- Company exceeds both revenue and Adjusted EBITDA guidance for

Q1

- Q1 revenue grew to $36.7 million, up 21% year-over-year

- Q1 net loss improved year-over-year to $6.2 million and

Adjusted EBITDA* improved to $4.4 million, representing a 12%

Adjusted EBITDA margin*

- Company raises full-year 2024 guidance

Innovid Corp. (NYSE:CTV) (the "Company"), an independent

software platform for the creation, delivery, measurement, and

optimization of advertising across connected TV (CTV), linear TV,

and digital, today announced financial results for the first

quarter ended March 31, 2024.

“We’re very proud to start 2024 with solid business momentum. We

exceeded our revenue and Adjusted EBITDA guidance, demonstrated

continuous improvement, and generated positive free cash flow for

the quarter,” said Zvika Netter, Co-Founder and CEO. "Most

recently, we launched our Harmony initiative and product suite to

optimize the CTV advertising ecosystem. This initiative brings

value to advertisers, publishers, technology players, and

ultimately, to viewers, as we seek to keep TV open for everyone and

controlled by no one.”

First Quarter 2024 Financial Summary

- Revenue increased to $36.7 million, reflecting year-over-year

growth of 21%.

- Net loss was $6.2 million, compared to a net loss of $8.6

million for the same period in 2023.

- Adjusted EBITDA* grew to $4.4 million, compared to $0.1 million

for the same period in 2023, representing a 12.0% Adjusted EBITDA

margin.*

- Operating cash flow was $4.7 million, compared to $0.4 million

in the same period of 2023.

- Free cash flow* was $2.0 million, an increase of $4.8 million,

compared to a use of $2.8 million in the same period in 2023.

Recent Business Highlights

- Recent new client wins, product expansions, and renewals with

leading brands such as Eli Lilly, Haleon, Homes.com, and Verizon;

as well as new publishers, including the Tennis Channel owned by

Sinclair.

- Launched Harmony initiative to optimize CTV advertising at the

infrastructure level to improve efficiency, enhance transparency

and control, reduce carbon emissions, and increase ROI to

ultimately provide better viewing experiences.

- Launched Harmony Direct, the first in a wave of new product

innovations released as part of the Harmony initiative. Harmony

Direct streamlines the supply path for non-biddable guaranteed

media to its purest form, and aims to direct more advertiser

dollars toward working media, increase revenue opportunities for

publishers, and create a more sustainable, transparent path. Agency

and publisher partners, including Assembly, CMI Media Group, PMG,

RPA, and Roku, are among the first using Harmony Direct.

- Won “Best Measurement Tool” in the 2024 Digiday Video & TV

Awards, highlighting the companies, campaigns, and technology

modernizing video and TV. Innovid is the first to receive

recognition within this new category.

- Launched a series of first-to-market interactive ads in

partnership with Paramount+ during SuperBowl LVIII - the

most-streamed Super Bowl ever. The ads engaged consumers with new

‘Add to Watchlist’ units to promote Paramount+ content, as well as

interactive ads for Pfizer, which drove viewers to their “Let’s

Outdo Cancer” website.

Financial Outlook

Innovid anticipates continued revenue growth and margin

expansion in 2024 as reflected in the following financial guidance

for Q2 and updated outlook for full year 2024:

- Q2 2024 revenue in a range between $37.5 million and $39.5

million, reflecting year-over-year growth between 9% and 14%.

- Q2 2024 Adjusted EBITDA* in a range between $5.0 million and

$6.0 million.

- FY 2024 revenue in a range between $156 million and $163

million, representing annual growth of between 12% and 17%. This

reflects an increase from prior guidance of $154 million and $162

million.

- FY 2024 Adjusted EBITDA* in a range between $24 million and $29

million, raised from the prior range of $22 million and $28

million.

*See non-GAAP financial measures and reconciliation of GAAP to

non-GAAP tables. This press release does not include a

reconciliation of forward-looking Adjusted EBITDA to

forward-looking GAAP Net Income (Loss) because the Company is

unable, without making unreasonable efforts, to provide a

meaningful or reasonably accurate calculation or estimation of

certain reconciling items which could be significant to the

Company’s results.

Conference Call

The Company will host a conference call and webcast to discuss

first quarter 2024 financial results today at 8:30 a.m. Eastern

Time. Hosting the call will be Zvika Netter, Co-founder and Chief

Executive Officer and Anthony Callini, Chief Financial Officer. The

conference call will be available via webcast at

investors.innovid.com. To participate via telephone, please dial

(+1) 866-682-6100 (toll free) or 862-298-0702 (toll-free

international).

