Filed Pursuant to General

Instruction II.L. of Form F-10

File Number 333-274097

The information contained

in this preliminary prospectus supplement is not complete and may be changed. This preliminary prospectus supplement and the accompanying

prospectus are not an offer to sell and are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale

is not permitted.

SUBJECT

TO COMPLETION, DATED NOVEMBER 6, 2023

PRELIMINARY PROSPECTUS SUPPLEMENT

To the Short Form Base Shelf Prospectus

dated August 18, 2023

| New Issue | November 6, 2023 |

ERO COPPER CORP.

US$ ●

● Common Shares

This prospectus supplement (this

“Prospectus Supplement”) of Ero Copper Corp. (the “Company” or “Ero”),

together with the short form base shelf prospectus dated August 18, 2023 (the “Prospectus”), qualifies the

distribution (the “Offering”) of ● common shares of the Company (the “Common Shares”) at

a price of US$ ● per Common Share (the “Offering Price”). The Common Shares will be issued pursuant to an

underwriting agreement (the “Underwriting Agreement”) dated as of November ●, 2023 among the Company, BMO

Nesbitt Burns Inc., as sole bookrunner and lead underwriter (the “Lead Underwriter”), ● and ●

(collectively with the Lead Underwriter, the “Underwriters”). The Common Shares will be offered in each of the

provinces and territories of Canada, except Quebec, in the United States and, subject to applicable law, in certain

jurisdictions outside of Canada and the United States through the Underwriters either directly or through their respective Canadian

or U.S. broker-dealer affiliates or agents in accordance with the Underwriting Agreement. See “Plan of

Distribution” and “Description of the Securities Being Distributed”.

Unless the context otherwise requires, references

to “Offering” and “Common Shares” include the additional Common Shares issuable upon exercise of

the Over-Allotment Option (as defined herein). The Offering Price has been determined by arm’s length negotiations between the

Company and the Lead Underwriter, on behalf of the Underwriters, with reference to the prevailing market price of the Common Shares.

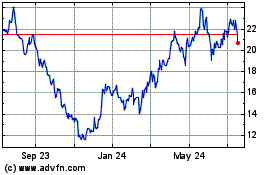

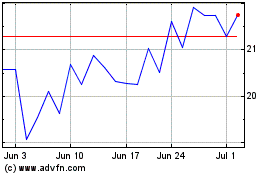

The outstanding Common Shares are listed on

the Toronto Stock Exchange (the “TSX”) and the New York Stock Exchange (“NYSE”) under the

symbol “ERO”. The closing prices of the Common Shares on the TSX and NYSE on November 3, 2023, the last trading day prior

to the date of this Prospectus Supplement, were C$18.50 and US$13.52, respectively. The Company intends to apply to list the Common Shares distributed hereunder on

the TSX and NYSE. Listing will be subject to Ero fulfilling all listing requirements of the TSX and NYSE.

| Price

US$● per Common Share |

| |

|

Price

to

the Public |

|

|

Underwriting

Commission(1) |

|

|

Net

Proceeds

to the Company(2) |

|

| Per Common Share |

|

|

US$● |

|

|

|

US$● |

|

|

|

US$● |

|

| Total(3) |

|

|

US$● |

|

|

|

US$● |

|

|

|

US$● |

|

Notes:

| (1) | Pursuant to the Underwriting Agreement, the

Company has agreed to pay to the Underwriters a cash fee (the “Underwriting Fee”)

representing ●% of the aggregate gross proceeds of the Offering, (including any proceeds

realized from the sale of any Over-Allotment Shares (as defined herein)). The total “Price

to the Public”, the “Underwriting Fee” and the “Net Proceeds to the

Company” (before deducting expenses of the Offering) will be US$●, US$●

and US$●. See “Plan of Distribution”. |

| (2) | After deducting the Underwriting Fee, but

before deducting expenses related to the Offering estimated at US$1,000,000, which will be

paid from the proceeds of the Offering. See “Use of Proceeds”. |

| (3) | The Company has granted to the Underwriters

an option (the “Over-Allotment Option”), exercisable in whole or in part

in the sole discretion of the Underwriters at any time until the date which is 30 days following

the Closing Date (as defined herein), to purchase up to an additional ● Common Shares

(the “Over-Allotment Shares”) at a price of US$● per Over-Allotment

Share to cover over-allotments, if any, and for market stabilization purposes. In all circumstances,

the number of Over-Allotment Shares available to be sold is subject to the maximum amounts

allowable under the Company’s final base shelf prospectus dated August 18, 2023.

If the Over-Allotment Option is exercised in full, the total “Price to the Public”,

the “Underwriting Fee” and the “Net Proceeds to the Company” (before

deducting expenses of the Offering) will be US$●, US$● and US$●,

respectively. This Prospectus Supplement and the Prospectus also qualify the grant of the

Over-Allotment Option and the distribution of the Over-Allotment Shares upon exercise of

the Over-Allotment Option. Any purchaser who acquires Common Shares forming part of the over-allotment

position of the Underwriters pursuant to the Over-Allotment Option acquires such securities

under this Prospectus Supplement and the Prospectus, regardless of whether the over-allocation

position is ultimately filled through the exercise of the Over-Allotment Option or secondary

market purchases. See “Plan of Distribution”. |

The following table sets forth the number of

Over-Allotment Shares issuable under the Over-Allotment Option:

Underwriters’

Position | |

Maximum

Number of

Available Securities | |

Exercise

Period | |

Exercise

Price |

| Over-Allotment Option | |

● Over-Allotment Shares | |

Up to 30 days from the Closing Date | |

US$● per Over-Allotment Share |

The Underwriters, as principals, conditionally

offer the Common Shares, subject to prior sale, if, as and when issued by the Company and accepted by the Underwriters in accordance

with the conditions contained in the Underwriting Agreement referred to under “Plan of Distribution” and subject to

approval of certain Canadian legal matters on behalf of the Company by Blake, Cassels & Graydon LLP, certain United States legal

matters on behalf of the Company by Paul, Weiss, Rifkind, Wharton & Garrison LLP, certain Canadian legal matters on behalf of

the Underwriters by Cassels Brock & Blackwell LLP, and certain United States legal maters on behalf of the Underwriters by Skadden,

Arps, Slate, Meagher & Flom LLP.

Subscriptions for the Common Shares will be received

subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice.

The Underwriters may decrease the price of which the Common Shares are distributed from the Offering Price specified on the cover

page. See “Plan of Distribution”.

It is expected that the completion of the

sale of the Common Shares pursuant to the Offering (the “Closing”) will take place on or about November

14, 2023, or on such other date as may be agreed upon by the Company and the Lead Underwriter and, in any event, on or before

a date not later than 42 days after the date of this Prospectus Supplement (the “Closing Date”). Except as may be

otherwise agreed by the Company and the Lead Underwriter, the Offering will be conducted under the book-based system operated by CDS

Clearing and Depository Services Inc. (“CDS”). No certificates evidencing the Common Shares will be issued to

purchasers of the Common Shares. A purchaser who purchases Common Shares will receive only a customary confirmation from the

registered dealer from or through whom Common Shares are purchased and who is a CDS participant. CDS will record the CDS

participants who hold Common Shares on behalf of owners who have purchased Common Shares in accordance with the book-based system.

See “Plan of Distribution”.

