Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

May 27 2022 - 6:25AM

Edgar (US Regulatory)

SECURITIES AND

EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

6-K

Report

of Foreign Issuer

Pursuant

to Rule 13a-16 or 15d-16 of

the

Securities Exchange Act of 1934

For

the month of May 2022

Eni

S.p.A.

(Exact

name of Registrant as specified in its charter)

Piazzale

Enrico Mattei 1 -- 00144 Rome, Italy

(Address

of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form

20-F x Form 40-F ¨

(Indicate

by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information

to the Commission pursuant to Rule 12g3-2b under the Securities Exchange Act of 1934.)

Yes

¨ No x

(If

"Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):_________ )

Table

of contents

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, hereunto duly authorised.

| |

Eni S.p.A. |

| |

|

| |

|

| |

/s/ Paola Mariani |

| |

Name: |

Paola Mariani |

| |

Title: |

Head of Corporate |

| |

|

Secretary’s Staff Office |

Date: May 26, 2022

Eni: Board of Directors approves

measures to execute the buyback program

Rome, 26 May 2022

– Eni’s Board of Directors, chaired by Lucia Calvosa, in execution of the authorization granted by the Shareholders Meeting

held on 11 May 2022 has approved measures to execute the buyback program for an outlay of minimum €1.1 billion, that can be increase

for a maximum amount of €2.5 billion according to the Brent price scenario and up to a maximum of 357 million of shares (equal to

10% of the ordinary shares post cancellation) (the “Buyback Program”).

Eni will update

its 2022 Buyback Program scenario assessment in July and/or October. For scenarios above $90/bbl further buybacks equivalent to 30% of

the associated incremental Free Cash Flow will be made, without prejudice to the aforementioned limits. The potential increases will

be promptly disclosed to the public in the manners and terms provided for by the laws and regulations in force.

The Buyback Program

is intended to give the Company a flexible option to grant the shareholders additional remuneration beyond the distribution of dividends,

with the aim to share the value of Eni’s strategic progress and the improved scenario with investors.

Purchases will

be initiated by the first half of June 2022 and will end at the latest in April 2023.

The program will

be executed through an authorized third-party agent, who will take decisions regarding purchases at its own discretion, also in relation

to the timing of the transactions.

The purchases will

be made in accordance with the limits set out by the Eni’s Shareholders Meeting, at a purchase price that complies with the criteria

set out in the Delegated Regulation (EU) 2016/1052 and, in any case, cannot diverge downwards or upwards by more than 10% from the official

price that will be registered by the Eni share in the trading session of Euronext Milan, organised and managed by Borsa Italiana S.p.A.,

on the day prior to the execution of each individual purchase transaction.

Purchases will

be made on the Euronext Milan pursuant to Art. 144-bis, paragraph 1, letter b) of Consob Regulation no. 11971/1999 and in accordance

with the additional conditions set out in the Eni’s shareholder resolution of 11 May 2022, as well as in compliance with Regulation

(EU) no. 596/2014 on market abuse and Delegated Regulation (EU) 2016/1052.

Following the resolution

to cancel treasury shares adopted by the Shareholders' Meeting held on 11 May 2022, Eni holds 31,731,302 treasury shares, equal to approximately

0.89% of the share capital, purchased under previous buyback programs. Eni’s controlled subsidiaries do not hold Eni’s shares.

Details of purchases

will be announced to the market in compliance with terms and conditions defined by the current legislation.

Company Contacts:

Press Office: Tel.

+39.0252031875 – +39.0659822030

Freephone for shareholders

(from Italy): 800940924 Freephone for shareholders (from abroad): + 80011223456 Switchboard: +39-0659821

ufficio.stampa@eni.com

segreteriasocietaria.azionisti@eni.com

investor.relations@eni.com

Web site: www.eni.com

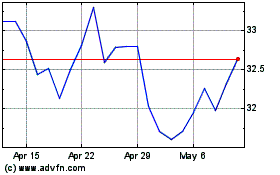

ENI (NYSE:E)

Historical Stock Chart

From Jun 2024 to Jul 2024

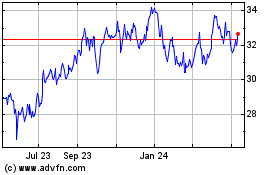

ENI (NYSE:E)

Historical Stock Chart

From Jul 2023 to Jul 2024