0001622194falseDC00016221942024-11-052024-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 or 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 5, 2024

Easterly Government Properties, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Maryland |

001-36834 |

47-2047728 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

2001 K Street NW, Suite 775 North, Washington, D.C. |

|

20006 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (202) 595-9500

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

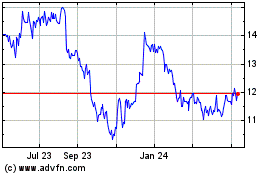

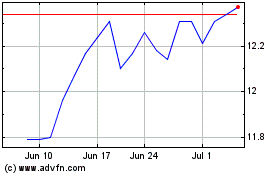

Common Stock |

DEA |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 5, 2024, we issued a press release announcing our results of operations for the third quarter ended September 30, 2024. A copy of this press release as well as a copy of our supplemental information package are available on our website and are attached hereto as Exhibits 99.1 and 99.2 and incorporated herein by reference. The information in this Item 2.02 as well as the attached Exhibits 99.1 and 99.2 are being furnished and shall not be deemed “filed” for any purpose, including for the purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, and shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language in such filing.

We will host a webcast and conference call at 11:00 a.m. Eastern Time on November 5, 2024, to review our third quarter ended 2024 performance, discuss recent events and conduct a question-and-answer session. A live webcast will be available in the Investor Relations section of our website. Please note that the full text of the press release and supplemental information package are available through our website at ir.easterlyreit.com. The information contained on our website is not incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

EASTERLY GOVERNMENT PROPERTIES, INC. |

|

|

By: |

|

/s/ Allison E. Marino |

Name: |

|

Allison E. Marino |

Title: |

|

Executive Vice President, Chief Financial Officer and Chief Accounting Officer |

Date: November 5, 2024

Exhibit 99.1

EASTERLY GOVERNMENT PROPERTIES

REPORTS THIRD QUARTER 2024 RESULTS

WASHINGTON, D.C. – November 5, 2024 – Easterly Government Properties, Inc. (NYSE: DEA) (the “Company” or “Easterly”), a fully integrated real estate investment trust (“REIT”) focused primarily on the acquisition, development and management of Class A commercial properties leased to the U.S. Government, today announced its results of operations for the quarter ended September 30, 2024.

Highlights for the Quarter Ended September 30, 2024:

•Net income of $5.1 million, or $0.05 per share on a fully diluted basis

•Core FFO of $32.2 million, or $0.30 per share on a fully diluted basis

•Entered into a construction loan agreement to lend up to $52.1 million to a developer in connection with the re-development of an approximately 68,669 square foot Drug Enforcement Administration (DEA) facility located in Bedford, Massachusetts (“DEA - Bedford”)

•Acquired, through the Company's previously announced joint venture (the “JV”), a 193,100 leased square foot Department of Veterans Affairs (the “VA”) outpatient clinic located in Jacksonville, Florida (“VA - Jacksonville”). VA - Jacksonville is the final property to be acquired in the previously announced portfolio of 10 properties 100% leased to the VA under predominately 20-year firm term leases

•Acquired a 99,246 square foot facility 100% leased to Northrop Grumman Systems Corporation (NYSE: NOC, S&P: BBB+), a multinational aerospace and defense company and located in Beavercreek, Ohio, a suburb of Dayton (“Northrop Grumman - Dayton”)

•Issued an aggregate of 2,631,727 shares of the Company's common stock in settlement of previously entered into forward sales transactions through the Company's $300.0 million ATM Program launched in December 2019 (the “December 2019 ATM Program”) at a weighted average price per share of $13.33, raising net proceeds to the Company of approximately $35.1 million

“Easterly's accelerated acquisition activity this quarter underscores our pipeline of long-term growth opportunities,” said Darrell Crate, President and CEO of Easterly Government Properties. “We achieved important milestones to expand our total addressable market in the government-adjacent space and continue to deliver value for our shareholders through specialized, mission critical real estate.”

Financial Results for the Nine Months Ended September 30, 2024:

Net income of $14.8 million, or $0.14 per share on a fully diluted basis

Core FFO of $94.3 million, or $0.87 per share on a fully diluted basis

Portfolio Operations

As of September 30, 2024, the Company or its JV owned 95 operating properties in the United States encompassing approximately 9.3 million leased square feet, including 92 operating properties that were leased primarily to U.S. Government tenant agencies, two operating properties that were entirely leased to private tenants, and one operating property leased primarily to tenant agencies of a high-credit U.S. state government.

In addition, the Company wholly owned two properties in development that the Company expects will encompass approximately 0.2 million rentable square feet upon completion. The first re-development project, located in Atlanta, Georgia, is currently under construction and, once complete, a 20-year lease with the U.S. General Services Administration (GSA) is expected to commence for the beneficial use of the U.S. Food and Drug Administration (FDA). The second project, located in Flagstaff, Arizona, is currently in design and, once complete, a 20-year lease with the GSA is expected to commence for the beneficial use of the United States Judiciary. As of September 30, 2024, the portfolio had a weighted average age of 14.8 years, based upon the date properties were built or renovated-to-suit, and had a weighted average remaining lease term of 10.2 years.

Balance Sheet and Capital Markets Activity

As of September 30, 2024, the Company had total indebtedness of approximately $1.5 billion comprised of $149.6 million outstanding on its senior unsecured revolving credit facility, $100.0 million outstanding on its 2016 term loan facility, $174.5 million outstanding on its 2018 term loan facility, $900.0 million of senior unsecured notes, and $157.4 million of mortgage debt (excluding unamortized premiums and discounts and deferred financing fees). The Company's outstanding debt had a weighted average maturity of 4.9 years and a weighted average interest rate of 4.6%. Further, the Company's Net Debt to total enterprise value was 49.0% and its Adjusted Net Debt to annualized quarterly pro forma EBITDA ratio was 7.0x.

Acquisitions and Development Lending Activity

On August 6, 2024, the Company entered into a construction loan agreement to lend up to $52.1 million to a developer (the “Borrower”) in connection with the re-development of an approximately 68,669 square foot Drug Enforcement Administration (DEA) facility located in Bedford, Massachusetts (“DEA - Bedford”). The construction loan will accrue interest monthly at a fixed market rate of 9.00% per annum and will be re-paid through draws made on the construction loan. The construction loan shall be repaid in full on or before August 31, 2027, the maturity date. Upon completion of the development, at the Company’s election, the Company has the option through a Membership Interest Purchase Agreement to purchase all of the issued and outstanding membership interest from the Borrower through a special purpose entity (“SPE”) which solely holds the developed property.