In connection with the Offering and subject to

applicable laws, the Underwriters may over-allot or effect transactions that stabilize or maintain the market price of the Common Shares

in accordance with applicable market stabilization rules. Such transactions, if commenced, may be discontinued at any time. See “Plan

of Distribution”.

Ero

is a foreign private issuer under United States securities laws and is permitted under the multi-jurisdictional disclosure system adopted

by the securities regulatory authorities in Canada and the United States (“MJDS”) to prepare this Prospectus Supplement in

accordance with Canadian disclosure requirements. Prospective investors should be aware that such requirements are different from those

of the United States. Ero has prepared its financial statements, included or incorporated herein by reference, in accordance with International

Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”) which is incorporated within

Part 1 of the CPA Canada Handbook - Accounting, and Ero’s consolidated financial statements are subject to Canadian generally

accepted auditing standards and auditor independence standards, in addition to the standards of the Public Company Accounting Oversight

Board (United States) and the United States Securities and Exchange Commission (the “SEC”) independence standards. Thus,

they may not be comparable to the financial statements of United States companies.

Prospective

investors should be aware that the acquisition and disposition of the Common Shares described herein may have tax consequences both in

the United States and in Canada. Such consequences for investors who are resident in, or citizens of, the United States or who are resident

in Canada may not be described fully herein. Prospective investors should read the tax discussion in this Prospectus Supplement and consult

their own tax advisors with respect to their particular circumstances. See “Certain Canadian Federal Income Tax Considerations”

and “Certain United States Federal Income Tax Considerations”.

The

ability of investors to enforce civil liabilities under United States federal securities laws may be affected adversely because Ero is

incorporated in British Columbia, Canada, some of Ero’s officers and directors and some or all of the experts named in this Prospectus

Supplement and the Prospectus are Canadian residents and a substantial portion of Ero’s assets are located outside of the United

States. See “Enforceability of Civil Liabilities”.

NONE

OF THE CANADIAN SECURITIES REGULATORY AUTHORITIES, THE SEC NOR ANY UNITED STATES STATE SECURITIES COMMISSION OR OTHER REGULATORY BODY

HAS APPROVED OR DISAPPROVED OF THESE SECURITIES, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS SUPPLEMENT AND THE PROSPECTUS.

ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

Certain of the Company’s directors and

officers reside outside of Canada and have appointed an agent for service of process in Canada. Purchasers are advised that it may not

be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise

organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the person or company has appointed an agent

for service of process in Canada. See “Agent for Service of Process”.

A Canadian chartered bank affiliate of

the Lead Underwriter and ● and ● are lenders to the Company under the Company’s second amended and restated credit

agreement dated January 12, 2023, as amended on November 2, 2023 (the “Senior Credit Facility Agreement”).

Consequently, the Company may be considered to be a “connected issuer”, as defined in National Instrument 33-105 — Underwriting

Conflicts, of the Lead Underwriter and ● and ● under applicable securities laws in certain Canadian provinces and

territories. See “Plan of Distribution – Connected Issuer”.

The Company’s head office is located at

Suite 1050, 625 Howe Street, Vancouver, British Columbia, V6C 2T6, Canada and our registered office is located at Suite 3500,

1133 Melville Street, Vancouver, British Columbia, V6E 4E5, Canada.

An investment in the Common Shares is highly

speculative and involves significant risks that potential investors should consider before purchasing such Common Shares. Potential investors

should carefully review the “Risk Factors” section of this Prospectus Supplement, the Prospectus and the documents

incorporated by reference herein and therein as well as the information under the heading “Cautionary Note Regarding Forward-Looking

Statements”.

TABLE OF CONTENTS

Page

TABLE OF CONTENTS OF THE SHORT FORM BASE

SHELF PROSPECTUS

ABOUT

THIS PROSPECTUS

This document is in two parts.

The first part is this Prospectus Supplement, which describes the terms of the Offering and also adds to and updates information contained

in the Prospectus and the documents incorporated by reference therein. The second part, the Prospectus, gives more general information,

some of which may not apply to the Common Shares being offered under this Prospectus Supplement. This Prospectus Supplement is deemed

to be incorporated by reference into the Prospectus solely for the purpose of the Offering constituted by this Prospectus Supplement.

Other documents are also incorporated, or are deemed to be incorporated by reference, into the Prospectus and reference should be made

to the Prospectus for full particulars thereof.

Potential investors should

rely only on the information contained in or incorporated by reference in this Prospectus Supplement and the Prospectus. The Company

has not, and the Underwriters have not, authorized anyone to provide potential investors with different or additional information. Neither

the Company nor the Underwriters are making an offer of the Common Shares in any jurisdiction where such offer is not permitted. This

Prospectus Supplement does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to

buy, any securities offered by this Prospectus Supplement by any person in any jurisdiction in which it is unlawful for such person to

make such an offer or solicitation. A potential investor should assume that the information appearing in this Prospectus Supplement or

the Prospectus is accurate only as of the date on the front of those documents and that information contained in any document incorporated

by reference herein or therein is accurate only as of the date of that document unless specified otherwise. The Company’s business,

financial condition, results of operations and prospects may have changed since those dates.

Market data and certain industry

forecasts used in this Prospectus Supplement and the Prospectus and the documents incorporated by reference herein and therein were obtained

from market research, publicly available information and industry publications. The Company believes that these sources are generally

reliable, but the accuracy and completeness of this information is not guaranteed. The Company has not independently verified such information,

and it does not make any representation as to the accuracy of such information.

In this Prospectus Supplement

and the Prospectus, unless otherwise indicated, all dollar amounts and references to “US$” are to U.S. dollars, references

to “C$” are to Canadian dollars and references to “R$” are to Brazilian Reais. See “Exchange Rate Information”.

In this Prospectus Supplement

and the Prospectus, unless the context otherwise requires, references to “we”, “us”, “our” or similar

terms, as well as references to “Ero” or the “Company”, refer to Ero Copper Corp. together with our subsidiaries.

CAUTIONARY

NOTE TO UNITED STATES INVESTORS

Unless otherwise indicated,

all mineral reserve and mineral resource estimates included in this Prospectus Supplement and the documents incorporated by reference

herein have been prepared in accordance with Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects

(“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Standards

on mineral resources and mineral reserves, as amended (the “CIM Standards”). NI 43-101 is a rule developed by

the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical

information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC,

and mineral reserve and mineral resource information included herein may not be comparable to similar information disclosed by U.S. companies.

In particular, and without limiting the generality of the foregoing, this Prospectus Supplement and the documents incorporated by reference

herein use the terms “measured mineral resources,” “indicated mineral resources” and “inferred mineral

resources” as defined in accordance with NI 43-101 and the CIM Standards.

Further to recent amendments,

mineral property disclosure requirements in the United States (the “U.S. Rules”) are governed by subpart 1300 of Regulation

S-K of the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”) which differ from the CIM Standards.

As a foreign private issuer that is eligible to file reports with the SEC pursuant to the multi-jurisdictional disclosure system, the

Company is not required to provide disclosure on its mineral properties under the U.S. Rules and will continue to provide disclosure

under NI 43-101 and the CIM Standards. If the Company ceases to be a foreign private issuer or loses its eligibility to file its annual

report on Form 40-F pursuant to the multi-jurisdictional disclosure system, then the Company will be subject to the U.S. Rules,

which differ from the requirements of NI 43-101 and the CIM Standards.

