Generac Holdings Inc. (NYSE: GNRC), a leading designer and

manufacturer of backup power generation products, today reported

financial results for its third quarter ended September 30, 2010.

Third Quarter 2010 Highlights

- Net sales increased year-over-year by 11.4% to $160.7 million

as compared to $144.3 million in the third quarter of 2009.

- Net income increased year-over-year by 60.6% to $23.0 million

as compared to $14.3 million for the third quarter of 2009;

Adjusted net income increased 35.3% to $36.7 million from $27.1

million in the third quarter of 2009.

- Net cash provided by operating activities improved 50.0%

year-over-year, from $24.3 million to $36.5 million during the

third quarter 2010.

- Diluted net income per common share was $0.34 per share;

Adjusted diluted net income per common share was $0.55 per

share.

- The Company successfully launched its new economy home standby

product, CorePower™ Series, establishing a new lower opening price

for the category.

"Despite the difficult operating environment which persisted

throughout the third quarter of 2010, we achieved a double digit

year-over-year increase in net sales, driven by increased sales for

both our residential and industrial products. Although we have not

had the benefit of major outage activity this summer, improved

industrial market conditions and our ability to expand distribution

and create awareness for our residential products have helped us

drive strong revenue growth in our business," said Aaron Jagdfeld,

President and Chief Executive Officer of Generac.

Residential product sales of $101.0 million increased 12.6% in

the third quarter 2010 from $89.7 million in the third quarter last

year. This year-over-year increase was driven primarily by our

marketing programs for home standby generators, continued expansion

of our residential products distribution network, and a shift

towards in-season buying.

Industrial and commercial product sales of $49.6 million in the

third quarter increased 7.6% from $46.0 million for the comparable

period in 2009. This increase was driven by an improvement in our

focused end markets and expansion of our distribution.

The Company has also announced the following strategic

initiatives designed to improve Generac's long-term growth

profile:

- In October 2010, the Company announced it had reached a

licensing agreement with Honeywell to be the exclusive licensee of

Honeywell branded standby and portable generators. By leveraging

Generac's product offering and support network, the Honeywell brand

will provide incremental access to underpenetrated channels for the

Company including security and HVAC.

- At the recent 2011 Green Industry and Equipment (GIE) Expo in

Louisville, KY, the Company announced plans to re-enter the market

for residential and contractor grade pressure washers, allowing it

to leverage its existing customer base, supply-chain and

engineering expertise.

Overall, gross profit margin increased sequentially to 41.9%

from 39.0% in the second quarter 2010, but was down from 44.7% in

the same period last year. The year-over-year decline in gross

margins was mostly attributable to increased commodity costs versus

prior year and a higher mix of lower kilowatt residential products

sold during the current quarter compared to the prior year

quarter.

Operating expenses for the third quarter of 2010 increased 10.9%

to $37.6 million compared to $33.9 million in third quarter of

2009. The year-over-year increase in operating expenses was

attributable to increased administrative costs related to operating

as a public company, non-cash stock compensation expenses, higher

engineering and product development costs, and higher variable

operating expenses on higher net sales versus prior year.

Adjusted EBITDA of $45.7 million was relatively flat compared to

$46.1 million in the third quarter of 2009. Interest expense

decreased in the third quarter of 2010 to $6.5 million, compared to

$17.2 million in the same period last year due to debt repayments,

lower LIBOR rates, and the termination of certain interest rate

swap agreements.

Free cash flow generation remained strong, improving 51.1%

year-over-year to $35.2 million during the third quarter 2010 from

$23.3 million in the third quarter of 2009.

OUTLOOK

Mr. Jagdfeld concluded, "As we close out 2010, we expect to see

continued year-over-year strength from our industrial and

commercial products as demand in those markets continues to

improve. However, more than offsetting this improvement, we see our

fourth quarter 2010 residential product sales down year-over-year

as certain customers have approached seasonal stocking for lower

kilowatt products more conservatively this year versus last year.

Despite this, we remain confident in our longer term growth

initiatives including new product launches, continued expansion of

our distribution network and our entry into new geographies and

markets that will continue to drive sales growth and significant

cash flow generation for our business."

