-- HIGHLIGHTS -- COEUR D'ALENE, Idaho, Aug. 1

/PRNewswire-FirstCall/ -- Coeur d'Alene Mines Corporation

(NYSE:CDENYSE:TSX:NYSE:CDM) today reported all-time record

quarterly net income of $32.6 million, or $0.11 per diluted share,

for the second quarter of 2006, compared to a net loss of $1.7

million, or $0.01 per diluted share, for the year-ago period. Cash

provided by operations was an all-time quarterly record of $32.0

million, compared to $9.1 million of cash used by operations in the

year-ago quarter. Results for the second quarter of 2006 include

the favorable impact of the company's strategic sale of 100% of the

shares of Coeur Silver Valley (CSV), specifically a one-time

pre-tax gain of $11.2 million. The quarter also includes pre-tax

income of $1.4 million from CSV operations at the Galena mine.

Excluding the one-time gain and the income from Galena, the

company's net income in the second quarter of 2006 was still a

record $20.1 million, or $0.07 per diluted share. For the first six

months of 2006, the company reported record net income of $47.0

million, or $0.16 per diluted share, compared to a net loss of $2.8

million, or $0.01 per share, for the same period of 2005. Excluding

the one- time gain mentioned above and $2.0 million of pretax

income from discontinued operations, the company's net income for

the first six months of 2006 was still a record $33.9 million, or

$0.12 per diluted share. Metal sales from continuing operations in

the second quarter of 2006 increased 61 percent to $54.0 million

from $33.5 million in the year-ago quarter. Metal sales from

continuing operations for the first six months of 2006 increased 50

percent to $98.9 million from $65.7 million in the year-ago period.

In commenting on the company's performance relative to the year-ago

quarter, Dennis E. Wheeler, Chairman, President and Chief Executive

Officer, said, "The company's operating performance improved

sharply due to improvement in nearly all of our key business

indicators. Specifically, the company reported higher silver

production, lower per-ounce cash production costs for silver, and

sharply higher realized prices for silver and gold." Wheeler added,

"During the quarter, we completed the profitable sale of our

interest in Coeur Silver Valley as part of our strategy to focus

our growth on lower cost, longer-life mines. That transaction

generated $15 million in cash for the company. At the same time, by

eliminating the highest-cost mine in our system, where silver cash

production costs were recently running above $10 per ounce, the

transaction contributed to a significant reduction in the company's

overall per-ounce silver cash production cost. We are pleased that

we not only met our strategic objective with this sale but that we

also reported an increase in silver production from continuing

operations due largely to strong performance at Cerro Bayo combined

with the ounces generated by our Australian interests." Wheeler

said, "Gold and silver prices have remained at the kind of robust

levels that enable the company to generate healthy income and cash

flow. Our bullish view of the precious metals markets remains

unchanged. Growth in silver demand appears to be particularly

robust in the industrial sector, and we expect healthy price levels

to continue. At the same time, we are counting on strong operating

performance by our mines in the second half of the year and expect

to see silver production at noticeably higher levels than in the

first half, with the Cerro Bayo and Rochester mines, in particular,

setting the pace." Highlights by Individual Property -- Rochester

(Nevada) -- Silver cash cost per ounce declined by 66 percent,

relative to the year-ago quarter, due to a 27 percent increase in

gold production. Silver production was down modestly due to the

short-term impact of heavy rains that affected silver in the

solution flow. -- Cerro Bayo (Chile) -- Silver production was 53

percent above the level of the first quarter of 2006 as grades

returned to more typical levels as planned. At $1.82, silver cash

cost per ounce in the second quarter of 2006 was the lowest in the

Coeur system and was significantly below that reported for the

first quarter of 2006 due largely to higher silver production.