Pursuant to the U.S. Rules,

the SEC recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred

mineral resources.” In addition, the definitions of “proven mineral reserves” and “probable mineral reserves”

under the U.S. Rules are now “substantially similar” to the corresponding standards under NI 43-101. Mineralization

described using these terms has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been

characterized as reserves. Accordingly, U.S. investors are cautioned not to assume that any measured mineral resources, indicated mineral

resources, or inferred mineral resources that the Company reports are or will be economically or legally mineable. Further, “inferred

mineral resources” have a greater amount of uncertainty as to their existence and as to whether they can be mined legally or economically.

Under Canadian securities laws, estimates of “inferred mineral resources” may not form the basis of feasibility or pre-feasibility

studies, except in rare cases. While the above terms under the U.S. Rules are “substantially similar” to the standards

under NI 43-101 and CIM Standards, there are differences in the definitions under the U.S. Rules and CIM Standards. Accordingly,

there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”,

“probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred

mineral resources” under NI 43-101 would be the same had the Company prepared the mineral reserve or mineral resource estimates

under the standards adopted under the U.S. Rules.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This Prospectus Supplement,

the Prospectus and the documents incorporated by reference herein and therein contain “forward-looking information”, “forward-looking

statements”, “future oriented financial information” and “financial outlook” within the meaning of applicable

Canadian and United States securities legislation (collectively herein referred to as “forward-looking information”),

including the “safe harbour” provisions of Canadian provincial securities legislation and the U.S. Private Securities Litigation

Reform Act of 1995, Section 21E of the U.S. Exchange Act of 1934, as amended (the “U.S. Exchange Act”), and Section 27A

of the U.S. Securities Act. The purpose of disclosing future oriented financial information and financial outlook is to provide a general

overview of management’s expectations regarding the anticipated results of operations including cash generated therefrom and costs

thereof and readers are cautioned that future oriented financial information and financial outlook may not be appropriate for other purposes.

Future oriented financial information and financial outlook has been prepared by the Company’s management. KPMG LLP, Chartered

Professional Accountants (“KPMG”), the Company’s independent registered public accounting firm, has not performed

any audit, review or compilation procedures with respect to the prospective information and accordingly does not provide any form of

assurance with respect thereto for the purpose of this offering.

Wherever possible, words

such as “plans”, “expects”, “guidance”, “projects”, “assumes”, “budget”,

“strategy”, “scheduled”, “estimates”, “forecasts”, “anticipates”, “believes”,

“intends”, “modeled”, “targets” and similar expressions or statements that certain actions, events

or results “may”, “could”, “would”, “might” or “will” be taken, occur or

be achieved, or the negative forms of any of these terms and similar expressions, have been used to identify forward-looking information.

Forward-looking information may include, but is not limited to, statements with respect to: the timing and closing of the Offering; the

listing of the Common Shares on the TSX and NYSE; the potential for the Underwriters to exercise the Over-Allotment Option or undertake

market stabilization transactions; the satisfaction of the conditions to closing of the Offering, including the receipt, in a timely

manner, of regulatory and other required approvals; the proposed use of proceeds of the Offering; mineral reserve and mineral resource

estimates; targeting additional mineral resources and expansion of deposits; the capital and operating cost estimates and the economic

analyses (including cash flow projections) from the Caraíba Operations Technical Report (as defined in the Prospectus), the Xavantina

Operations Technical Report (as defined in the Prospectus) and the Tucumã Project Technical Report (as defined in the Prospectus);

the Company’s expectations, strategies and plans for the Caraíba Operations (as defined below), the Xavantina Operations

(as defined below) and the Tucumã Project (as defined below), including the Company’s planned exploration, development and

production activities; the results of future exploration and drilling; estimated completion dates for certain milestones; successfully

adding or upgrading mineral resources and successfully developing new deposits; the costs and timing of future exploration, development

and construction including but not limited to the deepening extension project at the Caraíba Operations and the Tucumã

Project; the timing and amount of future production at the Caraíba Operations, the Tucumã Project and the Xavantina Operations;

the impacts of COVID-19 on the Company’s business and operations; the timing, receipt and maintenance of necessary approvals, licenses

and permits from applicable governments, regulators or third parties; expectations regarding consumption, demand and future price of

copper, gold and other metals; future financial or operating performance and condition of the Company and its business, operations and

properties, including expectations regarding liquidity, capital structure, competitive position and payment of dividends; the possibility

of entering judgments outside of Canada; expectations regarding future currency exchange rates; and our financing activities. Any statements

that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or

future events or performance are not statements of historical fact and may be forward-looking information.

Forward-looking information

is subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual results, actions, events,

conditions, performance or achievements to materially differ from those expressed or implied by the forward-looking information, including,

without limitation, risks related to:

| · | copper

and gold prices are volatile and may be lower than expected; |

| · | mining

operations are risky; |

| · | mining

operations require geologic, metallurgic, engineering, title, environmental, economic and

financial assessments that may be materially incorrect and thus the Company may not produce

as expected; |

| · | geotechnical,

hydrological and climatic events could suspend mining operations or increase costs; |

| · | actual

production, capital and operating costs may be different than those anticipated; |

| · | the

Company’s financial performance and results of operations are dependent on the Caraíba

Operations; |

| · | infectious

diseases, such as COVID-19, may affect the Company’s business and operations; |

| · | changes

in climate conditions may affect the Company’s operations; |

| · | currency

fluctuations can result in unanticipated losses; |

| · | the

successful operation of the Caraíba Operations and the Xavantina Operations and the

successful development, construction and operation of the Tucumã Project depend on

the skills of the Company’s management and teams; |

| · | operations

during mining cycle peaks are more expensive; |

| · | title

to the Caraíba Operations, the Xavantina Operations and/or the Tucumã Project

may be disputed; |

| · | the

Company may fail to comply with the law or may fail to obtain or renew necessary permits

and licenses; |

| · | the

failure of a tailings dam could negatively impact the Company’s business, reputation

and results of operations; |

| · | compliance

with environmental regulations can be costly; |

| · | social

and environmental activism can negatively impact exploration, development and mining activities; |

| · | the

construction and start-up of new mines and projects at existing mines is subject to a number

of factors and the Company may not be able to successfully complete new construction projects; |

| · | land

reclamation and mine closure requirements may be burdensome and costly; |

| · | the

mining industry is intensely competitive; |

| · | inadequate

infrastructure may constrain mining operations; |

| · | operating

cash flow may be insufficient for future needs; |

| · | fluctuations

in the market prices and availability of commodities and equipment affect the Company’s

business; |

| · | the

Company is subject to restrictive covenants that limit its ability to operate its business; |

| · | the

Company’s indebtedness could adversely affect its financial condition and prevent the

