Sunvalley Company DMCC Releases Strategic Plan to Put Canagold Resources Ltd. on the Right Path and Highlights Case for Change at the Company

June 29 2022 - 9:00AM

Business Wire

- Launches www.TheNewCanagold.com as a resource for Canagold

shareholders.

- Sun Valley’s strategic plan is available both on

www.TheNewCanagold.com and SEDAR (under Canagold’s profile).

- Vote only the BLUE proxy FOR Sun Valley’s

nominees by 5:00 p.m. EST on Thursday, July 14, 2022. To vote,

contact Kingsdale Advisors at 1-888-213-0093 or at contactus@kingsdaleadvisors.com.

- Even if you have voted using the management proxy, you can

still change your vote for Sun Valley’s nominees by submitting a

BLUE proxy today.

Sunvalley Company DMCC (“Sun Valley”,

www.sunvalleyinv.com), a strategic and long-term focused investor

of Canagold Resources Ltd. (TSX: CCM) (“Canagold”), today

released its strategic plan to put Canagold on the right track. The

plan details the case for change at the Canagold Board of Directors

(the "Board") and lays out Sun Valley’s strategic steps to

advance Canagold’s long-stalled flagship project, New Polaris, and

to strengthen Canagold's governance for the benefit to all

shareholders.

The complete investor deck is available on SEDAR and on

www.TheNewCanagold.com, which Sun Valley has developed as a

resource for shareholders and to provide more information about its

plan to enhance value for all shareholders. The website also allows

shareholders to review important materials and key developments

leading up to Canagold’s annual and special meeting on Tuesday,

July 19, 2022 (the “Meeting”).

Some highlights of the investor deck are as follows:

Change is Urgently Needed for a New Canagold

- Destruction of Shareholder Value: Since Canagold’s IPO

on the Toronto Stock Exchange in 1994, total shareholder return has

been erased by 98% under the leadership of Mr. Cooke. Canagold has

underperformed gold bullion by 23,000% and the S&P500 by

37,500%.

- Failed Operational and Financial Execution: Canagold’s

core asset, New Polaris, has been almost stagnant for 28 years.

Canagold is running out of cash but has rejected Sun Valley’s

premium financing offers, resulting in project delays.

- Poor Corporate Governance: Messrs. Cooke and Burian and

Dr. Malhotra have served on the Board for 35, 8 and 7 years,

respectively, and are culpable for Canagold’s dreadful long-term

performance. Despite poor results, Canagold’s Board has hiked 2021

compensation for executives and directors. The proposed stock

option plan only benefits the executives and the Board at the

expense of shareholders.

Sun Valley’s Strategic Plan for the New Canagold

Sun Valley’s plan is focused on finally delivering results that

are on time and on budget. The plan is to:

- Stop all royalty discussions

- Salvage this year’s drilling season and continue in 2022/23 to

further increase the resource base.

- Provide the appropriate guidance and oversight to finally

advance the New Polaris project as fast as reasonably possible by

- Tendering and then starting a feasibility study; This is the

vital next step needed to move the project forward and add

value for all shareholders.

- Current management have been talking about a feasibility study

for 20 years but have never started one and we can’t even find an

indication of a schedule for this in any of their corporate

presentations of the last 10 years

- Initiate the permitting process in Q2 2023

Sun Valley’s Highly Qualified Slate vs Incumbent Slate’s Poor

Corporate Governance

- Sun Valley’s three highly qualified director nominees – Dr.

Carmen Letton, Ms. Sofia Bianchi, and Mr. Andrew Trow – each

possess superior mining-sector experience and will add diverse and

valuable skillsets in mining operations, corporate governance and

audit

- Nominees are motivated to deliver results for all shareholders

and eliminate the complacent culture at Canagold that has been

fostered by the Company’s longest-tenured directors

- Dr. Letton is a mining engineer and mineral economist (PhD)

with over 35 years of global mining exposure in the Americas,

Australia, Asia, Europe and Africa. Notably, she was chosen as one

of the “100 Global Inspirational Women in Mining” in 2016 and

2018

- Ms. Bianchi has over 13 years of board experience on multiple

publicly listed and private companies. Most recently, Ms. Bianchi

was the Chair of the Corporate Governance and Nominating Committee

and a Member of the Audit, Technical and Remuneration Committees of

Endeavour Mining Corporation

- Mr. Trow is a Chartered Accountant with over 15 years of

experience in accounting, financial and operational restructurings,

fund management in special situations, private equity and debt

- In addition, Sun Valley works with several Canadian advisors

who have significant and relevant experience, notably Mr. Gordon J.

