UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

(Amendment No. )

| Filed by the Registrant x |

Filed by a Party other than the Registrant o |

Check the appropriate box:

| o |

Preliminary Proxy Statement |

| |

|

| o |

Confidential, for Use of the Commission

Only (as permitted by Rule 14a-6(e)(2)) |

| |

|

| x |

Definitive Proxy Statement |

| |

|

| o |

Definitive Additional Materials |

| |

|

| o |

Soliciting Material Pursuant to §240.14a-12 |

GRIFFON CORPORATION

(Name of Registrant as Specified

in its Charter)

(Name of Person(s) Filing Proxy

Statement, if the other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| x |

No fee required |

| |

|

| o |

Fee paid previously with preliminary materials |

| |

|

| o |

Fee computed on table in exhibit required by Item 25(b)

per Exchange Act Rules 14a-6(i)(1) and 0-11 |

PROXY STATEMENT

AND NOTICE OF

2024 ANNUAL MEETING

OF SHAREHOLDERS

Annual Meeting of Shareholders

March 20, 2024, 10:00 a.m. Eastern Time

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

Items of

Business: |

1. Election of thirteen directors for a term

of one year

2. Advisory vote on executive compensation

3. Approval of Amendment No. 1 to the Amended

and Restated 2016 Equity Incentive Plan to authorize an increase in the number of shares available for future awards

4. Ratification of the selection by our Audit

Committee of Grant Thornton LLP to serve as our independent registered public accounting firm for fiscal year 2024

5. Any other matters that properly come before

the meeting |

MEETING INFORMATION

Date: March 20, 2024

Time: 10:00 a.m. Eastern Daylight Time

Place: Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

WHO MAY VOTE

You can vote if you were a stockholder at the

close of business on January 22, 2024, the record date.

MATERIALS TO REVIEW

This booklet contains our Notice of Annual Meeting

and Proxy Statement. You may access this booklet, as well as our 2023 Annual Report to Stockholders and our Annual Report on Form

10-K for the fiscal year ended September 30, 2023, at the following website: http://www.astproxyportal.com/ast/03170

|

|

Your vote is extremely important. It is

important that your shares be represented at the Annual Meeting whether or not you are personally able to attend. Most stockholders

are unable to attend the Annual Meeting. Even if you do plan to attend the Annual Meeting, we urge you to promptly vote by using

the enclosed proxy card to vote by telephone or the Internet. You may also sign, date and return the proxy card in the postage-paid

envelope provided. Proxy cards that are signed and returned but do not include voting instructions will be voted by the proxies

as recommended by the Board of Directors. If your shares are held by a broker, bank or other nominee, you must follow the instructions

provided by your broker, bank or other nominee to vote your shares and you may not vote your shares in person at the meeting unless

you obtain a “legal proxy” from the broker, bank or other nominee that holds your shares giving you the right to vote

the shares at the Annual Meeting. You can change your voting instructions or revoke your proxy at any time prior to the Annual

Meeting by following the instructions included in this Proxy Statement and on the proxy card.

If you have any questions or need help voting

your shares, please call the firm assisting us with the proxy solicitation:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Shareholders may call toll free: (877) 800-5182

Banks and Brokers may call collect: (212) 750-5833

This Proxy Statement is dated January 29, 2024

and is being mailed with the form of proxy on or shortly after January 29, 2024.

INTERNET AVAILABILITY OF PROXY MATERIALS

In accordance with rules of the Securities

and Exchange Commission, we are using the Internet as our primary means of furnishing proxy materials to stockholders. Because

we are using the Internet, most stockholders will not receive paper copies of our proxy materials. We will instead send these stockholders

a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials, including our Proxy Statement

and Annual Report, and voting via the Internet. The Notice of Internet Availability of Proxy Materials also provides information

on how stockholders may obtain paper copies of our proxy materials if they so choose.

Important Notice Regarding the

Availability of Proxy Materials for the Stockholder Meeting to be held on Wednesday, March 20, 2024 at 10:00 a.m. at 1095

Avenue of the Americas, New York, NY 10036. The Company’s Proxy Statement, 2023 Annual Report on Form 10-K and Annual

Report to Stockholders will be available online at http://www.astproxyportal.com/ast/03170.

By Order of the Board of Directors

Seth L. Kaplan

Senior Vice President, General Counsel and Secretary

TABLE OF CONTENTS

PROXY STATEMENT SUMMARY

This summary highlights information contained

elsewhere in this Proxy Statement. It does not contain all of the information that you should consider. Please read the entire

Proxy Statement carefully before voting.

AGENDA AND VOTING RECOMMENDATIONS

| Proposal |

Board Vote

Recommendation |

Page

Reference |

| 1. Election of thirteen directors for a term of one year |

FOR |

15 |

| 2. Advisory vote on executive compensation |

FOR |

87 |

| 3. Approval of Amendment No. 1 to the Amended and Restated 2016 Equity Incentive Plan to increase the number of shares available for future awards |

FOR |

88 |

| 4. Ratification of the selection by our Audit Committee of Grant Thornton LLP to serve as our independent registered public accounting firm for fiscal year 2024 |

FOR |

103 |

COMPOSITION OF BOARD OF DIRECTORS

The following table provides summary information

about each nominee for election at the Annual Meeting. Each nominee is currently a director on our Board. For more detailed information

about our directors, see “Proposal 1–Election of Directors” on page 15.

| Name |

Age |

Director

Since |

Principal Occupation |

Independent |

Committee

Memberships |

| Henry A. Alpert |

76 |

1995 |

President, Spartan Petroleum Corp. |

|

Nominating

and Corporate Governance (NCG), Finance |

| Jerome L. Coben |

79 |

2020 |

Retired Partner, Skadden, Arps, Slate, Meagher and Flom LLP |

|

Compensation, Finance |

| Travis W. Cocke |

36 |

2023 |

Founder and Chief Investment Officer of Voss Capital |

|

NCG |

| H. C. Charles Diao |

66 |

2022 |

Senior Vice President, Finance and Corporate Treasurer, Bally’s Corporation |

|

Finance |

| Louis J. Grabowsky |

72 |

2015 |

Founder and principal of Juniper Capital Management |

|

Audit |

| Lacy M. Johnson |

71 |

2019 |

Partner, Public Affairs Strategies Group, Taft Stettinius & Hollister LLP |

|

Compensation, NCG |

| Ronald J. Kramer |

65 |

1993 |

Chief Executive Officer and Chairman of the Board, Griffon Corporation |

|

|

| General Victor Eugene Renuart |

74 |

2014 |

President, The Renuart Group, LLC |

|

Finance |

| James W. Sight |

68 |

2019 |

Private Investor |

|

Audit |

| Samanta Hegedus Stewart |

48 |

2018 |

Consumer, Technology and Financial Services practice of Egon Zehnder |

|

Compensation, NCG |

| Kevin F. Sullivan |

70 |

2013 |

Retired Executive |

|

Audit, Finance |

| Michelle L. Taylor |

55 |

2022 |

New Product Quality Director, Trane Technologies |

|

Audit |

| Cheryl L. Turnbull |

63 |

2018 |

Senior Director of the Keenan Center for Entrepreneurship at The Ohio State University |

|

Compensation |

GOVERNANCE HIGHLIGHTS

We recognize that strong corporate governance

contributes to long-term shareholder value. We strive to ensure that our corporate governance reflects best practices tailored,

as necessary, to our culture, goals and strategy. Our corporate governance practices include the items below:

| Recent Changes |

|

We made the following changes in 2022:

• Declassified the Board, so that each director is up for

election at each annual meeting of shareholders

• Reduced the percentage of outstanding voting power required

to call a special meeting to 25%

|

| |

| Independence |

Best Practices |

Accountability |

| |

|

|

• Every member

of the Board except our CEO is independent

• Strong independent

Lead Director with clearly delineated duties

• All standing

Board Committees composed entirely of independent directors

• Regular executive

sessions of independent directors

|

• Annual shareholder

outreach program

• Proactive Board

that responded to shareholder feedback with clear actions including:

- Declassification of

the Board

- Reduction of voting

power needed to call a special meeting

- Commitment to further

diversify with an objective that, by 2025, 40% of independent directors will be women or persons of color

• Diverse Board

in terms of gender, ethnicity, and specific skills and qualifications

• Regular Board

refreshment (6 of 13 directors have joined the Board in the last five years)

• Strategy and

risk oversight by full Board and Committees

• Periodic changes

to membership of standing Board Committees

• Long-standing

commitment to sustainability and corporate social responsibility

• Robust stock

ownership guidelines for executive officers and nonemployee directors

|

• Annual Board

and Committee self-evaluations, including individual Board member evaluation

• A substantial

portion of compensation paid to our NEOs is performance-based

• Clawback policy

that applies to our short and long-term incentive plans

|

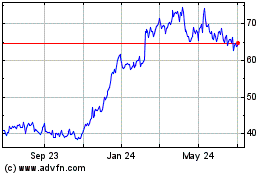

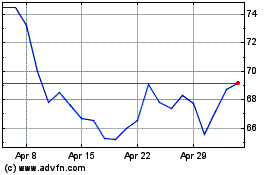

2023 PERFORMANCE SNAPSHOT

Our 2023 operating results continue to reflect

the impact of the strategic actions taken to strengthen Griffon and position ourselves for additional growth and increased profitability,

while providing the flexibility to return substantial capital to shareholders.

| Our business model is delivering results |

| We generated record adjusted EBITDA, adjusted EPS and free cash flow in fiscal 2023. Our fiscal 2023 free cash flow of $389 million allowed us to return a record $285 million to shareholders through a combination of dividends and share repurchases while reducing debt by $99 million. This contributed to a reduction in our net debt to EBITDA leverage ratio(1) from 2.9x at the end of fiscal 2022 to 2.6x at the end of 2023. Our strong balance sheet, coupled with our solid free cash flow and proven ability to access the capital markets, provides flexibility to both pursue strategic acquisitions and return capital to shareholders. |

FISCAL YEAR 2023 RESULTS OVERVIEW

| (1) | Calculated based on the applicable covenant in Griffon’s credit agreement. |

| (2) | On a continuing operations basis; excludes the results of the Telephonics business which was classified

as discontinued operations in our Annual Report on Form 10-K filed on November 17, 2021. |

| (3) | For a reconciliation of Adjusted EBITDA (defined as Segment Adjusted EBITDA less Unallocated amounts,

excluding depreciation) to Income (loss) before taxes from continuing operations for each of 2023, 2022, 2021 and 2020, see Appendix

A to this Proxy Statement. Income (loss) before taxes from continuing operations was $112.7 million for 2023, ($270.9) million

for 2022, $110.0 million for 2021, and $67.5 million for 2020. |

| (4) | For a reconciliation of Earnings (loss) per share from continuing operations to Adjusted EPS from

continuing operations for each of 2023, 2022, 2021 and 2022, see Appendix A to this Proxy Statement. Earnings (loss) per share

from continuing operations was $1.42 for 2023, $(5.57) for 2022, $1.32 for 2021, and $0.92 for 2020. |

| (5) | For a reconciliation of net cash from operating activities to free cash flow for each of 2023,

2022, 2021 and 2020, see Appendix A to this Proxy Statement. Net cash from operating activities was $431.8 million for 2023, $59.2

million for 2022, $69.8 million for 2021, and $106.9 million for 2020. |

EXECUTIVE COMPENSATION HIGHLIGHTS

We strive to provide incentives to senior

management to achieve both short-term and long-term objectives and to reward exceptional performance. We believe our compensation

practices and our overall level of executive compensation reflect our commitment to performance-based pay.

We provide highlights of our compensation

program below. Please review our Compensation Discussion and Analysis and compensation-related tables beginning on page 36 of this

Proxy Statement for a complete understanding of our compensation program.

| Compensation program highlights |

|

•

Based on shareholder feedback,

-

beginning in fiscal 2024, our CFO and

General Counsel will receive restricted stock grants with the same performance metrics and goals as the CEO and COO

-

beginning in fiscal 2023, we included

ESG as a performance metric for our short-term cash incentive program for our NEOs

-

beginning in fiscal 2022, we included

free cash flow as a component of our long-term cash incentive program for our NEOs

-

beginning in fiscal 2022, we included

return on invested capital as a performance measure for equity grants to our CEO and COO

•

For fiscal 2023 and fiscal 2024,

we use three different performance metrics as the basis for our short-term cash program, with weightings of 75% assigned to EBITDA,

15% assigned to working capital and 10% assigned to ESG

•

We reduced our CEO’s total

compensation by 8.2% from fiscal 2022 to fiscal 2023, and by 27.5% from fiscal 2021 to fiscal 2022, as reported in the summary

compensation table, notwithstanding that the Company generated record operating results in fiscal 2023

|

PERFORMANCE-BASED COMPENSATION STRUCTURE

[Note: equity awards are

based upon grant date value]

ABOUT THE MEETING

Why did I receive these

proxy materials?

Beginning on or shortly

after January 29, 2024, this Proxy Statement is being mailed to stockholders who were stockholders as of the January 22, 2024 record

date, as part of the Board of Directors’ solicitation of proxies for Griffon’s Annual Meeting and any postponements

or adjournments thereof. This Proxy Statement and Griffon’s 2023 Annual Report to Stockholders and Annual Report on Form

10-K (which have been made available to stockholders eligible to vote at the Annual Meeting) contain information that the Board

of Directors believes offers an informed view of Griffon Corporation (referred to as “Griffon,” the “Company,”

“we” or “us”) and meets the regulations of the Securities and Exchange Commission (the “SEC”)

for proxy solicitations. Our management prepared this Proxy Statement for the Board of Directors.

What is the Notice of Internet Availability

of Proxy Materials that I received in the mail instead of a full set of proxy materials?

As in past years, we

are pleased to be using the SEC rule that allows companies to furnish their proxy materials over the Internet, instead of mailing

printed copies of those materials to all stockholders. Consequently, most stockholders will not receive paper copies of our proxy

materials. These stockholders will instead receive a “Notice of Internet Availability of Proxy Materials” with instructions

for accessing our proxy materials, including our Proxy Statement and 2023 Annual Report, and voting via the Internet. The Notice

of Internet Availability of Proxy Materials also contains instructions on how stockholders can obtain a paper copy of our proxy

materials if they so choose. We believe this process will expedite stockholders’ receipt of proxy materials, lower the costs

of our Annual Meeting and conserve natural resources. If you previously elected to receive our proxy materials electronically,

these materials will continue to be sent via email unless you change your election. Stockholders who have elected to receive the

proxy materials electronically will be receiving an email on or about January 29, 2024 with information on how to access stockholder

information and instructions for voting.

What is being considered at the meeting?

You will be voting on

the following matters:

| 1. | The election of thirteen directors for a term of one year |

| 2. | An advisory vote on executive compensation |

| 3. | The approval of Amendment No. 1 to the Amended and Restated 2016 Equity Incentive Plan to increase

the number of shares available for future awards |

| 4. | The ratification of the selection by our Audit Committee of Grant Thornton LLP to serve as our

independent registered public accounting firm for fiscal year 2024 |

We do not expect you

to vote on any other matters at the meeting.