Silver production was 14 percent above that of a year ago due to an

increase in tons milled. Gold production declined relative to the

year-ago period due to lower grades. Lower gold production resulted

in a reduced by-product credit, which caused silver cash cost per

ounce to increase relative to the year-ago quarter. -- Martha

(Argentina) -- Silver and gold production were above the levels of

the year-ago quarter -- and sharply above the levels of the first

quarter of 2006 -- primarily because the operation encountered

grades for both metals that were much higher than forecast in the

mine plan. Silver cash cost per ounce increased relative to the

year-ago period due to higher royalties resulting from higher

market prices. -- Endeavor (Australia) -- Silver production was

above the level of the second quarter of 2005 because year-ago

results reflected only one month of production data following

Coeur's acquisition of this interest in June of 2005. Production

rates at Endeavor have not yet returned to expected quarterly

levels as the mine continues to recover from a rock fall that

occurred in October 2005. Coeur currently expects production levels

to return to normal levels during the fourth quarter of 2006. Cash

production cost in the second quarter of 2006 was above the level

of a year ago due to higher smelting and refining charges

associated with the increased market value of silver deductions

charged pursuant to the smelting and refining contracts. -- Broken

Hill (Australia) -- Silver production was 528,041 ounces, with a

cash cost per ounce of $3.27. Cash production cost per ounce was

above the level of the preceding quarter due to higher refining and

smelting charges associated with the increased market value of

silver deductions charged pursuant to the smelting and refining

contracts. (Year-ago comparisons for Broken Hill are not meaningful

because the mineral interest was acquired in the third quarter of

2005.) In addition, at Broken Hill, proven and probable silver

mineral reserve ounces increased 20 percent to 18.0 million

contained ounces as of June 2006 from 15.0 million contained ounces

at year-end 2005. Balance Sheet and Capital Investment Highlights

The company had $393.3 million in cash and short-term investments

as of June 30, 2006. Capital investment during the second quarter

of 2006 totaled $25.7 million, most of which was spent on the

Kensington (Alaska) gold project. -- At Kensington, capital

investment totaled $20.9 million during the quarter as the company

continued with an aggressive construction schedule. The company is

aiming to complete the project and start producing gold near the

end of 2007. Recent activity has focused on construction of the

mill building and completion of major earthworks. Kensington is

expected to produce 100,000 ounces of gold annually. -- At San

Bartolome, capital investment totaled $1.5 million during the

quarter. The company is aiming to complete construction activities

near the end of 2007. During the second quarter, the construction

activities continued to focus on rough-cut grading of the plant

site and construction of roads. Coeur has been pleased by the

recent cooperative and productive actions of the Government of

Bolivia. In particular, the company recently completed

renegotiation of a contract with the Bolivian State Mining Company

(COMIBOL) concerning timing of lease payments; entered into an

agreement with COMIBOL that calls for joint exploration of certain

COMIBOL silver properties in Potosi; and received a letter of

assurance from the Minister of Mines regarding the government's

support for the San Bartolome project. Based on such developments,

Coeur is proceeding with engineering and procurement activities.

