Community Health Systems, Inc. (NYSE: CYH) (the “Company”) today

announced financial and operating results for the three and six

months ended June 30, 2024.

The following highlights the financial and operating results for

the three months ended June 30, 2024.

- Net operating revenues totaled $3.140 billion.

- Net loss attributable to Community Health Systems, Inc.

stockholders was $(13) million, or $(0.10) per share (diluted),

compared to $(38) million, or $(0.29) per share (diluted), for the

same period in 2023. Excluding the adjusting items as presented in

the table in footnote (e) on page 15, net loss attributable to

Community Health Systems, Inc. stockholders was $(0.17) per share

(diluted), compared to $(0.22) per share (diluted) for the same

period in 2023.

- Adjusted EBITDA was $387 million.

- Net cash provided by operating activities was $101 million

for the three months ended June 30, 2024, compared to $86 million

for the same period in 2023.

- Completed a tack-on offering of an additional $1.225 billion

of Senior Secured Notes due 2032 and used the proceeds primarily to

redeem all remaining outstanding Senior Secured Notes due 2026 and

to fund repurchases of other outstanding notes.

- On a same-store basis, admissions increased 3.0 percent and

adjusted admissions increased 3.2 percent, compared to the same

period in 2023.

Commenting on the results, Tim L. Hingtgen, chief executive

officer of Community Health Systems, Inc., said, “Our team has

delivered another solid quarter that includes same-store,

year-over-year improvements in operating results, supported by

strong volume growth and expense management. This progress further

demonstrates our growth mindset and ability to consistently execute

on strategic opportunities to enhance our services, care for our

communities, and generate value for all of our stakeholders.”

Three Months Ended June 30, 2024

Net operating revenues for the three months ended June 30, 2024,

totaled $3.140 billion, a 0.8 percent increase compared to $3.115

billion for the same period in 2023. On a same-store basis, net

operating revenues increased 4.7 percent for the three months ended

June 30, 2024, compared to the same period in 2023. Net operating

revenues for the three months ended June 30, 2024, reflect a 2.8

percent decrease in admissions and a 2.4 percent decrease in

adjusted admissions, compared to the same period in 2023. On a

same-store basis, admissions increased 3.0 percent and adjusted

admissions increased 3.2 percent for the three months ended June

30, 2024, compared to the same period in 2023.

Net loss attributable to Community Health Systems, Inc.

stockholders was $(13) million, or $(0.10) per share (diluted), for

the three months ended June 30, 2024, compared to $(38) million, or

$(0.29) per share (diluted), for the same period in 2023. Excluding

the adjusting items as presented in the table in footnote (e) on

page 15, net loss attributable to Community Health Systems, Inc.

stockholders was $(0.17) per share (diluted) for the three months

ended June 30, 2024, compared to $(0.22) per share (diluted) for

the same period in 2023.

Adjusted EBITDA for the three months ended June 30, 2024, was

$387 million compared to $373 million for the same period in

2023.

The decrease in net loss attributable to Community Health

Systems, Inc. stockholders for the three months ended June 30,

2024, compared to the same period in 2023, is attributable, in

part, to certain non-operating items, including a gain from early

extinguishment of debt, as further discussed below, and

period-over-period changes in impairment and (gain) loss on the

sale of businesses, as well as a lower provision for income taxes.

In addition, higher same-store volumes, increased reimbursement

rates, a higher net benefit from supplemental reimbursement

programs, reduced expense for contract labor and reductions in

supplies expense contributed to a decrease in net loss attributable

to Community Health Systems, Inc. stockholders and the increase in

Adjusted EBITDA for the three months ended June 30, 2024, compared

to the same period in 2023.

Six Months Ended June 30, 2024

Net operating revenues for the six months ended June 30, 2024,

totaled $6.279 billion, a 0.9 percent increase compared to $6.223

billion for the same period in 2023. On a same-store basis, net

operating revenues increased 5.2 percent for the six months ended

June 30, 2024, compared to the same period in 2023. Net operating

revenues for the six months ended June 30, 2024, reflect a 2.6

percent decrease in admissions and a 3.2 percent decrease in

adjusted admissions, compared to the same period in 2023. On a

same-store basis, admissions increased 3.4 percent and adjusted

admissions increased 2.5 percent for the six months ended June 30,

2024, compared to the same period in 2023.

Net loss attributable to Community Health Systems, Inc.

stockholders was $(55) million, or $(0.42) per share (diluted), for

the six months ended June 30, 2024, compared to $(89) million, or

$(0.68) per share (diluted), for the same period in 2023. Excluding

the adjusting items as presented in the table in footnote (e) on

page 15, net loss attributable to Community Health Systems, Inc.

stockholders was $(0.31) per share (diluted) for the six months

ended June 30, 2024, compared to $(0.65) per share (diluted) for

the same period in 2023.

Adjusted EBITDA for the six months ended June 30, 2024, was $765

million compared to $707 million for the same period in 2023.

The decrease in net loss attributable to Community Health

Systems, Inc. stockholders for the six months ended June 30, 2024,

compared to the same period in 2023, is attributable, in part, to

certain non-operating items, including a gain from early

extinguishment of debt, as further discussed below, and

period-over-period changes in impairment and (gain) loss on the

sale of businesses, as well as a lower provision for income taxes.

In addition, higher same-store volumes, increased reimbursement

rates, a higher net benefit from supplemental reimbursement

programs, reduced expense for contract labor and reductions in

supplies expense contributed to a decrease in net loss attributable

to Community Health Systems, Inc. stockholders and an increase in

Adjusted EBITDA for the six months ended June 30, 2024, compared to

the same period in 2023.

