Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

October 26 2023 - 2:21PM

Edgar (US Regulatory)

First Trust Energy Infrastructure Fund

(FIF)

Portfolio of Investments

August 31, 2023

(Unaudited)

| Shares

|

| Description

|

| Value

|

| COMMON STOCKS (a) – 71.0%

|

|

|

| Construction & Engineering – 0.1%

|

|

|

| 1,890

|

| Quanta Services, Inc.

|

| $396,654

|

|

|

| Electric Utilities – 13.7%

|

|

|

| 114,690

|

| Alliant Energy Corp. (b)

|

| 5,753,997

|

| 94,400

|

| American Electric Power Co., Inc. (b)

|

| 7,400,960

|

| 9,110

|

| Duke Energy Corp.

|

| 808,968

|

| 18,930

|

| Emera, Inc. (CAD)

|

| 709,595

|

| 79,420

|

| Enel S.p.A., ADR

|

| 529,334

|

| 17,000

|

| Entergy Corp.

|

| 1,619,250

|

| 26,240

|

| Evergy, Inc.

|

| 1,442,413

|

| 63,130

|

| Eversource Energy

|

| 4,028,957

|

| 62,300

|

| Exelon Corp. (b)

|

| 2,499,476

|

| 18,450

|

| Fortis, Inc. (CAD)

|

| 723,554

|

| 7,230

|

| IDACORP, Inc.

|

| 692,923

|

| 40,913

|

| NextEra Energy, Inc.

|

| 2,732,988

|

| 11,600

|

| Orsted A/S, ADR

|

| 247,428

|

| 234,890

|

| PPL Corp. (b)

|

| 5,853,459

|

| 35,650

|

| Xcel Energy, Inc. (b)

|

| 2,036,684

|

|

|

|

|

| 37,079,986

|

|

|

| Energy Equipment & Services – 0.4%

|

|

|

| 80,600

|

| Archrock, Inc.

|

| 1,030,874

|

|

|

| Gas Utilities – 5.3%

|

|

|

| 18,700

|

| AltaGas Ltd. (CAD)

|

| 365,641

|

| 27,900

|

| Atmos Energy Corp.

|

| 3,235,005

|

| 154,200

|

| National Fuel Gas Co.

|

| 8,286,708

|

| 14,800

|

| New Jersey Resources Corp.

|

| 624,116

|

| 19,720

|

| ONE Gas, Inc.

|

| 1,429,108

|

| 13,894

|

| UGI Corp.

|

| 349,851

|

|

|

|

|

| 14,290,429

|

|

|

| Independent Power & Renewable Electricity Producers – 2.1%

|

|

|

| 222,170

|

| AES (The) Corp. (b)

|

| 3,983,508

|

| 51,970

|

| Clearway Energy, Inc., Class A

|

| 1,218,177

|

| 14,170

|

| EDP Renovaveis S.A. (EUR)

|

| 259,749

|

| 18,940

|

| Northland Power, Inc. (CAD)

|

| 358,139

|

|

|

|

|

| 5,819,573

|

|

|

| Multi-Utilities – 12.2%

|

|

|

| 147,910

|

| Atco Ltd., Class I (CAD)

|

| 4,083,069

|

| 17,020

|

| Canadian Utilities Ltd., Class A (CAD)

|

| 403,331

|

| 10,619

|

| CenterPoint Energy, Inc.

|

| 296,164

|

| 53,600

|

| CMS Energy Corp.

|

| 3,011,784

|

| 28,810

|

| DTE Energy Co.

|

| 2,978,378

|

| 89,000

|

| Public Service Enterprise Group, Inc.

|

| 5,436,120

|

| 190,640

|

| Sempra

|

| 13,386,741

|

| 41,320

|

| WEC Energy Group, Inc. (b)

|

| 3,475,838

|

|

|

|

|

| 33,071,425

|

|

|

| Oil, Gas & Consumable Fuels – 35.1%

|

|

|

| 165,090

|

| BP PLC, ADR (b)

|

| 6,138,046

|

| 45,178

|

| Cheniere Energy, Inc. (b)

|

| 7,373,050

|

| 318,590

|

| DT Midstream, Inc.

|

| 16,659,071

|

| 123,800

|

| Enbridge, Inc.