San Bartolome is expected to produce 8 million ounces of silver

annually. Exploration During the second quarter, the company

acquired two new exploration properties in the Santa Cruz province

near the company's Martha mine via option-to-purchase agreements

with private Argentinean interests. The largest is the Costa

property, at 98,500 acres, which lies about 90 miles north-

northwest of Martha. The second property, called El Aguila, is

located in the eastern part of the province approximately 90 miles

north of the town of San Julian. The company has commenced

exploration activities at both properties. In the second quarter,

the exploration program focused primarily on existing properties,

with an emphasis on reserve development/delineation drilling and

discovery of new mineralization at Cerro Bayo, Martha, and

Kensington. Approximate drilling totals were 62,000 feet at Cerro

Bayo, 17,000 feet at Martha, and 23,000 feet at Kensington. Coeur

d'Alene Mines Corporation is one of the world's leading primary

silver producers and has a strong presence in gold. The company has

mining interests in Alaska, Argentina, Australia, Bolivia, Chile,

and Nevada. Conference Call Information Coeur d'Alene Mines

Corporation will hold a conference call to discuss the Company's

second quarter 2006 results at 1 p.m. Eastern time on August 1,

2006. To listen live via telephone, call 877-704-5378 (US and

Canada) or 913-312-1292 (International). The conference call and

presentation will also be web cast on the Company's web site

http://www.coeur.com/. A replay of the call will be available

through August 7, 2006. The replay dial-in numbers are 888-203-1112

(US and Canada) and 719-457-0820 (International) and the access

code is 6631943. Cautionary Statement Company press releases may

contain numerous forward-looking statements within the meaning of

securities legislation in the United States and Canada relating to

the Company's silver and gold mining business. Such statements are

subject to numerous assumptions and uncertainties, many of which

are outside the Company's control. Operating, exploration and

financial data, and other statements in this document are based on

information the Company believes reasonable, but involve

significant uncertainties as to future gold and silver prices,

costs, ore grades, estimation of gold and silver reserves, mining

and processing conditions, construction schedules, currency

exchange rates, and the completion and/or updating of mining

feasibility studies, changes that could result from the Company's

future acquisition of new mining properties or businesses, the

risks and hazards inherent in the mining business (including

environmental hazards, industrial accidents, weather or

geologically related conditions), regulatory and permitting

matters, risks inherent in the ownership and operation of, or

investment in, mining properties or businesses in foreign

countries, as well as other uncertainties and risk factors set out

in the Company's filings from time to time with the SEC and the

Ontario Securities Commission, including, without limitation, the

Company's reports on Form 10-K and Form 10-Q. Actual results and

timetables could vary significantly from the estimates presented.

Readers are cautioned not to put undue reliance on forward-looking

statements. The Company disclaims any intent or obligation to

update publicly such forward-looking statements, whether as a

result of new information, future events or otherwise. The

definitions of proven and probable mineral reserves under Canadian

National Instrument 43-101 are substantially identical to the

definitions of such reserves under Guide 7 of the SEC's Securities

Act Industry Guides. Donald J. Birak, Coeur's Senior Vice President

of Exploration, is the qualified person responsible for the

preparation of the scientific and technical information in this

document. Mr. Birak has reviewed the available data and procedures

and believes the collection of exploration data and calculation of

mineral reserves reported in this document was conducted in a

professional and competent manner. For a description of the key

assumptions, parameters and methods used to estimate the Broken

Hill mineral reserves, as well as a general discussion of the

extent to which the estimate may be affected by any known

environmental, permitting, legal, title, taxation, socio-political,

marketing or other relevant factors, please see the Broken Hill

Mine Technical Report dated October 7, 2005 and filed on SEDAR at

http://www.sedar.com/. Contact: Scott Lamb 208-665-0777 Broken Hill

Mineral Reserves Short Silver Grade Silver Ounces Tons Ounces/ton

Contained (000s) (000s) June 30, 2006 Proven 10,065 1.46 14,651

Probable 2,842 1.18 3,365 Total 12,907 1.40 18,016 Mineral Reserves

at June 30, 2006; Metal prices; $0.907/pound of zinc and

$0.408/pound of lead Cut-off grade; 8% combined lead and zinc for

the North Mine. 7% combined lead and zinc for all other deposits.

Year-end 2005 Proven 8,522 1.31 11,134 Probable 2,998 1.27 3,822

Total 11,520 1.30 14,956 COEUR D'ALENE MINES CORPORATION AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS) (Unaudited) Three Months Six Months

