GeoPark Announces Exclusive Binding Agreement to Acquire Repsol Exploration and Production Assets in Colombia

November 29 2024 - 2:05AM

Business Wire

GeoPark Limited (“GeoPark” or the “Company”) (NYSE: GPRK), a

leading independent energy company with over 20 years of successful

operations across Latin America, announced today that the Company

has signed Sale and Purchase Agreements (SPAs) with Repsol

Exploración S.A. and Repsol E&P S.A.R.L (collectively,

“Repsol”) to acquire Repsol upstream oil and gas assets in

Colombia.

The potential acquisition would incorporate high-quality assets

located in the prolific Llanos Basin, one of Colombia’s most

productive oil regions where GeoPark already has a successful

oil-finding track record and is a well-established operator both

above and below ground. The agreements include the acquisition of

100% of Repsol Colombia O&G Limited, which owns a 45%

non-operated working interest in the CPO-9 Block in Meta Department

(operated by Ecopetrol with a 55% WI), and Repsol’s 25% interest in

SierraCol Energy Arauca LLC (“Llanos Norte”) in Arauca Department.

Together, these assets produced approximately 16,000 boepd net1 to

Repsol as of September 2024.

This acquisition firmly fits within GeoPark’s growth strategy –

“North Star”- by securing value accretive access to big

competitively advantaged assets, in big plays, and big proven

basins to build and deliver a highly profitable, dependable, and

sustainable oil and gas portfolio across Latin America. The Repsol

portfolio in Colombia would provide immediate and long-term

production, reserves, and cashflow, with low capital investment

intensity, significant low-risk growth potential and exploration

upside. This opportunity also strategically complements GeoPark’s

recent entry into the Vaca Muerta play in Argentina, enabling

robust asset, play and country risk diversification well into the

next decade.

The consideration for the potential acquisition at full scope is

approximately $530 million, funded through a combination of cash

resources and debt, including a non-recourse amortizing debt

facility of up to $345 million, led and arranged by Macquarie Bank

Limited, underscoring the security and strong cash generation

profile of the assets. The debt facility is paired up with a robust

hedging strategy that underpins debt service and provides price

downside protection.

The transaction is subject to the fulfillment of certain

conditions precedent and customary regulatory approvals, including

the waiver or non-execution of the preemptive rights by Repsol’s

current partners. Hence, no assurances can be given about the

transaction’s final scope and/or that it will ultimately be

completed. Due to confidentiality terms in the agreement, GeoPark

is not able to provide further information to the market on this

acquisition until the transaction is effectively closed, or

terminated, as the case may be.

_________________________ 1 Production at Repsol’s working

interest before royalties and economic rights.

NOTICE

Additional information about GeoPark can be found in the “Invest

with Us” section on the website at www.geo-park.com.

CAUTIONARY STATEMENTS RELEVANT TO

FORWARD-LOOKING INFORMATION

This press release contains statements that constitute

forward-looking statements. Many of the forward-looking statements

contained in this press release can be identified by the use of

forward-looking words such as ‘‘anticipate,’’ ‘‘believe,’’

‘‘could,’’ ‘‘expect,’’ ‘‘should,’’ ‘‘plan,’’ ‘‘intend,’’ ‘‘will,’’

‘‘estimate’’ and ‘‘potential,’’ among others.

Forward-looking statements that appear in a number of places in

this press release include, but are not limited to, statements

regarding the intent, belief or current expectations, regarding

various matters, including, expected production, reserves and the

closing of the acquisition. Forward-looking statements are based on

management’s beliefs and assumptions, and on information currently

available to the management. Such statements are subject to risks

and uncertainties, and actual results may differ materially from

those expressed or implied in the forward-looking statements due to

various factors.

Forward-looking statements speak only as of the date they are

made, and the Company does not undertake any obligation to update

them in light of new information or future developments or to

release publicly any revisions to these statements in order to

reflect later events or circumstances, or to reflect the occurrence

of unanticipated events. For a discussion of the risks facing the

Company which could affect whether these forward-looking statements

are realized, see filings with the U.S. Securities and Exchange

Commission (SEC).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241128264650/en/

INVESTORS:

Maria Catalina Escobar Shareholder Value and Capital

Markets Director mescobar@geo-park.com

Miguel Bello Investor Relations Officer

mbello@geo-park.com

Maria Alejandra Velez Investor Relations Leader

mvelez@geo-park.com

MEDIA:

Communications Department communications@geo-park.com

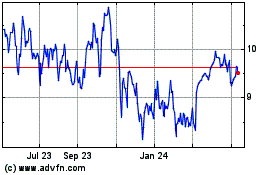

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Nov 2024 to Dec 2024

GeoPark (NYSE:GPRK)

Historical Stock Chart

From Dec 2023 to Dec 2024