Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

September 23 2024 - 12:33PM

Edgar (US Regulatory)

DNP SELECT INCOME FUND INC.

SCHEDULE OF INVESTMENTS

July 31, 2024

(Unaudited)

|

|

|

|

|

|

|

|

|

| Shares |

|

|

Description |

|

Value |

|

| |

|

|

|

|

|

|

|

|

| |

COMMON STOCKS & MLP INTERESTS - 111.9% |

|

|

|

|

|

|

|

|

|

|

|

ELECTRIC, GAS AND WATER - 74.4% |

|

|

|

|

| |

1,650,657 |

|

|

Alliant Energy Corp. (a) |

|

|

$91,875,569 |

|

| |

1,229,716 |

|

|

Ameren Corp. (a) |

|

|

97,479,587 |

|

| |

657,210 |

|

|

American Electric Power Co.,

Inc. (a) |

|

|

64,485,445 |

|

| |

293,942 |

|

|

American Water Works

Co. (a)(b) |

|

|

41,845,583 |

|

| |

627,315 |

|

|

Atmos Energy Corp. (a) |

|

|

80,221,042 |

|

| |

389,700 |

|

|

Black Hills Corp. |

|

|

23,011,785 |

|

| |

3,548,252 |

|

|

CenterPoint Energy,

Inc. (a) |

|

|

98,463,993 |

|

| |

1,406,609 |

|

|

CMS Energy Corp. (a) |

|

|

91,148,263 |

|

| |

1,238,640 |

|

|

Dominion Energy, Inc. (a) |

|

|

66,217,694 |

|

| |

591,120 |

|

|

DTE Energy Co. (a) |

|

|

71,247,694 |

|

| |

6,934,037 |

|

|

EDP-Energias de Portugal, S.A. (Portugal) |

|

|

28,512,591 |

|

| |

1,530,055 |

|

|

Emera Inc. (Canada) |

|

|

55,201,376 |

|

| |

5,332,200 |

|

|

Enel S.p.A. (Italy) |

|

|

38,047,165 |

|

| |

575,595 |

|

|

Entergy Corp. (a) |

|

|

66,751,752 |

|

| |

1,548,410 |

|

|

Essential Utilities,

Inc. (a)(b) |

|

|

62,942,867 |

|

| |

1,298,286 |

|

|

Evergy, Inc. (a) |

|

|

75,300,588 |

|

| |

482,140 |

|

|

Eversource Energy (a)(b) |

|

|

31,295,707 |

|

| |

1,138,500 |

|

|

FirstEnergy Corp. (a) |

|

|

47,714,535 |

|

| |

981,900 |

|

|

Fortis Inc. (Canada) |

|

|

41,025,928 |

|

| |

3,539,400 |

|

|

Iberdrola, S.A. (Spain) |

|

|

46,649,164 |

|

| |

4,377,587 |

|

|

National Grid plc (United Kingdom) |

|

|

55,440,964 |

|

| |

875,590 |

|

|

New Jersey Resources

Corp. (a) |

|

|

40,933,832 |

|

| |

1,243,797 |

|

|

NextEra Energy, Inc. (a)(b) |

|

|

95,013,653 |

|

| |

2,797,315 |

|

|

NiSource Inc. (a) |

|

|

87,416,094 |

|

| |

779,470 |

|

|

Northwest Natural Holding Co. |

|

|

31,163,211 |

|

| |

1,870,780 |

|

|

OGE Energy Corp. (a) |

|

|

72,530,141 |

|

| |

576,000 |

|

|

ONE Gas, Inc. (a)(b) |

|

|

40,106,880 |

|

| |

2,106,700 |

|

|

PG&E Corp. (a) |

|

|

38,447,275 |

|

| |

624,930 |

|

|

Pinnacle West Capital

Corp. (a) |

|

|

53,487,759 |

|

| |

1,488,861 |

|

|

PPL Corp. |

|

|

44,248,949 |

|

| |

1,000,879 |

|

|

Public Service Enterprise Group

Inc. (a) |

|

|

79,840,118 |

|

| |

1,329,191 |

|

|

Sempra Energy (a) |

|

|

106,415,031 |

|

| |

616,000 |

|

|

Severn Trent Plc. (United Kingdom) |

|

|

20,342,384 |

|

| |

1,048,771 |

|

|

Southern Co. (a) |

|

|

87,593,354 |

|

| |

776,340 |

|

|

Spire Inc. (a)(b) |

|

|

51,696,481 |

|

| |

1,126,885 |

|

|

WEC Energy Group, Inc. (a) |

|

|

96,979,723 |

|

| |

1,686,151 |

|

|

Xcel Energy Inc. (a) |

|

|

98,268,880 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,319,363,057 |

|

|

|

|

|

|

|

|

|

|

The accompanying note

is an integral part of this financial statement.

