MEDIA, Pa., Aug. 2 /PRNewswire-FirstCall/ -- InfraSource Services,

Inc. (NYSE:IFS), one of the largest specialty contractors servicing

electric, natural gas and telecommunications infrastructure in the

United States, today announced its results for the second quarter

ended June 30, 2007. Second Quarter Results Revenues for the second

quarter 2007 were $239.6 million, or 6% lower than for the same

quarter in 2006, due primarily to lower volumes of work in our

natural gas business related to a decline in housing starts. Net

income for the second quarter 2007 was $9.2 million, or $0.22 per

diluted share, versus $5.3 million, or $0.13 per diluted share, for

the second quarter last year. Net income for the second quarter

2007 included $0.3 million (net of tax), or $0.01 per diluted

share, of transaction costs related to the pending merger with

Quanta Services, Inc. (NYSE:PWR) and for the second quarter 2006

included a $2.6 million (net of tax), or $0.06 per diluted share,

non-cash charge associated with the refinancing of our bank debt.

Excluding these transaction costs, net income for the second

quarter 2007 would have been $9.5 million, or $0.23 per diluted

share, compared to $7.9 million, or $0.19 per diluted share, for

the second quarter last year. Backlog & Recent Award At the end

of the second quarter 2007, total backlog was $919 million,

comparable to the second quarter 2006 and 12% lower than at the end

of the first quarter 2007. Not included in second quarter backlog

is the award of a contract in July 2007 for the construction of a

73-mile, 500 kV electric transmission line in California, known as

the Tehachapi Renewable Transmission Project. The estimated

contract value of the project is $93.2 million. David Helwig,

Chairman, President and Chief Executive Officer, said, "We are very

pleased with our results for the quarter, the recent award for the

Tehachapi Renewable Transmission Project and our recent

acquisitions of approximately $14 million in dark fiber related

assets. We are looking forward to the final shareholder approvals

for the merger with Quanta Services on August 30, 2007 and are very

excited about the future of the combined company." About

InfraSource InfraSource Services, Inc. (NYSE:IFS) is one of the

largest specialty contractors servicing electric, natural gas and

telecommunications infrastructure in the United States. InfraSource

designs, builds, and maintains transmission and distribution

networks for utilities, power producers, and industrial customers.

Further information can be found at http://www.infrasourceinc.com/.

Safe Harbor Statement Certain statements contained in this press

release are forward-looking statements. These forward-looking

statements are based upon our current expectations about future

events. When used in this press release, the words "believe,"

"anticipate," "intend," "estimate," "expect," "will," "should,"

"may," and similar expressions, or the negative of such words and

expressions, are intended to identify forward-looking statements,

although not all forward- looking statements contain such words or

expressions. These forward-looking statements generally relate to

our plans, objectives and expectations for future operations and

are based upon management's current estimates and projections of

future results or trends. However, these statements are subject to

a number of known and unknown risks, uncertainties and other

factors affecting our business that could cause our actual results

to differ materially from those contemplated by the statements. You

should read this press release completely and with the

understanding that actual future results may be materially

different from what we expect as a result of these risks and

uncertainties and other factors, which include, but are not limited

to: (1) the possibility that the pending merger with Quanta

Services, Inc. will not be consummated; (2) technological,

structural and cyclical changes that could reduce the demand for

the services we provide; (3) loss of key customers; (4) the impact

of variations between actual and estimated costs under our

contracts, particularly our fixed-price contracts; (5) our ability

to attract and retain qualified personnel; (6) our ability to

successfully bid for and perform large-scale project work in

accordance with our estimated costs; (7) work hindrance due to

inclement weather events; (8) the definitive award of new contracts

and the timing of the performance of those contracts; (9) project

delays or cancellations; (10) the failure to meet schedule or

performance requirements of our contracts; (11) the uncertainty of

implementation of the recently enacted federal energy legislation;

(12) the presence of competitors with greater financial resources

and the impact of competitive products, services and pricing; (13)

successful integration of acquisitions into our business; (14)

close out of certain of our projects may or may not occur as

anticipated or may be unfavorable to us; and (15) other factors

detailed from time to time in our reports and filings with the

Securities and Exchange Commission. Except as required by law, we

do not intend to update forward-looking statements even though our

situation may change in the future. CONTACT: Terence R. Montgomery

610-480-8000 Mahmoud Siddig 212-889-4350 INFRASOURCE SERVICES, INC.