Ended June 30, Ended June 30, 2006 2005 2006 2005 REVENUES (In

thousands except per share data) Sales of metal $54,041 $33,504

$98,895 $65,739 COSTS and Expenses Production costs applicable to

sales 21,587 18,811 41,687 36,153 Depreciation and depletion 6,989

4,372 13,307 8,521 Administrative and general 4,528 5,156 9,618

10,705 Exploration 1,934 2,896 3,901 5,605 Pre-development -- 3,718

-- 6,086 Litigation settlements 469 -- 469 1,600 Total cost and

expenses 35,507 34,953 68,982 68,670 OTHER INCOME AND EXPENSE

Interest and other income 4,794 1,335 7,314 3,284 Interest expense,

net of capitalized interest (367) (562) (888) (1,132) Total other

income and expense 4,427 773 6,426 2,152 Income (loss) from

continuing operations before income taxes 22,961 (676) 36,339 (781)

Income tax benefit (provision) (2,829) 147 (2,481) (532) Income

(loss) from continuing operations 20,132 (529) 33,858 (1,313)

Income (loss) from discontinued operations, net of income taxes

1,357 (1,172) 1,968 (1,533) Gain on sale of net assets of

discontinued operations 11,159 -- 11,159 -- NET INCOME (LOSS)

32,648 (1,701) 46,985 (2,846) Other comprehensive income (loss)

1,736 121 1,740 120 COMPREHENSIVE INCOME (LOSS) $34,384 $(1,580)

$48,725 $(2,726) BASIC AND DILUTED INCOME (LOSS) PER SHARE Basic

income (loss) per share: Income (loss) from continuing operations

$0.07 $(0.00) $0.13 $(0.00) Income (loss) from discontinued

operations 0.05 (0.01) 0.05 (0.01) Net income (loss) $0.12 $(0.01)

$0.18 $(0.01) Diluted income (loss) per share: Income (loss) from

continuing operations $0.07 $(0.00) $0.12 $(0.00) Income (loss)