1

DNP SELECT INCOME FUND INC.

SCHEDULE OF INVESTMENTS — (Continued)

July 31, 2024

(Unaudited)

|

|

|

|

|

|

|

|

|

| Shares |

|

|

Description |

|

Value |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OIL & GAS STORAGE, TRANSPORTATION AND PRODUCTION - 22.1% |

|

|

|

|

| |

475,000 |

|

|

Cheniere Energy, Inc. (a) |

|

|

$86,754,000 |

|

| |

958,145 |

|

|

Enbridge Inc. (Canada) |

|

|

35,853,786 |

|

| |

3,650,062 |

|

|

Energy Transfer Equity LP |

|

|

59,386,509 |

|

| |

1,700,000 |

|

|

Enterprise Products Partners LP |

|

|

49,062,000 |

|

| |

1,000,000 |

|

|

Keyera Corp. (Canada) |

|

|

28,195,012 |

|

| |

1,625,026 |

|

|

Kinder Morgan, Inc. (a) |

|

|

34,336,799 |

|

| |

75,000 |

|

|

Marathon Petroleum Corp. |

|

|

13,276,500 |

|

| |

1,343,852 |

|

|

MPLX LP |

|

|

57,543,743 |

|

| |

317,391 |

|

|

New Fortress Energy Inc. |

|

|

6,265,298 |

|

| |

650,000 |

|

|

ONEOK, Inc. |

|

|

54,164,500 |

|

| |

1,151,600 |

|

|

Pembina Pipeline Corp. (Canada) |

|

|

44,606,838 |

|

| |

1,989,900 |

|

|

Plains All American Pipeline, LP |

|

|

36,196,281 |

|

| |

500,000 |

|

|

Targa Resources Corp. |

|

|

67,640,000 |

|

| |

1,150,000 |

|

|

TC Energy Corp.

(Canada) (a)(b) |

|

|

48,771,500 |

|

| |

55,000 |

|

|

Valero Energy Corp. |

|

|

8,894,600 |

|

| |

1,300,000 |

|

|

The Williams Companies, Inc. |

|

|

55,822,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

686,769,366 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TELECOMMUNICATIONS - 15.4% |

|

|

|

|

| |

374,650 |

|

|

American Tower Corp. (a) |

|

|

82,572,860 |

|

| |

2,584,500 |

|

|

AT&T Inc. (a)(b) |

|

|

49,751,625 |

|

| |

1,216,375 |

|

|

BCE Inc. (Canada) (a)(b) |

|

|

41,028,329 |

|

| |

730,050 |

|

|

Cellnex Telecom SA (Spain) |

|

|

25,421,758 |

|

| |

1,089,400 |

|

|

Comcast Corp. Class A (a) |

|

|

44,959,538 |

|

| |

735,895 |

|

|

Crown Castle Inc. (a)(b) |

|

|

81,007,322 |

|

| |

65,143 |

|

|

Equinix, Inc. (a) |

|

|

51,478,604 |

|

| |

2,666,500 |

|

|

Telus Corp. (Canada) |

|

|

43,024,565 |

|

| |

1,339,489 |

|

|

Verizon Communications

Inc. (a) |

|

|

54,276,094 |

|

| |

782,200 |

|

|

Vodafone Group Plc ADR (United Kingdom) |

|

|

7,321,392 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

480,842,087 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Common Stocks & MLP Interests |

|

|

|

|

|

|

|

|

(Cost $2,757,859,630) |

|

|

3,486,974,510 |

|

|

|

|

|

|

|

|

|

|

The accompanying note

is an integral part of this financial statement.

2

DNP SELECT INCOME FUND INC.

