0001401257--12-312024Q3FALSE0.33330.33330.3333xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesfet:segmentxbrli:purefet:performance_period00014012572024-01-012024-09-3000014012572024-10-2500014012572024-07-012024-09-3000014012572023-07-012023-09-3000014012572023-01-012023-09-3000014012572024-09-3000014012572023-12-3100014012572022-12-3100014012572023-09-300001401257us-gaap:CommonStockMember2023-12-310001401257us-gaap:AdditionalPaidInCapitalMember2023-12-310001401257us-gaap:TreasuryStockCommonMember2023-12-310001401257us-gaap:RetainedEarningsMember2023-12-310001401257us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001401257us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-3100014012572024-01-012024-03-310001401257us-gaap:CommonStockMember2024-01-012024-03-310001401257us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001401257us-gaap:RetainedEarningsMember2024-01-012024-03-310001401257us-gaap:CommonStockMember2024-03-310001401257us-gaap:AdditionalPaidInCapitalMember2024-03-310001401257us-gaap:TreasuryStockCommonMember2024-03-310001401257us-gaap:RetainedEarningsMember2024-03-310001401257us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-3100014012572024-03-310001401257us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-3000014012572024-04-012024-06-300001401257us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300001401257us-gaap:RetainedEarningsMember2024-04-012024-06-300001401257us-gaap:CommonStockMember2024-06-300001401257us-gaap:AdditionalPaidInCapitalMember2024-06-300001401257us-gaap:TreasuryStockCommonMember2024-06-300001401257us-gaap:RetainedEarningsMember2024-06-300001401257us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-3000014012572024-06-300001401257us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300001401257us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300001401257us-gaap:RetainedEarningsMember2024-07-012024-09-300001401257us-gaap:CommonStockMember2024-09-300001401257us-gaap:AdditionalPaidInCapitalMember2024-09-300001401257us-gaap:TreasuryStockCommonMember2024-09-300001401257us-gaap:RetainedEarningsMember2024-09-300001401257us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300001401257us-gaap:CommonStockMember2022-12-310001401257us-gaap:AdditionalPaidInCapitalMember2022-12-310001401257us-gaap:TreasuryStockCommonMember2022-12-310001401257us-gaap:RetainedEarningsMember2022-12-310001401257us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001401257us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-3100014012572023-01-012023-03-310001401257us-gaap:CommonStockMember2023-01-012023-03-310001401257us-gaap:TreasuryStockCommonMember2023-01-012023-03-310001401257us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001401257us-gaap:RetainedEarningsMember2023-01-012023-03-310001401257us-gaap:CommonStockMember2023-03-310001401257us-gaap:AdditionalPaidInCapitalMember2023-03-310001401257us-gaap:TreasuryStockCommonMember2023-03-310001401257us-gaap:RetainedEarningsMember2023-03-310001401257us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100014012572023-03-310001401257us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-3000014012572023-04-012023-06-300001401257us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300001401257us-gaap:RetainedEarningsMember2023-04-012023-06-300001401257us-gaap:CommonStockMember2023-06-300001401257us-gaap:AdditionalPaidInCapitalMember2023-06-300001401257us-gaap:TreasuryStockCommonMember2023-06-300001401257us-gaap:RetainedEarningsMember2023-06-300001401257us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-3000014012572023-06-300001401257us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001401257us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001401257us-gaap:RetainedEarningsMember2023-07-012023-09-300001401257us-gaap:CommonStockMember2023-09-300001401257us-gaap:AdditionalPaidInCapitalMember2023-09-300001401257us-gaap:TreasuryStockCommonMember2023-09-300001401257us-gaap:RetainedEarningsMember2023-09-300001401257us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001401257fet:VaripermHoldingsLtdMember2024-01-042024-01-040001401257us-gaap:LineOfCreditMember2024-01-022024-01-020001401257fet:SellerTermLoanMember2024-01-040001401257fet:SellerTermLoanMember2024-03-012024-03-310001401257fet:VaripermHoldingsLtdMember2024-07-012024-09-300001401257fet:VaripermHoldingsLtdMember2024-01-040001401257fet:VaripermHoldingsLtdMemberus-gaap:CustomerRelationshipsMember2024-01-040001401257fet:VaripermHoldingsLtdMemberus-gaap:OrderOrProductionBacklogMember2024-01-040001401257fet:VaripermHoldingsLtdMemberus-gaap:TradeNamesMember2024-01-040001401257fet:VaripermHoldingsLtdMember2024-01-012024-09-300001401257fet:LegacyFETAndVaripermMember2024-07-012024-09-300001401257fet:LegacyFETAndVaripermMember2023-07-012023-09-300001401257fet:LegacyFETAndVaripermMember2024-01-012024-09-300001401257fet:LegacyFETAndVaripermMember2023-01-012023-09-300001401257us-gaap:CustomerRelationshipsMember2024-09-300001401257us-gaap:CustomerRelationshipsMembersrt:MinimumMember2024-09-300001401257us-gaap:CustomerRelationshipsMembersrt:MaximumMember2024-09-300001401257fet:PatentsAndTechnologyMember2024-09-300001401257fet:PatentsAndTechnologyMembersrt:MinimumMember2024-09-300001401257fet:PatentsAndTechnologyMembersrt:MaximumMember2024-09-300001401257us-gaap:TradeNamesMember2024-09-300001401257us-gaap:TradeNamesMembersrt:MinimumMember2024-09-300001401257us-gaap:TradeNamesMembersrt:MaximumMember2024-09-300001401257us-gaap:TrademarksMember2024-09-300001401257us-gaap:NoncompeteAgreementsMember2024-09-300001401257us-gaap:CustomerRelationshipsMember2023-12-310001401257us-gaap:CustomerRelationshipsMembersrt:MinimumMember2023-12-310001401257us-gaap:CustomerRelationshipsMembersrt:MaximumMember2023-12-310001401257fet:PatentsAndTechnologyMember2023-12-310001401257fet:PatentsAndTechnologyMembersrt:MinimumMember2023-12-310001401257fet:PatentsAndTechnologyMembersrt:MaximumMember2023-12-310001401257us-gaap:TradeNamesMember2023-12-310001401257us-gaap:TradeNamesMembersrt:MinimumMember2023-12-310001401257us-gaap:TradeNamesMembersrt:MaximumMember2023-12-310001401257us-gaap:TrademarksMember2023-12-310001401257us-gaap:NoncompeteAgreementsMember2023-12-310001401257fet:A2025NotesMember2024-09-300001401257fet:A2025NotesMember2023-12-310001401257fet:SellerTermLoanMember2024-09-300001401257fet:SellerTermLoanMember2023-12-310001401257fet:A2017CreditFacilityMemberus-gaap:LineOfCreditMember2024-09-300001401257fet:A2017CreditFacilityMemberus-gaap:LineOfCreditMember2023-12-310001401257fet:OtherDebtMember2024-09-300001401257fet:OtherDebtMember2023-12-310001401257fet:A2025NotesMember2024-01-012024-09-300001401257fet:A2025NotesMember2024-09-300001401257fet:A2025NotesMember2023-01-310001401257fet:A2025NotesMember2023-01-012023-01-310001401257fet:A2025NotesMember2024-06-300001401257fet:A2025NotesMember2024-06-012024-06-300001401257fet:A2025NotesMember2024-08-310001401257fet:A2025NotesMember2024-08-012024-08-310001401257us-gaap:DebtInstrumentRedemptionPeriodOneMemberfet:SellerTermLoanMember2024-01-040001401257us-gaap:DebtInstrumentRedemptionPeriodTwoMemberfet:SellerTermLoanMember2024-01-040001401257us-gaap:DebtInstrumentRedemptionPeriodThreeMemberfet:SellerTermLoanMember2024-01-040001401257fet:SellerTermLoanMember2024-01-042024-01-040001401257fet:SellerTermLoan12.5OfBorrowingBaseMemberus-gaap:LineOfCreditMember2024-01-040001401257fet:SellerTermLoanMemberus-gaap:LineOfCreditMembersrt:MinimumMember2024-01-042024-01-040001401257fet:A2025NotesMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-01-012024-09-300001401257fet:SellerTermLoanMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-01-012024-09-300001401257fet:SellerTermLoanMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-09-300001401257us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-09-300001401257us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2024-09-300001401257us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberfet:CanadianSubsidiariesMember2024-09-300001401257us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMemberfet:CanadianSubsidiariesMember2024-09-300001401257fet:A2017CreditFacilityMemberus-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMember2024-09-300001401257us-gaap:LineOfCreditMember2024-09-300001401257us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberfet:SecuredOvernightFinancingRateSOFRFloorMember2024-01-012024-09-300001401257us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MinimumMember2024-01-012024-09-300001401257us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMembersrt:MaximumMember2024-01-012024-09-300001401257us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMembersrt:MinimumMember2024-01-012024-09-300001401257us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberus-gaap:BaseRateMembersrt:MaximumMember2024-01-012024-09-300001401257fet:A2017CreditFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:FederalFundsEffectiveSwapRateMember2024-01-012024-09-300001401257fet:A2017CreditFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-01-012024-09-300001401257us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberfet:CORRARateMembersrt:MinimumMember2024-01-012024-09-300001401257us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberfet:CORRARateMembersrt:MaximumMember2024-01-012024-09-300001401257fet:A2017CreditFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMembersrt:MinimumMember2024-01-012024-09-300001401257fet:A2017CreditFacilityMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMembersrt:MaximumMember2024-01-012024-09-300001401257us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMemberfet:CORRARateMember2024-01-012024-09-300001401257us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2023-09-300001401257fet:CreditFacilityUnusedPortionGreaterThan50Memberus-gaap:RevolvingCreditFacilityMember2024-01-012024-09-300001401257fet:CreditFacilityUnusedPortionLessThanOrEqualTo50Memberus-gaap:RevolvingCreditFacilityMember2024-01-012024-09-300001401257fet:A2017CreditFacility12.5OfBorrowingBaseMemberus-gaap:LineOfCreditMember2024-09-300001401257fet:A2017CreditFacility12.5OfBorrowingBaseMemberus-gaap:LineOfCreditMembersrt:MinimumMember2024-01-012024-09-300001401257fet:SeniorSecuredBondsDue2029Memberus-gaap:SubsequentEventMember2024-10-240001401257us-gaap:FairValueInputsLevel2Memberfet:A2025NotesMember2024-09-300001401257us-gaap:FairValueInputsLevel2Memberfet:A2025NotesMember2023-12-310001401257us-gaap:OperatingSegmentsMemberfet:DrillingAndCompletionsMember2024-07-012024-09-300001401257us-gaap:OperatingSegmentsMemberfet:DrillingAndCompletionsMember2023-07-012023-09-300001401257us-gaap:OperatingSegmentsMemberfet:DrillingAndCompletionsMember2024-01-012024-09-300001401257us-gaap:OperatingSegmentsMemberfet:DrillingAndCompletionsMember2023-01-012023-09-300001401257us-gaap:OperatingSegmentsMemberfet:ArtificialLiftAndDownholeMember2024-07-012024-09-300001401257us-gaap:OperatingSegmentsMemberfet:ArtificialLiftAndDownholeMember2023-07-012023-09-300001401257us-gaap:OperatingSegmentsMemberfet:ArtificialLiftAndDownholeMember2024-01-012024-09-300001401257us-gaap:OperatingSegmentsMemberfet:ArtificialLiftAndDownholeMember2023-01-012023-09-300001401257us-gaap:IntersegmentEliminationMember2024-07-012024-09-300001401257us-gaap:IntersegmentEliminationMember2023-07-012023-09-300001401257us-gaap:IntersegmentEliminationMember2024-01-012024-09-300001401257us-gaap:IntersegmentEliminationMember2023-01-012023-09-300001401257us-gaap:CorporateNonSegmentMember2024-07-012024-09-300001401257us-gaap:CorporateNonSegmentMember2023-07-012023-09-300001401257us-gaap:CorporateNonSegmentMember2024-01-012024-09-300001401257us-gaap:CorporateNonSegmentMember2023-01-012023-09-300001401257us-gaap:OperatingSegmentsMember2024-07-012024-09-300001401257us-gaap:OperatingSegmentsMember2023-07-012023-09-300001401257us-gaap:OperatingSegmentsMember2024-01-012024-09-300001401257us-gaap:OperatingSegmentsMember2023-01-012023-09-300001401257us-gaap:OperatingSegmentsMemberfet:DrillingAndCompletionsMember2024-09-300001401257us-gaap:OperatingSegmentsMemberfet:DrillingAndCompletionsMember2023-12-310001401257us-gaap:OperatingSegmentsMemberfet:ArtificialLiftAndDownholeMember2024-09-300001401257us-gaap:OperatingSegmentsMemberfet:ArtificialLiftAndDownholeMember2023-12-310001401257us-gaap:CorporateNonSegmentMember2024-09-300001401257us-gaap:CorporateNonSegmentMember2023-12-310001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:DrillingMemberus-gaap:SalesMember2024-07-012024-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:DrillingMemberus-gaap:SalesMember2023-07-012023-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:DrillingMemberus-gaap:SalesMember2024-01-012024-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:DrillingMemberus-gaap:SalesMember2023-01-012023-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:SubseaMemberus-gaap:SalesMember2024-07-012024-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:SubseaMemberus-gaap:SalesMember2023-07-012023-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:SubseaMemberus-gaap:SalesMember2024-01-012024-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:SubseaMemberus-gaap:SalesMember2023-01-012023-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:StimulationAndInterventionMemberus-gaap:SalesMember2024-07-012024-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:StimulationAndInterventionMemberus-gaap:SalesMember2023-07-012023-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:StimulationAndInterventionMemberus-gaap:SalesMember2024-01-012024-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:StimulationAndInterventionMemberus-gaap:SalesMember2023-01-012023-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:CoiledTubingMemberus-gaap:SalesMember2024-07-012024-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:CoiledTubingMemberus-gaap:SalesMember2023-07-012023-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:CoiledTubingMemberus-gaap:SalesMember2024-01-012024-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:CoiledTubingMemberus-gaap:SalesMember2023-01-012023-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:DownholeMemberus-gaap:SalesMember2024-07-012024-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:DownholeMemberus-gaap:SalesMember2023-07-012023-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:DownholeMemberus-gaap:SalesMember2024-01-012024-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:DownholeMemberus-gaap:SalesMember2023-01-012023-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:ProductionEquipmentMemberus-gaap:SalesMember2024-07-012024-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:ProductionEquipmentMemberus-gaap:SalesMember2023-07-012023-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:ProductionEquipmentMemberus-gaap:SalesMember2024-01-012024-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:ProductionEquipmentMemberus-gaap:SalesMember2023-01-012023-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:ValveSolutionsMemberus-gaap:SalesMember2024-07-012024-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:ValveSolutionsMemberus-gaap:SalesMember2023-07-012023-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:ValveSolutionsMemberus-gaap:SalesMember2024-01-012024-09-300001401257us-gaap:ProductConcentrationRiskMemberus-gaap:OperatingSegmentsMemberfet:ValveSolutionsMemberus-gaap:SalesMember2023-01-012023-09-300001401257country:USus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2024-07-012024-09-300001401257country:USus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2023-07-012023-09-300001401257country:USus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2024-01-012024-09-300001401257country:USus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2023-01-012023-09-300001401257country:CAus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2024-07-012024-09-300001401257country:CAus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2023-07-012023-09-300001401257country:CAus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2024-01-012024-09-300001401257country:CAus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2023-01-012023-09-300001401257us-gaap:MiddleEastMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2024-07-012024-09-300001401257us-gaap:MiddleEastMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2023-07-012023-09-300001401257us-gaap:MiddleEastMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2024-01-012024-09-300001401257us-gaap:MiddleEastMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2023-01-012023-09-300001401257fet:EuropeAndAfricaMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2024-07-012024-09-300001401257fet:EuropeAndAfricaMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2023-07-012023-09-300001401257fet:EuropeAndAfricaMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2024-01-012024-09-300001401257fet:EuropeAndAfricaMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2023-01-012023-09-300001401257srt:AsiaPacificMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2024-07-012024-09-300001401257srt:AsiaPacificMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2023-07-012023-09-300001401257srt:AsiaPacificMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2024-01-012024-09-300001401257srt:AsiaPacificMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2023-01-012023-09-300001401257srt:LatinAmericaMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2024-07-012024-09-300001401257srt:LatinAmericaMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2023-07-012023-09-300001401257srt:LatinAmericaMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2024-01-012024-09-300001401257srt:LatinAmericaMemberus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesMember2023-01-012023-09-300001401257fet:PerformanceRestrictedStockMember2024-01-012024-09-300001401257fet:PerformanceRestrictedStockMembersrt:MinimumMember2024-01-012024-09-300001401257fet:PerformanceRestrictedStockMembersrt:MaximumMember2024-01-012024-09-300001401257fet:TimeBasedRestrictedStockUnitsMemberfet:EmployeesMember2024-01-012024-09-300001401257fet:TimeBasedRestrictedStockUnitsMemberfet:NonEmployeeMembersOfBoardOfDirectorsMember2024-01-012024-09-300001401257fet:PerformanceRestrictedStockUnitsEquityClassifiedMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-01-012024-09-300001401257fet:TimeBasedRestrictedStockUnitsEquityClassifiedMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-01-012024-09-300001401257fet:RestrictedStockUnitsLiabilityClassifiedMember2024-05-102024-05-100001401257fet:PerformanceRestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2024-01-012024-09-300001401257fet:PerformanceRestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMember2024-01-012024-09-300001401257fet:PerformanceRestrictedStockMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMember2024-01-012024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