from discontinued operations 0.04 (0.01) 0.04 (0.01) Net income

(loss) $0.11 $(0.01) $0.16 $(0.01) Weighted average number of

shares of common stock Basic 277,474 240,028 265,049 240,007

Diluted 302,188 240,028 289,832 240,007 Operating Statistics From

Continuing Operations The following table presents information by

mine and consolidated sales information for the three- and

six-month periods ended June 30, 2006 and 2005: Three Months Ended

Six Months Ended June 30, June 30, 2006 2005 2006 2005 Rochester

Tons processed 2,737,547 2,293,621 5,269,447 4,652,034 Ore grade/Ag

oz 0.76 1.09 0.72 1.00 Ore grade/Au oz .009 .010 .011 .010

Recovery/Ag oz (A) 55.5% 48.5% 60.9% 50.5% Recovery/Au oz (A) 75.1%

63.4% 58.3% 62.8% Silver production ounces 1,153,295 1,208,584

2,301,658 2,344,581 Gold production ounces 18,265 14,412 34,382

28,404 Cash cost/oz $2.61 $7.58 $3.46 $6.96 Total cost/oz $5.80

$9.93 $6.70 $9.25 Cerro Bayo Tons milled 115,361 92,666 215,636

191,250 Ore grade/Ag oz 7.20 7.80 6.43 7.41 Ore grade/Au oz .094

.174 .094 .168 Recovery/Ag oz 95.1% 95.7% 94.2% 95.3% Recovery/Au

oz 92.1% 93.4% 92.1% 93.1% Silver production ounces 789,746 691,846

1,305,568 1,351,139 Gold production ounces 9,935 15,100 18,729

29,967 Cash cost/oz $1.82 $0.76 $2.47 $0.31 Total cost/oz $3.77

$2.28 $4.63 $2.03 Martha Mine Tons milled 6,817 8,915 15,666 16,753

Ore grade/Ag oz 97.79 70.82 79.75 61.54 Ore grade/Au oz .134 .088

.105 .077 Recovery/Ag oz 95.0% 96.0% 94.2% 95.6% Recovery/Au oz

91.8% 94.0% 92.0% 93.5% Silver production ounces 633,014 606,121

1,176,500 985,181 Gold production ounces 839 735 1,509 1,206 Cash

cost/oz $5.14 $4.43 $5.04 $4.68 Total cost/oz $5.61 $4.78 $5.50

$5.07 Endeavor (B) Tons milled 118,775 53,069 221,778 53,069 Ore

grade/Ag oz 1.11 1.46 1.20 1.46 Recovery/Ag oz 61.3% 75.5% 62.1%

75.5% Silver production ounces 80,890 58,464 165,170 58,464 Cash

cost/oz $2.79 $1.89 $2.45 $1.89 Total cost/oz $4.09 $3.13 $3.75

$3.13 Broken Hill (B) Tons milled 525,888 -- 1,106,911 -- Ore

grade/Ag oz 1.32 -- 1.35 -- Recovery/Ag oz 75.8% -- 72.2% -- Silver

production ounces 528,041 -- 1,085,353 -- Cash cost/oz $3.27 --

$3.07 -- Total cost/oz $6.02 -- $5.82 -- CONSOLIDATED PRODUCTION

TOTALS Silver ounces 3,184,986 2,565,015 6,034,249 4,739,365 Gold

ounces 29,039 30,247 54,620 57,577 Cash cost per oz/silver $3.03

$4.87 $3.46 $4.53 Total cost/oz $5.25 $6.50 $5.78 $6.25

CONSOLIDATED SALES TOTALS Silver ounces sold 3,249,854 2,881,145

6,127,744 5,534,242 Gold ounces sold 29,157 34,029 54,891 69,213

Realized price per silver ounce $13.10 $7.25 $11.82 $7.05 Realized

price per gold ounce $649 $431 $620 $427 (A) The leach cycle at

Rochester requires 5 to 10 years to recover gold and silver

contained in the ore. The Company estimates the ultimate recovery

to be approximately 61.5% for silver and 93% for gold. However,

ultimate recoveries will not be known until leaching operations

cease which is currently estimated for 2011. Current recovery may

vary significantly from ultimate recovery. See Critical Accounting

Policies and Estimates - Ore on Leach Pad. (B) The Company acquired

its interests in the Endeavor and Broken Hill mines in May 2005 and

September 2005, respectively. Operating Statistics From

Discontinued Operation The following table presents information for

Coeur Silver Valley, which was sold on June 1, 2006: Three Months

Ended Six Months Ended June 30, June 30, 2006 2005 2006 2005 Silver

Valley/Galena Tons milled 20,224 35,933 52,876 73,391 Ore

grade/Silver oz 13.92 16.01 15.15 17.79 Recovery/Silver oz 95.6%

97.3% 96.0% 97.3% Silver production ounces 269,027 559,700 768,674

1,269,996 Cash cost/oz $10.72 $8.05 $9.75 $7.32 Total cost/oz

$11.04 $8.95 $10.64 $8.11 Gold production 58 54 180 145 "Cash Costs

per Ounce" are calculated by dividing the cash costs computed for

each of the Company's mining properties for a specified period by

the amount of gold ounces or silver ounces produced by that

property during that same period. Management uses cash costs per

ounce as a key indicator of the profitability of each of its mining

properties. Gold and silver are sold and priced in the world

financial markets on a US dollar per ounce basis. "Cash Costs" are

costs directly related to the physical activities of producing

silver and gold, and include mining, processing and other plant

costs, third-party refining and smelting costs, marketing expense,

on-site general and administrative costs, royalties, in-mine

drilling expenditures that are related to production and other

direct costs. Sales of by-product metals are deducted from the

above in computing cash costs. Cash costs exclude depreciation,

depletion and amortization, corporate general and administrative

expense, exploration, interest, and pre-feasibility costs and

accruals for mine reclamation. Cash costs are calculated and

presented using the "Gold Institute Production Cost Standard"

applied consistently for all periods presented. Total cash costs

per ounce is a non-GAAP measurement and investors are cautioned not

to place undue reliance on it and are urged to read all GAAP

accounting disclosures presented in the consolidated financial

statements and accompanying footnotes. In addition, see the

reconciliation of "cash costs" to production costs under

"Reconciliation of Non-GAAP Cash Costs to GAAP Production Costs"

set forth below. Reconciliation of Non-GAAP Cash Costs to GAAP

Production Costs The tables below present reconciliations between

Non-GAAP cash costs per ounce to production costs applicable to

sales including depreciation, depletion and amortization (GAAP).

