Fourth quarter revenues increased 12% and net income increased 30%

over prior year period MEDIA, Pa., March 5 /PRNewswire-FirstCall/

-- InfraSource Services, Inc. (NYSE:IFS), one of the largest

specialty contractors servicing electric, natural gas and

telecommunications infrastructure in the United States, today

announced earnings of $0.19 per diluted share for the fourth

quarter ended December 31, 2006, above the upper end of previously

announced net income guidance of $0.15 to $0.17 per diluted share.

For the twelve months ended December 31, 2006, the Company's

earnings were $0.65 per diluted share compared to $0.34 in 2005.

Fourth Quarter Results Revenues for the fourth quarter 2006

increased $27.5 million, or 12%, to $247.9 million, compared to

$220.4 million for the same quarter in 2005 due primarily to growth

in our electric end market revenues. Net income for the fourth

quarter 2006 was $7.6 million, or $0.19 per diluted share, versus

$5.8 million, or $0.15 per diluted share, for the fourth quarter

last year. Excluding the items in the attached table, income as

adjusted (non-GAAP) was $7.9 million for the fourth quarter 2006

versus $6.7 million for the same quarter in 2005, an increase of

19%. Reconciliations of net income to our non- GAAP financial

measures are included in the attached tables. Backlog & New

Awards At the end of the fourth quarter 2006, total backlog was

$902 million which was 13% higher than at the end of the third

quarter 2006. This increase was primarily related to additional

natural gas backlog (36% increase), a 6% increase in electric

backlog due to industrial project awards and a 4% increase in

telecommunications backlog. Total backlog was 2% higher than at the

end of the fourth quarter 2005. Electric and telecommunications

backlogs increased 6% and 9%, respectively, offset by a 14%

decrease in natural gas backlog due to the planned exit of certain

low margin contracts and shorter than typical durations on the

renewals of several of our natural gas master services agreement

contracts. Among our awards adding to backlog during the fourth

quarter 2006 were 12 scopes of electrical work totaling $72

million, 7 scopes of natural gas work totaling $112 million and 7

scopes of telecommunications work totaling $67 million. Subsequent

to the end of the fourth quarter, bidding and award activity for

the Company's services continues to be strong including the

previously announced award of a multi-year construction and project

management contract with American Transmission Company which will

add approximately $100 million to our backlog. Twelve Months

Financial Review Revenues for the twelve months ended December 31,

2006 increased $139.2 million, or 16%, to $992.3 million, compared

to $853.1 million for 2005 due primarily to growth in revenues from

our electric and telecommunications end markets with natural gas

end market revenues comparable to 2005. Net income for 2006 was

$26.1 million, or $0.65 per diluted share, versus $13.7 million, or

$0.34 per diluted share, for the prior year. Net income for 2006

included a non-cash charge associated with the refinancing of our

bank debt of $0.06 per diluted share, stock-based compensation

expenses of $0.05 per diluted share pursuant to SFAS 123R and $0.02

per diluted share of amortization of intangible assets. Excluding

the items in the attached table, income as adjusted (non-GAAP) was

$31.7 million for 2006 versus $14.0 million for 2005. David Helwig,

Chairman, President and Chief Executive Officer, said, "We are very

pleased with the strength of our earnings for the quarter, the

sequential increase in our backlog and the growth in our earnings

for the year. We continue to believe that we are well positioned to

benefit from growth opportunities in our end markets including

opportunities in electric transmission and telecommunications

high-bandwidth infrastructures. Our continued efforts to capitalize

on the breadth and strength of our complementary services and the

level of activity in our end markets are encouraging; however, as

we have said previously, our quarterly revenue and earnings will

continue to depend on the timing and scope of contract awards,

especially those for large electric projects, and our performance

on those contracts." Conference Call InfraSource has scheduled a

conference call for March 5, 2007 at 9:00AM EDT to discuss the

results for the quarter and its updated guidance. This conference

call will be webcast live on the InfraSource website at

http://www.infrasourceinc.com/ by clicking on the investors,

webcasts & presentations links. A webcast replay will be

available immediately following the call at the same location on

the website through March 4, 2008. For those investors who prefer

to participate in the conference call by phone, please dial (480)