On August 29, 2024, the Company acquired the previously announced 193,100 leased square foot outpatient facility leased to the VA located in Jacksonville, Florida. VA - Jacksonville is the final property to be acquired in the previously announced portfolio of 10 properties 100% leased to the VA under predominately 20-year firm term leases. VA - Jacksonville supports veterans within the surrounding region through primary and specialty healthcare services including prosthetics, physical therapy, occupational therapy, traumatic brain injury treatment, and rehabilitation medicine. The facility also features a domiciliary which provides housing to veterans who are otherwise homeless, require substance abuse treatment, or need additional full-time care. Over 1.4 million veterans reside in the State of Florida, representing the third largest veteran population in the nation.

On September 4, 2024, the Company acquired Northrop Grumman - Dayton, a build-to-suit facility that has been occupied by Northrop Grumman Systems Corporation since 2012 and incorporates robust security enhancements, including secure design standards, access control systems, and security cameras, all of which aid in the confidentiality and integrity of the tenant’s operations. The property sits adjacent to Gate 22B at the Wright-Patterson Air Force Base, the main access point for the Air Force Research Laboratory’s (AFRL) headquarters and the Air Force Institute of Technology. Dating back to its founding in 1917, the AFRL is the primary scientific research and development center for the Department of the Air Force and plays an integral role in leading the discovery, development, and integration of warfighting technologies for the country’s air, space, and cyberspace force. With a workforce of more than 12,500 employees across nine technology areas and 40 other operations across the globe, AFRL provides a diverse portfolio of science and technology ranging from fundamental to advanced research and technology development.

Dividend

On October 31, 2024, the Board of Directors of Easterly approved a cash dividend for the third quarter of 2024 in the amount of $0.265 per common share. The dividend will be payable November 27, 2024 to shareholders of record on November 15, 2024.

Subsequent Events

On October 10, 2024, the Company acquired a 104,136 square foot facility 100% leased to Northrop Grumman Systems Corporation (NYSE: NOC, S&P: BBB+), a multinational aerospace and defense company, located in Aurora, Colorado (“Northrop Grumman - Aurora”). The facility, developed in 2002, was built-to-suit for TRW Inc., an aerospace and automotive corporation acquired by Northrop Grumman in that same year. Approximately 70% of the three-floor buildout is constructed under secure design standards as required by the U.S. Government related to the tenant’s contracts with Buckley Space Force Base (“Buckley SFB”). This secure space is certified and accredited as meeting Director of National Intelligence security standards for the processing, storage, and discussion of sensitive compartmented information. The property is located immediately west of Buckley SFB, which contributes an estimated $2.5 billion annually to the local economy and provides strategic and theater missile warning to the United States and its International Partners. The base supports 3,500 active-duty members from every service, 4,000 National Guard personnel and Reservists, four commonwealth international partners, 2,400 civilians, 2,500 contractors, 94,000 retirees and approximately 40,000 veterans and dependents.

Subsequent to the quarter ending September 30, 2024, the Company entered into forward sales transactions through the December 2019 ATM Program for the sale of 500,000 shares of the Company's common stock at a net weighted average initial forward sales price of $13.32 per share that have not yet been settled, for which, as of the date of this release, the Company expects to receive aggregate net proceeds of approximately $6.7 million, assuming these forward sales transactions are physically settled at such price.

Guidance

This guidance is forward-looking and reflects management’s view of current and future market conditions. The Company’s actual results may differ materially from this guidance.

Outlook for the 12 Months Ending December 31, 2024

The Company is maintaining its guidance for full-year 2024 Core FFO per share on a fully diluted basis at a range of $1.15 - $1.17.

|

|

|

|

|

|

|

|

|

|

Low |

|

|

High |

Net income (loss) per share – fully diluted basis |

|

$ |

0.22 |

|

|

|

0.24 |

Plus: Company’s share of real estate depreciation and amortization |

|

$ |

0.92 |

|

|

|

0.92 |

FFO per share – fully diluted basis |

|

$ |

1.14 |

|

|

|

1.16 |

Plus: Company’s share of depreciation of non-real estate assets |

|

$ |

0.01 |

|

|

|

0.01 |

Core FFO per share – fully diluted basis |

|

$ |

1.15 |

|

|

|

1.17 |

This guidance assumes (i) approximately $90 million in additional wholly owned acquisitions for the remainder of 2024, and (iii) $100 - $110 million of gross development-related investment during 2024.

Outlook for the 12 Months Ending December 31, 2025

The Company is introducing its guidance for full-year 2025 Core FFO per share on a fully diluted basis at a range of $1.17 - $1.21.

|

|

|

|

|

|

|

|

|

|

Low |

|

|

High |

Net income (loss) per share – fully diluted basis |

|

$ |

0.24 |

|

|

|

0.28 |

Plus: Company’s share of real estate depreciation and amortization |

|

$ |

0.92 |

|

|

|

0.92 |

FFO per share – fully diluted basis |

|

$ |

1.16 |

|

|

|

1.20 |

Plus: Company’s share of depreciation of non-real estate assets |

|

$ |

0.01 |

|

|

|

0.01 |

Core FFO per share – fully diluted basis |

|

$ |

1.17 |

|

|

|

1.21 |

This guidance assumes $25 - $35 million of gross development-related investment during 2025.

Non-GAAP Supplemental Financial Measures

This section contains definitions of certain non-GAAP financial measures and other terms that the Company uses in this press release and, where applicable, the reasons why management believes these non-GAAP financial measures provide useful information to investors about the Company’s financial condition and results of operations and the other purposes for which management uses the measures. These measures should not be considered in isolation or as a substitute for measures of performance in accordance with GAAP. A reconciliation of the differences between each non-GAAP financial measure and the comparable GAAP financial measure are included in this press release following the consolidated financial statements. Additional detail can be found in the Company’s most recent annual report on Form 10-K and quarterly report on Form 10-Q, as well as other documents filed with or furnished to the Securities and Exchange Commission from time to time. We present certain financial information and metrics “at Easterly’s Share,” which is calculated on an entity-by-entity basis. “At Easterly’s Share” information, which we also refer to as being “at share,” “pro rata,” or “our share” is not, and is not intended to be, a presentation in accordance with GAAP.

Cash Available for Distribution (CAD) is a non-GAAP financial measure that is not intended to represent cash flow for the period and is not indicative of cash flow provided by operating activities as determined under GAAP. CAD is calculated in accordance with the current Nareit definition as FFO minus normalized recurring real estate-related expenditures and other non-cash items, nonrecurring expenditures and the unconsolidated real estate venture’s allocated share of these adjustments. CAD is presented solely as a supplemental disclosure because the Company believes it provides useful information regarding the Company’s ability to fund its dividends. Because all companies do not calculate CAD the same way, the presentation of CAD may not be comparable to similarly titled measures of other companies.