Company from fulfilling its obligations under debt instruments; |

| · | the

Company may not be able to generate sufficient cash to service all of its indebtedness and

may be forced to take other actions to satisfy its obligations under such indebtedness, which

may not be successful; |

| · | counterparties

may default on their contractual obligations to the Company; |

| · | a

failure to maintain satisfactory labour relations can adversely impact the Company; |

| · | the

Company’s insurance coverage may be inadequate to cover potential losses; |

| · | it

may be difficult to enforce judgments and effect service of process on directors, officers

and experts named herein; |

| · | the

directors and officers may have conflicts of interest with the Company; |

| · | future

acquisitions may require significant expenditures and may result in inadequate returns; |

| · | disclosure

and internal control deficiencies may adversely affect the Company; |

| · | failures

of information systems or information security threats can be costly; |

| · | the

Company may be subject to costly legal proceedings; |

| · | the

Company may be subject to shareholder activism; |

| · | product

alternatives may reduce demand for the Company’s products; |

| · | a

lowering or withdrawal of the ratings assigned to the Company’s debt securities by

rating agencies may increase the Company’s future borrowing costs and reduce its access

to capital; |

| · | the

Company’s Brazilian operations are subject to political and other risks associated

with operating in a foreign jurisdiction; |

| · | the

Company may be negatively impacted by changes to mining laws and regulations; |

| · | a

failure to maintain relationships with the communities in which the Company operates and

other stakeholders may adversely affect the Company’s business; |

| · | inaccuracies,

corruption and fraud in Brazil relating to ownership of real property may adversely affect

the Company’s business; |

| · | the

Company is exposed to the possibility that applicable taxing authorities could take actions

that result in increased tax or other costs that might reduce the Company’s cash flow; |

| · | inflation

in Brazil, along with Brazilian governmental measures to combat inflation, may have a significant

negative effect on the Brazilian economy and also on the Company’s financial condition

and results of operations; |

| · | exchange

rate instability may have a material adverse effect on the Brazilian economy; |

| · | the

Company’s operations may be impaired as a result of restrictions to the acquisition

or use of rural properties by foreign investors or Brazilian companies under foreign control; |

| · | recent

disruptions in international and domestic capital markets may lead to reduced liquidity and

credit availability for the Company; |

| · | the

Company may be responsible for corruption and anti-bribery law violations; |

| · | investors

may lose their entire investment; |

| · | dilution

from equity financing could negatively impact holders of the Common Shares; |

| · | equity

securities are subject to trading and volatility risks; |

| · | sales

by existing shareholders can reduce share prices; |

| · | the

Company does not currently intend to pay dividends; |

| · | public

companies are subject to securities class action litigation risk; |

| · | if

securities or industry analysts do not publish research or publish inaccurate or unfavourable

research about the Company’s business, the price and trading volume of the Common Shares

could decline; |

| · | global

economic conditions can reduce the price of the Common Shares; |

| · | the

Company’s broad discretion relating to the use of any proceeds raised hereunder; |

| · | the

uncertainty of maintaining a liquid trading market for the Common Shares; |

| · | though

not expected, the Company may be classified as a passive foreign investment company within

the meaning of section 1297 of the U.S. Internal Revenue Code of 1986, as amended; and |

| · | other

risks relating to the completion of the Offering. |

This list is not exhaustive

of the factors that may affect any of our forward-looking information. Although we have attempted to identify important factors that

could cause actual results, actions, events, conditions, performance or achievements to differ materially from those contained in forward-looking

information, there may be other factors that cause results, actions, events, conditions, performance or achievements to differ from those

anticipated, estimated or intended.

Forward-looking information

is not a guarantee of future performance. There can be no assurance that forward-looking information will prove to be accurate, as actual

results and future events could differ materially from those anticipated in such information. Forward-looking information involves statements

about the future and is inherently uncertain, and our actual results, achievements or other future events or conditions may differ materially

from those reflected in the forward-looking information due to a variety of risks, uncertainties and other factors, including, without

limitation, those referred to in this Prospectus Supplement and the Prospectus under the heading “Risk Factors” and

elsewhere in this Prospectus Supplement, the Prospectus and the documents incorporated, or deemed to be incorporated, by reference.

Our forward-looking information

is based on the assumptions, beliefs, expectations and opinions of management on the date the statements are made, many of which may

be difficult to predict and beyond our control. In connection with the forward-looking information contained in this Prospectus Supplement,

the Prospectus and the documents incorporated, or deemed to be incorporated, by reference, we have made certain assumptions about, among

other things: favourable equity and debt capital markets; the ability to raise any necessary additional capital on reasonable terms to

advance the production, development, construction and exploration of the Company’s properties and assets; future prices of copper,

gold and other metals; the timing and results of exploration and drilling programs; the accuracy of any mineral reserve and mineral resource

estimates; the geology of the Caraíba Operations, the Xavantina Operations and the Tucumã Project being as described in

the Caraíba Operations Technical Report, the Xavantina Operations Technical Report and the Tucumã Project Technical Report,

respectively; production costs; the accuracy of budgeted exploration, development and construction costs and expenditures; the price

of other commodities such as fuel; future currency exchange rates and interest rates; operating conditions being favourable such that

the Company is able to operate in a safe, efficient and effective manner; work force continuing to remain healthy in the face of prevailing

epidemics, pandemics or other health risks (including COVID-19), political and regulatory stability; the receipt of governmental, regulatory

and third party approvals, licenses and permits on favourable terms; obtaining required renewals for existing approvals, licenses and

permits on favourable terms; requirements under applicable laws; sustained labour stability; stability in financial and capital goods

markets; availability of equipment; positive relations with local groups and the Company’s ability to meet its obligations under

its agreements with such groups; and satisfying the terms and conditions of the Company’s current loan arrangements. Although we

believe that the assumptions inherent in forward-looking information are reasonable as of the date of this Prospectus Supplement, these

assumptions are subject to significant business, social, economic, political, regulatory, competitive and other risks and uncertainties,

contingencies and other factors that could cause actual actions, events, conditions, results, performance or achievements to be materially

different from those projected in the forward-looking information. The Company cautions that the foregoing list of assumptions is not

exhaustive. Other events or circumstances could cause actual results to differ materially from those estimated or projected and expressed

in, or implied by, the forward-looking information contained in this Prospectus Supplement, the Prospectus and the documents incorporated,

or deemed to be incorporated, by reference.

We do not assume any obligation

to update forward-looking information, whether as a result of new information, future events or otherwise, other than as required by

applicable law. For the reasons set forth above, prospective investors should not place undue reliance on forward-looking information.

DOCUMENTS

INCORPORATED BY REFERENCE

This Prospectus Supplement

is deemed to be incorporated by reference in the Prospectus solely for the purpose of the Offering. Other documents are also incorporated

or deemed to be incorporated by reference in the Prospectus and reference should be made to the Prospectus for full particulars thereof.

Information has been incorporated

by reference in this Prospectus Supplement and the Prospectus from documents filed with the securities commissions or similar authorities

in Canada and with the SEC in the United States. Copies of the documents incorporated herein by reference may be obtained on request

without charge from the Corporate Secretary of the Company at the address set forth on the cover page of this Prospectus Supplement

and are also available electronically at https://www.sedarplus.ca/landingpage/ (“SEDAR”). Documents filed with,

or furnished to, the SEC are available through the SEC’s Electronic Data Gathering and Retrieval System (“EDGAR”)

at www.sec.gov.

The following documents of

the Company filed with the securities commissions or similar authorities in each of the provinces and territories of Canada, and filed

with, or furnished to, the SEC are specifically incorporated by reference into, and form an integral part of, this Prospectus Supplement:

| · | our

annual information form for the fiscal year ended December 31, 2022, dated as of March 7,

2023 (the “AIF”); |

| | | |

| · | our

audited annual consolidated financial statements for the fiscal years ended December 31,

2022 and 2021, together with the notes thereto and the reports of the independent registered

public accounting firm thereon (the “Annual Financial Statements”); |

| | | |

| · | our

management’s discussion and analysis for the years ended December 31, 2022 and

2021; |

| | | |

| · | our

unaudited condensed consolidated interim financial statements for the three and nine months

ended September 30, 2023 and 2022 (the “Interim Financial Statements”); |

| | | |

| · | our

management’s discussion and analysis for the three and nine months ended September 30,

2023; and |

| | | |

| · | our

management information circular dated March 7, 2023, distributed in connection with

our annual general and special meeting of shareholders held on April 26, 2023. |

Any document of the type

required by National Instrument 44-101 – Short Form Prospectus Distributions to be incorporated by reference into this

Prospectus Supplement, including any annual information forms, material change reports (except confidential material change reports),

business acquisition reports, interim financial statements, annual financial statements and the independent auditor’s report thereon,

management’s discussion and analysis and information circulars of Ero and any template version of “marketing materials”

(as defined in National Instrument 41-101 — General Prospectus Requirements) filed with securities commissions or similar

authorities in Canada after the date of this Prospectus Supplement and prior to the completion or withdrawal of the distribution of securities

shall be deemed to be incorporated by reference into this Prospectus Supplement.

