Filed by Colombier Acquisition Corp.

pursuant to Rule 425 under the

U.S. Securities Act of 1933, as amended,

under the Securities Exchange Act of 1934,

as amended

Subject Company: Colombier Acquisition Corp.

Commission File No.: 001-40457

Date: July 11, 2023

CLBR-PSQH Webinar Transcript (7.11.23)

Dan Zacchei:

Welcome and thank you all for being here today. I’m Dan Zacchei, external

investor relations for PublicSq. I’m joined today by the founder and CEO of PublicSq., Michael Seifert, as well as the CEO of Colombier

Acquisition Group, Omeed Malik. As you know, or as you may know, PublicSq. and Colombier are set to merge through a business combination

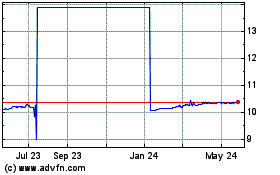

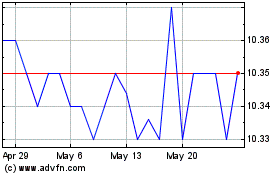

that will make PublicSq. a publicly traded company. The stock currently trades under the ticker CLBR, and anyone who wants to support

the company can become an investor by buying the stock today. Before we begin, I want to remind everyone that you’re free to ask questions

by using the GoTo webinar app. As a further reminder, today’s webinar includes forward-looking statements about our expectations for the

company’s future performance and actual results could differ materially. The company’s expectations and beliefs are expressed in good

faith, but there can be no assurance that they’ll be achieved or accomplished. Please refer to our SEC filings for further discussion.

Michael?

Michael Seifert:

Hi everybody. Great to see everyone here. It’s awesome to see this

webinar expand to consumers, businesses on our platform, already existing investors, prospective investors, and just interested parties.

It’s wonderful to know that there’s this much interest in what we are developing with this patriotic parallel economy, and I want to thank

everyone for building this parallel economy, first and foremost. None of the success that PublicSq., and more broadly, the patriotic parallel

economy have achieved to date, could have been possible without each and every one of you that are passionate about putting your values

in into the commerce experience, voting with your wallets, supporting the small businesses that make this nation so special, and we hope

today to answer any questions you might have about the next chapter in PublicSq.’s journey, which is taking this patriotic parallel economy

public, being a company by the people, for the people, and now owned by “We the People.”

So we’ve had a wild ride at PublicSq. We’re going to tell you a lot

about it today. We’re going to tell you where we’ve been, where we’re at today, and where we’re going in the near future, and we’re going

to introduce you to some of the major folks and leaders in this movement who have made this journey possible. We’re actually going to

start there. So before we get into introductions, just want to say thank you. Thank you for joining us. We hope that this is informative.

We hope that this webinar blesses you with all the information you need to know about how to invest and join us on this journey to being

accompanied by the people, for the people and owned by “We the People.” And make sure to utilize that chat feature, the question

feature that Dan mentioned so that you can input your questions and we hope to cover all that you might have today.

One more housekeeping, this will be recorded and shared with this audience

at the conclusion of this call. So if there are little details that you might have missed or you want to rewatch it or share it with friends

or community, you can do that. We will send this in a follow-up email to all registrants and also post on social media. So without further

ado, we’re excited to jump in. We’re going to start by some introductions. My name is Michael Seifert, CEO and founder of PublicSq. You

can find us at publicsq.com. We are the world’s largest marketplace of pro-American pro-constitution businesses and consumers that this

world has ever seen. And you’ll also see on the screen that we have a few very influential leaders in this movement, this parallel economy,

freedom commerce movement, starting with bottom right on my screen, I don’t know where he is presented on your screen, but we’ve got Nick

Ayers.

So Nick Ayers is a dear friend. He’s also an investor in PublicSq.

And, most recently, he was the chief of staff for Vice President Mike Pence in the White House, as well as the assistant to President

Trump. He has a notable career leading the Republican Governor’s Association as well. He’s also had a plethora of startup experiences.

He is an entrepreneur and a founder in his own rights, a few very successful endeavors. He’s also a board member of the company, Veeam,

if you’re familiar with that large enterprise. And we are very blessed because at the close of this transaction, Nick Ayers will actually

be a board member of this company as well.

He also sits as the executive chairman of our first D2C brand that

we are launching that we’ve referenced in our most recent public filings, which is called EveryLife. We’re not going to jump into that

a ton today, but we will get into that in the near future. Nick is very involved. We’re grateful to have him here. Nick, I would love

to start with you and I’d love to hear, you could be doing anything, you have such incredible experience and are really gifted in a lot

of ways, have built a very notable career in your own right, why would you choose to spend your time, money, or resources on PublicSq.?

Nick Ayers:

Thank you. I don’t deserve that introduction. The most important title

to me, Michael, is dad and husband and follower of Christ. So I hear all the other accolades and I really appreciate it. And good afternoon

to everyone. I’m thrilled to be with so many of the 55,000 plus small and medium-sized businesses on the PublicSq. app and the over 1.1

million users of PublicSq. who I really believe represent the backbone of this economy.

When I left the White House, I had two convictions, y’all. One, I did

want to spend more time with my wife and seven-year-old triplets. After 20 years in politics, I had not seen a lot of them. But two, that

this nation was beyond purely a political solution. And what I mean by that is I came to the conclusion that success in the next election

was no longer enough because I’d watched as nearly every major educational, government, global business, they were promoting harmful and

destructive economic and social policies that were way out of line of what made us the greatest country in the world, and they were completely

opposed to the values that drove my family’s life.

So on one hand I watched as people who share mine and your values voted

for candidates that align with that and were often successful in elections, 2016 is an example of that. But on the other hand, we were

giving all of our money to companies who were using those profits to defeat us at the ballot box and in the classroom and in the boardroom.

So I decided to invest a lot of my own capital after leaving the White House and most or all of my time to build companies that would

give voice to the majority of Americans who cherish freedom and whose faith guided those decisions.

A few years ago, as you all know, there were not many options, but

in my view, PublicSq. has changed everything. We’re no longer left only with the option of boycotting, which those of us who care about

this stuff, and there are over a hundred million of us that do, we’ve learned to do that effectively, but now we can leverage the power

of what we are buying and from whom.

This company has an amazing mission. It has an extraordinary product,

obviously you all have the app, but I want to tell you why personally Jamie and I decided to invest in PublicSq. above and beyond those

reasons were her people, the people that PublicSq. was serving, those of you on this webinar, but the people who created and are running

this company. As a board member, I’ll tell you, I’ve gotten to know their team really well. There’s not a better group of Americans who

cherish their faith and who are driven by this mission more than Michael and the men and women around him. You all would be so proud and

honored to watch how, while holding up their faith and their family as their top priorities, they are putting their blood, sweat and tears

into developing this business, not only to create a great return for those of us who invest in it. And the beauty of going public is this

wonderful investment in my view is no longer limited to people like me and Blake and Omeed and Michael.

Now, all of you, our hope is to partner with you. And so to truly let

the people who still love this country, who shared Judeo-Christian values, who believed in the excellence of this country, who believed

that capitalism is the best economic model, we can all do this together now thanks to PublicSq. So it’s an honor to be on it. Michael,

thank you for your kind words and I really look forward to partnering not only with you all, but the millions of people who are already

part of PublicSq.