Core Funds from Operations (Core FFO) adjusts FFO to present an alternative measure of the Company's operating performance, which, when applicable, excludes items which it believes are not representative of ongoing operating results, such as liability management related costs (including losses on extinguishment of debt and modification costs), catastrophic event charges, depreciation of non-real estate assets, provision for credit losses, and the unconsolidated real estate venture's allocated share of these adjustments. In future periods, the Company may also exclude other items from Core FFO that it believes may help investors compare its results. The Company believes Core FFO more accurately reflects the ongoing operational and financial performance of the Company's core business.

EBITDA is calculated as the sum of net income (loss) before interest expense, taxes, depreciation and amortization, (gain) loss on the sale of operating properties, impairment loss, and the unconsolidated real estate venture’s allocated share of these adjustments. EBITDA is not intended to represent cash flow for the period, is not presented as an alternative to operating income as an indicator of operating performance, should not be

considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP, is not indicative of operating income or cash provided by operating activities as determined under GAAP and may be presented on a pro forma basis. EBITDA is presented solely as a supplemental disclosure with respect to liquidity because the Company believes it provides useful information regarding the Company's ability to service or incur debt. Because all companies do not calculate EBITDA the same way, the presentation of EBITDA may not be comparable to similarly titled measures of other companies.

Funds From Operations (FFO) is defined, in accordance with the Nareit FFO White Paper - 2018 Restatement, as net income (loss), calculated in accordance with GAAP, excluding depreciation and amortization related to real estate, gains and losses from the sale of certain real estate assets, gains and losses from change in control and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. FFO includes the Company’s share of FFO generated by unconsolidated affiliates. FFO is a widely recognized measure of REIT performance. Although FFO is a non-GAAP financial measure, the Company believes that information regarding FFO is helpful to shareholders and potential investors.

Net Debt and Adjusted Net Debt Net Debt represents the Company's consolidated debt and its share of unconsolidated debt adjusted to exclude its share of unamortized premiums and discounts and deferred financing fees, less its share of cash and cash equivalents and property acquisition closing escrow, net of deposit. By excluding these items, the result provides an estimate of the contractual amount of borrowed capital to be repaid, net of cash available to repay it. The Company believes this calculation constitutes a beneficial supplemental non-GAAP financial disclosure to investors in understanding its financial condition. Adjusted Net Debt is Net Debt reduced by 1) for each project under construction or in design, the lesser of i) outstanding lump-sum reimbursement amounts and ii) the cost to date, 2) 40% times the amount by which the cost to date exceeds total lump-sum reimbursement amounts for each project under construction or in design and 3) outstanding lump-sum reimbursement amounts for projects previously completed. These adjustments are made to 1) remove the estimated portion of each project under construction, in design or previously completed that has been financed with debt which may be repaid with outstanding cost reimbursement payments from the US Government and 2) remove the estimated portion of each project under construction or in design, in excess of total lump-sum reimbursements, that has been financed with debt but has not yet produced earnings. See page 25 of the Company’s Q3 2024 Supplemental Information Package for further information. The Company’s method of calculating Net Debt and Adjusted Net Debt may be different from methods used by other REITs and may be presented on a pro forma basis. Accordingly, the Company's method may not be comparable to such other REITs.

Other Definitions

Fully diluted basis assumes the exchange of all outstanding common units representing limited partnership interests in the Company’s operating partnership, or common units, the full vesting of all shares of restricted stock, and the exchange of all earned and vested LTIP units in the Company’s operating partnership for shares of common stock on a one-for-one basis, which is not the same as the meaning of “fully diluted” under GAAP.

Conference Call Information

The Company will host a webcast and conference call at 11:00 am Eastern time on November 5, 2024 to review the third quarter 2024 performance, discuss recent events and conduct a question-and-answer session. A live webcast will be available in the Investor Relations section of the Company’s website. Shortly after the webcast, a replay of the webcast will be available on the Investor Relations section of the Company's website for up to twelve months. Please note that the full text of the press release and supplemental information package are also available through the Company’s website at ir.easterlyreit.com.

About Easterly Government Properties, Inc.

Easterly Government Properties, Inc. (NYSE: DEA) is based in Washington, D.C., and focuses primarily on the acquisition, development and management of Class A commercial properties that are leased to the U.S. Government. Easterly’s experienced management team brings specialized insight into the strategy and needs of mission-critical U.S. Government agencies for properties leased to such agencies either directly or through the U.S. General Services Administration (GSA). For further information on the company and its properties, please visit www.easterlyreit.com.

Contact:

Easterly Government Properties, Inc.

Lindsay S. Winterhalter

Senior Vice President, Investor Relations & Operations

202-596-3947

ir@easterlyreit.com

Forward Looking Statements

We make statements in this press release that are considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which are usually identified by the use of words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will,” and variations of such words or similar expressions and include our guidance with respect to Net income (loss) and Core FFO per share on a fully diluted basis. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and are including this statement in this press release for purposes of complying with those safe harbor provisions. These forward-looking statements reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation: risks associated with our dependence on the U.S. Government and its agencies for substantially all of our revenues, including credit risk and risk that the U.S. Government reduces its spending on real estate or that it changes its preference away from leased properties; risks associated with ownership and development of real estate; the risk of decreased rental rates or increased vacancy rates; the loss of key personnel; general volatility of the capital and credit markets and the market price of our common stock; the risk we may lose one or more major tenants; difficulties in completing and successfully integrating acquisitions; failure of acquisitions or development projects to occur at anticipated levels or yield anticipated results; risks associated with our joint venture activities; risks associated with actual or threatened terrorist attacks; intense competition in the real estate market that may limit our ability to attract or retain tenants or re-lease space; insufficient amounts of insurance or exposure to events that are either uninsured or underinsured; uncertainties and risks related to adverse weather conditions, natural disasters and climate change; exposure to liability relating to environmental and health and safety matters; limited ability to dispose of assets because of the relative illiquidity of real estate investments and the nature of our assets; exposure to litigation or other claims; risks associated with breaches of our data security; risks associated with our indebtedness; risks associated with derivatives or hedging activity; risks associated with mortgage debt or unsecured financing or the unavailability thereof, which could make it difficult to finance or refinance properties

and could subject us to foreclosure; adverse impacts from any future pandemic, epidemic or outbreak of any highly infectious disease on the U.S., regional and global economies and our financial condition and results of operations; and other risks and uncertainties detailed in the “Risk Factors” section of our Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission (SEC) on February 27, 2024, and under the heading “Risk Factors” in our other public filings. In addition, our anticipated qualification as a real estate investment trust involves the application of highly technical and complex provisions of the Internal Revenue Code of 1986, or the Code, and depends on our ability to meet the various requirements imposed by the Code through actual operating results, distribution levels and diversity of stock ownership. We assume no obligation to update publicly any forward looking statements, whether as a result of new information, future events or otherwise.