Bogden who has over 40 years in mining exploration and development,

mining finance, capital markets, strategy, mergers and acquisitions

advisory, and private equity

- Messrs. Cooke and Burian and Dr. Malhotra have served on the

Board for 35, 8 and 7 years, respectively, and should be held

accountable for fostering a culture of complacency

- Despite poor results, Canagold’s board has hiked 2021

compensation for executives and directors

- Between 2004 and 2021, Messrs. Cooke and Burian have received

17 WITHHOLD recommendations from the proxy advisors, including ISS,

for past director elections

- Despite multiple years on the Board, three of Canagold’s

directors hold a total of just 1.17% of the company’s shares

collectively but are seeking “free” equity at all shareholders

expense, while having continuously destroyed value

- Proposal to amend the stock option plan will result in 20%

dilution of the Company’s equity to the detriment of all existing

shareholders

Vote the BLUE proxy

Sun Valley’s Team and Nominees have a plan and the resources to

put Canagold on the right path.

Shareholders are encouraged to vote only the BLUE proxy

FOR all three of Sun Valley’s highly-experienced, independent

nominees – Dr. Carmen Letton, Ms. Sofia Bianchi and Mr. Andrew

Trow.

Don’t wait, voting is fast and easy. Please vote well in

advance of the proxy voting deadline of Thursday, July 14, 2022 at

5:00 p.m. ET. If you have questions or need help voting, contact

Kingsdale Advisors at 1-888-213-0093 or at

contactus@kingsdaleadvisors.com.

Advisors

Kingsdale Advisors is acting as strategic shareholder and

communications advisor to Sun Valley. Wildeboer Dellelce LLP and

Crawley Mackewn Brush LLP are acting as legal counsel to Sun

Valley.

About Sun Valley

Sun Valley is a private equity firm focused on the precious

metals industry with portfolio companies and branch offices in the

Americas, Europe and Asia. Sun Valley seeks to invest in

sustainable development projects and operations with growth

potential, low cash costs of production, or the operating

flexibility to insulate against volatility in the commodity

markets.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking information within

the meaning of applicable securities laws. In general,

forward-looking information refers to disclosure about future

conditions, courses of action, and events. All statements contained

in this press release that are not clearly historical in nature or

that necessarily depend on future events are forward-looking, and

the use of any of the words “anticipates”, “believes”, “expects”,

“intends”, “plans”, “will”, “would”, and similar expressions are

intended to identify forward-looking statements. These statements

are based on current expectations of Sun Valley and currently

available information. Forward-looking statements are not

guarantees of future performance, involve certain risks and

uncertainties that are difficult to predict, and are based upon

assumptions as to future events that may not prove to be accurate.

Sun Valley undertakes no obligation to update publicly or revise

any forward-looking statements, whether as a result of new

information, future events, or otherwise, except as required by

applicable securities legislation.

Disclaimer

The information contained or referenced herein is for

information purposes only in order to provide the views of Sun

Valley and the matters which Sun Valley believes to be of concern

to shareholders described herein. The information is not tailored

to specific investment objectives, the financial situations,

suitability, or particular need of any specific person(s) who may

receive the information, and should not be taken as advice in

considering the merits of any investment decision. The views

expressed herein represent the views and opinions of Sun Valley,

whose opinions may change at any time and which are based on

analyses of Sun Valley and its advisors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220629005349/en/

Daniel Henao Partner / VP Business Development Phone: 6042607046

Email: dhenao@sunvalleyinv.com

Kingsdale Advisors:

Tom Graham Executive Vice President, Western Canada Direct:

587-330-1924 Email: tgraham@kingsdaleadvisors.com

Media:

Hyunjoo Kim Vice President, Strategic Communications and

Marketing Direct: 416-867-2357 Email:

hkim@kingsdaleadvisors.com

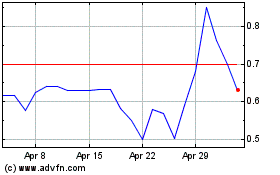

Concord Medical Services (NYSE:CCM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Concord Medical Services (NYSE:CCM)

Historical Stock Chart

From Jan 2024 to Jan 2025