Current Report Filing (8-k)

November 09 2022 - 4:05PM

Edgar (US Regulatory)

0000043920false00000439202022-11-092022-11-090000043920us-gaap:CommonClassAMember2022-11-092022-11-090000043920us-gaap:CommonClassBMember2022-11-092022-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

| | | | | |

| November 9, 2022 | November 8, 2022 |

Date of Report (Date of earliest event reported)

GREIF, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-00566 | 31-4388903 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | | | | |

425 Winter Road | Delaware | Ohio | 43015 |

(Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: (740) 549-6000

Not Applicable

(Former name or former address, if changed since last report.)

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

Class A Common Stock | GEF | New York Stock Exchange |

Class B Common Stock | GEF-B | New York Stock Exchange |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Section 1 – Registrant’s Business and Operations

Item 1.01 Entry into a Material Definitive Agreement.

The following material definitive agreement has been entered into by Greif Packaging LLC, a Delaware limited liability company (“Buyer”), a subsidiary of Greif, Inc. (the “Company”).

Membership Interest Purchase Agreement (the “Purchase Agreement”), dated as of November 8, 2022, by and among Buyer, LCC Topco, Inc., a Georgia corporation (“LCC Topco”), LI Topco, LLC, a Georgia limited liability company (“LI Topco”), LCIH Topco, Inc., an Iowa corporation (“LCIH Topco” and each of LCIH Topco, LCC Topco and LI Topco, a “Seller” and collectively, the “Sellers”). Under the Purchase Agreement, the Sellers are selling to Buyer, and Buyer is purchasing from Sellers, all of the issued and outstanding limited liability company membership interests of (i) Lee Container Corporation, LLC, a Georgia limited liability company (“LCC”); (ii) Lee Investments, LLC, a Georgia limited liability company (“LI”); and (iii) Lee Container Iowa Holdings, LLC, an Iowa limited liability company (“LCIH”, and collectively with LCC and LI, “Lee Container”), all as more particularly described in the Purchase Agreement (collectively, the “Acquisition”).

The purchase price for the Acquisition is $300 million, subject to certain adjustments. The purchase price will be paid in cash by Buyer with proceeds from the Company’s existing credit facilities. The Purchase Agreement provides that closing of the Acquisition is subject to the satisfaction or waiver of certain conditions, including, among other matters, the receipt of certain landlord consents to extend lease terms and provide renewal rights and the expiration or early termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”).

The Purchase Agreement may be terminated, and the Acquisition may be abandoned at any time prior to the closing, as follows: (i) by mutual written agreement of Buyer and Sellers; and (ii) by either Buyer or Sellers if the conditions set forth in the Purchase Agreement have not been, or it if it becomes apparent that any of such conditions will not be, fulfilled on or before the date that is 60 days after the date of the Purchase Agreement (the “Outside Date”) (subject to an option of either party to extend the Outside Date to 180 days after the date of the Agreement if the only condition not satisfied is the expiration or early termination of the waiting period under the HSR Act).

Investors should not rely on the representations, warranties and covenants in the Purchase Agreement or any descriptions thereof as characterizations of the actual state of facts or condition of any of the companies being acquired in the Acquisition. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Purchase Agreement, which subsequent information may or may not be fully reflected in the public disclosures of the Company.

The description of the Purchase Agreement and the transaction contemplated thereby contained in this Item 1.01 is not complete and is subject to, and is qualified in its entirety by, the full text of the Purchase Agreement attached to this Form 8-K as Exhibit 2.1, which is incorporated herein by reference.

Section 7 – Regulation FD

Item 7.01 Regulation FD Disclosure.

The Company issued a press release on November 9, 2022 regarding the Acquisition. A copy of the press release, which is attached to the Current Report on Form 8-K as Exhibit 99.1, is hereby furnished pursuant to Item 7.01. The Company also issued a press release on November 9, 2022 regarding its participation in the 2022 Baird Industrial Conference and regarding its reaffirmation of fiscal year 2022 guidance. A copy of the press release, which is attached to the Current Report on Form 8-K as Exhibit 99.2, is hereby furnished pursuant to Item 7.01.

Section 9 – Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| Membership Interest Purchase Agreement among LCC TopCo, Inc., LI TopCo, LLC, LCIH TopCo, Inc. and Greif Packaging LLC dated as of November 8, 2022.* |

| Press release issued by Greif, Inc. on November 9, 2022 regarding the Acquisition. |

| Press release issued by Greif, Inc. on November 9, 2022 regarding affirmation of guidance and participation at the Baird Industrial Conference. |

*Schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule will be furnished supplementally to the Securities and Exchange Commission upon request; provided, however, the that parties may request confidential treatment pursuant to Rule 24b-2 of the Exchange Act for any document so furnished.

Cautions Concerning Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to Company’s plans to acquire Lee Container and other statements about future expectations, prospects, estimates and other matters that are dependent upon future events or developments. These forward-looking statements may be identified by words such as "expect," "anticipate," "intend," "plan," "believe," "will," "should," "could," "would," "project," "continue," "likely," and similar expressions, and include statements reflecting future results, trends or guidance and statements of outlook. All forward-looking statements are based on assumptions, expectations and other information currently available to management. All forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those forecasted, projected or anticipated, whether expressed or implied. These risks and uncertainties include: the ability to successfully complete the acquisition of Lee Container on a timely basis, including receipt of required regulatory approvals; the occurrence of any event, change or other circumstance that could give rise to the termination of the definitive agreement; the outcome of any legal proceedings that may be instituted against the parties and others related to the acquisition of Lee Container; the satisfaction of certain conditions to the completion of the acquisition of Lee Container; if the acquisition of Lee Container is completed, the ability to retain the acquired businesses' customers and employees, the ability to successfully integrate the acquired businesses into the Company's operations, and the ability to achieve the expected synergies as well as accretion in margins, earnings or cash flow; competitive pressures in the Company’s various lines of business; the risk of non-renewal or a default under one or more key customer or supplier arrangements or changes to the terms of or level of purchases under those arrangements; uncertainties with respect to U.S. tax or trade laws; the effects of any investigation or action by any regulatory authority; and changes in foreign currency rates and the cost of commodities. The Company is subject to additional risks and uncertainties described in its Form 10-K, Form 10-Q and Form 8-K reports and exhibits to those reports. This Form 8-K reflects management's views as of November 8, 2022. Except to the extent required by applicable law, the Company undertakes no obligation to update or revise any forward-looking statement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| GREIF, INC. |

| Date: November 9, 2022 | By | /s/ Gary R. Martz |

| | Gary R. Martz

Executive Vice President |

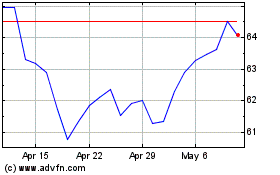

Greif (NYSE:GEF)

Historical Stock Chart

From Jun 2024 to Jul 2024

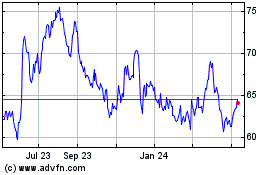

Greif (NYSE:GEF)

Historical Stock Chart

From Jul 2023 to Jul 2024