|

| 4,342,904

|

| 361,830

|

| Keyera Corp. (CAD)

|

| 8,938,636

|

| 904,565

|

| Kinder Morgan, Inc. (b)

|

| 15,576,609

|

First Trust Energy Infrastructure Fund

(FIF)

Portfolio of Investments

(Continued)

August 31, 2023

(Unaudited)

| Shares

|

| Description

|

| Value

|

| COMMON STOCKS (a) (Continued)

|

|

|

| Oil, Gas & Consumable Fuels (Continued)

|

|

|

| 23

|

| ONEOK, Inc.

|

| $1,500

|

| 109,230

|

| Shell PLC, ADR (b)

|

| 6,782,091

|

| 103,070

|

| Targa Resources Corp. (b)

|

| 8,889,788

|

| 20,455

|

| TC Energy Corp.

|

| 738,835

|

| 106,730

|

| TotalEnergies SE, ADR

|

| 6,714,384

|

| 374,750

|

| Williams (The) Cos., Inc. (b)

|

| 12,940,117

|

|

|

|

|

| 95,095,031

|

|

|

| Professional Services – 1.9%

|

|

|

| 38,000

|

| Jacobs Solutions, Inc. (b)

|

| 5,123,160

|

|

|

| Semiconductors & Semiconductor Equipment – 0.1%

|

|

|

| 2,040

|

| Enphase Energy, Inc. (c)

|

| 258,121

|

|

|

| Water Utilities – 0.1%

|

|

|

| 2,170

|

| American Water Works Co., Inc.

|

| 301,066

|

|

|

| Total Common Stocks

|

| 192,466,319

|

|

|

| (Cost $193,600,358)

|

|

|

| Units

|

| Description

|

| Value

|

| MASTER LIMITED PARTNERSHIPS (a) – 47.3%

|

|

|

| Chemicals – 0.6%

|

|

|

| 69,395

|

| Westlake Chemical Partners, L.P.

|

| 1,595,391

|

|

|

| Energy Equipment & Services – 0.1%

|

|

|

| 14,800

|

| USA Compression Partners, L.P.

|

| 314,056

|

|

|

| Independent Power & Renewable Electricity Producers – 2.9%

|

|

|

| 157,618

|

| NextEra Energy Partners, L.P. (b) (d)

|

| 7,861,986

|

|

|

| Oil, Gas & Consumable Fuels – 43.7%

|

|

|

| 99,089

|

| Cheniere Energy Partners, L.P.

|

| 5,142,719

|

| 1,572,880

|

| Energy Transfer, L.P.

|

| 21,186,694

|

| 29,780

|

| EnLink Midstream, LLC (d)

|

| 370,463

|

| 824,240

|

| Enterprise Products Partners, L.P.

|

| 21,933,026

|

| 432,710

|

| Hess Midstream, L.P., Class A (d)

|

| 12,505,319

|

| 52,246

|

| Holly Energy Partners, L.P.

|

| 1,112,840

|

| 354,772

|

| Magellan Midstream Partners, L.P.

|

| 23,563,956

|

| 240,770

|

| MPLX, L.P.

|

| 8,400,465

|

| 1,455,078

|

| Plains GP Holdings, L.P., Class A (d)

|

| 23,339,451

|

| 29,940

|

| Western Midstream Partners, L.P. (b)

|

| 799,099

|

|

|

|

|

| 118,354,032

|

|

|

| Total Master Limited Partnerships

|

| 128,125,465

|

|

|

| (Cost $94,599,235)

|

|

|

First Trust Energy Infrastructure Fund

(FIF)

Portfolio of Investments

(Continued)

August 31, 2023

(Unaudited)

| Shares

|

| Description

|

| Value

|

| MONEY MARKET FUNDS (a) – 6.4%

|

| 17,398,682

|

| Morgan Stanley Institutional Liquidity Funds - Treasury Portfolio - Institutional Class - 5.21% (e)

|

| $17,398,682

|

|

|

| (Cost $17,398,682)

|

|

|

|

|

| Total Investments – 124.7%

|

| 337,990,466

|

|

|

| (Cost $305,598,275)

|

|

|

| Number of Contracts

|

| Description

|

| Notional Amount

|

| Exercise Price

|

| Expiration Date

|

| Value

|

| CALL OPTIONS WRITTEN – (0.2)%

|

| (2,221)

|

| AES (The) Corp.