Following the call, a replay of the webcast will be available

for 90 days on the Innovid Investor Relations website.

Non-GAAP Financial Measures

This press release contains non-GAAP financial measures under

the rules of the U.S. Securities and Exchange Commission. This

non-GAAP information supplements and is not intended to represent a

measure of performance in accordance with disclosures required by

generally accepted accounting principles. Non-GAAP financial

measures are used internally as measures of operational efficiency

to understand and evaluate our core business operations. as well as

comparisons to peers as similar measures are frequently used by

securities analysts, investors, ratings agencies and other

interested parties to evaluate businesses in our industry.

Accordingly, Innovid believes it is useful for investors and others

to review both GAAP and non-GAAP measures in order for (a)

period-to-period comparisons of our core business, (b) comparisons

to peers as similar measures are frequently used by securities

analysts, investors, ratings agencies and other interested parties

to evaluate businesses in our industry, and (c) providing an

understanding and evaluation of our trends when comparing our

operating results, on a consistent basis, by excluding items that

we do not believe are indicative of our core operating performance.

However, these non-GAAP financial measures should not take the

place of GAAP financial measures in evaluating our business. The

primary limitations associated with the use of non-GAAP financial

measures are that these measures may not be directly comparable to

the amounts reported by other companies and they do not include all

items of income and expense that affect operations. Innovid

management compensates for these limitations by considering the

company’s financial results and outlook as determined in accordance

with GAAP and by providing a detailed reconciliation of the

non-GAAP financial measures to the most directly comparable GAAP

measures in the tables attached to this press release. We are not

able to provide a reconciliation of the projected Adjusted EBITDA

to expected net (loss) income attributable to Innovid for the

second quarter of 2024 or the full year 2024, without unreasonable

effort. This is due to the unknown effect, timing, and potential

significance of the effects of taxes on income in multiple

jurisdictions, finance (income)/expenses including valuations,

among others. These items have in the past, and may in the future,

significantly affect GAAP results in a particular period.

Forward-Looking Statements

This press release includes "forward-looking statements" within

the meaning of the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1996. The Company's actual

results may differ from its expectations, estimates, and

projections and consequently, you should not rely on these

forward-looking statements as predictions of future events. Words

such as "expect," "estimate," "project," "budget," "forecast,"

"anticipate," "intend," "plan," "may," "will," "could," "should,"

"believes," "predicts," "potential," "continue," "aim," and similar

expressions are intended to identify such forward-looking

statements. These forward-looking statements include, without

limitation, the Company's expectations regarding its future

financial results, expected growth, and future market opportunity.

These forward-looking statements involve significant risks and

uncertainties that could cause the actual results to differ

materially from the expected results, including Innovid's ability

to achieve and, if achieved, maintain profitability, decrease

and/or changes in CTV audience viewership behavior, Innovid's

failure to make the right investment decisions or to innovate and

develop new solutions, inaccurate estimates or projections of

future financial performance, Innovid's failure to manage growth

effectively, the dependence of Innovid's revenues and business on

the overall demand for advertising and a limited number of

advertising agencies and advertisers, the actual or potential

impacts of international conflicts and humanitarian crises on

global markets, the rejection of digital advertising by consumers,

future restrictions on Innovid's ability to collect, use and

disclose data, market pressure resulting in a reduction of

Innovid's revenues per impression, Innovid's failure to adequately

scale its platform infrastructure, exposure to fines and liability

if advertisers, publishers and data providers do not obtain

necessary and requisite consents from consumers for Innovid to

process their personal data, competition for employee talent,

seasonal fluctuations in advertising activity, payment-related

risks, interruptions or delays in services from third parties,

errors, defects, or unintended performance problems in Innovid's

platform, intense market competition, failure to comply with the

terms of third party open source components, changes in tax laws or

tax rulings, failure to maintain an effective system of internal

controls over financial reporting, failure to comply with data

privacy and data protection laws, infringement of third party

intellectual property rights, difficulty in enforcing Innovid's own

intellectual property rights, system failures, security breaches or

cyberattacks, additional financing if required may not be

available, the volatility of the price of Innovid's common stock

and warrants, and other important factors discussed under the

caption "Risk Factors" in Innovid's Annual Report on Form 10-K

filed with the SEC on February 29, 2024, as such factors may be

updated from time to time in its other filings with the SEC,

accessible on the SEC's website at www.sec.gov and the Investors

Relations section of Innovid's website at investors.innovid.com.