Form 10-Q

___________________________________

| | | | | | | | |

| | |

| ☑ | | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

For the Quarterly Period Ended September 30, 2024

OR

| | | | | | | | |

| | |

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission File Number 001-35504

FORUM ENERGY TECHNOLOGIES, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

| | | |

| |

| Delaware | | | 61-1488595 |

| (State or other jurisdiction of | | | (I.R.S. Employer Identification No.) |

| incorporation or organization) | | | |

| | | | | | | | | | | | | | |

| 10344 Sam Houston Park Drive | Suite 300 | Houston | Texas | 77064 |

| (Address of Principal Executive Offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

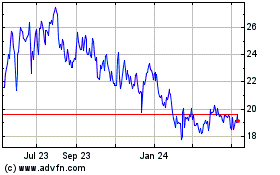

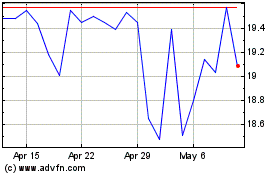

| Common stock | FET | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes þ No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of large accelerated filer, accelerated filer, smaller reporting company, and emerging growth company in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☑ |

| Non-accelerated filer | ☐ | | Smaller reporting company | ☑ |

| | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

As of October 25, 2024, there were 12,283,670 common shares outstanding.

Table of Contents

PART I — FINANCIAL INFORMATION

Item 1. Financial Statements

Forum Energy Technologies, Inc. and Subsidiaries

Condensed Consolidated Statements of Comprehensive Loss

(Unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| (in thousands, except per share information) | 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 207,806 | | | $ | 179,253 | | | $ | 615,407 | | | $ | 553,659 | |

| Cost of sales | 142,070 | | | 128,231 | | | 422,839 | | | 399,229 | |

| Gross profit | 65,736 | | | 51,022 | | | 192,568 | | | 154,430 | |

| Operating expenses | | | | | | | |

| Selling, general and administrative expenses | 56,326 | | | 45,496 | | | 164,683 | | | 135,364 | |

| Transaction expenses | 579 | | | — | | | 7,728 | | | — | |

| Loss (gain) on disposal of assets and other | (85) | | | (145) | | | 107 | | | 137 | |

| Total operating expenses | 56,820 | | | 45,351 | | | 172,518 | | | 135,501 | |

| Operating income | 8,916 | | | 5,671 | | | 20,050 | | | 18,929 | |

| Other expense (income) | | | | | | | |

| Interest expense | 7,650 | | | 4,504 | | | 25,069 | | | 13,742 | |

| Foreign exchange losses (gains) and other, net | 9,631 | | | (8,279) | | | 13,864 | | | 1,129 | |

| Loss on extinguishment of debt | 1,839 | | | — | | | 2,302 | | | — | |

| Total other expense (income), net | 19,120 | | | (3,775) | | | 41,235 | | | 14,871 | |

| Income (loss) before income taxes | (10,204) | | | 9,446 | | | (21,185) | | | 4,058 | |

| Income tax expense | 4,611 | | | 1,477 | | | 10,641 | | | 6,154 | |

| Net income (loss) | $ | (14,815) | | | $ | 7,969 | | | $ | (31,826) | | | $ | (2,096) | |

| | | | | | | |

| Weighted average shares outstanding | | | | | | | |

| Basic | 12,330 | | | 10,235 | | | 12,287 | | | 10,208 | |

| Diluted | 12,330 | | | 10,393 | | | 12,287 | | | 10,208 | |

| Earnings (loss) per share | | | | | | | |

| Basic | $ | (1.20) | | | $ | 0.78 | | | $ | (2.59) | | | $ | (0.21) | |

| Diluted | $ | (1.20) | | | $ | 0.77 | | | $ | (2.59) | | | $ | (0.21) | |

| | | | | | | |

Other comprehensive income (loss), net of tax of $0: | | | | | | | |

| Net income (loss) | $ | (14,815) | | | $ | 7,969 | | | $ | (31,826) | | | $ | (2,096) | |

| Change in foreign currency translation | 14,254 | | | (10,710) | | | 14,071 | | | 1,197 | |

| Gain (loss) on pension liability | 25 | | | (36) | | | 5 | | | (15) | |

| Comprehensive loss | $ | (536) | | | $ | (2,777) | | | $ | (17,750) | | | $ | (914) | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Forum Energy Technologies, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(Unaudited) | | | | | | | | | | | |

| (in thousands, except share information) | September 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 33,313 | | | $ | 46,165 | |

Accounts receivable—trade, net of allowances of $9,507 and $10,850 | 163,084 | | | 146,747 | |

| Inventories, net | 286,939 | | | 299,639 | |

| Prepaid expenses and other current assets | 22,701 | | | 21,887 | |

| Costs and estimated profits in excess of billings | 16,438 | | | 13,365 | |

| Accrued revenue | 1,250 | | | 1,801 | |

| Total current assets | 523,725 | | | 529,604 | |

| Property and equipment, net of accumulated depreciation | 83,408 | | | 61,401 | |

| Operating lease assets | 54,058 | | | 55,399 | |

| Deferred financing costs, net | 2,298 | | | 1,159 | |

| Intangible assets, net | 242,330 | | | 167,970 | |

| Goodwill | 65,619 | | | — | |

| Deferred income taxes, net | 149 | | | 368 | |

| Other long-term assets | 2,150 | | | 5,160 | |

| Total assets | $ | 973,737 | | | $ | 821,061 | |

| Liabilities and equity | | | |

| Current liabilities | | | |

| Current portion of long-term debt | $ | 69,385 | | | $ | 1,186 | |

| Accounts payable—trade | 117,164 | | | 125,918 | |

| Accrued liabilities | 70,579 | | | 62,463 | |

| Deferred revenue | 9,147 | | | 10,551 | |

| Billings in excess of costs and profits recognized | 4,748 | | | 4,221 | |

| Total current liabilities | 271,023 | | | 204,339 | |

| Long-term debt, net of current portion | 162,154 | | | 129,567 | |

| Deferred income taxes, net | 28,493 | | | 940 | |

| Operating lease liabilities | 57,908 | | | 61,450 | |

| Other long-term liabilities | 10,629 | | | 12,132 | |

| Total liabilities | 530,207 | | | 408,428 | |

| Commitments and contingencies | | | |

| Equity | | | |

Common stock, $0.01 par value, 14,800,000 shares authorized, 12,992,570 and 10,901,878 shares issued | 130 | | | 109 | |

| Additional paid-in capital | 1,417,914 | | | 1,369,288 | |

Treasury stock at cost, 708,900 and 708,900 shares | (142,057) | | | (142,057) | |

| Retained deficit | (731,297) | | | (699,471) | |

| Accumulated other comprehensive loss | (101,160) | | | (115,236) | |

| Total equity | 443,530 | | | 412,633 | |

| Total liabilities and equity | $ | 973,737 | | | $ | 821,061 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Forum Energy Technologies, Inc. and Subsidiaries