Balance Sheet

(Unaudited, in thousands, except share amounts)

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Real estate properties, net |

|

$ |

2,457,256 |

|

|

$ |

2,319,143 |

|

Cash and cash equivalents |

|

|

31,202 |

|

|

|

9,381 |

|

Restricted cash |

|

|

8,005 |

|

|

|

12,558 |

|

Tenant accounts receivable |

|

|

70,280 |

|

|

|

66,274 |

|

Investment in unconsolidated real estate venture |

|

|

315,886 |

|

|

|

284,544 |

|

Real estate loan receivable, net |

|

|

30,689 |

|

|

|

- |

|

Intangible assets, net |

|

|

146,204 |

|

|

|

148,453 |

|

Interest rate swaps |

|

|

514 |

|

|

|

1,994 |

|

Prepaid expenses and other assets |

|

|

41,073 |

|

|

|

37,405 |

|

Assets held for sale |

|

|

2,002 |

|

|

|

- |

|

Total assets |

|

$ |

3,103,111 |

|

|

$ |

2,879,752 |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Revolving credit facility |

|

|

149,550 |

|

|

|

79,000 |

|

Term loan facilities, net |

|

|

273,851 |

|

|

|

299,108 |

|

Notes payable, net |

|

|

894,523 |

|

|

|

696,532 |

|

Mortgage notes payable, net |

|

|

156,653 |

|

|

|

220,195 |

|

Intangible liabilities, net |

|

|

11,367 |

|

|

|

12,480 |

|

Deferred revenue |

|

|

121,767 |

|

|

|

82,712 |

|

Accounts payable, accrued expenses and other liabilities |

|

|

113,766 |

|

|

|

80,209 |

|

Total liabilities |

|

|

1,721,477 |

|

|

|

1,470,236 |

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

Common stock, par value $0.01, 200,000,000 shares authorized,

105,666,329 and 100,973,247 shares issued and outstanding at

September 30, 2024 and December 31, 2023, respectively |

|

|

1,056 |

|

|

|

1,010 |

|

Additional paid-in capital |

|

|

1,845,271 |

|

|

|

1,783,338 |

|

Retained earnings |

|

|

126,401 |

|

|

|

112,301 |

|

Cumulative dividends |

|

|

(658,042 |

) |

|

|

(576,319 |

) |

Accumulated other comprehensive income |

|

|

489 |

|

|

|

1,871 |

|

Total stockholders' equity |

|

|

1,315,175 |

|

|

|

1,322,201 |

|

Non-controlling interest in Operating Partnership |

|

|

66,459 |

|

|

|

87,315 |

|

Total equity |

|

|

1,381,634 |

|

|

|

1,409,516 |

|

Total liabilities and equity |

|

$ |

3,103,111 |

|

|

$ |

2,879,752 |

|

|

|

|

|

|

|

|

Income Statement

(Unaudited, in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Rental income |

|

$ |

72,536 |

|

|

$ |

68,205 |

|

|

$ |

215,465 |

|

|

$ |

204,111 |

|

Tenant reimbursements |

|

|

663 |

|

|

|

2,704 |

|

|

|

4,494 |

|

|

|

7,279 |

|

Asset management income |

|

|

579 |

|

|

|

526 |

|

|

|

1,680 |

|

|

|

1,560 |

|

Other income |

|

|

1,003 |

|

|

|

579 |

|

|

|

2,163 |

|

|

|

1,657 |

|

Total revenues |

|

|

74,781 |

|

|

|

72,014 |

|

|

|

223,802 |

|

|

|

214,607 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Property operating |

|

|

16,710 |

|

|

|

18,746 |

|

|

|

51,420 |

|

|

|

54,263 |

|

Real estate taxes |

|

|

8,000 |

|

|

|

7,814 |

|

|

|

24,072 |

|

|

|

22,901 |

|

Depreciation and amortization |

|

|

23,795 |

|

|

|

22,245 |

|

|

|

71,681 |

|

|

|

67,945 |

|

Acquisition costs |

|

|

600 |

|

|

|

321 |

|

|

|

1,427 |

|

|

|

1,226 |

|

Corporate general and administrative |

|

|

4,667 |

|

|

|

6,107 |

|

|

|

18,032 |

|

|

|

20,426 |

|

Provision for credit losses (1) |

|

|

1,260 |

|

|

|

- |

|

|

|

1,478 |

|

|

|

- |

|

Total expenses |

|

|

55,032 |

|

|

|

55,233 |

|

|

|

168,110 |

|

|

|

166,761 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

Income from unconsolidated real estate venture |

|

|

1,575 |

|

|

|

1,346 |

|

|

|

4,367 |

|

|

|

4,166 |

|

Interest expense, net |

|

|

(16,209 |

) |

|

|

(12,046 |

) |

|

|

(45,210 |

) |

|

|

(35,739 |

) |

Net income |

|

|

5,115 |

|

|

|

6,081 |

|

|

|

14,849 |

|

|

|

16,273 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest in Operating Partnership |

|

|

(252 |

) |

|

|

(707 |

) |

|

|

(749 |

) |

|

|

(1,905 |

) |

Net income available to Easterly Government |

|

|

|

|

|

|

|

|

|

|

|

|

Properties, Inc. |

|

$ |

4,863 |

|

|

$ |

5,374 |

|

|

$ |

14,100 |

|

|

$ |

14,368 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income available to Easterly Government |

|

|

|

|

|

|

|

|

|

|

|

|

Properties, Inc. per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.05 |

|

|

$ |

0.06 |

|

|

$ |

0.13 |

|

|

$ |

0.15 |

|

Diluted |

|

$ |

0.05 |

|

|

$ |

0.06 |

|

|

$ |

0.13 |

|

|

$ |

0.15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

103,515,246 |

|

|

|

93,537,121 |

|

|

|

102,671,381 |

|

|

|

92,674,039 |

|

Diluted |

|

|

103,904,581 |

|

|

|

93,849,444 |

|

|

|

102,980,995 |

|

|

|

92,938,221 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income, per share - fully diluted basis |

|

$ |

0.05 |

|

|

$ |

0.06 |

|

|

$ |

0.14 |

|

|

$ |

0.15 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - |

|

|

|

|

|

|

|

|

|

|

|

|

fully diluted basis |

|

|

108,488,604 |

|

|

|

105,888,188 |

|

|

|

108,162,965 |

|

|

|

105,014,057 |

|

(1) Provision for credit loss amounts previously classified within Corporate general and administrative have been reclassified to Provision for credit losses on our Consolidated Statements of Operations to conform with the current period presentation.

