Endeavor Group Holdings, Inc. (NYSE: EDR) (“Endeavor” or the

“Company”), a global sports and entertainment company, today

released its financial results for the quarterly period ended June

30, 2022.

Highlights

- $1.313 billion in Q2 2022 revenue

- Continued strength across the portfolio – Owned Sports

Properties, Representation, Events, Experiences & Rights – led

to increased Adjusted EBITDA guidance for full year 2022 (new range

between $1.130 to $1.170 billion, or a midpoint of $1.150 billion,

up $25 million from the midpoint of prior guidance range)

- Continued emphasis on managing debt portfolio and achieving

long-term leverage target, including intent to repay $250 million

of debt by the end of Q3 2022, supported by enhanced cash position

from recent $400 million reduction in OpenBet purchase price, as

well as expected proceeds from the recently announced sale of

Diamond Baseball Holdings

Q2 2022 Consolidated Financial Results

- Revenue: $1.313 billion

- Net income: $42.2 million

- Adjusted EBITDA: $306.4 million

“We benefited from strong growth globally across our segments in

the second quarter,” said Ariel Emanuel, CEO, Endeavor. “While we

recognize there are broader macroeconomic forces at play, given the

quarter’s performance and our line of sight through the end of the

year, we’ve once again raised our Adjusted EBITDA guidance. We

remain focused on our long-term strategy – leveraging the diversity

and scale of our businesses to drive maximum value for our

shareholders, our clients and our owned IP.”

Segment Operating Results

- Owned Sports Properties segment revenue was $331.9

million for the quarter, up $73.1 million, or 28% compared to the

second quarter of 2021. Growth was primarily driven by an increase

in media rights fees and live event, partnership, consumer product

and licensing revenues at UFC, as well as higher revenues at PBR,

and the inclusion of Diamond Baseball Holdings. The segment’s

Adjusted EBITDA was $161.3 million for the quarter, up $29.0

million, or 22%, year-over-year.

- Events, Experiences & Rights segment revenue was

$627.9 million for the quarter, up $99.2 million, or 19% compared

to the second quarter of 2021. Increases were primarily driven by

the return of full-capacity live events including music festivals,

the Masters, and the NCAA Final Four, as well as the inclusion of

the Madrid Open and NCSA acquisitions. The segment’s Adjusted

EBITDA was $108.1 million for the quarter, up $71.3 million, or

194%, year-over-year.

- Representation segment revenue was $358.0 million for

the quarter, up $29.7 million, or 9% compared to the second quarter

of 2021. Growth was primarily driven by the continued strong demand

for talent including the recovery of music and comedy touring, as

well as increased corporate client spending, partially offset by

the sale of the restricted portion of Endeavor Content. The

segment’s Adjusted EBITDA was $111.2 million for the quarter, up

$49.5 million, or 80%, year-over-year.

2022 Annual Guidance

- Revenue is expected to be between $5.235 billion and $5.475

billion

- Adjusted EBITDA is expected to be between $1.130 billion and

$1.170 billion

Balance Sheet and Liquidity

At June 30, 2022, cash and cash equivalents totaled $1.824

billion, compared to $2.030 billion at March 31, 2022. Total debt

was $5.684 billion at June 30, 2022, compared to $5.704 billion at

March 31, 2022.

For further information regarding the Company's financial

results, as well as certain non-GAAP financial measures, and the

reconciliations thereof, please refer to the following pages of

this release or visit the Company’s Investor Relation site at

investor.endeavorco.com.

Webcast Details

Endeavor will host an audio webcast to discuss its results and

provide a business update at 2 p.m. PT / 5 p.m. ET today. The event

can be accessed at:

https://events.q4inc.com/attendee/704814549.