Financing Activity

During the three months ended June 30, 2024, the Company

completed a tack-on offering of $1.225 billion principal amount of

its 10.875% Senior Secured Notes due 2032, which were originally

issued in December 2023, and used the net proceeds to redeem all

$1.116 billion of the remaining 8.000% Senior Secured Notes due

2026, to fund senior note repurchases in the amount of

approximately $98 million for the extinguishment of $130 million

principal amount of the 6⅞% Senior Notes due 2028, pay related fees

and expenses, and for general corporate purposes. Together, these

transactions resulted in the recognition of a net pre-tax gain from

early extinguishment of debt of approximately $26 million during

the three months ended June 30, 2024. In addition, during the three

months ended June 30, 2024, the Company amended and restated its

revolving asset-based loan facility to, among other things, extend

the maturity to June 5, 2029.

Other

During 2024, through the date of this press release, the Company

has not completed any hospital divestitures.

Financial and statistical data presented in this press release

includes the operating results of divested or closed businesses for

the periods prior to the consummation of the respective divestiture

or closure. Same-store operating results and statistical

information include operating results of businesses operated in the

comparable current year and prior year periods and exclude

businesses divested or closed in 2023.

Information About Non-GAAP Financial Measures

This press release presents Adjusted EBITDA, a non-GAAP

financial measure, which is EBITDA adjusted to add back net income

attributable to noncontrolling interests and to exclude loss (gain)

from early extinguishment of debt, impairment and (gain) loss on

sale of businesses, expense related to the Business Transformation

Costs (as defined in footnote (c) to the Financial Highlights,

Financial Statements and Selected Operating Data below), expense

related to government and other legal matters and related costs,

expense related to employee termination benefits and other

restructuring charges, the impact of a change in estimate to

increase the professional liability claims accrual recorded during

the fourth quarter of 2022 with respect to claims incurred in prior

years related to divested locations and the gain on sale by

HealthTrust Purchasing Group, L.P. (“HealthTrust”) of a majority

interest in CoreTrust Holdings, LLC (“CoreTrust”) completed during

the fourth quarter of 2022. For information regarding why the

Company believes Adjusted EBITDA provides useful information to

investors, and for a reconciliation of Adjusted EBITDA to net loss

attributable to Community Health Systems, Inc. stockholders, see

footnote (c) to the Financial Highlights, Financial Statements and

Selected Operating Data below.

Additionally, this press release presents adjusted net loss

attributable to Community Health Systems, Inc. stockholders per

share (diluted), a non-GAAP financial measure, to reflect the

impact on net loss attributable to Community Health Systems, Inc.

stockholders per share (diluted) from the selected items used in

the calculation of Adjusted EBITDA. For information regarding why

the Company believes this non-GAAP financial measure provides

useful information to investors, and for a reconciliation of this

non-GAAP financial measure to net loss attributable to Community

Health Systems, Inc. stockholders per share (diluted), see footnote

(e) to the Financial Highlights, Financial Statements and Selected

Operating Data below.

The non-GAAP financial measures set forth above are not

measurements of financial performance under U.S. GAAP, and should

not be considered in isolation or as a substitute for any financial

measure calculated in accordance with U.S. GAAP. Additionally, the

calculation of these non-GAAP financial measures may not be

comparable to similarly titled measures disclosed by other

companies.

Included on pages 16, 17, 18, 19 and 20 of this press release

are tables setting forth the Company’s 2024 updated annual earnings

guidance. The 2024 guidance is based on the Company’s historical

operating performance, current trends and other assumptions the

Company believes are reasonable at this time as more specifically

discussed below.

About Community Health Systems, Inc.

Community Health Systems, Inc. is one of the nation’s largest

healthcare companies. The Company’s affiliates are leading

providers of healthcare services, developing and operating

healthcare delivery systems in 40 distinct markets across 15

states. As of July 24, 2024, the Company’s subsidiaries own or

lease 71 affiliated hospitals with more than 11,000 beds and

operate more than 1,000 sites of care, including physician

practices, urgent care centers, freestanding emergency departments,

occupational medicine clinics, imaging centers, cancer centers and

ambulatory surgery centers.

The Company’s headquarters are located in Franklin, Tennessee, a

suburb south of Nashville. Shares in Community Health Systems, Inc.

are traded on the New York Stock Exchange under the symbol “CYH.”

More information about the Company can be found on its website at

www.chs.net.

Community Health Systems, Inc. will hold a conference call on

Thursday, July 25, 2024 at 10:00 a.m. Central, 11:00 a.m. Eastern,

to review financial and operating results for the second quarter

ended June 30, 2024. Investors will have the opportunity to listen

to a live internet broadcast of the conference call by clicking on

the Investor Relations link of the Company’s website at

www.chs.net. For those who cannot listen to the live broadcast, a

replay will be available shortly after the call and will continue

to be available for approximately 30 days. Copies of this press

release and conference call slide show, as well as the Company’s

Current Report on Form 8-K (including this press release), will be

available on the Company’s website at www.chs.net.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Financial Highlights

(a)(b)

(In millions, except per share

amounts)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Net operating revenues

$

3,140

$

3,115

$

6,279

$

6,223

Net income (loss) (f)

26

2

20

(18

)

Net loss attributable to Community Health

Systems, Inc. stockholders

(13

)

(38

)

(55

)

(89

)