Who is entitled to vote at the meeting?

You are entitled to

vote at the Annual Meeting if you owned stock as of the close of business on January 22, 2024. Each share of stock is entitled

to one vote.

How does the Board recommend I vote on each

of the proposals?

THE BOARD UNANIMOUSLY

RECOMMENDS THAT YOU VOTE AS FOLLOWS:

| • | “FOR” THE ELECTION OF EACH OF THE THIRTEEN DIRECTORS LISTED IN THIS PROXY STATEMENT

UNDER PROPOSAL 1 |

| • | “FOR” THE NON-BINDING, ADVISORY VOTE ON THE COMPANY’S NAMED EXECUTIVE

OFFICERS’ COMPENSATION UNDER PROPOSAL 2 |

| • | “FOR” THE PROPOSAL TO APPROVE AMENDMENT NO. 1 TO THE AMENDED AND RESTATED 2016

EQUITY INCENTIVE PLAN TO INCREASE THE NUMBER OF SHARES AVAILABLE FOR FUTURE AWARDS UNDER PROPOSAL 3 |

| • | “FOR” THE PROPOSAL TO RATIFY THE APPOINTMENT OF GRANT THORNTON LLP AS INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM TO THE COMPANY FOR THE CURRENT FISCAL YEAR UNDER PROPOSAL 4 |

All valid proxies will

be voted as the Board unanimously recommends, unless otherwise specified. A shareholder may revoke a proxy before the proxy is

voted at the Annual Meeting by giving written notice of revocation to the Secretary of the Company, by executing and delivering

a later-dated proxy, by casting a new vote by telephone or the Internet or by attending the Annual Meeting in person and voting

the shares the proxy represents at the Annual Meeting.

Can a Shareholder Raise Other Business at

the Annual Meeting?

Under our governing

documents, no other business may be raised by a shareholder at the Annual Meeting unless proper and timely notice has been given

to us by the shareholder seeking to bring such business before the Annual Meeting. As of the date of this Proxy Statement, the

Board knows of no business other than that set forth above to be transacted at the Annual Meeting, but if other matters requiring

a vote do arise, it is the intention of the persons named on the proxy card, to whom you are granting your proxy and to whom such

proxy confers discretionary authority to vote on any unanticipated matters, to vote in accordance with their best judgment on such

matters.

How do I vote?

VOTING

BY PROXY

For stockholders whose

shares are registered in their own names, as an alternative to voting in person at the Annual Meeting, you may vote by proxy via

the Internet, by telephone or by mailing a completed proxy card. For those stockholders who receive a Notice of Internet Availability

of Proxy Materials, the Notice of Internet Availability of Proxy Materials provides information on how to access your proxy card,

which contains instructions on how to vote via the Internet or by telephone. For those stockholders who receive a paper proxy card,

instructions for voting via the Internet or by telephone are set forth on the proxy card; alternatively such stockholders who receive

a paper proxy card may vote by mail by signing and returning the proxy card in the prepaid and addressed envelope that is enclosed

with the proxy materials. In each case, your shares will be voted at the Annual Meeting in the manner you direct.

If your shares are registered

in the name of a bank or brokerage firm (your record holder), you may also submit your voting instructions over the Internet or

by telephone by following the instructions provided by your record holder in the Notice of Internet Availability of Proxy Materials.

If you received printed copies of the proxy materials, you can submit voting instructions by telephone or mail by following the

instructions provided by your record holder on the enclosed voting instructions card. Those who elect to vote by mail should complete

and return the voting instructions card in the prepaid and addressed envelope provided.

VOTING

AT THE MEETING

If your shares are registered

in your own name, you have the right to vote in person at the Annual Meeting by using the ballot provided at the Annual Meeting.

If you hold shares through a bank or brokerage firm and wish to be able to vote in person at the Annual Meeting, you must obtain

a “legal proxy” from your brokerage firm, bank or other holder of record and present it to the inspector of elections

with your ballot at the Annual Meeting. Even if you plan to attend the Annual Meeting, we recommend that you submit your proxy

or voting instructions in advance of the meeting as described above so that your vote will be counted if you later decide not to

attend the Annual Meeting. Submitting your proxy or voting instructions in advance of the meeting will not affect your right to

vote in person should you decide to attend the Annual Meeting.

It is extremely

important that your shares be represented and voted at the Annual Meeting. If you have any questions or need assistance voting,

please call Innisfree, our proxy solicitor, at (212) 750-5833 (call collect) or (877) 800-5182 (toll-free from the U.S. and Canada).

Can I change my mind after I return my proxy?

Yes, you may change

your mind at any time before the vote is taken at the meeting. You may revoke or change a previously delivered proxy at any time

before the Annual Meeting by delivering another proxy card with a later date, by voting again via the Internet or by telephone,

or by delivering written notice of revocation of your proxy to Griffon’s Secretary at our principal executive offices before

the beginning of the Annual Meeting. You may also revoke your proxy by attending the Annual Meeting and voting in person, although

attendance at the Annual Meeting will not, in and of itself, revoke a valid proxy that was previously delivered. If you hold shares

through a bank or brokerage firm, you must contact that bank or brokerage firm to revoke any prior voting instructions. You also

may revoke any prior voting instructions by voting in person at the Annual Meeting if you obtain a legal proxy as described above.

What if I return my proxy

card but do not include voting instructions?

If you signed and return

a proxy card, but do not include voting instructions, your shares will be voted FOR the election of the nominee directors,

FOR the approval, on an advisory basis, of the compensation of Griffon’s named executive officers as presented in

this Proxy Statement, FOR the approval of Amendment No. 1 to the Amended and Restated 2016 Equity Compensation Plan to increase

the number of shares available for future awards and FOR the ratification of Grant Thornton LLP to serve as our independent

registered public accounting firm for fiscal year 2024, and in the discretion of the proxy holders as to any other matters that

may properly come before the Annual Meeting or any postponement or adjournment of the Annual Meeting.

What does it mean if

I receive more than one proxy card?

If you receive multiple

Proxy Statements or proxy cards, your shares are likely registered differently or are in more than one account, such as individually

and also jointly with your spouse. Please vote each and every proxy card or voting instruction form you receive. Only the latest

dated proxy you submit will be counted.

We recommend that, at

some point, you contact your broker and/or our transfer agent to consolidate as many accounts as possible under the same name and

address. Our transfer agent is Equiniti Trust Company, LLC (“Equiniti”) and its telephone number is 718-921-8200.

I share an address with another stockholder,

and we received only one paper copy of the proxy materials. How may I obtain an additional copy of the proxy materials?

We have adopted a procedure

called “householding,” which the SEC has approved. Under this procedure, we are delivering a single copy of the Notice

of Internet Availability of Proxy Materials and, if applicable, this Proxy Statement and our 2023 Annual Report to multiple stockholders

who share the same address unless we have received contrary instructions from one or more of the stockholders. This procedure reduces

our printing costs, mailing costs and fees, and conserves natural resources. Stockholders who participate in householding will

continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate

copy of the Notice of Internet Availability of Proxy Materials and, if applicable, this Proxy Statement and our 2023 Annual Report

to any stockholder at a shared address to which we delivered a single copy of any of these documents. To receive a separate copy

of the Notice of Internet Availability of Proxy Materials and, if applicable, this Proxy Statement or our 2023 Annual Report, stockholders

may write or call our proxy solicitor at the following address and telephone number:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

Shareholders may call toll free: (877) 800-5182

Banks and Brokers may call collect: (212) 750-5833

Stockholders who are the beneficial, but

not the record holder, of shares of Griffon stock may contact their brokerage firm, bank, broker-dealer or other similar organization

to request information about householding.