The link to the webcast, as well as a recording, will also be

available within the News/Events section of

investor.endeavorco.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Statements that do not relate to matters of historical fact

should be considered forward-looking statements, including the

Company’s guidance for full year 2022 and its deleveraging efforts

and debt repayment, and timing thereof. These forward-looking

statements are based on management’s current expectations. These

statements are neither promises nor guarantees and involve known

and unknown risks, uncertainties and other important factors that

may cause actual results, performance or achievements to be

materially different from what is expressed or implied by the

forward-looking statements, including, but not limited to: the

impact of COVID-19 on Endeavor’s business, financial condition,

liquidity and results of operations; changes in public and consumer

tastes and preferences and industry trends; Endeavor’s ability to

adapt to or manage new content distribution platforms or changes in

consumer behavior; Endeavor’s dependence on the relationships of

its management, agents, and other key personnel with clients;

Endeavor’s dependence on key relationships with television and

cable networks, satellite providers, digital streaming partners,

corporate sponsors, and other distribution partners; risks related

to Endeavor’s organization and structure; and other important

factors discussed in Part I, Item 1A “Risk Factors” in Endeavor’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2021, as updated by Part II, Item 1A “Risk Factors” in Endeavor’s

Quarterly Report on Form 10-Q for the quarterly period ended June

30, 2022, as any such factors may be updated from time to time in

its other filings with the Securities and Exchange Commission (the

“SEC”), accessible on the SEC’s website at www.sec.gov and

Endeavor’s Investor Relations site at investor.endeavorco.com.

Forward-looking statements speak only as of the date they are made

and, except as may be required under applicable law, Endeavor

undertakes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise.

Non-GAAP Financial Measures

We refer to certain financial measures that are not recognized

under United States generally accepted accounting principles

(“GAAP”). Please see “Note Regarding Non-GAAP Financial Measures"

and the reconciliation tables below for additional information and

a reconciliation of the Non-GAAP financial measures to the most

comparable GAAP financial measures.

About Endeavor

Endeavor is a global sports and entertainment company, home to

many of the world’s most dynamic and engaging storytellers, brands,

live events and experiences. The company is comprised of industry

leaders including entertainment agency WME; sports, fashion, events

and media company IMG; and premier mixed martial arts organization

UFC. The Endeavor network specializes in talent representation,

sports operations & advisory, event & experiences

management, media production & distribution, experiential

marketing and brand licensing.

Website Disclosure

Investors and others should note that we announce material

financial and operational information to our investors using press

releases, SEC filings and public conference calls webcasts, as well

as our Investor Relations site at investor.endeavorco.com. In

addition, you may automatically receive email alerts and other

information about Endeavor when you enroll your email address by

visiting the “Investor Email Alerts” option under the Resources tab

on investor.endeavorco.com.

Consolidated Statements of

Operations

(Unaudited)

(In thousands, except share and

per share data)

Three Months Ended June 30, Six Months Ended June

30,

2022

2021

2022

2021

Revenue

$

1,312,515

$

1,111,272

$

2,786,278

$

2,180,854

Operating expenses: Direct operating costs

508,385

570,955

1,203,026

1,117,347

Selling, general and administrative expenses

587,499

785,101

1,127,705

1,166,214

Insurance recoveries

—

(10,210

)

(993

)

(29,867

)

Depreciation and amortization

65,612

69,161

131,606

136,397

Impairment charges

—

3,770

—

3,770

Total operating expenses

1,161,496

1,418,777

2,461,344

2,393,861

Operating income (loss)

151,019

(307,505

)

324,934

(213,007

)

Other (expense) income: Interest expense, net

(62,505

)

(83,836

)

(121,777

)

(152,187

)

Loss on extinguishment of debt

—

(28,628

)

—

(28,628

)

Tax receivable agreements liability adjustment

2,405

—

(51,092

)

—

Other (expense) income, net

(6,133

)

7,933

453,808

4,718

Income (loss) before income taxes and equity losses of affiliates

84,786

(412,036

)

605,873

(389,104

)

Provision for (benefit from) income taxes

2,699

60,918

(14,535

)

66,003

Income (loss) before equity losses of affiliates

82,087

(472,954

)

620,408

(455,107

)

Equity losses of affiliates, net of tax

(39,867

)

(43,813

)

(60,522

)

(59,284

)

Net income (loss)

42,220

(516,767

)

559,886

(514,391

)

Less: Net income (loss) attributable to non-controlling interests

16,414

(190,354

)

214,534

(163,108

)

Less: Net loss attributable to Endeavor Operating Company, LLC

prior to the reorganization transactions

—

(6,816

)

—

(31,686

)

Net income (loss) attributable to Endeavor Group Holdings, Inc.