SCHEDULE OF INVESTMENTS — (Continued)

July 31, 2024

(Unaudited)

|

|

|

|

|

|

|

|

|

| Par Value |

|

|

Description |

|

Value |

|

| |

|

|

|

|

|

|

|

|

| |

BONDS - 22.2% |

|

|

|

|

|

|

|

|

|

|

|

ELECTRIC, GAS AND WATER - 11.5% |

|

|

|

|

| |

$6,000,000 |

|

|

AEP Texas Inc. |

|

|

|

|

|

|

|

|

5.40%, 6/01/33 |

|

|

$5,995,132 |

|

| |

7,000,000 |

|

|

Ameren Corp. |

|

|

|

|

|

|

|

|

5.70%, 12/01/26 |

|

|

7,121,602 |

|

| |

15,000,000 |

|

|

American Electric Power |

|

|

|

|

|

|

|

|

5 5/8%, 3/01/33 |

|

|

15,394,225 |

|

| |

18,500,000 |

|

|

American Water Capital Corp. |

|

|

|

|

|

|

|

|

3.40%, 3/01/25 (a)(b) |

|

|

18,292,415 |

|

| |

10,000,000 |

|

|

American Water Capital Corp. |

|

|

|

|

|

|

|

|

5.15%, 3/01/34 |

|

|

10,165,010 |

|

| |

22,000,000 |

|

|

Arizona Public Service Co. |

|

|

|

|

|

|

|

|

6 7/8%, 8/01/36 (a)(b) |

|

|

24,186,337 |

|

| |

10,000,000 |

|

|

Atlantic City Electric |

|

|

|

|

|

|

|

|

3 3/8%, 9/01/24 |

|

|

9,977,852 |

|

| |

10,000,000 |

|

|

Berkshire Hathaway Inc. |

|

|

|

|

|

|

|

|

8.48%, 9/15/28 (a)(b) |

|

|

11,457,636 |

|

| |

9,000,000 |

|

|

CMS Energy Corp. |

|

|

|

|

|

|

|

|

3.45%, 8/15/27 (a)(b) |

|

|

8,696,066 |

|

| |

8,000,000 |

|

|

Connecticut Light & Power Co. |

|

|

|

|

|

|

|

|

3.20%, 3/15/27 |

|

|

7,720,447 |

|

| |

10,000,000 |

|

|

DPL Capital Trust II |

|

|

|

|

|

|

|

|

8 1/8%, 9/01/31 |

|

|

9,400,000 |

|

| |

10,000,000 |

|

|

DTE Electric Co. |

|

|

|

|

|

|

|

|

5.10%, 3/1/29 |

|

|

10,095,177 |

|

| |

9,500,000 |

|

|

DTE Electric Co. |

|

|

|

|

|

|

|

|

5.85%, 6/1/34 |

|

|

9,894,598 |

|

| |

10,000,000 |

|

|

Duke Energy Corp. |

|

|

|

|

|

|

|

|

3.15%, 8/15/27 (a)(b) |

|

|

9,562,748 |

|

| |

5,000,000 |

|

|

Duke Energy Ohio, Inc. |

|

|

|

|

|

|

|

|

3.65%, 2/1/29 (a)(b) |

|

|

4,801,551 |

|

| |

8,000,000 |

|

|

Edison International |

|

|

|

|

|

|

|

|

4.70%, 8/15/25 (a)(b) |

|

|

7,952,241 |

|

| |

5,600,000 |

|

|

Edison International |

|

|

|

|

|

|

|

|

4 1/8%, 3/15/28 |

|

|

5,441,247 |

|

| |

9,970,000 |

|

|

Entergy Louisiana, LLC |

|

|

|

|

|

|

|

|

4.44%, 1/15/26 (a)(b) |

|

|

9,922,344 |

|

| |

7,000,000 |

|

|

Entergy Louisiana, LLC |

|

|

|

|

|

|

|

|

3.12%, 9/01/27 (a)(b) |

|

|

6,704,317 |

|

| |

4,000,000 |

|

|

Entergy Texas, Inc. |

|

|

|

|

|

|

|

|

4.00%, 3/30/29 |

|

|

3,889,871 |

|

| |

4,000,000 |

|

|

Essential Utilities, Inc. |

|

|

|

|

|

|

|

|

3.57%, 5/01/29 (a)(b) |

|

|

3,796,693 |

|

| |

10,000,000 |

|

|

Eversource Energy |

|

|

|

|

|

|

|

|

4 1/4%, 4/01/29 |

|

|

9,720,712 |

|

The accompanying note

is an integral part of this financial statement.

3

DNP SELECT INCOME FUND INC.