Michael Seifert:

Thank you, Nick. That’s amazing. I love that you started with the most

important accolade, which certainly is your family. You’re a good man and a good father, and it’s been a pleasure being your friend and

business partner. I’m going to take it to Blake Masters now who is also a dear friend and a great business partner in this endeavor, very

experienced in his own right. He is also a loving husband and father as well from the great state of Arizona, most recently US Senate

candidate for Arizona and ran one of the best political campaigns I’ve ever witnessed. Your message was heartfelt, Blake. It was genuine,

and it resonated with our consumer base, I can tell you that.

And the values that you stand for, values for family, for the principles

of the Constitution are very inspiring to know us, and you’ve done that in the political realm. You’ve also done that in the corporate

world as well. You’re a COO of Thiel Capital. You actually wrote the most successful startup book of all time, of which I’ve read four

times, “Zero to One.” I highly recommend it. If you have not read it, it is one of the greatest books ever read about how

to grow and scale a business. And so Blake, it’s really an honor to have you here. You are also an investor in this company and are joining

our board post-close of this transaction here in a week. So Blake, thank you so much. I would love to ask you the same question. You could

do anything, why would you choose to spend your time, money, or resource on PublicSq.?

Blake Masters:

Well, thank you so much Michael, and thank you all for your time today.

It’s great to be with you. I have two very simple and direct answers to that question, both born of personal experience. So like Michael

mentioned last year, I was Arizona’s Republican nominee for the United States Senate. And running for office is not easy, I’ll tell you

that, but the best part about it, far and away, is just chatting with so many voters. I got to meet tens of thousands of voters and they

would tell me their stories. And some of these stories, I always like hearing them, but some of them are really maddening and frustrating

to hear, right? I’ve heard hundreds if not thousands of stories from people who are just fed up with how increasingly big business in

America is relentlessly pushing woke political values onto us as consumers in the marketplace.

And I won’t bore you with examples, you know all the examples, you’re

living this, I’m living this. We’ve seen it. And I will tell you this, I’ve just seen how badly needed PublicSq. is. It’s not just Republicans,

by the way, who are crying out. If you look at survey data, it’s Republicans, it’s Democrats, it’s Independents. Pretty much nobody likes

corporate America just deciding to install woke values on us when we’re trying to shop for toilet paper or buy a new crib for our baby.

And so this app, this marketplace, this incredible PublicSq. company, by providing people this alternative where you can actually feel

good about voting with your dollars, patronizing businesses that are going to respect you instead of hate you and demean you, it’s an

incredible market opportunity, and that was clear as soon as I learned about the business.

Now the second reason, not to get all gushy on you, Michael, but the

second reason why I’m so excited to get involved in PublicSq., he is on this call, it’s Michael. Before politics, I was in venture capital,

like Michael mentioned, I ran Peter Thiel’s family office for a number of years. And so I don’t know how many companies I’ve worked with,

but it’s in the hundreds at this point. Mostly early-stage tech companies that grow and eventually get sold or become public.

And so I’ve worked with so many talented entrepreneurs and I will tell

you, Michael is as good as it gets. This guy is laser-focused, Nick spoke to Michael’s character and I’ve seen that play out in spades.

But just on the business side, he’s laser-focused, he’s relentless. I’ve seen how well he manages this company day to day and it’s because

he cares. He cares about this long-term vision. And so when I got to know Michael and I got to see this team that he was building around

him, I said, “How can I get more involved?” I said, “Please take my money. I want to invest in this company.” And

then I was honored when he asked me to join the board. This is important work that we’re doing. We’re just getting started and I can’t

wait to see all the good things this company does. So thanks for being a part of it and being on this journey with us.

Michael Seifert:

Well, Blake, thank you. I do not deserve those words, but I’m very

grateful for them. So thank you. It’s a pleasure to have you on this team as a leader in this and as certainly an advisor to me and our

team more broadly.

I want to introduce two more folks, one of which was just able to join.

He’s got a very busy schedule. We’re glad that he jumped in here today. We weren’t sure that he was going to be able to make it, but we

just got note that he is here helping... He’s been in Colorado helping Lauren Boebert’s campaign, which is a worthwhile cause, which

is awesome. We’ve got Donald Trump Jr., who’s an investor in this company and is a dear friend who has helped tremendously along this

journey. He’s had a real voice to the people in this country that have felt the frustrations that have driven this country to a real breaking

point, but he’s so hopeful for the solutions that we’re providing and he’s been a leader in providing those solutions. So Don, Jr., very

grateful to have you here. If you can present, that would be awesome. I just got note that you’re presenter, Dan, is that confirmed? Don,

can you-

Donald John Trump Jr.:

I can hear you guys.

Michael Seifert:

Hey, great. How are you, Don?

Donald John Trump Jr.:

I can hear you. Yeah, I’m sort of in the middle of nowhere, and so

I was struggling for WiFi, but I wanted to make sure to be able to jump on. I hear what’s going on, talk about the importance of this

movement, because honestly, if you look at the state of the country, if you see the things that are going on, frankly, as far as I’m concerned,

nothing could be more important than doing this and supporting the great American businesses that have been left behind by woke corporate

America and being able to help those families, consumers who want to support those values.

And I think now watching what’s going on and going public, it’s sort

of amazing because people can actually now participate in an economy of a forgotten portion of the populace that just happens to be probably

about 175 million people, where you see people who share those common incredible values that at no other point in time in world history,

frankly, but certainly in American history, would any of these things be controversial, would they be frowned upon, would banks, insurance

companies look down upon these businesses?

And so linking these people, who again, are part of that sort of forgotten

man, woman, and business of this country is just awesome. So to be a part of this team, to see what’s going on, to hear the success stories

of the people that have been helped by the platform, even in its infancy over the last, let’s call it year and a half of my involvement,

it’s just a very, very exciting time. Super excited about the team that we’ve put together. The people that are involved now, I think

just punching way above our weight class because those are people who were in some of those major woke corporations but didn’t buy into

it, didn’t ascribe to it, but also weren’t willing to put their values aside to assimilate to that nonsense.

And so what’s the amazing opportunity to hear business-wise is that,

again, I think no one wants to even look at these things. Woke corporate can’t even think about doing it, it doesn’t fit their ESG requirements.

And I think it just creates an incredible opportunity to do it. Something amazing for patriots across this country. I think it creates

an incredible financial opportunity as well for those who are getting in early to a movement that I think is incredibly large and has

no limits.

And so being a part of this team and being with this group has just

been awesome. I want to thank everyone for being on today, and Michael, for the job that you’ve done, really spearheading this. When I

met Michael about a year and a half ago, it was rare. I’ve seen business deals my whole life. Contrary to popular belief prior, to politics,

we actually did a lot of business and a lot of pretty big deals in this and I met Michael and you see a lot of people that have good ideas,

but they’re not capable of executing. You meet some people that are very capable but have very bad ideas. Michael was an incredible blend

of those, where you had the passion, the enthusiasm, the ability, the fortitude, and an idea that’s absolutely unstoppable in my mind.

And I think, you have that incredible combination. And I think the rest of the team, as it’s filling in, I’m just shocked on a daily basis

of what this team is putting together, and I’m excited to be a part of it and taking it to the next level.