Condensed Consolidated Statements of Cash Flows

(Unaudited) | | | | | | | | | | | |

| Nine Months Ended September 30, |

| (in thousands) | 2024 | | 2023 |

| Cash flows from operating activities | | | |

| Net loss | $ | (31,826) | | | $ | (2,096) | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | |

| Depreciation expense | 12,660 | | | 7,920 | |

| Amortization of intangible assets | 28,896 | | | 18,074 | |

| Inventory write down | 3,313 | | | 1,918 | |

| Stock-based compensation expense | 5,180 | | | 3,345 | |

| Loss on extinguishment of debt | 2,302 | | | — | |

| Deferred income taxes | (3,180) | | | (93) | |

| Other | 5,572 | | | 4,702 | |

| Changes in operating assets and liabilities | | | |

| Accounts receivable—trade | 7,619 | | | (4,779) | |

| Inventories | 23,441 | | | (35,613) | |

| Prepaid expenses and other current assets | 4,572 | | | 413 | |

| Cost and estimated profit in excess of billings | (2,766) | | | 6,819 | |

| Accounts payable, deferred revenue and other accrued liabilities | (2,499) | | | (8,257) | |

| Billings in excess of costs and profits recognized | 391 | | | 4,570 | |

| Net cash provided by (used in) operating activities | 53,675 | | | (3,077) | |

| Cash flows from investing activities | | | |

| Capital expenditures for property and equipment | (5,735) | | | (5,497) | |

| Proceeds from sale of property and equipment | 236 | | | 1,341 | |

| Payments related to business acquisition, net of cash acquired | (150,408) | | | — | |

| Net cash used in investing activities | (155,907) | | | (4,156) | |

| Cash flows from financing activities | | | |

| Borrowings on Credit Facility | 568,293 | | | 351,635 | |

| Repayments on Credit Facility | (459,250) | | | (351,635) | |

| Cash paid to repurchase 2025 Notes | (72,996) | | | — | |

| Proceeds from issuance of Seller Term Loan | 59,677 | | | — | |

| Payment of Seller Term Loan | (1,250) | | | — | |

| Payment of capital lease obligations | (887) | | | (910) | |

| Deferred financing costs | (3,070) | | | — | |

| Repurchases of stock | — | | | (3,497) | |

| Payment of withheld taxes on stock-based compensation plans | (1,090) | | | (2,499) | |

| Net cash provided by (used in) financing activities | 89,427 | | | (6,906) | |

| | | |

| Effect of exchange rate changes on cash | (47) | | | 261 | |

| | | |

| Net decrease in cash, cash equivalents and restricted cash | (12,852) | | | (13,878) | |

| Cash, cash equivalents and restricted cash at beginning of period | 46,165 | | | 51,029 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 33,313 | | | $ | 37,151 | |

| | | |

| Noncash activities | | | |

| Operating lease assets obtained in exchange for lease obligations | $ | 6,574 | | | $ | 5,194 | |

| Finance lease assets obtained in exchange for lease obligations | 2,032 | | | 1,521 | |

| Stock issuance related to business acquisition | 44,220 | | | — | |

| Liability awards converted to shares settled | 337 | | | — | |

| Accrued purchases of property and equipment | 1,225 | | | — | |

| Conversion of debt to common stock | — | | | 113,650 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Forum Energy Technologies, Inc. and Subsidiaries

Condensed Consolidated Statements of Changes in Stockholders’ Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2024 | | | | | |

| (in thousands) | | Common stock | | Additional paid-in capital | | Treasury stock | | Retained

deficit | | Accumulated

other

comprehensive

income / (loss) | | Total equity | | | | | |

| Balance at December 31, 2023 | | $ | 109 | | | $ | 1,369,288 | | | $ | (142,057) | | | $ | (699,471) | | | $ | (115,236) | | | $ | 412,633 | | | | | | |

| Stock-based compensation expense | | — | | | 1,573 | | | — | | | — | | | — | | | 1,573 | | | | | | |

| Restricted stock issuance, net of forfeitures | | 1 | | | (1,091) | | | — | | | — | | | — | | | (1,090) | | | | | | |

| Stock issuance related to business acquisition | | 20 | | | 44,200 | | | — | | | — | | | — | | | 44,220 | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Currency translation adjustment | | — | | | — | | | — | | | — | | | (804) | | | (804) | | | | | | |

| Change in pension liability | | — | | | — | | | — | | | — | | | (15) | | | (15) | | | | | | |

| Net loss | | — | | | — | | | — | | | (10,315) | | | — | | | (10,315) | | | | | | |

| Balance at March 31, 2024 | | $ | 130 | | | $ | 1,413,970 | | | $ | (142,057) | | | $ | (709,786) | | | $ | (116,055) | | | $ | 446,202 | | | | | | |

| Stock-based compensation expense | | — | | | 1,531 | | | — | | | — | | | — | | | 1,531 | | | | | | |

| | | | | | | | | | | | | | | | | |

| Liability awards converted to share settled | | — | | | 337 | | | — | | | — | | | — | | | 337 | | | | | | |

| Currency translation adjustment | | — | | | — | | | — | | | — | | | 621 | | | 621 | | | | | | |

| Change in pension liability | | — | | | — | | | — | | | — | | | (5) | | | (5) | | | | | | |

| Net loss | | — | | | — | | | — | | | (6,696) | | | — | | | (6,696) | | | | | | |

| Balance at June 30, 2024 | | $ | 130 | | | $ | 1,415,838 | | | $ | (142,057) | | | $ | (716,482) | | | $ | (115,439) | | | $ | 441,990 | | | | | | |

| Stock-based compensation expense | | — | | | 2,076 | | | — | | | — | | | — | | | 2,076 | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Currency translation adjustment | | — | | | — | | | — | | | — | | | 14,254 | | | 14,254 | | | | | | |

| Change in pension liability | | — | | | — | | | — | | | — | | | 25 | | | 25 | | | | | | |

| Net loss | | — | | | — | | | — | | | (14,815) | | | — | | | (14,815) | | | | | | |

| Balance at September 30, 2024 | | $ | 130 | | | $ | 1,417,914 | | | $ | (142,057) | | | $ | (731,297) | | | $ | (101,160) | | | $ | 443,530 | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Forum Energy Technologies, Inc. and subsidiaries

Condensed Consolidated Statements of Changes in Stockholders’ Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 |

| (in thousands) | | Common stock | | Additional paid-in capital | | Treasury stock | | Retained

deficit | | Accumulated

other

comprehensive

income / (loss) | | Total equity |

| Balance at December 31, 2022 | | $ | 62 | | | $ | 1,253,613 | | | $ | (138,560) | | | $ | (680,595) | | | $ | (127,485) | | | $ | 307,035 | |

| Stock-based compensation expense | | — | | | 841 | | | — | | | — | | | — | | | 841 | |

| Restricted stock issuance, net of forfeitures | | 1 | | | (1,874) | | | — | | | — | | | — | | | (1,873) | |

| Conversion of debt to common stock | | 46 | | | 113,604 | | | — | | | — | | | — | | | 113,650 | |

| Treasury stock | | — | | | — | | | (3,497) | | | — | | | — | | | (3,497) | |

| Currency translation adjustment | | — | | | — | | | — | | | — | | | 4,158 | | | 4,158 | |

| Change in pension liability | | — | | | — | | | — | | | — | | | 15 | | | 15 | |

| Net loss | | — | | | — | | | — | | | (3,486) | | | — | | | (3,486) | |

| Balance at March 31, 2023 | | $ | 109 | | | $ | 1,366,184 | | | $ | (142,057) | | | $ | (684,081) | | | $ | (123,312) | | | $ | 416,843 | |

| Stock-based compensation expense | | — | | | 1,257 | | | — | | | — | | | — | | | 1,257 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Currency translation adjustment | | — | | | — | | | — | | | — | | | 7,749 | | | 7,749 | |

| Change in pension liability | | — | | | — | | | — | | | — | | | 6 | | | 6 | |

| Net loss | | — | | | — | | | — | | | (6,579) | | | — | | | (6,579) | |

| Balance at June 30, 2023 | | $ | 109 | | | $ | 1,367,441 | | | $ | (142,057) | | | $ | (690,660) | | | $ | (115,557) | | | $ | 419,276 | |

| Stock-based compensation expense | | — | | | 1,247 | | | — | | | — | | | — | | | 1,247 | |

| Restricted stock issuance, net of forfeitures | | — | | | (626) | | | — | | | — | | | — | | | (626) | |

| Currency translation adjustment | | — | | | — | | | — | | | — | | | (10,710) | | | (10,710) | |

| Change in pension liability | | — | | | — | | | — | | | — | | | (36) | | | (36) | |

| Net income | | — | | | — | | | — | | | 7,969 | | | — | | | 7,969 | |

| Balance at September 30, 2023 | | $ | 109 | | | $ | 1,368,062 | | | $ | (142,057) | | | $ | (682,691) | | | $ | (126,303) | | | $ | 417,120 | |

The accompanying notes are an integral part of these condensed consolidated financial statements.