Will my shares be voted

if I do not provide my proxy?

If you hold your shares

directly in your own name, they will not be voted if you do not provide a proxy, unless you attend the meeting and vote in person.

Your shares may be voted

under certain circumstances if they are held in the name of a brokerage firm. Under applicable NYSE rules, brokerage firms generally

have the authority to vote customers’ shares on certain “routine” matters, including the ratification of the

independent registered public accounting firm. At our meeting, these shares will be counted as voted by the brokerage firm with

respect to the ratification of the independent registered public accounting firm in proposal four.

Brokers are prohibited

from exercising discretionary authority on non-routine matters. Proposals one, two and three are considered non-routine matters,

and therefore brokers cannot exercise discretionary authority regarding these proposals for beneficial owners who have not returned

proxies to the brokers (so-called “broker non-votes”). In the case of broker non-votes, and in cases in which you abstain

from voting on a matter when present at the meeting and entitled to vote, those shares will still be counted for purposes of determining

if a quorum is present.

How are shares in the

Griffon Corporation Employee Stock Ownership Plan Voted?

If you are a participant

in the Griffon Corporation Employee Stock Ownership Plan (“ESOP”), you may vote the shares you own through the ESOP

via the Internet, by telephone or, if you receive a proxy card in the mail, by mailing a completed proxy card. Shares owned by

ESOP participants may NOT be voted in person at the Annual Meeting.

Equiniti will tabulate

the votes of participants in the ESOP. The results of the votes received from the ESOP participants will serve as voting instructions

to Principal Financial Services, Inc., the trustee of the ESOP. The trustee will vote the shares as instructed by the ESOP participants.

If a participant does not provide voting instructions, the trustee will vote the shares allocated to the participant’s ESOP

account in the same manner and proportions as those votes cast by other participants submitting timely voting instructions. The

trustee will also vote the unallocated shares in the ESOP in the same manner and proportions as those votes cast by participants

submitting timely voting instructions. Equiniti will keep how you vote your shares confidential.

How many votes must be

present to hold the meeting?

Your shares are counted

as present at the meeting if you attend the meeting and vote in person or if you properly submit your proxy. In order for us to

conduct our meeting, the holders of a majority of our outstanding shares of common stock as of January 22, 2024 must be present

at the meeting. This is referred to as a quorum. On January 22, 2024, there were 51,309,064 shares of common stock outstanding

and entitled to vote.

What vote is required

to elect directors?

Directors are elected

by a plurality of the votes cast, so the thirteen director nominees receiving the most votes will be elected. You may vote “FOR”

up to thirteen nominees to the Board, or you may WITHHOLD authority with respect to all nominees or one or more nominees. Broker

non-votes will have no impact on the outcome of the vote.

What vote is required

to approve the advisory vote on executive compensation?

Approval of the advisory

vote on executive compensation requires the favorable vote of a majority of the shares present in person or by proxy and entitled

to vote on the matter at the Annual Meeting once a quorum is present. Abstentions will have the same impact as a vote against this

proposal. Broker non-votes will have no impact on the outcome of this vote. Because this vote is advisory, it will not be binding

on the Board or the Company. However, the Board will review the voting results and take them into consideration when making future

decisions regarding executive compensation.

What vote is required to approve Amendment

No. 1 to the Amended and Restated 2016 Equity Incentive Plan?

Approval of Amendment

No. 1 to the Amended and Restated 2016 Equity Incentive Plan requires the favorable vote of a majority of the shares present in

person or by proxy and entitled to vote on the matter at the Annual Meeting once a quorum is present. In determining whether the

proposal to approve Amendment No. 1 receives the required number of affirmative votes, a vote to abstain will be counted and will

have the same effect as a vote against the proposal. Under applicable NYSE rules, brokers are not permitted to vote shares held

for a customer on this proposal without specific instructions from the customer. Broker non-votes will be disregarded and will

have no effect on the outcome of the vote.

What vote is required to ratify the selection

by our Audit Committee of Grant Thornton LLP as our independent registered public accounting firm?

The affirmative vote

of the holders of a majority of the shares present in person or by proxy and entitled to vote on the item will be required for

approval. Abstentions will have the same impact as a vote against this proposal.

|

PROPOSAL 1 - ELECTION

OF DIRECTORS

Summary

We have the right board

to continue executing on Griffon’s strategy to drive margin expansion and organic growth, while opportunistically pursuing

value-enhancing acquisitions. We believe that our Board is composed of individuals who collectively possess the right mix of skills,

qualifications, and experience to promote shareholder interests and oversee management as it executes on its strategic plans and

positions Griffon for future growth and increased profitability.

|

Our certificate of incorporation

currently provides for a Board of Directors consisting of not less than twelve nor more than fourteen directors. Our Board was

previously divided into three classes, with the term of each class expiring in successive years. In 2022 we amended our Certificate

of Incorporation to eliminate our classified structure over the course of two years. Beginning at the 2024 Annual Meeting of Stockholders,

each director will be elected for a one-year term.

Our Board of Directors

now consists of thirteen directors as set forth below. Each director on our Board has been nominated for re-election at the 2024

Annual Meeting of Stockholders. Based on the recommendation of the Nominating and Corporate Governance Committee, the Board intends

to evaluate and consider the appropriate size and composition of the Board on a go forward basis.

GRIFFON’S CURRENT BOARD OF DIRECTORS

| |

Members of the Board |

|

Henry A. Alpert |

| |

(To Serve Until the Annual Meeting of |

|

Jerome L. Coben |

| |

Stockholders in 2024) |

|

Travis W. Cocke |

| |

|

|

H. C. Charles Diao |

| |

|

|

Louis J. Grabowsky |

| |

|

|

Lacy M. Johnson |

| |

|

|

Ronald J. Kramer |

| |

|

|

General Victor Eugene Renuart (USAF Ret.) |

| |

|

|

James W. Sight |

| |

|

|

Samanta Hegedus Stewart |

| |

|

|

Kevin S. Sullivan |

| |

|

|

Michelle L. Taylor |

| |

|

|

Cheryl L. Turnbull |

Cooperation Agreement with Voss

Travis W. Cocke, a director of Griffon,

is the Founder, Chief Investment Officer and Managing Member of Voss Capital, LLC. On January 8, 2023, Griffon entered into a cooperation

agreement (the “Cooperation Agreement”) with Voss Capital, LLC and certain of its affiliates (collectively, “Voss”).

Pursuant to the Cooperation Agreement, Mr. Cocke was appointed to the Board and to the Nominating and Corporate Governance Committee

effective on January 9, 2023, and each of Mr. Cocke and H. C. Charles Diao were nominated for election at the 2023 Annual Meeting

of Shareholders (the “2023 Annual Meeting”). The Cooperation Agreement also provides that at Voss’s election,

from and after the 2023 Annual Meeting, we will ensure that the size of the Board following the 2023 Annual Meeting is not more

than thirteen members.

The Cooperation Agreement contains customary

standstill restrictions, voting commitments, and other provisions restricting certain conduct and activities during the cooperation

period, as specified in the Cooperation Agreement. The cooperation period generally continues for successive one-year periods so

long as Mr. Cocke consents to be, and is, renominated for election to the Board at the annual meeting of shareholders. Upon such

renomination, the cooperation period continues until at least the date (the “Cooperation Period Extension Date”) that

is fifteen days prior to the end of the period during which stockholders can submit nominations for the election of directors at

the next succeeding annual meeting of shareholders. Since Mr. Cocke has been renominated (with his consent) for election to the

Board at the 2024 Annual Meeting of Shareholders, the cooperation period will continue until at least December 20, 2024. Should

Mr. Cocke not be renominated for election at a future annual meeting of shareholders (or not consent to such renomination), the

cooperation period will end five days after he ceases to be a member of the Board, but not prior to the then current Cooperation

Period Extension Date. The Cooperation Agreement contains certain procedures for determining a replacement director for Mr. Cocke

should he be unable or unwilling to serve as a director or resign at any time prior to the 2024 Annual Meeting of Shareholders.