Adjusted EBITDA (c)

387

373

765

707

Net cash provided by operating

activities

101

86

197

91

Loss per share attributable to Community

Health Systems, Inc. stockholders:

Basic (f)

$

(0.10

)

$

(0.29

)

$

(0.42

)

$

(0.68

)

Diluted (e), (f)

(0.10

)

(0.29

)

(0.42

)

(0.68

)

Weighted-average number of shares

outstanding (d):

Basic

132

131

132

130

Diluted

132

131

132

130

__________

For footnotes, see pages 13, 14 and

15.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Condensed Consolidated

Statements of Loss (a)(b)

(In millions, except per share

amounts)

(Unaudited)

Three Months Ended June

30,

2024

2023

% of Net

% of Net

Operating

Operating

Amount

Revenues

Amount

Revenues

Net operating revenues

$

3,140

100.0

%

$

3,115

100.0

%

Operating costs and expenses:

Salaries and benefits

1,329

42.3

%

1,338

42.9

%

Supplies

483

15.4

%

504

16.2

%

Other operating expenses

882

28.1

%

836

26.8

%

Lease cost and rent

73

2.3

%

80

2.6

%

Depreciation and amortization

125

4.0

%

124

4.0

%

Impairment and (gain) loss on sale of

businesses, net (f)

10

0.3

%

(13

)

(0.4

)%

Total operating costs and expenses

2,902

92.4

%

2,869

92.1

%

Income from operations (f)

238

7.6

%

246

7.9

%

Interest expense, net

216

6.9

%

207

6.6

%

Gain from early extinguishment of debt

(26

)

(0.8

)%

-

-

%

Equity in earnings of unconsolidated

affiliates

(2

)

(0.1

)%

(1

)

(0.0

)%

Income before income taxes

50

1.6

%

40

1.3

%

Provision for income taxes

24

0.8

%

38

1.2

%

Net income (f)

26

0.8

%

2

0.1

%

Less: Net income attributable to

noncontrolling interests

39

1.2

%

40

1.3

%

Net loss attributable to Community Health

Systems, Inc. stockholders

$

(13

)

(0.4

)%

$

(38

)

(1.2

)%

Loss per share attributable to Community

Health Systems, Inc. stockholders:

Basic (f)

$

(0.10

)

$

(0.29

)

Diluted (e), (f)

$

(0.10

)

$

(0.29

)

Weighted-average number of shares

outstanding (d):

Basic

132

131

Diluted

132

131

__________

For footnotes, see pages 13, 14 and

15.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Condensed Consolidated

Statements of Loss (a)(b)

(In millions, except per share

amounts)

(Unaudited)

Six Months Ended June

30,

2024

2023

% of Net

% of Net

Operating

Operating

Amount

Revenues

Amount

Revenues

Net operating revenues

$

6,279

100.0

%

$

6,223

100.0

%

Operating costs and expenses:

Salaries and benefits

2,696

43.0

%

2,703

43.5

%

Supplies

969

15.4

%

1,011

16.2

%

Other operating expenses

1,727

27.5

%

1,671

26.9

%

Lease cost and rent

151

2.4

%

161

2.6

%

Depreciation and amortization

241

3.8

%

255

4.1

%

Impairment and (gain) loss on sale of

businesses, net (f)

27

0.4

%

(35

)

(0.6

)%

Total operating costs and expenses

5,811

92.5

%

5,766

92.7

%

Income from operations (f)

468

7.5

%

457

7.3

%

Interest expense, net

426

6.9

%

414

6.6

%

Gain from early extinguishment of debt

(26

)

(0.4

)%

-

-

%

Equity in earnings of unconsolidated

affiliates

(4

)

(0.1

)%

(4

)

(0.1

)%

Income before income taxes

72

1.1

%

47

0.8

%

Provision for income taxes

52

0.8

%

65

1.1

%

Net income (loss) (f)

20

0.3

%

(18

)

(0.3

)%

Less: Net income attributable to

noncontrolling interests

75

1.2

%

71

1.1

%

Net loss attributable to Community Health

Systems, Inc. stockholders

$

(55

)

(0.9

)%

$

(89

)

(1.4

)%

Loss per share attributable to Community

Health Systems, Inc. stockholders:

Basic (f)

$

(0.42

)

$

(0.68

)

Diluted (e), (f)

$

(0.42

)

$

(0.68

)

Weighted-average number of shares

outstanding (d):

Basic

132

130

Diluted

132

130

__________

For footnotes, see pages 13, 14 and

15.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Condensed Consolidated

Statements of Comprehensive Loss

(In millions)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Net income (loss)

$

26

$

2

$

20

$

(18

)

Other comprehensive income (loss), net of

income taxes:

Net change in fair value of

available-for-sale debt securities, net of tax

3

(1

)

2

2

Other comprehensive income (loss)

3

(1

)

2

2

Comprehensive income (loss)

29

1

22

(16

)

Less: Comprehensive income attributable to

noncontrolling interests

39

40

75

71

Comprehensive loss attributable to

Community Health Systems, Inc. stockholders

$

(10

)

$

(39

)

$

(53

)

$

(87

)

__________

For footnotes, see pages 13, 14 and

15.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Selected Operating Data

(a)

(Dollars in millions)

(Unaudited)

Three Months Ended June

30,

Consolidated

Same-Store

2024

2023

%

Change

2024

2023

%

Change

Number of hospitals (at end of period)

71

78

71

71

Licensed beds (at end of period)

11,868

12,735

11,868

11,934

Beds in service (at end of period)

