- Canagold’s potential has been crippled by decades of business

and financial mismanagement at the hands of Mr. Bradford Cooke and

the incumbent Board.

- It’s time to end 28 years of hibernation and value destruction.

It’s time for material change at the Board to improve governance

and to realize the true potential of New Polaris for the benefit of

all shareholders. Sun Valley’s highly experienced and independent

director nominees will provide much-needed oversight and guidance

to advance the project.

- Mr. Cooke has rejected financing offers at significant market

premiums from Sun Valley, even though Canagold’s treasury is almost

empty. Instead, Mr. Cooke has been pursuing a strategy that would

encumber the project with a second royalty and has started a

needless and costly proxy fight out of a selfish interest to

maintain control of Canagold.

Sunvalley Company DMCC (“Sun Valley”), a strategic and

long-term focused investor of Canagold Resources Ltd (TSX: CCM)

(“Canagold” or the “Company”), today set the record

straight in response to Canagold’s press release on June 16, 2022,

and announced its slate of three independent directors for election

at Canagold’s annual and special meeting on Tuesday, July 19, 2022

(the “Meeting”).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20220620005429/en/

Sun Valley has been investing in Canagold since November 20,

2020, and currently beneficially holds 17.61% of the Company’s

shares. Sun Valley has been and will continue to be deeply

committed to the Company’s success for the benefit of all

shareholders. We believe that Canagold’s potential has been

crippled by decades of business and financial mismanagement at the

hands of Mr. Bradford Cooke and other members of the board of

directors (the “Board”), who are harming the Company out of

a self-interest to maintain control – all at the expense of

shareholders. We are not alone as other shareholders share our

beliefs and back this action.

Mr. Cooke Rejected Multiple Premium

Financing Offers to Maintain Control of Canagold

Contrary to Canagold’s claim, on June 15, 2022, Sun Valley

offered the Company CAD $7.6 million in equity at a 20% premium

above market price or a 60% premium on a flow-through basis. The

premium is highly favourable to Canagold’s shareholders as it

reduces dilution and adds support for a higher price. It would also

fund the Company through the 2022 drilling season and advance the

feasibility study at New Polaris, a project that has gone almost

nowhere in 28 years, and enable all shareholders to benefit from

the Company’s true potential.

However, Canagold has rejected the funding, is refusing to

discuss it further, and is protecting Mr. Cooke’s entrenchment in

the Company. Rather than accepting the premium investment, Sun

Valley has discovered that the Company has been pursuing a strategy

that would encumber the project with a second royalty. It is

important for shareholders to understand that Canagold already has

a royalty on net profits at New Polaris. Adding another royalty

on top of the existing royalty when the project is still in the

early exploration stage would destroy shareholder value. Canagold

has omitted its plans from its circular. While we did not want a

proxy fight, we are outraged by these value-destroying plans and

will fight to protect the future potential upside for all

shareholders.

When challenged on this plan on April 28, 2022, Mr. Cooke

responded that a royalty “was exclusively a management decision”

and implied that the opinion of his shareholders did not matter. We

believe that a second royalty would depress the share price further

and make raising funds for the feasibility study and mine

construction significantly more difficult and expensive.

Mr. Cooke and the Board have a fiduciary duty to the Company and

its shareholders. Shareholders should question why Mr. Cooke is

actively pursuing a path that damages shareholder value while

allowing him to maintain control.

It’s also important for shareholders to know that, according

to public disclosures, between April 24, 2021 and April 22, 2022,

Mr. Cooke’s share position was reduced by 2.3 MILLION shares, 44%

of his shareholding. However, on June 16, 2022 – just one day after

our most recent offer for a premium financing – Mr. Cooke began

purchasing Canagold shares once again.

Mr. Cooke’s Proxy Fight at the Expense

of Shareholders

Instead of focusing on turning the Company around and taking the

premium financing we offered to advance New Polaris, Mr. Cooke and

the Board are wasting money by forcing a proxy fight at the expense

of shareholders to further entrenchment.

In fact, we understand that contrary to the press release dated

June 14, 2022, Canagold has already put the New Polaris drill

campaign on hold – jeopardizing this year’s drilling season – to

focus on a proxy fight they forced and we did not want.

