Generac Holdings - Aggressive Growth

October 16 2011 - 8:00PM

Zacks

Generac Holdings Inc (GNRC) recently raised it outlook,

which sent estimates and shares higher. Valuations are looking good

and the company is growing organically and through acquisition.

Company Description

Generac makes backup power generation products serving

residential, light commercial and industrial markets.

Raising the Bar

One of the best things a company can do for its share price is

to raise its outlook and Generac did just that on Sep 26. The

company said that given the recent impact of wide spread outages

the second half of the year should be better than anticipated.

Analysts quickly raised their forecasts as well. The Zacks

Consensus Estimate for this year is up 9 cents on the news, to

$1.77. Next year's average projection is up 11 cents, to $2.02.

Those upward revisions and the last earnings surprise factored

into GNRC's Zacks #1 Rank (Strong Buy).

M&A Activity

On Oct 3 Generac announced the $80 million purchase of Magnum

Products. Gererac said the move enhances their industrial product

offerings and will bring in new product offerings. The company said

EPS for Q4 should get a 3 or 4 cent boost and revenue should be up

$25-$30 million.

The Chart

Raising the guidance couldn't have come at a better time for

shareholders. The stock plunged in late September, but has since

bounced back and is now at 52-week highs.

Even though shares have popped, you can still get in at decent

valuations. The forward P/E is just under 12 times and the PEG

ratio is at 0.9.

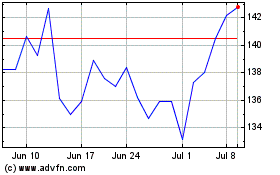

Generac (NYSE:GNRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

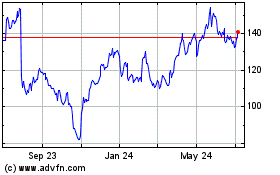

Generac (NYSE:GNRC)

Historical Stock Chart

From Jul 2023 to Jul 2024