SCHEDULE OF INVESTMENTS — (Continued)

July 31, 2024

(Unaudited)

|

|

|

|

|

|

|

|

|

| Par Value |

|

|

Description |

|

Value |

|

| |

|

|

|

|

|

|

|

|

| |

$5,000,000 |

|

|

Florida Power & Light Co. |

|

|

|

|

|

|

|

|

5.30%, 6/15/34 |

|

|

$5,174,849 |

|

| |

18,000,000 |

|

|

Interstate Power & Light |

|

|

|

|

|

|

|

|

3 1/4%, 12/01/24 |

|

|

17,863,047 |

|

| |

6,000,000 |

|

|

Kentucky Utilities Co. |

|

|

|

|

|

|

|

|

5.45%, 4/15/33 |

|

|

6,204,335 |

|

| |

5,000,000 |

|

|

Nextera Energy Capital |

|

|

|

|

|

|

|

|

4.45% 6/20/25 (a)(b) |

|

|

4,965,418 |

|

| |

19,000,000 |

|

|

NiSource Finance Corp. |

|

|

|

|

|

|

|

|

3.49%, 5/15/27 (a)(b) |

|

|

18,358,263 |

|

| |

5,000,000 |

|

|

Ohio Power Co. |

|

|

|

|

|

|

|

|

6.60%, 2/15/33 (a)(b) |

|

|

5,453,145 |

|

| |

10,000,000 |

|

|

Progress Energy Inc. |

|

|

|

|

|

|

|

|

7 3/4%, 3/01/31 |

|

|

11,485,334 |

|

| |

5,000,000 |

|

|

Public Service Electric |

|

|

|

|

|

|

|

|

3.00%, 5/15/25 |

|

|

4,916,498 |

|

| |

10,000,000 |

|

|

Public Service Electric |

|

|

|

|

|

|

|

|

3.00%, 5/15/27 (a)(b) |

|

|

9,608,945 |

|

| |

5,000,000 |

|

|

Public Service New Mexico |

|

|

|

|

|

|

|

|

3.85%, 8/01/25 |

|

|

4,920,129 |

|

| |

5,000,000 |

|

|

Sempra Energy |

|

|

|

|

|

|

|

|

5.50%, 8/01/33 |

|

|

5,120,195 |

|

| |

6,000,000 |

|

|

Southern California Gas Co. |

|

|

|

|

|

|

|

|

3.15%, 9/15/24 |

|

|

5,986,860 |

|

| |

16,300,000 |

|

|

Southern Power Co. |

|

|

|

|

|

|

|

|

4.15%, 12/01/25 (a)(b) |

|

|

16,136,282 |

|

| |

9,000,000 |

|

|

Southern Power Co. |

|

|

|

|

|

|

|

|

5 3/4%, 9/15/33 |

|

|

9,432,091 |

|

| |

8,500,000 |

|

|

Virginia Electric & Power Co. |

|

|

|

|

|

|

|

|

3 1/2%, 3/15/27 (a)(b) |

|

|

8,268,591 |

|

| |

4,000,000 |

|

|

Virginia Electric & Power Co. |

|

|

|

|

|

|

|

|

2 7/8%, 7/15/29 |

|

|

3,689,769 |

|

| |

2,880,000 |

|

|

Wisconsin Energy Corp. |

|

|

|

|

|

|

|

|

3.55%, 6/15/25 (a)(b) |

|

|

2,834,297 |

|

| |

9,000,000 |

|

|

Xcel Energy Inc. |

|

|

|

|

|

|

|

|

3.35%, 12/01/26 (a)(b) |

|

|

8,695,462 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

359,301,731 |

|

|

|

|

|

|

|

|

|

|

The accompanying note

is an integral part of this financial statement.

4

DNP SELECT INCOME FUND INC.

SCHEDULE OF INVESTMENTS — (Continued)

July 31, 2024

(Unaudited)

|

|

|

|

|

|

|

|

|

| Par Value |

|

|

Description |

|

Value |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OIL & GAS STORAGE, TRANSPORTATION AND PRODUCTION - 7.1% |