A summary of the Cooperation Agreement

is included in a Form 8-K filed with the U.S. Securities and Exchange Commission on January 9, 2023, with the full

Cooperation Agreement filed as an exhibit to such Form 8-K.

Director Diversity

Our directors have a diverse mix of backgrounds,

qualifications, skills and experiences that we believe contribute to a well-rounded Board that is positioned to effectively oversee

our strategy. We have a balance of new and tenured directors, reflecting our commitment to proactive Board refreshment.

| • | The average age of our directors is 65 years and the median tenure is 5 years |

| | |

| • | 12 of our 13 directors, or 93%, are independent |

| | |

| • | 31% of our directors are diverse |

The charts below provide additional information

regarding our Board.

Board Composition

We believe that each

of our directors should demonstrate, by significant accomplishment in his or her field, an ability to make a meaningful contribution

to the Board’s supervision and oversight of the business and affairs of Griffon. We consider the following when selecting

candidates for recommendation to our Board: character and business judgment; broad business knowledge; leadership, financial and

industry-specific experience and expertise; technology and education experience; professional relationships; diversity; personal

and professional integrity; time availability in light of other commitments; dedication; and such other factors that we consider

appropriate, from time to time, in the context of the needs or stated requirements of the Board. The directors’ experiences,

qualifications and skills that the Board considered in their nomination are included in their individual biographies.

The following matrix

provides information regarding certain qualifications and experience possessed by the members of our Board, which our Board believes

are relevant to our business and industry and provide a range of viewpoints that are invaluable for our Board’s discussions

and decision-making processes. The matrix does not encompass all of the qualifications, experiences or attributes of the members

of our Board, and the fact that a particular qualification, experience or attribute is not listed does not mean that a director

does not possess it. In addition, the absence of a particular qualification, experience or attribute with respect to any of the

members of our Board does not mean the director in question is unable to contribute to the decision-making process in that area.

The type and degree of qualification and experience listed below may vary among the members of the Board.

| |

|

Public

Company

Leadership

(CEO/

Board) |

|

Senior

Leadership

(C-Suite

Executive or

equivalent) |

|

Operations

Management |

|

Relevant

Industry

Experience |

|

Business

Owner |

|

Financial,

Transactional,

Accounting |

|

Investment

Asset

Management |

|

Legal |

| Alpert |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Coben |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cocke |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diao |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Grabowsky |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Johnson |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Kramer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Renuart |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sight |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stewart |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sullivan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Taylor |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Turnbull |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DIRECTOR

BIOGRAPHIES

Each current

member of our Board is nominated for election at the 2024 Annual Meeting of Shareholders.

|

| |

| |

|

|

|

Henry A. Alpert

Age: 76

Independent Director

Since: 1995

Committee: Nominating and

Corporate Governance +

Finance

|

|

Mr. Henry A. Alpert has been a director since 1995. Mr. Alpert has been President of Spartan Petroleum Corp., a real estate investment firm and a distributor of petroleum products, since 1985. Mr. Alpert is also a director of Boyar Value Fund, a mutual fund (NASDAQ: BOYAX). Mr. Alpert brings to the Board an understanding of the perspectives of public mutual fund stockholders, and experience in operations. |

| |

|

|

| |

|

|

| |

|

|

|

Jerome L. Coben

Age: 79

Lead Independent Director

Since: 2020

Committee: Compensation +

Finance

|

|

Mr. Jerome L. Coben has been a director since 2020. For almost four decades, Mr. Coben was a corporate lawyer focusing on mergers and acquisitions, securities and finance matters and other business transactions. Mr. Coben co-founded the Los Angeles office of Skadden, Arps, Slate, Meagher and Flom LLP in 1983 and remained a partner at Skadden until his retirement from the practice of law in 2008, having served on various national firm management committees. From 2009 to 2011, Mr. Coben was a partner at the Zeughauser Group, a firm that provides management consulting services to law firms. Mr. Coben has served as a director of both public and private corporations and has occupied leadership roles with a variety of non-profit and community organizations, and continues to serve in similar roles today. Through his representation of countless public and private companies in connection with a wide variety of corporate and governance matters and business transactions, Mr. Coben brings to the Board a wealth of experience in advising public and private companies regarding corporate legal matters. |

| |

|

|

|

| |

|

|

|

Travis W. Cocke

Age: 36

Independent Director

Since: 2023

Committee: Nominating and

Corporate Governance

|

|

Mr. Travis W. Cocke has been a Director since January 2023. Mr. Cocke was appointed to the Board of Directors effective January 9, 2023 pursuant to the Cooperation Agreement. Mr. Cocke has served as the Founder, Chief Investment Officer and Managing Member of Voss Capital, LLC, a fundamental research-driven, value-oriented hedge fund focused on special situations, since October 2011. Prior to founding Voss Capital, Mr. Cocke served as a Portfolio Manager at Farney Management Corp., a family investment office, from 2010 to 2011. Prior to that, Mr. Cocke served as a Generalist Research Analyst at Ascendant Advisors, LLC, a Houston-based registered investment adviser, from August 2009 to July 2010. Mr. Cocke is a designee of Voss Capital and brings to the Board experience as an investor in the public equity markets and the perspective of a significant stockholder. |

| |

|

|

| |

|

|

|

H. C. Charles Diao

Age: 66

Independent Director

Since: 2022

Committee: Finance

|

|

Mr. H. C. Charles Diao has been a Director since February 2022. Since June 2023 Mr. Diao has served as Senior Vice President, Finance and Corporate Treasurer at Bally’s Corporation (NYSE: BALY), an international gaming and interactive entertainment company, with responsibility for and management of corporate finance, global treasury operations, tax, risk management/insurance, and capital markets. From 2012 until 2021, Mr. Diao was Senior Vice President of Finance and Corporate Development and Corporate Treasurer at DXC Technology Company (NYSE:DXC) and Vice President and Corporate Treasurer of its predecessor, Computer Sciences Corporation. From 2008 to 2012, and from 2021 to 2023, Mr. Diao provided strategic and M&A advisory services to corporate clients, and from 2008 to 2012 Mr. Diao was CIO of an investment management firm that managed alternative investments on behalf of institutional family offices. Mr. Diao was formerly a Senior Managing Director at Bear Stearns & Co. where he was Group Head of Special Situations Credit, a partner within the firm’s TMT investment banking practice and a member of the firm’s Investment Banking Committee and IPO Committee. Prior to that, Mr. Diao was Group Head of the Telecom & Media Group at Prudential Securities Inc. where he began his career in mergers & acquisitions and in the Merchant Banking group. Mr. Diao has served on the board of directors of Turning Point Brands, Inc. (NYSE: TPB), a manufacturer, marketer and distributor of branded consumer products, since 2012, where he is currently Chairman of the Audit Committee and a member of the Nominating and ESG Committee. Mr. Diao has served on the board of directors of Synechron Holdings Ltd., a global provider of digital transformation and technology consulting services focused on major financial institutions, since 2022, where he is currently Chair of the Nominating and Corporate Governance Committee and a member of the Compensation and Human Capital Committee. Mr. Diao also served as a member of the board of directors of television broadcaster and digital media company Media General Inc. (formerly NYSE: MEG), the successor via merger to New Young Broadcasting Holdings Inc., from August 2012 until January 2017. Mr. Diao has been an executive officer at numerous corporations and brings to the Board significant experience in finance and banking. |

