(FROM THE WALL STREET JOURNAL 3/18/16)

By James R. Hagerty and Bob Tita

Caterpillar Inc. on Thursday acknowledged what Brandon Millican

of Malta, Mont., already knew: It's getting ever harder to sell

heavy equipment into an economy weighed down by falling oil

production.

The Peoria, Ill.-based maker of construction and mining

equipment issued downbeat first-quarter estimates for revenue and

profit. Meanwhile, Mr. Millican, who runs construction-related

businesses, has resorted to trying to sell three idle Caterpillar

generators on Craigslist.

Caterpillar, which left its full-year outlook unchanged, now

projects first-quarter profit of 50 cents to 55 cents a share.

Excluding restructuring costs, it forecast earnings of 65 cents to

70 cents a share; analysts were expecting 97 cents a share. "The

question remains whether this revised guide is adequately

conservative," said Ann Duignan, an analyst for J.P. Morgan

Chase.

Mr. Millican spotted an opportunity several years ago when

shale-oil production soared in western North Dakota. He bought

three Caterpillar generators for roughly $138,000 each and rented

them to oil-production firms needing mobile electric power for

their equipment.

Now that oil exploration and production have plunged, Mr.

Millican can't find anyone to rent those machines and is trying to

sell them on Craigslist. "I'd rather not have them sit around if

oil takes five or 10 years to come back," Mr. Millican said.

Recently, crude prices have shown signs of life, with the U.S.

oil benchmark on Thursday breaking above $40 a barrel for the first

time this year, up more than 50% from lows hit in mid-February.

Wary of the boom-and-bust cycle, oil-and-gas producers rent much

of their equipment rather than buying. That leaves rental companies

holding lots of generators and searching for ways to unload them --

which is also drying up sales of new machines for Caterpillar,

Cummins Inc. and other companies that manufacture them. The pain

being felt by these companies illustrates how the energy bust has

rippled far beyond the oil patch and is chilling a large part of

the economy.

"There's been a tremendous amount of [used] equipment hitting

the market, and there will be a tremendous amount more," said Dick

Davis, president of Depco Power Systems, a Houston-based dealer in

new and used generators. In the range of 30 to 300 kilowatts, there

probably are more than 10,000 surplus generators available for sale

because of the oil bust, estimated Will Perry, chief executive of

Worldwide Power Products, another Houston dealer.

"We don't see any relief on the horizon," said Aaron Jagdfeld,

chief executive of Wisconsin-based Generac Holdings Inc., a leading

manufacturer of generators. Its sales to the oil and gas sector

fell about 45% in 2015, and it is expecting a drop of 35% to 40%

this year. Its overall revenue dropped 10% last year to $1.3

billion, while profit sank 55% to $77.7 million, partly because of

one-time charges. "Everybody is hoping for the best and bracing for

the worst. You've got to let the air come out of the balloon," Mr.

Jagdfeld said.

For some, the generator glut spells opportunity. Justin

Crownover, a farmer in Sunray, Texas, is finding bargain prices on

used generators. Mr. Crownover, whose family farm is about 65 miles

north of Amarillo, is using some of those natural gas-fueled

generators to power irrigation pumps for fields of corn and

sorghum. A used 210-kilowatt Caterpillar generator, roughly the

size of Ford F-150 pickup truck, would have cost about $90,000 two

years ago but now can go for as little as $50,000, hesaid.

An index of values for used generatorsof various types compiled

by Rouse Services, a data provider in Beverly Hills, Calif., fell

15% through January from its peak in April. That is sharper than

the 6.4% drop in prices for used construction and warehouse

equipment broadly.

Global Power Supply LLC, a generator rental and sales concern

based in Santa Barbara, Calif., has dozens of generators in the 75-

to 150-kilowatt range that were destined for oil-field use but now

aren't needed there, said Mike Wolfe, who heads the firm's

generator operations. He said a very lightly used Caterpillar G3306

generator that would have sold for roughly $150,000 about 18 months

ago now might cost roughly $85,000.

"They will get cheaper and cheaper," said Eddie Boudreau, owner

of Pan American Power, a generator dealer in Covington, La. Some

will be sold in the U.S., he said, but most are likely to be

exported to Latin America or Asia.

To keep from further depressing used-market prices, Tractor

& Equipment Co., the Caterpillar dealer in North Dakota's

Bakken shale-oil region, has been shifting some generators and

other rental equipment to dealers elsewhere and holding others at

its Williston, N.D., rental lot. Demand for rented Caterpillar

generators in Williston fell by about 40% last year, the dealer

said.

United Rentals Inc., the biggest U.S. equipment-rental company,

is redeploying generators from the oil fields to petrochemical

plants, commercial buildings, golf tournaments and outdoor

concerts, said Paul McDonnell, a senior vice president.

Dewey Bailey, an area sales manager for industrial power at

Tractor & Equipment in Williston, said he is holding on to many

of his rental generators in anticipation of an eventual recovery.

"There's a lot of wells left to be completed and when that happens

there will be demand" for power, he said.

---

Joshua Jamerson contributed to this article.

(END) Dow Jones Newswires

March 18, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

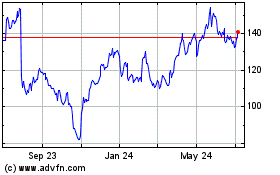

Generac (NYSE:GNRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

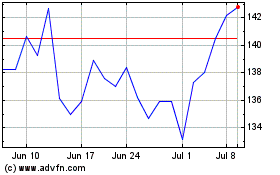

Generac (NYSE:GNRC)

Historical Stock Chart

From Jul 2023 to Jul 2024