INNOVATE Corp. Announces Preliminary Results of Rights Offering

April 22 2024 - 8:01AM

INNOVATE Corp. (“INNOVATE” or the “Company”) (NYSE: VATE), a

diversified holding company, announced today the preliminary

results of its successful rights offering, which expired

at 5:00 p.m., New York City time, on April 19,

2024 (the “expiration date”). According to Computershare

Trust Company, N.A. (the “subscription agent”), as of the

expiration date, 18.1 million basic subscription rights were

exercised to purchase an aggregate of 5.2 million shares of common

stock and 0.1 million additional shares of common stock were

subscribed for under the over-subscription privilege, subject to

proration.

Further, in accordance with the Investment

Agreement (the “Investment Agreement”) entered into by the Company

with Lancer Capital LLC (“Lancer Capital”), an investment

fund led by Avram Glazer, the Chairman of the Board of

Directors of the Company and the Company’s largest

stockholder, Lancer Capital agreed to partially backstop

the rights offering in an amount not to exceed $19.0

million by purchasing newly issued Series C Non-Voting

Convertible Participating Preferred Stock, par

value $0.001 per share (the “preferred stock”). Based on

the preliminary results, we expect that 15.3 thousand shares of

preferred stock at a price of $1,000 per share will be purchased

under the backstop commitment. This includes 6.3 thousand shares of

preferred stock to be purchased at the upcoming closing and 9.0

thousand shares already purchased as part of an equity advance

arrangement under the Investment Agreement (the “equity advance”).

On March 28, 2024, the Company issued and sold 25.0 thousand shares

of the preferred stock to Lancer Capital for an aggregate purchase

price of $25.0 million under the equity advance. The remaining 16.0

thousand shares of preferred stock purchased under the equity

advance are part of the previously announced concurrent private

placement. The preferred stock can be convertible into common stock

at the price equivalent to the subscription price under the rights

offering contingent on shareholder approval, which will be voted on

at the next annual meeting.

The shares of common stock to be issued at the

closing of the rights offering will be purchased at the

subscription price of $0.70 per whole share. The Company

expects the subscription agent to distribute the shares of common

stock and the proceeds from the rights offering on or

about April 24, 2024, subject to customary closing

conditions.

The results of the rights offering are

preliminary and subject to change pending finalization of

subscription procedures by the subscription agent. The Company

expects to issue a press release on April 24, 2024, to

announce the final results of the rights offering.

The Company will receive aggregate gross

proceeds of approximately $35.0 million from the rights

offering and concurrent private placement, and expects to use the

proceeds for general corporate purposes, including debt service and

for working capital.

If a holder did not exercise its subscription

rights prior to the expiration date, such rights have expired and

are void and have no value. Investors who have participated in the

rights offering should expect to see the shares of common stock

issued to them in uncertificated book-entry form. Any excess

subscription payments received by subscription agent will be

returned by the subscription agent to investors, without interest

or deduction, through the same method by which they participated in

the rights offering.

The rights offering was made pursuant to

INNOVATE’s effective shelf registration statement on Form S-3,

filed with the SEC on September 29, 2023, and declared effective on

October 6, 2023, and a prospectus supplement containing the

detailed terms of the rights offering filed with the SEC on March

8, 2024, as amended by that certain Amendment No. 1 to the

prospectus supplement, filed with the SEC on March 25, 2024, and

further amended by that certain Amendment No. 2 to the prospectus

supplement, filed with the SEC on April 9,

2024. The information in this press

release is not complete and is subject to change, including with

respect to the expected closing date of the rights offering. This

press release shall not constitute an offer to sell or a

solicitation of an offer to buy any securities (including without

limitation the preferred stock to be issued and sold in the

concurrent private placement), nor shall there be any offer,

solicitation or sale of the securities in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful under

the securities laws of such state or jurisdiction. The rights

offering was made only by means of a prospectus and a related

prospectus supplement, copies of which were distributed to all

eligible rights holders as of the rights offering record date and

may also be obtained free of charge at the website maintained by

the SEC

at www.sec.gov or by

contacting the information agent for the rights

offering.

The preferred stock to be issued to

Lancer Capital pursuant to the backstop commitment and the

concurrent private placement will not be registered under the

Securities Act of 1933, as amended, and may not be offered or sold

in the United States absent registration or an applicable exemption

from registration requirements.

About INNOVATE

INNOVATE Corp. is a portfolio of

best-in-class assets in three key areas of the new economy –

Infrastructure, Life Sciences and Spectrum. Dedicated to

stakeholder capitalism, INNOVATE employs approximately 4,000 people

across its subsidiaries. For more information, please

visit: www.INNOVATECorp.com.

Cautionary Statement Regarding

Forward-Looking Statements

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995: This press release

contains, and certain oral statements made by our representatives

from time to time may contain, forward-looking statements regarding

the proposed rights offering, including, among others, statements

related to the expected timing, eligible offerees, backstop

purchasers and expectations regarding participation in

the rights offering, the use of proceeds from the rights offering,

the size of the rights offering and other terms of the rights

offering, all of which involve risks, assumptions and

uncertainties, many of which are outside of the Company’s control,

and are subject to change. Accordingly, no assurance can be given

that the rights offering will be consummated on the terms described

above or at all. All forward-looking statements speak only as of

the date made, and unless legally required, INNOVATE undertakes no

obligation to update or revise publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Contact:

Solebury Strategic CommunicationsAnthony

Rozmusir@innovatecorp.com(212) 235-2691

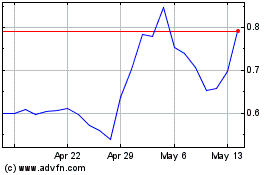

INNOVATE (NYSE:VATE)

Historical Stock Chart

From Oct 2024 to Nov 2024

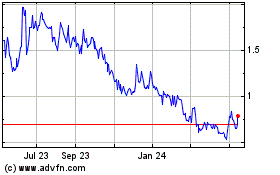

INNOVATE (NYSE:VATE)

Historical Stock Chart

From Nov 2023 to Nov 2024