| |

|

|

|

| |

|

|

|

Louis J. Grabowsky

Age: 72

Independent Director

Since: 2015

Committee: Audit

|

|

Mr. Louis J. Grabowsky has been a Director since 2015. He is a founder and principal of Juniper Capital Management, a financial sponsor that provides capital to high growth potential but under-resourced U.S. entrepreneurial companies. Prior to founding Juniper Capital, Mr. Grabowsky was a partner at Grant Thornton LLP from 2002 to 2014, serving as Chief Operating Officer from 2009 to 2013 and Senior Advisor, Operations from 2013 until his retirement in July 2014. Mr. Grabowsky currently serves on the boards of various portfolio companies in which Juniper Capital is an investor. From 2015 to 2019, Mr. Grabowsky served on the Board of Directors of Cambrex Corporation (NYSE: CBM). Mr. Grabowsky brings to the Board and the Audit Committee an in-depth understanding of the financial reporting, auditing and accounting issues that come before the Board and the Audit Committee. |

| |

|

|

| |

|

|

| |

|

|

|

Lacy M. Johnson

Age: 71

Independent Director

Since: 2019

Committee: Compensation +

Nominating & Corporate

Governance

|

|

Mr. Lacy M. Johnson has been a director since 2019. In 2021 Mr. Johnson joined the law firm Taft Stettinius & Hollister LLP, where he is a partner in the Public Affairs Strategies Group and partner-in-charge of the firm’s Washington D.C. office. From 1993 to February 2021, Mr. Johnson was a partner with the law firm of Ice Miller LLP, where his primary practice areas focused on public affairs services and he served as co-chair of the firm’s Public Affairs and Gaming Group. Before joining Ice Miller, Mr. Johnson served as Attorney, Government Relations Services, Sagamore-Bainbridge, Inc., Director of Security for the Indiana State Lottery, liaison with the Indiana General Assembly, and Lt. Colonel and deputy superintendent for Support Services for the Indiana State Police. He is a Democratic National Committeeman and former Lt. Commander of the United States Naval Intelligence Reserves. Mr. Johnson serves on the Board of Directors of Kemper Corporation (NYSE: KMPR). As a practicing attorney for over twenty years, Mr. Johnson brings to the Board broad experience and insight in various aspects of business law; in addition, Mr. Johnson’s background in public affairs and government relations brings a unique perspective to the Board. |

| |

|

|

|

| |

|

|

|

Ronald J. Kramer

Age: 65

Chairman and CEO, Griffon Since: 1993

Committee: N/A

|

|

Mr. Ronald J. Kramer has been our Chief Executive Officer since April 2008, a director since 1993 and Chairman of the Board since January 2018. Mr. Kramer was Vice Chairman of the Board from 2003 until January 2018. From 2002 through March 2008, he was President and a director of Wynn Resorts, Ltd. (NASDAQ: WYNN), a developer, owner and operator of destination casino resorts. From 1999 to 2001, Mr. Kramer was a Managing Director at Dresdner Kleinwort Wasserstein, an investment banking firm, and its predecessor Wasserstein Perella & Co. He currently serves on the Board of Directors of Douglas Elliman Inc. (NYSE: DOUG), Franklin BSP Capital Corporation, Franklin BSP Lending Corporation and Franklin BSP Private Credit Fund. Mr. Kramer has been a senior executive officer of a number of corporations and brings to the Board extensive experience in all aspects of finance and business transactions. |

| |

|

|

| |

|

|

| |

|

|

|

General Victor Eugene Renuart (USAF Ret.)

Age: 74

Independent Director

Since: 2014

Committee: Finance

|

|

General Victor Eugene Renuart (USAF Ret.) has been a director since 2014. He was an officer in the United States Air Force for over thirty-nine years prior to his retirement in 2010. General Renuart’s military service culminated with his service as Commander, North American Aerospace Defense Command and United States Northern Command from 2007-2010. During his tenure in the U.S. Air Force, General Renuart served as Senior Military Assistant to the Secretary of Defense for Secretaries Donald Rumsfeld and Robert Gates; Director of Strategic Plans and Policy, The Joint Staff; Vice Commander, Pacific Air Forces; and Director of Operations, United States Central Command. From 2010 to 2012, General Renuart served as Vice President, National Security and Senior Military Advisor to the CEO for BAE Systems, Inc. Since 2012, General Renuart has been President of The Renuart Group, LLC, a defense, homeland security, energy, and leadership consulting firm. He currently serves on the Board of Kymeta Corp., a satellite systems manufacturer, Precision Aerospace Holdings, an aerospace machining corporation, as well as on the boards various private companies in the defense industry. As the former Chief Executive and Chief Operating Officer for large military organizations with responsibility for annual multi-billion dollar budgets, General Renuart brings to the Board experience in the management and fiscal oversight of large organizations. |

| |

|

|

|

| |

|

|

|

James W. Sight

Age: 68

Independent Director

Since: 2019

Committee: Audit*

|

|

Mr. James W. Sight has been a Director since 2019. He is currently on the Board of Fiduciary Benchmarks Insights, LLC, an independent, private company that provides consulting services to the retirement plan industry. Mr. Sight has been a private investor for over twenty-five years, serving on the boards of numerous public companies, including most recently ImageWare Systems, Inc. (OTCQB: IWSY) from May 2021 to September 2021 and Photomedex, Inc. (formerly NASDAQ: PHMD) from 2010 through 2015. Mr. Sight has over two decades of experience in corporate restructurings and financings, having advised both public companies and creditors in these areas serving as a board member, consultant and on creditors’ committees. From 2007 through 2012, Mr. Sight was a significant shareholder of Feldman Mall Properties, Inc., a real estate investment trust (formerly NYSE: FLMP), and served in the office of the REIT’s President; and from 1998 to 2006, he served as a consultant to LSB Industries (NYSE: LXU). Mr. Sight brings to the Board substantial experience regarding financing matters, as well as the perspective of a long-term investor. |

| |

|

|

| |

|

|

| |

|

|

|

Samanta Hegedus Stewart

Age: 48

Independent Director

Since: 2018

Committee: Compensation +

Nominating and Corporate

Governance

|

|

Ms. Samanta Hegedus Stewart has been a Director since 2018. In March 2022, Ms. Stewart joined the Consumer, Technology and Financial Services practice of Egon Zehnder, a preeminent global leadership advisory firm. She was Senior Vice President and Head of Investor Relations at Endeavor, a global leader in sports, entertainment and fashion with a portfolio of companies including WME, IMG and UFC, since February 2019. From 2013 to 2018, she was Head of Investor Relations for Manchester United, an English Premier League football team; Director of Investor Relations at Snap Inc. (NYSE: SNAP), leading the investor relations efforts behind its initial public offering; and Chief Investment Officer of Soho House, a global private membership club and lifestyle brand that features hotels, food and beverage venues, gyms and retail outlets. Prior to such time, Ms. Stewart was Vice President of Investor Relations for Wynn Resorts, Ltd. (NASDAQ: WYNN), a developer, owner and operator of destination casino resorts, for ten years. Ms. Stewart began her career in investment banking at Morgan Stanley. Ms. Stewart brings to the Board important perspectives regarding potential investments and acquisitions, as well as regarding investor relations and media and public relations. |