You should carefully consider the risks and uncertainties described

in the documents filed by the Company from time to time with the

U.S. Securities and Exchange Commission. These filings identify and

address other important risks and uncertainties that could cause

actual events and results to differ materially from those contained

in the forward-looking statements. Most of these factors are

outside the Company's control and are difficult to predict. The

Company cautions not to place undue reliance upon any

forward-looking statements, including projections, which speak only

as of the date made. The Company does not undertake or accept any

obligation to release publicly any updates or revisions to any

forward-looking statements to reflect any change in its

expectations or any change in events, conditions or circumstances

on which any such statement is based.

About Innovid

Innovid (NYSE:CTV) is an independent software platform for the

creation, delivery, measurement, and optimization of advertising

across connected TV (CTV), linear, and digital. Through a global

infrastructure that enables cross-platform ad serving, data-driven

creative, and measurement, Innovid offers its clients always-on

intelligence to optimize advertising investment across channels,

platforms, screens, and devices. Innovid is an independent platform

that leads the market in converged TV innovation, through

proprietary technology and exclusive partnerships designed to

reimagine TV advertising. Headquartered in New York City, Innovid

serves a global client base through offices across the Americas,

Europe, and Asia Pacific. To learn more, visit

https://www.innovid.com/ or follow us on LinkedIn or X.

INNOVID, CORP. AND ITS

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited and in thousands,

except share and per share data)

March 31, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

31,574

$

49,585

Trade receivables, net

41,814

46,420

Prepaid expenses and other current

assets

6,099

5,615

Total current assets

79,487

101,620

Long-term restricted deposits

434

412

Property and equipment, net

19,613

18,419

Goodwill

102,473

102,473

Intangible assets, net

23,314

24,318

Operating lease right of use asset

11,129

1,435

Other non-current assets

1,055

1,278

Total assets

$

237,505

$

249,955

Liabilities and Stockholders'

Equity

Current liabilities:

Trade payables

$

1,527

$

2,810

Employees and payroll accruals

11,324

14,060

Lease liabilities - current portion

928

1,200

Accrued expenses and other current

liabilities

10,835

7,426

Total current liabilities

24,614

25,496

Long-term debt

—

20,000

Lease liabilities - non-current

portion

10,630

634

Other non-current liabilities

7,833

7,528

Warrants liability

511

307

Common stock

13

13

Additional paid-in capital

382,935

378,774

Accumulated deficit

(189,031

)

(182,797

)

Total stockholders’ equity

193,917

195,990

Total liabilities and stockholders’

equity

$

237,505

$

249,955

INNOVID, CORP. AND ITS

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited and in thousands,

except share and per share data)

Three months ended March

31,

2024

2023

Revenue

$

36,738

$

30,485

Cost of revenue (1)

8,732

8,265

Research and development (1)

6,321

7,117

Sales and marketing (1)

11,626

11,637

General and administrative (1)

10,535

9,650

Depreciation and amortization

2,624

2,030

Operating loss

(3,100

)

(8,214

)

Finance (income) expenses, net

(42

)

(2,475

)

Loss before taxes

(3,058

)

(5,739

)

Taxes on income

3,176

2,824

Net loss

$

(6,234

)

$

(8,563

)

Net loss per share common share—basic and

diluted

$

(0.04

)

$

(0.06

)

Weighted-average number of shares used in

computing net loss per share:

Basic and diluted

142,376,026

136,008,998

(1) Exclusive of depreciation and

amortization presented separately.

INNOVID, CORP. AND ITS

SUBSIDIARIES

CONDENSED STATEMENTS

STOCKHOLDERS’ EQUITY

(Unaudited and in thousands,

except share and per share data)

Common stock

Additional paid-in

capital

Accumulated deficit

Total stockholders’

equity

Number

Amount

Balance as of December 31, 2022

133,882,414

$

13

$

356,801

$

(150,886

)

$

205,928

Stock-based compensation

4,897

4,897

Issuance of common stock

—exercised options and RSUs vested

2,734,320

—

250

250

Net loss

(8,563

)

(8,563

)

Balance as of March 31, 2023

136,616,734

$

13

$

361,948

$

(159,449

)

$

202,512

Common stock

Additional paid-in

capital

Accumulated deficit

Total stockholders’

equity

Number

Amount

Balance as of December 31, 2023

141,194,179

$

13

$

378,774

$

(182,797

)

