UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the

month of January 2022

Commission

File Number 001-15170

GlaxoSmithKline plc

(Translation

of registrant's name into English)

980 Great West Road, Brentford, Middlesex, TW8 9GS

(Address

of principal executive office)

Indicate

by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form

20-F . . . .X. . . . Form 40-F . . . . . . . .

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate

by check mark if the registrant is submitting the Form 6-K in paper

as permitted by Regulation S-T Rule 101(b)(7): ____

Issued: 15 January 2022, London UK

Update - GSK Consumer Healthcare

GlaxoSmithKline (GSK) plc today confirms that it has received three

unsolicited, conditional and non-binding proposals from Unilever

plc to acquire the GSK Consumer Healthcare business. The latest

proposal received on 20th December 2021 was for a total acquisition

value of £50 billion comprising £41.7 billion in cash and

£8.3 billion in Unilever shares. The Consumer Healthcare

business is a Joint Venture between GSK and Pfizer, with GSK

holding a majority controlling interest of 68% and Pfizer

32%.

GSK rejected all three proposals made on the basis that they

fundamentally undervalued the Consumer Healthcare business and its

future prospects.

The Board of GSK is strongly focused on maximising value for GSK

shareholders and has carefully evaluated each Unilever proposal. In

doing so, the Board and its advisers assessed the proposals

relative to the financial planning assessments completed to support

the proposed demerger of the business in mid-2022, including the

sales growth outlook set out below.

Global leader in Consumer Healthcare

The Consumer Healthcare business has been transformed since 2014

through the successful integrations of GSK's business with the

Novartis consumer health portfolio in 2015 and the Pfizer portfolio

in 2019. Importantly, this transformation has also provided a

platform to scale and optimise many aspects of the Consumer

Healthcare business including divesting lower growth brands,

introducing a new R&D/innovation model, optimising the supply

chain and manufacturing network, alongside continued investment in

new digital, data and analytic platforms and

capabilities.

This has resulted in the creation of a leading global consumer

healthcare business with annual sales of £9.6 billion in

20211.

The business has an exceptional portfolio of world-class,

category-leading brands; global scale with footprint and

distribution capability to serve more than 100 markets; strong

brand building, innovation and digital capabilities; and offers a

unique proposition that combines trusted science with human

understanding.

The business is led by a highly skilled management team with deep

experience in consumer healthcare and FMCG with strong commitment

to delivery on its purpose and growth ambitions.

Superior growth and highly attractive financial

profile

The business is well-positioned to sustainably grow ahead of its

categories in the years to come. The fundamentals for the £150

billion consumer healthcare sector are strong, reflecting an

increased focus on health and wellness, significant demand from an

ageing population and emerging middle class, and sizeable unmet

consumer needs.

Over the period 2019-2021 the Consumer Healthcare business

delivered a 4% organic sales growth CAGR2 outpacing

its categories and despite the adverse impact of the COVID

pandemic.

Superior sales growth for the business is expected to result from a

strategy that puts the consumer at the heart of the business to

better address every-day health and wellness needs, in particular

by increasing household penetration of its leading brands and

capitalising on new and emerging growth opportunities arising from

innovation and the use of new technologies and digital platforms,

all underpinned by continued strong execution and financial

discipline. Over the medium term, superior sales growth is expected

to be primarily driven by continued momentum of key brands in Oral

Care, VMS, and Pain Relief; accelerating innovation in the US and

China; and further growth in emerging markets.

Reflecting these trends, and the investments made and planned for

the business, the Board of GSK is confident that the Consumer

Healthcare business can sustainably deliver annual organic sales

growth in the range of 4-6% (CER) over the medium

term.

The combination of superior organic sales growth, operating margin

expansion and consistent high cash generation will, we believe,

offer both existing and prospective shareholders a highly

attractive financial profile that facilitates continued investment

in growth, the delivery of attractive returns and the opportunity

of continued participation in long-term value

creation.

Proposals fundamentally failed to reflect the intrinsic value of

the business and its potential

The Board of GSK unanimously concluded that the proposals were not

in the best interests of GSK shareholders as they fundamentally

undervalued the Consumer Healthcare business and its future

prospects.

The Board of GSK therefore remains focused on executing its

proposed demerger of the Consumer Healthcare business, to create a

new independent global category-leading consumer company which,

subject to approval from shareholders, is on track to be achieved

in mid-2022.

Capital Markets event

GSK intends to share further details of the strategy, brands,

capabilities and operations, including detailed financial

information and future growth ambitions for the new Consumer

Healthcare business at a virtual Capital Markets Day for investors

and analysts on Monday 28th February 2022.

Notes

1Unaudited. (2021 full year

results for GSK due to be announced on 9th February

2022)

2 Excluding the impact of

brands divested/ under review, on a CER basis

About GSK

GSK is a science-led global healthcare company. For further

information please visit www.gsk.com/about-us.

|

GSK enquiries:

|

|

|

|

|

Media enquiries:

|

Tim Foley

|

+44 (0) 20 8047 5502

|

(London)

|

|

|

Kathleen Quinn

|

+1 202 603 5003

|

(Washington DC)

|

|

|

|

|

|

|

Analyst/Investor enquiries:

|

Nick Stone

|

+44 (0) 7717 618834

|

(London)

|

|

|

Sonya Ghobrial

|

+44 (0) 7392 784784

|

(Consumer)

|

|

|

James Dodwell

|

+44 (0) 20 8047 2406

|

(London)

|

|

|

Mick Readey

|

+44 (0) 7990 339653

|

(London)

|

|

|

Josh Williams

|

+44 (0) 7385 415719

|

(London)

|

|

|

Jeff McLaughlin

|

+1 215 751 7002

|

(Philadelphia)

|

|

|

Frannie DeFranco

|

+1 215 751 4855

|

(Philadelphia)

|

Cautionary statement regarding forward looking

statements

This announcement contains statements that are, or may be deemed to

be, "forward-looking statements". GSK cautions investors that any

forward-looking statements or projections made by GSK, including

those made in this announcement, are subject to risks and

uncertainties that may cause actual results to differ materially

from those projected. Such factors include, but are not limited to,

those described in the

Company's Annual Report on Form 20-F for 2020, GSK's 2021 Q3

Results and any impacts of

the COVID-19 pandemic. GSK undertakes no obligation to

update any forward-looking statements, whether as a result of new

information, future events or otherwise. Accordingly, no

assurance can be given that any particular expectation will be met

and investors are cautioned not to place undue reliance on the

forward-looking statements.

Registered

in England & Wales:

No.

3888792

Registered Office:

980

Great West Road

Brentford,

Middlesex

TW8

9GS

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorised.

|

|

GlaxoSmithKline plc

|

|

|

(Registrant)

|

|

|

|

|

Date: January

17, 2022

|

|

|

|

|

|

|

By:/s/ VICTORIA

WHYTE

--------------------------

|

|

|

|

|

|

Victoria Whyte

|

|

|

Authorised

Signatory for and on

|

|

|

behalf

of GlaxoSmithKline plc

|

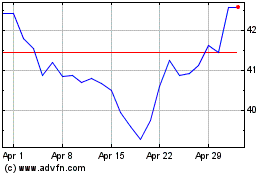

GSK (NYSE:GSK)

Historical Stock Chart

From Aug 2024 to Sep 2024

GSK (NYSE:GSK)

Historical Stock Chart

From Sep 2023 to Sep 2024