Lowered Q4 Adjusted EBITDA loss by More Than

50% year over year

Exited 2023 with Cash and Short-Term

Investments over $100 million; Expected to Carry ESS Well Into

H1’25

Delivered First Energy Warehouses to

Honeywell

Energy Warehouse manufacturing cost lowered

by 60% in 2023

Target 40% 2024 EW Cost Reduction to Achieve

non-GAAP Gross Margin Profitability

ESS Tech, Inc. (“ESS,” “ESS, Inc.” or the “Company”) (NYSE:GWH),

a leading manufacturer of long-duration energy storage systems

(LDES) for commercial and utility-scale applications, today

announced financial results for its fourth quarter and full year

ended December 31, 2023.

“During 2023 our team made significant progress towards our most

important objectives, including securing transformative

partnerships with LEAG and Honeywell, optimizing our internal

operations, and pursuing design initiatives to lower production

costs by improving manufacturability and scale. While we faced

customer-related delays that impacted our financial results, the

team’s work during the year laid a solid foundation for us to scale

the business, launch the Energy Center and move toward unit

profitability in 2024. In fact, our strategic decision to make

fewer Energy Warehouses (EWs) and ship them to customers with the

greatest long-term opportunity allowed us to conserve cash and exit

the year with a cash and short-term investments balance over $100

million. Importantly, we brought down costs to build an EW by

almost 60% during 2023 and successfully cut our Q4 adjusted EBITDA

loss in half year over year,” said Eric Dresselhuys, CEO of ESS.

“ESS continues to make tremendous progress on our strategy to build

a world class, scalable company that is well-positioned to serve

the immense long-duration energy storage market. The actions we’ve

already taken have resonated with customers and we continue to see

robust customer engagement. In 2024 we plan to further reduce EW

unit costs by up to 40% as we move toward unit profitability while

ramping our scale and maintaining a healthy cash balance.”

Recent Business Highlights

- Achieved record revenue of $7.5M for FY 2023.

- Delivered first Energy Warehouses™ under the partnership with

Honeywell in Q4 2023 and recently cleared previously announced

customer delays in Australia, which we expect will result in

revenue of approximately $2 million in Q1 2024 which was originally

anticipated in Q4 2023.

- At the end of 2023, ESS successfully “lifted” its first Energy

Center™ (EC), a key milestone in the manufacturing process. The EC

is a utility-scale, front-of-the-meter long-duration energy storage

product which provides up to eight hours of energy storage with a

flexible, scalable platform to meet the LDES needs of utilities

worldwide. We expect this inaugural EC system will be commissioned

and delivered to Portland General Electric later this year.

- Delivered an Energy Warehouse™ system to the Burbank Water and

Power (BWP) EcoCampus, BWP’s first utility-scale battery storage

project. This EW will be paired with an on-site solar array where

ESS technology will demonstrate the critical role of LDES in a

fully renewable grid.

- Delivered two Energy Warehouses™ to Turlock Irrigation District

(TID) in Central California to support TID’s Project Nexus. At TID,

the EW will be paired with a proof of concept of solar panels over

irrigation canals. which aims to conserve water resources by

reducing evaporation while generating clean energy, reducing diesel

generation and reducing energy costs.

- Completed commissioning of an Energy Warehouse™ system at the

Contingency Base Integration Training Evaluation Center (CBITEC)

operated by the US Army Corps of Engineers Engineer Research and

Development Center in Fort Leonard Wood, Missouri. This EW has been

incorporated into a tactical microgrid at CBITEC and will

demonstrate the key role that LDES, specifically iron flow battery

technology, can play to reduce fuel consumption at Contingency

Bases such as Forward Operating Bases or other temporary use

locations providing humanitarian assistance or disaster

relief.

Conference Call Details

ESS will hold a conference call on Wednesday, March 13, 2024 at

5:00 p.m. EDT to discuss financial results for its fourth quarter

and full year ended December 31, 2023. Interested parties may join

the conference call beginning at 5:00 p.m. EDT on Wednesday, March

13, 2024 via telephone by calling (833) 927-1758 in the U.S., or

for international callers, by calling +1 (929) 526-1599 and

entering conference ID 261003. A telephone replay will be available

until March 20, 2024, by dialing (866) 813-9403 in the U.S., or for

international callers, +44 (204) 525-0658 with conference ID

769695. A live webcast of the conference call will be available on

ESS’ Investor Relations website at

http://investors.essinc.com/.

A replay of the call will be available via the web at

http://investors.essinc.com/.

About ESS, Inc.