| |

|

|

|

| |

|

|

|

Kevin F. Sullivan

Age: 70

Independent Director

Since: 2013

Committee: Audit and Finance

|

|

Mr. Kevin F. Sullivan has been a Director since 2013. Mr. Sullivan was a Managing Director at MidOcean Credit Partners, a private investment firm that specializes in U.S. hedge fund investments, from 2013 until his retirement in December 2021. Prior to joining MidOcean in 2013, Mr. Sullivan was a Managing Director with Deutsche Bank, and a predecessor bank, Bankers Trust, from 1980 until November 2012. Mr. Sullivan held positions of increasing responsibility over his 32 years at Deutsche Bank and Bankers Trust, including Global Head for Loan Sales, Trading and Capital Markets; Head of Leveraged Finance—Asia; and last serving as Group Head for Asset Based Lending. He was also a member of the Capital Commitments Committee from 2002 to 2012 and a member of the Equity Investments Committee from 2008 to 2012. Mr. Sullivan serves on the Board of Directors of Studio City International Holdings Limited (NYSE:MSC). Mr. Sullivan’s decades of experience in finance, banking and capital markets allow him to assist the Board in evaluating all aspects of potential financing and capital markets transactions. |

| |

|

|

| |

|

|

| |

|

|

|

Michelle L. Taylor

Age: 55

Independent Director

Since: 2022

Committee: Audit

|

|

Ms. Michelle L. Taylor has been a director since February 2022. She has served as Director, New Product Quality, at Trane Technologies (NYSE: TT) since March 2021, responsible for leading the North America Commercial HVAC New Product Quality Team. Prior to joining Trane, Ms. Taylor spent ten years at Cummins, Inc. (NYSE: CMI), a global power leader, where she held several roles including Executive Director, Global Supplier Quality; Director, North America Defense and Government Sales; and Global Diversity Procurement Director. Prior to joining Cummins, Ms. Taylor held positions at the Allison Transmission Division of General Motors, Ford Motor Company and Delco Remy International, as well as with IC Leadership Training Group, a provider of professional and business development services for small businesses. Ms. Taylor brings to the Board a broad range of industrial experience, particularly in the areas of manufacturing, supply chain management and quality. |

| |

|

|

|

| |

|

|

|

Cheryl L. Turnbull

Age: 63

Independent Director

Since: 2018

Committee: Compensation

|

|

Ms. Cheryl L. Turnbull has been a director since 2018. She is the Senior Director of the Keenan Center for Entrepreneurship at The Ohio State University. Ms. Turnbull has been with Ohio State in a number of different capacities since 2013. From 2009 to 2012, Ms. Turnbull was a founding partner at Capital Transactions, LLC, a corporate advisory firm that partners with senior management teams and corporate boards at privately held companies to consult regarding business strategy, operating and financial plans and funding. Prior to 2012, Ms. Turnbull served in a variety of private equity, venture capital and other investment management roles, and served as a managing director at a merchant bank. Ms. Turnbull currently serves on the boards of directors of a number of non-profit and community organizations. Her extensive experience in working with corporate management teams and boards allows her to assist the Board in a wide array of operational and financial matters. |

| |

|

|

|

OUR

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE

FOR ELECTION

OF EACH NOMINEE FOR DIRECTOR

|

Note: All ages as of January 1, 2024

CORPORATE GOVERNANCE

Highlights

We strive to ensure that our corporate governance reflects

best practices tailored, as necessary, to our culture, goals and strategy.

| |

|

|

| |

Key Corporate Governance Characteristics |

|

| |

|

|

| |

Independent

Lead Director Independent

Lead Director

Stock Ownership Guidelines Stock Ownership Guidelines

Executive Sessions of Independent Directors Executive Sessions of Independent Directors

Independent Compensation Consultant Independent Compensation Consultant

Annual Board and Board Committee Self Evaluations Annual Board and Board Committee Self Evaluations

Code of Business Conduct and Ethics Code of Business Conduct and Ethics

Annual Stock Grant to Non-Employee Directors Annual Stock Grant to Non-Employee Directors

Ethics Hotline, with Anonymous Reporting Ethics Hotline, with Anonymous Reporting

|

Related Party Transaction Policy Related Party Transaction Policy

Disclosure Committee for Financial Reporting Disclosure Committee for Financial Reporting

Annual Stockholder Approval of Executive Compensation Annual Stockholder Approval of Executive Compensation

Annual Shareholder Outreach to Solicit Input on Executive

Compensation and Corporate Governance Matters Annual Shareholder Outreach to Solicit Input on Executive

Compensation and Corporate Governance Matters

Flexibility for Shareholders to Call Special Meetings

of Shareholders Flexibility for Shareholders to Call Special Meetings

of Shareholders

|

|

| |

|

|

|

Board Leadership Structure

Our Board of Directors maintains a leadership structure

composed of a lead independent director and a Chair who is not an independent director. Our Chief Executive Officer serves as Chairman

of the Board; our lead independent director is selected by all independent directors on our Board and plays an active oversight role.

As noted earlier, other than Mr. Kramer, each of our other twelve directors is independent.

CHAIRMAN

Currently, the Company’s Chairman and CEO roles

are held by Mr. Kramer. The Board believes that this structure serves the Company and its shareholders well, based primarily on (i) Mr.

Kramer’s background, skills and experience, as detailed in his biography above; (ii) his history with Griffon and successful track

record spearheading the Company’s strategic positioning, including strong improvements to financial performance and operations;

and (iii) a deliberate approach to capital allocation, M&A and divestitures.

The Chairman has the authority to call meetings of

the Board and presides at such meetings. He has primary responsibility for shaping Board agendas (in consultation with the Lead Independent

Director) and communicates with all directors on key issues and concerns outside of Board meetings.

LEAD INDEPENDENT DIRECTOR

Our lead independent director, Mr. Jerome L. Coben,

has served in this role since March 2023. We believe that a lead independent director helps ensure independent oversight of the Company.

The below list provides a comprehensive, but not exhaustive, list of the key duties and responsibilities of the lead independent director.

| |

|

|

| |

Key Responsibilities of the

Lead Independent Director |

|

| |

|

|

| |

Presides at meetings of the Board at which the

Chairman is not present Presides at meetings of the Board at which the

Chairman is not present

Presides at executive sessions of the independent

directors Presides at executive sessions of the independent

directors

Serves as a liaison between the Chairman and the

independent directors Serves as a liaison between the Chairman and the

independent directors

Together with the Chairman, establishes the agenda

for meetings of the Board Together with the Chairman, establishes the agenda

for meetings of the Board

Oversees the board and committee annual self-evaluation

process Oversees the board and committee annual self-evaluation

process

|

Oversees the flow of information to the Board,

and coordinates with the independent directors to ensure that they have access to information they request from time to time Oversees the flow of information to the Board,

and coordinates with the independent directors to ensure that they have access to information they request from time to time

Collaborates with the Nominating and Corporate

Governance Committee in monitoring the composition and structure of the Board Collaborates with the Nominating and Corporate

Governance Committee in monitoring the composition and structure of the Board

|

|

| |

|

|

|

EXECUTIVE SESSIONS

Independent directors have the opportunity to meet

in executive session without management present at their request. Executive sessions are chaired by the Independent Lead Director, Mr.

Jerome L. Coben, and occur at least once annually. The Audit Committee and Compensation Committee also meet regularly in executive session.

During executive sessions, the independent directors may review CEO performance and compensation; succession planning, strategy and risk;

corporate governance matters; and any other matters of importance to the Company raised during a meeting or otherwise presented by the

independent directors.