|

|

|

|

| |

$4,000,000 |

|

|

Conoco Inc. |

|

|

|

|

|

|

|

|

6.95%, 4/15/29 |

|

|

$4,400,809 |

|

| |

20,000,000 |

|

|

Enbridge Inc. (Canada) |

|

|

|

|

|

|

|

|

4 1/4%, 12/01/26 (a)(b) |

|

|

19,740,072 |

|

| |

5,000,000 |

|

|

Energy Transfer Partners |

|

|

|

|

|

|

|

|

9.00%, 11/1/24 |

|

|

5,032,902 |

|

| |

3,000,000 |

|

|

Energy Transfer Partners |

|

|

|

|

|

|

|

|

4.05%, 3/15/25 (a)(b) |

|

|

2,974,769 |

|

| |

8,850,000 |

|

|

Energy Transfer Partners |

|

|

|

|

|

|

|

|

8 1/4%, 11/15/29 (a)(b) |

|

|

10,122,022 |

|

| |

5,000,000 |

|

|

Energy Transfer Partners |

|

|

|

|

|

|

|

|

6.55%, 12/01/33 |

|

|

5,401,941 |

|

| |

7,900,000 |

|

|

Energy Transfer Partners |

|

|

|

|

|

|

|

|

5.80%, 6/15/38 |

|

|

8,033,983 |

|

| |

6,000,000 |

|

|

Enterprise Products Operating LP |

|

|

|

|

|

|

|

|

3 1/8%, 7/31/29 |

|

|

5,602,096 |

|

| |

8,000,000 |

|

|

Enterprise Products Operating LP |

|

|

|

|

|

|

|

|

5.35%, 1/31/33 |

|

|

8,274,650 |

|

| |

5,000,000 |

|

|

Kinder Morgan Energy Partners, LP |

|

|

|

|

|

|

|

|

7 3/4%, 3/15/32 (a)(b) |

|

|

5,747,478 |

|

| |

16,000,000 |

|

|

Kinder Morgan Energy Partners, LP |

|

|

|

|

|

|

|

|

5.80%, 3/15/35 |

|

|

16,513,338 |

|

| |

8,000,000 |

|

|

MPLX LP |

|

|

|

|

|

|

|

|

4 1/4%, 12/01/27 |

|

|

7,846,839 |

|

| |

7,000,000 |

|

|

MPLX LP |

|

|

|

|

|

|

|

|

4.95%, 9/01/32 |

|

|

6,858,505 |

|

| |

5,000,000 |

|

|

MPLX LP |

|

|

|

|

|

|

|

|

5.00%, 3/01/33 |

|

|

4,894,794 |

|

| |

11,000,000 |

|

|

ONEOK, Inc. |

|

|

|

|

|

|

|

|

5.00%, 3/1/26 (a)(b) |

|

|

11,002,458 |

|

| |

11,000,000 |

|

|

ONEOK, Inc. |

|

|

|

|

|

|

|

|

6.00%, 6/15/35 |

|

|

11,539,630 |

|

| |

7,500,000 |

|

|

ONEOK Partners, LP |

|

|

|

|

|

|

|

|

4.90%, 3/15/25 (a)(b) |

|

|

7,472,928 |

|

| |

16,000,000 |

|

|

Phillips 66 |

|

|

|

|

|

|

|

|

3.90%, 3/15/28 (a)(b) |

|

|

15,560,064 |

|

| |

10,000,000 |

|

|

Plains All American Pipeline, LP |

|

|

|

|

|

|

|

|

4.65%, 10/15/25 |

|

|

9,934,766 |

|

| |

20,000,000 |

|

|

Targa Resource Partners |

|

|

|

|

|

|

|

|

6 1/2%, 7/15/27 (a)(b) |

|

|

20,213,920 |

|

| |

18,500,000 |

|

|

Valero Energy Partners LP |

|

|

|

|

|

|

|

|

4 1/2%, 3/15/28 (a)(b) |

|

|

18,296,731 |

|

| |

15,000,000 |

|

|

The Williams Companies, Inc. |

|

|

|

|

|

|

|

|

5.15%, 3/15/34 |

|

|

14,967,020 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

220,431,715 |

|

|

|

|

|

|

|

|

|

|

The accompanying note

is an integral part of this financial statement.

5

DNP SELECT INCOME FUND INC.

SCHEDULE OF INVESTMENTS — (Continued)

July 31, 2024

(Unaudited)

|

|

|

|

|

|

|

|

|

| Par Value |

|

|

Description |

|

Value |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TELECOMMUNICATIONS - 3.6% |