629-9562. An audio replay of the conference call will be available

shortly after the call through March 12, 2007 by calling (303)

590-3030 and using passcode 3705229. For more information, please

contact Mahmoud Siddig at Taylor Rafferty at (212) 889-4350. About

InfraSource InfraSource Services, Inc. (NYSE:IFS) is one of the

largest specialty contractors servicing electric, natural gas and

telecommunications infrastructure in the United States. InfraSource

designs, builds, and maintains transmission and distribution

networks for utilities, power producers, and industrial customers.

Further information can be found at http://www.infrasourceinc.com/.

Safe Harbor Statement Certain statements contained in this press

release are forward-looking statements. These forward-looking

statements are based upon our current expectations about future

events. When used in this press release, the words "believe,"

"anticipate," "intend," "estimate," "expect," "will," "should,"

"may," and similar expressions, or the negative of such words and

expressions, are intended to identify forward-looking statements,

although not all forward- looking statements contain such words or

expressions. These forward-looking statements generally relate to

our plans, objectives and expectations for future operations and

are based upon management's current estimates and projections of

future results or trends. However, these statements are subject to

a number of known and unknown risks, uncertainties and other

factors affecting our business that could cause our actual results

to differ materially from those contemplated by the statements. You

should read this press release completely and with the

understanding that actual future results may be materially

different from what we expect as a result of these risks and

uncertainties and other factors, which include, but are not limited

to: (1) technological, structural and cyclical changes that could

reduce the demand for the services we provide; (2) loss of key

customers; (3) the impact of variations between actual and

estimated costs under our contracts, particularly our fixed-price

contracts; (4) our ability to attract and retain qualified

personnel; (5) our ability to successfully bid for and perform

large-scale project work in accordance with our estimated costs;

(6) work hindrance due to inclement weather events; (7) the

definitive award of new contracts and the timing of the performance

of those contracts; (8) project delays or cancellations; (9) the

failure to meet schedule or performance requirements of our

contracts; (10) the uncertainty of implementation of the recently

enacted federal energy legislation; (11) the presence of

competitors with greater financial resources and the impact of

competitive products, services and pricing; (12) successful

integration of acquisitions into our business; (13) close out of

certain of our projects may or may not occur as anticipated or may

be unfavorable to us; and (14) other factors detailed from time to

time in our reports and filings with the Securities and Exchange

Commission. Except as required by law, we do not intend to update

forward- looking statements even though our situation may change in

the future. INFRASOURCE SERVICES, INC. AND SUBSIDIARIES

Consolidated Statements of Income (Unaudited) (In thousands, except

per share data) Three Months Three Months Ended Ended December 31,

December 31, 2005 2006 Revenues $220,431 $247,889 Cost of revenues

188,018 212,004 Gross profit 32,413 35,885 Selling, general and

administrative expenses 19,886 23,573 Provision for uncollectible

accounts 11 1,464 Amortization of intangible assets 600 256 Income

from operations 11,916 10,592 Interest income 60 315 Interest

expense (2,285) (1,711) Other income, net 914 1,699 Income from

continuing operations before income taxes 10,605 10,895 Income tax

expense 4,546 3,621 Income from continuing operations 6,059 7,274

Discontinued operations: Loss from discontinued operations (net of

income tax benefit of $(142) and $(8), respectively) (270) (28)

Gain on disposition of discontinued operation (net of income tax

(benefit) provision of $(60) and $187, respectively) 42 308 Net

income $5,831 $7,554 Basic income (loss) per share: Income from

continuing operations $0.16 $0.18 Loss from discontinued operations

(0.01) (0.00) Gain on disposition of discontinued operation - 0.01

Net income $0.15 $0.19 Weighted average basic common shares

outstanding 39,337 40,052 Diluted income (loss) per share: Income

from continuing operations $0.16 $0.18 Loss from discontinued

operations (0.01) (0.00) Gain on disposition of discontinued

operation - (0.01) Net income $0.15 $0.19 Weighted average diluted

common shares outstanding 40,141 40,621 INFRASOURCE SERVICES, INC.