EBITDA

(Unaudited, in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

Net income |

|

$ |

5,115 |

|

|

$ |

6,081 |

|

|

$ |

14,849 |

|

|

$ |

16,273 |

|

Depreciation and amortization |

|

|

23,795 |

|

|

|

22,245 |

|

|

|

71,681 |

|

|

|

67,945 |

|

Interest expense |

|

|

16,209 |

|

|

|

12,046 |

|

|

|

45,210 |

|

|

|

35,739 |

|

Tax expense |

|

|

(431 |

) |

|

|

283 |

|

|

|

(458 |

) |

|

|

803 |

|

Unconsolidated real estate venture allocated share of above adjustments |

|

|

1,999 |

|

|

|

1,960 |

|

|

|

6,154 |

|

|

|

5,842 |

|

EBITDA |

|

$ |

46,687 |

|

|

$ |

42,615 |

|

|

$ |

137,436 |

|

|

$ |

126,602 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pro forma adjustments(1) |

|

|

853 |

|

|

|

|

|

|

|

|

|

|

Pro forma EBITDA |

|

$ |

47,540 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Pro forma assuming a full quarter of operations from the two operating properties acquired in the third quarter of 2024.

FFO and CAD

(Unaudited, in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

5,115 |

|

|

$ |

6,081 |

|

|

$ |

14,849 |

|

|

$ |

16,273 |

|

Depreciation of real estate assets |

|

|

23,543 |

|

|

|

21,995 |

|

|

|

70,926 |

|

|

|

67,194 |

|

Unconsolidated real estate venture allocated share of above adjustments |

|

|

1,976 |

|

|

|

1,887 |

|

|

|

5,984 |

|

|

|

5,637 |

|

FFO |

|

$ |

30,634 |

|

|

$ |

29,963 |

|

|

$ |

91,759 |

|

|

$ |

89,104 |

|

Adjustments to FFO: |

|

|

|

|

|

|

|

|

|

|

|

|

Loss on extinguishment of debt |

|

$ |

2 |

|

|

$ |

- |

|

|

$ |

260 |

|

|

$ |

14 |

|

Provision for credit losses |

|

|

1,260 |

|

|

|

- |

|

|

|

1,478 |

|

|

|

- |

|

Natural disaster event expense, net of recovery |

|

|

7 |

|

|

|

8 |

|

|

|

(1 |

) |

|

|

86 |

|

Depreciation of non-real estate assets |

|

|

252 |

|

|

|

250 |

|

|

|

755 |

|

|

|

751 |

|

Unconsolidated real estate venture allocated share of above adjustments |

|

|

17 |

|

|

|

17 |

|

|

|

50 |

|

|

|

50 |

|

Core FFO |

|

$ |

32,172 |

|

|

$ |

30,238 |

|

|

$ |

94,301 |

|

|

$ |

90,005 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FFO, per share - fully diluted basis |

|

$ |

0.28 |

|

|

$ |

0.28 |

|

|

$ |

0.85 |

|

|

$ |

0.85 |

|

Core FFO, per share - fully diluted basis |

|

$ |

0.30 |

|

|

$ |

0.29 |

|

|

$ |

0.87 |

|

|

$ |

0.86 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Core FFO |

|

$ |

32,172 |

|

|

$ |

30,238 |

|

|

$ |

94,301 |

|

|

$ |

90,005 |

|

Straight-line rent and other non-cash adjustments |

|

|

(1,349 |

) |

|

|

(1,296 |

) |

|

|

(3,123 |

) |

|

|

(2,661 |

) |

Amortization of above-/below-market leases |

|

|

(390 |

) |

|

|

(676 |

) |

|

|

(1,464 |

) |

|

|

(2,052 |

) |

Amortization of deferred revenue |

|

|

(1,762 |

) |

|

|

(1,572 |

) |

|

|

(5,125 |

) |

|

|

(4,678 |

) |

Non-cash interest expense |

|

|

662 |

|

|

|

264 |

|

|

|

1,358 |

|

|

|

752 |

|

Non-cash compensation |

|

|

(180 |

) |

|

|

1,658 |

|

|

|

2,209 |

|

|

|

4,625 |

|

Natural Disaster event expense, net of recovery |

|

|

(7 |

) |

|

|

(8 |

) |

|

|

1 |

|

|

|

(86 |

) |

Principal amortization |

|

|

(1,093 |

) |

|

|

(1,100 |

) |

|

|

(3,288 |

) |

|

|

(3,226 |

) |

Maintenance capital expenditures |

|

|

(2,672 |

) |

|

|

(3,207 |

) |

|

|

(8,209 |

) |

|

|

(8,276 |

) |

Contractual tenant improvements |

|

|

(287 |

) |

|

|

(355 |

) |

|

|

(860 |

) |

|

|

(1,368 |

) |

Unconsolidated real estate venture allocated share of above adjustments |

|

|

8 |

|

|

|

12 |

|

|

|

(7 |

) |

|

|

(62 |

) |

Cash Available for Distribution (CAD) |

|

$ |

25,102 |

|

|

$ |

23,958 |

|

|

$ |

75,793 |

|

|

$ |

72,973 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares outstanding - fully diluted basis |

|

|

108,488,604 |

|

|

|

105,888,188 |

|

|

|

108,162,965 |

|

|

|

105,014,057 |

|

Net Debt and Adjusted Net Debt

(Unaudited, in thousands)