10,068

10,843

10,068

10,135

Admissions

105,748

108,799

-2.8

%

105,748

102,679

3.0

%

Adjusted admissions

243,343

249,442

-2.4

%

243,343

235,840

3.2

%

Patient days

458,409

486,142

458,409

459,891

Average length of stay (days)

4.3

4.5

4.3

4.5

Occupancy rate (average beds in

service)

50.0

%

49.3

%

50.0

%

49.9

%

Net operating revenues

$

3,140

$

3,115

0.8

%

$

3,140

$

2,999

4.7

%

Net inpatient revenues as a % of net

operating revenues

47.1

%

47.0

%

47.1

%

46.9

%

Net outpatient revenues as a % of net

operating revenues

52.9

%

53.0

%

52.9

%

53.1

%

Income from operations (f)

$

238

$

246

-3.3

%

Income from operations as a % of net

operating revenues

7.6

%

7.9

%

Depreciation and amortization

$

125

$

124

Net loss attributable to Community Health

Systems, Inc. stockholders

$

(13

)

$

(38

)

65.8

%

Net loss attributable to Community Health

Systems, Inc. stockholders as a % of net operating revenues

-0.4

%

-1.2

%

Adjusted EBITDA (c)

$

387

$

373

3.8

%

Adjusted EBITDA as a % of net operating

revenues

12.3

%

12.0

%

Net cash provided by operating

activities

$

101

$

86

17.4

%

__________

For footnotes, see pages 13, 14 and

15.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Selected Operating Data

(a)

(Dollars in millions)

(Unaudited)

Six Months Ended June

30,

Consolidated

Same-Store

2024

2023

%

Change

2024

2023

%

Change

Number of hospitals (at end of period)

71

78

71

71

Licensed beds (at end of period)

11,868

12,735

11,868

11,934

Beds in service (at end of period)

10,068

10,843

10,068

10,135

Admissions

212,803

218,423

-2.6

%

212,803

205,851

3.4

%

Adjusted admissions

479,280

495,275

-3.2

%

479,284

467,413

2.5

%

Patient days

952,233

994,067

952,233

939,059

Average length of stay (days)

4.5

4.6

4.5

4.6

Occupancy rate (average beds in

service)

52.0

%

50.6

%

52.0

%

51.2

%

Net operating revenues

$

6,279

$

6,223

0.9

%

$

6,280

$

5,969

5.2

%

Net inpatient revenues as a % of net

operating revenues

47.8

%

47.1

%

47.8

%

47.0

%

Net outpatient revenues as a % of net

operating revenues

52.2

%

52.9

%

52.2

%

53.0

%

Income from operations (f)

$

468

$

457

2.4

%

Income from operations as a % of net

operating revenues

7.5

%

7.3

%

Depreciation and amortization

$

241

$

255

Net loss attributable to Community Health

Systems, Inc. stockholders

$

(55

)

$

(89

)

38.2

%

Net loss attributable to Community Health

Systems, Inc. stockholders as a % of net operating revenues

-0.9

%

-1.4

%

Adjusted EBITDA (c)

$

765

$

707

8.2

%

Adjusted EBITDA as a % of net operating

revenues

12.2

%

11.4

%

Net cash provided by operating

activities

$

197

$

91

116.5

%

__________

For footnotes, see pages 13, 14 and

15.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Condensed Consolidated Balance

Sheets

(In millions, except share

data)

(Unaudited)

June 30,

2024

December 31,

2023

ASSETS

Current assets

Cash and cash equivalents

$

39

$

38

Patient accounts receivable

2,195

2,231

Supplies

337

328

Prepaid income taxes

92

76

Prepaid expenses and taxes

244

260

Other current assets

292

275

Total current assets

3,199

3,208

Property and equipment

9,594

9,511

Less accumulated depreciation and

amortization

(4,372

)

(4,304

)

Property and equipment, net

5,222

5,207

Goodwill

3,972

3,958

Deferred income taxes

29

29

Other assets, net

1,989

2,053

Total assets

$

14,411

$

14,455

LIABILITIES AND STOCKHOLDERS’

DEFICIT

Current liabilities

Current maturities of long-term debt

$

27

$

21

Current operating lease liabilities

114

124

Accounts payable

896

912

Accrued liabilities:

Employee compensation

499

571

Accrued interest

258

160

Other

378

354

Total current liabilities

2,172

2,142

Long-term debt (g)

11,504

11,466

Deferred income taxes

351

369

Long-term operating lease liabilities

542

563

Other long-term liabilities

721

739

Total liabilities

15,290

15,279

Redeemable noncontrolling interests in

equity of consolidated subsidiaries

324

323

STOCKHOLDERS’ DEFICIT

Community Health Systems, Inc.

stockholders’ deficit:

Preferred stock, $.01 par value per share,

100,000,000 shares authorized; none issued

-

-

Common stock, $.01 par value per share,

300,000,000 shares authorized; 138,960,194 shares issued and

outstanding at June 30, 2024, and 136,774,911 shares issued and

outstanding at December 31, 2023

1

1

Additional paid-in capital

2,190

2,185

Accumulated other comprehensive loss

(13

)

(14

)

Accumulated deficit

(3,619

)

(3,564

)

Total Community Health Systems, Inc.

stockholders’ deficit

(1,441

)

(1,392

)

Noncontrolling interests in equity of

consolidated subsidiaries

238

245

Total stockholders’ deficit

(1,203

)

(1,147

)

Total liabilities and stockholders’

deficit

$

14,411

$

14,455

__________

For footnotes, see pages 13, 14 and

15.

