Filing of Certain Prospectuses and Communications in Connection With Business Combination Transactions (425)

March 25 2021 - 7:33PM

Edgar (US Regulatory)

Filed by II-VI Incorporated

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: Coherent, Inc.

Commission File No.: 001-33962

Date: March 25, 2021

|

|

|

|

|

|

II-VI Incorporated

375 Saxonburg Boulevard

Saxonburg, PA

16056

|

March 25, 2021

Dear One II-VI Employees,

I am very pleased to report that we have entered into a definitive agreement to acquire Coherent. II-VI and Coherent

are an ideal fit for one another, and we are really excited to welcome the talented Coherent team to II-VI. Together, we will create a global leader in photonic solutions, compound semiconductors and laser

technology & systems with:

|

|

•

|

|

vast opportunities to accelerate our growth through complementary platforms,

|

|

|

•

|

|

increase competitiveness with combined scale across the entire value chain,

|

|

|

•

|

|

deeper market intelligence from complementary business models, and

|

|

|

•

|

|

greater diversification of revenue by end-market and geography.

|

I have attached our press release that describes the transaction and the benefits of the combination of these two great companies in

more detail. For all these reasons and more, we believe that this is a great combination that will fuel and accelerate our long-term growth. We hope you share our excitement as well!

Today’s announcement is just the first step and we expect the transaction will close by year-end 2021. Until

then, it remains business as usual here at II-VI.

As always, if you receive any inquiries, please do not comment,

but direct them to Corporate Communications at corporate.communications@ii-vi.com.

Thank you for staying

focused on your great work and for your continued dedication to our great company. We’re looking forward to embarking on this next chapter of II-VI with Coherent and delivering even greater value to all

our stakeholders.

Sincerely,

Bob Bashaw

President

|

|

|

|

|

|

|

|

|

T. 724.352.4455 | F. 724.352.5284 | ii-vi.com

|

|

1

|

|

|

|

|

|

|

II-VI Incorporated

375 Saxonburg Boulevard

Saxonburg, PA

16056

|

Forward-looking Statements

This communication contains forward-looking statements relating to future events and expectations that are based on certain assumptions and contingencies. The

forward-looking statements are made pursuant to the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. The forward-looking statements in this communication involve risks and uncertainties, which could cause actual

results, performance or trends to differ materially from those expressed in the forward-looking statements herein or in previous disclosures.

The Company

believes that all forward-looking statements made in this communication have a reasonable basis, but there can be no assurance that management’s expectations, beliefs or projections as expressed in the forward-looking statements will actually

occur or prove to be correct. Factors that could cause actual results to differ materially from those discussed in the forward-looking statements herein include, but are not limited to: (i) the failure of any one or more of the assumptions

stated above to prove to be correct; (ii) the conditions to the completion of the business combination transaction with Coherent(the “Transaction”) and the equity investment by Bain, including the receipt of any required stockholder

and regulatory approvals, and the risks that those conditions will not be satisfied in a timely manner or at all; (iii) the occurrence of any event, change or other circumstances that could give rise to an amendment or termination of the merger

agreement, including the receipt by Coherent of an unsolicited proposal from a third party; (iv) the Company’s ability to finance the Transaction, the substantial indebtedness the Company expects to incur in connection with the Transaction

and the need to generate sufficient cash flows to service and repay such debt; (v) the possibility that the Company may be unable to achieve expected synergies, operating efficiencies and other benefits within the expected time-frames or at all

and to successfully integrate Coherent’s operations with those of the Company; (vi) the possibility that such integration may be more difficult, time-consuming or costly than expected or that operating costs and business disruption

(including, without limitation, disruptions in relationships with employees, customers or suppliers) may be greater than expected in connection with the Transaction; (vii) litigation and any unexpected costs, charges or expenses resulting from

the Transaction; (viii) the risk that disruption from a Transaction materially and adversely affects the respective businesses and operations of the Company and Coherent; (ix) potential adverse reactions or changes to business

relationships resulting from the announcement, pendency or completion of the Transaction; (x) the ability of the Company to retain and hire key employees; (xi) the risks relating to forward-looking statements and other “Risk