Other Examples of Mr. Cooke and the

Board’s Business and Financial Mismanagement

- As of March 28, 2022, Canagold had just US$824,000 of cash on

hand. It is short on money, cannot finish the drilling required and

is wasting valuable time this drilling season, nor can they begin

the feasibility study.

- Since listing on the Toronto Stock Exchange in 1994, Canagold

investors have suffered an unconscionable 98% destruction of shareholder value.

If an investor had given Mr. Cooke $100 on

Canagold’s IPO, they will have less than $2 today.

Meanwhile, the same investment in gold would be worth over $460

today. Mr. Cooke’s track record of over 23,000% underperformance to gold is one of the

worst ever in the junior mining industry.

- While shareholders have seen their investment plummet, between

1994 and 2021, Mr. Cooke was paid over C$2.6 million in cash, and

to date, has been granted millions of options.

- Despite the Company’s dismal performance, the Board has

increased the 2021 executive compensation packages, with increases

ranging from 173% to 355%, all while shares plummetted by 50%.

2019

2020

2021

% Raise

2020-2021

CEO and Director

231,067

268,244

558,954

208%

CFO, VP, Finance and Secretary

141,129

149,440

257,980

173%

President and COO

283,966

123,470

226,898

184%

VP, Exploration

105,357

374,344

355%

VP, Corporate Development

282,798

NA

Additionally, for 2021, Mr. Cooke’s

director fees increased a whopping 685% to $199,497 from $25,400 in

2020.

- Canagold’s Compensation Committee reviews the compensation of

senior officers and management, and the Board provides approvals,

without any formal objectives, criteria and analysis. Mr. Cooke

sits on the Compensation Committee, contrary to good corporate

governance practices.

- The Board has no skin in the game, with three of Canagold’s

four directors holding a total of just 1% of the Company’s

shares.

- Mr. Cooke has had multiple WITHHOLD recommendations from

Institutional Shareholder Services Inc. (“ISS”), a leading

and independent third-party proxy advisor (in 2004, 2005, 2006,

2011, 2012, 2013, 2019 and 2020).

On top of this laundry list of failures, now, at the 2022 Annual

and Special Meeting, Canagold is asking shareholders approve an

updated stock option plan to increase the maximum number of common

shares available for issuance under the plan from 8,852,339 common

shares to 17,311,919, representing 20% of the I/O as of June 6,

2022.

The revised stock option plan contains many problematic features

that benefit the executives and the Board at the expense of

shareholders. In fact, Canagold’s revised stock option plan

contains two provisions that ISS believes warrants automatic

opposition by shareholders. Sun Valley will vote AGAINST Canagold’s

revised stock option plan.

Shareholders will have Real Leadership

with Sun Valley’s Qualified, Independent and Diverse

Nominees

Sun Valley’s nominees, who will be proposed at the Meeting, are

Dr. Carmen Letton, Ms. Sofia Bianchi and Mr. Andrew Trow (each, a

“Nominee” and together, the “Nominees”). These three

nominees are highly experienced, respected industry leaders who

will provide the much-needed independent oversight to put Canagold

back on track. The proposed nominees will also bring diversity to

the current all-male slate.

Dr. Carmen Letton

- Selected as one of the “100 Global Inspirational Women in

Mining” in 2016 and 2018

- Mining engineer and mineral economist (PhD) with over 35 years

of global mining exposure in the Americas, Australia, Asia, Europe

and Africa

- Former Head of Resource Development Plan and Life Asset Plan

(Asset Strategy Development) at Anglo American, and has held senior

positions at BHP Billiton, Rio Tinto and Newmont

- Former non-executive director of Endeavour Mining Corporation

plc and former non-executive director of Gold Fields Ltd.

- Diverse background in senior leadership roles in operations,

business improvement, operational excellence and sustainable

mining

- Extensive technical expertise in open pit and underground mines

across multiple commodities and the many stages of asset

development

- PhD Mineral Economics at University of Queensland and BEng

(Mining)(Hons) at WA School of Mines, Kalgoorlie

Skills and Expertise: Strategy

& Leadership, Metals & Mining, Operations and Business

Improvement, Technical and Optimization, ESG – Corporate Governance

and Integrated Sustainability.

