UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-17f-2 OMB

Approval

-----------------

------------

Certificate of Accounting of Securities and OMB Number:

3235-0360

Similar Investments in the Custody Expires:

December 31, 2014

of Management Investment Companies Estimate average

burden hours

per response .

. . . . 2.00

Pursuant to Rule 17f-2 [17 CFR 270.17f-2] -----------------

------------

--------------------------------------------------------------

---------------

1. Investment Company Act File Number: Date examination

completed:

811-03364 October 26,

2012

--------------------------------------------------------------

---------------

2. State Identification Number:

AL AK AZ AR CA

CO X

CT DE DC FL GA

HI

ID IL IN IA KS

KY

LA ME MD MA MI

MN

MS MO MT NE NV

NH

NJ NM NY NC ND

OH

OK OR PA RI SC

SD

TN TX UT VT VA

WA

WV WI WY PUERTO RICO

|

Other (specify):

3. Exact name of investment company as specified in

registration statement:

Great-West Funds, Inc.

4. Address of principal executive office

(number,street,city,state,zip code):

8515 E. Orchard Road, Greenwood Village, CO 80111

October 26, 2012

United States Securities and Exchange Commission

Office of Applications and Report Services

450 Fifth Street, N.W.

Washington, DC 20549

Dear Sirs:

Enclosed is one copy of Form N-17f-2 and our related report,

dated October 26, 2012, on our examination of the investment

portfolio of the following portfolios of the Maxim Series

Fund, Inc. as of the close of business on July 16, 2012.

Maxim Stock Index Portfolio

Maxim S&P SmallCap 600 Index Portfolio

Maxim S&P 500 Index Portfolio

Maxim S&P MidCap 400 Index Portfolio

Maxim Aggressive Profile I Portfolio

Maxim Conservative Profile I Portfolio

Maxim Moderate Profile I Portfolio

Maxim Moderately Aggressive Profile I Portfolio

Maxim Moderately Conservative Profile I Portfolio

Maxim Aggressive Profile II Portfolio

Maxim Conservative Profile II Portfolio

Maxim Moderate Profile II Portfolio

Maxim Moderately Aggressive Profile II Portfolio

Maxim Moderately Conservative Profile II Portfolio

Maxim SecureFoundation Balanced Portfolio

Maxim SecureFoundation Lifetime 2015 Portfolio

Maxim SecureFoundation Lifetime 2020 Portfolio

Maxim SecureFoundation Lifetime 2025 Portfolio

Maxim SecureFoundation Lifetime 2030 Portfolio

Maxim SecureFoundation Lifetime 2035 Portfolio

Maxim SecureFoundation Lifetime 2040 Portfolio

Maxim SecureFoundation Lifetime 2045 Portfolio

Maxim SecureFoundation Lifetime 2050 Portfolio

Maxim SecureFoundation Lifetime 2055 Portfolio

Maxim Lifetime 2015 Portfolio I

Maxim Lifetime 2015 Portfolio II

Maxim Lifetime 2015 Portfolio III

Maxim Lifetime 2025 Portfolio I

Maxim Lifetime 2025 Portfolio II

Maxim Lifetime 2025 Portfolio III

Maxim Lifetime 2035 Portfolio I

Maxim Lifetime 2035 Portfolio II

Maxim Lifetime 2035 Portfolio III

Maxim Lifetime 2045 Portfolio I

Maxim Lifetime 2045 Portfolio II

Maxim Lifetime 2045 Portfolio III

Maxim Lifetime 2055 Portfolio I

Maxim Lifetime 2055 Portfolio II

Maxim Lifetime 2055 Portfolio III

As of September 24, 2012 the Maxim Series Fund, Inc. changed

its name to Great-West Funds, Inc and each series of the

Great-West Funds, Inc. ceased to use to term "Maxim" within

its name.