|

|

|

|

|

September 30, 2024 |

|

Total Debt(1) |

$ |

1,481,463 |

|

Less: Cash and cash equivalents |

|

(33,239 |

) |

Net Debt |

$ |

1,448,224 |

|

Less: Adjustment for development projects(2) |

|

(121,270 |

) |

Adjusted Net Debt |

$ |

1,326,954 |

|

|

|

|

1 Excludes unamortized premiums / discounts and deferred financing fees.

2 See definition of Adjusted Net Debt on Page 5 of this release.

|

|

Disclaimers |

|

|

Forward-looking Statement

We make statements in this Supplemental Information Package that are considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, which are usually identified by the use of words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “may,” “plans,” “projects,” “seeks,” “should,” “will,” and variations of such words or similar expressions. We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and are including this statement in this Supplemental Information Package for purposes of complying with those safe harbor provisions. These forward-looking statements reflect our current views about our plans, intentions, expectations, strategies and prospects, which are based on the information currently available to us and on assumptions we have made. Although we believe that our plans, intentions, expectations, strategies and prospects as reflected in or suggested by those forward-looking statements are reasonable, we can give no assurance that the plans, intentions, expectations or strategies will be attained or achieved. Furthermore, actual results may differ materially from those described in the forward-looking statements and will be affected by a variety of risks and factors that are beyond our control including, without limitation: risks associated with our dependence on the U.S. Government and its agencies for substantially all of our revenues, including credit risk and risk that the U.S. Government reduces its spending on real estate or that it changes its preference away from leased properties; risks associated with ownership and development of real estate; the risk of decreased rental rates or increased vacancy rates; the loss of key personnel; general volatility of the capital and credit markets and the market price of our common stock; the risk we may lose one or more major tenants; difficulties in completing and successfully integrating acquisitions; failure of acquisitions or development projects to occur at anticipated levels or yield anticipated results; risks associated with our joint venture activities; risks associated with actual or threatened terrorist attacks; intense competition in the real estate market that may limit our ability to attract or retain tenants or re-lease space; insufficient amounts of insurance or exposure to events that are either uninsured or underinsured; uncertainties and risks related to adverse weather conditions, natural disasters and climate change; exposure to liability relating to environmental and health and safety matters; limited ability to dispose of assets because of the relative illiquidity of real estate investments and the nature of our assets; exposure to litigation or other claims; risks associated with breaches of our data security; risks associated with our indebtedness; risks associated with derivatives or hedging activity; risks associated with mortgage debt or unsecured financing or the unavailability thereof, which could make it difficult to finance or refinance properties and could subject us to foreclosure; adverse impacts from any future pandemic, epidemic or outbreak of any highly infectious disease on the U.S., regional and global economies and the financial condition and results of operations of the Company; and other risks and uncertainties detailed in the “Risk Factors” section of our Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission, or the SEC, on February 27, 2024 and included under the heading “Risk Factors” in our other public filings. In addition, our qualification as a real estate investment trust involves the application of highly technical and complex provisions of the Internal Revenue Code of 1986, or the Code, and depends on our ability to meet the various requirements imposed by the Code through actual operating results, distribution levels and diversity of stock ownership. We assume no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Ratings

Ratings are not recommendations to buy, sell or hold the Company’s securities.

The following discussion related to the consolidated financial statements of the Company should be read in conjunction with the financial statements for the quarter ended September 30, 2024 that will be released in our Form 10-Q to be filed with the SEC on or about November 5, 2024.

|

|

Supplemental Definitions |

|

|

This section contains definitions of certain non-GAAP financial measures and other terms that the Company uses in this Supplemental Information Package and, where applicable, the reasons why management believes these non-GAAP financial measures provide useful information to investors about the Company’s financial condition and results of operations and the other purposes for which management uses the measures. These measures should not be considered in isolation or as a substitute for measures of performance in accordance with GAAP. Additional detail can be found in the Company’s most recent quarterly report on Form 10-Q and the Company’s most recent annual report on Form 10-K, as well as other documents filed with or furnished to the SEC from time to time. We present certain financial information and metrics “at Easterly’s Share,” which is calculated on an entity-by-entity basis. “At Easterly’s Share” information, which we also refer to as being “at share,” “pro rata,” “our pro rata share” or “our share” is not, and is not intended to be, a presentation in accordance with GAAP.

Annualized lease income is defined as the annualized contractual base rent for the last month in a specified period, plus the annualized straight-line rent adjustments for the last month in such period and the annualized net expense reimbursements earned by us for the last month in such period.

Cash Available for Distribution (CAD) is a non-GAAP financial measure that is not intended to represent cash flow for the period and is not indicative of cash flow provided by operating activities as determined under GAAP. CAD is calculated in accordance with the current Nareit definition as FFO minus normalized recurring real estate-related expenditures and other non-cash items, nonrecurring expenditures and the unconsolidated real estate venture’s allocated share of these adjustments. CAD is presented solely as a supplemental disclosure because the Company believes it provides useful information regarding the Company’s ability to fund its dividends. Because all companies do not calculate CAD the same way, the presentation of CAD may not be comparable to similarly titled measures of other companies.

Cash fixed charge coverage ratio is calculated as EBITDA divided by the sum of principal amortization and interest expense, excluding amortization of premiums / discounts and deferred financing fees, for the most recent quarter.

Cash interest coverage ratio is calculated as EBITDA divided by interest expense, excluding amortization of premiums / discounts and deferred financing fees, for the most recent quarter.

Core Funds from Operations (Core FFO) adjusts FFO to present an alternative measure of the Company's operating performance, which, when applicable, excludes items which it believes are not representative of ongoing operating results, such as liability management related costs (including losses on extinguishment of debt and modification costs), catastrophic event charges, depreciation of non-real estate assets, provision for credit losses, and the unconsolidated real estate venture's allocated share of these adjustments. In future periods, the Company may also exclude other items from Core FFO that it believes may help investors compare its results. The Company believes Core FFO more accurately reflects the ongoing operational and financial performance of the Company's core business.

EBITDA is calculated as the sum of net income (loss) before interest expense, taxes, depreciation and amortization, (gain) loss on the sale of operating properties, impairment loss, and the unconsolidated real estate venture’s allocated share of these adjustments. EBITDA is not intended to represent cash flow for the period, is not presented as an alternative to operating income as an indicator of operating performance, should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP, is not indicative of operating income or cash provided by operating activities as determined under GAAP and may be presented on a pro forma basis. EBITDA is presented solely as a supplemental disclosure with respect to liquidity because the Company believes it provides useful information regarding the Company's ability to service or incur debt. Because all companies do not calculate EBITDA the same way, the presentation of EBITDA may not be comparable to similarly titled measures of other companies.

Fully diluted basis assumes the exchange of all outstanding common units representing limited partnership interests in the Company’s operating partnership, or common units, the full vesting of all shares of restricted stock, and the exchange of all earned and vested LTIP units in the Company’s operating partnership for shares of common stock on a one-for-one basis, which is not the same as the meaning of “fully diluted” under GAAP.

|

|

Supplemental Definitions |

|

|

Funds From Operations (FFO) is defined, in accordance with the Nareit FFO White Paper - 2018 Restatement, as net income (loss), calculated in accordance with GAAP, excluding depreciation and amortization related to real estate, gains and losses from the sale of certain real estate assets, gains and losses from change in control and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. FFO includes the Company’s share of FFO generated by unconsolidated affiliates. FFO is a widely recognized measure of REIT performance. Although FFO is a non-GAAP financial measure, the Company believes that information regarding FFO is helpful to shareholders and potential investors.