Michael Seifert:

Thank you so much, Don. Means a lot that you’d call in. Appreciate

it a ton. You’re running and gunning, and so we’re grateful for your time, grateful that you had service and could join us from the beautiful

state of Colorado and certainly appreciate your kind words and your investment and involvement in this country in leading this movement

to shop our values. So appreciate it, Don. One more introduction.

My new business partner who I’m incredibly grateful for, Omeed Malik

next to me, to my right. Omeed has been a real leader in his own right coming from an incredible career on Wall Street, where he has led,

I guess, he’s going to tell you a lot more about it, but where he has led with his values, in the avenue of commerce and is really passionate

about democratizing the capital markets. He’s respected in this space. I’ve enjoyed getting to know him, because he’s an ethical businessman.

He’s honest, he’s genuine, and he’s not going to beat around the bush. I can always trust him to get an honest answer from him. And on

Wall Street, that’s rare and so incredibly grateful for Omeed and this new friendship we’ve developed.

I believe that we’re a dynamite team, because PublicSq., we have the

opportunity to represent the values of Main Street in a really profound way and bring them to Omeed’s world, which is Wall Street. And

so these forces combining and uniting to create an incredible business, is something I’m excited about.

One more thing I’ll mention before kicking it to Omeed. A lot of SPACs,

which is the mechanism that we’re utilizing for investments. It’s rare to see the sponsor, the CEO and Chairman, Omeed joining the board

of the company, joining us in the lockup, really saying with both his time, his money and his resources, I’m in this and I want to be

a part of this fight for the long haul. So I’m honored to be the recipient of that, Omeed, off to you.

Omeed Malik:

Thank you. As you guys can see, if you’re watching, we’re sitting very

close together, but after all those compliments, Michael’s head is so big, I’m being pushed off the screen, so I’m not going to do anymore.

Michael Seifert:

I didn’t ask for that.

Omeed Malik:

Right. In all seriousness, none of that was scripted. Everybody here

is very genuine, and I actually echo all the same sentiments. He really has been an incredible partner. We’ve been in the trenches, as

you guys can imagine, 24/7 over the past several months. And yeah, I mean work ethic is really everything to me professionally, and I’ve

never seen someone like Michael, even though on a relative basis, he’s younger than those of us on the call. It is quite tremendous when

you see someone that has that thing you can’t teach, he’s definitely got it. All of us on this call see that, and that’s what we keep

referring to. So he’s the right person, at the right time, to not only have started, but lead this company to the future. And I’m kind

of giving reasons as to why this had to be the deal we needed to do.

So for those of you who don’t know, I’m the chairman and CEO of the

SPAC, and that’s the public company on the New York Stock Exchange called Colombier Acquisition Corp. Its ticker is CLBR. And the opportunity

today is that people want to support this mission, they can just go and buy whatever they’re comfortable of CLBR today. You can look at

it pretty similarly to donating to a political campaign, 5, 10 bucks. This is just supposed to be grassroots.

And it goes back to the first conversation I had with Michael when

I was taking my SPAC, which is a company that’s public right now. We’re emerging with his, and then his company will be the surviving

company on New York Stock Exchange. And what’s so exciting is after all this process, all that’s going to take place very soon, the morning

of July 20th, when this group that you heard from today, is going to be standing at the New York Stock Exchange and ringing the opening

bell, which is extremely exciting, not only from a substantive, but symbolic standpoint that a company that represents this values will

finally be listed on the New York Stock Exchange, probably the first of its kind.

So that’s kind of the backdrop for what’s going on here, and that’s

the opportunity in front of you guys who are all passionate users of the product. But when I first met Michael, the thing he said is,

I want to do this, because I want my relative who’s a truck driver to be able to take this company. When you stay private, people don’t

realize that there are all these regulations about whether or not you can invest in a company. They’re called the Accredited Investor

Rules, and they put very high thresholds for better or for worse, for people to be able to invest.

And so the real reason we’re doing this is so PublicSq., this company,

which you guys know is so important in this new parallel economy. I call it foundational, because I’m a student of history. I look at

how commerce has developed over any civilization, and you always see the first thing that has to happen is an exchange. People have to

find a place to buy and sell. It used to be physical bazaars in ancient times, and now that’s all become digital. It’s okay for us to

have an idea, but if you can’t find the community, you’ll never be able to actually build an economy. So that’s why more than any other

product, we had to start with PublicSq., which is that digital exchange for all of us on this call to buy and sell the on. And so that’s

the foundational aspect of it.

And we believe this is the most impressive, exciting market I think

I’ve ever seen, because guess what? It’s over half of the greatest country in the world. It’s over half of the United States of America.

And what we say is it’s actually the third-largest economy left in the world. Because if you look at GDP, just for people that voted for

Don’s dad, that’s 30% of American GDP, that’s $7 trillion, that as Blake and Nick rightfully pointed out, not only are people ignoring

us, they’re actually going on their way to alienate us, and to offend us. And we haven’t done anything about that, until now. And that’s

understandable that people wanted to boycott, because people were frustrated over the last 10 or 12 years. But we haven’t given anyone

any solutions. Well, this is the first, if you’re sick of it, like all of us are, we decided to come together and do something about it.

And going public is not only going to give a ton of opportunity for

the business to grow even further than it already has, but what it’s also going to do, is allow everyone that feels the same way to be

a part of it and own a part of this. So we look at this, not only as a business transaction, but a movement that all of you are now able

to be a part of, because we don’t come together, I think, this is our last best chance to do something.

We’ve already seen that the country’s divided politically and culturally.

And personally, I moved from New York to Florida because of that. But the next area that they’re going to try to come after us is in the

private sector. A lot of you guys work on social media and try to express yourselves, and you saw what the federal government did, using

these big tech companies to suppress your speech. They violated our constitutional rights over the last few years, by using these big

tech companies to do that. We’re never going to win if the big tech companies and the biggest businesses in the world, not only don’t

share our values, but want to actually violate our constitutional protections. So you have to be able to form other businesses that are

going to be immune from that.

So that’s why PublicSq. being the foundation of this new economy. That’s

not only going to allow us to shop our values and patronize those businesses, but also insulate us from being platformed or being censored.

That’s the other part that’s extremely important, and why this movement needs to happen for those of us that share our values. It’s not

just Democrats and Republicans or Independents, this is a transcendent movement that anyone who believes in Liberty should be a part of,

and I think is a part. And so that’s really the theme that we have here. I’d be happy to go into any more details, Michael, as you see

fit or any questions we get, but I just wanted to provide that backdrop as to why as a financier, I thought it was so important for us

to all come together around commerce, and make sure that it’s part of the country as a voice.

Michael Seifert:

Love it. Thank you, Omeed. Dan, I’d like to kick it back to you. And

if you’d like to lead a line of questioning, Dan’s got a lot of great questions. And so we’re basically going to have Dan moderate this

conversation, Omeed and I will answer any questions that you all have presented that are relevant to the business, the transaction, what

the path looks like going forward. We want to break this down as simple as possible so that you have some really clear next steps for

however you’d like to get involved with that. So Dan, I’d love to kick it to you.

Dan Zacchei:

Right. So Michael, a question we’ve seen is how exactly did you come

up with the idea for PublicSq.? What really led you to this point, and to the realization that this could be a real business that would

resonate with people?