AND SUBSIDIARIES Consolidated Statements of Income (Unaudited) (In

thousands, except per share data) Year Ended Year Ended December

31, December 31, 2005 2006 Revenues $853,076 $992,305 Cost of

revenues 750,248 846,646 Gross profit 102,828 145,659 Selling,

general and administrative expenses 73,737 94,787 Merger related

costs 218 - Provision for uncollectible accounts 156 1,500

Amortization of intangible assets 4,911 1,004 Income from

operations 23,806 48,368 Interest income 388 953 Interest expense

(8,157) (6,908) Write-off of deferred financing costs - (4,296)

Other income, net 6,663 4,144 Income from continuing operations

before income taxes 22,700 42,261 Income tax expense 9,734 16,391

Income from continuing operations 12,966 25,870 Discontinued

operations: (Loss) income from discontinued operations (net of

income tax (benefit) provision of $(699) and $1, respectively)

(1,069) 2 Gain on disposition of discontinued operation (net of

income tax provision of $1,372 and $165, respectively) 1,832 273

Net income $13,729 $26,145 Basic income (loss) per share: Income

from continuing operations $0.33 $0.65 (Loss) income from

discontinued operations (0.03) 0.00 Gain on disposition of

discontinued operation 0.05 0.01 Net income $0.35 $0.66 Weighted

average basic common shares outstanding 39,129 39,757 Diluted

income (loss) per share: Income from continuing operations $0.32

$0.64 (Loss) income from discontinued operations (0.03) 0.00 Gain

on disposition of discontinued operation 0.05 0.01 Net income $0.34

$0.65 Weighted average diluted common shares outstanding 39,943

40,364 INFRASOURCE SERVICES, INC. AND SUBSIDIARIES Consolidated

Balance Sheets (Unaudited) (In thousands, except share data)

December 31, December 31, 2005 2006 Current assets: Cash and cash

equivalents $ 31,639 $26,209 Contract receivables (less allowances

for doubtful accounts of $3,184 and $3,770, respectively) 136,610

166,780 Costs and estimated earnings in excess of billings 84,360

59,012 Inventories 5,131 5,443 Deferred income taxes 4,683 8,201

Other current assets 7,678 6,384 Current assets - discontinued

operations 3,033 746 Total current assets 273,134 272,775 Property

and equipment (less accumulated depreciation of $55,701 and

$73,302, respectively) 143,881 154,578 Goodwill 138,054 146,933

Intangible assets (less accumulated amortization of $19,861 and

$20,865, respectively) 1,884 900 Deferred charges and other assets,

net 12,117 5,529 Assets held for sale - 517 Non-current assets -

discontinued operations 319 - Total assets $569,389 $581,232

Current liabilities: Current portion of long-term debt $889 $ 42

Current portion of capital lease obligations - 35 Short-term credit

facility borrowings - 1,077 Other liabilities - related parties

11,299 766 Accounts payable 50,923 47,846 Accrued compensation and

benefits 20,402 27,951 Other current and accrued liabilities 20,434

22,096 Accrued insurance reserves 30,550 36,166 Billings in excess

of costs and estimated earnings 15,012 23,245 Deferred revenues

6,590 6,188 Current liabilities - discontinued operations 1,501 -

Total current liabilities 157,600 165,412 Long-term debt, net of

current portion 83,019 50,014 Capital lease obligations, net of

current portion - 56 Deferred revenues 17,826 16,347 Other

long-term liabilities - related party 420 900 Deferred income taxes

3,320 3,750 Other long-term liabilities 5,298 5,568 Non-current

liabilities - discontinued operations 50 - Total liabilities

267,533 242,047 Commitments and contingencies Shareholders' equity:

Preferred stock, $.001 par value (authorized - 12,000,000 shares; 0

shares issued and outstanding) - - Common stock $.001 par value

(authorized - 120,000,000 shares; issued 39,396,694 and 40,263,739

shares, respectively, and outstanding - 39,366,824 and 40,233,869,

respectively) 39 40 Treasury stock at cost (29,870 shares) (137)

(137) Additional paid-in capital 278,387 288,517 Deferred

compensation (1,641) - Retained earnings 24,640 50,785 Accumulated

other comprehensive income (loss) 568 (20) Total shareholders'

equity 301,856 339,185 Total liabilities and shareholders' equity

$569,389 $581,232 INFRASOURCE SERVICES, INC. AND SUBSIDIARIES

Reconciliation of GAAP and Non-GAAP Financial Measures (Unaudited)

(In thousands) We believe investors' understanding of our operating

performance is enhanced by disclosing the following non-GAAP

financial measures: -- Net income, as adjusted ("Income as

adjusted"), which we define as GAAP net income, adjusted for

certain significant non-core items that, in management's opinion,

are not indicative of our core operating performance; -- EBITA from

continuing operations before extraordinary items, net ("EBITA from

continuing operations"), which we define as net income before

discontinued operations, income tax expense, interest expense,

interest income and amortization; -- EBITA from continuing

operations, as adjusted ("EBITA as adjusted"), which we define as

EBITA from continuing operations, adjusted for certain significant

items that, in management's opinion, are not indicative of our core

operating performance; -- EBITDA from continuing operations before

extraordinary items, net ("EBITDA from continuing operations"),

which we define as EBITA from continuing operations before

depreciation; and -- EBITDA from continuing operations, as adjusted

("EBITDA as adjusted"), which we define as EBITA as adjusted before

depreciation. The significant non-core items for the periods shown

are set forth in the tables below. We believe it is helpful to an

understanding of our business to assess the effects of these items

on our results of operations in order to evaluate our performance

from period to period on a more consistent basis. This presentation

should not be construed as an indication that similar charges will

not recur or that our future results will be unaffected by other

charges and gains we consider to be outside the ordinary course of

our business. We present these non-GAAP financial measures

primarily as supplemental performance measures because we believe

they facilitate operating performance comparisons from period to

period and company to company as they exclude certain items that we

believe are not representative of our core operations. In addition,

we believe that these measures are used by financial analysts as

measures of our financial performance and that of other companies

in our industry. Because Income as adjusted, EBITA from continuing

operations, EBITDA from continuing operations, EBITA as adjusted

and EBITDA as adjusted facilitate internal comparisons of our

historical financial position and operating performance on a more

consistent basis, we also use these measures for business planning

and analysis purposes, in measuring our performance relative to

that of our competitors and/or in evaluating acquisition

opportunities. In addition, we use certain of these measures in

establishing incentive compensation goals and/or determining

compliance with covenants in our senior credit facility. We use

EBITA from continuing operations and EBITA as adjusted in addition

to our other non-GAAP measures because they include all aspects of

our equipment charges, including both operating leases and

depreciation from owned equipment. We believe these are important

measures for analyzing our performance because they eliminate the

variation related to lease versus purchase decisions on capital

equipment. Because Income as adjusted, EBITA from continuing

