Buenaventura Announces Fourth Quarter 2021 Production Results and 2022 Production Guidance

January 31 2022 - 7:01PM

Business Wire

Compañia de Minas Buenaventura S.A.A. (“Buenaventura” or

“the Company”) (NYSE: BVN; Lima Stock Exchange: BUE.LM), Peru’s

largest publicly-traded precious metals mining company, today

announced 4Q21 results for production and volume sold, as well as

2022 production guidance.

4Q21 Production per Metal and

2022 Guidance (100% basis)

1Q21 (Actual)

2Q21 (Actual)

3Q21 (Actual)

4Q21 (Actual)

FY21 (Actual)

2022 Guidance (1) (2)

Gold (Oz.)

Orcopampa

5,986

9,130

15,547

19,358

50,020

57k - 65k

Tambomayo

15,347

17,964

17,837

18,406

69,554

45k - 50k

La Zanja

3,908

4,447

5,967

8,289

22,611

37k - 45k

Coimolache

26,133

30,378

29,597

24,468

110,575

75k - 80k

El Brocal

3,067

4,317

5,360

5,123

17,868

10k - 13k

Silver (Oz.)

Uchucchacua

1,243,916

1,268,082

1,220,393

0

3,732,391

0

El Brocal

1,574,305

1,603,208

1,482,163

1,499,305

6,158,981

4.2M - 4.8M

Tambomayo

284,677

432,638

509,836

588,138

1,815,288

1.8M - 2.4M

Julcani

648,854

570,248

657,494

695,439

2,572,036

2.2M - 2.5M

Lead (MT)

El Brocal

2,140

2,812

2,754

2,389

10,096

7.0k - 10.0k

Uchucchacua

1,292

1,715

1,830

0

4,836

0

Tambomayo

1,504

2,767

1,978

3,058

9,307

4.0k - 6.0k

Zinc (MT)

El Brocal

10,207

8,612

8,930

8,227

35,975

18.0k - 22.0k

Uchucchacua

1,246

3,029

1,928

0

6,203

0

Tambomayo

1,821

3,671

3,397

4,247

13,135

5.0k - 7.0k

Copper (MT)

El Brocal

7,965

10,494

9,146

10,308

37,914

40.0k - 45.0k

1. 2022 outlook projections shown above are considered

forward-looking statements and represent management’s good faith

estimates or expectations of future production results as of

December 2021. 2. Please consider that this updated guidance could

potentially be adversely impacted due to further effects related to

COVID-19.

FY2021 and 2022 Guidance

Comments

- Tambomayo: 2021 gold and silver production was in line

with Buenaventura’s revised 2021 guidance announced in the third

quarter 2021. 2021 lead and zinc production exceeded revised

guidance. 2022 Guidance: the Company expects a year on year

decrease in gold production due to mining of lower grade blocks, as

per the planned Life-of-Mine sequence.

- Orcopampa: 2021 gold production exceeded revised

guidance. 2022 Guidance: gold production is expected to maintain a

similar pace as 3Q and 4Q 2021, with mining primarily within the

Ramal-4 vein system and consistent with Orcopampa’s improved

production results subsequent to mine development and preparation

completed in the first half of 2021.

- Coimolache: 2021 gold production was in line with

revised guidance. 2022 Guidance: the Company expects decreased gold

production in 2022 due to leach pad capacity limitations resulting

from Covid-related permitting delays.

- La Zanja: 2021 gold production slightly exceeded revised

guidance. 2022 Guidance: expected increase in 2022 gold production

as 2021 Pampa Verde open pit stripping progressed according to

plan.

- Julcani: 2021 silver production exceeded revised

guidance. 2022 Guidance: 2022 silver production is expected to be

in line with prior years.

- Uchucchacua: 2021 silver, lead and zinc production was

adversely impacted by the suspension of Uchucchacua operations

since September. 2022 Guidance: No production is expected in 2022

as mine operations will be focused on drifting and on diamond

drilling for exploration at Uchucchacua and project development

surrounding Yumpag.

- El Brocal: Gold, lead and copper production were in line

with revised guidance. Silver production exceeded revised guidance.

Zinc production was slightly below revised guidance. 2022 Guidance:

the El Brocal open pit mining sequence will begin transitioning

from polymetallic to copper mining in 2022, resulting in an

expected increase in copper production which will offset decreased

zinc, lead, silver and gold production during the year.

4Q21 Payable Volume Sold (100%

basis)

4Q21 Volume sold per Metal

(100% basis)

1Q21 (Actual)

2Q21

(Actual)

3Q21 (Actual)

4Q21 (Actual)

FY21 (Actual)

Gold (Oz.)

Orcopampa

5,698

9,618

15,646

19,106

50,068

Tambomayo

14,631

16,652

15,943

16,386

63,611

La Zanja

3,897

4,455

5,169

8,468

21,990

Coimolache

28,094

29,815

30,893

23,515

112,316

El Brocal

1,951

2,805

3,806

3,513

12,076

Silver (Oz.)