Michael Seifert:

I think one of the deepest drives for most people, especially those

in our movement, is we want to feel connected. We don’t want to feel alone. And for years, the tyrants, the authoritarians in society,

have tried to make us feel alone. There are a few multinational corporations that have embraced globalist principles at the expense of

small businesses, community members, people that love the country, the Constitution, and the values that the Constitution protects. These

corporations have made us feel isolated, that our values aren’t represented, or don’t matter anymore.

Our most average consumer on our platform, on PublicSq., the most typical

consumer, is a 37-year-old mom with kids. These are the Mama Bears of society that make up 70% of daily purchases for the household. This

is my wife, this is Omeed’s wife, two amazing wives and moms that are leaders in their communities, that have very respected voices,

that have just been totally abandoned and silenced. Target, a consumer entity that presents itself to mom consumers, going out of their

way to indoctrinate the kids on issues of sexuality and gender. It makes no sense, and we’ve witnessed this happen for the last

10 years. But we are really driven to find solutions that would help people that love our values and align to these values, feel the opposite

of alone, which is truly connected. That we have options for our commerce needs that would be trustworthy and would be reliable, not just

because the quality of their products, but also because we know that they’re not going to abuse or stand against our values.

And after witnessing for this for a decade, COVID season became too

much. The government came around and labeled some businesses as essential and other businesses as non-essential, and it just hit a fever

pitch. It was a boiling point. And in January of 2021, after developing a list of local businesses that were taking a stand for freedom

and liberty during the COVID season, and realizing that list was very attractive to people that loved liberty and the values that are

spelled by the Constitution, we had this sort of aha moment of, what if we actually put that list in the digital environment and we had

the ability for businesses to add themselves to the list? And we could create this incredible community that was centered around commerce,

so that consumers would know with blessed assurance, that not only are they not alone, but they can actually push back in a positive,

hopeful manner with the power of their wallet.

We’re only able to vote every two and four years. What if we could

vote every day? Because ultimately, if we want to see the power structures of society shift back toward “We the People”, that

has to happen through the power of our wallets, that happens through commerce. So in January of ’21, that’s when that idea came about.

In February of ’21, began to bring some of our closest friends around it, my incredible co-founder Sebastian Harris, our CFO, Brad Searle,

John and Christina Warner, two of our leaders at our company.

We had this amazing community that started to coalesce around this

idea for a digital economy that would be centered around trust and connection. And 30 months later, we are the world’s largest marketplace

of its kind over 1.1 million active consumer members on the platform. We hit a million members from our national launch faster than Twitter

and Spotify and Airbnb just to showcase the incredible interest that this platform has garnered, over 55,000 business vendors, 90% plus

of which are small businesses that make our country special. So Dan, it’s been a wild ride over the last two and a half years, but it

all started with a desire for the millions of Americans that are a part of our community, to no longer feel alone, but to feel like they

have the ability to, with their dollars, push back on behalf of their values.

Dan Zacchei:

That’s great, Michael. So I think some people who are tuning in already

know how to find the app and know how to work with the app, but how do vendors who are interested in partnering with PublicSq., how do

they find you and what kind of companies are on PublicSq.?

Michael Seifert:

That’s a great question. Over 90% are small businesses, which is special,

because as Omeed pointed out, the small businesses, they’re the backbone of our economy. These are the businesses that will ultimately

stand the strongest against ESG and DEI mandates that focus more on social politics than they do on meritocracy and provided quality services.

The small businesses in our community, are the people that make our nation special, and the economy continue to grow and prosper. And

so for us, we’re proud to be the largest representation of those values aligning small businesses, that the country’s ever seen.

On top of that, what’s pretty cool about how PublicSq. has grown is

that it’s happened with virtually no marketing spend. Our customer acquisition cost is a fraction of some of the major commerce brands,

because thankfully we exist not only as a lucrative business, but as a very attractive movement, meeting the needs of millions of consumers

that have felt like this is something that would really scratch the edge for them. And so we’ve had the opportunity to have five hits

on the media per week, on average. We have an incredible community of 500 ambassadors and influencers with a following of over 50 million

people in the aggregate, that have joined forces with us.

And so when you ask about how businesses are hearing about us, that’s

how. They’re hearing about us on the media. They’re hearing about us from their favorite influencer that they trust. They’re hearing about

us from the community ambassador that’s literally knocking on their doors, asking if their business would like to join the platform. And

these businesses encompass so many different industries, all of which are vital and essential, to the future well-being of our great republic.

Omeed Malik:

One point I’ll make, Dan, is the reason why this product is so important,

that has nothing to do with politics, is that during the COVID lockdowns, we saw the greatest wealth transfer in history from the middle

class to the big tech monopolies and their billionaire founders. And what PublicSq. is doing, even if you’re not necessarily the same

as us ideologically, is making sure that those mom-and-pop, brick-and-mortar stores that were ruined during those lockdowns, are going

to be patronizing. There’s no overlap between multinational businesses or who posts on Amazon, but PublicSq., you’re probably not going

to have heard of any of those businesses. But what it allows you to do, again, with technology is to be able to support them. And I think

to me, that’s the part as someone who is very outspoken against those lockdowns, is what I love the most about this, is being able to

patronize those businesses that need help the most and quite frankly, represent the backbone of this country, which is the middle class,

and has certainly been left behind.

Dan Zacchei:

Got it. So does it cost more to buy something on PublicSq.? Because

I think a lot of people have heard about the idea and thought to themselves, this sounds great, but ultimately where they shop, and what

they shop, it comes down to price. How would you answer that?

Michael Seifert:

Yeah, that’s a great question. This is why we’ve encouraged the majority

of the businesses on our platform, and thankfully they’ve accepted this encouragement and have run with it, to actually offer discounts

to consumers for going to these businesses. So for example, I’m from San Diego. We recently just moved our headquarters to Florida. We

are jumping into a business-friendly state here, but my heart’s in San Diego. California’s a wonderful state that we’re fighting for,

but man, it’s gone through the ringer past few years, obviously. But in San Diego, there’s an amazing coffee shop on our platform called

Invita Cafe. It was one of the first businesses that joined. It’s an incredible community coffee shop run by a second-generation American

who’s an Italian immigrant family to the country and they run an extremely high-quality business.

When I walk in to get premium coffee, it tastes great. The aesthetics

in the room are fantastic, the people are friendly. They’ll actually give me a free drip coffee if I showcase my PublicSq. hat. And we’re

seeing this happen with all these different businesses on the platform that are wanting to actually give you incentive to spend money

in alignment with your values. And I think that’ll be the way forward in a pretty profound fashion. We have exciting developments in the

world of user rewards and further incentives to spend money at a number of businesses on the platform where you’ll actually receive reward

for doing that. And we kind of gamified the experience.

We have a lot of things in the works here that’ll be exciting for the

consumers to bridge that gap between cost and values. And our encouragement too is to consumers to recognize that these businesses on

the platform, they really deserve our dollars in a fashion that you can’t say for some of the major multinational corporations, all of

which are basically owned by Unilever and Proctor and Gamble for your household goods. These businesses will actually often last longer.

These are products that are made with more intentionality. Many of these products are made in the United States, which helps up the actual

benefits of who prospers because they’re purchasing their products. So those are the encouragement we try to give to consumers. We want

to make that process as seamless and streamlined as possible.