$

25,806

$

(319,597

)

$

345,352

$

(319,597

)

Earnings (loss) per share of Class A common stock(1): Basic

$

0.09

$

(1.24

)

$

1.27

$

(1.24

)

Diluted

$

0.09

$

(1.24

)

$

1.24

$

(1.24

)

Weighted average number of shares used in computing earnings

(loss) per share: Basic

281,623,228

258,266,323

275,092,484

258,266,323

Diluted(2)

449,733,965

258,266,323

446,419,024

258,266,323

(1) Basic and diluted loss per share of Class A common stock

presented for 2021 is applicable only for the period from May 1,

2021 through June 30, 2021, which is the period following the

initial public offering ("IPO") and the related Reorganization

Transactions (2) The diluted weighted average number of

shares of 446,419,024 for the six months ended June 30, 2022

includes weighted average Class A common shares outstanding, plus

an assumed exchange of Endeavor Manager Units and Endeavor

Operating Units into 166,746,315 shares, an assumed exchange of

Endeavor Profits Units into 2,450,488 shares of the Company’s Class

A common stock and additional shares from Stock Options, RSUs and

Phantom Units, as noted in the table below: Weighted average

Class A Common Shares outstanding - Basic

275,092,484

Additional shares assuming exchange of all Endeavor Profits Units

2,450,488

Additional shares from RSUs, stock options and Phantom Units, as

calculated using the treasury stock method

2,129,737

Additional shares assuming exchange of all Endeavor Operating Units

and Endeavor Manager Units

166,746,315

Weighted average Class A Common Shares outstanding - Diluted

446,419,024

Segment Results

(Unaudited)

(In thousands)

Three Months Ended June 30, Six Months Ended June

30,

2022

2021

2022

2021

Revenue: Owned Sports Properties

$

331,930

$

258,865

$

628,619

$

542,346

Events, Experiences & Rights

627,872

528,672

1,453,685

1,068,282

Representation

357,955

328,232

715,276

577,141

Eliminations

(5,242

)

(4,497

)

(11,302

)

(6,915

)

Total Revenue

$

1,312,515

$

1,111,272

$

2,786,278

$

2,180,854

Adjusted EBITDA: Owned Sports Properties

$

161,270

$

132,267

$

310,011

$

277,816

Events, Experiences & Rights

108,117

36,800

240,600

75,850

Representation

111,221

61,685

212,926

123,168

Corporate

(74,253

)

(62,704

)

(142,733

)

(109,320

)

Consolidated Balance

Sheets

(Unaudited)

(In thousands, except share

data)

June 30, December 31,

2022

2021

ASSETS Current Assets: Cash and cash equivalents

$

1,824,012

$

1,560,995

Restricted cash

324,899

232,041

Accounts receivable (net of allowance for doubtful accounts of

$62,631 and $57,102, respectively)

826,715

615,010

Deferred costs

222,067

255,371

Assets held for sale

19,690

885,633

Other current assets

243,646

204,697

Total current assets

3,461,029

3,753,747

Property and equipment, net

630,280

629,807

Operating lease right-of-use assets

357,406

373,652

Intangible assets, net

1,915,898

1,611,684

Goodwill

4,540,660

4,506,554

Investments

483,590

298,212

Other assets

347,755

260,861

Total assets

$

11,736,618

$

11,434,517

LIABILITIES, REDEEMABLE INTERESTS AND SHAREHOLDERS'