AND SUBSIDIARIES Condensed Consolidated Statements of Operations

Three Months Ended Three Months Ended June 30, 2006 June 30, 2007

(Unaudited) (In thousands, except per share data) Revenues $254,261

$ 239,572 Cost of revenues 218,386 200,531 Gross profit 35,875

39,041 Selling, general and administrative expenses 22,612 23,831

Merger related costs - 483 Provision for uncollectible accounts 41

780 Amortization of intangible assets 237 93 Income from operations

12,985 13,854 Interest income 173 144 Interest expense (1,682)

(1,050) Write-off of deferred financing costs (4,296) - Other

income, net 1,487 2,074 Income from continuing operations before

income taxes 8,667 15,022 Income tax expense 3,506 5,863 Income

from continuing operations 5,161 9,159 Discontinued operations:

Income from discontinued operations (net of income tax expense of

$112 and $4, respectively) 166 6 Net income $5,327 $9,165 Basic

income per share: Income from continuing operations $0.13 $0.23

Income from discontinued operations - - Net income $0.13 $0.23

Weighted average basic common shares outstanding 39,735 40,590

Diluted income per share: Income from continuing operations $0.13

$0.22 Income from discontinued operations - - Net income $0.13

$0.22 Weighted average diluted common shares outstanding 40,336

41,252 INFRASOURCE SERVICES, INC. AND SUBSIDIARIES Condensed

Consolidated Statements of Operations December 31, June 30, 2006

2007 (Unaudited) (In thousands, except share data) Current assets:

Cash and cash equivalents $ 26,209 $18,868 Contract receivables

(less allowances for doubtful accounts of $3,770 and $4,865,

respectively) 166,780 144,359 Costs and estimated earnings in

excess of billings 59,012 76,397 Inventories 5,443 4,421 Deferred

income taxes 8,201 7,006 Other current assets 6,384 11,900 Current

assets - discontinued operations 746 184 Total current assets

272,775 263,135 Property and equipment (less accumulated

depreciation of $73,302 and $81,218, respectively) 154,578 176,183

Goodwill 146,933 147,276 Intangible assets, net 900 747 Deferred

charges and other assets, net 5,529 4,862 Assets held for sale 517

400 Total assets $581,232 $592,603 Current liabilities: Current

portion of long-term debt and short-term borrowings $1,154 $ 10,055

Other liabilities - related parties 766 940 Accounts payable 47,846

33,744 Accrued compensation and benefits 27,951 24,111 Other

current and accrued liabilities 22,096 25,586 Accrued insurance

reserves 36,166 35,272 Billings in excess of costs and estimated

earnings 23,245 20,977 Deferred revenues 6,188 6,611 Total current

liabilities 165,412 157,296 Long-term debt, net of current portion

50,070 50,043 Deferred revenues 16,347 15,617 Other long-term

liabilities - related party 900 - Deferred income taxes 3,750 2,233

Other long-term liabilities 5,568 6,494 Total liabilities 242,047

231,683 Commitments and contingencies Shareholders' equity:

Preferred stock, $.001 par value (authorized - 12,000,000 shares; 0

shares issued and outstanding) - - Common stock, $.001 par value

(authorized - 120,000,000 shares; issued 40,263,739 and 40,899,040

shares, respectively, and outstanding - 40,233,869 and 40,866,570,

respectively) 40 41 Treasury stock, at cost (29,870 shares and

32,470 shares, respectively) (137) (224) Additional paid-in capital

288,517 301,814 Retained earnings 50,785 58,774 Accumulated other

comprehensive income (loss) (20) 515 Total shareholders' equity

339,185 360,920 Total liabilities and shareholders' equity $581,232

$592,603 INFRASOURCE SERVICES, INC. AND SUBSIDIARIES Supplemental

Financial Data (Unaudited) (In millions) Three Three Months Months

Ended Ended Increase/(decrease) June 30, 2006 June 30, 2007 $ %

Revenues by End Market Electric - Transmission $ 59.4 23.4% $ 60.8

25.4% $1.4 2.4% - Substation 58.1 22.8% 46.7 19.5% (11.4) -19.6% -

Other Electric 32.3 12.7% 37.2 15.5% 4.9 15.2% Subtotal 149.8 58.9%

144.7 60.4% (5.1) -3.4% Natural Gas 72.3 28.4% 56.9 23.7% (15.4)

-21.3% Telecommunications 29.8 11.7% 33.3 13.9% 3.5 11.7% Other 2.4

0.9% 4.7 2.0% 2.3 95.8% Total $254.3 100.0% $239.6 100.0% $(14.7)

-5.8% Six Six Months Months Ended Ended Increase/(decrease) June

30, 2006 June 30, 2007 $ % Electric - Transmission $117.2 25.0%

$119.2 26.9% $ 2.0 1.7% - Substation 96.9 20.7% 93.0 21.0% (3.9)

-4.0% - Other Electric 69.6 14.9% 67.2 15.2% (2.4) -3.4% Subtotal

283.7 60.6% 279.4 63.0% (4.3) -1.5% Natural Gas 126.2 26.9% 94.7

21.4% (31.5) -25.0% Telecommunications 54.0 11.5% 58.4 13.2% 4.4

8.1% Other 4.6 1.0% 10.9 2.5% 6.3 137.0% Total $468.5 100.0% $443.4

100.0% $(25.1) -5.4% Increase/(decrease) Backlog by End Market June

30, 2006 June 30, 2007 $ % Electric - Transmission $214.7 23.4%

$134.5 14.6% $(80.2) -37.4% - Substation 136.5 14.9% 157.4 17.1%

20.9 15.3% - Other Electric 88.1 9.6% 191.9 20.9% 103.8 117.8%

Subtotal 439.3 48.0% 483.8 52.6% 44.5 10.1% Natural Gas 247.4 27.0%

196.5 21.4% (50.9) -20.6% Telecommunications 221.4 24.2% 222.0

24.1% 0.6 0.3% Other 7.7 0.8% 17.0 1.8% 9.3 120.8% Total $915.8

100.0% $919.3 100.0% $ 3.5 0.4% Increase/(decrease) March 31, 2006

June 30, 2007 $ % Electric - Transmission $171.8 16.4% $134.5 14.6%

$(37.3) -21.7% - Substation 181.1 17.3% 157.4 17.1% (23.7) -13.1% -

Other Electric 203.0 19.4% 191.9 20.9% (11.1) -5.5% Subtotal 555.9

53.1% 483.8 52.6% (72.1) -13.0% Natural Gas 231.5 22.1% 196.5 21.4%

(35.0) -15.1% Telecommunications 237.7 22.7% 222.0 24.1% (15.7)

-6.6% Other 22.4 2.1% 17.0 1.8% (5.4) -24.1% Total $1,047.5 100.0%

$919.3 100.0% $(128.2) -12.2% Total $1,047.5 100.0% $919.3 100.0%

$(128.2) -12.2% Note: Percentages may not add due to rounding

DATASOURCE: InfraSource Services, Inc. CONTACT: Terence R.

Montgomery, +1-610-480-8000, or ; or Mahmoud Siddig,

+1-212-889-4350, or , for InfraSource Services, Inc. Web site:

http://www.infrasourceinc.com/

Copyright

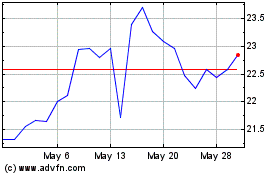

Intercorp Financial Serv... (NYSE:IFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Intercorp Financial Serv... (NYSE:IFS)

Historical Stock Chart

From Jul 2023 to Jul 2024