Omeed Malik:

And there is a cost to continue to patronize companies like Amazon.

Michael Seifert:

True.

Omeed Malik:

Not only is it cheaper in some cases to use PublicSq., but there’s

a cost that this country has not fully recognized, and is only beginning to by continuing to patronize companies that ultimately subsidize

the Chinese Communist Party. And so this is a broader theme, which is to say again, which is I think also a universal theme. Do we want

to make things here? Do we want to patronize businesses here or do we want to continue to outsource that aspect of our economy? Which

has actually provided no benefits to the vast majority of American citizens. It’s been really great for citizens abroad, but it hasn’t

helped Americans. So yeah, that’s another reason why, all else being equal, if you want our country to stay prosperous in the number one

economy, you should purchase products from companies here as well.

Dan Zacchei:

Got it. So that’s talking about the customers. How do you think about

your employees at PublicSq.?

Michael Seifert:

What’s pretty cool is that we get the question often, “Hey, are

you having a hard time with the talent situation right now? There’s a lot of turnover in these tech companies. Are you guys facing any

sort of talent crunch? You’re having a hard time recruiting new folks?” And what I’m proud to say is that, just like there is a desire

for consumers to spend money in alignment with their values, just like there’s a desire for investors to invest money in alignment with

their values, which you can do literally today by taking part in this transaction and purchasing CLBR from your broker on the New York

Stock Exchange, there is also a desire for employees to work for companies that respect and share their values.

And so we’ve had titans of industry from other major companies, like

Target, Yelp, Amazon, actually leave these woke progressive entities and come and join our team because they’re saying, “Finally,

I feel like I can be myself in the office. I feel like I can share my values with my fellow employees and not live under fear of firing

because I didn’t agree with whatever social policy the company was coming out with that week.”

We’ve heard horror stories from inside these other incumbent companies

and it’s refreshing for a lot of these folks to be able to come to a company here where they know that they can be themselves and speak

their mind and share the truth and not come under retribution for it. On top of that, we try to go above and beyond. We’re by no means

perfect, but we try to go above and beyond with honoring the values that are core to our company with our employees. Meaning last year

when Roe Vs. Wade was overturned in the Dobbs decision, you had about 300 major corporate entities come out and say that they were going

to fund their employees abortions.

So if you were an employee of their company, they would pay you $4,500

for all the travel expenses and everything to go get an abortion, which by the way, I think is incredibly cruel. I think for an employer

to fund the diminishing of their employees family unit is about one of the most insulting things you can do. It’s also just a way of protecting

their bottom line, because they’re essentially saying, “We’re saying we care about your healthcare, but in reality we just want to

pay less on maternity leave.” We wanted to sing the opposite tune. We wanted to say that we love our employees and we believe that

their families are a wonderful thing for the community and the company at large. And the best way we can have happy employees is by making

sure that their families are happy. And so we would like to contribute to the growth of their families.

So we announced the baby bonus. If you’re an employee at PublicSq.,

we want to not only make sure that you have your family taken care of from a benefits perspective, but we want to go above and beyond

to offer $5,000 in a bonus after tax if you have a baby or adopt. So if you’re on our team, you or your spouse has a child or you choose

to adopt, we’re going to contribute $5,000 after tax and a bonus to that endeavor. Thankfully, we’ve already had about four employees

take us up on it, and we just had another four pregnancies announced. So the growth of PublicSq. families is a good thing for our company

and more importantly, the country is only as strong as the families that make up this country. Strong families will build a strong nation

and we’re trying to lead the way there. So we try to practice what we preach and we hope that that leads to longevity of happiness for

our team members.

Omeed Malik:

So if you think that customers are sick of these woke corporations

lecturing them and putting transgender people on beer cans, now imagine if you will, working at one of these companies. Imagine being

an employee where about 80% of your day is going to human resources indoctrination camps, and the rest of your day walking on eggshells

to make sure you don’t offend someone so you don’t get fired. That is a day in the life of people today at large multinationals.

So if you haven’t seen a movie from the late nineties called Office

Space, it makes that look like a utopia. That’s what large offices are now today. And so what that provides us with is a significant brain

drain from those places that are looking for normal places to work. And right now there are very few normal places to work. So again,

not only are we beneficiary of all of these faux pas that Anheuser-Busch, Bud Light, Ben & Jerry’s, Target and Disney have done, $52.5

billion of market cap eviscerated. We are the only game in town to be a beneficiary of that. We are also one of the only games in town

of places for people to work that are growing this way. So that’s another advantage of PublicSq. So it’s made hiring very easy for Mike.

Dan Zacchei:

That’s great. That’s great. So going back to something you were talking

about, Michael, which is PublicSq.’s commitment to family and how much that’s an important part of your values. We know that you’ve

talked in the past a little bit about how baby care is actually an area where you’re developing your own products. Talk a little bit about

that and whether this trend of you guys developing products is something that you plan on continuing in the future.

Michael Seifert:

Yeah, thanks Dan. Great question. So our business model is that today

we sell advertisement to businesses on the platform that want to increase their exposure to the consumers. For example, we have well over

a thousand clothing companies on the platform. If you want to be ranked in the top of those clothing companies and engage with consumers

with greater exposure, that’s an advertising feature. So we have businesses paying us $50 a month. We have businesses paying us $15,000

a month just depending on how much exposure that they would like. So while it’s free for a business to join, then we will absolutely build

them a profile. Excited about it, excited to push them to our consumers. For that additional exposure, folks can pay for advertising.

That’s the revenue stream number one that’s been in flight for the past year.

The very cool thing about PublicSq. is that it’s an ecosystem that’s

been created of businesses and consumers interacting with one another. That ecosystem creates for us a lot of insight about what this

consumer cohort is looking for. So for example, if you’re a Christian conservative mom from the Midwest, there are no multinational corporations

speaking to you, obviously, as we’ve learned from Target recently. But we have 55,000 plus businesses on our platform that would love

to speak to you. When we have these consumers searching our search bar and scrolling through the categories and browsing the different

products and services that are offered, that helps us know what they’re looking for, that we can then cross reference with the market

and discover where there are holes.

So for example, when we have a mom on our platform that looks for product

X, and product X doesn’t have any values-aligned alternatives in the market, all of the big brands are woke and progressive and act more

like social organizations than they do a profitable business, we have an opportunity there to create product X, sell it back into our

marketplace with better margins than the competitors, because we have a lot of the infrastructure built in and we have the customer acquisition

model baked into the cake with our platform, and then we can see greater returns in revenue than we would ever be able to do with just

advertising alone.

This is why a lot of celebrities want to start a skincare line, because

they recognize if you’ve built an affinity community and a following and you can nail a quality product with great margins, you can absolutely

crush it from a revenue perspective. And so for us, that’s our playbook. We have this ecosystem. Ecosystem creates insights about what

our consumer cohort is looking for. We can then figure out where there are holes in the market, we can create products that fill that

need in the market, and we see the flywheel spin at a greater velocity.