EQUITY Current Liabilities: Accounts payable

$

600,026

$

558,863

Accrued liabilities

490,577

524,061

Current portion of long-term debt

87,113

82,022

Current portion of operating lease liabilities

58,989

59,743

Deferred revenue

564,267

651,760

Deposits received on behalf of clients

312,336

216,632

Liabilities held for sale

4,985

507,303

Other current liabilities

150,417

105,053

Total current liabilities

2,268,710

2,705,437

Long-term debt

5,596,660

5,631,714

Long-term operating lease liabilities

345,762

363,568

Other long-term liabilities

400,137

402,472

Total liabilities

8,611,269

9,103,191

Commitments and contingencies Redeemable

non-controlling interests

48,630

209,863

Shareholders' Equity: Class A common stock, $0.00001 par

value; 5,000,000,000 shares authorized; 285,731,884 and 265,553,327

shares issued and outstanding as of June 30, 2022 and December 31,

2021, respectively

2

2

Class B common stock, $0.00001 par value; 5,000,000,000 shares

authorized; none issued and outstanding as of June 30, 2022 and

December 31, 2021

—

—

Class C common stock, $0.00001 par value; 5,000,000,000 shares

authorized; none issued and outstanding as of June 30, 2022 and

December 31, 2021

—

—

Class X common stock, $0.00001 par value; 4,987,036,068 and

5,000,000,000 shares authorized; 183,897,784 and 186,222,061 shares

issued and outstanding as of June 30, 2022 and December 31, 2021,

respectively

1

1

Class Y common stock, $0.00001 par value; 997,261,325 and

1,000,000,000 shares authorized; 235,001,875 and 238,154,296 shares

issued and outstanding as of June 30, 2022 and December 31, 2021,

respectively

2

2

Additional paid-in capital

1,962,051

1,624,201

Retained earnings (accumulated deficit)

—

(296,625

)

Accumulated other comprehensive loss

(61,265

)

(80,535

)

Total Endeavor Group Holdings, Inc. shareholders' equity

1,900,791

1,247,046

Nonredeemable non-controlling interests

1,175,928

874,417

Total shareholders' equity

3,076,719

2,121,463

Total liabilities, redeemable interests and shareholders' equity

$

11,736,618

$

11,434,517

Note Regarding Non-GAAP Financial Measures

This press release includes financial measures that are not

calculated in accordance with United States generally accepted

accounting principles (“GAAP”), including Adjusted EBITDA, Adjusted

EBITDA Margin and Adjusted Net Income.

Adjusted EBITDA is a non-GAAP financial measure and is defined

as net income (loss), excluding income taxes, net interest expense,

depreciation and amortization, equity-based compensation, merger,

acquisition and earn-out costs, certain legal costs, restructuring,

severance and impairment charges, certain non-cash fair value

adjustments, certain equity earnings, tax receivable agreements

liability adjustment and certain other items, including

gains/losses on business divestitures, when applicable. Adjusted

EBITDA margin is a non-GAAP financial measure defined as Adjusted

EBITDA divided by Revenue.

Management believes that Adjusted EBITDA is useful to investors

as it eliminates the significant level of non-cash depreciation and

amortization expense that results from our capital investments and

intangible assets recognized in business combinations, and improves

comparability by eliminating the significant level of interest

expense associated with our debt facilities, as well as income

taxes, which may not be comparable with other companies based on

our tax structure.

Adjusted EBITDA and Adjusted EBITDA margin are used as the

primary bases to evaluate our consolidated operating

performance.

Adjusted Net Income is a non-GAAP financial measure and is

defined as net income (loss) attributable to Endeavor Operating

Company adjusted to exclude our share (excluding those relating to

certain non-controlling interests) of the adjustments used to

calculate Adjusted EBITDA, other than income taxes, net interest

expense and depreciation, on an after-tax basis, the release of tax

valuation allowances and other tax items.

Adjusted Net Income adjusts income or loss attributable to the

Company for items that are not considered to be reflective of our

operating performance. Management believes that such non-GAAP

information is useful to investors and analysts as it provides a

better understanding of the performance of our operations for the

periods presented and, accordingly, facilitates the development of

future projections and earnings growth prospects.