In addition, to the extent

that any document or information incorporated by reference into this Prospectus Supplement is filed with, or furnished to, the SEC pursuant

to the U.S. Exchange Act after the date of this Prospectus Supplement, such document or information will be deemed to be incorporated

by reference as an exhibit to the Registration Statement of which this Prospectus Supplement forms a part. In

addition, if and to the extent indicated therein, the Company may incorporate by reference in this Prospectus documents that it files

with or furnishes to the SEC pursuant to Section 13(a), 13(c) or 15(d) of the U.S. Exchange Act.

Any statement in this

Prospectus Supplement, the Prospectus or a document incorporated or deemed to be incorporated by reference herein or therein is deemed

to be modified or superseded, for purposes of this Prospectus Supplement, to the extent that a statement contained herein or in the Prospectus

or in any other subsequently filed document which also is or is deemed to be incorporated by reference herein or in the Prospectus, modifies

or supersedes such statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement

or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseded statement

shall not be deemed an admission for any purposes that the modified or superseded statement, when made, constituted a misrepresentation,

an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to

make a statement not misleading in light of the circumstances in which it was made. Any statement so modified or superseded will not

be deemed in its unmodified or superseded form, to constitute a part of this Prospectus Supplement, except as so modified or superseded.

References to the Company’s

website or any other website in this Prospectus Supplement, the Prospectus or any documents that are incorporated by reference herein

and therein do not incorporate by reference the information on such website into the Prospectus Supplement and the Prospectus, and we

disclaim any such incorporation by reference.

MARKETING MATERIALS

In connection with the Offering,

the Underwriters may use “marketing materials” (as such term is defined in NI 44-101 Short Form Prospectus Distributions).

The marketing materials do not form part of this Prospectus Supplement and the Prospectus to the extent that the contents of the marketing

materials have been modified or superseded by a statement contained in this Prospectus Supplement. Any template version of any “marketing

materials” filed after the date of this Prospectus Supplement and before the termination of the distribution of the securities

offered pursuant to this Prospectus Supplement (together with the Prospectus) is deemed to be incorporated by reference in this Prospectus

Supplement.

FINANCIAL INFORMATION

The financial statements

of the Company included or incorporated by reference in this Prospectus Supplement and the Prospectus are reported

in United States dollars. Ero’s financial statements included or incorporated by reference in this Prospectus Supplement and the Prospectus are

prepared in accordance with IFRS, which differs from accounting principles generally accepted in the United States (“U.S. GAAP”).

The SEC has adopted rules to allow foreign private issuers, such as Ero, to prepare and file financial statements prepared in accordance

with IFRS without reconciliation to U.S. GAAP. Accordingly, Ero will not be providing a description of the principal differences between

U.S. GAAP and IFRS. Unless otherwise indicated, all financial information contained and incorporated or deemed incorporated by reference

in this Prospectus Supplement and the Prospectus is presented in accordance with IFRS. As a result, Ero’s

financial statements and other financial information included or incorporated by reference in this Prospectus Supplement and the Prospectus may

not be comparable to financial statements and financial information of United States companies.

EXCHANGE

RATE INFORMATION

The following table sets

forth for each period indicated: (i) the exchange rates in effect at the end of the period; (ii) the high and low exchange

rates during such period; and (iii) the average exchange rates for such period, for one Canadian dollar, expressed in U.S. dollars,

as quoted by the Bank of Canada.

| | |

Three

Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2021 | |

| | |

US$ | | |

US$ | | |

US$ | |

| Closing | |

| 0.7396 | | |

| 0.7296 | | |

| 0.7849 | |

| High | |

| 0.7617 | | |

| 0.7841 | | |

| 0.8102 | |

| Low | |

| 0.7313 | | |

| 0.7285 | | |

| 0.7778 | |

| Average | |

| 0.7457 | | |

| 0.7662 | | |

| 0.7937 | |

| | |

Year Ended

December 31, | |

| | |

2022 | | |

2021 | | |

2020 | |

| | |

US$ | | |

US$ | | |

US$ | |

| Closing | |

| 0.7383 | | |

| 0.7888 | | |

| 0.7854 | |

| High | |

| 0.8031 | | |

| 0.8306 | | |

| 0.7863 | |

| Low | |

| 0.7217 | | |

| 0.7727 | | |

| 0.6898 | |

| Average | |

| 0.7692 | | |

| 0.7980 | | |

| 0.7461 | |

On November 3, 2023, the daily

average exchange rate as quoted by the Bank of Canada was C$1.00 = US$0.7308 (US$1.00 = C$1.3683).

The following table sets

forth for each period indicated: (i) the exchange rates in effect at the end of the period; (ii) the high and low exchange

rates during such period; and (iii) the average exchange rates for such period, for one Canadian dollar, expressed in Brazilian

Real, as quoted by the Bank of Canada.

| | |

Three

Months Ended September 30, | |

| | |

2023 | | |

2022 | | |

2021 | |

| | |

R$ | | |

R$ | | |

R$ | |

| Closing | |

| 3.7078 | | |

| 3.9386 | | |

| 4.2571 | |

| High | |

| 3.7397 | | |

| 4.2553 | | |

| 4.2790 | |

| Low | |

| 3.5727 | | |

| 3.8226 | | |

| 4.0502 | |

| Average | |

| 3.6398 | | |

| 4.0187 | | |

| 4.1525 | |

| | |

Year Ended

December 31, | |

| | |

2022 | | |

2021 | | |

2020 | |

| | |

R$ | | |

R$ | | |

R$ | |

| Closing | |

| 3.9032 | | |

| 4.3956 | | |

| 4.0800 | |

| High | |

| 4.4763 | | |

| 4.6062 | | |

| 4.3535 | |

| Low | |

| 3.6900 | | |

| 3.9904 | | |

| 3.0998 | |

| Average | |

| 3.9701 | | |

| 4.3058 | | |

| 3.8433 | |

On November 3, 2023, the daily average

exchange rate as quoted by the Bank of Canada was C$1.00 = R$3.5765 (R$1.00 = C$ 0.2796).

DOCUMENTS

FILED AS PART OF THE REGISTRATION STATEMENT

The following documents have

been, or will be, filed with the SEC as part of a registration statement on Form F-10 (File No. 333-274097) (the “Registration

Statement”) of which this Prospectus Supplement forms a part: (1) the Underwriting Agreement; (2) the documents listed

under “Documents Incorporated by Reference”; (3) the consent of KPMG LLP with respect to their independent registered

public accounting firm's report on the Annual Financial Statements; (4) powers of attorney from certain of the Company's directors

and officers (included on the signature page to the Registration Statement); and (5) the consents of the "qualified persons"

referred to in the Prospectus under "Interest of Experts".