COMMUNITY HEALTH SYSTEMS, INC.

AND SUBSIDIARIES

Condensed Consolidated

Statements of Cash Flows

(In millions)

(Unaudited)

Six Months Ended June

30,

2024

2023

Cash flows from operating activities

Net income (loss)

$

20

$

(18

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

241

255

Deferred income taxes

(17

)

29

Stock-based compensation expense

8

10

Impairment and (gain) loss on sale of

businesses, net (f)

27

(35

)

Gain from early extinguishment of debt

(26

)

-

Other non-cash expenses, net

94

88

Changes in operating assets and

liabilities, net of effects of acquisitions and divestitures:

Patient accounts receivable

39

(2

)

Supplies, prepaid expenses and other

current assets

(23

)

(73

)

Accounts payable, accrued liabilities and

income taxes

(88

)

(130

)

Other

(78

)

(33

)

Net cash provided by operating

activities

197

91

Cash flows from investing activities

Acquisitions of facilities and other

related businesses

(1

)

(15

)

Purchases of property and equipment

(181

)

(227

)

Proceeds from disposition of hospitals and

other ancillary operations

-

111

Proceeds from sale of property and

equipment

4

24

Purchases of available-for-sale debt

securities and equity securities

(23

)

(99

)

Proceeds from sales of available-for-sale

debt securities and equity securities

32

137

Purchases of investments in unconsolidated

affiliates

(4

)

(7

)

Increase in other investments

(34

)

(29

)

Net cash used in investing activities

(207

)

(105

)

Cash flows from financing activities

Repurchase of restricted stock shares for

payroll tax withholding requirements

(2

)

(4

)

Deferred financing costs and other

debt-related costs

(9

)

-

Proceeds from noncontrolling investors in

joint ventures

1

3

Redemption of noncontrolling investments

in joint ventures

(2

)

(1

)

Distributions to noncontrolling investors

in joint ventures

(84

)

(83

)

Other borrowings

18

29

Issuance of long-term debt

1,296

-

Proceeds from ABL Facility

1,906

1,527

Repayments of long-term indebtedness

(3,113

)

(1,457

)

Net cash provided by financing

activities

11

14

Net change in cash and cash

equivalents

1

-

Cash and cash equivalents at beginning of

period

38

118

Cash and cash equivalents at end of

period

$

39

$

118

__________

For footnotes, see pages 13, 14 and

15.

Footnotes to Financial Highlights, Financial

Statements and Selected Operating Data

(a)

Both financial and statistical results

include the operating results of divested or closed businesses for

the periods prior to the consummation of the respective divestiture

or closing. Same-store operating results and statistical

information include operating results of businesses operated in the

comparable current year and prior year periods and exclude

businesses divested or closed in 2023. There were no discontinued

operations reported for the periods presented.

(b)

The following table provides information

needed to calculate loss per share, which is adjusted for income

attributable to noncontrolling interests (in millions):

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Net loss attributable to Community Health

Systems, Inc. stockholders:

Net income (loss)

$

26

$

2

$

20

$

(18

)

Less: Income attributable to

noncontrolling interests, net of taxes

39

40

75

71

Net loss attributable to Community Health

Systems, Inc. stockholders — basic and diluted

$

(13

)

$

(38

)

$

(55

)

$

(89

)

(c)

EBITDA is a non-GAAP financial measure

which consists of net loss attributable to Community Health

Systems, Inc. before interest, income taxes, and depreciation and

amortization. Adjusted EBITDA, also a non-GAAP financial measure,

is EBITDA adjusted to add back net income attributable to

noncontrolling interests and to exclude loss (gain) from early

extinguishment of debt, impairment and (gain) loss on sale of

businesses, expense from third-party consulting costs associated

with significant process and systems redesign across multiple

functions (the “Business Transformation Costs”) as part of the

Company’s previously disclosed multi-year initiative to modernize

and consolidate technology platforms and associated processes,

expense related to government and other legal matters and related

costs, expense related to employee termination benefits and other

restructuring charges, the impact of a change in estimate to

increase the professional liability claims accrual recorded during

the fourth quarter of 2022 with respect to claims incurred in prior

years related to divested locations and the gain on sale by

HealthTrust of a majority interest in CoreTrust completed during

the fourth quarter of 2022. The Company has from time to time sold

noncontrolling interests in certain of its subsidiaries or acquired

subsidiaries with existing noncontrolling interest ownership

positions. The Company believes that it is useful to present

Adjusted EBITDA because it adds back the portion of EBITDA

attributable to these third-party interests. The Company reports

Adjusted EBITDA as a measure of financial performance. Adjusted

EBITDA is a key measure used by management to assess the operating

performance of the Company’s hospital operations and to make

decisions on the allocation of resources. Adjusted EBITDA is also

used to evaluate the performance of the Company’s executive

management team and is one of the primary metrics used in

connection with determining short-term cash incentive compensation

and the achievement of vesting criteria with respect to

performance-based equity awards. In addition, management utilizes

Adjusted EBITDA in assessing the Company’s consolidated results of

operations and operational performance and in comparing the

Company’s results of operations between periods.

