GameStop Plunges on Lower Guidance - Analyst Blog

January 15 2014 - 10:50AM

Zacks

Shares of GameStop

Corp. (GME) plunged roughly 20% yesterday on lowered

earnings outlook as demand for Microsoft Corp.'s

(MSFT) Xbox 360 and Sony Corp.'s (SNE) PlayStation

3 software was soft during the holiday period. This resulted in a

22.5% drop in the videogame retailer’s new software category

sales.

This Grapevine, Texas based company

now projects fourth-quarter earnings between $1.85 and $1.95 and

fiscal-year 2013 earnings in the band of $2.96 to $3.06 per share.

The guidance provided fell short of the current Zacks Consensus

Estimate of $2.14 and $3.24 for the fourth quarter and fiscal 2013,

respectively. Also, this was enough to hurt investors’

sentiment.

Earlier, this Zacks Rank #3 (Hold)

stock had forecasted fourth-quarter earnings in the range of $1.97

to $2.14 and fiscal-year 2013 earnings between $3.08 and $3.25 per

share. In the coming days, we could witness a downtrend in the

Zacks Consensus Estimate and a revision in the Zacks’ Rank.

GameStop said that global sales

during the nine-week holiday period ended Jan 4, 2014 increased

9.3% to $3.15 billion. Total comparable-store sales rose 10.2%,

portraying an increase of 7.1% at the U.S. and 17.4% at

international locations buoyed by new video game console sales,

including Xbox One and PlayStation 4 that fueled a 99.8% surge in

new hardware sales.

GameStop, which competes with

Amazon.com Inc. (AMZN), now envisions

comparable-store sales for the fourth quarter and fiscal 2013 to

dovetail with the upper end of the previously provided guidance

range. The company had predicted comparable-store sales to increase

by 2% to 9% during the fourth quarter and by 1.5% to 4.5% during

the fiscal year.

The pre-owned category jumped 7%.

Management now anticipates gross margins for the pre-owned category

in the range of 46% to 49% for the fourth quarter and the fiscal

year. The Other category sales climbed 4.8%. Within this category,

digital receipts increased 14.9% to $207.3 million, while mobile

sales rose 23.8% to $94.8 million.

GameStop’s worldwide sales through

mobile, web-in-store, pick-up at store and ecommerce surged 57%.

Sales via mobile site jumped 47%, web-in-store and pick-up at store

sales together escalated over 120%, while sales through the

company’s website grew 37%.

The operator of 6,488 stores

repurchased 800,500 shares at a price $49.39 per share, aggregating

$39.5 million during the holiday period. The company informed that

at the end of the holiday period, it still had the authorization to

buy shares worth $467.1 million.

AMAZON.COM INC (AMZN): Free Stock Analysis Report

GAMESTOP CORP (GME): Free Stock Analysis Report

MICROSOFT CORP (MSFT): Free Stock Analysis Report

SONY CORP ADR (SNE): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

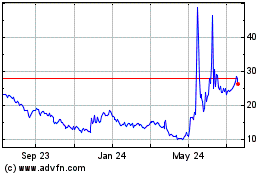

GameStop (NYSE:GME)

Historical Stock Chart

From Jun 2024 to Jul 2024

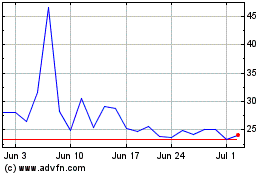

GameStop (NYSE:GME)

Historical Stock Chart

From Jul 2023 to Jul 2024