THE

COMPANY

Name, Address and Incorporation

The Company was incorporated

under the Business Corporations Act (British Columbia) (“BCBCA”) on May 16, 2016. Ero’s head office is

located at Suite 1050, 625 Howe Street, Vancouver, British Columbia, Canada, V6C 2T6 and its registered office is located at Suite 3500,

1133 Melville Street, Vancouver, British Columbia, V6E 4E5, Canada.

Intercorporate Relationships

The Company indirectly holds

approximately 99.6% of the voting shares of Mineração Caraíba S.A. (“MCSA”) through its wholly-owned

subsidiary, Ero Brasil Participações Ltda., and indirectly holds approximately 97.6% of the voting shares of NX Gold S.A.

(“NX” or “NX Gold”) through its wholly-owned subsidiary, Ero Gold Corp. (“Ero Gold”),

incorporated under the BCBCA. MCSA holds a 100% interest in each of the Company’s mining operations located within the Curaçá

Valley, northeastern Bahia State, Brazil (the “Caraíba Operations” and formerly known as the MCSA Mining Complex)

and the Tucumã Project, which is located within southeastern Pará State, Brazil (referred to herein as the “Tucumã

Project” and formerly known as the “Boa Esperança Project”). NX Gold holds a 100% interest in the Company’s

mining operations located approximately 18 kilometers west of the town of Nova Xavantina, southeastern Mato Grosso State, Brazil (the

“Xavantina Operations” formerly known as the “NX Gold Mine”). MCSA and NX Gold were formed under the laws

of Brazil. The remaining voting shares of MCSA are held by a minority group of shareholders, including former employees of MCSA. The

remaining voting shares of NX Gold are held by a minority group of shareholders, including former employees of NX Gold. The following

chart illustrates the Company’s principal subsidiaries, together with the governing law of each subsidiary and the percentage of

voting securities beneficially owned or over which control or direction is exercised by the Company, as well as the Company’s operating

mines and development projects.

RISK

FACTORS

Investing in our securities is speculative

and involves a high degree of risk due to the nature of our business and the present stage of its development. The following risk factors,

as well as risks currently unknown to us, could materially and adversely affect our current or future business, properties, operations,

results, cashflows, financial condition and prospects and could cause them to differ materially from the statements made in forward-looking

statements relating to the Company, or its business, properties or financial results, each of which could cause purchasers of our securities

to lose part or all of their investment. The risks discussed below also include forward-looking statements, and our actual results may

differ substantially from those discussed in these forward-looking statements. The risks set out below are not the only risks we face;

risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect

our business, financial condition, results of operations and prospects. Potential investors should also refer to the other information

set forth or incorporated by reference (including subsequently filed documents incorporated by reference) in this Prospectus Supplement,

the Prospectus or any applicable prospectus supplement, including our AIF, Annual Financial Statements, and related notes.

Risks Related to our Securities

Investors may lose their entire investment

An investment in our securities is speculative

and may result in the loss of an investor’s entire investment. Only potential investors who are experienced in high risk investments

and who can afford to lose their entire investment should consider an investment in the Company.

Dilution from equity financing could negatively

impact holders of Common Shares

The Company may from time to time raise funds

through the issuance of Common Shares or the issuance of debt instruments or other securities convertible into Common Shares. The Company

cannot predict the size or price of future issuances of Common Shares or the size or terms of future issuances of debt instruments or

other securities convertible into Common Shares, or the effect, if any, that future issuances and sales of the Company’s securities

will have on the market price of the Common Shares. Sales or issuances of substantial numbers of Common Shares, or the perception that

such sales or issuances could occur, may adversely affect prevailing market prices of the Common Shares. With any additional sale or issuance

of Common Shares, or securities convertible into Common Shares, investors will suffer dilution to their voting power and the Company may

experience dilution in its earnings per share.

Additional issuances of our securities may involve

the issuance of a significant number of our Common Shares at prices less than the current market price for the Common Shares. Any transaction

involving the issuance of previously authorized but unissued Common Shares, or securities convertible into Common Shares, would result

in dilution, possibly substantial, to security holders. Sales of substantial amounts of our securities by us or our existing shareholders,

or the availability of such securities for sale, could adversely affect the prevailing market prices for our securities and, in the case

of sales of our securities from treasury, dilute investors’ earnings per share. Sales of our Common Shares by shareholders might

also make it more difficult for us to sell equity securities at a time and price that we deem appropriate. Exercises of presently outstanding

share options (“Options”) or settlement of presently outstanding restricted share units (“RSUs”)

or performance share units (“PSUs”) in Common Shares may also result in dilution to security holders. A decline in

the market prices of our securities could impair our ability to raise additional capital through the sale of securities should we desire

to do so.

Equity securities are subject to trading

and volatility risks

The securities of publicly traded companies can

experience a high level of price and volume volatility and the value of the Company’s securities can be expected to fluctuate depending

on various factors, not all of which are directly related to the success of the Company and its operating performance, underlying asset

values or prospects. These include the risks described elsewhere in this Prospectus Supplement, the Prospectus and the AIF. Factors which

may influence the price of the Company’s securities, including the Common Shares, include, but are not limited to:

| · | worldwide economic conditions; |

| · | global political conditions or events such as the ongoing conflict in the Middle East and Russia-Ukraine

conflict; |

| · | changes in government policies; |

| · | investor perceptions; |

| · | movements in global interest rates and global stock markets; |

| · | variations in operating costs; |

| · | the cost of capital that the Company may require in the future; |

| · | metals prices; |

| · | currency exchange fluctuation; |

| · | the price of commodities necessary for the Company’s operations; |

| · | recommendations by securities research analysts; |

| · | issuances of equity securities or debt securities by the Company; |

| · | operating performance and, if applicable, the share price performance of the Company’s competitors; |

| · | the addition or departure of key management and other personnel; |

| · | significant acquisitions or business combinations, strategic partnerships, joint ventures or capital commitments

by or involving the Company or its competitors; |

| · | news reports relating to trends, concerns, technological or competitive developments, regulatory changes,

global health crises, such as COVID-19, and other related industry and market issues affecting the mining sector; |

| · | litigation; |

| · | publicity about the Company, the Company’s personnel or others operating in the industry; |

| · | loss of a major funding source; and |

| · | all market conditions that are specific to the mining industry. |

There can be no assurance that such factors will

not affect the price of the Company’s securities, and consequently purchasers of Common Shares may not be able to sell Common Shares

at prices equal to or greater than the price or value at which they purchased the Common Shares or acquired them by way of the secondary

market.

Sales by existing shareholders can reduce

share prices

Sales of a substantial number of Common Shares

in the public market could occur at any time. These sales, or the market perception that the holders of a large number of Common Shares

intend to sell Common Shares, could reduce the market price of the Common Shares. If this occurs and continues, it could impair the Company’s

ability to raise additional capital through the sale of securities.

The Company does not currently intend to

pay dividends

The Company has not, since the date of its incorporation,

declared or paid any dividends or other distributions on its Common Shares. The Senior Credit Facility Agreement and the Note Indenture

(as defined in the Prospectus) impose certain restrictions on the Company’s ability to declare or pay dividends or distributions.

The declaration and payment of any dividends in

the future is at the discretion of the Board and will depend on numerous factors, including compliance with applicable laws, financial

performance, contractual restriction (as noted above), working capital requirements of the Company and its subsidiaries and such other

factors as its directors consider appropriate.