Footnotes to Financial Highlights, Financial

Statements and Selected Operating Data (Continued)

The Company believes it is useful to provide investors and other

users of the Company’s financial statements this performance

measure to align with how management assesses the Company’s results

of operations. Adjusted EBITDA also is comparable to a similar

metric called Consolidated EBITDA, as defined in the Company’s

asset-based loan facility (the “ABL Facility”) and the Company’s

existing note indentures, which is a key component in the

determination of the Company’s compliance with certain covenants

under the ABL Facility and such note indentures (including the

Company’s ability to service debt and incur capital expenditures),

and is used to determine the interest rate and commitment fee

payable under the ABL Facility (although Adjusted EBITDA does not

include all of the adjustments described in the ABL Facility).

Adjusted EBITDA includes the Adjusted EBITDA attributable to

hospitals that were divested during the course of such year, but in

each case solely to the extent relating to the period prior to the

consummation of the applicable divestiture.

Adjusted EBITDA is not a measurement of financial performance

under U.S. GAAP. It should not be considered in isolation or as a

substitute for net income, operating income, or any other

performance measure calculated in accordance with U.S. GAAP. The

items excluded from Adjusted EBITDA are significant components in

understanding and evaluating financial performance. The Company

believes such adjustments are appropriate as the magnitude and

frequency of such items can vary significantly and are not related

to the assessment of normal operating performance. Additionally,

this calculation of Adjusted EBITDA may not be comparable to

similarly titled measures disclosed by other companies.

The following table reflects the reconciliation of Adjusted

EBITDA, as defined, to net loss attributable to Community Health

Systems, Inc. stockholders as derived directly from the condensed

consolidated financial statements (in millions):

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Net loss attributable to Community Health

Systems, Inc. stockholders

$

(13

)

$

(38

)

$

(55

)

$

(89

)

Adjustments:

Provision for income taxes

24

38

52

65

Depreciation and amortization

125

124

241

255

Net income attributable to noncontrolling

interests

39

40

75

71

Interest expense, net

216

207

426

414

Gain from early extinguishment of debt

(26

)

-

(26

)

-

Impairment and (gain) loss on sale of

businesses, net

10

(13

)

27

(35

)

Expense from government and other legal

matters and related costs

-

-

-

10

Expense from business transformation

costs

12

6

25

6

Expense related to employee termination

benefits and other restructuring charges

-

9

-

10

Adjusted EBITDA

$

387

$

373

$

765

$

707

(d)

The following table sets forth components

reconciling the basic weighted-average number of shares to the

diluted weighted-average number of shares (in millions):

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Weighted-average number of shares

outstanding - basic

132

131

132

130

Add effect of dilutive securities:

Stock awards and options

-

-

-

-

Weighted-average number of shares

outstanding - diluted

132

131

132

130

Footnotes to Financial Highlights, Financial

Statements and Selected Operating Data (Continued)

The Company generated a net loss attributable to Community

Health Systems, Inc. stockholders for the three and six months

ended June 30, 2024 and 2023, so the effect of dilutive securities

is not considered because their effect would be antidilutive. If

the Company had generated net income, the effect of stock awards

and options on the diluted shares calculation would have been an

increase of 864,816 shares and 202,182 shares during the three

months ended June 30, 2024 and 2023, respectively, and 654,307

shares and 335,188 shares during the six months ended June 30, 2024

and 2023, respectively.

(e)

The following supplemental table

reconciles net loss attributable to Community Health Systems, Inc.

stockholders, as reported, on a per share (diluted) basis, to net

loss attributable to Community Health Systems, Inc. stockholders

per share (diluted) with the adjustments described herein (total

per share amounts may not add due to rounding). The Company

believes that the presentation of non-GAAP adjusted net loss

attributable to Community Health Systems, Inc. stockholders per

share (diluted) presents useful information to investors by

highlighting the impact on net loss attributable to Community

Health Systems, Inc. stockholders per share (diluted) of selected

items used in calculating Adjusted EBITDA which may not reflect the

Company’s underlying operating performance and assisting in

comparing the Company’s results of operations between periods.

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Net loss per share (diluted), as

reported

$

(0.10

)

$

(0.29

)

$

(0.42

)

$

(0.68

)

Adjustments:

Gain from early extinguishment of debt

(0.20

)

-

(0.20

)

-

Impairment and (gain) loss on sale of

businesses, net

0.06

(0.02

)

0.16

(0.13

)

Expense from government and other legal

matters and related costs

-

-

-

0.06

Expense from business transformation

costs

0.07

0.04

0.15

0.04

Expense related to employee termination

benefits and other restructuring charges

-

0.05

-

0.06

Net loss per share (diluted), excluding

adjustments

$

(0.17

)

$

(0.22

)

$

(0.31

)

$

(0.65

)

(f)

Both income from operations and net income

(loss) included a net non-cash impairment expense of $10 million

and income of $13 million for the three months ended June 30, 2024

and 2023, respectively, and a net non-cash impairment expense of

$27 million and income of $35 million for the six months ended June

30, 2024 and 2023, respectively. The impairment expense for 2024

was primarily to reduce the carrying value of several assets that

were idled, disposed of or held-for-sale. The income for 2023 was

primarily from gains on the sale of certain businesses during the

periods and also impairment charges to reduce the value of certain

long-lived assets at businesses the Company identified for closure,

sale or sold. These gains and impairment charges do not have an

impact on the calculation of the Company’s financial covenants

under the ABL Facility.

(g)

The maximum aggregate principal amount

under the ABL Facility is $1.0 billion, subject to borrowing base

capacity. At June 30, 2024, the Company had outstanding borrowings

of $273 million and approximately $599 million of additional

borrowing capacity (after taking into consideration $67 million of

outstanding letters of credit) under the ABL Facility.

