment of $51.0 million in the three months

ended July 31, 2024 related to CrossKnowledge which is recorded as

a contra asset account within Current assets held-for-sale and

Non-current assets held-for-sale.

JOHN WILEY & SONS,

INC. SUPPLEMENTARY INFORMATION (1) CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands)

(unaudited) Three Months Ended July 31,

2024

2023

Operating activities: Net loss

$

(1,436

)

$

(92,264

)

Impairment of goodwill

-

26,695

(Gains) losses on sale of businesses and impairment charges related

to assets held-for-sale

(5,801

)

75,929

Amortization of intangible assets

12,927

15,648

Amortization of product development assets

4,476

6,687

Depreciation and amortization of technology, property, and

equipment

19,850

21,393

Other noncash charges

20,067

8,753

Net change in operating assets and liabilities

(138,795

)

(145,176

)

Net cash used in operating activities

(88,712

)

(82,335

)

Investing activities: Additions to technology,

property, and equipment

(14,502

)

(20,086

)

Product development spending

(3,351

)

(3,747

)

Businesses acquired in purchase transactions, net of cash acquired

(915

)

(1,500

)

Net cash (transferred) proceeds related to the sale of businesses

(6,387

)

457

Acquisitions of publication rights and other

1,348

(866

)

Net cash used in investing activities

(23,807

)

(25,742

)

Financing activities: Net debt borrowings

143,749

145,473

Cash dividends

(19,184

)

(19,382

)

Purchases of treasury shares

(12,500

)

(10,000

)

Other

(10,476

)

(10,277

)

Net cash provided by financing activities

101,589

105,814

Effects of exchange rate changes on cash, cash

equivalents and restricted cash

798

2,257

Change in cash, cash equivalents and restricted cash for

period

(10,132

)

(6

)

Cash, cash equivalents and restricted cash -

beginning

99,543

107,262

Cash, cash equivalents and restricted cash - ending (2)

$

89,411

$

107,256

CALCULATION OF NON-GAAP FREE CASH FLOW LESS PRODUCT

DEVELOPMENT SPENDING (3) Three Months Ended

July 31,

2024

2023

Net cash used in operating activities

$

(88,712

)

$

(82,335

)

Less: Additions to technology, property, and equipment

(14,502

)

(20,086

)

Less: Product development spending

(3,351

)

(3,747

)

Free cash flow less product development spending

$

(106,565

)

$

(106,168

)

Notes: (1) The supplementary information included in

this press release for the three months ended July 31, 2024 is

preliminary and subject to change prior to the filing of our

upcoming Quarterly Report on Form 10-Q with the Securities and

Exchange Commission. (2) Cash, cash equivalents and

restricted cash as of July 31, 2024 includes held-for-sale cash,

cash equivalents and restricted cash of $6.8 million. (3)

See Explanation of Usage of Non-GAAP Performance Measures included

in this supplemental information.

JOHN WILEY & SONS,

INC.

EXPLANATION OF USAGE OF NON-GAAP PERFORMANCE MEASURES

In this earnings release and supplemental information, management

may present the following non-GAAP performance measures:

- Adjusted Earnings Per Share (Adjusted EPS);

- Free Cash Flow less Product Development Spending;

- Adjusted Revenue;

- Adjusted Operating Income and margin;

- Adjusted Income Before Taxes;

- Adjusted Income Tax Provision;

- Adjusted Effective Tax Rate;

- EBITDA, Adjusted EBITDA and margin;

- Organic revenue; and

- Results on a constant currency basis.

Management uses these non-GAAP performance measures as

supplemental indicators of our operating performance and financial

position as well as for internal reporting and forecasting

purposes, when publicly providing our outlook, to evaluate our

performance and calculate incentive compensation. We present

these non-GAAP performance measures in addition to US GAAP

financial results because we believe that these non-GAAP

performance measures provide useful information to certain

investors and financial analysts for operational trends and

comparisons over time. The use of these non-GAAP performance

measures may also provide a consistent basis to evaluate operating

profitability and performance trends by excluding items that we do

not consider to be controllable activities for this purpose.

The performance metric used by our chief operating decision maker

to evaluate performance of our reportable segments is Adjusted

Operating Income. We present both Adjusted Operating Income and

Adjusted EBITDA for each of our reportable segments as we believe

Adjusted EBITDA provides additional useful information to certain

investors and financial analysts for operational trends and

comparisons over time. It removes the impact of depreciation and

amortization expense, as well as presents a consistent basis to

evaluate operating profitability and compare our financial

performance to that of our peer companies and competitors.

For example:

- Adjusted EPS, Adjusted Revenue, Adjusted Operating Income,

Adjusted Income Before Taxes, Adjusted Income Tax Provision,

Adjusted Effective Tax Rate, Adjusted EBITDA, and organic revenue

(excluding acquisitions) provide a more comparable basis to analyze

operating results and earnings and are measures commonly used by

shareholders to measure our performance.

- Free Cash Flow less Product Development Spending helps assess

our ability, over the long term, to create value for our

shareholders as it represents cash available to repay debt, pay

common stock dividends, and fund share repurchases and

acquisitions.

- Results on a constant currency basis remove distortion from the

effects of foreign currency movements to provide better

comparability of our business trends from period to period. We

measure our performance excluding the impact of foreign currency

(or at constant currency), which means that we apply the same

foreign currency exchange rates for the current and equivalent

prior period.

In addition, we have historically provided these or similar

non-GAAP performance measures and understand that some investors

and financial analysts find this information helpful in analyzing

our operating margins and net income, and in comparing our

financial performance to that of our peer companies and

competitors. Based on interactions with investors, we also believe

that our non-GAAP performance measures are regarded as useful to

our investors as supplemental to our US GAAP financial results, and

that there is no confusion regarding the adjustments or our

operating performance to our investors due to the comprehensive

nature of our disclosures. We have not provided our 2025

outlook for the most directly comparable US GAAP financial

measures, as they are not available without unreasonable effort due

to the high variability, complexity, and low visibility with

respect to certain items, including restructuring charges and

credits, gains and losses on foreign currency, and other gains and

losses. These items are uncertain, depend on various factors, and

could be material to our consolidated results computed in

accordance with US GAAP. Non-GAAP performance measures do

not have standardized meanings prescribed by US GAAP and therefore

may not be comparable to the calculation of similar measures used

by other companies and should not be viewed as alternatives to

measures of financial results under US GAAP. The adjusted metrics

have limitations as analytical tools, and should not be considered

in isolation from, or as a substitute for, US GAAP information. It

does not purport to represent any similarly titled US GAAP

information and is not an indicator of our performance under US

GAAP. Non-GAAP financial metrics that we present may not be

comparable with similarly titled measures used by others. Investors

are cautioned against placing undue reliance on these non-GAAP

measures.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240905678059/en/

Investor Brian Campbell brian.campbell@wiley.com

201.748.6874

Media Andrea Sherman asherman@wiley.com (203)

536-7564

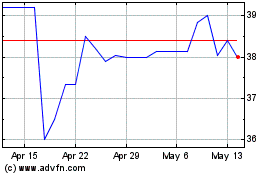

John Wiley and Sons (NYSE:WLYB)

Historical Stock Chart

From Nov 2024 to Dec 2024

John Wiley and Sons (NYSE:WLYB)

Historical Stock Chart

From Dec 2023 to Dec 2024