Table of Contents

Forum Energy Technologies, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

1. Organization and Basis of Presentation

Forum Energy Technologies, Inc. (the “Company,” “FET,” “we,” “our,” or “us”), a Delaware corporation, is a global manufacturing company serving the oil, natural gas, industrial and renewable energy industries. With headquarters located in Houston, Texas, FET provides value added solutions that increase the safety and efficiency of energy exploration and production.

Basis of Presentation

The Company's accompanying unaudited condensed consolidated financial statements include the accounts of the Company and its subsidiaries. All intercompany transactions have been eliminated in consolidation.

In management's opinion, all adjustments, consisting of normal recurring adjustments, necessary for the fair statement of the Company’s financial position, results of operations and cash flows have been included. Operating results for the three and nine months ended September 30, 2024 are not necessarily indicative of the results that may be expected for the year ending December 31, 2024 or any other interim period.

These interim financial statements are unaudited and have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission (“SEC”) regarding interim financial reporting. Accordingly, they do not include all of the information and notes required by accounting principles generally accepted in the United States of America (“U.S. GAAP”) for complete consolidated financial statements and should be read in conjunction with the audited consolidated financial statements for the year ended December 31, 2023, which are included in the Company’s 2023 Annual Report on Form 10-K filed with the SEC on March 5, 2024.

Change of Segment

In the first quarter 2024, following the acquisition (the “Variperm Acquisition”) of Variperm Holdings Ltd. ("Variperm"), we aligned our reportable segments with business activity drivers and the manner in which management reviews and evaluates operating performance. FET now operates in the following two reportable segments: (1) Drilling and Completions and (2) Artificial Lift and Downhole. Refer to Note 10 Business Segments for the product lines making up each segment. Our historical results of operations were recast retrospectively to reflect these changes in accordance with U.S. GAAP.

2. Recent Accounting Pronouncements

From time to time, new accounting pronouncements are issued by the Financial Accounting Standards Board ("FASB"), which the Company adopts as of the specified effective date. Unless otherwise discussed, management believes that the impact of recently issued standards, which are not yet effective, will not have a material impact on the Company's consolidated financial statements upon adoption.

Accounting Standards Issued But Not Yet Adopted

Segment Reporting (Topic 280). In November 2023, FASB issued ASU 2023-07, which improves reportable segment disclosure requirements, primarily through enhanced disclosures about significant expenses. This update is effective retrospectively for fiscal years beginning after December 15, 2023, and interim periods within fiscal years after December 15, 2024. Early adoption is permitted. The Company is in the process of evaluating the impact it may have on our consolidated financial statements.

Income Taxes (Topic 740). In December 2023, FASB issued ASU 2023-09, which improves income tax disclosures. This update is effective for fiscal years beginning after December 15, 2025. Early adoption is permitted. This update should be applied prospectively but retrospective application is permitted. The Company is in the process of evaluating the impact it may have on our consolidated financial statements.

3. Revenue

Revenue is recognized when control of the promised goods or services is transferred to our customers, in an amount that reflects the consideration we expect to be entitled to receive in exchange for those goods or services. For a detailed discussion of our revenue recognition policies, refer to the Company’s 2023 Annual Report on Form 10-K.

Forum Energy Technologies, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

Disaggregated Revenue

Refer to Note 10 Business Segments for disaggregated revenue by product line and geography.

Contract Balances

Contract balances are determined on a contract by contract basis. Contract assets represent revenue recognized for goods and services provided to our customers when payment is conditioned on something other than the passage of time. Similarly, the Company records a contract liability when we receive consideration, or such consideration is unconditionally due, from a customer prior to transferring goods or services to the customer under the terms of a sales contract. Such contract liabilities typically result from billings in excess of costs incurred on construction contracts and advance payments received on product sales.

The following table reflects the changes in our contract assets and contract liabilities balances for the nine months ended September 30, 2024 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 | | Increase / (Decrease) |

| | | $ | | % |

| Accrued revenue | $ | 1,250 | | | $ | 1,801 | | | | | |

| Costs and estimated profits in excess of billings | 16,438 | | | 13,365 | | | | | |

| Contract assets - current | 17,688 | | | 15,166 | | | | | |

| Contract assets - noncurrent | — | | | 1,828 | | | | | |

| Contract assets | $ | 17,688 | | | $ | 16,994 | | | $ | 694 | | | 4 | % |

| | | | | | | |

| Deferred revenue | $ | 9,147 | | | $ | 10,551 | | | | | |

| Billings in excess of costs and profits recognized | 4,748 | | | 4,221 | | | | | |

| Contract liabilities | $ | 13,895 | | | $ | 14,772 | | | $ | (877) | | | (6) | % |

During the nine months ended September 30, 2024, our contract assets increased by $0.7 million and our contract liabilities decreased $0.9 million primarily due to the timing of milestone billings for projects in our Subsea product line. The noncurrent portion of contract assets is recorded on the consolidated balance sheets as other long-term assets.

During the nine months ended September 30, 2024, we recognized $8.7 million of revenue that was included in the contract liabilities balance at the beginning of the period.

Substantially all of our contracts are less than one year in duration. As such, we have elected to apply the practical expedient which allows an entity to exclude disclosures about its remaining performance obligations if such obligation is part of a contract that has an original expected duration of one year or less.

Forum Energy Technologies, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

4. Acquisition

On January 4, 2024, the Company and its wholly owned subsidiary acquired all of the issued and outstanding common shares of Variperm in the Variperm Acquisition. Variperm, headquartered in Canada, is a manufacturer of downhole technology solutions, providing sand and flow control products for heavy oil applications.

Total consideration for the Variperm Acquisition included approximately $150.0 million of cash and 2.0 million shares of the Company’s common stock, which was subject to customary purchase price adjustments. In connection with the closing, to fund the cash portion of the purchase price, the Company borrowed $90.0 million under its senior secured asset-based lending facility (“Credit Facility”) on January 2, 2024 and entered into a $60.0 million second lien seller term loan credit agreement (“Seller Term Loan”) on January 4, 2024. In March 2024, in connection with the finalization of working capital adjustments, the principal amount of the Seller Term Loan was reduced by $0.3 million. During the quarter, the Company finalized the purchase price allocation resulting in an adjustment to goodwill of $2.8 million. Adjustments primarily related to deferred income taxes.

During the three and nine months ended September 30, 2024, the Company recognized acquisition-related costs of $0.6 million and $7.7 million, respectively, for consulting fees and other costs expensed as transaction expenses. The acquisition of business on the statement of cash flow is presented net of the cash and cash equivalents acquired.

The following table summarizes the fair value of identified assets acquired and liabilities assumed at the date of acquisition. The allocation of consideration transferred is based on management's estimates, judgments and assumptions. Management estimated that consideration paid exceeded the fair value of the net assets acquired. Therefore, goodwill of $66.8 million was recorded, most of which is not expected to be deductible for income tax purposes. The Company has estimated the useful lives of customer relationships, backlog and trade names as approximately eight years, two years and eight years, respectively.

The following table summarizes the fair values of the assets acquired and liabilities assumed at the date of the acquisition (in thousands):

| | | | | | | | |

| Cash and cash equivalents | | $ | 4,388 | |

| Accounts receivable—trade | | 24,036 | |

| Inventories | | 13,422 | |

| | |

| Property and equipment | | 26,213 | |

| Intangible assets | | 104,600 | |

| | |

| | |

| | |

| | |

| | |

| Prepaid expenses and other assets | | 3,718 | |

| Total assets acquired | | 176,377 | |

| | |

| | |

| Current liabilities | | 11,760 | |

| | |

| | |

| Long-term liabilities | | 32,379 | |

| Total liabilities assumed | | 44,139 | |

| Total identifiable net assets acquired | | 132,238 | |

| Goodwill | | 66,778 | |

| Total purchase consideration | | $ | 199,016 | |

The excess of the total equity value of Variperm based on the purchase consideration over net assets acquired was recorded as goodwill. The goodwill is primarily attributable to revenue synergies and assembled workforce expected to be realized from the acquisition. Intangible assets acquired as a result of the Variperm Acquisition are amortized on a straight-line basis to reflect the pattern in which the economic benefits of the intangible assets are realized. Acquired goodwill and intangibles relate to our Downhole reporting unit and Downhole asset group.