At ESS (NYSE: GWH), our mission is to accelerate global

decarbonization by providing safe, sustainable, long-duration

energy storage that powers people, communities and businesses with

clean, renewable energy anytime and anywhere it’s needed. As more

renewable energy is added to the grid, long-duration energy storage

is essential to providing the reliability and resiliency we need

when the sun is not shining, and the wind is not blowing.

Our technology uses earth-abundant iron, salt and water to

deliver environmentally safe solutions capable of providing up to

12 hours of flexible energy capacity for commercial and

utility-scale energy storage applications. Established in 2011,

ESS, Inc. enables project developers, independent power producers,

utilities and other large energy users to deploy reliable,

sustainable long-duration energy storage solutions. For more

information visit www.essinc.com.

Use of Non-GAAP Financial Measures

In this press release and the accompanying earnings call, the

Company includes Non-GAAP Operating Expenses and Adjusted EBITDA,

which are non-GAAP performance measures that the Company uses to

supplement its results presented in accordance with U.S. GAAP. As

required by the rules of the Securities and Exchange Commission

(“SEC”), the Company has provided herein a reconciliation of the

non-GAAP financial measures contained in this press release and the

accompanying earnings call to the most directly comparable measures

under GAAP. The Company’s management believes Non-GAAP Operating

Expenses and Adjusted EBITDA are useful in evaluating its operating

performance and are similar measures reported by publicly-listed

U.S. companies, and regularly used by securities analysts,

institutional investors, and other interested parties in analyzing

operating performance and prospects. By providing these non-GAAP

measures, the Company’s management intends to provide investors

with a meaningful, consistent comparison of the Company’s

profitability for the periods presented. Adjusted EBITDA is not

intended to be a substitute for net income/loss or any U.S. GAAP

financial measure and, as calculated, may not be comparable to

other similarly titled measures of performance of other companies

in other industries or within the same industry. Further, Non-GAAP

Operating Expenses are not intended to be a substitute for GAAP

Operating Expenses or any U.S. GAAP financial measure and, as

calculated, may not be comparable to other similarly titled

measures of performance of other companies in other industries or

within the same industry.

The Company defines and calculates Non-GAAP Operating Expenses

as GAAP Operating Expenses adjusted for stock-based compensation

and other special items determined by management as they are not

indicative of business operations. The Company defines and

calculates Adjusted EBITDA as net loss before interest, other

non-operating expense or income, (benefit) provision for income

taxes, and depreciation, and further adjusted for stock-based

compensation and other special items determined by management,

including, but not limited to, fair value adjustments for certain

financial liabilities associated with debt and equity transactions

as they are not indicative of business operations.

Forward-Looking Statements

This communication contains certain forward-looking statements,

including statements regarding ESS and its management team’s

expectations, hopes, beliefs, intentions or strategies regarding

the future. The words “anticipate”, “believe”, “continue”, “could”,

“estimate”, “expect”, “intends”, “may”, “might”, “plan”,

“possible”, “potential”, “predict”, “project”, “should”, “will”

“would” and similar expressions may identify forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. Examples of forward-looking

statements include, among others, statements regarding the

Company’s manufacturing plans, the Company’s order and sales

pipeline, the Company’s ability to execute on orders, the Company’s

ability to effectively manage costs and the Company’s partnerships

with third parties such as Amsterdam Airport Schiphol, BWP, CMS,

ESIAP, the Sacramento Municipal Utility District and the Turlock

Irrigation District. These forward-looking statements are based on

ESS’ current expectations and beliefs concerning future

developments and their potential effects on ESS. Many factors could

cause actual future events to differ materially from the

forward-looking statements in this communication. There can be no

assurance that the future developments affecting ESS will be those

that we have anticipated. These forward-looking statements involve

a number of risks, uncertainties (some of which are beyond ESS

control) or other assumptions that may cause actual results or

performance to be materially different from those expressed or

implied by these forward-looking statements, which include, but are

not limited to, continuing supply chain issues; delays,

disruptions, or quality control problems in the Company’s

manufacturing operations; the Company’s ability to hire, train and

retain an adequate number of manufacturing employees; issues

related to the shipment and installation of the Company’s products;

issues related to customer acceptance of the Company’s products;

issues related to the Company’s partnerships with third parties;

inflationary pressures; risk of loss of government funding for

customer projects; and the Company’s need to achieve significant

business growth to achieve sustained, long-term profitability.

Except as required by law, ESS is not undertaking any obligation to

update or revise any forward-looking statements whether as a result

of new information, future events or otherwise.