THREE MONTHS ENDED JUNE 30, 2006 (In thousands except ounces and

per ounce costs) Broken Cerro Endeavor Hill Rochester Bayo Martha

(1) (1) Total Production of Silver (ounces) 1,153,295 789,746

633,014 80,890 528,041 3,184,186 Cash Costs per ounce $2.61 $1.82

$5.14 $2.79 $3.27 $3.03 Total Cash Costs (Non-GAAP) $3,008 $1,439

$3,251 $225 $1,727 $9,650 Add/Subtract: Third party smelting costs

-- (1,021) (469) (155) (762) (2,407) By-product credit (2) 11,535

6,298 522 -- -- 18,355 Other adjustments 197 -- -- -- -- 197 Change

in inventory (4,130) (245) (159) (6) 332 (4,208) Depreciation,

depletion and amortization 3,480 1,537 302 105 1,452 6,876

Production costs applicable to sales, including depreciation,

depletion and amortization (GAAP) $14,090 $8,008 $3,447 $169 $2,749

$28,463 THREE MONTHS ENDED JUNE 30, 2005 (In thousands except

ounces and per ounce costs) Broken Cerro Endeavor Hill Rochester

Bayo Martha (1) (1) Total Production of Silver (ounces) 1,208,584

691,846 606,121 58,464 -- 2,565,015 Cash Costs per ounce $7.58

$0.76 $4.43 $1.89 -- $4.87 Total Cash Costs (Non- GAAP) $9,166 $527

$2,683 $111 -- 12,487 Add/Subtract: Third party smelting costs --

(519) (302) (58) -- (879) By-product credit (2) 6,168 6,452 314 --

-- 12,934 Other adjustment (101) (18) (101) -- -- (220) Change in

inventory (8,240) 2,600 167 (38) -- (5,511) Depreciation, depletion

and amortization 2,838 1,051 215 72 4,176 Production costs

applicable to sales, including depreciation, depletion and

amortization (GAAP) $9,831 $10,093 $2,976 $87 -- $22,987 (GAAP)

$14,090 $8,008 $3,447 $169 $2,749 $28,463 SIX MONTHS ENDED JUNE 30,

2006 (In thousands except ounces and per ounce costs) Broken Cerro

Endeavor Hill Rochester Bayo Martha (1) (1) Total Production of

Silver (ounces) 2,301,658 1,305,568 1,176,500 165,170 1,085,353

6,034,249 Cash Costs per ounce $3.46 $2.47 $5.04 $2.45 $3.07 $3.46

Total Cash Costs (Non-GAAP) $7,972 $3,222 $5,932 $405 $3,336

$20,867 Add/Subtract: Third party smelting costs -- (1,792) (781)

(257) (1,334) (4,164) By-product credit (2) 20,476 11,171 893 -- --

32,540 Other adjustments 936 -- -- -- -- 936 Change in inventory

(7,022) (1,596) (223) (54) 403 (8,492) Depreciation, depletion and

amortization 6,518 2,820 540 214 2,985 13,077 Production costs

applicable to sales, including depreciation, depletion and

amortization (GAAP) $28,880 $13,825 $6,361 $308 $5,390 $54,764 SIX

MONTHS ENDED JUNE 30, 2005 (In thousands except ounces and per

ounce costs) Broken Cerro Endeavor Hill Rochester Bayo Martha (1)