Net Debt and Adjusted Net Debt Net Debt represents the Company's consolidated debt and its share of unconsolidated debt adjusted to exclude its share of unamortized premiums and discounts and deferred financing fees, less its share of cash and cash equivalents and property acquisition closing escrow, net of deposit. By excluding these items, the result provides an estimate of the contractual amount of borrowed capital to be repaid, net of cash available to repay it. The Company believes this calculation constitutes a beneficial supplemental non-GAAP financial disclosure to investors in understanding its financial condition. Adjusted Net Debt is Net Debt reduced by 1) for each project under construction or in design, the lesser of i) outstanding lump-sum reimbursement amounts and ii) the cost to date, 2) 40% times the amount by which the cost to date exceeds total lump-sum reimbursement amounts for each project under construction or in design and 3) outstanding lump-sum reimbursement amounts for projects previously completed. These adjustments are made to 1) remove the estimated portion of each project under construction, in design or previously completed that has been financed with debt which may be repaid with outstanding cost reimbursement payments from the US Government and 2) remove the estimated portion of each project under construction or in design, in excess of total lump-sum reimbursements, that has been financed with debt but has not yet produced earnings. See page 25 for further information. The Company’s method of calculating Net Debt and Adjusted Net Debt may be different from methods used by other REITs and may be presented on a pro forma basis. Accordingly, the Company's method may not be comparable to such other REITs.

Net Operating Income (NOI) and Cash NOI NOI is calculated as net income adjusted to exclude depreciation and amortization, acquisition costs, corporate general and administrative costs, provision for credit losses, interest expense, gains or losses from sales of property, impairment loss, and the unconsolidated real estate venture’s allocated share of these adjustments. Cash NOI excludes from NOI straight-line rent, amortization of above-/below-market leases, amortization of deferred revenue (which results from landlord assets funded by tenants), and the unconsolidated real estate venture’s allocated share of these adjustments. NOI and Cash NOI presented by the Company may not be comparable to NOI and Cash NOI reported by other REITs that define NOI and Cash NOI differently. The Company believes that NOI and Cash NOI provide investors with useful measures of the operating performance of its properties. NOI and Cash NOI should not be considered an alternative to net income as an indication of the Company's performance or to cash flows as a measure of the Company's liquidity or its ability to make distributions.

|

|

Table of Contents |

|

|

|

|

Corporate Information and Analyst Coverage |

|

|

|

|

|

|

Corporate Information |

|

|

|

|

Corporate Headquarters |

Stock Exchange Listing |

Information Requests |

Investor Relations |

2001 K Street NW |

New York Stock Exchange |

Please contact ir@easterlyreit.com |

Lindsay Winterhalter |

Suite 775 North |

|

or 202-596-3947 to request an |

Senior VP, Investor Relations & Operations |

Washington, DC 20006 |

Ticker |

Investor Relations package |

|

202-595-9500 |

DEA |

|

|

|

|

|

|

Executive Team |

|

Board of Directors |

|

Darrell Crate, President & CEO |

Mark Bauer, EVP Development |

William Binnie, Chairman |

Emil Henry Jr. |

Michael Ibe, Vice-Chairman & EVP |

Franklin Logan, GC |

Darrell Crate |

Michael Ibe |

Allison Marino, CFO & CAO |

Andrew Pulliam, EVP Acquisitions |

Cynthia Fisher |

Tara Innes |

Stuart Burns, EVP Government Relations |

|

Scott Freeman |

|

Nick Nimerala, SVP Chief Asset Officer |

|

|

|

|

|

|

Equity Research Coverage |

|

|

|

|

|

Citigroup |

Raymond James & Associates |

RBC Capital Markets |

Michael A. Griffin |

Jonathan Hughes |

Michael Carroll |

212-816-5871 |

727-567-2438 |

440-715-2649 |

|

|

|

Jefferies |

Truist Securities |

Compass Point Research & Trading, LLC |

Peter Abramowitz |

Michael R. Lewis |

Merrill Ross |

212-336-7241 |

212-319-5659 |

202-534-1392 |

|

|

|

BMO Capital Markets |

|

|

John P. Kim |

|

|

212-885-4115 |

|

|

Any opinions, estimates, forecasts or predictions regarding Easterly Government Properties, Inc.’s performance made by these analysts are theirs alone and do not represent opinions, estimates, forecasts or predictions of Easterly Government Properties, Inc. or its management. Easterly Government Properties, Inc. does not by its reference above or distribution imply its endorsement of or concurrence with such opinions, estimates, forecasts or predictions.

|

|

Executive Summary (In thousands, except share and per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Outstanding Classes of Stock and Partnership Units - Fully Diluted Basis |

At September 30, 2024 |

|

|

Earnings |

Three months ended September 30, 2024 |

|

Three months ended September 30, 2023 |

|

Common shares |

|

105,619,594 |

|

|

Net income available to Easterly Government Properties, Inc. |

$ |

4,863 |

|

$ |

5,374 |

|

Unvested restricted shares |

|

46,735 |

|

|

Net income available to Easterly Government Properties, Inc. |

|

|

|

|

Common partnership and vested LTIP units |

|

5,339,579 |

|

|

per share: |

|

|

|

|

Total - fully diluted basis |

|

111,005,908 |

|

|

Basic |

$ |

0.05 |

|

$ |

0.06 |

|

|

|

|

|

Diluted |

$ |

0.05 |

|

$ |

0.06 |

|

|

|

|

|

|

|

|

|

|

Market Capitalization |

At September 30, 2024 |

|

|

Net income |

$ |

5,115 |

|

$ |

6,081 |

|

Price of Common Shares |

$ |

13.58 |

|

|

Net income, per share - fully diluted basis |

$ |

0.05 |

|

$ |

0.06 |

|

Total equity market capitalization - fully diluted basis |

$ |

1,507,460 |

|

|

Funds From Operations (FFO) |

$ |

30,634 |

|

$ |

29,963 |

|

Net Debt |

|

1,448,224 |

|

|

FFO, per share - fully diluted basis |

$ |

0.28 |

|

$ |

0.28 |

|

Total enterprise value |

$ |

2,955,685 |

|

|

|

|

|

|

|

|

|

|

|

Core FFO |

$ |

32,172 |

|

$ |

30,238 |

|

|

|

|

|

Core FFO, per share - fully diluted basis |

$ |

0.30 |

|

$ |

0.29 |

|

Ratios |

At September 30, 2024 |

|

|

|

|

|

|

|

Net debt to total enterprise value |

|

49.0 |

% |

|

Cash Available for Distribution (CAD) |

$ |

25,102 |

|

$ |

23,958 |

|

Net debt to annualized quarterly EBITDA |

|

7.8 |

x |

|

|

|

|

|

|

Adjusted Net Debt to annualized quarterly pro forma EBITDA |

|

7.0 |

x |

|

Liquidity |

At September 30, 2024 |

|

Cash interest coverage ratio |

|

3.0 |

x |

|

Cash and cash equivalents |

|

|

$ |

33,239 |

|

Cash fixed charge coverage ratio |

|

2.8 |

x |

|

Available under $400 million senior unsecured 2024 revolving credit facility(1) |