Ms. Sofia Bianchi

- Most recently, Mr. Bianchi was the Chair of the Corporate

Governance and Nominating Committee and a Member of the Audit,

Technical and Remuneration Committees of Endeavour Mining

Corporation

- Former Head of Special Situations and Member of the Investment

Committee for Debt and Infrastructure at the UK government’s

development finance institution: CDC Group plc

- Previously she was Head of Special Situations at BlueCrest

Capital Management

- As Deputy Managing Director of the Emerging Africa

Infrastructure Fund, she was a lead participant in establishing and

running the fund, the first of its kind

- 13 years of board experience on multiple publicly listed and

private companies

- Seasoned international finance professional with expertise in

corporate governance, strategy and value creation

- Founding Partner of Atlante Capital Partners

- BA in Economics from the George Washington University and an

MBA from The Wharton School

Mr. Andrew Trow

- Chartered Accountant with over 15 years of experience in

financial and operational restructurings, fund management in

special situations, private equity and debt

- Partner at Atlante Capital Partners

- Director at Insight Strategic Growth & Investment

- Former Investment Manager at BlueCrest Capital Management (UK)

LLP, working extensively in managing financial and operational

turn-arounds and sale processes across various sectors, with a

focus on mining and energy

- Started his career at the Deloitte USA and South Africa

offices

- BCom (Honors) in Chartered Accountancy from University of Port

Elizabeth

Canagold’s False and Misleading Allegations Against Ms. Sofia

Bianchi

In an attempt to further entrench themselves and to continue

using Canagold as their personal property, Canagold falsely blames

the bankruptcy of a TSX Venture Issuer on Ms. Bianchi.

- It’s important for shareholders to have the facts:

- Ms. Bianchi, as Head of the Special Situations team at the UK's

development institution (CDC Group, now called British

International Investment), was a nominee of CDC on the company's

board during a phase of deep financial and operational

restructuring

- The issuer and each of its subsidiaries entered into a support

agreement with its two largest shareholders

- The support agreement set out an agreement amongst the parties

whereby a third-party sales process would be conducted

- If that sales process did not result in a more favourable

transaction, the parties agreed to initiate a proceeding pursuant

to Division I, Part III of the Bankruptcy and Insolvency Act

(Canada)

- In November 2020, the company announced the closing of the

transaction after all of its operations had been sold pursuant to

the planned, agreed and announced restructuring transaction; the

Canadian entity was subsequently declared bankrupt

- The agreement was made to ensure the survival of the business

and to save several thousand jobs

In addition to our highly-qualified director nominees, Sun

Valley and our nominees work with several Canadian advisors who

have a wealth of mining experience, notably Mr. Gordon J.

Bogden.

Mr. Bogden has over 40 years in mining exploration and

development, mining finance, capital markets, strategy, mergers and

acquisitions advisory, and private equity. He is a former

investment banker at CIBC and at several financial

institutions.

Mr. Bogden is also a former director of IAMGold, Orvana

Minerals, Royal Gold, NexGen Energy, Volta Resources, Canplats

Resources, and several other TSX-listed mining companies. He is

also a founding member of the Advisory Council of the Development

Partner Institute (DPI), a past Chairman of the Canada Mining

Innovation Council (CMIC), past CEO and director of Alloycorp

Mining Inc. Gordon is currently a Senior Advisor and Advisory Board

Director at Origin Merchant Partners, Chairman of Black Loon Group,

Chairman of Allegiant Gold, and Chairman of the Advisory Board of

Tamarack Mining Services.

Mr. Bogden’s experience with the First Nations of the Taku River

where New Polaris is located, would be of great value for the

development of the project.

Enough is enough. It’s Time for

Material Change. It’s Time for a New, Action-Focused Plan to

Advance New Polaris

Sun Valley has offered premium financing for the benefit of all

shareholders and has a clear plan to advance New Polaris. Our

highly experienced, independent director nominees can provide the

much-needed oversight and guidance to advance the project as fast

as reasonably possible.

Our aim is to:

- Immediately tender the feasibility study and start it this

year. We expect the feasibility study to take approximately 18

months to complete, but we expect it would provide sufficient data

to define the design parameters needed for permitting to begin

within six months.

- Initiate the permitting process in Q2 2023.

