UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2014

EMPRESA DISTRIBUIDORA Y COMERCIALIZADORA NORTE S.A. (EDENOR)

(DISTRIBUTION AND MARKETING COMPANY OF THE NORTH )

(Translation of Registrant's Name Into English)

Argentina

(Jurisdiction of incorporation or organization)

Av. del Libertador 6363,

12th Floor,

City of Buenos Aires (A1428ARG),

Tel: 54-11-4346-5000

(Address of principal executive offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F

(Indicate by check mark whether the registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes No X

(If "Yes" is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82- .)

MINUTES No. 269 OF THE SUPERVISORY COMMITTEE’S MEETING

In the City of Buenos Aires, on November 7, 2014, at 10:00 a.m., the undersigning members of the Supervisory Committee, to wit Daniel Abelovich, Damián Burgio and Jorge Pardo held a meeting at Av. del Libertador 6363, 11th floor. After discussion, it was resolved that Mr. Daniel Abelovich should chair the Meeting who, after verifying legal and statutory quorum, declared the meeting duly held and moved to consider the FIRST ITEM of the Agenda: 1) ConsideraTION OF THE FINANCIAL STATEMENTS FOR THE PERIOD ENDED SEPTEMBER 30, 2014. The Chairman stated that as members of the Supervisory Committee had been provided access to and timely delivery of the documents related to the fiscal year under consideration, as well as the independent auditor's report, the Committee had reviewed them, as well as the remaining documents including the conclusions of such auditors’ report, whose criteria were shared by the Committee. As a result of the analysis conducted by the members of the Supervisory Committee, and having all of them been aware of the documents and decisions made by corporate bodies, Mr. Abelovich moved to approve all decisions. After discussion, the motion was unanimously approved. The Chairman proposed considering the SECOND ITEM of the Agenda 2) SUPERVISORY COMMITTEE’S REPORT AND OTHER RELATED DOCUMENTS. signature authorization. Mr. Abelovich stated that the Supervisory Committee shall issue its report and requested all attendees to consider a draft report, which is transcribed below:

Supervisory Committee’s Report

To the Shareholders of

Empresa Distribuidora y Comercializadora Norte Sociedad Anónima (Edenor S.A.)

1. In accordance with the provisions of section 294 of Argentine Companies Law No. 19.550 and the Rules of the Argentine Securities and Exchange Commission (Comisión Nacional de Valores, CNV), we have reviewed the interim condensed financial statements of Empresa Distribuidora y Comercializadora Norte Sociedad Anónima (Edenor S.A.) (hereinafter referred to as “Edenor” or “the Company”), including the balance sheet as of September 30, 2014, the statements of comprehensive income for the nine- and three-month periods ended September 30, 214 and the statement of changes in stockholders´ equity and cash flow for the nine-month period then ended, and selected supplementary notes thereto. Balances and other information pertaining to the 2013 fiscal year and its interim periods are an integral part of the financial statements mentioned above and shall then be considered in connection with those financial statements.

2. The Company’s Board of Directors is responsible for preparing and filing the financial statements in accordance with the International Financial Reporting Standards (IFRS) adopted by the Argentine Federation of Professional Councils of Economic Sciences (Federación Argentina de Consejos Profesionales de Ciencias Económicas, FACPCE) as professional accounting standards and incorporated by the CNV to its regulations, as approved by the International Accounting Standards Board (IASB) and, therefore, it is responsible for preparing and filing the interim condensed financial statements mentioned in paragraph 1 in accordance with International Accounting Standard 34 “Interim Financial Reporting” (IAS 34). Our responsibility is to render a conclusion based on the review conducted with the scope described in paragraph 3.

3. Our review was conducted in accordance with prevailing auditing standards. Such standards require financial statements to be reviewed subject to the procedures set forth by International Standard on Review Engagements (Norma Internacional de Encargos de Revisión, NIER) 2410 “Review of Interim Financial Information Performed by the Independent Auditor of the Entity”, which was adopted as review standard in Argentina through Technical Resolution No. 33 of FACPCE, as approved by the International Auditing and Assurance Standards Board (IAASB), including the verification of the consistency of the documents reviewed with the information on corporate decisions, as disclosed in minutes, and the conformity of those decisions to the law and the Company’s by-laws insofar as concerns formal and documentary aspects. Our professional task was conducted based on a review of the audit performed by the Company’s independent auditors, Price Waterhouse & Co. S.R.L., who issued a report dated November 7, 2014. An interim financial information review mainly consists in making inquiries to the Company’s personnel responsible for preparing the information included in the interim condensed financial statements and applying analytic and other review methods. The scope of this review is considerably inferior to an audit performed in line with the international auditing standards; accordingly, a review does not ensure knowledge of every significant issue that might otherwise be identified in an audit. Consequently, we do not render an opinion on the financial condition, comprehensive income and cash flows of the Company. We have not assessed any business administrative, financing, and marketing criteria, as they fall within the exclusive competence of the Board of Directors and the Shareholders’ Meeting.

4. Based on our review, we noticed no particular aspect that led us to believe that the interim condensed financial statements mentioned in paragraph 1 were not prepared, in all material respects, in accordance with International Accounting Standard 34.