Adjusted EBITDA, Adjusted EBITDA margin, and Adjusted Net Income

have limitations as analytical tools, and you should not consider

them in isolation or as a substitute for analysis of our results as

reported under GAAP. Some of these limitations are:

- they do not reflect every cash expenditure, future requirements

for capital expenditures, or contractual commitments;

- Adjusted EBITDA does not reflect the significant interest

expense or the cash requirements necessary to service interest or

principal payments on our debt;

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized will often have to be

replaced or require improvements in the future, and Adjusted

EBITDA, Adjusted EBITDA margin, and Adjusted Net Income do not

reflect any cash requirement for such replacements or improvements;

and they are not adjusted for all non-cash income or expense items

that are reflected in our statements of cash flows; and

- they are not adjusted for all non-cash income or expense items

that are reflected in our statements of cash flows.

We compensate for these limitations by using Adjusted EBITDA,

Adjusted EBITDA margin and Adjusted Net Income along with other

comparative tools, together with GAAP measurements, to assist in

the evaluation of operating performance.

Adjusted EBITDA, Adjusted EBITDA margin and Adjusted Net Income

should not be considered substitutes for the reported results

prepared in accordance with GAAP and should not be considered in

isolation or as alternatives to net income (loss), as indicators of

our financial performance, as measures of discretionary cash

available to us to invest in the growth of our business or as

measures of cash that will be available to us to meet our

obligations. Although we use Adjusted EBITDA, Adjusted EBITDA

margin and Adjusted Net Income as financial measures to assess the

performance of our business, such use is limited because it does

not include certain material costs necessary to operate our

business. Our presentation of Adjusted EBITDA, Adjusted EBITDA

Margin and Adjusted Net Income should not be construed as

indications that our future results will be unaffected by unusual

or nonrecurring items. These non-GAAP financial measures, as

determined and presented by us, may not be comparable to related or

similarly titled measures reported by other companies.

Set forth below are reconciliations of our most directly

comparable financial measures calculated in accordance with GAAP to

these non-GAAP financial measures on a consolidated basis.

A reconciliation of the Company’s Adjusted EBITDA guidance to

the most directly comparable GAAP financial measure cannot be

provided without unreasonable efforts and is not provided herein

because of the inherent difficulty in forecasting and quantifying

certain amounts that are necessary for such reconciliations,

including adjustments that are made for equity-based compensation

expense, restructuring charges, gains, losses and impairments

related to acquisitions and divestitures of businesses, non-cash

fair value adjustments of embedded foreign currency derivatives,

equity method earnings or losses and fair value adjustments for

investments, certain tax items and other adjustments reflected in

our reconciliation of historical Adjusted EBITDA, the amounts of

which, could be material.

Adjusted EBITDA and Adjusted

Net Income

(Unaudited)

(In thousands)

Adjusted EBITDA Three Months Ended June 30,

Six Months Ended June 30,

2022

2021

2022

2021

Net income (loss)

$

42,220

$

(516,767

)

$

559,886

$

(514,391

)

Provision for (benefit from) income taxes

2,699

60,918

(14,535

)

66,003

Interest expense, net

62,505

83,836

121,777

152,187

Depreciation and amortization

65,612

69,161

131,606

136,397

Equity-based compensation expense (1)

60,607

387,017

111,463

403,508

Merger, acquisition and earn-out costs (2)

14,568

14,199

27,362

25,184

Certain legal costs (3)

8,598

574

9,600

4,526

Restructuring, severance and impairment (4)

1,442

4,026

1,960

4,433

Fair value adjustment - equity investments (5)

(11,691

)

(5,905

)

(13,344

)

(13,704

)

Equity method losses - Learfield IMG College and Endeavor Content

(6)

41,511

42,655

65,915

61,460

Gain on sale of the restricted Endeavor Content business(7)

—

—

(463,641

)

—

Tax receivable agreements liability adjustment (8)

(2,405

)

—

51,092

—

Other (9)

20,689

28,334

31,663

41,911

Adjusted EBITDA

$

306,355

$

168,048

$

620,804

$

367,514

Net income (loss) margin

3.2

%

(46.5

%)

20.1

%

(23.6

%)

Adjusted EBITDA margin

23.3

%

15.1

%

22.3

%

16.9

%

Adjusted Net Income Three Months Ended June

30, Six Months Ended June 30,

2022

2021

2022

2021

Net income (loss)

$

42,220

$

(516,767

)

$

559,886

$

(514,391

)

Net (income) loss attributable to non-controlling interests

(16,414

)

190,354

(214,534

)

163,108

Net loss attributable to Endeavor Operating Company, LLC prior to

the reorganization transactions

—

6,816

—

31,686

Net income (loss) attributable to Endeavor Group Holdings, Inc.