Public companies are subject to securities

class action litigation risk

In the past, securities class action litigation

has often been brought against a company following a decline in the market price of its securities. If the Company faces such litigation,

it could result in substantial costs and a diversion of management’s attention and resources, which could materially harm its business.

If securities or industry analysts do not

publish research or publish inaccurate or unfavourable research about the Company’s business, the price and trading volume of the

Common Shares could decline

The trading market for the Common Shares will

depend on the research and reports that securities or industry analysts publish about the Company and its business. The Company does not

have any control over these analysts. The Company cannot assure that analysts will cover it or provide accurate or favourable coverage.

If one or more of the analysts who cover the Company downgrade its stock or change their opinion of the Common Shares, price of Common

Shares would likely decline. If one or more of these analysts cease coverage of the Company or fail to regularly publish reports, the

Company could lose visibility in the financial markets, which could cause the price and trading volume of the Common Shares to decline.

Global economic conditions can reduce the

price of the Common Shares

Global economic conditions may adversely affect

the Company’s growth, profitability and ability to obtain financing. Events in global financial markets continue to be characterized

as volatile. In recent years, global markets have been adversely impacted by various credit crises and significant fluctuations in fuel

and energy costs and metals prices, including because of COVID-19 and due to significant fluctuations in commodity prices because of the

continuance or escalation of the conflict in the Middle East and/or Russia-Ukraine conflict and the economic sanctions imposed thereon

in connection therewith. Many industries, including

the mining industry, have been impacted by these market conditions. Global economic conditions remain subject to sudden and rapid destabilizations

in response to future events, as government authorities may have limited resources to respond to future crises. A continued or worsened

slowdown in the financial markets or other economic conditions, including but not limited to consumer spending, employment rates, business

conditions, inflation, fuel and energy costs, consumer debt levels, lack of available credit, the state of the financial markets, interest

rates and tax rates, may adversely affect the Company’s growth, profitability and ability to obtain financing. A number of issues

related to economic conditions could have a material adverse effect on the Company’s business, financial condition, results of operations,

cash flows or prospects, including, but not limited to: (i) contraction in credit markets could impact the cost and availability

of financing and the Company’s overall liquidity; (ii) the volatility of copper, gold and other metal prices would impact the

Company’s revenues, profits, losses and cash flow; (iii) recessionary pressures could adversely impact demand for the Company’s

production; (iv) volatile energy, commodity and consumables prices and currency exchange rates could impact the Company’s production

costs; and, (v) the devaluation and volatility of global stock markets could impact the valuation of the Company’s equity and

other securities.

The Company will have broad discretion in

the use of the net proceeds of the Offering

While detailed information regarding the use of

proceeds from the sale of our securities are described in this Prospectus Supplement, we will have broad discretion over the use of the

net proceeds from the Offering and future offerings of securities. Because of the number and variability of factors that will determine

our use of such proceeds, our ultimate use might vary substantially from our planned use. Purchasers may not agree with how we allocate

or spend the proceeds from the Offering of our securities. We may pursue acquisitions, collaborations or other opportunities that do not

result in an increase in the market value of our securities, including the market value of our Common Shares, and may increase our losses.

There is no assurance of a sufficient liquid

trading market for the Common Shares in the future

Shareholders of the Company may be unable to sell

significant quantities of Common Shares into the public trading markets without a significant reduction in the price of their Common Shares,

or at all. There can be no assurance that there will be sufficient liquidity of the Common Shares on the trading market, and that the

Company will continue to meet the listing requirements of the TSX or the NYSE or achieve listing on any other public listing exchange.

Although not expected, the Company may be

classified as a passive foreign investment company (“PFIC”) within the meaning of section 1297 of the U.S. Internal Revenue

Code of 1986, as amended (the “Code”).

Prospective U.S. investors should be aware that

although the Company does not expect to be classified as a PFIC for the current taxable year or any future taxable year, in the event

that the Company is classified as a PFIC for the current taxable year or a future taxable year, such investors could be subject to certain

adverse U.S. federal income tax consequences. The determination of the Company’s PFIC status for any year is very fact specific,

being based on the types of income the Company earns and the types and value of the Company’s assets from time to time, all of which

are subject to change, as well as, in part, the application of complex U.S. federal income tax rules, which are subject to differing

interpretations. The Company believes that it likely was not classified as a PFIC for the preceding taxable year and likely will not be

classified as a PFIC for the current taxable year or any future taxable year. Prospective investors should consult their own tax advisors

regarding the likelihood and consequences of the Company being treated as a PFIC for U.S. federal income tax purposes, including the advisability

of making certain elections that may mitigate certain possible adverse U.S. federal income tax consequences that may result in an inclusion

in gross income without receipt of such income.

CONSOLIDATED

CAPITALIZATION

Other than as set out under

the heading “Prior Sales”, there have been no material changes in the share and loan capital of the Company since September 30,

2023 to the date of this Prospectus Supplement. The following table outlines the consolidated capitalization of the Company as at September 30,

2023 and as at September 30, 2023 after giving effect to the Offering:

| | |

As at September 30, 2023 (expressed in thousands of

US dollars except equity

security amounts) | | |

As at September 30, 2023,

after giving effect to the

Offering(5) (expressed in thousands of US

dollars except equity security

amounts) | |

As at September 30, 2023,

after giving effect to the

Offering, and including

the full exercise of the

Over-Allotment Option(5) (expressed in thousands of

US dollars except equity

security amounts) |

| Cash and cash equivalents(1) | |

US$87,600 | | |

US$● | |

US$● |

| Share Capital | |

| | |

| |

|

| Common Shares | |

93,437,575

US$163,131 | | |

●

US$● | |

●

US$● |

| Equity Reserves(2)(3)(4) | |

US($42,351) | | |

US($42,351) | |

US($42,351) |

| Retained Earnings | |

512,981 | | |

512,981 | |

512,981 |

| Total Shareholder’s Equity | |

US$633,761 | | |

US$● | |

US$● |

| Loan Capital | |

| | |

| |

|

| Loans and borrowings | |

US$419,420 | | |

US$419,420 | |

US$419,420 |

| Total Capitalization | |

US$1,140,781 | | |

US$● | |

US$● |

| (1) | Includes US$42.8 million in short-term investments. |

| (2) | Excludes 773,726 Performance Share Units and 233,544 Deferred Share Units which are treated as liability awards to be settled in cash

for accounting purposes. |

| (3) | Includes 1,440,274 Options and 257,810 Restricted Share Units which are treated as equity awards for accounting purposes. |

| (4) | Each Option is exercisable by the holder thereof into one Common Share. Each Restricted Share Unit, Performance Share Unit and Deferred

Share Unit entitles the holder thereof to receive one Common Share, its equivalent cash value, or a combination thereof as determined

by the Compensation Committee in its sole discretion. |

| (5) | Excluding the related costs of the Offering. |

| (6) | This table should be read in conjunction with the Interim Financial Statements, including the notes thereto. |

USE

OF PROCEEDS

The estimated net proceeds

received by the Company from the Offering (assuming no exercise of the Over Allotment Option) will be approximately US$● (determined

after deducting the Underwriting Fee of US$● and estimated expenses of the Offering of US$1,000,000). If the Over Allotment Option

is exercised in full, the estimated net proceeds received by the Company from the Offering will be US$● (determined after deducting

the Underwriting Fee of US$● and estimated expenses of the Offering of US$1,000,000).