We wish to emphasize the situation described in Note 1 to the interim condensed financial statements, which identifies the causes for the Company reporting in the interim period closed on September 30, 2014, a net loss of AR$1443.7 million, accumulated losses of AR$1,557.1 million and a working capital deficit of AR$3,090.6 million. As described in Note 1, the Company reports that:

· In fiscal years ended December 31, 2012 and 2011, it posted operating and net losses, and both its liquidity and working capital were significantly and adversely affected;

· Also in 2013 fiscal year, it recorded operating and net losses, before reflecting the effects of ES Resolution 250/13, which neither allowed for a regularization of the cash flow required to render a public utility and to materialize all investments.

· This situation mainly derives from the constant increase in operation costs necessary to maintain the same level of service and the delay in receiving rate increases and/or acknowledgment of real higher costs.

· Although the effects of the partial acknowledgment of higher costs by ES Resolution 250/13 and ES Notes 6852/13, 4012/14 and 486/14 meant an important and significant step towards the recovery of the Company’s situation, they do not stand as a final solution to the Company’s economic and financial equation, as the level of income generated by current tariff schemes, even considering the effects of applying those rules, does not allow for the absorption of operating costs, investment requirements and payment of financial services

· Resolution of integral tariff scheme is uncertain not only as regards periods of time but also in terms of its final formalization.

· The Company’s Board of Directors continues exploring the different scenarios and opportunities to ease off or reduce the adverse impact of Edenor’s situation on operating cash flows and to propose alternate courses of actions to the shareholders; however, restructuring of income to balance the financial-economic equation of the concession still stands as the most relevant aspect.

All these aspects lead to uncertainty as regards the Company being able to continue operating as a going concern. The Company has prepared the interim condensed financial statements attached hereto using accounting standards applicable to any going concern. Therefore, those financial statements do not include the effects of any adjustments and/or reclassifications, if any, that might be required in case the situation above described is not sorted out enabling the Company to continue doing business and in the event the Company is forced to realize its assets and repay its liabilities, including contingent liabilities, under conditions other than in the ordinary course of business.

Our conclusion includes no qualification in connection with the situations described above.

5. In compliance with the relevant rules in force, we inform, in connection with the Company, that:

a) Edenor’s interim condensed financial statements as of September 30, 2014 are entered in the "Inventory and Balance Sheet" book and comply, as regards matters in our scope, with the provisions of Argentine Companies Act and with the relevant resolutions passed by the Argentine Securities and Exchange Commission;

b) Edenor’s interim condensed financial statements as of September 30, 2014 derive from the accounting records maintained, in all their formal aspects, in accordance with legal rules, which provide for their safety and integrity, upon which conditions they were authorized by the Argentine Securities and Exchange Commission;

6. The provisions of section No. 294 of Law No. 19.550 have been duly met.

City of Buenos Aires, November 7, 2014.

|

By Supervisory Committee |

|

|

|

|

|

|

|

|

|

Daniel Abelovich |

|

|

Thereafter, Mr. Jorge Pardo took the floor, and proposed a report that differed from the draft text of Mr. Abelovich, thus he moved the Committee to approve the report with the text below:

Supervisory Committee’s Report

To the Shareholders of

Empresa Distribuidora y Comercializadora Norte Sociedad Anónima (Edenor S.A.)

1. In accordance with the provisions of section 294 of Argentine Companies Law No. 19.550 and the Rules of the Argentine Securities and Exchange Commission (Comisión Nacional de Valores, CNV), we have reviewed the interim condensed financial statements of Empresa Distribuidora y Comercializadora Norte Sociedad Anónima (Edenor S.A.) (hereinafter referred to as “Edenor” or “the Company”), including the balance sheet as of September 30, 2014 and the statements of comprehensive income for the nine- and three-month periods ended September 30, 2014, the statement of changes in stockholders´ equity and cash flow for the nine-month period then ended, and selected supplementary notes thereto. Balances and other information pertaining to the 2013 fiscal year and its interim periods are an integral part of the financial statements mentioned above and shall then be considered in connection with those financial statements.

2. The Company’s Board of Directors is responsible for preparing and filing the financial statements in accordance with the International Financial Reporting Standards (IFRS) adopted by the Argentine Federation of Professional Councils of Economic Sciences (Federación Argentina de Consejos Profesionales de Ciencias Económicas, FACPCE) as professional accounting standards and incorporated by the CNV to its regulations as approved by the International Accounting Standards Board (IASB) and, therefore, it is responsible for preparing and filing the interim condensed financial statements mentioned in paragraph 1 in accordance with the International Accounting Standard 34 “Interim Financial Reporting” (IAS 34). Our responsibility is to render a conclusion based on the review conducted with the scope described in paragraph 3.