- Save this year’s drilling season and continue drilling in

2022/23 to increase the resource base with a view to move inferred

mineral resources to indicated mineral resources.

We believe the feasibility study will result in a steadily

increasing share price, and once the permitting is near completion,

we expect that the shares will revalue dramatically.

The Choice is Clear:

Positive change with Sun Valley’s highly

experienced, independent nominees:

- Strong technical guidance

- Strong stewardship

- Access to financing at premiums,

OR

Continue on a losing path with an

entrenched Board that has:

× Destroyed shareholder value

× Crippled Canagold’s potential for

decades

× Refused premium offers, instead choosing

to waste shareholders’ money on starting a proxy fight – all to

maintain control of the Company

Additional Information

Canagold announced it will hold its Meeting on Tuesday, July 19,

2022. Sun Valley anticipates that its nominees will be considered

for election at the Meeting or any adjournment(s) or

postponement(s) thereof. The information contained in this press

release does not and is not meant to constitute a solicitation of a

proxy within the meaning of applicable Canadian securities laws.

Company shareholders are not being asked at this time to execute a

proxy in favour of the Nominees. In connection with the Meeting,

Sun Valley will file an information circular in due course.

Information in Support of Public Broadcast

Solicitation

Notwithstanding the foregoing, Sun Valley has voluntarily

provided in this press release the disclosure required under

section 9.2(4) of National Instrument 51-102 - Continuous

Disclosure Obligations (NI 51-102) and has filed a document (the

"Document") containing the disclosure required under section 9.2(6)

of NI 51-102 in respect of the Nominees in accordance with

corporate and securities laws applicable to public broadcast

solicitations. The Document is available under the Company's

profile on SEDAR at www.sedar.com. Sun Valley is relying on the

exemption under sections 9.2(4) and 9.2(6) of National Instrument

51-102 – Continuous Disclosure Obligations.

Sun Valley is not requesting that Canagold shareholders submit a

proxy at this time. Once Sun Valley has commenced a formal

solicitation of proxies in connection with the Meeting, any

solicitation made by Sun Valley in advance of the Meeting is, or

will be, as applicable, made by Sun Valley and not by or on behalf

of the management of Canagold.

Sun Valley intends to solicit proxies in accordance with all

applicable securities and corporate law requirements and, in

connection therewith, intends to provide a form of proxy in due

course that includes the names of the Sun Valley nominees to

shareholders of Canagold. Upon commencement of a formal

solicitation, proxies may be solicited by Sun Valley pursuant to an

information circular sent to shareholders after which solicitations

may be made by or on behalf of Sun Valley, by mail, telephone, fax,

email or other electronic means as well as by newspaper or other

media advertising, and in person by directors, officers and

employees of Sun Valley, who will not be specifically remunerated

therefore. Sun Valley may also solicit proxies in reliance upon the

public broadcast exemption to the solicitation requirements under

applicable corporate and securities laws, conveyed by way of public

broadcast, including through press releases, speeches or

publications, and by any other manner permitted under applicable

Canadian laws. Sun Valley may engage the services of one or more

agents and authorize other persons to assist in soliciting proxies

on behalf of Sun Valley.

Sun Valley has retained Kingsdale Advisors (“Kingsdale”) as its

strategic advisor and to assist Sun Valley in the solicitation of

proxies. Sun Valley will pay Kingsdale fees currently estimated at

up to C$100,000. All costs incurred for any solicitation are being

borne by Sun Valley. While Sun Valley may be entitled to seek

reimbursement under applicable law, Sun Valley will not seek

reimbursement from Canagold for fees incurred in connection with a

successful reconstitution of the Board.

Kingsdale’s responsibilities will principally include advising

Sun Valley on governance best practices, where applicable, liaising

with proxy advisory firms, developing and implementing shareholder

communication and engagement strategies, and advising with respect

to meeting and proxy protocol.