ESS Tech, Inc. Statements of

Operations and Comprehensive Loss (Unaudited, in thousands,

except share and per share data)

Three Months Ended December

31,

2023

2022

Revenue:

Revenue

$

2,796

$

15

Revenue - related parties

—

1

Total revenue

2,796

16

Cost of revenue

10,312

—

Gross profit (loss)

(7,516

)

16

Operating expenses:

Research and development

3,842

22,789

Sales and marketing

2,096

1,721

General and administrative

5,611

6,902

Total operating expenses

11,549

31,412

Loss from operations

(19,065

)

(31,396

)

Other income (expenses), net:

Interest income, net

1,525

1,188

Gain on revaluation of common stock

warrant liabilities

1,375

5,273

Other income (expense), net

35

(140

)

Total other income, net

2,935

6,321

Net loss and comprehensive loss to

common stockholders

$

(16,130

)

$

(25,075

)

Net loss per share - basic and

diluted

$

(0.09

)

$

(0.16

)

Weighted average shares used in per

share calculation - basic and diluted

173,552,254

153,414,471

ESS Tech, Inc. Statements of

Operations and Comprehensive Loss (in thousands, except

share and per share data)

Years Ended December

31,

2023

2022

Revenue:

Revenue

$

7,537

$

610

Revenue - related parties

3

284

Total revenue

7,540

894

Cost of revenue

20,495

—

Gross profit (loss)

(12,955

)

894

Operating expenses:

Research and development

42,632

71,979

Sales and marketing

7,744

6,938

General and administrative

22,574

27,469

Total operating expenses

72,950

106,386

Loss from operations

(85,905

)

(105,492

)

Other income (expenses), net:

Interest income, net

5,262

2,187

Gain on revaluation of common stock

warrant liabilities

2,292

25,788

Other income (expense), net

773

(452

)

Total other income, net

8,327

27,523

Net loss and comprehensive loss to

common stockholders

$

(77,578

)

$

(77,969

)

Net loss per share - basic and

diluted

$

(0.48

)

$

(0.51

)

Weighted average shares used in per

share calculation - basic and diluted

159,958,645

152,676,155

ESS Tech, Inc. Balance Sheets

(in thousands, except share data)

December 31, 2023

December 31, 2022

Assets

Current assets:

Cash and cash equivalents

$

20,165

$

34,767

Restricted cash, current

1,373

1,213

Accounts receivable, net

1,990

4,952

Short-term investments

87,899

105,047

Inventory

3,366

—

Prepaid expenses and other current

assets

3,305

5,657

Total current assets

118,098

151,636

Property and equipment, net

16,266

17,570

Intangible assets, net

4,923

—

Operating lease right-of-use assets

2,167

3,401

Restricted cash, non-current

945

675

Other non-current assets

833

271

Total assets

$

143,232

$

173,553

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

2,755

$

3,036

Accrued and other current liabilities

10,755

14,125

Accrued product warranties

2,129

1,643

Operating lease liabilities, current

1,581

1,421

Deferred revenue, current

2,546

6,168

Notes payable, current

—

1,600

Total current liabilities

19,766

27,993

Notes payable, non-current

—

315

Operating lease liabilities,

non-current

957

2,535

Deferred revenue, non-current

3,835

2,442

Deferred revenue, non-current - related

parties

14,400

—

Common stock warrant liabilities

917

3,209

Other non-current liabilities

—

85

Total liabilities

39,875

36,579

Stockholders’ equity:

Preferred stock ($0.0001 par value,

200,000,000 shares authorized, none issued and outstanding as of

December 31, 2023 and 2022)

—

—

Common stock ($0.0001 par value;

2,000,000,000 shares authorized, 174,211,911 and 153,821,339 shares

issued and outstanding as of December 31, 2023 and 2022,

respectively)

18

16

Additional paid-in capital

799,496

755,537

Accumulated deficit

(696,157

)

(618,579

)

Total stockholders’ equity

103,357

136,974

Total liabilities and stockholders’

equity

$

143,232

$

173,553

ESS Tech, Inc. Consolidated

Statements of Cash Flows (in thousands)

Years Ended December

31,

2023

2022

Cash flows from operating

activities:

Net loss

$

(77,578

)

$

(77,969

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

6,513

1,523

Non-cash interest income

(3,635

)

(1,349

)

Non-cash lease expense

1,234

1,134

Stock-based compensation expense

10,635

11,889

Inventory write-down and losses on

noncancellable purchase commitments

11,932

—

Change in fair value of common stock

warrant liabilities

(2,292

)

(25,788

)

Other non-cash income and expenses,

net

(60

)

483

Changes in operating assets and

liabilities:

Accounts receivable, net

3,633

(1,886

)

Inventory

(14,661

)

—

Prepaid expenses and other current

assets

2,422

(311

)

Accounts payable

(229

)

1,464

Accrued and other current liabilities

(3,378

)