operations, EBITDA from continuing operations, EBITA as adjusted

and EBITDA as adjusted have limitations as analytical tools, you

should not consider these measures in isolation or as a substitute

for analysis of our results as reported under GAAP. Some of these

limitations are: -- These measures do not include cash expenditures

for capital purchases or contractual commitments; -- Although

depreciation and amortization are non-cash charges, the assets

being depreciated and amortized will often have to be replaced in

the future, and these measures do not reflect cash requirements for

such replacements; -- These measures do not reflect the non-cash

costs of our stock-based compensation plans, which are an on-going

component of our executive compensation program. -- These measures

do not reflect changes in, or cash requirements necessary to

service interest or principal payments on, our indebtedness; --

Income as adjusted, EBITA as adjusted and EBITDA as adjusted do not

necessarily reflect adjustments for all earnings or charges

resulting from matters that we may consider not to be indicative of

our core operations; and -- Other companies, including companies in

our industry, may calculate these measures differently than we do,

limiting their usefulness as a comparative measure. INFRASOURCE

SERVICES, INC. AND SUBSIDIARIES Reconciliation of GAAP and Non-GAAP

Financial Measures (Unaudited) (In thousands) Three Months Three

Months Ended Ended December 31, December 31, 2005 2006 Net income

(GAAP) $5,831 $7,554 Loss from discontinued operations (net of tax)

270 28 Gain on disposition of discontinued operation (net of tax)

(42) (308) Amortization of intangible assets relating to purchase

accounting 343 171 Stock compensation expenses 261 458 Income as

adjusted (a non-GAAP financial measure) $6,663 $7,903 Three Months

Three Months Ended Ended December 31, December 31, 2005 2006 Net

income (GAAP) $5,831 $7,554 Loss from discontinued operations (net

of tax) 270 28 Gain on disposition of discontinued operation (net

of tax) (42) (308) Income tax expense 4,546 3,621 Interest expense

2,285 1,711 Interest income (60) (315) Amortization of intangible

assets relating to purchase accounting 600 256 EBITA from

continuing operations (a non-GAAP financial measure) 13,430 12,547

Stock compensation expenses 457 686 EBITA as adjusted (a non-GAAP

financial measure) $13,887 $13,233 Depreciation 6,916 5,063 EBITDA

from continuing operations (a non-GAAP financial measure) $20,346

$17,610 EBITDA as adjusted (a non-GAAP financial measure) $20,803

$18,296 INFRASOURCE SERVICES, INC. AND SUBSIDIARIES Reconciliation

of GAAP and Non-GAAP Financial Measures (Unaudited) (In thousands)

Year Ended Year Ended December 31, December 31, 2005 2006 Net

income (GAAP) $13,729 $26,145 Loss (income) from discontinued

operations (net of tax) 1,069 (2) Gain on disposition of

discontinued operation (net of tax) (1,832) (273) Amortization of

intangible assets relating to purchase accounting 2,805 615

Litigation judgment reversal (2,162) - Stock compensation expenses

406 2,118 Secondary offering expenses - 451 Write-off of deferred

financing costs - 2,630 Income as adjusted (a non-GAAP financial

measure) $14,015 $31,684 Year Ended Year Ended December 31,

December 31, 2005 2006 Net income (GAAP) $13,729 $26,145 Loss

(income) from discontinued operations (net of tax) 1,069 (2) Gain

on disposition of discontinued operation (net of tax) (1,832) (273)

Income tax expense 9.734 16,391 Interest expense 8,157 6,908

Interest income (388) (953) Amortization of intangible assets

relating to purchase accounting 4,911 1,004 EBITA from continuing

operations (a non-GAAP financial measure) 35,380 49,220 Litigation

judgment reversal (3,785) - Stock compensation expenses 711 3,460

Secondary offering expenses - 737 Write-off of deferred financing

costs - 4,296 EBITA as adjusted (a non-GAAP financial measure)