|

|

|

|

| |

$5,000,000 |

|

|

American Tower Corp. |

|

|

|

|

|

|

|

|

5.80%, 11/15/28 |

|

|

$5,189,377 |

|

| |

8,000,000 |

|

|

American Tower Corp. |

|

|

|

|

|

|

|

|

5.65%, 3/15/33 |

|

|

8,254,504 |

|

| |

8,000,000 |

|

|

AT&T Inc. |

|

|

|

|

|

|

|

|

2.30%, 6/01/27 (a)(b) |

|

|

7,504,627 |

|

| |

5,900,000 |

|

|

Comcast Corp. |

|

|

|

|

|

|

|

|

7.05%, 3/15/33 (a)(b) |

|

|

6,758,795 |

|

| |

5,000,000 |

|

|

Comcast Corp. |

|

|

|

|

|

|

|

|

7 1/8%, 2/15/28 |

|

|

5,411,679 |

|

| |

17,000,000 |

|

|

Crown Castle Inc. |

|

|

|

|

|

|

|

|

4.45%, 2/15/26 (a)(b) |

|

|

16,843,081 |

|

| |

9,000,000 |

|

|

Digital Realty Trust, Inc. |

|

|

|

|

|

|

|

|

3.60%, 7/01/29 |

|

|

8,502,361 |

|

| |

15,000,000 |

|

|

Koninklijke KPN NV (Netherlands) |

|

|

|

|

|

|

|

|

8 3/8%, 10/01/30 (a)(b) |

|

|

17,589,151 |

|

| |

10,000,000 |

|

|

Telus Corp. |

|

|

|

|

|

|

|

|

2.80% 2/16/27 (a)(b) |

|

|

9,532,064 |

|

| |

15,500,000 |

|

|

Verizon Global Funding Corp. |

|

|

|

|

|

|

|

|

7 3/4%, 12/01/30 |

|

|

18,040,150 |

|

| |

7,500,000 |

|

|

Vodafone Group Plc (United Kingdom) |

|

|

|

|

|

|

|

|

7 7/8%, 2/15/30 |

|

|

8,642,419 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

112,268,208 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Bonds |

|

|

|

|

|

|

|

|

(Cost $694,983,110) |

|

|

692,001,654 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENTS - 134.1% |

|

|

|

|

|

|

|

|

(Cost $3,452,842,740) |

|

|

4,178,976,164 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Secured borrowings - (24.8)% |

|

|

(773,000,000 |

) |

|

|

|

|

Secured notes - (6.4)% |

|

|

(200,000,000 |

) |

|

|

|

|

Mandatory Redeemable Preferred Shares at liquidation value - (4.2)% |

|

|

(132,000,000 |

) |

|

|

|

|

Other assets less other liabilities - 1.3% |

|

|

42,230,431 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET ASSETS APPLICABLE TO COMMON STOCK - 100.0% |

|

|

$3,116,206,595 |

|

|

|

|

|

|

|

|

|

|

The accompanying note

is an integral part of this financial statement.

6

DNP SELECT INCOME FUND INC.

SCHEDULE OF INVESTMENTS — (Continued)

July 31, 2024

(Unaudited)

| (a) |

All or a portion of this security has been pledged as collateral for borrowings and made available for loan

|

| (b) |

All or a portion of this security has been loaned |

The percentage shown for each investment category is the total value of that category as a percentage of the net assets applicable to common stock of the Fund.

Note 1. Investment Valuation

The Fund’s

investments are carried at fair value which is defined as the price that the Fund might reasonably expect to receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the

investment. The three-tier hierarchy of inputs established to classify fair value measurements for disclosure purposes is summarized in the three broad levels listed below.

Level 1 - quoted prices in active markets for identical securities

Level 2 - other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risks, etc.)

Level 3 - significant unobservable inputs (including the Investment Adviser’s Valuation Committee’s own assumptions in determining fair value of

investments)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in these

securities. For more information about the Fund’s policy regarding valuation of investments and other significant accounting policies, please refer to the Fund’s most recent financial statements contained in its semi-annual report. The

following is a summary of the inputs used to value each of the Fund’s investments at July 31, 2024:

|

|

|

|

|

|

|

|

|

| |

|

Level 1 |

|

|

Level 2 |

|

| Common Stocks & MLP Interests |

|

$ |

3,486,974,510 |

|

|

|

— |

|

| Bonds |

|

|

— |

|

|

$ |

692,001,654 |

|

| Total |

|

$ |

3,486,974,510 |

|

|

$ |

692,001,654 |

|

There were no Level 3 priced securities held and there were no transfers into or out of Level 3.

Other information regarding the Fund is available on the Fund’s website at www.dpimc.com/dnp or the Securities and Exchange Commission’s website at

www.sec.gov.

7

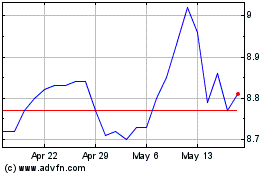

DNP Select Income (NYSE:DNP)

Historical Stock Chart

From Nov 2024 to Dec 2024

DNP Select Income (NYSE:DNP)

Historical Stock Chart

From Dec 2023 to Dec 2024