6,789

Accrued product warranties

486

1,643

Deferred revenue

11,500

1,881

Operating lease liabilities

(1,418

)

(1,123

)

Net cash used in operating

activities

(54,896

)

(81,620

)

Cash flows from investing

activities:

Purchases of property and equipment

(5,790

)

(14,180

)

Maturities and purchases of short-term

investments, net

20,861

(103,704

)

Net cash provided by (used in)

investing activities

15,071

(117,884

)

Cash flows from financing

activities:

Proceeds from issuance of common stock and

common stock warrants, net of issuance costs

27,132

—

Payments on notes payable

(1,733

)

(1,900

)

Proceeds from stock options exercised

237

—

Repurchase of shares from employees for

income tax withholding purposes

(310

)

(2,808

)

Proceeds from contributions to Employee

Stock Purchase Plan

541

492

Proceeds from warrants exercised

—

165

Other, net

(214

)

(22

)

Net cash provided by (used in)

financing activities

25,653

(4,073

)

Net change in cash, cash equivalents

and restricted cash

(14,172

)

(203,577

)

Cash, cash equivalents and restricted

cash, beginning of period

36,655

240,232

Cash, cash equivalents and restricted

cash, end of period

$

22,483

$

36,655

ESS Tech, Inc. Consolidated

Statements of Cash Flows (continued) (in thousands)

Years Ended December

31,

2023

2022

Supplemental disclosures of cash flow

information:

Cash paid for operating leases included in

cash used in operating activities

$

1,670

$

1,625

Cash paid for interest

—

154

Non-cash investing and financing

transactions:

Common stock warrants issued for the

acquisition of intangible assets

4,990

—

Purchase of property and equipment

included in accounts payable and accrued and other current

liabilities

704

1,358

Right-of-use operating lease assets

obtained in exchange for lease obligations

—

4,534

Right-of-use finance lease assets obtained

in exchange for lease obligations

—

123

Warrant vested under contracts with

customers

—

46

Cash and cash equivalents

$

20,165

$

34,767

Restricted cash, current

1,373

1,213

Restricted cash, non-current

945

675

Total cash, cash equivalents and

restricted cash shown in the statements of cash flows

$

22,483

$

36,655

ESS Tech, Inc. Reconciliation of GAAP

to Non-GAAP Operating Expenses (Unaudited, in

thousands)

Three Months Ended December

31,

Twelve Months Ended December

31,

2023

2023

Research and development

$

3,842

$

42,632

Less: stock-based compensation(1)

(295

)

(2,696

)

Non-GAAP research and development

$

3,547

$

39,936

Sales and marketing

$

2,096

$

7,744

Less: stock-based compensation(1)

(290

)

(816

)

Non-GAAP sales and marketing

$

1,806

$

6,928

General and administrative

$

5,611

$

22,574

Less: stock-based compensation(1)

(1,502

)

(5,370

)

Non-GAAP general and administrative

$

4,109

$

17,204

Total operating expenses

$

11,549

$

72,950

Less: stock-based compensation

(2,087

)

(8,882

)

Non-GAAP total operating expenses

$

9,462

$

64,068

(1) For purposes of calculating Non-GAAP

total operating expenses, stock-based compensation is allocated on

a departmental basis based on the classification of the award

holder.

ESS Tech, Inc. Reconciliation of GAAP

Net Loss to Adjusted EBITDA (Unaudited, in

thousands)

Three Months Ended December

31,

Twelve Months Ended December

31,

2023

2023

Net loss

$

(16,130

)

$

(77,578

)

Interest income, net

(1,525

)

(5,262

)

Stock-based compensation

2,962

10,635

Depreciation and amortization

3,326

6,513

Gain on revaluation of warrant

liabilities

(1,375

)

(2,292

)

Other expense, net

(35

)

(773

)

Adjusted EBITDA

$

(12,777

)

$

(68,757

)

Source: ESS Tech, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240313875100/en/

Investors: Erik Bylin investors@essinc.com

Media: Morgan Pitts 503.568.0755

Morgan.Pitts@essinc.com

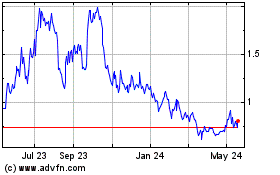

ESS Tech (NYSE:GWH)

Historical Stock Chart

From Nov 2024 to Dec 2024

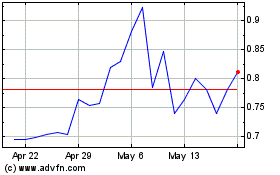

ESS Tech (NYSE:GWH)

Historical Stock Chart

From Dec 2023 to Dec 2024