Regulation FD Disclosure

Set forth below is selected information concerning the Company’s

projected consolidated operating results for the year ending

December 31, 2024. These projections update selected guidance

provided on February 20, 2024, and are based on the Company’s

historical operating performance, current trends and other

assumptions that the Company believes are reasonable at this time.

This 2024 guidance should be considered in conjunction with the

assumptions included herein. See pages 18, 19 and 20 for a list of

factors that could affect the future results of the Company or the

healthcare industry generally. The following is provided as

guidance to analysts and investors:

2024 Projection Range

Net operating revenues (in millions)

$

12,500

to

$

12,700

Adjusted EBITDA (in millions)

$

1,520

to

$

1,600

Net loss per share - diluted

$

(0.45

)

to

$

(0.30

)

Weighted-average diluted shares (in

millions)

132

to

133

The following assumptions were used in developing the 2024

guidance provided above:

- The Company’s projections exclude the following:

- Effect of debt refinancing activities, including gains and

losses from early extinguishment of debt;

- Impairment of goodwill and long-lived assets;

- The impact of any potential future divestitures;

- Gains or losses from the sales of businesses;

- Employee termination benefits and restructuring costs;

- Resolution of government investigations or other significant

legal settlements;

- Costs incurred in connection with divestitures;

- Expense for third-party consulting costs associated with

significant process and systems redesign across multiple functions

as part of the Company's previously disclosed business

transformation initiative; and

- Other significant gains or losses that neither relate to the

ordinary course of business nor reflect the Company’s underlying

business performance.

Other assumptions used in the above guidance:

- Expressed as a percentage of net operating revenues,

depreciation and amortization of approximately 4.0% for 2024.

Additionally, this is a fixed cost and the percentages may vary

based on changes in net operating revenues. Such amounts exclude

the possible impact of any future hospital fixed asset

impairments.

- Interest expense is estimated to be between $850 million and

$865 million while cash paid for interest, which excludes the

amortization of deferred financing costs, is expected to be $730

million to $740 million. Total fixed rate debt is expected to

average approximately 98% of total debt during 2024.

- Expressed as a percentage of net operating revenues, net income

attributable to noncontrolling interests of approximately 1.2% to

1.3% for 2024.

- Expressed as a percentage of net operating revenues, provision

for income taxes of approximately 0.9% to 1.0% for 2024.

A reconciliation of the Company’s projected 2024 Adjusted

EBITDA, a forward-looking non-GAAP financial measure, to the

Company’s projected net loss attributable to Community Health

Systems, Inc. stockholders, the most directly comparable GAAP

financial measure, is shown below (in millions):

Year Ending

December 31, 2024

Low

High

Net loss attributable to Community Health

Systems, Inc. stockholders (1)

$

(59

)

$

(46

)

Adjustments:

Depreciation and amortization

465

480

Interest expense, net

850

865

Provision for income taxes

114

136

Net income attributable to noncontrolling

interests

150

165

Adjusted EBITDA (1)

$

1,520

$

1,600

(1) The Company does not include in this reconciliation the

impact of certain items not included in the Company’s forecast set

forth above that would be included in a reconciliation of

historical net loss attributable to Community Health Systems, Inc.

stockholders to Adjusted EBITDA such as, but not limited to, losses

(gains) from early extinguishment of debt, impairment and (gain)

loss on sale of businesses and expense from government and other

legal matters and related costs, in light of the fact that such

items are not determinable, and/or the inherent difficulty in

quantifying such projected amounts, on a forward-looking basis.

- Capital expenditures are projected as follows (in

millions):

2024

Guidance

Total

$

350

to

$

400

- Net cash provided by operating activities, including estimated

cash payments for income taxes of $150 million to $200 million, are

projected as follows (in millions):

2024

Guidance

Total

$

500

to

$

650

- Diluted weighted-average shares outstanding are projected to be

approximately 132 million to 133 million for 2024.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, Section 21E of the Securities Exchange Act of 1934, as

amended, and the Private Securities Litigation Reform Act of 1995

that involve risk and uncertainties. All statements in this press

release other than statements of historical fact, including

statements regarding projections, expected operating results, and

other events that depend upon or refer to future events or

conditions or that include words such as “expects,” “anticipates,”

“intends,” “plans,” “believes,” “estimates,” “thinks,” and similar

expressions, are forward-looking statements. Although the Company

believes that these forward-looking statements are based on

reasonable assumptions, these assumptions are inherently subject to

significant economic and competitive uncertainties and

contingencies, which are difficult or impossible to predict

accurately and may be beyond the control of the Company.

Accordingly, the Company cannot give any assurance that its

expectations will in fact occur and cautions that actual results

may differ materially from those in the forward-looking statements.

A number of factors could affect the future results of the Company

or the healthcare industry generally and could cause the Company’s

expected results to differ materially from those expressed in this

press release.