(1) Total Production of Silver (ounces) 2,344,581 1,351,139 985,181

58,464 -- 4,739,365 Cash Costs per ounce $6.96 $0.31 $4.68 $ 1.89

-- $4.53 Total Cash Costs (Non-GAAP) $16,319 $418 $4,615 $111 --

$21,463 Add/Subtract: Third party smelting costs -- (1,238) (499)

(58) -- (1,795) By-product credit (2) 12,160 12,800 515 -- --

25,475 Other adjustment (201) (10) (174) -- -- (385) Change in

inventory (11,798) 3,266 (35) (38) -- (8,605) Depreciation,

depletion and amortization 5,368 2,322 381 73 -- 8,144 Production

costs applicable to sales, including depreciation, depletion and

amortization (GAAP) $21,848 $17,558 $4,803 $88 -- $44,297 The

following tables present a reconciliation between non-GAAP cash

costs per ounce to GAAP production costs applicable to sales

reported in Discontinued Operations (see Note D): Coeur Silver

Valley/Galena THREE MONTHS SIX MONTHS ENDED JUNE 30, ENDED JUNE 30,

2006(3) 2005 2006(3) 2005 (In thousands except ounces and per ounce

costs) Production of Silver (ounces) 269,027 559,700 768,674

1,269,996 Cash Costs per ounce $10.72 $8.05 $9.75 $7.32 Total Cash

Costs (Non-GAAP) $2,883 $4,508 $7,498 $9,290 Add/Subtract: Third

party smelting costs (595) (835) (1,464) (1,959) By-product credit

(2) 677 689 1,473 1,628 Change in inventory 1,008 373 726 (323)

Depreciation, depletion and amortization 86 501 681 1,013

Production costs applicable to sales, including depreciation,

depletion and amortization (GAAP) $4,059 $5,236 $8,914 $9,649 (1)

The Company's share of silver production at Endeavor and Broken

Hill commenced in May 2005 and September 2005, respectively. (2)

By-product credits are based upon production units and the period's

average metal price for the purposes of reporting cash costs per

ounce. (3) Amounts represent two and five months ended May 31,

2006, respectively. COEUR D'ALENE MINES CORPORATION AND

SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (Unaudited) June 30,

December 31, 2006 2005 ASSETS (In Thousands) CURRENT ASSETS Cash

and cash equivalents $373,392 $214,616 Short-term investments

19,896 25,726 Receivables 28,597 27,986 Ore on leach pad 28,740

25,394 Metal and other inventories 13,394 12,807 Deferred tax

assets 3,855 2,255 Prepaid expenses and other 6,590 4,707 Assets of

discontinued operations held for sale (Note D) -- 14,828 474,464

328,319 PROPERTY, PLANT AND EQUIPMENT Property, plant and equipment

111,918 105,107 Less accumulated depreciation (61,033) (57,929)

50,885 47,178 MINING PROPERTIES Operational mining properties

124,721 121,441 Less accumulated depletion (110,759) (105,486)