Uchucchacua

1,029,816

1,226,055

1,107,282

95,215

3,458,368

El Brocal

1,244,168

1,325,553

1,235,143

1,212,618

5,017,482

Tambomayo

257,290

380,029

445,525

510,196

1,593,040

Julcani

614,164

547,606

606,737

659,178

2,427,685

Lead (MT)

El Brocal

2,239

2,597

2,461

2,201

9,497

Uchucchacua

1,014

1,450

1,562

110

4,135

Tambomayo

1,440

2,575

1,813

2,848

8,675

Julcani

113

91

83

66

352

Zinc (MT)

El Brocal

8,491

7,117

7,367

6,907

29,882

Uchucchacua

914

2,309

1,444

378

5,045

Tambomayo

1,401

3,049

2,304

3,440

10,195

Copper (MT)

El Brocal

7,536

9,948

8,677

9,793

35,954

Realized Metal Prices*

1Q21 (Actual)

2Q21 (Actual)

3Q21 (Actual)

4Q21 (Actual)

FY21 (Actual)

Gold (Oz)

1,726

1,815

1,764

1,784

1,775

Silver (Oz)

26.98

27.06

23.94

21.54

25.09

Lead (MT)

2,129

2,192

2,412

2,429

2,291

Zinc (MT)

3,220

3,010

3,048

3,482

3,182

Copper (MT)

8,994

10,033

9,488

9,193

9,455

*Buenaventura consolidated

figures.

Buenaventura will issue further 2022 guidance on the Company’s

Q4 2021 Earnings Results Press Release to be released on February

24, 2022.

Appendix

1. 4Q21 Production per

Metal

1Q21 (Actual)

2Q21 (Actual)

3Q21 (Actual)

4Q21 (Actual)

FY21 (Actual)

Gold (Oz.)

Julcani

13

48

85

23

169

Silver (Oz.)

Orcopampa

1,043

1,781

4,716

7,274

14,814

La Zanja

27,042

20,519

24,011

32,961

104,534

Coimolache

200,993

166,327

159,072

121,076

647,468

Lead (MT)

Julcani

146

123

114

95

478

2. 4Q21 Volume Sold per

Metal

1Q21 (Actual)

2Q21 (Actual)

3Q21 (Actual)

4Q21 (Actual)

FY21 (Actual)

Gold (Oz.)

Julcani

10

46

64

87

206

Silver (Oz.)

Orcopampa

1,878

1,518

4,709

6,460

14,565

La Zanja

28,964

24,710

26,683

40,394

120,750

Coimolache

215,648

178,729

169,499

115,780

679,656

Lead (MT)

Julcani

113

91

83

66

352

Company Description

Compañía de Minas Buenaventura S.A.A. is Peru’s largest,

publicly traded precious and base metals Company and a major holder

of mining rights in Peru. The Company is engaged in the

exploration, mining development, processing and trade of gold,

silver and other base metals via wholly-owned mines and through its

participation in joint venture projects. Buenaventura currently

operates several mines in Peru (Orcopampa*, Uchucchacua*, Julcani*,

Tambomayo*, El Brocal, La Zanja and Coimolache).

The Company owns 19.58% of Sociedad Minera Cerro Verde, an

important Peruvian copper producer (a partnership with

Freeport-McMorRan Inc. and Sumitomo Corporation).

For a printed version of the Company’s 2019 Form 20-F, please

contact the persons indicated above, or download a PDF format file

from the Company’s web site. (*) Operations wholly owned by

Buenaventura

Note on Forward-Looking Statements

This press release may contain forward-looking information (as

defined in the U.S. Private Securities Litigation Reform Act of

1995) that involve risks and uncertainties, including those

concerning Cerro Verde’s costs and expenses, results of

exploration, the continued improving efficiency of operations,

prevailing market prices of gold, silver, copper and other metals

mined, the success of joint ventures, estimates of future

explorations, development and production, subsidiaries’ plans for

capital expenditures, estimates of reserves and Peruvian political,

economic, social and legal developments. These forward-looking

statements reflect the Company’s view with respect to Cerro Verde’s

future financial performance. Actual results could differ

materially from those projected in the forward-looking statements

as a result of a variety of factors discussed elsewhere in this

Press Release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220131005582/en/

Contacts in Lima: Daniel Dominguez, Chief Financial

Officer (511) 419 2540

Gabriel Salas, Head of Investor Relations (511) 419

2591 / Gabriel.salas@buenaventura.pe

Contacts in NY: Barbara Cano (646) 452 2334

barbara@inspirgroup.com

Company Website:

www.buenaventura.com/en/inversionistas

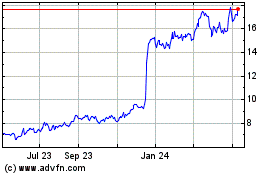

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Dec 2024 to Jan 2025

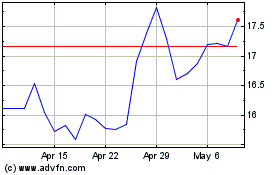

Compania De Minas Buenav... (NYSE:BVN)

Historical Stock Chart

From Jan 2024 to Jan 2025