Janus Henderson (NYSE: JHG) today announced it has launched the

Janus Henderson Income ETF (Ticker: JIII).

The new ETF seeks high current income with a secondary focus on

capital appreciation. The Fund pursues its investment objective by

primarily investing across fixed income sectors in a portfolio of

US and non-US debt securities of varying maturities that the

investment team believes have high relative income potential. Janus

Henderson’s research expertise across corporate credit, securitized

credit, and emerging market debt research provides the foundation

for security selection within the portfolio.

The Fund is managed by Portfolio Managers John Kerschner,

CFA, and John Lloyd. They are supported by the full

resources of the Janus Henderson fixed income team, including

credit research, securitized research, quantitative research,

trading, and risk management. Mr. Kerschner and Mr. Lloyd have a

successful track record in managing portfolios across fixed income

sectors together over the past 10 years.

The investment team believes the Fund’s overall volatility may

be reduced by investing in multiple sectors that have lower

correlation to each other.

John Kerschner, Head of U.S. Securitized Products and

Portfolio Manager at Janus Henderson, said: “We believe the

income solution space will be one of the fastest growing active ETF

opportunities over the next five years. The launch of JIII

demonstrates the expansion of our robust active fixed income ETF

product offerings designed to meet client needs.”

John Lloyd, Lead, Multi-Sector Credit Strategies and

Portfolio Manager at Janus Henderson, said: “Our goal is to

create a portfolio across all fixed income sectors, aiming to build

a portfolio of best ideas across fixed income sectors, striving for

higher yields than those of standard core-plus portfolios and

greater diversification than single-sector, high-yield

strategies.”

Janus Henderson has been at the forefront of active fixed income

ETF innovation and offers a number of pioneering fixed income ETFs.

These include JAAA, the largest CLO ETF1, JBBB, the second largest

CLO ETF2 which provides exposure to floating-rate CLOs generally

rated BBB, JSI, which invests in opportunities across the U.S.

securitized markets, JMBS, the largest actively managed

mortgage-backed securities ETF3, VNLA, an active global short

duration income ETF, JLQD, a corporate bond ETF, and JEMB, an

emerging markets debt hard currency ETF. Janus Henderson is the

fourth largest active fixed income ETF provider globally.4 The firm

won Global Capital’s inaugural CLO ETF Provider of the Year award

in 2024.5

1 Source: Morningstar as of September 30, 2024 2 Source:

Morningstar as of September 30, 2024 3 Source: Morningstar as of

September 30, 2024 4 Source: Morningstar as of September 30, 2024 5

The CLO ETF Provider of the Year is chosen at Global Capital’s

discretion and is based on a process that includes both

self-submitted applications and independent research conducted by

the awarding body. Global Capital evaluates organizations based on

their involvement in innovative or complex transactions, execution

quality and structuring, business growth and advancement, and the

extent of their securitization capabilities.

Notes to editors

About Janus Henderson

Janus Henderson Group is a leading global active asset manager

dedicated to helping clients define and achieve superior financial

outcomes through differentiated insights, disciplined investments,

and world-class service. As of September 30, 2024, Janus Henderson

had approximately US$382.3 billion in assets under management, more

than 2,000 employees, and offices in 24 cities worldwide. The firm

helps millions of people globally invest in a brighter future

together. Headquartered in London, Janus Henderson is listed on the

New York Stock Exchange.

Source: Janus Henderson Group plc

Please consider the charges, risks, expenses, and investment

objectives carefully before investing. For a prospectus or, if

available, a summary prospectus containing this and other

information, please call Janus Henderson at 800.668.0434 or

download the file from janushenderson.com/info. Read it carefully

before you invest or send money.

Past performance is no guarantee of future results.

Investing involves risk, including the possible loss of

principal and fluctuation of value. There is no assurance the

stated objective(s) will be met.

Fixed income securities are subject to interest rate,

inflation, credit and default risk. The bond market is volatile. As

interest rates rise, bond prices usually fall, and vice versa. The

return of principal is not guaranteed, and prices may decline if an

issuer fails to make timely payments or its credit strength

weakens.

High-yield or "junk" bonds involve a greater risk of

default and price volatility and can experience sudden and sharp

price swings.

Bank loans often involve borrowers with low credit

ratings whose financial conditions are troubled or uncertain,

including companies that are highly leveraged or in bankruptcy

proceedings.

Securitized products, such as mortgage- and asset-backed

securities, are more sensitive to interest rate changes, have

extension and prepayment risk, and are subject to more credit,

valuation and liquidity risk than other fixed-income

securities.

Collateralized Loan Obligations (CLOs) are debt

securities issued in different tranches, with varying degrees of

risk, and backed by an underlying portfolio consisting primarily of

below investment grade corporate loans. The return of principal is

not guaranteed, and prices may decline if payments are not made

timely or credit strength weakens. CLOs are subject to liquidity

risk, interest rate risk, credit risk, call risk and the risk of

default of the underlying assets.

Janus Henderson Investors US LLC is the investment adviser and

ALPS Distributors, Inc. is the distributor. ALPS is not affiliated

with Janus Henderson or any of its subsidiaries.

Janus Henderson is a trademark of Janus Henderson Group plc or

one of its subsidiaries. © Janus Henderson Group plc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241113222675/en/

Press Inquiries Sarah Johnson, +1 720-364-0708

sarah.johnson@janushenderson.com Candice Sun, +1 303-336-5452

candice.sun@janushenderson.com Investor Relations Inquiries

Jim Kurtz, +1 303-336-4529 jim.kurtz@janushenderson.com

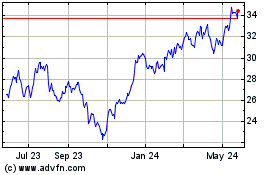

Janus Henderson (NYSE:JHG)

Historical Stock Chart

From Dec 2024 to Jan 2025

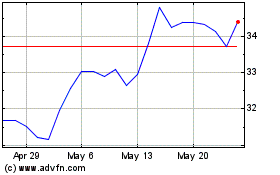

Janus Henderson (NYSE:JHG)

Historical Stock Chart

From Jan 2024 to Jan 2025