Factors” discussed in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2020 and additional risk factors that may be identified from time to time in future filings of

the Company; (xii) the purchasing

|

|

|

|

|

|

|

|

|

T. 724.352.4455 | F. 724.352.5284 | ii-vi.com

|

|

2

|

|

|

|

|

|

|

II-VI Incorporated

375 Saxonburg Boulevard

Saxonburg, PA

16056

|

patterns of customers and end-users; (xiii) the timely release of new products, and acceptance of such new products by the market; (xiv) the

introduction of new products by competitors and other competitive responses; (xv) the Company’s ability to integrate recently acquired businesses and realize synergies, cost savings and opportunities for growth in connection therewith,

together with the risks, costs and uncertainties associated with such acquisitions and integration efforts; (xvi) the Company’s ability to devise and execute strategies to respond to market conditions; (xvii) the risks to anticipated

growth in industries and sectors in which the Company and Coherent operate; (xviii) the risks to realizing the benefits of investments in R&D and commercialization of innovations; (xix) the risks that the Company’s stock price

will not trade in line with industrial technology leaders; and (xx) the risks of business and economic disruption related to the currently ongoing COVID-19 outbreak and any other worldwide health

epidemics or outbreaks that may arise. The Company disclaims any obligation to update information contained in these forward-looking statements whether as a result of new information, future events or developments, or otherwise.

No Offer or Solicitation

This

document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration

or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information and Where to Find It

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities. This communication relates to a proposal that II-VI has made for a business combination transaction with Coherent. In furtherance of this proposal and subject to future developments, II-VI may file one or more

registration statements, proxy statements, tender offer statements or other documents with the SEC. This communication is not a substitute for any proxy statement, registration statement, tender offer statement, prospectus or other document II-VI and/or Coherent may file with the SEC in connection with the Transaction. INVESTORS AND SECURITY HOLDERS OF II-VI AND COHERENT ARE URGED TO READ THE PROXY STATEMENT(S),

REGISTRATION STATEMENT, TENDER OFFER STATEMENT, PROSPECTUS AND/OR OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION. Any definitive proxy

statement(s) or prospectus(es) (if and when available) will be mailed to stockholders of II-VI and/or Coherent, as applicable. Investors and security holders will be able to obtain free copies of these

documents (if and when available) and other documents filed with the SEC by II-VI through the web site maintained by the SEC at www.sec.gov, and by visiting II-VI’s

investor relations site at https://ii-vi.com/investor-relations/.

|

|

|

|

|

|

|

|

|

T. 724.352.4455 | F. 724.352.5284 | ii-vi.com

|

|

3

|

|

|

|

|

|

|

II-VI Incorporated

375 Saxonburg Boulevard

Saxonburg, PA

16056

|

Participants in the Solicitation

This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, II-VI and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the Transaction. You can find information

about II-VI’s executive officers and directors in II-VI’s proxy statement for its 2020 annual meeting, which was filed with the SEC on September 29, 2020

and in II-VI’s Annual Report on Form 10-K for the fiscal year ended June 30, 2020, which was filed with the SEC on August 26, 2020. Additional information

regarding the interests of such potential participants will be included in one or more registration statements, proxy statements, tender offer statements or other documents filed with the SEC if and when they become available. These documents (if

and when available) may be obtained free of charge from the SEC’s website www.sec.gov, and by visiting II-VI’s investor relations site at

https://ii-vi.com/investor-relations/.

|

|

|

|

|

|

|

|

|

T. 724.352.4455 | F. 724.352.5284 | ii-vi.com

|

|

4

|

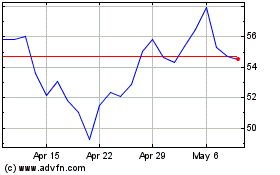

Coherent (NYSE:COHR)

Historical Stock Chart

From Jun 2024 to Jul 2024

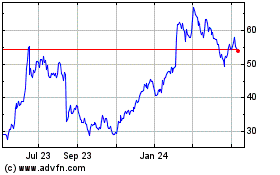

Coherent (NYSE:COHR)

Historical Stock Chart

From Jul 2023 to Jul 2024