Conference Call and Webcast

Generac management will hold a conference call at 10:00am EDT on

Thursday, November 4, 2010 to discuss highlights of this earnings

release. The conference call can be accessed by dialing (800)

435-1398 (domestic) or +1 (617) 614-4078 (international) and

entering passcode 74351458.

The conference call will also be webcast simultaneously on

Generac's website (http://www.generac.com), under the Investor

Relations link.

The webcast is also being distributed through the Thomson

Reuters StreetEvents Network. Individual investors can listen to

the call at http://www.earnings.com, Thomson Reuters' individual

investor portal, powered by StreetEvents. Institutional investors

can access the call via StreetEvents (http://www.streetevents.com),

a password-protected event management site.

Following the live webcast, a replay will be available on the

Company's web site. A telephonic replay will also be available

three hours after the call and can be accessed by dialing (888)

286-8010 (domestic) or +1 (617) 801-6888 (international) and

entering passcode 36086456. The telephonic replay will be available

for 30 days.

Generac company news is available 24 hours a

day, on-line at: http://www.generac.com.

About Generac

Since 1959, Generac has been a leading designer and manufacturer

of a wide range of backup power generation products serving

residential, light commercial and industrial markets. Generac's

power systems range in output from 800 watts to 9 megawatts and are

available through a broad network of independent dealers, retailers

and wholesalers.

Forward-looking Information

Certain statements contained in this news release, as well as

other information provided from time to time by Generac Holdings

Inc. or its employees, may contain forward looking statements that

involve risks and uncertainties that could cause actual results to

differ materially from those in the forward looking statements.

Forward-looking statements give Generac's current expectations and

projections relating to the Company's financial condition, results

of operations, plans, objectives, future performance and business.

You can identify forward-looking statements by the fact that they

do not relate strictly to historical or current facts. These

statements may include words such as "anticipate," "estimate,"

"expect," "project," "plan," "intend," "believe," "confident,"

"may," "should," "can have," "likely," "future" and other words and

terms of similar meaning in connection with any discussion of the

timing or nature of future operating or financial performance or

other events.

Any such forward looking statements are not guarantees of

performance or results, and involve risks, uncertainties (some of

which are beyond the Company's control) and assumptions. Although

Generac believes any forward-looking statements are based on

reasonable assumptions, you should be aware that many factors could

affect Generac's actual financial results and cause them to differ

materially from those anticipated in any forward-looking

statements, including:

- demand for Generac products;

- frequency of major power outages;

- availability of raw materials and key components used in

producing Generac products;

- competitive factors in the industry in which Generac

operates;

- Generac's dependence on its distribution network;

- Generac's ability to invest in, develop or adapt to changing

technologies and manufacturing techniques;

- Generac's ability to adjust to operating as a public

company;

- loss of key management and employees;

- increase in liability claims; and

- changes in environmental, health and safety laws and

regulations.

Should one or more of these risks or uncertainties materialize,

Generac's actual results may vary in material respects from those

projected in any forward-looking statements. A detailed discussion

of these and other factors that may affect future results is

contained in Generac's filings with the Securities and Exchange

Commission, or SEC.

Any forward-looking statement made by Generac in this press

release speaks only as of the date on which it is made. Generac

undertakes no obligation to update any forward-looking statement,

whether as a result of new information, future developments or

otherwise, except as may be required by law.

Reconciliations to GAAP Financial Metrics

Adjusted EBITDA

To supplement the Company's condensed consolidated financial

statements presented in accordance with US GAAP, Generac provides a

summary to show the computation of Adjusted EBITDA, taking into

account certain charges that were taken during the periods

presented. The computation of Adjusted EBITDA is based on the

definition of EBITDA contained in Generac's credit agreement, dated

as of November 10, 2006.

Adjusted Net Income

To further supplement Generac's condensed consolidated financial

statements presented in accordance with US GAAP, the Company

provides a summary to show the computation of Adjusted net income

(loss). Adjusted net income (loss) is defined as Net income (loss)

before provision (benefit) for income taxes adjusted for the

following items: cash income tax expense (benefit), amortization of

intangible assets, amortization of deferred loan costs related to

the Company's debt, intangible impairment charges, and certain

non-cash gains.