|

| $(3,982,253)

|

| $23.00

|

| 09/15/23

|

| (6,663)

|

| (1,146)

|

| Alliant Energy Corp. (f) (g)

|

| (5,749,482)

|

| 57.50

|

| 09/15/23

|

| 0

|

| (944)

|

| American Electric Power Co., Inc.

|

| (7,400,960)

|

| 82.50

|

| 10/20/23

|

| (69,856)

|

| (1,650)

|

| BP PLC, ADR

|

| (6,134,700)

|

| 37.50

|

| 09/15/23

|

| (70,950)

|

| (451)

|

| Cheniere Energy, Inc.

|

| (7,360,320)

|

| 175.00

|

| 09/15/23

|

| (14,432)

|

| (623)

|

| Exelon Corp.

|

| (2,499,476)

|

| 42.00

|

| 10/20/23

|

| (21,805)

|

| (380)

|

| Jacobs Solutions, Inc.

|

| (5,123,160)

|

| 140.00

|

| 10/20/23

|

| (50,160)

|

| (6,285)

|

| Kinder Morgan, Inc.

|

| (10,822,770)

|

| 18.00

|

| 10/20/23

|

| (100,560)

|

| (1,424)

|

| NextEra Energy Partners, L.P.

|

| (7,102,912)

|

| 60.00

|

| 09/15/23

|

| (4,272)

|

| (1,200)

|

| PPL Corp. (f) (g)

|

| (2,990,400)

|

| 29.00

|

| 09/15/23

|

| 0

|

| (1,148)

|

| PPL Corp.

|

| (2,860,816)

|

| 26.00

|

| 10/20/23

|

| (22,960)

|

| (1,092)

|

| Shell PLC, ADR

|

| (6,780,228)

|

| 63.00

|

| 09/15/23

|

| (50,232)

|

| (1,030)

|

| Targa Resources Corp.

|

| (8,883,750)

|

| 87.50

|

| 09/15/23

|

| (120,510)

|

| (413)

|

| WEC Energy Group, Inc.

|

| (3,474,156)

|

| 90.00

|

| 10/20/23

|

| (19,617)

|

| (299)

|

| Western Midstream Partners, L.P. (f) (g)

|

| (798,031)

|

| 30.00

|

| 09/15/23

|

| (299)

|

| (1,500)

|

| Williams (The) Cos., Inc.

|

| (5,179,500)

|

| 36.00

|

| 10/20/23

|

| (40,500)

|

| (356)

|

| Xcel Energy, Inc.

|

| (2,033,828)

|

| 60.00

|

| 10/20/23

|

| (18,156)

|

|

|

| Total Call Options Written

|

| (610,972)

|

|

|

| (Premiums received $1,088,567)

|

|

|

|

|

|

|

|

|

|

| Outstanding Loans – (25.9)%

| (70,300,000)

|

|

| Net Other Assets and Liabilities – 1.4%

| 3,864,991

|

|

| Net Assets – 100.0%

| $270,944,485

|

Interest Rate Swap Agreements:

| Counterparty

|

| Rate Receivable

|

| Expiration Date

|

| Notional

Amount

|

| Rate Payable

|

| Unrealized

Appreciation

(Depreciation)/

Value

|

| Bank of Nova Scotia(1)

|

| 5.424%(2)

|

| 09/03/24

|

| $36,475,000

|

| 2.367%(3)

|

| $1,166,120

|

| N/A(4) (5)

|

| 5.330%(6)

|

| 10/21/25

|

| 303,796

|

| 5.320%(7)

|

| (156)

|

|

|

|

|

|

|

| $36,778,796

|

|

|

| $1,165,964

|

| (1) Payment frequency is monthly

|

| (2) SOFR + 0.11448%

|

| (3) Fixed Rate

|

|

|

|

|

|

|

|

|

|

|

| (4) Centrally cleared on the Chicago Mercantile Exchange

|

| (5) No cash payments are made by either party prior to the expiration dates shown above

|

| (6) Federal Funds Rate

|

|

|

|

|

|

|

|

|

|

|

| (7) SOFR + 0.01036%

|

|

|

|

|

|

|

|

|

|

|

| (a)

| All of these securities are available to serve as collateral for the outstanding loans.