So to the baby care point, the first product that we’re launching is

actually a baby care brand. That’ll be introduced here in the next few days. That’s exciting. We’ve disclosed that in filings. It’s called

EveryLife. So while all the other major baby brands in the United States are acting in a very anti-life and anti-family manner with donations

to abortion organizations and anti-family messaging, we’re going to sing a different tune. We’re launching a brand called EveryLife where

the message is simple. No matter where you come from, no matter what you look like, no matter your socioeconomic status or the circumstances

of your conception, every life is a miracle.

What we will then do is replicate this process for the next eight brands.

And we’re looking forward to this being a very core part of our business model. I’m happy to speak on the third revenue stream just briefly,

which is the move to e-commerce. We will actually make the move from a business directory toward an e-commerce platform this fall, before

the Christmas shopping season, where you will be able to shop your values with a click of a button, one shopping cart, multiple vendors.

And this will help us really achieve feature and functionality that puts us on par with the Amazons and the Etsy’s of the world. So that’s

where we’re going and we hope that you guys will continue to join us along the journey.

Dan Zacchei:

Really exciting stuff. Hey guys, a question that we’ve actually gotten

from some of the listeners, how does it work as you go through this transaction in terms of them continuing to support the company as

investors? Do they just need to do nothing and the stock will just transition? Do they need to talk to their broker? What actually do

folks who hold the CLBR stock have to do to take advantage or really to participate, I guess in the business combination?

Omeed Malik:

Yeah. Do you want to answer that question?

Omeed Malik:

No, it’s a little bit of a joke because the person you would be interacting

with in some cases would be, and his firm, his firm is called Longacre, they do a great job. And what they do is they actually interact

with shareholders both on the institutional and retail side. So if you purchase CLBR or have purchased CLBR, yeah, you have an automatic

ability to now own the company when that transition occurs. The ticker will go from CLBR to PSQH on the New York stock exchange on July

20th, Thursday. And while this whole crew, as I think I mentioned, will be ringing the bell that day and the ticker is going to change.

And so in the interim, what we have is a website, Dan, that I’ll let you talk about as well as an email address that they can email with

any questions. And we have all of this information that we can provide over the next few days for how that whole process works. So Dan,

if you want to just maybe talk about those email addresses and the materials, that’d be great.

Dan Zacchei:

Yeah, if you look at any of the, probably the best thing to do is just

if you just Google the name of the company, Colombier, or if you want to Google CLBR, there’s a website as well as a number of press releases

and things like that, that all have contact information that allows you, whether it’s by phone or by email or via the website to get all

the information you need about how to vote your shares, or just to take part in the transition over to the new company. And that actually

brings up another question, guys, that we’re getting from a couple people.

So you’ve talked a lot about how large companies have seen their values

shift or how their values are not necessarily in line with a lot of your customers and what they’re looking for. How can people be reassured

that as you go through this potential transaction and become a public company, that it’s not going to get taken over by some other group

or some type of corporate raider whose values are going to be incompatible with yours and with those of your customers?

Michael Seifert:

Yeah, that’s a great question. And this was a non-negotiable for us

when we set out to do this journey because while we do want to be a public company so we can be owned by we, the people, democratize the

capital markets in the process, we never wanted to do that at the expense of our values and our commitment to our core convictions. From

the beginning, I’ve always said that if we had to compromise to see success, none of it’s worth it. We cannot compromise our values. That’s

not what the country’s looking for. The country is looking for genuine expression of our values. And so for us, the only way this deal

is going to work is if we can figure out a way to make sure that our values that guide this experience were protected. And thankfully

we figured out a way to do it. So what happens in this transaction is that if you purchase CLBR right now, it’s essentially a way of getting

in on the transaction before the formal close.

So on the 19th, the shareholder vote takes place for Colombier shareholders.

The ticker changes on the 20th, as Omeed mentioned. And your ownership in CLBR becomes ownership in PSQH. And when that happens at the

close, I will actually retain majority voting control with a special class of shares that ensures that we will not be just bought out

by activist investors. So if we were to not have this provision, a George Soros of the world could come along and could essentially purchase

enough of the shares to start electing board seats, and start to play with the voting control of the company to enforce their agenda.

That’s not present in this deal.

We have the ability to ensure majority control as long as I own over

50% of my position. And as I hope you can tell today, I’m a believer in the future of this company. And so I’m on the ride for as long

as this company exists. And with that, we ensure that the mission is kept pure. On top of that, we have a very ideologically aligned board

of directors, which is incredibly important. Four of which you’re seeing on this call right here. We want to make sure that this company,

from the very top, all the way down through all the consumers that enjoy the platform, our values aligned and respect the goals of this

company. And so we are not shy about that. We’re unashamed about the fact that ESG is not a priority for our company. And not only is

it not a priority, it’s something we actively stand against. FTX had the highest ESG score of any company last year. How well did that

work out for them? Sri Lanka has one of the highest ESG scores in the world and the country’s in total disarray. DEI and ESG policies

are destroying this economy and we refuse to participate, and we will always be active and honest about that, and some of the mechanisms

that I’ve described in this deal are present to help protect that.

I would also refer you, and I’ll finish with this, to Rumble. Rumble

is another great player in this parallel economy. They went public last year via SPAC. Chris Pavlovski, the CEO and founder of Rumble

has similar provisions in that transaction and that’s helped them ensure mission integrity as they continue going forward.

Omeed Malik:

The one thing I’m going to say and just be very direct about it is

if you like the product, which I think you do because you use it, and you agree with all the issues that are happening in our country

right now, then we need your help. Everybody does because the four of us, five of us can’t do it alone. It has to be the people that we

all know feel this way coming together and doing something positive. We are not going to win if all we do is complain. That’s destructive,

that’s negative. We have to start innovating, we have to start creating, and we have to start supporting each other. So the way that we’re

proposing to do that is not to get into a 501(c)- (3) or a political candidate. You can do all that stuff. That’s been around for a long

time, but the area that we’re farthest behind is in the private sector.

Every part of our economy right now, the plumbing of the internet,

the modern-day railroads, is controlled by people that don’t have these values. So if you want to fight back against that, because that

ultimately, with technological advancements, is the most important part of this, then your opportunity right now you want to support it

is to buy CLBR. It’s just that simple, and it’s not like I’m sitting here and saying, “Oh, you should do $1 million,” you should

do whatever you can because that’s just going to give us more power to do what we’re all talking about here.

That’s really what this is, in my opinion, is a call to action amongst

all Americans that agree with this. And so that’s what we’re talking directly to you here today. That’s the opportunity. Everything else...

Yeah, go ahead.

Dan Zacchei:

No, no, no. Thank you.

Omeed Malik:

No, I was going to just say, and I think the guys agree with me here,

is that everything else is words, but what we’re trying to do is action. And for those of people that agree with us, then we need people

to have to, that’s how we’re going to win.

Dan Zacchei:

So guys, obviously going public, that is a major accomplishment, an

awesome achievement, but beyond that, what excites you the most about this business? As you look out, say over the next year, what really

for you is the one thing that you’d want people to take away and understand about where PublicSq. is going?

Michael Seifert:

I would love for people to understand how early we are. I would love

for people to understand the implications of that reality, which is that we need people to build this with us. I would love for people

to understand that we can actually create an alternative to Proctor & Gamble and have a marketplace where these products could coalesce

and come together. We can have that reality happen here by empowering the small businesses on the platform, but especially over the next

year, the only way we get there is if the people build it with us. We have never been a company with a cult of personality. I was a nobody.