Free Cash Flow

In addition, we reference free cash flow to further supplement

Generac's condensed consolidated financial statements presented in

accordance with US GAAP. Free cash flow is defined as Net cash

provided by operating activities less Expenditures for property and

equipment and is intended to be a measure of operational cash flow

taking into account additional capital expenditure investment into

the business.

The presentation of this additional information is not meant to

be considered in isolation of, or as a substitute for, results

prepared in accordance with US GAAP. Please see our SEC filings for

additional discussion of the basis for Generac's reporting of

Non-GAAP financial measures.

Generac Holdings Inc.

Condensed Consolidated Statements of Operations

(Dollars in Thousands, Except Share and Per Share Data)

(Unaudited)

Three Months Ended Nine Months Ended

September 30, September 30,

2010 2009 2010 2009

----------- ----------- ----------- -----------

Net sales $ 160,666 $ 144,261 $ 431,839 $ 434,284

Costs of goods sold 93,304 79,770 258,314 262,078

----------- ----------- ----------- -----------

Gross profit 67,362 64,491 173,525 172,206

Operating expenses:

Selling and service 15,295 14,620 43,416 44,863

Research and

development 3,580 2,515 10,784 7,752

General and

administrative 5,654 3,671 16,492 11,538

Amortization of

intangibles 13,063 13,097 38,745 38,863

----------- ----------- ----------- -----------

Total operating expenses 37,592 33,903 109,437 103,016

----------- ----------- ----------- -----------

Income from operations 29,770 30,588 64,088 69,190

Other (expense) income:

Interest expense (6,540) (17,204) (20,752) (53,652)

Investment income 62 129 172 2,089

Gain on extinguishment

of debt - 1,235 - 14,745

Write-off of deferred

financing costs

related to debt

extinguishment - - (4,180) -

Other, net (216) (320) (791) (941)

----------- ----------- ----------- -----------

Total other expense,

net (6,694) (16,160) (25,551) (37,759)

----------- ----------- ----------- -----------

Income before provision

for income taxes 23,076 14,428 38,537 31,431

Provision for income

taxes 78 112 237 324

----------- ----------- ----------- -----------

Net income 22,998 14,316 38,300 31,107

Preferential

distribution to:

Series A preferred

stockholders - (3,709) (2,042) (9,821)

Class B common

stockholders - (25,349) (12,133) (74,208)

Beneficial conversion

- see note 1 - - (140,690) -

----------- ----------- ----------- -----------

Net income (loss)

attributable to

common stockholders

(formerly Class A

common stockholders) $ 22,998 $ (14,742) $ (116,565) $ (52,922)

=========== =========== =========== ===========

Net income (loss) per

common share

- basic (2):

Common stock

(formerly Class A

common stock) $ 0.34 $ (8,492) $ (2.05) $ (30,485)

Class B common stock n/a $ 1,055 $ 3,364 $ 3,090

Net income (loss) per

common share

- diluted (2):

Common stock

(formerly Class A

common stock) $ 0.34 $ (8,492) $ (2.05) $ (30,485)

Class B common stock n/a $ 1,055 $ 3,364 $ 3,090

Weighted average common

shares outstanding

- basic (2):

Common stock

(formerly Class A

common stock) 67,094,447 1,736 56,760,150 1,736

Class B common stock n/a 24,018 3,607 24,018

Weighted average common

shares outstanding

- diluted (2):

Common stock

(formerly Class A

common stock) 67,231,403 1,736 56,760,150 1,736

Class B common stock n/a 24,018 3,607 24,018

(1) Beneficial conversion feature related to Class B common stock and

Series A preferred stock was reflected during the first quarter as a

result of Generac's corporate reorganization and IPO. See discussion of

Generac's equity structure and corporate reorganization in the 2009

Annual Report on Form 10-K for the fiscal year ended December 31, 2009.

(2) 2010 Net income (loss) per common share and weighted average common

shares outstanding reflect the corporate reorganization and IPO that

occurred on February 10, 2010. The share structure prior to

February 10, 2010 has been retroactively restated to only reflect the

reverse stock split that occurred with the corporate reorganization.

Generac Holdings Inc.