Very truly yours,

Bryan Morris

Partner

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors of the Maxim Series Fund, Inc.:

We have examined management's assertion included in the

accompanying Management Statement Regarding Compliance with

Certain Provisions of the Investment Company Act of 1940 that

Maxim Stock Index Portfolio, Maxim S&P SmallCap 600 Index

Portfolio, Maxim S&P 500 Index Portfolio, Maxim S&P MidCap

400 Index Portfolio, Maxim Aggressive Profile I Portfolio,

Maxim Conservative Profile I Portfolio, Maxim Moderate Profile

I Portfolio, Maxim Moderately Aggressive Profile I Portfolio,

Maxim Moderately Conservative Profile I Portfolio, Maxim

Aggressive Profile II Portfolio, Maxim Conservative Profile II

Portfolio, Maxim Moderate Profile II Portfolio, Maxim

Moderately Aggressive Profile II Portfolio, Maxim Moderately

Conservative Profile II Portfolio, Maxim SecureFoundation

Balanced Portfolio, Maxim SecureFoundation Lifetime 2015

Portfolio, Maxim SecureFoundation Lifetime 2020 Portfolio,

Maxim SecureFoundation Lifetime 2025 Portfolio, Maxim

SecureFoundation Lifetime 2030 Portfolio, Maxim

SecureFoundation Lifetime 2035 Portfolio, Maxim

SecureFoundation Lifetime 2040 Portfolio, Maxim

SecureFoundation Lifetime 2045 Portfolio, Maxim

SecureFoundation Lifetime 2050 Portfolio, Maxim

SecureFoundation Lifetime 2055 Portfolio, Maxim Lifetime 2015

Portfolio I, Maxim Lifetime 2015 Portfolio II, Maxim Lifetime

2015 Portfolio III, Maxim Lifetime 2025 Portfolio I, Maxim

Lifetime 2025 Portfolio II, Maxim Lifetime 2025 Portfolio III,

Maxim Lifetime 2035 Portfolio I, Maxim Lifetime 2035 Portfolio

II, Maxim Lifetime 2035 Portfolio III, Maxim Lifetime 2045

Portfolio I, Maxim Lifetime 2045 Portfolio II, Maxim Lifetime

2045 Portfolio III, Maxim Lifetime 2055 Portfolio I, Maxim

Lifetime 2055 Portfolio II, and Maxim Lifetime 2055 Portfolio

III (each a "Portfolio, collectively the "Portfolios") of the

Maxim Series Fund, Inc. (the "Fund") complied with the

requirements of subsections (b) and (c) of Rule 17f-2 under

the Investment Company Act of 1940 as of July 16, 2012.

Management is responsible for each Portfolio's compliance with

those requirements. Our responsibility is to express an

opinion on management's assertion about the Portfolios

compliance based on our examination.

Our examination was conducted in accordance with attestation

standards established by the Public Company Accounting

Oversight Board (United States), and accordingly, included

examining on a test basis, evidence about the Portfolio's

compliance with those requirements and performing such other

procedures as we considered necessary in the circumstances.

Included among our procedures were the following tests

performed as of July 16, 2012, and with respect to agreement

of security purchases and sales, for the period from December

31, 2011 (the date of our last examination) through July 16,

2012:

1. Confirmation of all securities held by the Depository Trust

Company (DTC) in book entry form. Since the DTC confirmation

can be only provided as of the month close, i.e. July 31,

2012, we have performed rollforward procedures on July 16,

2012 by adding the purchases and subtracting sales for the

period 7/16 to 7/31 to arrive at the balance as at July 31,

2012. D&T agreed the 7/31/2012 balance to the 7/31/2012

holdings w/o/e. And further, D&T confirmed the securities held

by the DTC as of 7/31/2012.

2. Reconciliation of all such securities to the books and records

of Portfolio and the Bank of New York (the "Custodian"); and

DST (the transfer agent).

3. Confirmation of all repurchase agreements with brokers/banks

and agreement of underlying collateral with Custodian records;

and

4. Agreement of one security purchases and one security sales or

maturities since our last report from the books and records of

the Portfolio to broker confirmations.

We believe that our examination provides a reasonable basis

for our opinion. Our examination does not provide a legal

determination on the Portfolios compliance with specified

requirements.

In our opinion, management's assertion that each of the

Portfolios of the Maxim Series Fund, Inc. complied with the

requirements of subsections (b) and (c) of Rule 17f-2 of the

Investment Company Act of 1940 as of July 16, 2012, with

respect to securities reflected in the investment account of

the Portfolio is fairly stated, in all material respects.

This report is intended solely for the information and use of

management and the Board of Directors of Maxim Series Fund,

Inc. and the Securities and Exchange Commission and is not

intended to be and should not be used by anyone other than

these specified parties.

As of September 24, 2012 the Maxim Series Fund, Inc. changed

its name to Great-West Funds, Inc and each series of the

Great-West Funds, Inc. ceased to use to term "Maxim" within

its name.