Once the Sun Valley has commenced a formal solicitation of

proxies in connection with the Meeting, a registered shareholder of

Canagold that gives a proxy may revoke it: (a) by completing and

signing a valid proxy bearing a later date than the proxy being

revoked and returning the newly completed and signed proxy in

accordance with the instructions contained in the form of proxy;

(b) by depositing an instrument in writing executed by the

shareholder or by the shareholder’s attorney authorized in writing,

as the case may be: (i) at the registered office of Canagold at any

time up to and including the last business day preceding the day of

the Meeting at which the proxy is to be used, or (ii) with the

chairman of the Meeting on the day of the Meeting; or (c) in any

other manner permitted by law. A non-registered holder of common

shares of Canagold will be entitled to revoke a form of proxy or

voting instruction form given to an intermediary at any time by

written notice to the intermediary in accordance with the

instructions given to the non-registered holder by its

intermediary.

Canagold’s registered office address is 625 Howe Street, Suite

810, Vancouver, British Columbia, Canada, V6C 2T6.

Sun Valley will file this press release containing the

information required by Form 51‐102F5 – Information Circular in

respect of its proposed nominees. A copy of this Sun Valley press

release may be obtained on Canagold’s SEDAR profile at

www.sedar.com.

To the knowledge of Sun Valley, neither Sun Valley, nor any of

its directors or officers, or any associates or affiliates of the

foregoing, nor any of the Sun Valley Nominees or their respective

associates or affiliates has: (a) any material interest, direct or

indirect, in any transaction since the commencement of the

Company’s most recently completed financial year or in any proposed

transaction which has materially affected or would materially

affect the Company or any of its subsidiaries; or (b) any material

interest, direct or indirect, by way of beneficial ownership of

securities or otherwise, in any matter to be acted on at the

Meeting, other than nominating the Nominees for election as a

director at the Meeting, in the case of Sun Valley, and standing

for election as a director in the case of each Nominee.

Advisors

Kingsdale Advisors is acting as strategic shareholder and

communications advisor to Sun Valley. Wildeboer Dellelce LLP and

Crawley Mackewn Brush LLP are acting as legal counsel to Sun

Valley.

About Sun Valley

Sun Valley is a private equity firm focussed on the precious

metals industry with portfolio companies and branch offices in the

Americas, Europe and Asia. Sun Valley seeks to invest in

sustainable development projects and operations with growth

potential, low cash costs of production, or the operating

flexibility to insulate against volatility in the commodity

markets.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking information within

the meaning of applicable securities laws. In general,

forward-looking information refers to disclosure about future

conditions, courses of action, and events. All statements contained

in this press release that are not clearly historical in nature or

that necessarily depend on future events are forward-looking, and

the use of any of the words “anticipates”, “believes”, “expects”,

“intends”, “plans”, “will”, “would”, and similar expressions are

intended to identify forward-looking statements. These statements

are based on current expectations of Sun Valley and currently

available information. Forward-looking statements are not

guarantees of future performance, involve certain risks and

uncertainties that are difficult to predict, and are based upon

assumptions as to future events that may not prove to be accurate.

Sun Valley undertakes no obligation to update publicly or revise

any forward-looking statements, whether as a result of new

information, future events, or otherwise, except as required by

applicable securities legislation.

Disclaimer

The information contained or referenced herein is for

information purposes only in order to provide the views of Sun

Valley and the matters which Sun Valley believes to be of concern

to shareholders described herein. The information is not tailored

to specific investment objections, the financial situations,

suitability, or particular need of any specific person(s) who may

receive the information, and should not be taken as advice in

considering the merits of any investment decision. The views

expressed herein represent the views and opinions of Sun Valley,

whose opinions may change at any time and which are based on

analyses of Sun Valley and its advisors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220620005429/en/

Daniel Henao Partner / VP Business Development Phone: 6042607046

Email: dhenao@sunvalleyinv.com

Kingsdale Advisors: Tom Graham Executive Vice President,

Western Canada Direct: 587-330-1924 Email:

tgraham@kingsdaleadvisors.com

Media: Hyunjoo Kim Vice President, Strategic

Communications and Marketing Direct: 416-867-2357 Email:

hkim@kingsdaleadvisors.com

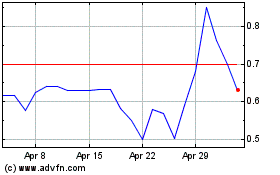

Concord Medical Services (NYSE:CCM)

Historical Stock Chart

From Dec 2024 to Jan 2025

Concord Medical Services (NYSE:CCM)

Historical Stock Chart

From Jan 2024 to Jan 2025