Condensed Consolidated Balance Sheets

(Dollars in Thousands, Except Share and Per Share Data)

September 30, December 31,

2010 2009

------------- -------------

(Unaudited)

Assets

Current assets:

Cash and cash equivalents $ 128,334 $ 161,307

Accounts and notes receivable, less

allowance for doubtful accounts 73,787 54,130

Inventories 127,358 123,700

Prepaid expenses and other assets 3,526 5,880

------------- -------------

Total current assets 333,005 345,017

Property and equipment, net 71,852 73,374

Customer lists, net 106,047 134,674

Patents, net 86,904 92,753

Other intangible assets, net 6,781 7,791

Deferred financing costs, net 7,020 13,070

Trade names 141,148 144,407

Goodwill 525,875 525,875

Other assets 527 282

------------- -------------

Total assets $ 1,279,159 $ 1,337,243

============= =============

Liabilities and stockholders' equity

Current liabilities:

Accounts payable $ 61,487 $ 33,639

Accrued wages and employee benefits 6,390 6,930

Other accrued liabilities 36,006 52,326

Current portion of long-term debt - 39,076

------------- -------------

Total current liabilities 103,883 131,971

Long-term debt 731,422 1,052,463

Other long-term liabilities 22,987 17,418

------------- -------------

Total liabilities 858,292 1,201,852

Class B convertible voting common stock,

par value $0.01, 110,000 shares

authorized, 0 and 24,018 shares issued at

September 30, 2010 and December 31, 2009,

respectively - 765,096

Series A convertible non-voting preferred

stock, par value $0.01, 30,000 shares

authorized, 0 and 11,311 shares issued at

September 30, 2010 and December 31, 2009,

respectively - 113,109

Stockholders' equity (deficit):

Common stock (formerly Class A common

stock), par value $0.01, 500,000,000

shares authorized, 67,522,096 and 1,617

shares issued at September 30, 2010 and

December 31, 2009, respectively 675 -

Additional paid-in capital 1,132,189 2,394

Excess purchase price over predecessor

basis (202,116) (202,116)

Accumulated deficit (500,271) (538,571)

Accumulated other comprehensive loss (9,610) (4,492)

Stockholder notes receivable - (29)

------------- -------------

Total stockholders' equity (deficit) 420,867 (742,814)

------------- -------------

Total liabilities and stockholders' equity $ 1,279,159 $ 1,337,243

============= =============

Generac Holdings Inc.

Condensed Consolidated Statements of Cash Flows

(Dollars in Thousands)

(Unaudited)

Nine Months Ended

September 30,

2010 2009

------------- -------------

Operating activities

Net income $ 38,300 $ 31,107

Adjustment to reconcile net income to net

cash provided by operating activities:

Depreciation 5,777 5,818

Amortization 38,745 38,863

Gain on extinguishment of debt - (14,745)

Write-off of deferred financing costs

related to debt extinguishment 4,180 -

Amortization of deferred finance costs 1,870 2,562

Amortization of unrealized loss on

interest rate swaps - 18,167

Provision for losses on accounts

receivable 1 89

Loss on disposal of property and

equipment 31 36

Share-based compensation expense 4,634 28

Net changes in operating assets and

liabilities:

Accounts receivable (19,658) 6,094

Inventories (3,658) (19,711)

Other assets 1,431 1,369

Accounts payable 27,848 9,421

Accrued wages and employee benefits (511) (14)

Other accrued liabilities (15,869) (33,953)

------------- -------------

Net cash provided by operating activities 83,121 45,131

Investing activities

Proceeds from sale of property and equipment 38 56

Expenditures for property and equipment (4,324) (2,902)

Collections on receivable notes - 105

------------- -------------

Net cash used in investing activities (4,286) (2,741)

Financing activities

Stockholders' contributions of capital

- Series A preferred stock - 20,000

Proceeds from issuance of common stock 248,309 -

Payment of short-term and long-term debt (360,117) (9,500)

------------- -------------

------------- -------------

Net cash (used in) provided by financing

activities (111,808) 10,500

------------- -------------

Net (decrease) increase in cash and cash

equivalents (32,973) 52,890

Cash and cash equivalents at beginning of

period 161,307 81,229

------------- -------------

Cash and cash equivalents at end of period $ 128,334 $ 134,119

============= =============

Supplemental disclosure of noncash financing

and investing activities

Contributions of capital related to debt

extinguishment $ - $ 14,754

Generac Holdings Inc.