/s/ DELOITTE & TOUCHE LLP

Denver, Colorado

October 26, 2012

|

MANAGEMENT STATEMENT REGARDING COMPLIANCE WITH CERTAIN

PROVISIONS OF THE INVESTMENT COMPANY ACT OF 1940

We, as members of management of Maxim Stock Index Portfolio,

Maxim S&P SmallCap 600 Index Portfolio, Maxim S&P 500 Index

Portfolio, Maxim S&P MidCap 400 Index Portfolio , Maxim

Aggressive Profile I Portfolio, Maxim Conservative Profile I

Portfolio, Maxim Moderate Profile I Portfolio, Maxim

Moderately Aggressive Profile I Portfolio, Maxim Moderately

Conservative Profile I Portfolio, Maxim Aggressive Profile II

Portfolio, Maxim Conservative Profile II Portfolio, Maxim

Moderate Profile II Portfolio, Maxim Moderately Aggressive

Profile II Portfolio, Maxim Moderately Conservative Profile II

Portfolio, Maxim SecureFoundation Balanced Portfolio, Maxim

SecureFoundation Lifetime 2015 Portfolio, Maxim

SecureFoundation Lifetime 2020 Portfolio, Maxim

SecureFoundation Lifetime 2025 Portfolio, Maxim

SecureFoundation Lifetime 2030 Portfolio, Maxim

SecureFoundation Lifetime 2035 Portfolio, Maxim

SecureFoundation Lifetime 2040 Portfolio, Maxim

SecureFoundation Lifetime 2045 Portfolio, Maxim

SecureFoundation Lifetime 2050 Portfolio, Maxim

SecureFoundation Lifetime 2055 Portfolio, Maxim Lifetime 2015

Portfolio I, Maxim Lifetime 2015 Portfolio II, Maxim Lifetime

2015 Portfolio III, Maxim Lifetime 2025 Portfolio I, Maxim

Lifetime 2025 Portfolio II, Maxim Lifetime 2025 Portfolio III,

Maxim Lifetime 2035 Portfolio I, Maxim Lifetime 2035 Portfolio

II, Maxim Lifetime 2035 Portfolio III, Maxim Lifetime 2045

Portfolio I, Maxim Lifetime 2045 Portfolio II, Maxim Lifetime

2045 Portfolio III, Maxim Lifetime 2055 Portfolio I, Maxim

Lifetime 2055 Portfolio II, and Maxim Lifetime 2055 Portfolio

III (each a "Portfolio, collectively the "Portfolios") of the

Maxim Series Fund, Inc. (the "Fund"), are responsible for

complying with the requirements of subsections (b) and (c) of

Rule 17f-2, "Custody of Investments by Registered Management

Investment Companies," of the Investment Company Act of 1940.

We are also responsible for establishing and maintaining

effective internal controls over compliance with those

requirements. We have performed an evaluation of each of the

Portfolio's compliance with the requirements of subsections

(b) and (c) of Rule 17f-2 as of July 16, 2012 and from

December 31, 2011 (the date of our last examination) through

July 16, 2012.

Based on this evaluation, we assert that each of the

Portfolios were in compliance with the requirements of

subsections (b) and (c) of Rule 17f-2 of the Investment

Company Act of 1940 as of July 16, 2012, and from December 31,

2011 (the date of our last examination) through July 16, 2012,

with respect to securities reflected in the investment

accounts of the Fund.

As of September 24, 2012 the Maxim Series Fund, Inc. changed

its name to Great-West Funds, Inc and each series of the

Great-West Funds, Inc. ceased to use to term "Maxim" within

its name.

Great-West Funds, Inc.

By:

Mitchell Graye

President and Chief Executive Officer

Mary Maiers

Chief Financial Officer and Treasurer

Beverly Byrne

Chief Compliance Officer

October 26, 2012

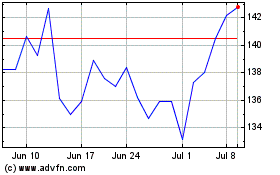

Generac (NYSE:GNRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

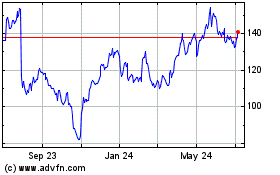

Generac (NYSE:GNRC)

Historical Stock Chart

From Jul 2023 to Jul 2024