$

195,990

Stock-based compensation

4,118

4,118

Issuance of common stock

—exercised options and RSUs vested

2,667,430

—

43

43

Net loss

(6,234

)

(6,234

)

Balance as of March 31, 2024

143,861,609

$

13

$

382,935

$

(189,031

)

$

193,917

INNOVID, CORP. AND ITS

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited and in thousands)

Three months ended March

31,

2024

2023

Cash flows from operating activities:

Net loss

$

(6,234

)

$

(8,563

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

2,624

2,030

Stock-based compensation

3,838

4,533

Change in fair value of warrants

204

(2,714

)

Loss on foreign exchange, net

90

—

Changes in operating assets and

liabilities:

Trade receivables, net

4,606

3,708

Prepaid expenses and other assets

(201

)

(2,922

)

Operating lease right of use assets

376

459

Trade payables

(1,282

)

1,558

Employee and payroll accruals

(2,736

)

(299

)

Operating lease liabilities

(347

)

(584

)

Accrued expenses and other liabilities

3,714

3,162

Net cash provided by operating

activities

4,652

368

Cash flows from investing activities:

Internal use software capitalization

(2,269

)

(3,091

)

Purchases of property and equipment

(272

)

(89

)

Withdrawal of short-term bank deposits

—

10,000

Investment in short-term bank deposits

(53

)

7

Net cash (used in) provided by investing

activities

(2,594

)

6,827

Cash flows from financing activities:

Proceeds from loan

—

5,000

Payment on loan

(20,000

)

(5,000

)

Proceeds from exercise of options

43

250

Net cash (used in) provided by financing

activities

(19,957

)

250

Effect of exchange rates on cash, cash

equivalents and restricted cash

(90

)

—

(Decrease) increase in cash, cash

equivalents, and restricted cash

(17,989

)

7,445

Cash, cash equivalents, and restricted

cash at the beginning of the period

49,997

37,971

Cash, cash equivalents, and restricted

cash at the end of the period

$

32,008

$

45,416

INNOVID, CORP. AND ITS

SUBSIDIARIES

OTHER INFORMATION

(Unaudited and in thousands)

RECONCILIATION OF GAAP NET

LOSS TO NON-GAAP ADJUSTED EBITDA AND ADJUSTED EBITDA MARGIN

PERCENT

Three months ended March

31,

2024

2023

Net loss

$

(6,234

)

$

(8,563

)

Net loss margin percent

(17

)%

(28

)%

Depreciation and amortization

2,624

2,030

Stock-based compensation

3,838

4,625

Finance (income) expenses, net (a)

(42

)

(2,475

)

Retention bonus expenses (b)

92

297

Legal claims

928

314

Severance cost (c)

—

821

Other

14

272

Taxes on income

3,176

2,824

Adjusted EBITDA

$

4,396

$

145

Adjusted EBITDA margin percent

12.0

%

0.5

%

(a) Finance (income) expenses, net

consists mostly of remeasurement related to revaluation of our

warrants, remeasurement of our foreign subsidiary’s monetary

assets, liabilities and operating results, and our interest

expense.

(b) Retention bonus expenses consists of

retention bonuses for TVS employees.

(c) Severance cost is related to the

personnel reductions that occurred during the first quarter of

2023.

RECONCILIATION OF NET CASH PROVIDED BY

OPERATING ACTIVITIES TO NON-GAAP FREE CASH FLOW

Three months ended March

31,

2024

2023

Net cash provided by operating

activities

$

4,652

$

368

Gain (loss) on foreign exchange, net

(90

)

—

Capital expenditures

(2,541

)

(3,180

)

Free Cash Flow

$

2,021

$

(2,812

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507073455/en/

Investors Brinlea Johnson IR@innovid.com

Media Megan Garnett Coyle megan@innovid.com

Caroline Yodice cyodice@daddibrand.com

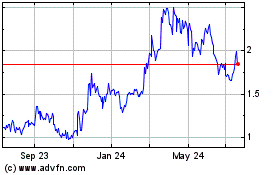

Innovid (NYSE:CTV)

Historical Stock Chart

From Dec 2024 to Jan 2025

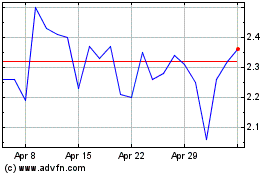

Innovid (NYSE:CTV)

Historical Stock Chart

From Jan 2024 to Jan 2025