Colombier Acquisition Corp. II Announces Pricing of Upsized $150 Million Initial Public Offering

November 20 2023 - 5:40PM

Business Wire

Colombier Acquisition Corp. II (the “Company,” “Colombier II”)

today announced the pricing of its upsized initial public offering

of 15,000,000 units at a price of $10.00 per unit. The units will

be listed on the New York Stock Exchange ("NYSE") and trade under

the ticker symbol "CLBR.U" beginning on November 21, 2023. Each

unit consists of one Class A ordinary share and one-third of one

redeemable warrant, with each whole warrant exercisable to purchase

one Class A ordinary share at a price of $11.50 per share. After

the securities comprising the units begin separate trading, the

Class A ordinary shares and warrants are expected to be listed on

the NYSE under the symbols "CLBR" and "CLBR WS," respectively.

Colombier II is a blank check company formed for the purpose of

effecting a merger, capital share exchange, asset acquisition,

share purchase, reorganization or similar business combination with

one or more businesses. While Colombier II may pursue an

acquisition opportunity in any business, industry, sector or

geographical location, it intends to focus on industries that

complement the management team’s background and network, such as

companies categorized by Entrepreneurship, Innovation, and Growth

(“EIG”), including but not limited to parallel economies, the

return of products and services developed within the United States,

sectors with impaired value due to certain investor mandates and

businesses within regulated areas that are disrupting

inefficiencies related thereto.

The team is led by seasoned capital markets professionals with

experience in the EIG ecosystem including Chief Executive Officer

and Chairman, Omeed Malik, Chief Financial Officer and

Co-President, Joe Voboril, Chief Investment Officer and

Co-President, Andrew Nasser and Chief Operating Officer, Jordan

Cohen. The Company’s board of directors includes Chris Buskirk,

Founder and Chief Investment Officer of 1789 Capital; Candice

Willoughby, Capital Markets Executive; Michael Seifert, Founder,

Chief Executive Officer and Chairman of the Board of PSQ Holdings,

Inc; and Ryan Kavanaugh, Co-Founder of Triller.

BTIG, LLC is acting as sole bookrunner and representative of the

underwriters of the offering. The Company has granted the

underwriters a 45-day option to purchase up to an additional

2,250,000 units at the initial public offering price less the

underwriting discounts and commissions to cover over-allotments, if

any.

The offering is being made only by means of a prospectus. When

available, copies of the prospectus relating to the offering may be

obtained from BTIG, LLC, Attention: 65 E. 55th Street, New York,

New York 10022 or by email: ProspectusDelivery@btig.com.

A registration statement relating to these securities was

declared effective by the U.S. Securities and Exchange Commission

(the "SEC") on November 20, 2023. This press release shall not

constitute an offer to sell or the solicitation of an offer to buy,

nor shall there be any sale of these securities in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities law of any such state or jurisdiction.

Forward Looking Statements

This press release contains statements that constitute

"forward-looking statements," including with respect to the initial

public offering and the anticipated use of the net proceeds. No

assurance can be given that the offering discussed above will be

completed on the terms described, or at all, or that the net

proceeds of the offering will be used as indicated. Forward-looking

statements are subject to numerous conditions, many of which are

beyond the control of the Company, including those set forth in the

Risk Factors section of the Company's registration statement and

preliminary prospectus for the offering filed with the SEC. Copies

are available on the SEC's website, www.sec.gov. The Company

undertakes no obligation to update these statements for revisions

or change after the date of this release, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231120516584/en/

Company Contact: Colombier Acquisition Corp. Email:

ir@colombierspac.com

Media Contact: Ashley DeSimone ICR, Inc.

Ashley.DeSimone@icrinc.com

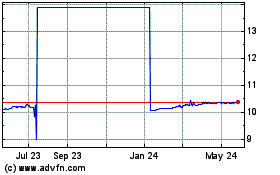

Colombier Acquisition (NYSE:CLBR)

Historical Stock Chart

From Nov 2024 to Dec 2024

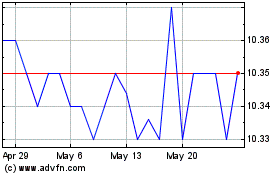

Colombier Acquisition (NYSE:CLBR)

Historical Stock Chart

From Dec 2023 to Dec 2024