$32,306 $57,713 Depreciation 27,540 25,601 EBITDA from continuing

operations (a non-GAAP financial measure) $62,920 $74,821 EBITDA as

adjusted (a non-GAAP financial measure) $59,846 $83,314 INFRASOURCE

SERVICES, INC. AND SUBSIDIARIES Supplemental Financial Data

(Unaudited) (In millions) Revenues by End Market Three Months Ended

Three Months Ended December 31, December 31, 2005 2006

Increase/(decrease) $ % Electric - Transmission $ 48.0 21.8% $ 66.4

26.8% $ 18.4 38.3% - Substation 32.4 14.7% 47.0 19.0% 14.6 45.1% -

Other Electric 43.8 19.9% 39.9 16.1% (3.9) -8.9% Subtotal 124.2

56.4% 153.3 61.8% 29.1 23.4% Natural Gas 63.2 28.7% 66.1 26.7% 2.9

4.6% Telecommunications 28.9 13.1% 25.2 10.2% (3.7) -12.8% Other

4.1 1.9% 3.3 1.3% (0.8) -19.5% Total $220.4 100.0% $247.9 100.0% $

27.5 12.5% Year Ended Year Ended December 31, December 31, 2005

2006 Increase/(decrease) $ % Electric - Transmission $160.7 18.8%

$259.6 26.2% $98.9 61.5% - Substation 138.6 16.2% 204.1 20.6% 65.5

47.3% - Other Electric 171.1 20.1% 144.7 14.6% (26.4) -15.4%

Subtotal 470.4 55.1% 608.4 61.3% 138.0 29.3% Natural Gas 265.5

31.1% 268.6 27.1% 3.1 1.2% Telecommunications 101.2 11.9% 105.5

10.6% 4.3 4.2% Other 16.0 1.9% 9.8 1.0% (6.2) -38.8% Total $853.1

100.0% $992.3 100.0% $139.2 16.3% Backlog by End Market December

31, December 31, 2005 2006 Increase/(decrease) $ % Electric -

Transmission $184.3 20.9% $138.8 15.4% $(45.5) -24.7% - Substation

123.9 14.1% 132.0 14.6% 8.1 6.5% - Other Electric 45.5 5.2% 102.4

11.4% 56.9 125.1% Subtotal 353.7 40.1% 373.2 41.4% 19.5 5.5%

Natural Gas 284.4 32.3% 245.6 27.2% (38.8) -13.6%

Telecommunications 232.4 26.4% 254.0 28.2% 21.6 9.3% Other 10.5

1.2% 29.3 3.2% 18.8 179.0% Total $881.0 100.0% $902.1 100.0% $21.1

2.4% September 30, December 31, 2006 2006 Increase/(decrease) $ %

Electric - Transmission $152.4 19.0% $138.8 15.4% $(13.6) -8.9% -

Substation 132.2 16.5% 132.0 14.6% (0.2) -0.2% - Other Electric

67.2 8.4% 102.4 11.4% 35.2 52.4% Subtotal 351.8 43.9% 373.2 41.4%

21.4 6.1% Natural Gas 180.4 22.5% 245.6 27.2% 65.2 36.1%

Telecommunications 245.5 30.6% 254.0 28.2% 8.5 3.5% Other 24.0 3.0%

29.3 3.2% 5.3 22.1% Total $801.7 100.0% $902.1 100.0% $100.4 12.5%

Note: Percentages may not add due to rounding. CONTACT: Terence R.

Montgomery 610-480-8000 Mahmoud Siddig 212-889-4350 DATASOURCE:

InfraSource Services, Inc. CONTACT: Terence R. Montgomery,

+1-610-480-8000, , Mahmoud Siddig, +1-212-889-4350, Web site:

http://www.infrasourceinc.com/

Copyright

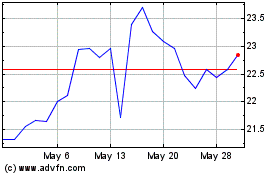

Intercorp Financial Serv... (NYSE:IFS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Intercorp Financial Serv... (NYSE:IFS)

Historical Stock Chart

From Jul 2023 to Jul 2024