Toyota Invests in SUVs in Canada - Analyst Blog

March 29 2012 - 10:15AM

Zacks

Toyota Motor Corp. (TM) decided to invest $80

million in its Woodstock, Ontario plant in Canada in order to boost

output of RAV4 sport utility vehicles (SUVs). The company’s

decision was led by strong demand for the SUV and an expected

recovery in North America.

The investment will create 400 jobs at the plant as Toyota plans

to raise the annual production capacity by one third to 200,000

vehicles. Woodstock and other plants in Ontario employ about 6,500

workers. Apart from RAV4, they manufacture the Corolla and Matrix

compacts as well as the Lexus RX 350 luxury SUV.

Despite a 23% fall in sales of RAV4, the SUV was ranked 20th

among the best-selling vehicles in the U.S. last year. The decrease

in sales was attributable to delay in supply of vehicles due to

disruptions caused by the earthquake and tsunami in Japan on March

11, 2011.

Sales trend in the U.S. auto industry is much more stable now,

indicating an improvement in the broad fundamentals of the economy.

Last month, light vehicle sales in the U.S. escalated 15.7% to

seasonally adjusted annual rate (SAAR) of 15.1 million units,

despite higher gasoline price (up 10% to $3.74 per gallon) and

lower spending on discounts and promotions by automakers (down 4.7%

to $2,457 per vehicle). This compared with SAAR of 12.8 million

vehicles in full year 2011.

Further, the average price of vehicles went up by a robust

$1,943 last month compared with February last year, according to

TrueCar.com. We believe strong pent-up demand will continue to

revive the industry from recessionary lows.

Toyota’s sales increased 12% to 159,423 vehicles in February

driven by higher demand for fuel-efficient vehicles. Yaris

subcompact car was the most popular model during the month with an

86% rise in sales to 3,611 units. Meanwhile, its compatriot

Honda Motor Co.’s (HMC) sales

scaled up 7.8% to 110,157 vehicles in the month driven by strong

sales of Civic cars and CR-V SUVs.

Despite an expected rebound in the U.S., we are disappointed by

the company’s sales earnings guidance. The automaker expects to

record a profit of ¥200 billion ($2.4 billion) for the fiscal year

ending March 31, 2012, which is less than half compared with the

year-ago profit of ¥408.18 billion. The company also expects

revenues of ¥18.3 trillion ($220.7 billion), a decrease of 4% from

the prior-year.

As a result, the company retains a Zacks #3 Rank on its shares,

which translates to a “Hold” rating for the short term (1 to 3

months). We have also recommended the shares of the company as

“Neutral” for the long-term (more than 6 months).

HONDA MOTOR (HMC): Free Stock Analysis Report

TOYOTA MOTOR CP (TM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

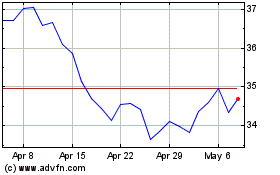

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jun 2024 to Jul 2024

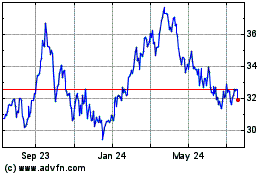

Honda Motor (NYSE:HMC)

Historical Stock Chart

From Jul 2023 to Jul 2024