It’s not like we had any social big presence or influencers backing this from the very beginning. We were a bunch of normal people that

just cared enough to do something.

And so we need people to build this with us. And the thing I hope to

leave with all of the people on this call is that if that will happen, if the people that are partaking in this parallel economy will

build this experience with us, if we will all lock arms, not only can we create B2C products that fulfill the needs of our consumers,

not only can we create incredible e-commerce, but we can actually build upon this ecosystem in a way that has lasting impact into multiple

different sectors of the economy. You can start to imagine the B2B potential and the opportunity for the businesses on our platform to

actually connect with one another. You can imagine the different features that will allow us to not only be a replica of Amazon, we actually

want to be better in the technology that we implement into our platform, but it’ll only happen if we, the people, join us.

So this transaction is a big step in that direction, Dan, that’s what

I’m most excited about, is that we get to expand the owners of this company from more than just a few dozen, but to thousands of people.

Omeed Malik:

I would just totally agree with that. What’s most exciting I think

to all of us on this call is what we see in front of us, not behind us. This is only step one. In 2010, no one had heard of ESG. In the

last 13 years, it’s become a multi-trillion dollar scam because it’s nothing but a cult and it has no value. If something that represents

really nothing can become worth trillions of dollars, what could a genuine movement with substance become? And so we aren’t even in the

top of first of this yet. That’s the opportunity, is to become part of this substantive movement basically in spring training.

Dan Zacchei:

So guys, here’s a really related question from the audience that is

interesting. The question is how do you guys plan on taking advantage of this opportunity you both were just talking about and getting

the word out to consumers on a wide, wide scale and just letting them know that this platform is here and driving them to use it?

Michael Seifert:

I would start by saying that what’s pretty cool about this experience

is that it hasn’t been purely political. It’s actually far deeper than that. It’s principles, and these principles that we’re adopting

and then ultimately spreading, have wide-reaching ramifications for country music, action sports, pop culture, entertainment. The types

of influencers and audience members that have joined this experience and have helped build PublicSq. come from all different sets of culture.

And for us, that means that as we move forward into the future, there’s really no limit to what we can achieve when it comes to getting

the word out about PublicSq.

We talk often about our target market of 100 million Americans that

are low hanging fruit for this type of opportunity because we know election data has shown and commerce data has shown that they’re aligned

with us and would enjoy this. But we haven’t talked anything on this call about the wide-reaching cultural impact when you can get country

music fans behind this endeavor. And thankfully, we’ve had incredible influencers in that space begin to push this.

What happens when athletics and the largest action sports entertainment

group in the world, Nitro Circus, who I used to look up to all those guys as a kid, Travis Pastrana and the crew, now we’re a very key

partner of theirs in their 20th-anniversary tour this fall that we’ve just recently announced. What can happen when you get

that audience behind this? What can happen when you get professional surfing and skateboarding behind this? What happens when you get

NASCAR and their community of drivers and audience members behind this? What happens when we actually look at the international implications?

We have international wait lists established where we can actually help them have their own national marketplace. There are a lot of opportunities

here that are far-reaching that we don’t talk about super often, but that consumers and investors should certainly know we spend a lot

of time thinking about.

So as we look to get the word out, we’re grateful for an incredibly

low customer acquisition cost. The average in commerce platforms is over $29 per consumer. Our customer acquisition cost is less than

a 10th of that. And for us, we think that that puts us in a cool opportunity to not have to spend millions and millions of dollars on

growing the brand to be able to do it organically through the actual people that use it from all these different industries.

Dan Zacchei:

That’s great. So guys, we’re nearing the end here. So want to end with

just one question. One more time. People who want to support the company, support the mission, support the stock, how can they become

investors today?

Michael Seifert:

Would you like to take this?

Omeed Malik:

Yeah. Basically any service that you use to buy a stock or you ever

have, whether that’s calling a broker, logging onto an e-trade account, Ameritrade, whatever it may be, you can use that to purchase whatever

you’re comfortable with. If you want to support of the ticker, which is CLBR on the New York Stock Exchange.

Michael Seifert:

You can head to publicsqcolombier.com for more information on that

site. You also can check out some of those press releases that Dan mentioned if you’d like to learn more. One more important note that

we didn’t mention is that any money that is invested into the company that stays around through the close of this deal, so if you invest

by the 17th and stay in this deal through the close, that capital is actually translated then to cash on our balance sheet. So that’s

money that stays in the deal, sticks through the close, is cash on our balance sheet that we can utilize for working capital. Then when

that ticker changes over and your ownership transfers into PSQH, we’re off to the races as a public company and we hope to provide substantive

and significant returns both, and most importantly, in impact first and secondly, in capital. And we believe that both of those things

can happen at the same time and we look forward to going on that journey with you all. Nick, would you like to share too?

Nick Ayers:

Yeah. I want to encourage everyone, irrespective of if you invest or

how much you invest, my background for 20 years was in professional politics and a lot of those years was in running campaigns. And one

of the best lessons I learned from one of the best politicians I ever saw, both as a candidate and someone who held office and did what

he said he would do, he would tell people when they would say, “How are you going to win this election? The odds don’t look very

favorable for you. You’re going to be out spent. How are you going to win?” And he would always answer it this way. He would say,

and these are people who were supporting him. He would say, “Don’t ever underestimate your value in helping us win.” The most

powerful form of advertisement, whether it’s in politics or business, is someone who knows you, respects you as your friend or family

member hearing from you why you are a part of something.

It’s one thing for them to hear it from Michael or Omeed or Blake or

me or even Don Jr. It’s not as powerful as you asking a business that you frequent often, who you know the owners are great people, for

you to say, “Have you heard about PubliSq.? Let me show you this app. You all should be on it. They’re doing great things for the

country. I use it. I want you on it because I want your business to succeed.” Don’t ever underestimate the power... How PublicSq.

has grown faster than all these other technology companies that are now household names is that exact dynamic. We had a few very passionate

first movers when only 100 people were on the platform who turned it into 1000 and those 1000 turned it into 10,000. The way we grow and

succeed, we’re going to do our part. We’re going to work very hard, but you are the way we succeed in partnering with us and don’t underestimate

your value and your impact in this journey.

Michael Seifert:

Thanks, Nick.

Dan Zacchei:

Well said. And with that, thank you everyone for attending.

Michael Seifert:

Thank you all. Appreciate the time.

Omeed Malik:

Thank you.