The Company intends to use

the net proceeds of the Offering for the following principal purposes:

| Use of Proceeds | |

Approximate

Amount | |

| Growth initiatives at the Tucumã Project | |

| US$● | |

| Growth initiatives at the Caraíba Operations | |

| US$● | |

| Regional exploration expenditures | |

| US$● | |

| Working Capital and Other General Corporate Purposes | |

| US$● | |

| Total | |

| US$● | |

The key business objective

the Company intends to meet with the net proceeds of the Offering, together with existing cash and equivalents, are:

| · | advancement of construction of the Tucumã Project; |

| | | |

| · | advancement of growth initiatives at the Caraiba Operations, including construction of the new external

shaft; and |

| | | |

| · | advancement of regional exploration in Brazil. |

It is anticipated that the applicable net proceeds

of the Offering will be spent for the principal purposes set out above approximately over the next 18 months.

If the Underwriters’

Over-Allotment Option is exercised in whole or in part, the Company will use the additional net proceeds from such exercise for working

capital and other general corporate purposes.

While the Company intends

to use the net proceeds of the Offering as described, the Company’s actual use may vary depending on its operating and capital needs

from time to time, and as such, there may be circumstances where, for sound business reasons, a reallocation of the use of proceeds is

necessary. See “Risk Factors”.

PLAN

OF DISTRIBUTION

Pursuant to the Underwriting

Agreement, the Company has agreed to issue and sell and the Underwriters have severally (and not jointly nor jointly and severally) agreed

to purchase, as principals, subject to compliance with all necessary legal requirements and the terms and conditions contained in the

Underwriting Agreement, a total of ● Common Shares at the Offering Price of US$● per Common Share, payable in cash to

the Company against delivery of such Common Shares on the Closing Date. The obligations of the Underwriters under the Underwriting Agreement

are conditional and may be terminated at their discretion on the basis of “material change out”, “disaster out”,

“regulatory out”, and “breach out” termination provisions in the Underwriting Agreement and may also be terminated

upon the occurrence of certain other stated events. The Underwriters are, however, obligated to take up and pay for all of the Common

Shares offered by this Prospectus Supplement (not including the Over-Allotment Shares issuable upon exercise of the Over-Allotment Option)

if any Common Shares are purchased under the Underwriting Agreement, subject to certain exceptions.

Pursuant to the Underwriting

Agreement, Ero has granted to the Underwriters the Over-Allotment Option, exercisable in whole or in part at any time up to 30 days after

the Closing Date, to purchase up to an additional ● Common Shares at the Offering Price to cover over-allocations, if any, and

for market stabilization purposes, on the same terms and conditions as apply to the purchase of Common Shares thereunder (provided that

such issuance does not exceed the aggregate maximum number of shares issuable under the Prospectus). This Prospectus Supplement qualifies

for distribution the Common Shares as well as the grant of the Over-Allotment Option and the issuance of the Over-Allotment Shares pursuant

to the exercise of the Over-Allotment Option. A purchaser who acquires Over-Allotment Shares forming part of the Underwriters’ over-allocation

position acquires those Over-Allotment Shares under this Prospectus Supplement, regardless of whether the over-allocation position is

ultimately filled through the exercise of the Over-Allotment Option or secondary market purchases.

In consideration for their

services in connection with the Offering, the Underwriters will be paid the Underwriting Fee equal to ●% of the gross proceeds

of the Offering (including in connection with any gross proceeds from the sale of the Over-Allotment Shares). The Offering Price was determined

by arm’s length negotiation between the Company and the Lead Underwriter, on behalf of the Underwriters, with reference to the prevailing

market price of the Common Shares. See “Risk Factors”.

The Common Shares will be

offered in each of the provinces and territories of Canada, except Quebec, in the United States and, subject to applicable law,

in certain jurisdictions outside of Canada and the United States through the Underwriters either directly or through their respective

Canadian or U.S broker-dealer affiliates or agents in accordance with the Underwriting Agreement.

The Company intends to apply to list the Common Shares distributed hereunder on the TSX and NYSE. Listing will be subject to Ero fulfilling

all listing requirements of the TSX and NYSE.

Pursuant to rules and

policy statements of certain securities regulators, the Underwriters may not, at any time during the period of distribution under the

Offering, bid for or purchase Common Shares for their own accounts or for accounts over which they exercise control or direction. The

foregoing restriction is subject to certain exceptions, including: (i) a bid or purchase permitted under the Universal Market Integrity

Rules for Canadian Marketplaces administered by the Investment Industry Regulatory Organization of Canada relating to market stabilization

and passive market making activities; (ii) a bid or purchase made for or on behalf of a customer where the order was not solicited

during the period of the distribution, provided that the bid or purchase was for the purpose of maintaining a fair and orderly market

and not engaged in for the purpose of creating actual or apparent active trading in, or raising the price of, such securities, or (iii) a

bid or purchase to cover a short position entered into prior to the commencement of the prescribed restricted period. Consistent with

these requirements, and in connection with the Offering, the Underwriters may over-allot and effect transactions which are intended to

stabilize or maintain the market price of the Common Shares at levels other than those which otherwise might prevail on the open market.

If these activities are commenced, they may be discontinued by the Underwriters at any time. The Underwriters may carry out these transactions

on the TSX, in the over-the-counter market or otherwise.

Certain of the Underwriters

and their affiliates have performed investment banking, commercial banking and advisory services for the Company from time to time for

which they have received customary fees and expenses. The Underwriters and their affiliates may, from time to time, engage in transactions

with and perform services for the Company in the ordinary course of their business.

The Common Shares sold

by the Underwriters to the public will initially be offered at the Offering Price specified on the cover page. After the Underwriters

have made a reasonable effort to sell all of the Common Shares at the Offering Price specified on the cover page, the Underwriters may

decrease the Offering Price to an amount not greater than the Offering Price set forth on the cover page, and the compensation realized

by the Underwriters will be decreased by the amount that the aggregate price paid by the purchasers for the Common Share is less than

the gross proceeds paid by the Underwriters to the Company. The decrease in the Offering Price will not decrease the amount of net proceeds

of the Offering to the Company.

Ero has agreed in the

Underwriting Agreement to reimburse the Underwriters for certain legal fees and certain other expenses in connection with the

Offering, including for the Underwriters’ Canadian counsel and the Underwriters’ U.S. counsel (plus applicable taxes and

disbursements).

The Company has agreed, pursuant

to the Underwriting Agreement, to indemnify and save harmless the Underwriters and their respective subsidiaries and affiliates, and each

of their respective directors, officers, employees, partners, agents, and shareholders against certain liabilities, including civil liabilities

under Canadian and United States securities legislation in certain circumstances or to contribute to payments the Underwriters may have

to make because of such liabilities.

The Company has agreed in

the Underwriting Agreement that the Company will not, directly or indirectly issue any Common Shares or securities or other financial instruments convertible into

or having the right to acquire Common Shares (other than pursuant to rights or obligations under securities or instruments outstanding)

or enter into any agreement or arrangement under which the Company acquires or transfers to another, in whole or in part, any of the economic

consequences of ownership of Common Shares, or agree to become bound to do so, or disclose to the public any intention to do so, for a

period of 90 days following the Closing Date without the prior written consent of the Lead Underwriter, which consent

will not be unreasonably withheld provided that, notwithstanding the foregoing, the Company may: (i) grant options, share units or