Reconciliation Schedules

(Dollars in Thousands, Except Share and Per Share Data)

Net income to Adjusted

EBITDA reconciliation

Three months ended Nine months ended

September 30, September 30,

------------------------- ------------------------

2010 2009 2010 2009

(unaudited) (unaudited) (unaudited) (unaudited)

Net income $ 22,998 $ 14,316 $ 38,300 $ 31,107

Interest expense 6,540 17,204 20,752 53,652

Depreciation and

amortization 15,011 15,060 44,522 44,681

Income taxes provision 78 112 237 324

Non-cash impairment and

other charges (1) (781) (23) (217) (1,389)

Non-cash share-based

compensation

expense (2) 1,675 - 4,634 -

Write-off of deferred

financing costs

related to debt

extinguishment - - 4,180 -

Transaction costs and

credit facility fees 183 458 850 1,168

Non-cash gains (3) - (1,235) - (14,745)

Other 9 198 245 208

----------- ----------- ----------- -----------

Adjusted EBITDA $ 45,713 $ 46,090 $ 113,503 $ 115,006

=========== =========== =========== ===========

(1) Includes losses on disposals of assets and unrealized mark-to-market

adjustments on commodity contracts. A full description of these and the

other reconciliation adjustments contained in these schedules is

included in Generac's SEC filings.

(2) Includes share-based compensation expense to account for stock options,

restricted stock and other stock awards issued in connection with

Generac's initial public offering over their respective vesting

periods.

(3) Includes gains on extinguishment of debt.

Net income to Adjusted

net income reconciliation

Three months ended Nine months ended

September 30, September 30,

------------------------ ------------------------

2010 2009 2010 2009

(unaudited) (unaudited) (unaudited) (unaudited)

Net income $ 22,998 $ 14,316 $ 38,300 $ 31,107

Provision for income

taxes 78 112 237 324

----------- ----------- ----------- -----------

Income before provision

for income taxes 23,076 14,428 38,537 31,431

Amortization of

intangible assets 13,063 13,097 38,745 38,863

Amortization of

deferred loan costs 569 852 1,870 2,562

Write-off of deferred

financing costs

related to debt

extinguishment - - 4,180 -

Gain on extinguishment

of debt - (1,235) - (14,745)

----------- ----------- ----------- -----------

Adjusted net income

before provision for

income taxes 36,708 27,142 83,332 58,111

Cash income tax expense (22) (26) (395) (389)

----------- ----------- ----------- -----------

Adjusted net income $ 36,686 $ 27,116 $ 82,937 $ 57,722

=========== =========== =========== ===========

Adjusted net income

per common share

- diluted (4): $ 0.55 n/m n/m n/m

Weighted average common

shares outstanding

- diluted (4): 67,231,403 n/m n/m n/m

(4) pre-IPO share and per share data is not meaningful due to the corporate

reorganization which occurred in conjunction with the IPO during the

first quarter of 2010.

Free Cash Flow

Reconciliation

Three months ended Nine months ended

September 30, September 30,

------------------------ ------------------------

2010 2009 2010 2009

(unaudited) (unaudited) (unaudited) (unaudited)

Net cash provided by

operating activities $ 36,476 $ 24,310 $ 83,121 $ 45,131

Expenditures for

property and equipment (1,289) (1,017) (4,324) (2,902)

----------- ----------- ----------- -----------

Free Cash Flow $ 35,187 $ 23,293 $ 78,797 $ 42,229

=========== =========== =========== ===========

For Investor Inquiries: Generac Holdings Inc. York Ragen Chief

Financial Officer 262-506-6064

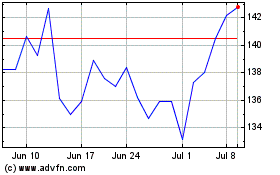

Generac (NYSE:GNRC)

Historical Stock Chart

From Jun 2024 to Jul 2024

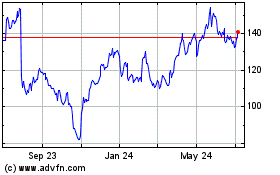

Generac (NYSE:GNRC)

Historical Stock Chart

From Jul 2023 to Jul 2024