Edison International Revenue Falls in Latest Quarter

May 02 2016 - 5:15PM

Dow Jones News

By Ezequiel Minaya

Edison International posted weaker-than-expected results for the

first quarter, hurt by the timing of a rate-case decision last year

and higher costs.

The California Public Utilities Commission's final decision in

November had a 2015 revenue requirement that was below existing

rates and was retroactive to Jan. 1, 2015.

Shares of the utility fell 1.3% to $70.50 in after-hours

trading.

In the wake of the latest results, Edison bumped up by a penny

its annual guidance for basic earnings on a per-share basis to

$3.82 to $4.02. Analysts surveyed by Thomson Reuters expect $3.89 a

share.

For the quarter ended in March, Edison posted earnings of $301

million, or 82 cents a share after the payout of preferred

dividends, compared with a profit of $327 million, or 91 cents a

share, a year earlier.

Total operating revenue declined 2.9% to $2.44 billion.

Analysts surveyed by Thomson Reuters had expected earnings of 88

cents on $2.82 billion in revenue.

Write to Ezequiel Minaya at Ezequiel.Minaya@wsj.com

(END) Dow Jones Newswires

May 02, 2016 17:00 ET (21:00 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

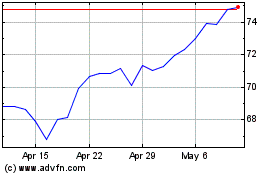

Edison (NYSE:EIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

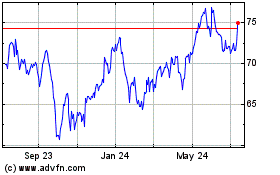

Edison (NYSE:EIX)

Historical Stock Chart

From Apr 2023 to Apr 2024