13,962 15,955 Mineral interests 72,201 72,201 Less accumulated

depletion (5,417) (2,218) 66,784 69,983 Non-producing and

development properties 119,519 72,488 200,265 158,426 OTHER ASSETS

Ore on leach pad, non-current portion 34,265 29,254 Restricted cash

and cash equivalents 19,035 16,943 Debt issuance costs, net 5,303

5,454 Deferred tax assets 2,292 923 Other 7,574 8,319 68,469 60,893

TOTAL ASSETS $794,083 $594,816 COEUR D'ALENE MINES CORPORATION AND

SUBSIDIARIES CONSOLIDATED BALANCE SHEETS(Unaudited) June 30,

December 31, 2006 2005 (In thousands except share data) LIABILITIES

AND SHAREHOLDERS' EQUITY CURRENT LIABILITIES Accounts payable

$24,324 $17,189 Other current liabilities 11,315 6,274 Accrued

interest payable 1,031 1,031 Accrued salaries and wages 6,723 7,840

Current taxes payable 5,445 66 Liabilities of discontinued

operations held for sale (Note D) -- 12,908 48,838 45,308 LONG-TERM

LIABILITIES 1 1/4% Convertible Senior Notes due January 2024

180,000 180,000 Reclamation and mine closure 24,278 24,082 Other

long-term liabilities 3,677 3,873 207,955 207,955 COMMITMENTS AND

CONTINGENCIES SHAREHOLDERS' EQUITY Common Stock, par value $1.00

per share; authorized 500,000,000 shares, issued 278,994,490 and

250,961,353 shares in 2006 and 2005 (1,059,211 shares held in

treasury) 278,994 250,961 Additional paid-in capital 776,305

656,977 Accumulated deficit (504,722) (551,357) Shares held in

treasury (13,190) (13,190) Accumulated other comprehensive loss

(97) (1,838) 537,290 341,553 TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY $794,083 $594,816 COEUR D'ALENE MINES CORPORATION AND

SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS Three and Six

Months Ended June 30, 2006 and 2005 (Unaudited) Three Months Six

Months Ended June 30, Ended June 30, 2006 2005 2006 2005 (In

Thousands) CASH FLOWS FROM OPERATING ACTIVITIES: Net income (loss)

$32,648 $(1,701) $46,985 $(2,846) Add (deduct) non-cash items:

Depreciation and depletion 6,989 4,372 13,307 8,521 Deferred taxes

(1,058) (559) (3,131) 120 Unrealized loss on embedded derivative,

net 4,760 426 3,201 35 Share based compensation 538 174 1,164 574

Loss (gain) on sale of net assets of discontinued operations and

other, net (11,306) 167 (11,322) 167 Other charges 175 429 692 840

Changes in Operating Assets and Liabilities: Receivables (4,020)

(11,554) 810 (12,871) Prepaid and other current assets (1,362)

(1,603) (1,025) (722) Inventories (4,355) (5,937) (8,945) (9,193)

Accounts payable and accrued liabilities 8,554 4,695 7,636 2,363

Discontinued operations 469 1,946 (176) 1,370 CASH PROVIDED BY

(USED IN) OPERATING ACTIVITIES 32,032 (9,145) 49,196 (11,642) CASH

FLOWS FROM INVESTING ACTIVITIES: Capital expenditures (25,677)

(21,889) (53,484) (25,388) Purchases of short-term investments

1,498 (12,294) (9,883) (22,840) Proceeds from sales of short-term

investments 3,300 16,097 13,616 22,112 Other (202) 61 (443) 33

Discontinued operations 14,862 (733) 14,365 (1,366) CASH USED IN

INVESTING ACTIVITIES (6,219) (18,758) (35,829) (27,449) CASH FLOWS

FROM FINANCING ACTIVITIES: Retirement of long-term debt (352) (76)

(689) (156) Proceeds from issuance of common stock -- -- 154,560 --

Payment of public offering costs -- 17 (8,388) (552) Other 280 --

(74) -- CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES: (72) (59)

145,409 (708) INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS

25,741 (27,962) 158,776 (39,799) Cash and cash equivalents at

beginning of period 347,651 261,231 214,616 273,068 Cash and cash

equivalents at end of period $373,392 $233,269 $373,392 $233,269

DATASOURCE: Coeur d'Alene Mines Corporation CONTACT: Scott Lamb,

+1-208-665-0777 Web site: http://www.coeur.com/

Copyright

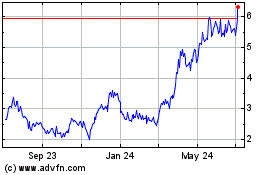

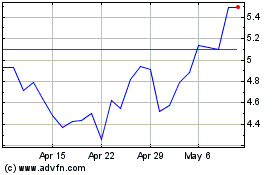

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Coeur Mining (NYSE:CDE)

Historical Stock Chart

From Jul 2023 to Jul 2024