Forum Energy Technologies, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

The fair value for trade names were estimated using the income approach, specifically the relief-from-royalty method which estimates the cost savings that accrue to the owner of the intangible assets that would otherwise be payable as royalties or licenses fees on revenues earned through the use of the asset. The fair value of customer relationships and backlog were estimated using the multi-period excess earnings method. The excess earning method model estimates revenues and cash flows derived from the asset and then deducts portions of the cash flow that can be attributed to supporting assets. The resulting cash flow, which is attributable solely to the asset acquired, is then discounted at a rate of return commensurate with the risk of the asset to calculate the present value.

Unaudited Pro Forma Financial Information

The contributed revenues and net income to the Company of the acquired Variperm business, for the period from January 4, 2024 to September 30, 2024 were as follows (in thousands):

| | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2024 | | Nine Months Ended September 30, 2024 |

| Revenue | | $ | 27,378 | | | $ | 81,649 | |

| Net income (loss) | | 6,071 | | | 15,572 | |

The following unaudited pro forma summary presents the results of operations of the Company as if the acquisition of Variperm occurred on January 1, 2023 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | $ | 207,806 | | | $ | 208,939 | | | $ | 615,407 | | | $ | 651,558 | |

| Net income (loss) | (14,427) | | | 22,464 | | | (27,516) | | | 11,495 | |

The amounts have been calculated after applying the Company's accounting policies and adjusting the results of Variperm to reflect additional depreciation, amortization, and other purchase accounting adjustments assuming the fair value adjustments to the property, plant and equipment and intangibles assets and other purchase accounting adjustments have been applied on January 1, 2023. The pro forma amounts do not include any potential cost savings or other expected benefits of the acquisition, and are presented for illustrative purposes only and are not necessarily indicative of results that would have been achieved if the acquisition had occurred as of January 1, 2023 or of future operating performance.

5. Inventories

The Company's significant components of inventory at September 30, 2024 and December 31, 2023 were as follows (in thousands):

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| Raw materials and parts | $ | 109,038 | | | $ | 92,563 | |

| Work in process | 33,068 | | | 28,693 | |

| Finished goods | 181,087 | | | 216,570 | |

| Total inventories | 323,193 | | | 337,826 | |

| Less: inventory reserve | (36,254) | | | (38,187) | |

| Inventories, net | $ | 286,939 | | | $ | 299,639 | |

Forum Energy Technologies, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

6. Goodwill and Intangible Assets

Goodwill

The changes in the carrying amount of goodwill from December 31, 2023 to September 30, 2024, were as follows (in thousands):

| | | | | | | | |

| | Artificial Lift and Downhole |

| Goodwill, December 31, 2023 | | $ | — | |

| Acquisitions | | 66,778 | |

| Impact on non-U.S. local currency translation | | (1,159) | |

| Goodwill, September 30, 2024 | | $ | 65,619 | |

Goodwill is not amortized and is tested for impairment at least annually or when events and circumstances indicate that fair value may be below its carrying value.

Intangible Assets

Intangible assets consisted of the following as of September 30, 2024 and December 31, 2023, respectively (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2024 |

| Gross Carrying Amount | | Accumulated Amortization | | Net Intangibles | | Amortization Period (In Years) |

| Customer relationships | $ | 367,596 | | | $ | (187,983) | | | $ | 179,613 | | | 10 - 35 |

| Patents and technology | 89,356 | | | (45,576) | | | 43,780 | | | 5 - 19 |

| Trade names | 46,841 | | | (30,618) | | | 16,223 | | | 7 - 19 |

| Trademarks | 5,089 | | | (2,375) | | | 2,714 | | | 15 |

| Non-compete agreements | 191 | | | (191) | | | — | | | 5 |

| Total intangible assets | $ | 509,073 | | | $ | (266,743) | | | $ | 242,330 | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 |

| Gross Carrying Amount | | Accumulated Amortization | | Net Intangibles | | Amortization Period (In Years) |

| Customer relationships | $ | 267,838 | | | $ | (164,672) | | | $ | 103,166 | | | 10 - 35 |

| Patents and technology | 89,151 | | | (41,189) | | | 47,962 | | | 5 - 19 |

| Trade names | 42,847 | | | (28,974) | | | 13,873 | | | 7 - 19 |

| Trademarks | 5,089 | | | (2,120) | | | 2,969 | | | 15 |

| Non-compete agreements | 190 | | | (190) | | | — | | | 5 |

| Total intangible assets | $ | 405,115 | | | $ | (237,145) | | | $ | 167,970 | | | |

Forum Energy Technologies, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

7. Debt

Debt as of September 30, 2024 and December 31, 2023 consisted of the following (in thousands):

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| 2025 Notes | $ | 61,212 | | | $ | 134,208 | |

| Seller Term Loan | 58,427 | | | — | |

| Credit Facility | 109,043 | | | — | |

| Other debt | 3,784 | | | 2,864 | |

| Long-term debt, principal amount | 232,466 | | | 137,072 | |

| Unamortized debt discount | (1,266) | | | (5,074) | |

| Debt issuance cost | 339 | | | (1,245) | |

| Long-term debt, carrying value | 231,539 | | | 130,753 | |

| Less: current portion | (69,385) | | | (1,186) | |

| Long-term debt, net of current portion | $ | 162,154 | | | $ | 129,567 | |

2025 Notes

Our 9.00% convertible secured notes due August 2025 (“2025 Notes”), of which $61.2 million principal amount was outstanding at September 30, 2024, pay interest at the rate of 9.00%, of which 6.25% is payable in cash and 2.75% is payable in cash or additional notes, at the Company’s option. The 2025 Notes are secured by a first lien on substantially all of the Company’s assets, except for Credit Facility priority collateral, which secures the 2025 Notes on a second lien basis. In January 2023, $122.8 million or 48% of the then-outstanding principal amount of the 2025 Notes mandatorily converted into approximately 4.5 million shares of common stock.

In June 2024, we repurchased $13.0 million in aggregate principal amount of our 2025 Notes for $13.0 million. The net carrying value of the extinguished debt, including unamortized debt discount and debt issuance costs, was $12.5 million, resulting in a $0.5 million loss on extinguishment of debt.

In August 2024, we redeemed $60.0 million in aggregate principal amount of our 2025 Notes for $60.0 million. The net carrying value of the extinguished debt, including amortized debt discount and debt issuance costs, was $58.2 million, resulting in a $1.8 million loss on extinguishment of debt.

Seller Term Loan

On January 4, 2024, the Company entered into the Seller Term Loan in connection with the closing of the Variperm Acquisition, which had an initial principal amount of $60.0 million and matures in December 2026. In March 2024, in connection with the finalization of purchase price adjustments, the principal amount of the Seller Term Loan was reduced by $0.3 million. The Seller Term Loan bears interest at the rate of (i) 11.00% per year for the period commencing on the Closing Date to (but excluding) the first anniversary of the Closing Date, (ii) 17.00% per annum for the period commencing on the first anniversary of the Closing Date to (but excluding) the second anniversary of the Closing Date and (iii) 17.50% per annum for the period commencing on the second anniversary of the Closing Date to (but excluding) the maturity date. The Company has an option to prepay the Seller Term Loan anytime without premium or penalty.

The Seller Term Loan requires the Company to maintain a fixed charge coverage ratio of at least 1.00 to 1.00 as of the last day of each fiscal quarter commencing at the time excess availability is less than the greater of (x) 12.5% of the Line Cap and (y) $31.25 million and continuing until excess availability exceeds the greater of (x) 12.5% of the Line Cap and (y) $31.25 million for 60 consecutive days. “Line Cap” has the meaning set forth in the Credit Facility.