|

$ |

250,325 |

|

|

|

|

|

|

|

|

|

|

(1) 2024 revolving credit facility has an accordion feature that provides additional capacity, subject to syndication of the increase and the satisfaction of customary terms and conditions, of up to $300 million, for a total revolving credit facility size of not more than $700 million.

|

|

Balance Sheets (Unaudited, in thousands, except share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2024 |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Real estate properties, net |

|

$ |

2,457,256 |

|

|

$ |

2,319,143 |

|

Cash and cash equivalents |

|

|

31,202 |

|

|

|

9,381 |

|

Restricted cash |

|

|

8,005 |

|

|

|

12,558 |

|

Tenant accounts receivable |

|

|

70,280 |

|

|

|

66,274 |

|

Investment in unconsolidated real estate venture |

|

|

315,886 |

|

|

|

284,544 |

|

Real estate loan receivable, net |

|

|

30,689 |

|

|

|

- |

|

Intangible assets, net |

|

|

146,204 |

|

|

|

148,453 |

|

Interest rate swaps |

|

|

514 |

|

|

|

1,994 |

|

Prepaid expenses and other assets |

|

|

41,073 |

|

|

|

37,405 |

|

Assets held for sale |

|

|

2,002 |

|

|

|

- |

|

Total assets |

|

$ |

3,103,111 |

|

|

$ |

2,879,752 |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

|

Revolving credit facility |

|

|

149,550 |

|

|

|

79,000 |

|

Term loan facilities, net |

|

|

273,851 |

|

|

|

299,108 |

|

Notes payable, net |

|

|

894,523 |

|

|

|

696,532 |

|

Mortgage notes payable, net |

|

|

156,653 |

|

|

|

220,195 |

|

Intangible liabilities, net |

|

|

11,367 |

|

|

|

12,480 |

|

Deferred revenue |

|

|

121,767 |

|

|

|

82,712 |

|

Accounts payable, accrued expenses and other liabilities |

|

|

113,766 |

|

|

|

80,209 |

|

Total liabilities |

|

|

1,721,477 |

|

|

|

1,470,236 |

|

|

|

|

|

|

|

|

Equity |

|

|

|

|

|

|

Common stock, par value $0.01, 200,000,000 shares authorized,

105,666,329 and 100,973,247 shares issued and outstanding at

September 30, 2024 and December 31, 2023, respectively |

|

|

1,056 |

|

|

|

1,010 |

|

Additional paid-in capital |

|

|

1,845,271 |

|

|

|

1,783,338 |

|

Retained earnings |

|

|

126,401 |

|

|

|

112,301 |

|

Cumulative dividends |

|

|

(658,042 |

) |

|

|

(576,319 |

) |

Accumulated other comprehensive income |

|

|

489 |

|

|

|

1,871 |

|

Total stockholders' equity |

|

|

1,315,175 |

|

|

|

1,322,201 |

|

Non-controlling interest in Operating Partnership |

|

|

66,459 |

|

|

|

87,315 |

|

Total equity |

|

|

1,381,634 |

|

|

|

1,409,516 |

|

Total liabilities and equity |

|

$ |

3,103,111 |

|

|

$ |

2,879,752 |

|

|

|

|

|

|

|

|

|

|

Income Statements (Unaudited, in thousands, except share and per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

|

September 30, 2024 |

|

|

September 30, 2023 |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Rental income |

|

$ |

72,536 |

|

|

$ |

68,205 |

|

|

$ |

215,465 |

|

|

$ |

204,111 |

|

Tenant reimbursements |

|

|

663 |

|

|

|

2,704 |

|

|

|

4,494 |

|

|

|

7,279 |

|

Asset management income |

|

|

579 |

|

|

|

526 |

|

|

|

1,680 |

|

|

|

1,560 |

|

Other income |

|

|

1,003 |

|

|

|

579 |

|

|

|

2,163 |

|

|

|

1,657 |

|

Total revenues |

|

|

74,781 |

|

|

|

72,014 |

|

|

|

223,802 |

|

|

|

214,607 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Property operating |

|

|

16,710 |

|

|

|

18,746 |

|

|

|

51,420 |

|

|

|

54,263 |

|

Real estate taxes |

|

|

8,000 |

|

|

|

7,814 |

|

|

|

24,072 |

|

|

|

22,901 |

|

Depreciation and amortization |

|

|

23,795 |

|

|

|

22,245 |

|

|

|

71,681 |

|

|

|

67,945 |

|

Acquisition costs |

|

|

600 |

|

|

|

321 |

|

|

|

1,427 |

|

|

|

1,226 |

|

Corporate general and administrative |

|

|

4,667 |

|

|

|

6,107 |

|

|

|

18,032 |

|

|

|

20,426 |

|

Provision for credit losses (1) |

|

|

1,260 |

|

|

|

- |

|

|

|

1,478 |

|

|

|

- |

|

Total expenses |

|

|

55,032 |

|

|

|

55,233 |

|

|

|

168,110 |

|

|

|

166,761 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

Income from unconsolidated real estate venture |

|

|

1,575 |

|

|

|

1,346 |

|

|

|

4,367 |

|

|

|

4,166 |

|

Interest expense, net |

|

|

(16,209 |

) |

|

|

(12,046 |

) |

|

|

(45,210 |

) |

|

|

(35,739 |

) |

Net income |

|

|

5,115 |

|

|

|

6,081 |

|

|

|

14,849 |

|

|

|

16,273 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest in Operating Partnership |

|

|

(252 |

) |

|

|

(707 |

) |

|

|

(749 |

) |

|

|

(1,905 |

) |

Net income available to Easterly Government |

|

|

|

|

|

|

|

|

|

|

|

|

Properties, Inc. |

|

$ |

4,863 |

|

|

$ |

5,374 |

|

|

$ |

14,100 |

|

|

$ |

14,368 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|