These factors include, among other things:

- general economic and business conditions, both nationally and

in the regions in which we operate, including the impact of current

negative macroeconomic conditions, inflationary conditions, the

current high interest rate environment, and current geopolitical

instability, as well as the potential impact on us of political,

financial, credit and capital conditions;

- the impact of current or future federal and state health reform

initiatives;

- the extent to and manner in which states adopt changes to

Medicaid programs, implement health insurance exchanges or alter or

reduce the provision of, or payment for, healthcare to state

residents through legislation, regulation or otherwise;

- changes related to health insurance enrollment, including those

affecting the beneficiary enrollment process and the stability of

health insurance exchanges;

- risks associated with our substantial indebtedness, leverage

and debt service obligations, including our ability to refinance

such indebtedness on acceptable terms or to incur additional

indebtedness, and our ability to remain in compliance with debt

covenants;

- demographic changes;

- changes in, or the failure to comply with, federal, state or

local laws or governmental regulations affecting our business;

- judicial developments impacting the Company or the healthcare

industry, including the potential impact of the recent decisions of

the U.S. Supreme Court regarding the actions of federal

agencies;

- potential adverse impact of known and unknown legal, regulatory

and governmental proceedings and other loss contingencies,

including governmental investigations and audits, and federal and

state false claims act litigation;

- our ability, where appropriate, to enter into and maintain

provider arrangements with payors and the terms of these

arrangements, which may be further affected by the increasing

consolidation of health insurers and managed care companies and

vertical integration efforts involving payors and healthcare

providers;

- changes in, or the failure to comply with, contract terms with

payors and changes in reimbursement policies, methodologies or

rates paid by federal or state healthcare programs or commercial

payors;

- security breaches, cyber-attacks, loss of data, other

cybersecurity threats or incidents, including those experienced

with respect to our information systems or the information systems

of third parties with whom we conduct business, and any actual or

perceived failures to comply with legal requirements governing the

privacy and security of health information or other regulated,

sensitive or confidential information, or legal requirements

regarding data privacy or data protection;

- any potential impairments in the carrying value of goodwill,

other intangible assets, or other long-lived assets, or changes in

the useful lives of other intangible assets;

- the effects related to the sequestration spending reductions

pursuant to both the Budget Control Act of 2011 and the

Pay-As-You-Go Act of 2010 and the potential for future deficit

reduction legislation;

- increases in the amount and risk of collectability of patient

accounts receivable, including decreases in collectability which

may result from, among other things, self-pay growth and

difficulties in recovering payments for which patients are

responsible, including co-pays and deductibles;

- the efforts of insurers, healthcare providers, large employer

groups and others to contain healthcare costs, including the trend

toward value-based purchasing;

- the impact of competitive labor market conditions, including in

connection with our ability to hire and retain qualified nurses,

physicians, other medical personnel and key management, and

increased labor expenses arising from inflation and/or competition

for such positions;

- the inability of third parties with whom we contract to provide

hospital-based physicians and the effectiveness of our efforts to

mitigate such non-performance including through acquisitions of

outsourced medical specialist businesses, engagement with new or

replacement providers, employment of physicians and re-negotiation

or assumption of existing contracts;

- any failure to obtain medical supplies or pharmaceuticals at

favorable prices;

- liabilities and other claims asserted against us, including

self-insured professional liability claims;

- competition;

- trends toward treatment of patients in less acute or specialty

healthcare settings, including ambulatory surgery centers or

specialty hospitals or via telehealth;

- changes in medical or other technology;

- any failure of our ongoing process of redesigning and

consolidating key business functions, including through the

implementation of a new core enterprise resource planning system,

to proceed as expected or to be completed successfully;

- changes in U.S. GAAP;

- the availability and terms of capital to fund any additional

acquisitions or replacement facilities or other capital

expenditures;

- our ability to successfully make acquisitions or complete

divestitures, our ability to complete any such acquisitions or

divestitures on desired terms or at all, the timing of the

completion of any such acquisitions or divestitures, and our

ability to realize the intended benefits from any such acquisitions

or divestitures;

- the impact that changes in our relationships with joint venture

or syndication partners could have on effectively operating our

hospitals or ancillary services or in advancing strategic

opportunities;

- our ability to successfully integrate any acquired hospitals

and/or outpatient facilities, or to realize expected benefits from

acquisitions such as increased growth in patient service

revenues;

- the impact of severe weather conditions and climate change, as

well as the timing and amount of insurance recoveries in relation

to severe weather events;

- our ability to obtain adequate levels of insurance, including

general liability, professional liability, cyber liability and

directors and officers liability insurance;

- timeliness of reimbursement payments received under government

programs;

- effects related to pandemics, epidemics, or outbreaks of

infectious diseases on our business, results of operations,

financial condition, and/or cash flows;

- any failure to comply with our obligations under license or

technology agreements;

- challenging economic conditions in non-urban communities in

which we operate;

- the concentration of our revenue in a small number of

states;

- our ability to realize anticipated cost savings and other

benefits from our current strategic and operational cost savings

initiatives;

- any changes in or interpretations of income tax laws and

regulations; and

- the risk factors set forth in our Annual Report on Form 10-K

for the year ended December 31, 2023, filed with the Securities and

Exchange Commission (the “SEC”) on February 21, 2024 and other

filings filed with the SEC.

The consolidated operating results for the three and six months

ended June 30, 2024, are not necessarily indicative of the results

that may be experienced for any future periods. The Company

cautions that the projections for calendar year 2024 set forth in

this press release are given as of the date hereof based on

currently available information. The Company undertakes no

obligation to revise or update any forward-looking statements

(including such guidance), or to make any other forward-looking

statements, whether as a result of new information, future events

or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724619204/en/

Investor Contact:

Kevin Hammons President and Chief Financial Officer (615)

465-7000

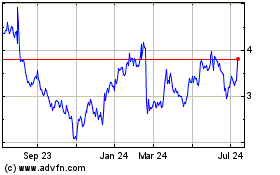

Community Health Systems (NYSE:CYH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Community Health Systems (NYSE:CYH)

Historical Stock Chart

From Jul 2023 to Jul 2024