Subject to customary exceptions, all obligations under the Seller Term Loan are guaranteed, jointly and severally, by our wholly owned U.S. and Canadian subsidiaries and are secured by substantially all assets of each such entity and the Company, subject to customary exclusions pursuant to certain intercreditor arrangements.

The Seller Term Loan also contains customary representations and warranties and affirmative and negative covenants, as well as customary events of default, with corresponding grace periods, including, without limitation, payment defaults, cross-defaults to other agreements evidencing indebtedness and bankruptcy-related defaults.

Forum Energy Technologies, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

Credit Facility

Our Credit Facility matures on the earliest of (a) September 8, 2028, (b) the date that is 91 days prior to the maturity of 2025 Notes (which will not apply if the 2025 Notes are repaid prior to such 91st day) and (c) the date that is 91 days prior to the maturity of the Seller Term Loan if the outstanding aggregate principal amount thereunder is equal to or greater than $30.0 million. The Credit Facility provides revolving credit commitments of $250.0 million (with a sublimit of up to $70.0 million available for the issuance of letters of credit for the account of the Company and certain of its domestic subsidiaries) (the “U.S. Line”), of which up to $50.0 million is available to certain of our Canadian subsidiaries for loans in U.S. or Canadian dollars (with a sublimit of up to $10.0 million available for the issuance of letters of credit for the account of our Canadian subsidiaries) (the “Canadian Line”). Lender commitments under the Credit Facility, subject to certain limitations, may be increased by an additional $100.0 million.

Availability under the Credit Facility is subject to a borrowing base calculated by reference to eligible accounts receivable in the U.S., Canada and certain other jurisdictions (subject to a cap) and eligible inventory in the U.S. and Canada. Our borrowing capacity under the Credit Facility could be reduced or eliminated, depending on future fluctuations in our receivables and inventory. As of September 30, 2024, our total borrowing base was $184.8 million, of which $109.0 million amount was drawn and $17.0 million was used as security for outstanding letters of credit, resulting in remaining availability of $58.8 million.

Borrowings under the U.S. Line bear interest at a rate equal to, at our option, either (a) the Secured Overnight Financing Rate (“SOFR”), subject to a floor of 0.00%, plus a margin of 2.25% to 2.75%, or (b) a base rate plus a margin of 1.25% to 1.75%, in each case based upon the Company's quarterly total net leverage ratio. The U.S. Line base rate is determined by reference to the greatest of (i) the federal funds rate plus 0.50% per annum, (ii) the one-month adjusted term SOFR plus 1.00% per annum, and (iii) the “prime rate” of interest announced by Wells Fargo Bank, National Association, subject to a floor of 0.00%.

Borrowings under the Canadian Line bear interest at a rate equal to, at our Canadian borrowers’ option, either (a) Canadian Overnight Repo Rate Average (“CORRA”), subject to a floor of 0.00%, plus a margin of 2.25% to 2.75%, or (b) a base rate plus a margin of 1.25% to 1.75%, in each case based upon the Company's quarterly net leverage ratio. The Canadian Line base rate is determined by reference to the greater of (i) the one-month CORRA plus 1.00% per annum and (ii) the prime rate for Canadian dollar commercial loans made in Canada as reported by Thomson Reuters, subject to a floor of 0.00%.

The weighted average interest rate under the Credit Facility was approximately 8.37% and 8.28% for the nine months ended September 30, 2024 and 2023, respectively.

The Credit Facility also provides for a commitment fee in the amount of (a) 0.375% on the unused portion of revolving commitments if average usage of the Credit Facility is greater than 50% and (b) 0.500% on the unused portion of revolving commitments if average usage of the Credit Facility is less than or equal to 50%.

If excess availability under the Credit Facility falls below the greater of 12.5% of the borrowing base and $31.25 million, we will be required to maintain a fixed charge coverage ratio of at least 1.00:1.00 as of the end of each fiscal quarter until excess availability under the Credit Facility exceeds such threshold for 60 consecutive days.

Subject to customary exceptions, all obligations under the Credit Facility are guaranteed, jointly and severally, by our wholly-owned U.S. subsidiaries and, in the case of the Canadian Line, our wholly-owned Canadian subsidiaries, and are secured by substantially all assets of each such entity and the Company, subject to customary exclusions.

The Credit Facility contains various covenants that, among other things, limit our ability (none of which are absolute) to incur additional indebtedness or issue certain preferred shares, grant certain liens, make certain loans and investments, pay dividends, make distributions or make other restricted payments, enter into mergers or acquisitions unless certain conditions are satisfied, change our lines of business, prepay certain indebtedness, enter into certain affiliate transactions or engage in certain asset dispositions.

If an event of default exists under the Credit Facility, the lenders will have the right to accelerate the maturity of the obligations outstanding under the Credit Facility and exercise other rights and remedies. Obligations outstanding under the Credit Facility, however, will be automatically accelerated upon an event of default arising from a bankruptcy or insolvency event. An event of default includes, among other things, nonpayment of principal, interest, fees or other amounts within certain grace periods; representations and warranties proving to be untrue in any material respect; failure to perform or otherwise comply with covenants in the Credit Facility or other loan documents, subject, in certain instances, to grace periods; cross-defaults to certain other indebtedness if such

Forum Energy Technologies, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

default occurs at the final maturity of such indebtedness or if the effect of such default is to cause, or permit the holders of such indebtedness to cause, the acceleration of such indebtedness; bankruptcy or insolvency events; material monetary judgment defaults; invalidity or unenforceability of the Credit Facility or any other loan document; and the occurrence of a Change of Control (as defined in the Credit Facility).

In October 2024, we entered into an amendment (the “Credit Agreement Amendment”) to our Credit Facility. Pursuant to the Credit Agreement Amendment, the Credit Agreement will, upon satisfaction of conditions precedent specified therein, be modified to (i) permit the issuance of the 2029 Bonds (as defined below), (ii) permit, subject to specified conditions and up to specified amounts, redemption of the 2029 Bonds in certain circumstances and (iii) specify the extent to which collateral will be granted to secure Credit Agreement obligations by subsidiaries of Forum organized or domiciled under the laws of the United Kingdom, Germany or any territory or county thereof.

10.5% Senior Secured Bonds due 2029

On October 24, 2024, we priced an issuance (the “Offering”) of $100.0 million aggregate principal amount of 10.5% senior secured bonds due 2029 (the “2029 Bonds”). We expect to use the net proceeds from the Offering, together with cash on hand, to redeem in full all outstanding 2025 Notes and to repay all borrowings outstanding under the Seller Term Loan. The Offering is expected to close on November 7, 2024, subject to customary closing conditions.

Other Debt

Other debt consists of various finance leases of equipment.

Letters of Credit and Guarantees

We execute letters of credit in the normal course of business to secure the delivery of product from specific vendors and also to guarantee our fulfillment of performance obligations relating to certain large contracts. The Company had $17.0 million and $20.3 million in total outstanding letters of credit as of September 30, 2024 and December 31, 2023, respectively.

8. Income Taxes

For interim periods, our income tax expense or benefit is computed based on our estimated annual effective tax rate and any discrete items that impact the interim periods. For the three and nine months ended September 30, 2024, the Company recorded a tax expense of $4.6 million and $10.6 million, respectively. For the three and nine months ended September 30, 2023, the Company recorded a tax expense of $1.5 million and $6.2 million, respectively. The estimated annual effective tax rates for all periods were impacted by losses in jurisdictions where the recording of a tax benefit is not available. Furthermore, the tax expense or benefit recorded can vary from period to period depending on the Company’s relative mix of earnings and losses by jurisdiction. Finally, the Company believes that it is reasonably possible that a decrease of approximately $1.5 million of noncurrent unrecognized tax benefits may occur by the end of 2024 as a result of a lapse of the statute of limitations.

The Organization for Economic Co-operation and Development introduced Base Erosion and Profit Shifting Pillar 2 rules that impose a global minimum tax rate of 15%. Numerous countries, including European Union member states, have enacted, or are expected to enact, legislation to be effective January 1, 2024 with general implementation of a global minimum tax by January 1, 2025. Based on current enacted legislation, we do not expect a material impact on our future effective tax rate.

