Energy Transfer Announces Increase in Quarterly Cash Distribution

January 25 2023 - 4:30PM

Business Wire

Distribution Represents Approximate 75

Percent Increase Compared to Prior Year

Energy Transfer LP (NYSE: ET) today announced a quarterly

cash distribution of $0.305 per Energy Transfer common unit ($1.22

on an annualized basis) for the fourth quarter ended December 31,

2022, which will be paid on February 21, 2023 to unitholders of

record as of the close of business on February 7, 2023.

The distribution per unit is an approximate 75 percent increase

over the fourth quarter of 2021 and is a 15 percent increase over

the third quarter of 2022. This distribution increase represents

another step in Energy Transfer’s plan to return additional value

to unitholders while maintaining its target leverage ratio of

4.0x-4.5x debt-to-EBITDA. Future distributions will be evaluated,

while balancing the partnership’s leverage target, growth

opportunities and unit buy-backs.

In addition, as previously announced, Energy Transfer plans to

release earnings for the fourth quarter and full year 2022 on

Wednesday, February 15, 2023, after the market closes. The company

will also conduct a conference call on Wednesday, February 15, 2023

at 3:30 p.m. Central Time/4:30 p.m. Eastern Time to discuss

quarterly results and provide a company update including an outlook

for 2023. The conference call will be broadcast live via an

internet webcast, which can be accessed on Energy Transfer’s

website at energytransfer.com. The call will also be available for

replay on Energy Transfer’s website for a limited time.

Energy Transfer LP (NYSE: ET) owns and operates one of

the largest and most diversified portfolios of energy assets in the

United States, with a strategic footprint in all of the major U.S.

production basins. Energy Transfer is a publicly traded limited

partnership with core operations that include complementary natural

gas midstream, intrastate and interstate transportation and storage

assets; crude oil, natural gas liquids (NGL) and refined product

transportation and terminalling assets; and NGL fractionation.

Energy Transfer also owns Lake Charles LNG Company, as well as the

general partner interests, the incentive distribution rights and

28.5 million common units of Sunoco LP (NYSE: SUN), and the general

partner interests and 46.1 million common units of USA Compression

Partners, LP (NYSE: USAC). For more information, visit the Energy

Transfer LP website at energytransfer.com.

Forward Looking Statements

This press release may include certain statements concerning

expectations for the future that are forward-looking statements as

defined by federal law. Such forward-looking statements are subject

to a variety of known and unknown risks, uncertainties, and other

factors that are difficult to predict and many of which are beyond

management’s control. An extensive list of factors that can affect

future results, including future distribution levels and leverage

ratio, are discussed in the Partnership’s Annual Report on Form

10-K and other documents filed from time to time with the

Securities and Exchange Commission. In addition to the risks and

uncertainties previously disclosed, the Partnership has also been,

or may in the future be, impacted by new or heightened risks

related to the COVID-19 pandemic, and we cannot predict the length

and ultimate impact of those risks. The Partnership undertakes no

obligation to update or revise any forward-looking statement to

reflect new information or events.

Qualified Notice

This release serves as qualified notice to nominees as provided

for under Treasury Regulation Section 1.1446-4(b)(4) and (d).

Please note that one hundred percent (100%) of Energy Transfer LP’s

distributions to foreign investors are attributable to income that

is effectively connected with a United States trade or business.

Accordingly, all of Energy Transfer LP’s distributions to foreign

investors are subject to federal tax withholding at the highest

applicable effective tax rate. Nominees, and not Energy Transfer

LP, are treated as withholding agents responsible for withholding

distributions received by them on behalf of foreign investors. For

purposes of Treasury Regulation section 1.1446(f)-4(c)(2)(iii),

brokers and nominees should treat one hundred percent (100%) of the

distributions as being in excess of cumulative net income for

purposes of determining the amount to withhold.

The information contained in this press release is available on

our website at energytransfer.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230125005690/en/

Investor Relations: Bill Baerg Brent Ratliff Lyndsay Hannah

214-981-0795

Media Relations: Vicki Granado 214-840-5820

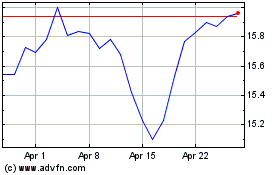

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Oct 2024 to Nov 2024

Energy Transfer (NYSE:ET)

Historical Stock Chart

From Nov 2023 to Nov 2024