FCPT Announces Acquisition of Ten Restaurant Properties for $15.6 Million in Its First OP Unit Transaction

November 09 2016 - 4:02PM

Business Wire

Four Corners Property Trust (NYSE:FCPT), a real

estate investment trust engaged in the ownership of high-quality,

net-leased restaurant properties, is pleased to announce the

acquisition of ten restaurant properties consisting of seven

restaurant concepts (two Arby’s, two Wendy’s, two Steak ‘n Shake,

one Burger King, one Denny’s, one Zaxby’s, and one Fazoli’s) across

8 states for $15.6 million. The restaurants are occupied under

triple-net leases with a weighted average 10 years of remaining

term and the transaction closed at an effective going-in cap rate

of 6.6%, exclusive of transaction costs. The operators at these

properties are a mix of corporate tenants and strong

franchisees.

FCPT funded the acquisition with 274,744 Operating Partnership

units (“OP units”) at $20.13 per unit and $10.1 million in cash

drawn from its revolving line of credit. The seller, US Restaurant

Properties Inc. (“USRP”), is an experienced private net lease REIT,

and its principals led the formerly publicly traded REIT of the

same name.

Bill Lenehan, with FCPT, commented “We are excited to announce

our first OP unit transaction and to acquire this diverse,

high-quality portfolio from USRP. The team at USRP has assembled a

very strong portfolio and we are honored that they have become

significant personal investors in FCPT. We look forward to continue

working with their team and have already benefited from their

collaboration and depth of experience.”

Robert Stetson, the founder and CEO at USRP, stated “The team at

USRP is enthused about both this partnership transaction and the

prospect of assisting FCPT in its future growth. At USRP, we have

been focused on buying net-lease, restaurant properties for over 20

years and have purchased more than 1,000 restaurant properties over

that time. The FCPT portfolio is by far the best large scale

portfolio we have encountered and is a key reason we are investing

significant personal capital in FCPT. Like FCPT, we started USRP

with a single tenant and focused on a diversification strategy that

over time generated outsized returns for our shareholders.”

About FCPT

FCPT, headquartered in Mill Valley, CA, is a real estate

investment trust primarily engaged in the acquisition and leasing

of restaurant properties. The Company will seek to grow its

portfolio by acquiring additional real estate to lease, on a

triple-net basis, for use in the restaurant and related food

services industry. Additional information about FCPT can be found

on the website at http://www.fourcornerspropertytrust.com/.

About US Restaurant Properties

Mr. Stetson is a founder of one of the first REITs dedicated to

restaurant properties, U.S. Restaurant Properties Inc. ("USRP").

Prior to USRP, Mr. Stetson served as the former President of Burger

King Corp.--Restaurant Division and Chief Financial Officer of

several brands, including Pizza Hut Inc. USRP was founded in 1994,

traded on the NYSE, and was ultimately acquired by GE

Capital in 2007 with an enterprise value of $2.8 billion. In its

current form, USRP is now a Dallas-based private company

focused upon restaurant and related properties.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161109006246/en/

Four Corners Property TrustBill Lenehan, 415-965-8031CEOorGerry

Morgan, 415-965-8032CFO

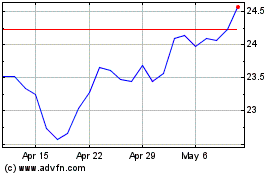

Four Corners Property (NYSE:FCPT)

Historical Stock Chart

From Feb 2025 to Mar 2025

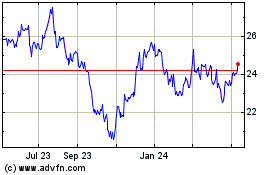

Four Corners Property (NYSE:FCPT)

Historical Stock Chart

From Mar 2024 to Mar 2025