Additional Information and Where to Find It

In connection with the proposed transaction (the

“Proposed Transaction”), Colombier has filed a registration statement on Form S-4 (the “Registration Statement”)

with, and now declared effective by, the Securities and Exchange Commission (“SEC”), which includes a preliminary proxy statement

and a prospectus in connection with the Proposed Transaction. STOCKHOLDERS OF COLOMBIER ARE ADVISED TO READ, THE PRELIMINARY PROXY STATEMENT,

ANY AMENDMENTS THERETO, THE DEFINITIVE PROXY STATEMENT, THE PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH

THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION. HOWEVER, THIS

DOCUMENT WILL NOT CONTAIN ALL THE INFORMATION THAT SHOULD BE CONSIDERED CONCERNING THE PROPOSED TRANSACTION. IT IS ALSO NOT INTENDED TO

FORM THE BASIS OF ANY INVESTMENT DECISION OR ANY OTHER DECISION IN RESPECT OF THE PROPOSED TRANSACTION. Now that the Registration Statement

has been declared effective, Colombier has mailed the definitive proxy statement/prospectus and a proxy card to each stockholder of Colombier

as of the record date for the special meeting of Colombier stockholders for voting on the Proposed Transaction. Stockholders and other

interested persons are also able to obtain copies of the preliminary proxy statement/prospectus, the definitive proxy statement/prospectus,

the Registration Statement and other documents filed by Colombier with the SEC that are incorporated by reference therein, without charge,

once available, at the SEC’s website at www.sec.gov. Stockholders are urged to read these materials (including any amendments or

supplements thereto) and any other relevant documents in connection with the Proposed Transaction that Colombier has filed or will file

with the SEC, when they become available, because they do or will contain important information about Colombier, PublicSq., and the Proposed

Transaction.

Colombier’s stockholders will also be able

to obtain a copy of such documents, without charge, by directing a request to: Colombier Acquisition Corp., 214 Brazilian Avenue, Suite

200-J, Palm Beach, FL 33480; e-mail: ir@colombierspac.com. These documents, once available, can also be obtained, without charge, at the

SEC’s website www.sec.gov.

Participants in Solicitation

Colombier, PublicSq. and their respective directors

and executive officers may be deemed participants in the solicitation of proxies of Colombier’s stockholders in connection with

the Proposed Transaction. Colombier’s stockholders and other interested persons may obtain more detailed information regarding the

names, affiliations, and interests of certain of Colombier executive officers and directors in the solicitation by reading Colombier’s

final prospectus filed with the SEC on June 9, 2021 in connection with Colombier’s initial public offering, Colombier’s Annual

Report on Form 10-K for the year ended December 31, 2022, as filed with the SEC on March 24, 2023 and Colombier’s other filings

with the SEC. A list of the names of such directors and executive officers and information regarding their interests in the Proposed Transaction,

which may, in some cases, be different from those of stockholders generally, are set forth in the Registration Statement. These documents

can be obtained free of charge from the source indicated above.

No Offer or Solicitation

Neither the dissemination of this press release

nor any part of its contents is to be taken as any form of commitment on the part of Colombier or PublicSq. or any of their respective

affiliates to enter any contract or otherwise create any legally binding obligation or commitment. This press release shall not constitute

or form part of any offer or invitation to sell, or any solicitation of a proxy, consent or authorization with respect to any securities

or in respect of the Proposed Transaction. This press release shall not constitute an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction. This press release is

not, and under no circumstances is to be construed as, a prospectus, a public offering, or an offering memorandum as defined under applicable

securities laws and shall not form the basis of any contract. No offering of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended or an exemption therefrom.

Forward-Looking Statements

This communication may contain forward-looking

statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended,

and for purposes of the “safe harbor” provisions under the United States Private Securities Litigation Reform Act of 1995.

Any statements other than statements of historical fact contained herein are forward-looking statements. Such forward-looking statements

include, but are not limited to, expectations, hopes, beliefs, intentions, plans, prospects, financial results or strategies regarding

PublicSq. and the Proposed Transaction and the future held by the respective management teams of Colombier or PublicSq., the anticipated

benefits and the anticipated timing of the Proposed Transaction, future financial condition and performance of PublicSq. and expected

financial impacts of the Proposed Transaction (including future revenue, pro forma enterprise value and cash balance), the satisfaction

of closing conditions to the Proposed Transaction, financing transactions, if any, related to the Proposed Transaction, the level of redemptions

of Colombier’s public stockholders and the products and markets and expected future performance and market opportunities of PublicSq.

These forward-looking statements generally are identified by the words “anticipate,” “believe,” “could,”

“expect,” “estimate,” “future,” “intend,” “may,” “might,” “strategy,”

“opportunity,” “plan,” “project,” “possible,” “potential,” “project,”

“predict,” “scales,” “representative of,” “valuation,” “should,” “will,”

“would,” “will be,” “will continue,” “will likely result,” and similar expressions, but

the absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections

and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks

and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication,

including, without limitation: (i) the risk that the Proposed Transaction may not be completed in a timely manner or at all, which may

adversely affect the price of Colombier’s securities, (ii) the risk that the Proposed Transaction may not be completed by Colombier’s

business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by Colombier,

(iii) the failure to obtain the approval of the Proposed Transactions from the stockholders of Colombier and PSQ, respectively, (iv) the

failure to obtain regulatory approvals, as applicable, required to consummate the Proposed Transaction, (v) the occurrence of any event,

change or other circumstance that could give rise to the termination of the Merger Agreement, (vi) the effect of the announcement or pendency

of the Proposed Transaction on PublicSq.’s business relationships, operating results, and business generally, (vii) risks that the

Proposed Transaction disrupts current plans and operations of PublicSq., (viii) the outcome of any legal proceedings that may be instituted

against PublicSq. or against Colombier related to the Merger Agreement or the Proposed Transaction, (ix) the ability to satisfy and maintain

the listing of Colombier’s securities on the New York Stock Exchange or another national securities exchange, (x) changes in the

competitive industries and markets in which PublicSq. operates; variations in performance across competitors, changes in laws and regulations

affecting PublicSq.’s business and changes in the combined capital structure, (xi) the ability to implement business plans, growth,

marketplace and other expectations after the completion of the Proposed Transaction, and identify and realize additional opportunities,

(xii) the potential inability of PublicSq. to achieve its business and consumer growth and technical development plans, (xiii) the ability

of PublicSq. to enforce its current or future intellectual property, including patents and trademarks, along with potential claims of

infringement by PublicSq. of the intellectual property rights of others, (xiv) risk of loss of key influencers, media outlets and promoters

of PublicSq.’s business or a loss of reputation of PublicSq. or reduced interest in the mission and values of PublicSq. and the

segment of the consumer marketplace it intends to serve and (xv) the risk of economic downturn, increased competition, a changing regulatory

landscape and related impacts that could occur in the highly competitive consumer marketplace, both online and through “bricks and

mortar” operations. The foregoing list of factors is not exhaustive. Recipients should carefully consider such factors and the other

risks and uncertainties described and to be described in the “Risk Factors” section of Colombier’s IPO prospectus filed

with the SEC on June 9, 2021, Colombier’s Annual Report on Form 10-K filed for the year ended December 31, 2022, as filed with the

SEC on March 24, 2023, and subsequent periodic reports filed by Colombier with the SEC, the Registration Statement and other documents

filed or to be filed by Colombier from time to time with the SEC. These filings identify and address other important risks and uncertainties

that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking

statements speak only as of the date they are made. Recipients are cautioned not to put undue reliance on forward-looking statements,

and neither PublicSq. nor Colombier assume any obligation to, nor intend to, update or revise these forward-looking statements, whether

as a result of new information, future events, or otherwise, except as required by law. Neither PublicSq. nor Colombier gives any assurance

that either PublicSq. or Colombier, or the combined company, will achieve its expectations.

Information Sources; No Representations

This press release has been prepared for use by

Colombier and PublicSq. in connection with the Proposed Transaction. The information therein does not purport to be all-inclusive. The

information therein is derived from various internal and external sources, with all information relating to the business, past performance,