25,806

(319,597

)

345,352

(319,597

)

Amortization

41,380

46,649

84,296

92,377

Equity-based compensation expense (1)

60,607

387,017

111,463

403,508

Merger, acquisition and earn-out costs (2)

14,568

14,199

27,362

25,184

Certain legal costs (3)

8,598

574

9,600

4,526

Restructuring, severance and impairment (4)

1,442

4,026

1,960

4,433

Fair value adjustment - equity investments (5)

(11,691

)

(5,905

)

(13,344

)

(13,704

)

Equity method losses - Learfield IMG College and Endeavor Content

(6)

41,511

42,655

65,915

61,460

Gain on sale of the restricted Endeavor Content business(7)

—

—

(463,641

)

—

Tax receivable agreements liability adjustment (8)

(2,405

)

—

51,092

—

Other (9)

20,689

28,334

31,663

41,911

Tax effects of adjustments (10)

(10,829

)

77,550

10,275

71,231

Other tax items (11)

2,830

17,608

(53,683

)

17,608

Adjustments allocated to non-controlling interests (12)

(62,036

)

(241,635

)

51,372

(337,462

)

Adjusted Net Income

$

130,470

$

51,475

$

259,682

$

51,475

____________

(1)

Equity-based compensation represents

primarily non-cash compensation expense associated with our

equity-based compensation plans.

The decrease for the three and six months

ended June 30, 2022 as compared to the three and six months ended

June 30, 2021 was primarily due to modification of certain pre-IPO

equity-based awards primarily to remove certain forfeiture and

discretionary call terms as well as grants under the 2021 Incentive

Award Plan that were issued in connection with the IPO.

Equity-based compensation was recognized in all segments and

Corporate for three and six months ended June 30, 2022 and

2021.

(2)

Includes (i) certain costs of professional

advisors related to mergers, acquisitions, dispositions or joint

ventures and (ii) fair value adjustments for contingent

consideration liabilities related to acquired businesses and

compensation expense for deferred consideration associated with

selling shareholders that are required to retain our employees.

Such costs for the three months ended June

30, 2022 primarily related to fair value adjustments for contingent

consideration liabilities related to acquired businesses and

acquisition earn-out adjustments of approximately $8 million, which

primarily related to our Representation segment. Professional

advisor costs were approximately $7 million and related to all of

our segments.

Such costs for the three months ended June

30, 2021 primarily related to fair value adjustments for contingent

consideration liabilities related to acquired businesses and

acquisition earn-out adjustments of approximately $13 million,

which primarily related to our Events, Experiences & Rights

segment. Professional advisor costs were approximately $1 million

and primarily related to our Events, Experiences & Rights

segment.

Such costs for the six months ended June

30, 2022 primarily related to fair value adjustments for contingent

consideration liabilities related to acquired businesses and

acquisition earn-out adjustments of approximately $16 million,

which primarily related to our Representation segment. Professional

advisor costs were approximately $12 million and related to all of

our segments.

Such costs for the six months ended June

30, 2021 primarily related to fair value adjustments for contingent

consideration liabilities related to acquired businesses and

acquisition earn-out adjustments of approximately $20 million,

which primarily related to our Events, Experiences & Rights and

Representation segments. Professional advisor costs were

approximately $5 million and primarily related to our Events,

Experiences & Rights segment.

(3)

Includes costs related to certain

litigation or regulatory matters in each of our segments and

Corporate.