|

| (b)

| All or a portion of this security’s position represents cover for outstanding options written.

|

| (c)

| Non-income producing security.

|

| (d)

| This security is taxed as a “C” corporation for federal income tax purposes.

|

| (e)

| Rate shown reflects yield as of August 31, 2023.

|

First Trust Energy Infrastructure Fund

(FIF)

Portfolio of Investments

(Continued)

August 31, 2023

(Unaudited)

| (f)

| This investment is fair valued by the Advisor’s Pricing Committee in accordance with procedures approved by the Fund’s Board of Trustees, and in accordance with the

provisions of the Investment Company Act of 1940 and rules thereunder, as amended. At August 31, 2023, investments noted as such are valued at $(299) or (0.0)% of net assets.

|

| (g)

| This investment’s value was determined using significant unobservable inputs (see Valuation Inputs section).

|

| Abbreviations throughout the Portfolio of Investments:

|

| ADR

| American Depositary Receipt

|

| CAD

| Canadian Dollar

|

| EUR

| Euro

|

| SOFR

| Secured Overnight Financing Rate

|

Valuation Inputs

The Fund is subject to

fair value accounting standards that define fair value, establish the framework for measuring fair value and provide a three-level hierarchy for fair valuation based upon the inputs to the valuation as of the

measurement date. The three levels of the fair value hierarchy are as follows:

| •

| Level 1 – Level 1 inputs are quoted prices in active markets for identical investments.

|

| •

| Level 2 – Level 2 inputs are observable inputs, either directly or indirectly. (Quoted prices for similar investments, valuations based on interest rates and yield curves, or valuations derived

from observable market data.)

|

| •

| Level 3 – Level 3 inputs are unobservable inputs that may reflect the reporting entity’s own assumptions about the assumptions that market participants would use in

pricing the investment.

|

The inputs or

methodologies used for valuing investments are not necessarily an indication of the risk associated with investing in those investments.

A summary of the inputs

used to value the Fund’s investments as of August 31, 2023 is as follows:

| ASSETS TABLE

|

|

| Total

Value at

8/31/2023

| Level 1

Quoted

Prices

| Level 2

Significant

Observable

Inputs

| Level 3

Significant

Unobservable

Inputs

|

Common Stocks*

| $ 192,466,319

| $ 192,466,319

| $ —

| $ —

|

Master Limited Partnerships*

| 128,125,465

| 128,125,465

| —

| —

|

Money Market Funds

| 17,398,682

| 17,398,682

| —

| —

|

Total Investments

| 337,990,466

| 337,990,466

| —

| —

|

Interest Rate Swap Agreements

| 1,166,120

| —

| 1,166,120

| —

|

Total

| $ 339,156,586

| $ 337,990,466

| $ 1,166,120

| $—

|

|

|

| LIABILITIES TABLE

|

|

| Total

Value at

8/31/2023

| Level 1

Quoted

Prices

| Level 2

Significant

Observable

Inputs

| Level 3

Significant

Unobservable

Inputs

|

Call Options Written

| $ (610,972)

| $ (591,056)

| $ (19,617)

| $ (299)

|

Interest Rate Swap Agreements

| (156)

| —

| (156)

| —

|

Total

| $ (611,128)

| $ (591,056)

| $ (19,773)

| $ (299)

|

| *

| See Portfolio of Investments for industry breakout.

|

Level 3 investments are

fair valued by the Advisor’s Pricing Committee and are footnoted in the Portfolio of Investments. All Level 3 values are based on unobservable inputs.

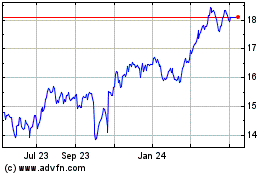

First Trust Energy Infra... (NYSE:FIF)

Historical Stock Chart

From Apr 2024 to May 2024

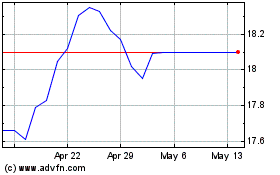

First Trust Energy Infra... (NYSE:FIF)

Historical Stock Chart

From May 2023 to May 2024