3. Our review was conducted in accordance with prevailing auditing standards. Such standards require financial statements to be reviewed subject to the procedures set forth by International Standard on Review Engagements (Norma Internacional de Encargos de Revisión, NIER) 2410 “Review of Interim Financial Information Performed by the Independent Auditor of the Entity”, which was adopted as review standard in Argentina through Technical Resolution No. 33 of FACPCE, as approved by the International Auditing and Assurance Standards Board (IAASB), including the verification of the consistency of the documents reviewed with the information on corporate decisions, as disclosed in minutes, and the conformity of those decisions to the law and the Company’s by-laws insofar as concerns formal and documentary aspects. Our professional task was conducted based on a review of the audit performed by the Company’s independent auditors, Price Waterhouse & Co. S.R.L., who issued a report dated November 7, 2014. An interim financial information review mainly consists in making inquiries to the Company’s personnel responsible for preparing the information included in the interim condensed financial statements and applying analytic and other review methods. The scope of this review is considerably inferior to an audit performed in line with the international auditing standards. Accordingly, a review does not ensure knowledge of every significant issue that might otherwise be identified in an audit. Consequently, we do not render an opinion on the financial condition, comprehensive income and cash flows of the Company. We have not assessed any business administrative, financing, and marketing criteria, as they fall within the exclusive competence of the Board of Directors and the Shareholders’ Meeting.

4. Based on our review, we noticed no particular aspect that led us to believe that the interim condensed financial statements mentioned in paragraph 1 were not prepared, in all material respects, in accordance with International Accounting Standard 34.

In that sense, it should be highlighted the situation described in Note 1 of the interim condensed financial statements, which explains the reasons causing the Company to report in the interim period closed on September 30, 2014, a net loss of AR$1,443.7 million, accumulated losses of AR$1,557.1 million and a working capital deficit of AR$3,090.6 million. As described in Note 1, the Company reports that:

· In fiscal years ended December 31, 2012 and 2011, it posted operating and net losses, and both its liquidity and working capital were significantly and adversely affected;

· Also in 2013 fiscal year, it recorded operating and net losses, before reflecting the effects of ES Resolution 250/13, which neither allowed for a regularization of the cash flow required to render a public utility and to materialize all investments.

· This situation mainly derives from the constant increase in operation costs necessary to maintain the same level of service and the delay in receiving rate increases and/or acknowledgment of real higher costs.

· Although the effects of the partial acknowledgment of higher costs by ES Resolution 250/13 and ES Notes 6852/13, 4012/14 and 486/14 meant an important and significant step towards the recovery of the Company’s situation, they do not stand as a final solution to the Company’s economic and financial equation, as the level of income generated by current tariff schemes, even considering the effects of applying those rules, does not allow for the absorption of operating costs, investment requirements and payment of financial services.

· Resolution of integral tariff scheme is uncertain not only as regards periods of time but also in terms of its final formalization.

· The Company’s Board of Directors continues exploring the different scenarios and opportunities to ease off or reduce the adverse impact of Edenor’s situation on operating cash flows and to propose alternate courses of actions to the shareholders; however, restructuring of income to balance the financial-economic equation of the concession still stands as the most relevant aspect.

Our conclusion includes no qualification in connection with the situations described above.

5. In compliance with the relevant rules in force, we inform, in connection with the Company, that:

a) Edenor S.A.’s interim condensed financial statements as of September 30, 2014 are entered in the Inventory and Balance Sheet book and comply with the provisions of the Argentine Companies Law and with the relevant resolutions passed by the CNV;

b) Edenor S.A.’s interim condensed financial statements as of September 30, 2014 derive from accounting records maintained, in their formal aspects, in accordance with legal rules, which provide for their safety and integrity, upon which conditions they were authorized by the CNV;

6. The provisions of section No. 294 of Law No. 19.550 have been duly met.

City of Buenos Aires, November 7, 2014.

|

By Supervisory Committee |

|

|

|

|

|

|

|

|

|

Jorge R. Pardo |

|

|

In addition, Mr. Jorge Pardo moved that in the event the report proposed by him were not approved, it would be submitted to the Board of Directors’ consideration as a report presented by the minority and the report finally approved, as a report presented by the majority. Thereafter, after discussion, by majority of votes present, the Supervisory Committee RESOLVED to approve the report prepared by Mr. Abelovich, as the only report of the Committee, ad-referendum of the approval of the financial statements therein considered by the Board of Directors called on the date hereof. Besides, Mr. Daniel Abelovich was authorized to sign the report, as well as any other documents mentioned above.

There being no further issues to transact, the meeting was adjourned at 10:45 a.m. by Mr. Abelovich.

Daniel Abelovich Damián Burgio Jorge Roberto Pardo

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Empresa Distribuidora y Comercializadora Norte S.A. |

| |

|

|

| |

|

|

| |

By: |

/s/ Leandro Montero |

| |

Leandro Montero |

| |

Chief Financial Officer |

Date: November 17, 2014

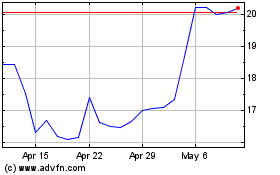

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Oct 2024 to Nov 2024

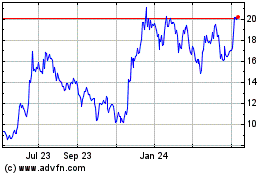

Empresa Distribuidora Y ... (NYSE:EDN)

Historical Stock Chart

From Nov 2023 to Nov 2024