Director Independence

The Board of Directors has determined that each of

Messrs. Alpert, Coben, Cocke, Diao, Grabowsky, Johnson, Renuart, Sight and Sullivan, and Ms. Stewart, Ms. Taylor and Ms. Turnbull, are

independent under New York Stock Exchange Rule 303A. The Board of Directors affirmatively determined that no director (other than Ronald

J. Kramer) has a material relationship with the Company, either directly or as a partner, stockholder or officer of an organization that

has a relationship with the Company.

In making this determination, the Board considered

all relevant facts and circumstances. With respect to Mr. Grabowsky, the Board considered that Mr. Grabowsky was a partner and member

of the senior management of Grant Thornton LLP until his retirement from Grant Thornton LLP in August 2014. In determining that this former

relationship does not constitute a “material relationship” that would impede the exercise of independent judgment by Mr. Grabowsky,

the Board considered, among other things, that Mr. Grabowsky never personally performed any work on the audits of Griffon’s financial

statements, and that Mr. Grabowsky has no financial relationship with Grant Thornton LLP and no ability to influence Grant Thornton LLP’s

operations or policies.

With respect to Mr. Cocke, the Board considered that

Mr. Cocke is the founder and Chief Investment Officer of Voss Capital, and considered the relationships and transactions between Griffon

and Voss, which are described above under “Election of Directors—Cooperation Agreement with Voss” and below under “Certain

Relationships and Related Person Transactions.” In concluding that these relationships and transactions do not result in a “material

relationship” between Griffon and Voss that would impede the exercise of independent judgment by Mr. Cocke, the Board considered,

among other things, that Voss’ rights and obligations arise directly as a result of its Griffon stock ownership; that the

amount of certain expenses of Voss that Griffon agreed

to reimburse is well below the threshold set forth in the applicable New York Stock Exchange Rule regarding independence; and that the

purchase by Griffon of 400,000 shares of its common stock from funds managed by Voss was made at a discount to market and did not create

any ongoing obligations between Griffon and Voss.

Board Committees

We currently have the following standing committees:

the Compensation Committee, the Nominating and Corporate Governance Committee, the Audit Committee and the Finance Committee. All of the

standing committees of the Board of Directors are composed entirely of independent directors.

| COMPENSATION

COMMITTEE |

|

| |

|

|

|

| Chair: |

|

Cheryl L. Turnbull |

Members: Jerome L. Coben

Lacy M. Johnson

Samanta Hegedus Stewart

Meetings in Fiscal 2023: 5 |

| |

|

|

|

|

| |

| Key responsibilities |

| |

| Our Compensation Committee has the responsibility for determining and approving the compensation of our Chief Executive Officer and other senior executive officers, as well as the Presidents of our business units. This includes reviewing and approving the annual base salaries and annual incentive opportunities paid to such persons. Our Compensation Committee awards restricted stock and other equity-based awards to officers and employees. The Compensation Committee may form and delegate authority to subcommittees as it deems appropriate. The Compensation Committee considers recommendations from our executive officers with respect to executive compensation matters. The Company utilizes the services of an independent consultant to perform analyses and to make recommendations relative to executive compensation matters. These analyses and recommendations are conveyed to the Compensation Committee, and the Compensation Committee takes such information into consideration in making its compensation decisions. A copy of the Compensation Committee charter can be found on our website at www.griffon.com. |

| |

|

| NOMINATING AND CORPORATE GOVERNANCE COMMITTEE |

| |

|

|

|

| Chair: |

|

Lacy M. Johnson |

Members: Henry A. Alpert

Travis W. Cocke

Samanta Hegedus Stewart

Meetings in Fiscal 2023: 5 |

| |

|

|

|

|

| |

| Key responsibilities |

| |

| The Nominating

and Corporate Governance Committee is responsible for (1) reviewing suggestions of candidates for director made by directors and

others; (2) identifying individuals qualified to become Board members, and recommending to the Board the director nominees for the

next annual meeting of stockholders or to fill vacancies that occur between annual meetings; (3) recommending to the Board director

nominees for each committee of the Board; (4) recommending to the Board the corporate governance principles applicable to the Company;

and (5) overseeing the annual evaluation of the Board and management. There is no difference in the manner in which a nominee is

evaluated based on whether the nominee is recommended by a stockholder or otherwise. The Nominating and Corporate Governance Committee

has nominated the directors to be elected at this meeting. A copy of the Nominating and Corporate Governance Committee charter can

be found on our website at www.griffon.com. |

| |

| AUDIT COMMITTEE |

| |

|

|

|

| Chair: |

|

Louis J. Grabowsky |

Members: James W. Sight

Kevin F. Sullivan

Michelle L. Taylor

Meetings in Fiscal 2023: 6 |

| |

|

|

|

|

| |

| Key responsibilities |

| |

| We have a

separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act

of 1934 (the “Exchange Act”). Our Audit Committee is involved in discussions with management and our independent registered

public accounting firm with respect to financial reporting and our internal accounting controls. The Audit Committee has the sole

authority and responsibility to select, evaluate and replace our independent registered public accounting firm. The Audit Committee

must pre-approve all audit engagement fees and terms and all non-audit engagements with the independent registered public accounting

firm. The Audit Committee is responsible for monitoring compliance with our Code of Business Conduct and Ethics. The Audit Committee

consults with management but does not delegate these responsibilities. A copy of the Audit Committee charter can be found on our

website at www.griffon.com. |

| |

| The Board has determined that Louis J. Grabowsky, who became a member

of the Audit Committee in November 2015, qualifies as an “Audit Committee Financial Expert,” as defined by SEC rules,

based on his education, experience and background. |

| |

| FINANCE COMMITTEE |

|

| |

|

|

|

| Chair: |

|

Kevin F. Sullivan |

Members: Henry A. Alpert

Jerome L. Coben

H. C. Charles Diao

General Victor Eugene Renuart

Meetings in Fiscal 2023: 3 |

| |

|

|

|

| |

Key responsibilities

The Finance Committee is responsible for reviewing proposed transactions that will materially impact the Company’s capital

structure, as well as any material changes to the Company’s capital structure, after which it shall make a non-binding recommendation

to the full Board of Directors. This includes any offerings or sales of debt or equity securities of the Company, and material credit

agreements or other material financing arrangements. A copy of the Finance Committee Charter can be found on our website at www.griffon.com. |

| |

Board and Committee Meetings

During the fiscal year ended September 30, 2023, there

were 13 meetings of the Board of Directors. Each of our directors attended or participated in at least 75% of the meetings of the Board

of Directors, and of the respective committees of which he or she is a member, held during the period such director was a director during

the fiscal year ended September 30, 2023.

We encourage all our directors to attend our annual

meetings of stockholders. All 13 of our directors attended last year’s annual meeting of stockholders either in-person or via teleconference.

From May 2022 to April 2023,

Griffon was engaged in a process to explore strategic alternatives under the oversight of a committee on strategic considerations

that consisted of Messrs. Sight (Chair), Coben, Cocke, Diao, Grabowsky and Sullivan, and Ms. Turnbull. This committee met 15 times

in fiscal 2023.

Risk Oversight

Management is responsible for the day-to-day management

of risks for Griffon and its subsidiaries, while our Board of Directors, as a whole and through its committees, is responsible for the

oversight of risk management. The Board sets our overall risk management strategy and our risk appetite and ensures the implementation

of our risk management framework. Specific board committees are responsible for overseeing specific types of risk. Our Audit Committee

periodically discusses risks as they relate to its review of the Company’s financial statements, the evaluation of the effectiveness

of internal control over financial reporting, compliance with legal and regulatory requirements including the Sarbanes-Oxley Act, performance

of the internal audit function, and review of related party transactions, among other responsibilities set forth in the Audit Committee’s