Infosys Grapples With Whistleblower Complaints in the U.S. and India

October 23 2019 - 8:07AM

Dow Jones News

By Newley Purnell

NEW DELHI--Whistleblower complaints roiling one of India's

biggest outsourcing companies come at a bad time for an industry

that is already struggling to boost growth.

Shares in Infosys Ltd. remained depressed Wednesday as investors

tried to factor in what the company's investigation into anonymous

complaints of alleged "unethical practices" at the outsourcer will

mean for its future. The company declined to disclose any new

details on the accusations Wednesday.

Nandan Nilekani, Infosys's co-founder and chairman, said in a

statement to stock exchanges in India and the U.S. Tuesday that a

member of the company's board received two anonymous complaints

that have been placed before its audit committee and nonexecutive

members of the board. Infosys is listed on the New York Stock

Exchange, Nasdaq, the National Stock Exchange of India and the

Bombay Stock Exchange.

Among the complaints are allegations related to the chief

executive's travel to Mumbai and the U.S., the statement said.

Infosys had been made aware last week of a letter to the Office of

the Whistleblower at the Securities and Exchange Commission, an

Infosys spokesman said Wednesday.

The letter refers to one of the complaints and "emails and voice

recordings in support of the allegations," Infosys said in a

statement, adding that the company doesn't have a copy of the

emails or recordings.

"These complaints are being dealt with in an objective manner,"

the company said. Infosys's chief executive and chief financial

officer have been recused from the investigation to ensure its

independence.

The law firm Shardul Amarchand Mangaldas & Co. will conduct

an independent investigation, Infosys said. An Infosys spokesman

declined to comment Wednesday when asked when the investigation

would be completed.

The issue presents the latest challenge for the Bangalore-based

company, whose former chief executive resigned in 2017, citing a

resistance to change at the company that deteriorated into

accusations of mismanagement.

Infosys, an outsourcing pioneer that employs hundreds of

thousands of staff has, like its biggest Indian rivals Tata

Consultancy Services Ltd. and Wipro Ltd., been trying to remake its

offerings for the smartphone and cloud computing age. Long known

for their traditional information technology skills, they are

trying to offer more complex services customers want, such as big

data analytics.

Infosys and other Indian outsourcers are also trying to cope

with the impact of rising global tensions over trade and the

movement of money and people. The Trump administration has

tightened restrictions on H-1B visas, which the firms use to send

workers to the major market.

Infosys's BSE-listed shares have given up as much as 19% since

the news emerged over a three-day weekend break in Mumbai, hitting

an almost 11-month intraday low of around 630 rupees ($8.90) on

Wednesday before rising slightly to post a gain for the day.

The company earlier this month reported net profit of 40.19

billion rupees ($567.5 million) for the quarter ended Sept. 30,

down from 41.10 billion rupees a year earlier.

Write to Newley Purnell at newley.purnell@wsj.com

(END) Dow Jones Newswires

October 23, 2019 07:52 ET (11:52 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

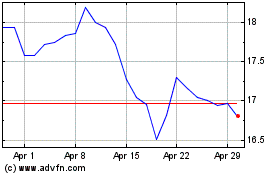

Infosys (NYSE:INFY)

Historical Stock Chart

From Apr 2024 to May 2024

Infosys (NYSE:INFY)

Historical Stock Chart

From May 2023 to May 2024