(4)

Includes certain costs related to our

restructuring activities and non-cash impairment charges.

Such costs for the three and six months

ended June 30, 2022 primarily relates to a write off of an asset in

Corporate and the restructuring expenses in our Events, Experiences

& Rights and Representation segments.

Such costs for the three and six months

ended June 30, 2021 primarily relates to the impairment of goodwill

in our Representation and Events, Experiences & Rights

segments.

(5)

Includes the net change in fair value for

certain equity investments with and without readily determinable

fair values, based on observable price changes.

(6)

Relates to equity method losses from our

investment in Learfield IMG College as well as losses from the 20%

interest we retained in the restricted Endeavor Content business,

which we sold in January 2022.

(7)

Relates to the gain recorded for the sale

of the restricted Endeavor Content business, net of transactions

costs of $15.0 million.

(8)

Includes the adjustment for the tax

receivable agreements liability related to the expected realization

of certain tax benefits after concluding that such TRA payments

would be probable based on estimates of future taxable income over

the terms of the TRAs.

(9)

For the three months ended June 30, 2022,

other costs were comprised primarily of losses of approximately $17

million on foreign exchange transactions, which related to all of

our segments and Corporate and approximately $2 million related to

non-cash fair value adjustments of embedded foreign currency

derivatives, which related primarily to our Events, Experiences

& Rights segment.

For the three months ended June 30, 2021,

other costs were comprised primarily of approximately $29 million

related to a loss on debt extinguishment, which related to

Corporate, and a gain of approximately $2 million related to

non-cash fair value adjustments of embedded foreign currency

derivatives, which related primarily to our Events, Experiences

& Rights segment.

For the six months ended June 30, 2022,

other costs were comprised primarily of losses of approximately $22

million on foreign exchange transactions, which related to all of

our segments and Corporate, approximately $3 million of transaction

bonuses related to the sale of the restricted Endeavor Content

business in our Representation segment, approximately $1 million

related to non-cash fair value adjustments of embedded foreign

currency derivatives, which related primarily to our Events,

Experiences & Rights segment and an approximately $1 million

loss on disposal of an asset related to our Events, Experiences

& Rights segment.

For the six months ended June 30, 2021,

other costs were comprised primarily of approximately $29 million

related to a loss on debt extinguishment, which related primarily

to Corporate, and a loss of approximately $9 million related to

non-cash fair value adjustments of embedded foreign currency

derivatives, which related primarily to our Events, Experiences

& Rights segment and approximately $2 million related to

transaction costs associated with the repricing of the UFC Credit

Facilities in our Owned Sports Properties segment.

(10)

Reflects the tax effect of the adjustments

noted above.

(11)

Such items for the three and six months

ended June 30, 2022 reflects the adjustment to or release of,

respectively, a valuation allowance on deferred tax assets due to

the expected realization of certain tax benefits related to the TRA

liability. Such items for the three and six months ended June 30,

2021 includes $7.4 million of deferred tax liabilities associated

with indefinite lived intangibles recorded as a result of the IPO

and tax expense of $10.2 million, related to a change in tax rate

in the United Kingdom.

(12)

Prior to the IPO and associated

reorganization transactions, reflects the share of adjustments

attributable to the non-controlling interests in UFC. Subsequent to

the IPO and associated reorganization transactions, reflects the

share of adjustments attributable to the non-controlling interests

of certain former members of Endeavor Operating Company who retain

ownership interests in Endeavor Manager and Endeavor Operating

Company.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220811005464/en/

Investors: investor@endeavorco.com Press:

press@endeavorco.com

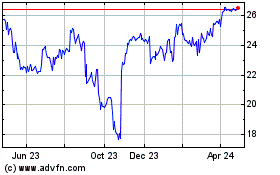

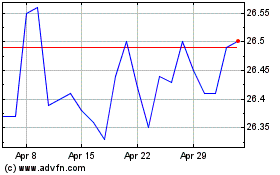

Endeavor (NYSE:EDR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Endeavor (NYSE:EDR)

Historical Stock Chart

From Apr 2023 to Apr 2024