We have deferred tax assets related to net operating loss and other tax carryforwards in the U.S. and in certain states and foreign jurisdictions. We recognize deferred tax assets to the extent that we believe these assets are more likely than not to be realized. In making such a determination, we consider all available positive and negative evidence, including, but not limited to, our recent history of pretax losses over the prior three year period, the goodwill and intangible asset impairments for various reporting units, the future reversals of existing taxable temporary differences, the projected future taxable income or loss and tax-planning. We believe that there is a reasonable possibility that within the next 12 months, a portion of the valuation allowance will no longer be needed. Release of the valuation allowance would result in the recognition of certain deferred tax assets and a decrease to income tax expense for the period the release is recorded. However, the exact timing and amount of the valuation allowance release are subject to change on the basis of the level of profitability that we are able to actually achieve. As of September 30, 2024, we do not anticipate being able to fully utilize all of the losses prior to their expiration in the following jurisdictions: the U.S., the U.K., Germany, Singapore, China and Saudi Arabia. As a result, we have certain valuation allowances against our deferred tax assets as of September 30, 2024.

Forum Energy Technologies, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

9. Fair Value Measurements

The Company had $109.0 million and $58.4 million borrowings outstanding under the Credit Facility and Seller Term Loan as of September 30, 2024. The Credit Facility incurs interest at a variable interest rate, and therefore, the carrying amount approximates fair value. The Company has an option to prepay the Seller Term Loan anytime without premium or penalty, therefore, the carrying amount approximates fair value. The fair value of the debt is classified as a Level 2 measurement because interest rates charged are similar to other financial instruments with similar terms and maturities.

The fair value of our 2025 Notes is estimated using Level 2 inputs in the fair value hierarchy and is based on quoted prices for those or similar instruments. At September 30, 2024, the fair value and the carrying value of our 2025 Notes approximated $60.4 million and $59.8 million, respectively. At December 31, 2023, the fair value and the carrying value of our 2025 Notes approximated $130.9 million and $127.9 million, respectively.

There were no other significant outstanding financial instruments as of September 30, 2024 and December 31, 2023 that required measuring the amounts at fair value on a recurring basis. We did not change our valuation techniques associated with recurring fair value measurements from prior periods, and there were no transfers between levels of the fair value hierarchy during the nine months ended September 30, 2024.

10. Business Segments

In the first quarter 2024, following the Variperm Acquisition, we aligned our reportable segments with business activity drivers and the manner in which management reviews and evaluates operating performance. FET now operates in the following two reportable segments: (1) Drilling and Completions and (2) Artificial Lift and Downhole. Our historical results of operations were recast retrospectively to reflect these changes in accordance with U.S. GAAP.

The Drilling and Completions segment designs, manufactures and supplies products and solutions to the drilling, subsea, coiled tubing, well stimulation and intervention markets, including applications in oil and natural gas, renewable energy, defense and communications. The Artificial Lift and Downhole segment designs, manufactures and supplies products and solutions for the artificial lift, production and infrastructure markets.

The Company’s reportable segments are strategic units that offer distinct products and services. They are managed separately since each business segment requires different marketing strategies. Operating segments have not been aggregated as part of a reportable segment. The Company evaluates the performance of its reportable segments based on operating income. This segmentation is representative of the manner in which our Chief Operating Decision Maker and our board of directors make decisions on how to allocate resources and assess performance. We consider the Chief Operating Decision Maker to be the Chief Executive Officer.

The amounts indicated below as “Corporate” relate to costs and assets not allocated to the reportable segments.

Forum Energy Technologies, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

Summary financial data by segment follows (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenue | | | | | | | |

| Drilling and Completions | $ | 123,587 | | | $ | 118,920 | | | $ | 359,683 | | | $ | 376,026 | |

| Artificial Lift and Downhole | 84,226 | | | 60,357 | | | 255,737 | | | 177,681 | |

| Eliminations | (7) | | | (24) | | | (13) | | | (48) | |

| Total revenue | $ | 207,806 | | | $ | 179,253 | | | $ | 615,407 | | | $ | 553,659 | |

| | | | | | | |

| Segment operating income | | | | | | | |

| Drilling and Completions | $ | 7,030 | | | $ | 3,868 | | | $ | 14,464 | | | $ | 15,483 | |

| Artificial Lift and Downhole | 10,784 | | | 8,519 | | | 36,031 | | | 24,121 | |

| Corporate | (8,404) | | | (6,861) | | | (22,610) | | | (20,538) | |

| Segment operating income | 9,410 | | | 5,526 | | | 27,885 | | | 19,066 | |

| Transaction expenses | 579 | | | — | | | 7,728 | | | — | |

| Loss (gain) on disposal of assets and other | (85) | | | (145) | | | 107 | | | 137 | |

| Operating income | $ | 8,916 | | | $ | 5,671 | | | $ | 20,050 | | | $ | 18,929 | |

A summary of consolidated assets by reportable segment is as follows (in thousands):

| | | | | | | | | | | |

| September 30, 2024 | | December 31, 2023 |

| Drilling and Completions | $ | 573,395 | | | $ | 615,033 | |

| Artificial Lift and Downhole | 383,727 | | | 178,785 | |

| Corporate | 16,615 | | | 27,243 | |

| Total assets | $ | 973,737 | | | $ | 821,061 | |

Corporate assets primarily include cash, certain prepaid assets and deferred loan costs.

Forum Energy Technologies, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

The following table presents our revenues disaggregated by product line (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Drilling | $ | 35,741 | | | $ | 41,703 | | | $ | 107,714 | | | $ | 126,918 | |

| Subsea | 20,903 | | | 14,748 | | | 59,537 | | | 40,894 | |

| Stimulation and Intervention | 38,037 | | | 32,541 | | | 113,823 | | | 126,241 | |

| Coiled Tubing | 28,906 | | | 29,928 | | | 78,609 | | | 81,973 | |

| Downhole | 50,562 | | | 23,480 | | | 155,883 | | | 68,763 | |

| Production Equipment | 17,968 | | | 21,706 | | | 54,508 | | | 59,268 | |

| Valve Solutions | 15,696 | | | 15,171 | | | 45,346 | | | 49,650 | |

| Eliminations | (7) | | | (24) | | | (13) | | | (48) | |

| Total revenue | $ | 207,806 | | | $ | 179,253 | | | $ | 615,407 | | | $ | 553,659 | |

The following table presents our revenues disaggregated by geography (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| United States | $ | 108,363 | | | $ | 103,453 | | | $ | 322,232 | | | $ | 352,183 | |

| Canada | 35,719 | | | 12,333 | | | 107,694 | | | 40,400 | |

| Middle East | 24,678 | | | 27,359 | | | 67,411 | | | 64,058 | |

| Europe & Africa | 15,826 | | | 16,832 | | | 58,481 | | | 39,177 | |

| Asia-Pacific | 10,472 | | | 10,091 | | | 30,790 | | | 27,623 | |

| Latin America | 12,748 | | | 9,185 | | | 28,799 | | | 30,218 | |

| Total revenue | $ | 207,806 | | | $ | 179,253 | | | $ | 615,407 | | | $ | 553,659 | |

11. Commitments and Contingencies

In the ordinary course of business, the Company is, and in the future could be, involved in various pending or threatened legal actions, some of which may or may not be covered by insurance. Management has reviewed such pending judicial and legal proceedings, the reasonably anticipated costs and expenses in connection with such proceedings, and the availability and limits of insurance coverage, and has established reserves that are believed to be appropriate in light of those outcomes that are believed to be probable and can be estimated. The reserves accrued at September 30, 2024 and December 31, 2023, respectively, are immaterial. In the opinion of management, the Company’s ultimate liability, if any, with respect to these actions is not expected to have a material adverse effect on the Company’s financial position, results of operations or cash flows.

For further disclosure regarding certain litigation matters, refer to Note 12 of the notes to the consolidated financial statements included in Item 8 of the Company’s 2023 Annual Report on Form 10-K filed with the SEC on March 5, 2024.

Forum Energy Technologies, Inc. and Subsidiaries

Notes to Condensed Consolidated Financial Statements (Continued)

(Unaudited)

12. Earnings (Loss) Per Share

The calculation of basic and diluted earnings per share for each period presented was as follows (dollars and shares in thousands, except per share amounts):

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, | | September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net income (loss) | $ | (14,815) | | | $ | 7,969 | | | $ | (31,826) | | | $ | (2,096) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Weighted average shares outstanding - basic | 12,330 | | | 10,235 | | | 12,287 | | | 10,208 | |